Key players in the global geriatric medicine market are engaged in regulatory approvals, technologically advanced products, launch of new products, and acquisition & collaborative agreements with other companies. These strategies are likely to fuel the growth of the global geriatric medicine market. A few expansion strategies adopted by players operating in the global geriatric medicine market are:

The report on the global geriatric medicine market discussed individual strategies, followed by company profiles of manufacturers of geriatric medicine. The competitive landscape section has been included in the report to provide readers with a dashboard view and a company market share analysis of key players operating in the global geriatric medicine market.

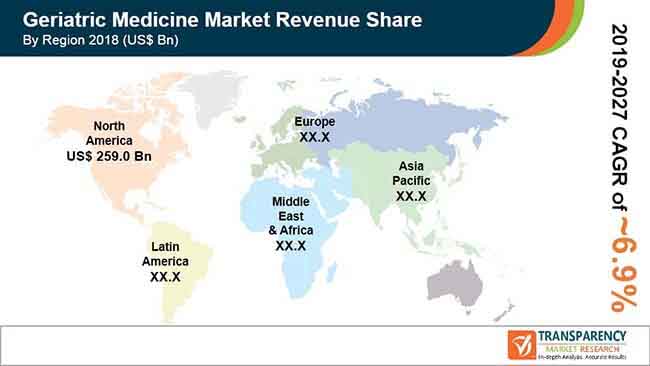

Geriatric medicines market to reach US$ 1142.8 Bn by 2027

Geriatric medicines market to expand at a CAGR of 6.9% from 2019 to 2027

Geriatric medicines market is driven by rise in chronic diseases and and technological advancement for medication assistance

The analgesic segment dominated the global geriatric medicine market and the trend is projected to continue during the forecast period

Key players in the global geriatric medicine market include Pfizer, Inc., Merck & Co., Inc., AstraZeneca, Bristol-Myers Squibb Company, Novartis AG

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Geriatric Medicine Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Geriatric Medicine Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Regulatory Scenario, by Region/Globally

5.2. Pipeline Analysis

5.3. Mergers & Acquisitions

6. Global Geriatric Medicine Market Analysis and Forecast, by Therapeutic Category

6.1. Introduction & Definition

6.1.1. Key Findings / Developments

6.2. Global Geriatric Medicine Market Value Forecast, by Therapeutic Category, 2017–2027

6.2.1. Analgesic

6.2.2. Antihypertensive

6.2.3. Statins

6.2.4. Antidiabetic

6.2.5. Proton Pump Inhibitor

6.2.6. Anticoagulant

6.2.7. Antipsychotic and Antidepressant

6.2.8. Others

6.3. Global Geriatric Medicine Market Attractiveness, by Therapeutic Category

7. Global Geriatric Medicine Market Analysis and Forecast, by Condition

7.1. Introduction & Definition

7.1.1. Key Findings / Developments

7.2. Global Geriatric Medicine Market Value Forecast, by Condition, 2017–2027

7.2.1. Cardiovascular

7.2.2. Arthritis

7.2.3. Diabetes

7.2.4. Neurological

7.2.5. Cancer

7.2.6. Osteoporosis

7.2.7. Respiratory

7.2.8. Others

7.3. Global Geriatric Medicine Market Attractiveness, by Condition

8. Global Geriatric Medicine Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.1.1. Key Findings / Developments

8.2. Global Geriatric Medicine Market Value Forecast, by Distribution Channel, 2017–2027

8.2.1. Hospital Pharmacies

8.2.2. Retail Pharmacies

8.2.3. Online Pharmacies

8.3. Global Geriatric Medicine Market Attractiveness, by Distribution Channel

9. Global Geriatric Medicine Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global Geriatric Medicine Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Geriatric Medicine Market Attractiveness, by Region

10. North America Geriatric Medicine Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. North America Geriatric Medicine Market Value (US$ Mn) Forecast, by Therapeutic Category, 2017–2027

10.2.1. Analgesic

10.2.2. Antihypertensive

10.2.3. Statins

10.2.4. Antidiabetic

10.2.5. Proton Pump Inhibitor

10.2.6. Anticoagulant

10.2.7. Antipsychotic and Antidepressant

10.2.8. Others

10.3. North America Geriatric Medicine Market Value (US$ Mn) Forecast, by Condition, 2017–2027

10.3.1. Cardiovascular

10.3.2. Arthritis

10.3.3. Diabetes

10.3.4. Neurological

10.3.5. Cancer

10.3.6. Osteoporosis

10.3.7. Respiratory

10.3.8. Others

10.4. North America Geriatric Medicine Market Value (US$ Mn) Forecast, by Distribution Channels, 2017–2027

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. North America Geriatric Medicine Market Value (US$ Mn) Forecast, by Country, 2017–2027

10.5.1. U.S.

10.5.2. Canada

10.6. North America Geriatric Medicine Market Attractiveness Analysis

10.6.1. By Therapeutic Category

10.6.2. By Condition

10.6.3. By Distribution Channels

10.6.4. By Country

11. Europe Geriatric Medicine Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Europe Geriatric Medicine Market Value (US$ Mn) Forecast, by Therapeutic Category, 2017–2027

11.2.1. Analgesic

11.2.2. Antihypertensive

11.2.3. Statins

11.2.4. Antidiabetic

11.2.5. Proton Pump Inhibitor

11.2.6. Anticoagulant

11.2.7. Antipsychotic and Antidepressant

11.2.8. Others

11.3. Europe Geriatric Medicine Market Value (US$ Mn) Forecast, by Condition, 2017–2027

11.3.1. Cardiovascular

11.3.2. Arthritis

11.3.3. Diabetes

11.3.4. Neurological

11.3.5. Cancer

11.3.6. Osteoporosis

11.3.7. Respiratory

11.3.8. Others

11.4. Europe Geriatric Medicine Market Value (US$ Mn) Forecast, by Distribution Channels, 2017–2027

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Europe Geriatric Medicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Europe Geriatric Medicine Market Attractiveness Analysis

11.6.1. By Therapeutic Category

11.6.2. By Condition

11.6.3. By Distribution Channels

11.6.4. By Country/Sub-region

12. Asia Pacific Geriatric Medicine Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Asia Pacific Geriatric Medicine Market Value (US$ Mn) Forecast, by Therapeutic Category, 2017–2027

12.2.1. Analgesic

12.2.2. Antihypertensive

12.2.3. Statins

12.2.4. Antidiabetic

12.2.5. Proton Pump Inhibitor

12.2.6. Anticoagulant

12.2.7. Antipsychotic and Antidepressant

12.2.8. Others

12.3. Asia Pacific Geriatric Medicine Market Value (US$ Mn) Forecast, by Condition, 2017–2027

12.3.1. Cardiovascular

12.3.2. Arthritis

12.3.3. Diabetes

12.3.4. Neurological

12.3.5. Cancer

12.3.6. Osteoporosis

12.3.7. Respiratory

12.3.8. Others

12.4. Asia Pacific Geriatric Medicine Market Value (US$ Mn) Forecast, by Distribution Channels, 2017–2027

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Asia Pacific Geriatric Medicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Asia Pacific Geriatric Medicine Market Attractiveness Analysis

12.6.1. By Therapeutic Category

12.6.2. By Condition

12.6.3. By Distribution Channels

12.6.4. By Country/Sub-region

13. Latin America Geriatric Medicine Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Latin America Geriatric Medicine Market Value (US$ Mn) Forecast, by Therapeutic Category, 2017–2027

13.2.1. Analgesic

13.2.2. Antihypertensive

13.2.3. Statins

13.2.4. Antidiabetic

13.2.5. Proton Pump Inhibitor

13.2.6. Anticoagulant

13.2.7. Antipsychotic and Antidepressant

13.2.8. Others

13.3. Latin America Geriatric Medicine Market Value (US$ Mn) Forecast, by Condition, 2017–2027

13.3.1. Cardiovascular

13.3.2. Arthritis

13.3.3. Diabetes

13.3.4. Neurological

13.3.5. Cancer

13.3.6. Osteoporosis

13.3.7. Respiratory

13.3.8. Others

13.4. Latin America Geriatric Medicine Market Value (US$ Mn) Forecast, by Distribution Channels, 2017–2027

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Latin America Geriatric Medicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America Latin America

13.6. Latin America Geriatric Medicine Market Attractiveness Analysis

13.6.1. By Therapeutic Category

13.6.2. By Condition

13.6.3. By Distribution Channels

13.6.4. By Country/Sub-region

14. Middle East & Africa Geriatric Medicine Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Middle East & Africa Geriatric Medicine Market Value (US$ Mn) Forecast, by Therapeutic Category, 2017–2027

14.2.1. Analgesic

14.2.2. Antihypertensive

14.2.3. Statins

14.2.4. Antidiabetic

14.2.5. Proton Pump Inhibitor

14.2.6. Anticoagulant

14.2.7. Antipsychotic and Antidepressant

14.2.8. Others

14.3. Middle East & Africa Geriatric Medicine Market Value (US$ Mn) Forecast, by Condition, 2017–2027

14.3.1. Cardiovascular

14.3.2. Arthritis

14.3.3. Diabetes

14.3.4. Neurological

14.3.5. Cancer

14.3.6. Osteoporosis

14.3.7. Respiratory

14.3.8. Others

14.4. Middle East & Africa Geriatric Medicine Market Value (US$ Mn) Forecast, by Distribution Channels, 2017–2027

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Middle East & Africa Geriatric Medicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Middle East & Africa Geriatric Medicine Market Attractiveness Analysis

14.6.1. By Therapeutic Category

14.6.2. By Condition

14.6.3. By Distribution Channels

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by Tier and Size of companies)

15.2. Company Profiles

15.2.1. Pfizer, Inc.

15.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.1.2. Growth Strategies

15.2.1.3. SWOT Analysis

15.2.2. Merck & Co., Inc.

15.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.2.2. Growth Strategies

15.2.2.3. SWOT Analysis

15.2.3. AstraZeneca

15.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.3.2. Growth Strategies

15.2.3.3. SWOT Analysis

15.2.4. Bristol-Myers Squibb Company

15.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.4.2. Growth Strategies

15.2.4.3. SWOT Analysis

15.2.5. Novartis AG

15.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.5.2. Growth Strategies

15.2.5.3. SWOT Analysis

15.2.6. Sanofi S.A.

15.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.6.2. Growth Strategies

15.2.6.3. SWOT Analysis

15.2.7. GlaxoSmithKline plc

15.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.7.2. Growth Strategies

15.2.7.3. SWOT Analysis

15.2.8. Eli Lilly and Company

15.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.8.2. Growth Strategies

15.2.8.3. SWOT Analysis

15.2.9. Abbott Laboratories

15.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.9.2. Growth Strategies

15.2.9.3. SWOT Analysis

15.2.10. Boehringer Ingelheim GmbH

15.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.10.2. Growth Strategies

15.2.10.3. SWOT Analysis

List of Table

Table 01: Major Causes of Death for Persons Aged 65 or Over, 2014 (Standardized Death Rates per 100,000 Inhabitants)

Table 02: Healthcare Overview (2016 or latest available)

Table 03: Global Geriatric Medicines Market Value (US$ Mn) Forecast, by Therapeutic Category, 2017–2017

Table 04: Global Geriatric Medicines Market Value (US$ Mn) Forecast, by Condition, 2017–2017

Table 05: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2017

Table 06: Global Geriatric Medicines Market Value (US$ Mn) Forecast, by Region, 2017–2017

Table 07: North America Geriatric Medicines Market Value (US$ Mn) Forecast, by Therapeutic Category, 2017–2027

Table 08: North America Geriatric Medicines Market Value (US$ Mn) Forecast, by Condition, 2017–2027

Table 09: North America Geriatric Medicines Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2017

Table 10: North America Geriatric Medicines Market Value (US$ Mn) Forecast, by Country, 2017–2017

Table 11: Europe Geriatric Medicines Market Value (US$ Mn) Forecast, by Therapeutic Category, 2017–2027

Table 12: Europe Geriatric Medicines Market Value (US$ Mn) Forecast, by Condition, 2017–2027

Table 13: Europe Geriatric Medicines Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2017

Table 14: Europe Geriatric Medicines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2017

Table 15: Asia Pacific Geriatric Medicines Market Value (US$ Mn) Forecast, by Therapeutic Category, 2017–2027

Table 16: Asia Pacific Geriatric Medicines Market Value (US$ Mn) Forecast, by Condition, 2017–2027

Table 17: Asia Pacific Geriatric Medicines Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2017

Table 18: Asia Pacific Geriatric Medicines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2017

Table 19: Latin America Geriatric Medicines Market Value (US$ Mn) Forecast, by Therapeutic Category, 2017–2027

Table 20: Latin America Geriatric Medicines Market Value (US$ Mn) Forecast, by Condition, 2017–2027

Table 21: Latin America Geriatric Medicines Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2017

Table 22: Latin America Geriatric Medicines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2017

Table 23: Middle East & Africa (MEA) Geriatric Medicines Market Value (US$ Mn) Forecast, by Therapeutic Category, 2017–2027

Table 24: Middle East & Africa (MEA) Geriatric Medicines Market Value (US$ Mn) Forecast, by Condition, 2017–2027

Table 25: Middle East & Africa (MEA) Geriatric Medicines Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2017

Table 26: Middle East & Africa (MEA) Geriatric Medicines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2017

List of Figure

Figure 01: Global Geriatric Medicines Market Snapshot

Figure 02: Global Geriatric Medicines Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2027

Figure 04: Market Value Share By Condition (2018)

Figure 06: Market Value Share By Region (2018)

Figure 03: Market Value Share By Therapeutic Category (2018)

Figure 05: Market Value Share By Distribution Channel (2018)

Figure 07: Global Geriatric Medicines Market Value Share, by Therapeutic Category, 2018 and 2027

Figure 08: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Analgesics

Figure 09: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Antihypertensive

Figure 10: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Statins

Figure 11: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Antidiabetic

Figure 12: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Proton Pump Inhibitor

Figure 13: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Anticoagulant

Figure 14: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Antipsychotic and Antidepressant

Figure 15: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Others

Figure 16: Global Geriatric Medicines Market Value Share, by Condition, 2018 and 2027

Figure 17: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Cardiovascular

Figure 18: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Arthritis

Figure 19: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Diabetes

Figure 20: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Neurological

Figure 21: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Cancer

Figure 22: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Osteoporosis

Figure 23: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Antipsychotic and Antidepressant

Figure 24: Global Geriatric Medicines Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027, by Others

Figure 25: Global Geriatric Medicines Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 26: Global Geriatric Medicines Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospital Pharmacies, 2017–2027

Figure 27: Global Geriatric Medicines Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Retail Pharmacies, 2017–2027

Figure 28: Global Geriatric Medicines Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Online Pharmacies, 2017–2027

Figure 29: Global Geriatric Medicines Market Value Share, by Region, 2018 and 2027

Figure 30: North America Geriatric Medicines Market Value (US$ Mn) Forecast, 2017–2027

Figure 31: North America Market Attractiveness Analysis, by Country

Figure 32: North America Geriatric Medicines Market Value Share Analysis, by Therapeutic Category, 2018 and 2027

Figure 33: North America Geriatric Medicines Market Value Share Analysis, by Condition, 2018 and 2027

Figure 34: North America Geriatric Medicines Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 35: North America Geriatric Medicines Market Value Share Analysis, by Country, 2018 and 2027

Figure 36: Europe Geriatric Medicines Market Value (US$ Mn) Forecast, 2017–2027

Figure 37: Europe Market Attractiveness Analysis, by Country/Sub-region

Figure 38: Europe Geriatric Medicines Market Value Share Analysis, by Therapeutic Category, 2018 and 2027

Figure 39: Europe Geriatric Medicines Market Value Share Analysis, by Condition, 2018 and 2027

Figure 40: Europe Geriatric Medicines Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 41: Europe Geriatric Medicines Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 42: Asia Pacific Geriatric Medicines Market Value (US$ Mn) Forecast, 2017–2027

Figure 43: Asia Pacific Market Attractiveness Analysis, by Country

Figure 44: Asia Pacific Geriatric Medicines Market Value Share Analysis, by Therapeutic Category, 2018 and 2027

Figure 45: Asia Pacific Geriatric Medicines Market Value Share Analysis, by Condition, 2018 and 2027

Figure 46: Asia Pacific Geriatric Medicines Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 47: Asia Pacific Geriatric Medicines Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 48: Latin America Geriatric Medicines Market Value (US$ Mn) Forecast, 2017–2027

Figure 49: Latin America Market Attractiveness Analysis, by Country

Figure 50: Latin America Geriatric Medicines Market Value Share Analysis, by Therapeutic Category, 2018 and 2027

Figure 51: Latin America Geriatric Medicines Market Value Share Analysis, by Condition, 2018 and 2027

Figure 52: Latin America Geriatric Medicines Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 53: Latin America Geriatric Medicines Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 54: Middle East & Africa (MEA) Geriatric Medicines Market Value (US$ Mn) Forecast, 2017–2027

Figure 55: Middle East & Africa (MEA) Market Attractiveness Analysis, by Country/Sub-region

Figure 56: Middle East & Africa (MEA) Geriatric Medicines Market Value Share Analysis, by Therapeutic Category, 2018 and 2027

Figure 57: Middle East & Africa (MEA) Geriatric Medicines Market Value Share Analysis, by Condition, 2018 and 2027

Figure 58: Middle East & Africa (MEA) Geriatric Medicines Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 59: Middle East & Africa (MEA) Geriatric Medicines Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 60: Pfizer, Inc. Revenue (US$ Bn) and Y-o-Y Growth (%), 2015–2018

Figure 61: Pfizer, Inc. R&D Intensity (%) - Company Level or Segment Level, 2016–2018

Figure 62: Pfizer, Inc. Breakdown of Net Sales, by Region, 2017

Figure 63: Merck & Co., Inc. Revenue (US$ Bn) and Y-o-Y Growth (%), 2015–2018

Figure 64: Merck & Co., Inc. R&D Intensity (%) - Company Level or Segment Level, 2016–2018

Figure 65: Merck & Co., Inc. Break-up of Net Sales, by Region, 2017

Figure 66: AstraZeneca Revenue (US$ Bn) and Y-o-Y Growth (%), 2015–2018

Figure 67: AstraZeneca Breakdown of Net Sales, by Region, 2018

Figure 68: AstraZeneca Marketing & Sales and R&D Expenses, 2016–2018

Figure 69: Bristol-Myers Squibb Company Revenue (US$ Bn) and Y-o-Y Growth (%), 2015–2018

Figure 70: Bristol-Myers Squibb Company R&D Intensity (%) - Company Level or Segment Level, 2016–2018

Figure 71: Bristol-Myers Squibb Company Breakdown of Net Sales, by Region, 2018

Figure 72: Novartis AG Revenue (US$ Bn) and Y-o-Y Growth (%), 2015–2018

Figure 73: Novartis AG Marketing & Sales and R&D Expenses, 2016–2018

Figure 74: Novartis AG Breakdown of Net Sales, by Business Segment, 2018

Figure 75: Novartis AG Breakdown of Net Sales, by Region, 2018

Figure 76: Sanofi S.A. Breakdown of Net Sales, by Region, 2018

Figure 77: Sanofi S.A. Revenue (US$ Bn) and Y-o-Y Growth (%), 2015–2018

Figure 78: Sanofi S.A. Breakdown of Net Sales, by Business Segment, 2018

Figure 79: Sanofi S.A. R&D Intensity and Sales & Marketing Intensity (Pharmaceutical Segment) - Company Level, 2016–2018

Figure 80: GlaxoSmithKline plc Revenue (US$ Bn) and Y-o-Y Growth (%), 2015–2018

Figure 81: GlaxoSmithKline plc Marketing & Sales and R&D Expenses, 2016–2018

Figure 82: GlaxoSmithKline plc Breakdown of Net Sales, by Business Segment, 2018

Figure 83: GlaxoSmithKline plc Breakdown of Net Sales, by Region, 2018

Figure 84: Eli Lilly and Company Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 85: Eli Lilly and Company R&D Intensity (%) - Company Level or Segment Level, 2016–2018

Figure 86: Eli Lilly and Company Breakdown of Net Sales, by Region, 2018

Figure 87: Abbott Laboratories, Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 88: Abbott Laboratories, Breakdown of Net Sales, by Business Segment, 2018

Figure 89: Abbott Laboratories, Breakdown of Net Sales, by Region 2018

Figure 90: Boehringer Ingelheim GmbH, Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 91: Boehringer Ingelheim GmbH, Breakdown of Net Sales, by Business Segment, 2018

Figure 92: Boehringer Ingelheim GmbH, Breakdown of Net Sales, by Region 2018

Figure 93: Boehringer Ingelheim GmbH, R&D (US$ Mn) and Y-o-Y Growth (%), 2016–2018