Analysts’ Viewpoint on Market Scenario

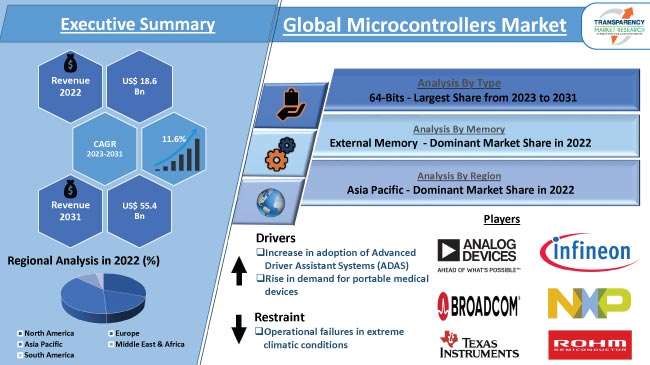

The global microcontrollers market value is expected to grow at a rapid pace in the near future due to the increase in adoption of Advanced Driver Assistant Systems (ADAS). Microcontrollers are employed in a wide range of products such as vehicles, electronic gadgets, home appliances, and robots. Rise in adoption of smart buildings, smart homes, and wearable devices is also boosting the demand for microcontrollers.

Expansion in the automotive sector is likely to offer lucrative opportunities for players in the microcontrollers industry. Key vendors are manufacturing and designing low-power and low-cost microcontroller chips to expand customer base and increase their microcontrollers market share.

Microcontroller is an Integrated Circuit (IC) designed to control specific tasks within an electronic system. It contains all the essential components of a microcomputer such as RAM, CPU, ROM/EPROM, and I/O lines.

Microcontroller Units (MCUs) are widely used in office machinery, medical equipment, toys, vending machines, home appliances, engine control systems, and other embedded systems to perform specific tasks such as sensing, data acquisition, data processing, and control of external devices.

Rise in focus on vehicle safety is driving the usage of Advance Driver Assistant Systems (ADAS). Furthermore, automakers are offering advanced electronic control systems. GPS-based navigation, stability management, by-wire steering and braking, voice recognition, and collision warning systems are gaining traction in the automotive sector.

According to the India Brand Equity Foundation, vehicle exports in India are expected to increase five-fold from 2016 to 2026. Thus, growth in adoption of ADAS and expansion in the automotive sector are propelling microcontrollers market dynamics.

Portable medical devices, such as heart rate monitors, blood glucose monitors, pain-blocking implants, and ingestible gastrointestinal (GI) tract monitors, help improve the quality of life in patients suffering from chronic or acute diseases.

These portable products require low-power MCUs to accept commands from the user or operator in order to provide readings and status updates. Increase in adoption of portable medical devices is projected to positively impact the microcontrollers market growth in the next few years.

According to the latest microcontrollers market trends, the 64-bits type segment is anticipated to account for the largest share with a CAGR of 13.6% from 2023 to 2031. The segment constituted 36.8% market share in 2022.

64-bit microcontrollers can handle more data than other types of microcontrollers. They provide higher performance than 32-bit microcontrollers. 64-bit microcontrollers allow users to multitask. Users can easily switch between different applications without facing performance lags.

According to the latest microcontrollers market analysis, the external memory segment is projected to dominate the industry with a CAGR of 13.9% during the forecast period. The segment accounted for 54.9% share in 2022.

Applications that require large amounts of memory, such as high-end audio or video processing, rely on external memory to provide sufficient storage capacity. External memory is preferred for security reasons, as it allows the program code and data to be stored separately from the microcontroller, thus making it more difficult for hackers to access.

According to the latest microcontrollers market forecast, Asia Pacific is estimated to hold the largest share from 2023 to 2031. The region accounted for prominent share of 37.1% in 2022. Rise in demand for advanced consumer and medical devices and expansion in the automotive sector are boosting market progress in the region.

North America constituted 28.3% share of the global market in 2022. Surge in adoption of portable electronic devices, such as tablets, smartphones, and personal computers, is fueling market expansion in the region.

The global business is fragmented, with the presence of a large number of players including Analog Devices Inc., Broadcom, Fujitsu Semiconductor Limited, Infineon Technologies AG, Intel Corporation, Microchip Technology Inc., NXP Semiconductor, Semiconductor Components Industries, LLC, Renesas Electronics Corporation, ROHM CO., LTD, Samsung Electronics, Silabs India Private Limited, STMicroelectronics Private Limited, Texas Instruments Incorporated, Toshiba Electronic Devices & Storage Corporation, and Vishwa Group.

Each of these players has been profiled in the microcontrollers market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Manufacturers are differentiating their products by offering a range of features and capabilities to meet the specific needs of their customers. They are also employing various marketing and sales strategies to boost their revenue streams.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 | US$ 18.6 Bn |

| Market Forecast Value in 2031 | US$ 55.4 Bn |

| Growth Rate (CAGR) | 11.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value and Billion Units for Volume |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 18.6 Bn in 2022

It is expected to advance at a CAGR of 11.6% from 2023 to 2031

Increase in adoption of Advanced Driver Assistant Systems (ADAS) and rise in demand for portable medical devices

The 64-bits type segment accounted for major share of 36.8% in 2022

The external memory segment accounted for significant share of 54.9% in 2022

Asia Pacific was a more attractive region with 37.1% share in 2022

The market in the country was valued at US$ 3.0 Bn in 2022

Analog Devices Inc., Broadcom, Fujitsu Semiconductor Limited, Infineon Technologies AG, Intel Corporation, Microchip Technology Inc., NXP Semiconductor, Semiconductor Components Industries, LLC, Renesas Electronics Corporation, ROHM CO., LTD, Samsung Electronics, Silabs India Private Limited, STMicroelectronics Private Limited, Texas Instruments Incorporated, Toshiba Electronic Devices & Storage Corporation, and Vishwa Group

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Microcontrollers Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Semiconductor Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Microcontrollers Market Analysis, By Type

5.1. Microcontrollers Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Type, 2017-2031

5.1.1. 8-Bits

5.1.2. 16-Bits

5.1.3. 32-Bits

5.1.4. 64-Bits

5.2. Market Attractiveness Analysis, By Type

6. Global Microcontrollers Market Analysis, By Architecture

6.1. Microcontrollers Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Architecture, 2017-2031

6.1.1. x86 Architecture

6.1.2. AVR Architecture

6.1.3. PIC Architecture

6.1.4. ARM Architecture

6.1.5. Others (Power Architecture, MIPS, etc.)

6.2. Market Attractiveness Analysis, By Architecture

7. Global Microcontrollers Market Analysis, By Memory

7.1. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By Memory, 2017-2031

7.1.1. Embedded Memory

7.1.2. External Memory

7.2. Market Attractiveness Analysis, By Memory

8. Global Microcontrollers Market Analysis, By Application

8.1. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

8.1.1. Home Appliances

8.1.2. Lighting Control Units

8.1.3. Power & Energy Metering Systems

8.1.4. Networking & Connectivity Devices

8.1.5. Measurement & Instrumentation

8.1.6. Machine Vision Systems

8.1.7. Telematics & Tracking Devices

8.1.8. Audio & Entertainment Systems

8.1.9. Others (Interactive Kiosk Modules, Sensors Control Units, etc.)

8.2. Market Attractiveness Analysis, By Application

9. Global Microcontrollers Market Analysis, By End-use Industry

9.1. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

9.1.1. Consumer Electronics

9.1.2. Automotive

9.1.3. Aerospace & Defense

9.1.4. IT & Telecommunication

9.1.5. Manufacturing

9.1.6. Energy & Utility

9.1.7. Others (Healthcare, Agriculture, etc.)

9.2. Market Attractiveness Analysis, By End-use Industry

10. Global Microcontrollers Market Analysis and Forecast, By Region

10.1. Microcontrollers Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Region, 2017-2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Market Attractiveness Analysis, By Region

11. North America Microcontrollers Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Microcontrollers Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Type, 2017-2031

11.3.1. 8-Bits

11.3.2. 16-Bits

11.3.3. 32-Bits

11.3.4. 64-Bits

11.4. Microcontrollers Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Architecture, 2017-2031

11.4.1. x86 Architecture

11.4.2. AVR Architecture

11.4.3. PIC Architecture

11.4.4. ARM Architecture

11.4.5. Others (Power Architecture, MIPS, etc.)

11.5. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By Memory, 2017-2031

11.5.1. Embedded Memory

11.5.2. External Memory

11.6. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

11.6.1. Home Appliances

11.6.2. Lighting Control Units

11.6.3. Power & Energy Metering Systems

11.6.4. Networking & Connectivity Devices

11.6.5. Measurement & Instrumentation

11.6.6. Machine Vision Systems

11.6.7. Telematics & Tracking Devices

11.6.8. Audio & Entertainment Systems

11.6.9. Others (Interactive Kiosk Modules, Sensors Control Units, etc.)

11.7. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

11.7.1. Consumer Electronics

11.7.2. Automotive

11.7.3. Aerospace & Defense

11.7.4. IT & Telecommunication

11.7.5. Manufacturing

11.7.6. Energy & Utility

11.7.7. Others (Healthcare, Agriculture, etc.)

11.8. Microcontrollers Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.8.1. U.S.

11.8.2. Canada

11.8.3. Rest of North America

11.9. Market Attractiveness Analysis

11.9.1. By Type

11.9.2. By Architecture

11.9.3. By Memory

11.9.4. By Application

11.9.5. By End-use Industry

11.9.6. By Country/Sub-region

12. Europe Microcontrollers Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Microcontrollers Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Type, 2017-2031

12.3.1. 8-Bits

12.3.2. 16-Bits

12.3.3. 32-Bits

12.3.4. 64-Bits

12.4. Microcontrollers Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Architecture, 2017-2031

12.4.1. x86 Architecture

12.4.2. AVR Architecture

12.4.3. PIC Architecture

12.4.4. ARM Architecture

12.4.5. Others (Power Architecture, MIPS, etc.)

12.5. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By Memory, 2017-2031

12.5.1. Embedded Memory

12.5.2. External Memory

12.6. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

12.6.1. Home Appliances

12.6.2. Lighting Control Units

12.6.3. Power & Energy Metering Systems

12.6.4. Networking & Connectivity Devices

12.6.5. Measurement & Instrumentation

12.6.6. Machine Vision Systems

12.6.7. Telematics & Tracking Devices

12.6.8. Audio & Entertainment Systems

12.6.9. Others (Interactive Kiosk Modules, Sensors Control Units, etc.)

12.7. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

12.7.1. Consumer Electronics

12.7.2. Automotive

12.7.3. Aerospace & Defense

12.7.4. IT & Telecommunication

12.7.5. Manufacturing

12.7.6. Energy & Utility

12.7.7. Others (Healthcare, Agriculture, etc.)

12.8. Microcontrollers Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.8.1. U.K.

12.8.2. Germany

12.8.3. France

12.8.4. Rest of Europe

12.9. Market Attractiveness Analysis

12.9.1. By Type

12.9.2. By Architecture

12.9.3. By Memory

12.9.4. By Application

12.9.5. By End-use Industry

12.9.6. By Country/Sub-region

13. Asia Pacific Microcontrollers Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Microcontrollers Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Type, 2017-2031

13.3.1. 8-Bits

13.3.2. 16-Bits

13.3.3. 32-Bits

13.3.4. 64-Bits

13.4. Microcontrollers Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Architecture, 2017-2031

13.4.1. x86 Architecture

13.4.2. AVR Architecture

13.4.3. PIC Architecture

13.4.4. ARM Architecture

13.4.5. Others (Power Architecture, MIPS, etc.)

13.5. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By Memory, 2017-2031

13.5.1. Embedded Memory

13.5.2. External Memory

13.6. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

13.6.1. Home Appliances

13.6.2. Lighting Control Units

13.6.3. Power & Energy Metering Systems

13.6.4. Networking & Connectivity Devices

13.6.5. Measurement & Instrumentation

13.6.6. Machine Vision Systems

13.6.7. Telematics & Tracking Devices

13.6.8. Audio & Entertainment Systems

13.6.9. Others (Interactive Kiosk Modules, Sensors Control Units, etc.)

13.7. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

13.7.1. Consumer Electronics

13.7.2. Automotive

13.7.3. Aerospace & Defense

13.7.4. IT & Telecommunication

13.7.5. Manufacturing

13.7.6. Energy & Utility

13.7.7. Others (Healthcare, Agriculture, etc.)

13.8. Microcontrollers Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.8.1. China

13.8.2. Japan

13.8.3. India

13.8.4. South Korea

13.8.5. ASEAN

13.8.6. Rest of Asia Pacific

13.9. Market Attractiveness Analysis

13.9.1. By Type

13.9.2. By Architecture

13.9.3. By Memory

13.9.4. By Application

13.9.5. By End-use Industry

13.9.6. By Country/Sub-region

14. Middle East & Africa Microcontrollers Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Microcontrollers Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Type, 2017-2031

14.3.1. 8-Bits

14.3.2. 16-Bits

14.3.3. 32-Bits

14.3.4. 64-Bits

14.4. Microcontrollers Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Architecture, 2017-2031

14.4.1. x86 Architecture

14.4.2. AVR Architecture

14.4.3. PIC Architecture

14.4.4. ARM Architecture

14.4.5. Others (Power Architecture, MIPS, etc.)

14.5. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By Memory, 2017-2031

14.5.1. Embedded Memory

14.5.2. External Memory

14.6. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

14.6.1. Home Appliances

14.6.2. Lighting Control Units

14.6.3. Power & Energy Metering Systems

14.6.4. Networking & Connectivity Devices

14.6.5. Measurement & Instrumentation

14.6.6. Machine Vision Systems

14.6.7. Telematics & Tracking Devices

14.6.8. Audio & Entertainment Systems

14.6.9. Others (Interactive Kiosk Modules, Sensors Control Units, etc.)

14.7. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

14.7.1. Consumer Electronics

14.7.2. Automotive

14.7.3. Aerospace & Defense

14.7.4. IT & Telecommunication

14.7.5. Manufacturing

14.7.6. Energy & Utility

14.7.7. Others (Healthcare, Agriculture, etc.)

14.8. Microcontrollers Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Market Attractiveness Analysis

14.9.1. By Type

14.9.2. By Architecture

14.9.3. By Memory

14.9.4. By Application

14.9.5. By End-use Industry

14.9.6. By Country/Sub-region

15. South America Microcontrollers Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. Microcontrollers Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Type, 2017-2031

15.3.1. 8-Bits

15.3.2. 16-Bits

15.3.3. 32-Bits

15.3.4. 64-Bits

15.4. Microcontrollers Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Architecture, 2017-2031

15.4.1. x86 Architecture

15.4.2. AVR Architecture

15.4.3. PIC Architecture

15.4.4. ARM Architecture

15.4.5. Others (Power Architecture, MIPS, etc.)

15.5. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By Memory, 2017-2031

15.5.1. Embedded Memory

15.5.2. External Memory

15.6. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

15.6.1. Home Appliances

15.6.2. Lighting Control Units

15.6.3. Power & Energy Metering Systems

15.6.4. Networking & Connectivity Devices

15.6.5. Measurement & Instrumentation

15.6.6. Machine Vision Systems

15.6.7. Telematics & Tracking Devices

15.6.8. Audio & Entertainment Systems

15.6.9. Others (Interactive Kiosk Modules, Sensors Control Units, etc.)

15.7. Microcontrollers Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

15.7.1. Consumer Electronics

15.7.2. Automotive

15.7.3. Aerospace & Defense

15.7.4. IT & Telecommunication

15.7.5. Manufacturing

15.7.6. Energy & Utility

15.7.7. Others (Healthcare, Agriculture, etc.)

15.8. Microcontrollers Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

15.8.1. Brazil

15.8.2. Rest of South America

15.9. Market Attractiveness Analysis

15.9.1. By Type

15.9.2. By Architecture

15.9.3. By Memory

15.9.4. By Application

15.9.5. By End-use Industry

15.9.6. By Country/Sub-region

16. Competition Assessment

16.1. Global Microcontrollers Market Competition Matrix - a Dashboard View

16.1.1. Global Microcontrollers Market Company Share Analysis, by Value (2022)

16.1.2. Technological Differentiator

17. Company Profiles (Global Manufacturers/Suppliers)

17.1. Analog Devices Inc.

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Key Financials

17.2. Broadcom

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Key Financials

17.3. Fujitsu Semiconductor Limited

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Key Financials

17.4. Infineon Technologies AG

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Key Financials

17.5. Intel Corporation

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Key Financials

17.6. Microchip Technology Inc.

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Key Financials

17.7. NXP Semiconductor

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Key Financials

17.8. Semiconductor Components Industries, LLC

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Key Financials

17.9. Renesas Electronics Corporation

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Key Financials

17.10. ROHM CO., LTD.

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Key Financials

17.11. Samsung Electronics

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Key Subsidiaries or Distributors

17.11.5. Strategy and Recent Developments

17.11.6. Key Financials

17.12. Silabs India Private Limited

17.12.1. Overview

17.12.2. Product Portfolio

17.12.3. Sales Footprint

17.12.4. Key Subsidiaries or Distributors

17.12.5. Strategy and Recent Developments

17.12.6. Key Financials

17.13. STMicroelectronics Private Limited

17.13.1. Overview

17.13.2. Product Portfolio

17.13.3. Sales Footprint

17.13.4. Key Subsidiaries or Distributors

17.13.5. Strategy and Recent Developments

17.13.6. Key Financials

17.14. Texas Instruments Incorporated

17.14.1. Overview

17.14.2. Product Portfolio

17.14.3. Sales Footprint

17.14.4. Key Subsidiaries or Distributors

17.14.5. Strategy and Recent Developments

17.14.6. Key Financials

17.15. Toshiba Electronic Devices & Storage Corporation

17.15.1. Overview

17.15.2. Product Portfolio

17.15.3. Sales Footprint

17.15.4. Key Subsidiaries or Distributors

17.15.5. Strategy and Recent Developments

17.15.6. Key Financials

17.16. Vishwa Group

17.16.1. Overview

17.16.2. Product Portfolio

17.16.3. Sales Footprint

17.16.4. Key Subsidiaries or Distributors

17.16.5. Strategy and Recent Developments

17.16.6. Key Financials

18. Go To Market Strategy

18.1. Identification of Potential Market Spaces

18.2. Understanding Buying Process of Customers

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Microcontrollers Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 2: Global Microcontrollers Market Volume (Billion Units) & Forecast, by Type, 2017-2031

Table 3: Global Microcontrollers Market Value (US$ Bn) & Forecast, by Architecture, 2017-2031

Table 4: Global Microcontrollers Market Volume (Billion Units) & Forecast, by Architecture, 2017-2031

Table 5: Global Microcontrollers Market Value (US$ Bn) & Forecast, by Memory, 2017-2031

Table 6: Global Microcontrollers Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 7: Global Microcontrollers Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 8: Global Microcontrollers Market Value (US$ Bn) & Forecast, by Region, 2017-2031

Table 9: Global Microcontrollers Market Volume (Billion Units) & Forecast, by Region, 2017-2031

Table 10: North America Microcontrollers Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 11: North America Microcontrollers Market Volume (Billion Units) & Forecast, by Type, 2017-2031

Table 12: North America Microcontrollers Market Value (US$ Bn) & Forecast, by Architecture, 2017-2031

Table 13: North America Microcontrollers Market Volume (Billion Units) & Forecast, byArchitecture, 2017-2031

Table 14: North America Microcontrollers Market Value (US$ Bn) & Forecast, by Memory, 2017-2031

Table 15: North America Microcontrollers Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 16: North America Microcontrollers Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 17: North America Microcontrollers Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 18: North America Microcontrollers Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 19: Europe Microcontrollers Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 20: Europe Microcontrollers Market Volume (Billion Units) & Forecast, by Type, 2017-2031

Table 21: Europe Microcontrollers Market Value (US$ Bn) & Forecast, by Architecture, 2017-2031

Table 22: Europe Microcontrollers Market Volume (Billion Units) & Forecast, by Architecture, 2017-2031

Table 23: Europe Microcontrollers Market Value (US$ Bn) & Forecast, by Memory, 2017-2031

Table 24: Europe Microcontrollers Market Volume (Billion Units) & Forecast, by Memory, 2017-2031

Table 25: Europe Microcontrollers Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 26: Europe Microcontrollers Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 27: Europe Microcontrollers Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 28: Europe Microcontrollers Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 29: Asia Pacific Microcontrollers Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 30: Asia Pacific Microcontrollers Market Volume (Billion Units) & Forecast, by Type, 2017-2031

Table 31: Asia Pacific Microcontrollers Market Value (US$ Bn) & Forecast, by Architecture, 2017-2031

Table 32: Asia Pacific Microcontrollers Market Volume (Billion Units) & Forecast, by Architecture, 2017-2031

Table 33: Asia Pacific Microcontrollers Market Value (US$ Bn) & Forecast, by Memory, 2017-2031

Table 34: Asia Pacific Microcontrollers Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 35: Asia Pacific Microcontrollers Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 36: Asia Pacific Microcontrollers Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 37: Asia Pacific Microcontrollers Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 38: Middle East & Africa Microcontrollers Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 39: Middle East & Africa Microcontrollers Market Volume (Billion Units) & Forecast, by Type, 2017-2031

Table 40: Middle East & Africa Microcontrollers Market Value (US$ Bn) & Forecast, by Architecture, 2017-2031

Table 41: Middle East & Africa Microcontrollers Market Volume (Billion Units) & Forecast, by Architecture, 2017-2031

Table 42: Middle East & Africa Microcontrollers Market Value (US$ Bn) & Forecast, by Memory, 2017-2031

Table 43: Middle East & Africa Microcontrollers Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 44: Middle East & Africa Microcontrollers Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 45: Middle East & Africa Microcontrollers Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 46: Middle East & Africa Microcontrollers Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 47: South America Microcontrollers Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 48: South America Microcontrollers Market Volume (Billion Units) & Forecast, by Type, 2017-2031

Table 49: South America Microcontrollers Market Value (US$ Bn) & Forecast, by Architecture, 2017-2031

Table 50: South America Microcontrollers Market Volume (Billion Units) & Forecast, by Architecture, 2017-2031

Table 51: South America Microcontrollers Market Value (US$ Bn) & Forecast, by Memory, 2017-2031

Table 52: South America Microcontrollers Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 53: South America Microcontrollers Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 54: South America Microcontrollers Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 55: South America Microcontrollers Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 01: Supply Chain Analysis - Global Microcontrollers Market

Figure 02: Porter Five Forces Analysis - Global Microcontrollers Market

Figure 03: Technology Road Map - Global Microcontrollers Market

Figure 04: Global Microcontrollers Market, Value (US$ Bn), 2017-2031

Figure 05: Global Microcontrollers Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017-2031

Figure 06: Global Microcontrollers Market Projections by Type, Value (US$ Bn), 2017-2031

Figure 07: Global Microcontrollers Market, Incremental Opportunity, by Type, 2023-2031

Figure 08: Global Microcontrollers Market Share Analysis, by Type, 2023 and 2031

Figure 09: Global Microcontrollers Market Projections by Architecture, Value (US$ Bn), 2017-2031

Figure 10: Global Microcontrollers Market, Incremental Opportunity, by Architecture, 2023-2031

Figure 11: Global Microcontrollers Market Share Analysis, by Architecture, 2023 and 2031

Figure 12: Global Microcontrollers Market Projections by Memory, Value (US$ Bn), 2017-2031

Figure 13: Global Microcontrollers Market, Incremental Opportunity, by Memory, 2023-2031

Figure 14: Global Microcontrollers Market Share Analysis, by Memory, 2023 and 2031

Figure 15: Global Microcontrollers Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 16: Global Microcontrollers Market, Incremental Opportunity, by Application, 2023-2031

Figure 17: Global Microcontrollers Market Share Analysis, by Application, 2023 and 2031

Figure 18: Global Microcontrollers Market Projections by End-use Industry, Value (US$ Bn), 2017-2031

Figure 19: Global Microcontrollers Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 20: Global Microcontrollers Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 21: Global Microcontrollers Market Projections by Region, Value (US$ Bn), 2017-2031

Figure 22: Global Microcontrollers Market, Incremental Opportunity, by Region, 2023-2031

Figure 23: Global Microcontrollers Market Share Analysis, by Region, 2023 and 2031

Figure 24: North America Microcontrollers Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 25: North America Microcontrollers Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017-2031

Figure 26: North America Microcontrollers Market Projections by Type Value (US$ Bn), 2017-2031

Figure 27: North America Microcontrollers Market, Incremental Opportunity, by Type, 2023-2031

Figure 28: North America Microcontrollers Market Share Analysis, by Type, 2023 and 2031

Figure 29: North America Microcontrollers Market Projections by Architecture Value (US$ Bn), 2017-2031

Figure 30: North America Microcontrollers Market, Incremental Opportunity, by Architecture, 2023-2031

Figure 31: North America Microcontrollers Market Share Analysis, by Architecture, 2023 and 2031

Figure 32: North America Microcontrollers Market Projections by Memory (US$ Bn), 2017-2031

Figure 33: North America Microcontrollers Market, Incremental Opportunity, by Memory, 2023-2031

Figure 34: North America Microcontrollers Market Share Analysis, by Memory, 2023 and 2031

Figure 35: North America Microcontrollers Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 36: North America Microcontrollers Market, Incremental Opportunity, by Application, 2023-2031

Figure 37: North America Microcontrollers Market Share Analysis, by Application, 2023 and 2031

Figure 38: North America Microcontrollers Market Projections by End-use Industry Value (US$ Bn), 2017-2031

Figure 39: North America Microcontrollers Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 40: North America Microcontrollers Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 41: North America Microcontrollers Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 42: North America Microcontrollers Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 43: North America Microcontrollers Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 44: Europe Microcontrollers Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 45: Europe Microcontrollers Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017-2031

Figure 46: Europe Microcontrollers Market Projections by Type Value (US$ Bn), 2017-2031

Figure 47: Europe Microcontrollers Market, Incremental Opportunity, by Type, 2023-2031

Figure 48: Europe Microcontrollers Market Share Analysis, by Type, 2023 and 2031

Figure 49: Europe Microcontrollers Market Projections by Architecture, Value (US$ Bn), 2017-2031

Figure 50: Europe Microcontrollers Market, Incremental Opportunity, by Architecture, 2023-2031

Figure 51: Europe Microcontrollers Market Share Analysis, by Architecture, 2023 and 2031

Figure 52: Europe Microcontrollers Market Projections by Memory, Value (US$ Bn), 2017-2031

Figure 53: Europe Microcontrollers Market, Incremental Opportunity, by Memory, 2023-2031

Figure 54: Europe Microcontrollers Market Share Analysis, by Memory, 2023 and 2031

Figure 55: Europe Microcontrollers Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 56: Europe Microcontrollers Market, Incremental Opportunity, by Application, 2023-2031

Figure 57: Europe Microcontrollers Market Share Analysis, by Application, 2023 and 2031

Figure 58: Europe Microcontrollers Market Projections by End-use Industry, Value (US$ Bn), 2017-2031

Figure 59: Europe Microcontrollers Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 60: Europe Microcontrollers Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 61: Europe Microcontrollers Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 62: Europe Microcontrollers Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 63: Europe Microcontrollers Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 64: Asia Pacific Microcontrollers Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 65: Asia Pacific Microcontrollers Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017-2031

Figure 66: Asia Pacific Microcontrollers Market Projections by Type Value (US$ Bn), 2017-2031

Figure 67: Asia Pacific Microcontrollers Market, Incremental Opportunity, by Type, 2023-2031

Figure 68: Asia Pacific Microcontrollers Market Share Analysis, by Type, 2023 and 2031

Figure 69: Asia Pacific Microcontrollers Market Projections by Architecture Value (US$ Bn), 2017-2031

Figure 70: Asia Pacific Microcontrollers Market, Incremental Opportunity, by Architecture, 2023-2031

Figure 71: Asia Pacific Microcontrollers Market Share Analysis, by Architecture, 2023 and 2031

Figure 72: Asia Pacific Microcontrollers Market Projections by Memory, Value (US$ Bn), 2017-2031

Figure 73: Asia Pacific Microcontrollers Market, Incremental Opportunity, by Memory, 2023-2031

Figure 74: Asia Pacific Microcontrollers Market Share Analysis, by Memory, 2023 and 2031

Figure 75: Asia Pacific Microcontrollers Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 76: Asia Pacific Microcontrollers Market, Incremental Opportunity, by Application, 2023-2031

Figure 77: Asia Pacific Microcontrollers Market Share Analysis, by Application, 2023 and 2031

Figure 78: Asia Pacific Microcontrollers Market Projections by End-use Industry, Value (US$ Bn), 2017-2031

Figure 79: Asia Pacific Microcontrollers Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 80: Asia Pacific Microcontrollers Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 81: Asia Pacific Microcontrollers Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 82: Asia Pacific Microcontrollers Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 83: Asia Pacific Microcontrollers Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 84: Middle East & Africa Microcontrollers Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 85: Middle East & Africa Microcontrollers Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017-2031

Figure 86: Middle East & Africa Microcontrollers Market Projections by Type Value (US$ Bn), 2017-2031

Figure 87: Middle East & Africa Microcontrollers Market, Incremental Opportunity, by Type, 2023-2031

Figure 88: Middle East & Africa Microcontrollers Market Share Analysis, by Type, 2023 and 2031

Figure 89: Middle East & Africa Microcontrollers Market Projections by Architecture Value (US$ Bn), 2017-2031

Figure 90: Middle East & Africa Microcontrollers Market, Incremental Opportunity, by Architecture, 2023-2031

Figure 91: Middle East & Africa Microcontrollers Market Share Analysis, by Architecture, 2023 and 2031

Figure 92: Middle East & Africa Microcontrollers Market Projections by Memory, Value (US$ Bn), 2017-2031

Figure 93: Middle East & Africa Microcontrollers Market, Incremental Opportunity, by Memory, 2023-2031

Figure 94: Middle East & Africa Microcontrollers Market Share Analysis, by Memory, 2023 and 2031

Figure 95: Middle East & Africa Microcontrollers Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 96: Middle East & Africa Microcontrollers Market, Incremental Opportunity, by Application, 2023-2031

Figure 97: Middle East & Africa Microcontrollers Market Share Analysis, by Application, 2023 and 2031

Figure 98: Middle East & Africa Microcontrollers Market Projections by End-use Industry Value (US$ Bn), 2017-2031

Figure 99: Middle East & Africa Microcontrollers Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 100: Middle East & Africa Microcontrollers Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 101: Middle East & Africa Microcontrollers Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 102: Middle East & Africa Microcontrollers Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 103: Middle East & Africa Microcontrollers Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 104: South America Microcontrollers Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 105: South America Microcontrollers Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017-2031

Figure 106: South America Microcontrollers Market Projections by Type Value (US$ Bn), 2017-2031

Figure 107: South America Microcontrollers Market, Incremental Opportunity, by Type, 2023-2031

Figure 108: South America Microcontrollers Market Share Analysis, by Type, 2023 and 2031

Figure 109: South America Microcontrollers Market Projections by Architecture Value (US$ Bn), 2017-2031

Figure 110: South America Microcontrollers Market, Incremental Opportunity, by Architecture, 2023-2031

Figure 111: South America Microcontrollers Market Share Analysis, by Architecture, 2023 and 2031

Figure 112: South America Microcontrollers Market Projections by Memory, Value (US$ Bn), 2017-2031

Figure 113: South America Microcontrollers Market, Incremental Opportunity, by Memory, 2023-2031

Figure 114: South America Microcontrollers Market Share Analysis, by Memory, 2023 and 2031

Figure 115: South America Microcontrollers Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 116: South America Microcontrollers Market, Incremental Opportunity, by Application, 2023-2031

Figure 117: South America Microcontrollers Market Share Analysis, by Application, 2023 and 2031

Figure 118: South America Microcontrollers Market Projections by End-use Industry Value (US$ Bn), 2017-2031

Figure 119: South America Microcontrollers Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 120: South America Microcontrollers Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 121: South America Microcontrollers Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 122: South America Microcontrollers Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 123: South America Microcontrollers Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 124: Global Microcontrollers Market Competition

Figure 125: Global Microcontrollers Market Company Share Analysis