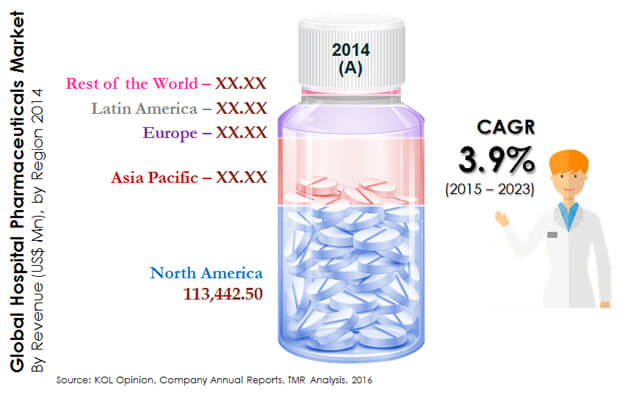

Jolted by the economic slowdown and the looming patent expiry of blockbuster drugs, the global hospital pharmaceuticals market is forecasted to exhibit a moderate CAGR of 3.9% between 2015 and 2023. Nevertheless, the increasing prevalence of chronic ailments worldwide, coupled with increasing healthcare spending is expected to keep the demand for hospital pharmaceuticals high in the near future. As per Transparency Market Research, the market stood at US$197.3 bn in 2014 and is expected to reach US$280.3 bn by the end of 2023. Emerging economies in Asia Pacific and Rest of the World are currently exhibiting highest demand for hospital pharmaceuticals.

As per reports from the World Health Organization (WHO), annual cases of cancer globally are expected to reach 22 million by 2030. This combined with the rising incidence of parasitic infections will boost demand for anti-parasitic drugs, thus driving the global hospital pharmaceuticals market in the forthcoming years.

Increasing Pharmaceuticals Spending in U.S. Boosts Prospects of Hospital Pharmaceuticals in North America

Regionally, North America held the largest share in the global market in 2014. The recovery of the pharmaceutical industry and the rise in R&D activities between 2013 and 2014 have bolstered opportunities for the hospital pharmaceuticals market in North America. As per TMR analysis, the increasing spending on pharmaceuticals by the U.S. government has considerably aided in the expansion of the hospital pharmaceuticals market in North America. The market in the region is projected to surge at a CAGR of 3.4% between 2015 and 2023.

Europe has emerged as the second-largest market for hospital pharmaceuticals, primarily due to the presence of renowned research organizations in the region. The sound intellectual property protection norms prevalent in Europe have also helped the market to thrive in the region. However, the region lacks proper reimbursement policies and regulatory framework for encouraging the development of novel therapeutics. This could restrain the market’s growth in Europe.

In the meantime, surging opportunities in Latin America and Asia Pacific will compel vendors to shift their focus from developed economies to emerging nations. The large population base in Asia Pacific, coupled with the increasing spending on research and development of novel therapeutics will aid expansion of the hospital pharmaceuticals market in emerging economies.

Demand from Oncology Segment to Surge in Response to Increasing Incidence of Cancer

The increasing incidence of cancer worldwide has catapulted the oncology segment at the forefront of the global hospital pharmaceuticals market, by therapeutic class. Cancer types such as stomach, breast, liver, and lung cancer have emerged as the leading causes of deaths due to cancer. The market is forecasted to gain momentum from a strong product pipeline as more drugs receive FDA approvals in the future. Since cancer is often associated with a high mortality rate, scientists around the world are engaged in the discovery of better treatment options and more efficient drugs. Demand for oncology drugs is therefore expected to surge in the forthcoming years. TMR has pegged the oncology segment in the global hospital pharmaceuticals market to rise at a CAGR of 6.35% during the forecast period.

Besides this, the increasing incidence of cardiovascular diseases will also fuel demand from the global hospital pharmaceuticals market. The increasing government initiatives, growing diseases awareness, and therapeutic interventions aimed at curbing the incidence of cardiovascular ailments are likely to boost demand for relevant hospital pharmaceuticals.

Demand for anti-hypersensitive drugs is also expected to increase during the forecast period.

Some of the most prominent vendors operating in the global hospital pharmaceuticals market include Novartis, Pfizer, Roche, Sanofi, Merch &Co., AstraZeneca, GlaxoSmithKline, Johnson & Johnson, Gilead Sciences, and others.

Rise in the Number of Hospitals to Foster Growth of the Hospital Pharmaceuticals Market

Huge increase in the number of hospitals around the world, pharmaceutical firms are likely to observe a strong rise in opportunities for growth in the global hospital pharmaceuticals market. With a rise in the number of important pharmaceutical companies penetrating the domain of oncology, which is actually amongst the most profitable therapeutic sectors in the global hospital pharmaceuticals market, the competitive environment is likely to intensify.

The massive rise in occurrence of various chronic diseases like diabetes, cancer, and a multitude of cardiovascular conditions is likely to work in favor of the global hospital pharmaceuticals market in near future. In addition to that, increasing healthcare expenses throughout the developing countries are further likely to drive the demand for hospital pharmaceuticals in near future. The market is anticipated to expand in the face of increasing rate of parasitic infection, which has increased hospital demand for anti-parasitic drugs. The rising number of cancer patients is also another factor propelling the market forward, and it is predicted to continue to be a key driving force in the years to come.

High Prevalence of Diseases like Cancer and Cardiovascular Diseases to Boost Demand

According to World Health Organization (WHO) statistics, cardiovascular diseases account for approximately 31% of all fatalities worldwide each year. As a result, hospital pharmacies dispense a significant volume of medicinal and diagnostic drugs for cardiovascular problems. However, due to a high level of market saturation, the sector of cardiovascular diseases is expected to grow at a slower rate than other indications in the years to come. On the other hand, due to the rising number of cases of cancer detected each year around the world, the oncology sector is anticipated to see a massive increase in valuation. Increased prevalence of such diseases worldwide is likely to pave way for rapid growth of the global hospital pharmaceuticals market in near future.

Table of Content

1. Preface

1.1. Report Description

1.2. Market Segmentation

1.3. Research Methodology

1.4. Assumptions

2. Executive Summary

2.1. Global Hospital Pharmaceuticals Market Revenue, by Therapeutic Area, 2014 & 2023 (US$ Mn)

2.2. Global Hospital Pharmaceuticals Market Revenue, by Countries, 2014 (US$ Mn)

2.3. Global Hospital Pharmaceuticals Market Revenue, by Geography, 2014 & 2023 (US$ Mn)

2.4. Global Hospital Pharmaceuticals Market, 2014 & 2023: Market Snapshot

3. Global Hospital Pharmaceuticals Market – Industry Analysis

3.1. Introduction

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Driver 1 - Increased emergency department visits drive demand for hospital drugs

3.2.1.2. Driver 2 - Rise in spending on medicines

3.2.1.3. Driver 3 - High prevalence of diseases across the world

3.2.1.4. Driver 4- Trend towards increase in use of telemedicine technology by hospitals

3.2.2. Restraints

3.2.2.1. Restraint 1- Patent Expirations of Blockbuster Drugs

3.2.2.2. Restraint 2- Shift toward use of home health care services

3.2.3. Opportunities

3.2.3.1. Opportunity 1- Extensive R&D activities lead to introduction of new drugs in market

3.2.3.2. Opportunity 2- Increasing no. of hospitals in developing economies

3.3. Event Impact Analysis

3.4. Value Chain Analysis

3.5. Market Attractiveness Analysis: Global Hospital Pharmaceuticals Market

3.6. Market Share Analysis: Global Hospital Pharmaceuticals Market, by Key Players, 2013 (Value %)

4. Market Segmentation – By Product Type

4.1. Introduction

4.1.1. Global Hospital Pharmaceuticals Market Revenue, by Major Therapeutic Area, (U.S. $ Mn), 2013-2023

4.2. Cardiology

4.2.1. Introduction

4.2.2. Global Cardiology Hospital Pharmaceuticals Market Revenue, by Therapeutic Class, (US$ Mn), 2013-2023

4.2.3. Global Antihypertensive Drugs Market Revenue, (US$ Mn), 2013-2023

4.2.4. Global Dyslipidemia Drugs Market Revenue, (US$ Mn), 2013-2023

4.2.5. Global Other Cardiology Drugs Market Revenue, (US$ Mn), 2013-2023

4.3. Oncology

4.3.1. Introduction

4.3.2. Global Oncology Hospital Pharmaceuticals Market Revenue, by Therapeutic Class, (US$ Mn), 2013-2023

4.3.3. Global Immunomodulating Agents Market Revenue, (US$ Mn), 2013-2023

4.3.4. Global Alkylating Agents Market Revenue, (US$ Mn), 2013-2023

4.3.5. Global Anti-metabolites Market Revenue, (US$ Mn), 2013-2023

4.3.6. Global Hormonal Agents Market Revenue, (US$ Mn), 2013-2023

4.3.7. Global Miscellaneous Oncology Drugs Market Revenue, (US$ Mn), 2013-2023

4.4. Nephrology and Urology

4.4.1. Introduction

4.4.2. Global Nephrology and Urology Hospital Pharmaceuticals Market Revenue, by Therapeutic Classs, (US$ Mn), 2013-2023

4.4.3. Global Diuretics Market Revenue, (US$ Mn), 2013-2023

4.4.4. Global Anti-Hypertensives Market Revenue, (US$ Mn), 2013-2023

4.4.5. Global Phosphate Binders Market Revenue, (US$ Mn), 2013-2023

4.4.6. Global Anti-Cholinergics Market Revenue, (US$ Mn), 2013-2023

4.4.7. Global 5-alpha-reductase Inhibitors Market Revenue, (US$ Mn), 2013-2023

4.5. Neurology

4.5.1. Introduction

4.5.2. Global Neurology Hospital Pharmaceuticals Market Revenue, by Therapeutic Class, (US$ Mn), 2013-2023

4.5.3. Global Diuretics Market Revenue, (US$ Mn), 2013-2023

4.5.4. Global Anti-Anxiety Market Revenue, (US$ Mn), 2013-2023

4.5.5. Global Anti-Migraine Market Revenue, (US$ Mn), 2013-2023

4.5.6. Global Anti-Depressant Market Revenue, (US$ Mn), 2013-2023

4.5.7. Global Anti-Psychotics Market Revenue, (US$ Mn), 2013-2023

4.6. Pain

4.6.1. Introduction

4.6.2. Global Pain Hospital Pharmaceuticals Market Revenue, by Therapeutic Class, (US$ Mn), 2013-2023

4.6.3. Global Anti-Convulsants Market Revenue, (US$ Mn), 2013-2023

4.6.4. Global Anesthetics Market Revenue, (US$ Mn), 2013-2023

4.6.5. Global NSAID's Market Revenue, (US$ Mn), 2013-2023

4.6.6. Global Opioids Market Revenue, (US$ Mn), 2013-2023

4.6.7. Global Non-Narcotic Agents Market Revenue, (US$ Mn), 2013-2023

4.7. Infection

4.7.1. Introduction

4.7.2. Global Infection Hospital Pharmaceuticals Market Revenue, by Therapeutic Class, (US$ Mn), 2013-2023

4.7.3. Global Anti-Bacterial Drugs Market Revenue, (US$ Mn), 2013-2023

4.7.4. Global Anti-Viral Drugs Market Revenue, (US$ Mn), 2013-2023

4.7.5. Global Anti-Fungal Drugs Market Revenue, (US$ Mn), 2013-2023

4.7.6. Global Anti-Parasite Drugs Market Revenue, (US$ Mn), 2013-2023

5. Market Segmentation – By Indication

5.1. Introduction

5.1.1. Global Hospital Pharmaceuticals Market Revenue, by Indication, (US$ Mn), 2013-2023

5.2. Cardiology

5.2.1. Global Cardiology Hospital Pharmaceuticals Market Revenue, by Indications, (US$ Mn), 2013-2023

5.2.2. Global Coronary Heart Disease Market Revenue, (US$ Mn), 2013-2023

5.2.3. Global Stroke Market Revenue, (US$ Mn), 2013-2023

5.2.4. Global High Blood Pressure Market Revenue, (US$ Mn), 2013-2023

5.2.5. Global Heart Failure Market Revenue, (US$ Mn), 2013-2023

5.2.6. Global Other Cardiology Indications Market Revenue, (US$ Mn), 2013-2023

5.3. Oncology

5.3.1. Global Oncology Hospital Pharmaceuticals Market Revenue, by Indications, (US$ Mn), 2013-2023

5.3.2. Global Lung Cancer Market Revenue, (US$ Mn), 2013-2023

5.3.3. Global Breast Cancer Market Revenue, (US$ Mn), 2013-2023

5.3.4. Global Colorectal Cancer Market Revenue, (US$ Mn), 2013-2023

5.3.5. Global Prostate Cancer Market Revenue, (US$ Mn), 2013-2023

5.3.6. Global Other Oncology Indications Market Revenue, (US$ Mn), 2013-2023

5.4. Nephrology and Urology

5.4.1. Global Nephrology and Urology Hospital Pharmaceuticals Market Revenue, by Indication, (US$ Mn), 2013-2023

5.4.2. Global Acute Kidney Failure Market Revenue, (US$ Mn), 2013-2023

5.4.3. Global Chronic Kidney Diseases Market Revenue, (US$ Mn), 2013-2023

5.4.4. Global Glomerular Diseases Market Revenue, (US$ Mn), 2013-2023

5.4.5. Global Diabetes Market Revenue, (US$ Mn), 2013-2023

5.4.6. Global Other Nephrology and Urology Indications Market Revenue, (US$ Mn), 2013-2023

5.5. Neurology

5.5.1. Global Neurology Hospital Pharmaceuticals Market Revenue, by Indication, (US$ Mn), 2013-2023

5.5.2. Global Epilepsy Market Revenue, (US$ Mn), 2013-2023

5.5.3. Global Alzheimer's Disease Market Revenue, (US$ Mn), 2013-2023

5.5.4. Global Parkinson's Disease Market Revenue, (US$ Mn), 2013-2023

5.5.5. Global Multiple Sclerosis Market Revenue, (US$ Mn), 2013-2023

5.5.6. Global Stroke Market Revenue, (US$ Mn), 2013-2023

5.5.7. Global Other Neurology Indications Market Revenue, (US$ Mn), 2013-2023

5.6. Pain

5.6.1. Global Pain Hospital Pharmaceuticals Market Revenue, by Indication, (US$ Mn), 2013-2023

5.6.2. Global Neuropathic Pain Market Revenue, (US$ Mn), 2013-2023

5.6.3. Global Fibromyalgia Market Revenue, (US$ Mn), 2013-2023

5.6.4. Global Osteoarthritis Market Revenue, (US$ Mn), 2013-2023

5.6.5. Global Rheumatoid Arthritis Market Revenue, (US$ Mn), 2013-2023

5.6.6. Global Cancer Pain Market Revenue, (US$ Mn), 2013-2023

5.6.7. Global Other Pain Indications Market Revenue, (US$ Mn), 2013-2023

5.7. Infection

5.7.1. Global Infection Hospital Pharmaceuticals Market Revenue, by Indication, (US$ Mn), 2013-2023

5.7.2. Global Tuberculosis Market Revenue, (US$ Mn), 2013-2023

5.7.3. Global Pneumonia Market Revenue, (US$ Mn), 2013-2023

5.7.4. Global Hepatitis A Market Revenue, (US$ Mn), 2013-2023

5.7.5. Global Hepatitis B Market Revenue, (US$ Mn), 2013-2023

5.7.6. Global Candida Infection Market Revenue, (US$ Mn), 2013-2023

5.7.7. Global Fungal Meningitis Market Revenue, (US$ Mn), 2013-2023

5.7.8. Global Shigellosis Market Revenue, (US$ Mn), 2013-2023

5.7.9. Global Amoebiasis Market Revenue, (US$ Mn), 2013-2023

5.7.10. Global Other Infection Indications Market Revenue, (US$ Mn), 2013-2023

6. Market Segmentation – By Geography

6.1. Global Hospital Pharmaceuticals Market Revenue, by Geography, (US$ Mn), 2013-2023

6.2. North America Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

6.2.1. U.S. Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

6.2.2. Canada Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

6.3. Europe Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

6.3.1. U.K. Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

6.3.2. Germany Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

6.3.3. Rest of Europe Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

6.4. Asia Pacific Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

6.4.1. China Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

6.4.2. Japan Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

6.4.3. Rest of Asia Pacific Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

6.5. Latin America Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

6.5.1. Brazil Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

6.5.2. Mexico Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

6.5.3. Rest of Latin America Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

6.6. Rest of the World Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

7. Company Profiles

7.1. AztraZeneca plc

7.2. Bayer AG

7.3. Bristol-Myers Squibb Company

7.4. Eli Lilly and Company

7.5. GlaxoSmithKline plc

7.6. Johnson and Johnson

7.7. Merck and Co., Inc.

7.8. Novartis AG

7.9. Pfizer, Inc.

7.10. Sanofi-Aventis

List of Tables

TABLE 1 Market Snapshot: Global Hospital Pharmaceuticals Market

TABLE 2 Major Patent Expirations in Forecast Period

TABLE 3 Event Impact Analysis: Hospital Pharmaceutical Market

TABLE 4 Global Hospital Pharmaceuticals Market Revenue, by Major Therapeutic Areas, 2013-2023 (US$ Million)

TABLE 5 Cardiology Pipeline Overview

TABLE 6 Oncology Pipeline Overview

TABLE 7 Nephrology and Urology Pipeline Overview

TABLE 8 Neurology Pipeline Overview

TABLE 9 Pain Pipeline Overview

TABLE 10 Infection Pipeline Overview

TABLE 11 Global Hospital Pharmaceuticals Market Revenue, by Indication, (US$ Mn), 2013-2023

TABLE 12 Global Hospital Pharmaceuticals Market Revenue, by Geography, (US$ Mn), 2013-2023

List of Figures

FIG. 1 Global Teleradiology Market Share, by Geography, 2014 (Value %)

FIG. 2 Hospital Pharmaceuticals Market Segmentation

FIG. 3 Global Hospital Pharmaceuticals Market, by Therapeutic Area, 2014 & 2023 (US$ Million)

FIG. 4 Global Hospital Pharmaceuticals Market Revenue, by Countries, 2014 (US$ Mn)

FIG. 5 Comparative Analysis: Global Hospital Pharmaceuticals Market, by Geography, 2014 & 2023 (Value %)

FIG. 6 Global Hospital Pharmaceutical Market, Value Chain Analysis

FIG. 7 Market Attractiveness Analysis: Global Hospital Pharmaceutical Market, by Geography, 2014

FIG. 8 Market Share Analysis: Global Hospital Pharmaceutical Market, by Key Players, 2014 (Value %)

FIG. 9 Global Hospital Pharmaceuticals Market, Cardiology Segmentation

FIG. 10 Global Cardiology Hospital Pharmaceuticals Market Revenue, by Therapeutic Class, 2013-2023 (US$ Mn)

FIG. 11 Global Hospital Pharmaceuticals Market, Oncology Segmentation

FIG. 12 Global Oncology Hospital Pharmaceuticals Market Revenue, by Therapeutic Class, 2013-2023 (US$ Mn)

FIG. 13 Global Hospital Pharmaceuticals Market, Nephrology and Urology segmentation

FIG. 14 Global Nephrology Hospital Pharmaceuticals Market Revenue, by Therapeutic Class, 2013-2023 (US$ Mn)

FIG. 15 Global Hospital Pharmaceuticals Market, Neurology Segmentation

FIG. 16 Global Neurology Hospital Pharmaceuticals Market Revenue, by Therapeutic Class, 2013-2023 (US$ Mn)

FIG. 17 Global Hospital Pharmaceuticals Market, Pain Segmentation

FIG. 18 Global Pain Hospital Pharmaceuticals Market Revenue, by Therapeutic Class, 2013-2023 (US$ Mn)

FIG. 19 Global Hospital Pharmaceuticals Market, Infection Segmentation

FIG. 20 Global Infection Hospital Pharmaceuticals Market Revenue, by Therapeutic Class, 2013-2023 (US$ Mn)

FIG. 21 Global Hospital Pharmaceuticals Market, segmentation by Indication

FIG. 22 Global Cardiology Hospital Pharmaceuticals Market Revenue, by Indications, (US$ Mn), 2013-2023

FIG. 23 Global Oncology Hospital Pharmaceuticals Market Revenue, by Indications, (US$ Mn), 2013-2023

FIG. 24 Global Nephrology and Urology Hospital Pharmaceuticals Market Revenue, by Indications, (US$ Mn), 2013-2023

FIG. 25 Global Neurology Hospital Pharmaceuticals Market Revenue, by Indications, (US$ Mn), 2013-2023

FIG. 26 Global Pain Hospital Pharmaceuticals Market Revenue, by Indications, (US$ Mn), 2013-2023

FIG. 27 Global Infection Hospital Pharmaceuticals Market Revenue, by Indications, (US$ Mn), 2013-2023

FIG. 28 Comparative Analysis: Global Hospital Pharmaceuticals Market Revenue, by Geography (Value %), 2014 & 2023

FIG. 29 North America Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

FIG. 30 Europe Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

FIG. 31 Asia Pacific Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

FIG. 32 Latin America Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

FIG. 33 Rest of the World Hospital Pharmaceuticals Market Revenue, (US$ Mn), 2013-2023

FIG. 34 AstraZeneca plc: Annual Revenue, 2012 – 2014 (US$ Million)

FIG. 35 Bayer AG Annual Revenue: 2012 – 2014 (US$ Million)

FIG. 36 Bristol-Myers Squibb Company: Annual Revenue, 2012 – 2014 (US$ Million)

FIG. 37 Eli Lilly and Company: Annual Revenue, 2012 – 2014 (US$ Million)

FIG. 38 GlaxoSmithKline plc: Annual Revenue, 2012 – 2014 (US$ Million)

FIG. 39 Johnson & Johnson: Annual Revenue, 2012– 2014 (US$ Million)

FIG. 40 Merck & Co., Inc.: Annual Revenue, 2012 – 2014 (US$ Million)

FIG. 41 Novartis AG Annual Revenue: 2012 – 2014 (US$ Million)

FIG. 42 Pfizer, Inc.: Annual Revenue 2012 – 2014 (US$ Million)

FIG. 43 Sanofi: Annual Revenue, 2012 – 2014 (US$ Million)