Tax Exemptions for LED Technology Encourage Use of LED Drivers and Chipsets

The prime concern about rising energy consumption and increasing carbon footprint at a global scale has prompted governments to motivate users to opt for LED technology, observes Transparency Market Research. LED technology is currently being used in a wide range of applications within displays and lighting solutions. These factors are collectively creating a positive impact on the growth of the global LED driver and chipset market, as LED drivers are crucial components for improving the performance of LED lights. Tax exemptions offered by governments on LED devices have also prompted several consumers to replace traditional lighting solutions with modern LED technology.

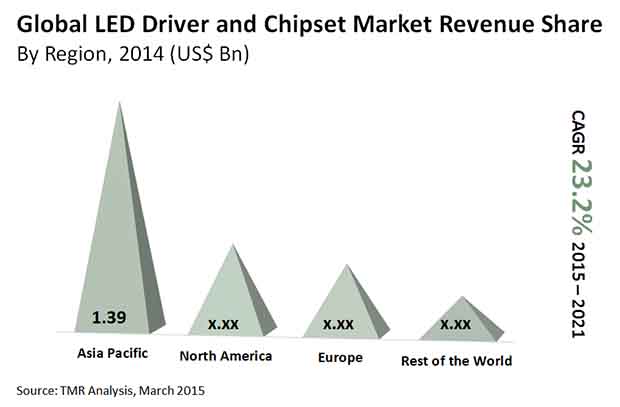

All of these factors put together are expected to create an opportunity worth US$11.99 bn in the global LED driver and chipset market by the end of 2021, rising from US$2.80 bn in 2014 at a CAGR of 23.2% between 2015 and 2021 in terms of revenue. The growing demand for prominent and large displays such as billboards and screens in sports stadiums, increased lifespan of LED lighting solutions, and reduced carbon footprint are some of the key factors augmenting the revenues of this market. However, the initial high cost of investment in LED drivers and chipsets is dissuading consumers. The lack of awareness about benefits of this technology as compared to conventional lighting solutions is also hampering the market growth.

LED Displays to Occupy Highest Share in the Revenue Pie

LED drivers and chipsets are used in lighting solutions and for in displays integrated in various electronic devices. The extensive demand for devices with displays is increasing the adoption of LED drivers and chipsets in the LED displays segment. Today, displays are in huge demand due to exponential consumption of mobile phones, television devices, sports arenas, medical devices, and billboards, amongst others.

The displays segment is expected to expand at a whopping CAGR of 23.0% between 2015 and 2021 due to the aforementioned factors. Display makers are proactively opting for LEDs as they drastically reduce the maintenance costs and replacement costs, thereby allowing users to use the devices without any hassles or additional costs.

Strong Presence of LED Manufacturers in China Augments Asia Pacific Market Growth

The global LED driver and chipset market is spread over regions such as North America, Europe, Asia Pacific, and Rest of the World. Out of these, Asia Pacific held the largest share in the market, accounting for nearly 49.60% in 2014 in terms of revenue. This contribution is expected to climb up to 50% by the end of 2021. The sharp fall in LED prices due to growing investments by companies in expanding production facilities has resulted in the surge of the LED driver and chipset market in Asia Pacific.

A strong presence of LED manufacturers in emerging economies of China, who are continuously improving conductivity, consumption, and voltage aspect of LEDs will propel the usage of LED drivers and chipsets over the forecast period.

Some of the important players operating in the global LED driver and chipset market are Diodes Inc., Advanced Analogic Technologies Inc., and Ixys Corp. Continuous product innovation to differentiate from other products available in the market is one of the key strategies adopted by manufacturers. Furthermore, players are also focusing on developing LED products that are in tandem with technological developments and unique demands of the consumers to stay ahead of the competition.

Focus on Reprogrammability of Products Key Consumer Proposition in LED Driver and Chipset Market

LED drivers and chipsets are conventionally used in driving the various performance characteristics of LED technologies notably in lighting applications. LED drivers are also used in signages meant for public spaces. The LED driver and chipsets market has made strides on the growing adoption of these in general lighting, backlighting, automotive, lighting, and RGB and monochromatic displays for smart consumer devices. Over the years, LED manufacturers have been successful in leveraging the potential of these in achieving high level of reprogrammability and configuration for LED devices. A case in point is the dimming capability. The demand for high power density options is a key trend fueling the adoption of LED drivers and chipsets. New designs and topologies have come to the fore using LED chipsets. IC manufacturers also use LED chipsets for analog devices in hand-held high-power lighting applications. The automotive industry is expected to be a massive driver for avenues in the LED driver and chipset market. Automotive manufacturers are looking for cutting-edge LED technologies for various energy-efficient lighting applications, which is expected to fuel the prospects in the LED drivers and chipsets market. In their pursuit, the emergence of new microchip fabrications methods will spur their progress.

The COVID-19 crisis that has fast spread throughout the economies across the globe in last few months, notably in latter part of 2020, has led to new business normals. These normals have changed the consumer capture propositions of businesses across industries. Several key industries including automotive showed a decline demand by consumers, hindering the prospects of the LED driver and chipset market. Numerous new entrants and even incumbent players have been able to gain foothold and consolidate their positions by actively shifting to new strategic frameworks. Moreover, researchers were able to continue their activities by shifting to new digital technologies for collaborations. This has positively driven the demands in various end-use industries.

Chapter 1 Preface

1.1 Report Description

1.2 Research Scope

1.3 Key takes away

1.4 Research Methodology

Chapter 2 Executive Summary

Chapter 3 Market Overview

3.1 Introduction

3.2 Market Dynamics

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.3 Competitive strategies adopted by major players

3.4 Market attractiveness analysis, by display

3.5 Market attractiveness analysis, by lighting

Chapter 4 Global LED Driver Chipset Market Revenue, By Application (USD Billion)

4.1 Global LED Driver Chipset Market Revenue, By Application, Overview

4.2 Display market, 2014-2021: Revenue forecast

4.2.1 Display market, 2014-2021: Revenue forecast, By Application

4.3 Lighting market, 2014-2021: Revenue forecast

4.3.1 Lighting market, 2014-2021: Revenue forecast, By Application

Chapter 5 Global LED Driver Chipset Market Revenue, By Region (USD Billion)

5.1 Global LED Driver Chipset Market Revenue, By Region, Overview

5.1.1 By Region: Revenue Share

5.2 North America LED Driver and Chipset market, 2014-2021: Revenue forecast

5.2.1 North America LED Driver and Chipset market, 2014-2021: Revenue forecast, by country

5.2.2 North America LED Driver and Chipset market, 2014-2021: Revenue forecast, by display

5.2.3 North America LED Driver and Chipset market, 2014-2021: Revenue forecast, by Lighting

5.3 Europe LED Driver and Chipset market, 2014-2021: Revenue forecast

5.3.1 Europe LED Driver and Chipset market, 2014-2021: Revenue forecast, by country

5.3.2 Europe LED Driver and Chipset market, 2014-2021: Revenue forecast, by display

5.3.3 Europe LED Driver and Chipset market, 2014-2021: Revenue forecast, by Lighting

5.4 Asia Pacific LED Driver and Chipset market, 2014-2021: Revenue forecast

5.4.1 Asia Pacific LED Driver and Chipset market, 2014-2021: Revenue forecast, by country

5.4.2 Asia Pacific LED Driver and Chipset market, 2014-2021: Revenue forecast, by display

5.4.3 Asia Pacific LED Driver and Chipset market, 2014-2021: Revenue forecast, by Lighting

5.5 RoW LED Driver and Chipset market, 2014-2021: Revenue forecast

5.5.1 RoW LED Driver and Chipset market, 2014-2021: Revenue forecast, by country

5.5.2 RoW LED Driver and Chipset market, 2014-2021: Revenue forecast, by display

5.5.3 RoW LED Driver and Chipset market, 2014-2021: Revenue forecast, by Lighting

Chapter 6 Company Profiles

6.1 Advanced Analogic Technologies, INC.

6.2 Texas Instruments, INC.

6.3 Diodes, INC

6.4 Exar Corp

6.5 Nxp Semiconductors Nv

6.6 Stmicroelectronics N.V.

6.7 Fairchild Semiconductor

6.8 Freescale Semiconductor, INC

6.9 Infineon Technologies AG

6.10 Maxim Integrated Products, INC

List of Tables

TABLE 1 Display market, 2014-2021: Revenue forecast, By Application

TABLE 2 Lighting market, 2014-2021: Revenue forecast, By Application

TABLE 3 North America LED Driver and Chipset market, 2014-2021: Revenue forecast, by country

TABLE 4 North America LED Driver and Chipset market, 2014-2021: Revenue forecast, by display

TABLE 5 North America LED Driver and Chipset market, 2014-2021: Revenue forecast, by lighting

TABLE 6 Europe LED Driver and Chipset market, 2014-2021: Revenue forecast, by country

TABLE 7 Europe LED Driver and Chipset market, 2014-2021: Revenue forecast, by display

TABLE 8 Europe LED Driver and Chipset market, 2014-2021: Revenue forecast, by lighting

TABLE 9 Asia Pacific LED Driver and Chipset market, 2014-2021: Revenue forecast, by country

TABLE 10 Asia Pacific LED Driver and Chipset market, 2014-2021: Revenue forecast, by display

TABLE 11 Asia Pacific LED Driver and Chipset market, 2014-2021: Revenue forecast, by lighting

TABLE 12 RoW LED Driver and Chipset market, 2014-2021: Revenue forecast, by country

TABLE 13 RoW LED Driver and Chipset market, 2014-2021: Revenue forecast, by display

TABLE 14 RoW LED Driver and Chipset market, 2014-2021: Revenue forecast, by lighting

List of Figures

FIG. 1 Market Segmentation ofLED Driver Chipset Market

FIG. 2 Snapshot: Global LED Driver and Chipset Market Market

FIG. 3 Market attractiveness analysis, by display, 2014

FIG. 4 Market attractiveness analysis, by lighting, 2014

FIG. 5 Global Display Market, 2014 – 2021, (USD Billion)

FIG. 6 Lighting Market, 2014 – 2021, (USD Billion)

FIG. 7 Global LED Driver and Chipset market revenue share, by region, 2014 Vs 2021

FIG. 8 North America LED Driver and Chipset market, 2014 – 2021, (USD Billion)

FIG. 9 Europe LED Driver and Chipset market, 2014 – 2021, (USD Billion)

FIG. 10 Asia Pacific LED Driver and Chipset market, 2014 – 2021, (USD Billion)

FIG. 11 RoW LED Driver and Chipset market, 2014 – 2021, (USD Billion)