Analysts’ Viewpoint on Market Scenario

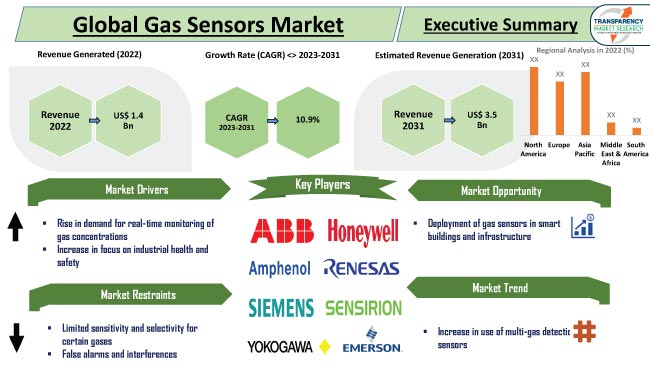

Rise in focus on industrial safety is expected to propel the gas sensors market size in the next few years. Surge in implementation of stringent environmental regulations and increase in concerns regarding residential and commercial safety are also projected to boost market expansion in the near future. Gas detectors are extensively used to detect and monitor various gases in research laboratories and development projects in several sectors including chemistry, environmental science, and materials science.

Growth in need for accurate and reliable gas detection systems for experimental purposes is likely to create lucrative opportunities for vendors in the global gas sensors industry. Vendors are investing significantly in the R&D of new and advanced products to expand their product portfolio and increase their gas sensors market share.

Gas sensors are devices designed to detect and measure the presence and concentration of specific gases in the environment. They play a vital role in various industries, research, and safety applications. Gas sensing devices are employed in diverse fields such as industrial safety, environmental monitoring, healthcare, and automotive. CO2 sensors, NO2 sensors, SO2 sensors, H2 sensors, natural gas sensors, and ammonia sensors are various types of gas sensors.

Gas monitoring sensors are constantly evolving with advancements in technology, leading to improved sensitivity, selectivity, miniaturization, and integration with other systems. These advancements enable more accurate and reliable gas detection, thereby enhancing safety, environmental monitoring, and overall quality of life. Ongoing technological advancements and increase in awareness about health and safety are projected to spur the gas sensors market growth during the forecast period.

IoT-based gas sensors enable real-time monitoring of gas concentrations, providing immediate alerts and notifications in case of gas leaks or abnormal conditions. This capability is crucial for ensuring safety in industries, residential buildings, and commercial spaces. Thus, surge in demand for real-time monitoring of gas concentrations is propelling the gas sensors market development.

IoT connectivity allows gas sensors to be accessed and controlled remotely, eliminating the need for physical presence. This feature is particularly valuable in large-scale industrial operations or geographically dispersed locations, where remote monitoring and control enhance operational efficiency and reduce operational costs.

According to Nasscom, in 2020, the IoT market in India reached US$ 9 Bn. Increase in demand for IoT-based gas sensors can be ascribed to rise in need for real-time monitoring, remote access and control, data analytics, regulatory compliance, cost-effective scalability, and alignment with Industry 4.0. Businesses are increasingly embracing digital transformation and prioritizing safety and efficiency, which is estimated to spur growth of the gas sensors industry in the next few years.

Gas sensors play a crucial role in ensuring the safety of workers and preventing accidents related to hazardous gases. Gas sensors are used to detect leaks of potentially hazardous gases such as methane, hydrogen sulfide, carbon monoxide, and Volatile Organic Compounds (VOCs). By continuously monitoring the environment, gas sensors can quickly identify and alert personnel to the presence of gas leaks, allowing prompt action to mitigate risks. Hence, surge in emphasis on industrial health and safety is fueling gas sensors market value.

Most manufacturing and industrial processes in various industries, such as food and beverage, mining, and automotive, rely on the production and/or use of chemicals and machinery capable of producing dangerous levels of poisonous and flammable gases. Any occasional gas leakage can represent a serious hazard to factory personnel or people living nearby. According to the International Journal of Creative Research Thoughts (IJCRT), in 2022, about 1.1 billion people inhaled unhealthy air and around 7 million deaths occur globally. Hence, rise in air pollution is propelling the gas sensors market revenue.

According to the latest gas sensors market trends, the infrared technology segment held 32.1% share in 2022. The segment is likely to maintain the status quo and advance at a CAGR of 11.6% during the forecast period.

Infrared gas sensors are widely used in industrial settings for monitoring and detecting combustible gases such as hydrocarbons and flammable vapors. These sensors play a crucial role in ensuring worker safety by enabling early detection of gas leaks or hazardous conditions. Surge in need for accurate gas detection, compliance with regulations, improved safety, environmental monitoring, and energy efficiency is fueling the segment.

According to the latest research report on the gas sensors market, the oil and gas end-use industry segment accounted for 26.4% share in 2022. It is expected to maintain the status quo and advance at a CAGR of 11.5% during the forecast period. Detection and prevention of gas leaks play a major role in various aspects of oil and gas operations including pipelines, storage tanks, wellheads, and refineries. Rapid and accurate detection of leaks helps prevent environmental contamination, fires, explosions, and potential loss of life.

According to the latest gas sensors market forecast, North America is expected to hold largest share from 2023 to 2031. The region accounted for major share of 33.2% in 2022. Rise in focus on worker health and safety is fueling the market trajectory in the region. Gas sensors are crucial for protecting workers from hazardous gases in industries such as oil and gas, manufacturing, and mining.

The industry in Asia Pacific held 30.8% share in 2022. Rapid growth in the industrial sector, especially in China, India, Japan, and South Korea, is augmenting market statistics in the region. Increase in focus on industrial safety and environmental monitoring, rise in awareness about air pollution, and growth in the automotive sector in Japan and South Korea are also contributing to market progress in Asia Pacific.

The global industry is fragmented, with the presence of several gas sensor companies including ABB Ltd., Aeroqual, Alphasense (AMETEK), Amphenol Advanced Sensors (Amphenol Corporation), ams-OSRAM AG, Bosch Sensortec GmbH, Dynament, Emerson Electric Co., Euro-Gas, Figaro Engineering Inc., Honeywell International Inc., Nemoto & Co., Ltd., Renesas Electronics Corporation, Sensirion AG, Siemens AG, and Yokogawa Electric Corporation.

Most gas sensor manufacturers are investing significantly in the R&D of new products to expand their product portfolio. They are also adopting partnerships, collaborations, and M&A strategies to broaden their regional and international presence.

Each of these players has been profiled in the gas sensors market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 1.4 Bn |

| Market Forecast Value in 2031 | US$ 3.5 Bn |

| Growth Rate (CAGR) | 10.9% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Bn for Value and Billion Units for Volume |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.4 Bn in 2022

It is projected to be 10.9% from 2023 to 2031

Rise in demand for real-time monitoring of gas concentrations and increase in focus on industrial health and safety

The infrared technology segment accounted for major share of 32.1% in 2022

North America recorded the highest demand in 2022

The sector in the U.S. was valued at US$ 900.0 Mn in 2022

ABB Ltd., Aeroqual, Alphasense (AMETEK), Amphenol Advanced Sensors (Amphenol Corporation), ams-OSRAM AG, Bosch Sensortec GmbH, Dynament, Emerson Electric Co., Euro-Gas, Figaro Engineering Inc., Honeywell International Inc., Nemoto & Co., Ltd., Renesas Electronics Corporation, Sensirion AG, Siemens AG, and Yokogawa Electric Corporation

1. Preface

1.1. Market and Segments Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Gas Sensors Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Sensor and Transducer Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

5. Global Gas Sensors Market Analysis, By Sensor Type

5.1. Gas Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis and Forecast, By Sensor Type, 2017-2031

5.1.1. CO2 Sensor

5.1.2. NO2 Sensor

5.1.3. SO2 Sensor

5.1.4. H2 Sensor

5.1.5. Natural Gas Sensor

5.1.6. Ammonia Sensor

5.1.7. Others (Flammable Gases, Hydrocarbons, etc.)

5.2. Market Attractiveness Analysis, By Sensor Type

6. Global Gas Sensors Market Analysis, By Technology

6.1. Gas Sensors Market Size (US$ Bn) and Analysis and Forecast, By Technology, 2017-2031

6.1.1. Infrared

6.1.2. Electrochemical

6.1.3. Catalytic

6.1.4. Magnetic

6.1.5. Others (Photoionization, Metal Oxide, etc.)

6.2. Market Attractiveness Analysis, By Technology

7. Global Gas Sensors Market Analysis, By Application

7.1. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By Application, 2017-2031

7.1.1. Indoor and Outdoor Air Quality

7.1.2. Automotive Emission Monitoring

7.1.3. Industrial Safety

7.1.4. Leak Detection

7.1.5. Others (Refrigeration, Appliance Control, etc.)

7.2. Market Attractiveness Analysis, By Application

8. Global Gas Sensors Market Analysis, By End-use Industry

8.1. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By End-use Industry, 2017-2031

8.1.1. Oil and Gas

8.1.2. Automotive

8.1.3. Building and Infrastructure

8.1.4. Consumer Electronics

8.1.5. Metal and Mining

8.1.6. Energy and Utilities

8.1.7. Chemicals

8.1.8. Others (Healthcare, Food and Beverage, etc.)

8.2. Market Attractiveness Analysis, By End-use Industry

9. Global Gas Sensors Market Analysis and Forecast, By Region

9.1. Gas Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis and Forecast, By Region, 2017-2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, By Region

10. North America Gas Sensors Market Analysis and Forecast

10.1. Market Snapshot

10.2. Gas Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis and Forecast, By Sensor Type, 2017-2031

10.2.1. CO2 Sensor

10.2.2. NO2 Sensor

10.2.3. SO2 Sensor

10.2.4. H2 Sensor

10.2.5. Natural Gas Sensor

10.2.6. Ammonia Sensor

10.2.7. Others (Flammable Gases, Hydrocarbons, etc.)

10.3. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By Technology, 2017-2031

10.3.1. Infrared

10.3.2. Electrochemical

10.3.3. Catalytic

10.3.4. Magnetic

10.3.5. Others (Photoionization, Metal Oxide, etc.)

10.4. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By Application, 2017-2031

10.4.1. Indoor and Outdoor Air Quality

10.4.2. Automotive Emission Monitoring

10.4.3. Industrial Safety

10.4.4. Leak Detection

10.4.5. Others (Refrigeration, Appliance Control, etc.)

10.5. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By End-use Industry, 2017-2031

10.5.1. Oil and Gas

10.5.2. Automotive

10.5.3. Building and Infrastructure

10.5.4. Consumer Electronics

10.5.5. Metal and Mining

10.5.6. Energy and Utilities

10.5.7. Chemicals

10.5.8. Others (Healthcare, Food and Beverage, etc.)

10.6. Gas Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis and Forecast, By Country and Sub-region, 2017-2031

10.6.1. U.S.

10.6.2. Canada

10.6.3. Rest of North America

10.7. Market Attractiveness Analysis

10.7.1. By Sensor Type

10.7.2. By Technology

10.7.3. By Application

10.7.4. By End-use Industry

10.7.5. By Country/Sub-region

11. Europe Gas Sensors Market Analysis and Forecast

11.1. Market Snapshot

11.2. Gas Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis and Forecast, By Sensor Type, 2017-2031

11.2.1. CO2 Sensor

11.2.2. NO2 Sensor

11.2.3. SO2 Sensor

11.2.4. H2 Sensor

11.2.5. Natural Gas Sensor

11.2.6. Ammonia Sensor

11.2.7. Others (Flammable Gases, Hydrocarbons, etc.)

11.3. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By Technology, 2017-2031

11.3.1. Infrared

11.3.2. Electrochemical

11.3.3. Catalytic

11.3.4. Magnetic

11.3.5. Others (Photoionization, Metal Oxide, etc.)

11.4. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By Application, 2017-2031

11.4.1. Indoor and Outdoor Air Quality

11.4.2. Automotive Emission Monitoring

11.4.3. Industrial Safety

11.4.4. Leak Detection

11.4.5. Others (Refrigeration, Appliance Control, etc.)

11.5. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By End-use Industry, 2017-2031

11.5.1. Oil and Gas

11.5.2. Automotive

11.5.3. Building and Infrastructure

11.5.4. Consumer Electronics

11.5.5. Metal and Mining

11.5.6. Energy and Utilities

11.5.7. Chemicals

11.5.8. Others (Healthcare, Food and Beverage, etc.)

11.6. Gas Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis and Forecast, By Country and Sub-region, 2017-2031

11.6.1. U.K.

11.6.2. Germany

11.6.3. France

11.6.4. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Sensor Type

11.7.2. By Technology

11.7.3. By Application

11.7.4. By End-use Industry

11.7.5. By Country/Sub-region

12. Asia Pacific Gas Sensors Market Analysis and Forecast

12.1. Market Snapshot

12.2. Gas Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis and Forecast, By Sensor Type, 2017-2031

12.2.1. CO2 Sensor

12.2.2. NO2 Sensor

12.2.3. SO2 Sensor

12.2.4. H2 Sensor

12.2.5. Natural Gas Sensor

12.2.6. Ammonia Sensor

12.2.7. Others (Flammable Gases, Hydrocarbons, etc.)

12.3. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By Technology, 2017-2031

12.3.1. Infrared

12.3.2. Electrochemical

12.3.3. Catalytic

12.3.4. Magnetic

12.3.5. Others (Photoionization, Metal Oxide, etc.)

12.4. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By Application, 2017-2031

12.4.1. Indoor and Outdoor Air Quality

12.4.2. Automotive Emission Monitoring

12.4.3. Industrial Safety

12.4.4. Leak Detection

12.4.5. Others (Refrigeration, Appliance Control, etc.)

12.5. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By End-use Industry, 2017-2031

12.5.1. Oil and Gas

12.5.2. Automotive

12.5.3. Building and Infrastructure

12.5.4. Consumer Electronics

12.5.5. Metal and Mining

12.5.6. Energy and Utilities

12.5.7. Chemicals

12.5.8. Others (Healthcare, Food and Beverage, etc.)

12.6. Gas Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis and Forecast, By Country and Sub-region, 2017-2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. South Korea

12.6.5. ASEAN

12.6.6. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Sensor Type

12.7.2. By Technology

12.7.3. By Application

12.7.4. By End-use Industry

12.7.5. By Country/Sub-region

13. Middle East & Africa Gas Sensors Market Analysis and Forecast

13.1. Market Snapshot

13.2. Gas Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis and Forecast, By Sensor Type, 2017-2031

13.2.1. CO2 Sensor

13.2.2. NO2 Sensor

13.2.3. SO2 Sensor

13.2.4. H2 Sensor

13.2.5. Natural Gas Sensor

13.2.6. Ammonia Sensor

13.2.7. Others (Flammable Gases, Hydrocarbons, etc.)

13.3. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By Technology, 2017-2031

13.3.1. Infrared

13.3.2. Electrochemical

13.3.3. Catalytic

13.3.4. Magnetic

13.3.5. Others (Photoionization, Metal Oxide, etc.)

13.4. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By Application, 2017-2031

13.4.1. Indoor and Outdoor Air Quality

13.4.2. Automotive Emission Monitoring

13.4.3. Industrial Safety

13.4.4. Leak Detection

13.4.5. Others (Refrigeration, Appliance Control, etc.)

13.5. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By End-use Industry, 2017-2031

13.5.1. Oil and Gas

13.5.2. Automotive

13.5.3. Building and Infrastructure

13.5.4. Consumer Electronics

13.5.5. Metal and Mining

13.5.6. Energy and Utilities

13.5.7. Chemicals

13.5.8. Others (Healthcare, Food and Beverage, etc.)

13.6. Gas Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis and Forecast, By Country and Sub-region, 2017-2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of Middle East & Africa

13.7. Market Attractiveness Analysis

13.7.1. By Sensor Type

13.7.2. By Technology

13.7.3. By Application

13.7.4. By End-use Industry

13.7.5. By Country/Sub-region

14. South America Gas Sensors Market Analysis and Forecast

14.1. Market Snapshot

14.2. Gas Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis and Forecast, By Sensor Type, 2017-2031

14.2.1. CO2 Sensor

14.2.2. NO2 Sensor

14.2.3. SO2 Sensor

14.2.4. H2 Sensor

14.2.5. Natural Gas Sensor

14.2.6. Ammonia Sensor

14.2.7. Others (Flammable Gases, Hydrocarbons, etc.)

14.3. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By Technology, 2017-2031

14.3.1. Infrared

14.3.2. Electrochemical

14.3.3. Catalytic

14.3.4. Magnetic

14.3.5. Others (Photoionization, Metal Oxide, etc.)

14.4. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By Application, 2017-2031

14.4.1. Indoor and Outdoor Air Quality

14.4.2. Automotive Emission Monitoring

14.4.3. Industrial Safety

14.4.4. Leak Detection

14.4.5. Others (Refrigeration, Appliance Control, etc.)

14.5. Gas Sensors Market Size (US$ Bn) Analysis and Forecast, By End-use Industry, 2017-2031

14.5.1. Oil and Gas

14.5.2. Automotive

14.5.3. Building and Infrastructure

14.5.4. Consumer Electronics

14.5.5. Metal and Mining

14.5.6. Energy and Utilities

14.5.7. Chemicals

14.5.8. Others (Healthcare, Food and Beverage, etc.)

14.6. Gas Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis and Forecast, By Country and Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Rest of South America

14.7. Market Attractiveness Analysis

14.7.1. By Sensor Type

14.7.2. By Technology

14.7.3. By Application

14.7.4. By End-use Industry

14.7.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Gas Sensors Market Competition Matrix - a Dashboard View

15.1.1. Global Gas Sensors Market Company Share Analysis, by Value (2022)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. ABB Ltd.

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Aeroqual

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Alphasense (AMETEK)

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Amphenol Advanced Sensors (Amphenol Corporation)

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. ams-OSRAM AG

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Bosch Sensortec GmbH

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Dynament

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Emerson Electric Co.

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Euro-Gas

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Figaro Engineering Inc.

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Honeywell International Inc.

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. Nemoto & Co., Ltd.

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

16.13. Renesas Electronics Corporation

16.13.1. Overview

16.13.2. Product Portfolio

16.13.3. Sales Footprint

16.13.4. Key Subsidiaries or Distributors

16.13.5. Strategy and Recent Developments

16.13.6. Key Financials

16.14. Sensirion AG

16.14.1. Overview

16.14.2. Product Portfolio

16.14.3. Sales Footprint

16.14.4. Key Subsidiaries or Distributors

16.14.5. Strategy and Recent Developments

16.14.6. Key Financials

16.15. Siemens AG

16.15.1. Overview

16.15.2. Product Portfolio

16.15.3. Sales Footprint

16.15.4. Key Subsidiaries or Distributors

16.15.5. Strategy and Recent Developments

16.15.6. Key Financials

16.16. Yokogawa Electric Corporation

16.16.1. Overview

16.16.2. Product Portfolio

16.16.3. Sales Footprint

16.16.4. Key Subsidiaries or Distributors

16.16.5. Strategy and Recent Developments

16.16.6. Key Financials

16.17. Other Key Players

16.17.1. Overview

16.17.2. Product Portfolio

16.17.3. Sales Footprint

16.17.4. Key Subsidiaries or Distributors

16.17.5. Strategy and Recent Developments

16.17.6. Key Financials

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Gas Sensors Market Value (US$ Bn) & Forecast, by Sensor Type, 2017-2031

Table 2: Global Gas Sensors Market Volume (Billion Units) & Forecast, by Sensor Type, 2017-2031

Table 3: Global Gas Sensors Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 4: Global Gas Sensors Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 5: Global Gas Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 6: Global Gas Sensors Market Value (US$ Bn) & Forecast, by Region, 2017-2031

Table 7: Global Gas Sensors Market Volume (Billion Units) & Forecast, by Region, 2017-2031

Table 8: North America Gas Sensors Market Value (US$ Bn) & Forecast, by Sensor Type, 2017-2031

Table 9: North America Gas Sensors Market Volume (Billion Units) & Forecast, by Sensor Type, 2017-2031

Table 10: North America Gas Sensors Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 11: North America Gas Sensors Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 12: North America Gas Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 13: North America Gas Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 14: North America Gas Sensors Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 15: Europe Gas Sensors Market Value (US$ Bn) & Forecast, by Sensor Type, 2017-2031

Table 16: Europe Gas Sensors Market Volume (Billion Units) & Forecast, by Sensor Type, 2017-2031

Table 17: Europe Gas Sensors Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 18: Europe Gas Sensors Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 19: Europe Gas Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 20: Europe Gas Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 21: Europe Gas Sensors Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 22: Asia Pacific Gas Sensors Market Value (US$ Bn) & Forecast, by Sensor Type, 2017-2031

Table 23: Asia Pacific Gas Sensors Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 24: Asia Pacific Gas Sensors Market Volume (Billion Units) & Forecast, by Technology, 2017-2031

Table 25: Asia Pacific Gas Sensors Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 26: Asia Pacific Gas Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 27: Asia Pacific Gas Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 28: Asia Pacific Gas Sensors Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 29: Middle East & Africa Gas Sensors Market Value (US$ Bn) & Forecast, by Sensor Type, 2017-2031

Table 30: Middle East & Africa Gas Sensors Market Volume (Billion Units) & Forecast, by Sensor Type, 2017-2031

Table 31: Middle East & Africa Gas Sensors Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 32: Middle East & Africa Gas Sensors Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 33: Middle East & Africa Gas Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 34: Middle East & Africa Gas Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 35: Middle East & Africa Gas Sensors Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 36: South America Gas Sensors Market Value (US$ Bn) & Forecast, by Sensor Type, 2017-2031

Table 37: South America Gas Sensors Market Volume (Billion Units) & Forecast, by Sensor Type, 2017-2031

Table 38: South America Gas Sensors Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 39: South America Gas Sensors Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 40: South America Gas Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 41: South America Gas Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 42: South America Gas Sensors Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 01: Supply Chain Analysis - Global Gas Sensors Market

Figure 02: Porter Five Forces Analysis - Global Gas Sensors Market

Figure 03: Technology Road Map - Global Gas Sensors Market

Figure 04: Global Gas Sensors Market, Value (US$ Bn), 2017-2031

Figure 05: Global Gas Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 06: Global Gas Sensors Market Projections by Sensor Type, Value (US$ Bn), 2017-2031

Figure 07: Global Gas Sensors Market, Incremental Opportunity, by Sensor Type, 2023-2031

Figure 08: Global Gas Sensors Market Share Analysis, by Sensor Type, 2023 and 2031

Figure 09: Global Gas Sensors Market Projections by Technology, Value (US$ Bn), 2017-2031

Figure 10: Global Gas Sensors Market, Incremental Opportunity, by Technology, 2023-2031

Figure 11: Global Gas Sensors Market Share Analysis, by Technology, 2023 and 2031

Figure 12: Global Gas Sensors Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 13: Global Gas Sensors Market, Incremental Opportunity, by Application, 2023-2031

Figure 14: Global Gas Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 15: Global Gas Sensors Market Projections by End-use Industry, Value (US$ Bn), 2017-2031

Figure 16: Global Gas Sensors Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 17: Global Gas Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 18: Global Gas Sensors Market Projections by Region, Value (US$ Bn), 2017-2031

Figure 19: Global Gas Sensors Market, Incremental Opportunity, by Region, 2023-2031

Figure 20: Global Gas Sensors Market Share Analysis, by Region, 2023 and 2031

Figure 21: North America Gas Sensors Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 22: North America Gas Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 23: North America Gas Sensors Market Projections by Sensor Type Value (US$ Bn), 2017-2031

Figure 24: North America Gas Sensors Market, Incremental Opportunity, by Sensor Type, 2023-2031

Figure 25: North America Gas Sensors Market Share Analysis, by Sensor Type, 2023 and 2031

Figure 26: North America Gas Sensors Market Projections by Technology (US$ Bn), 2017-2031

Figure 27: North America Gas Sensors Market, Incremental Opportunity, by Technology, 2023-2031

Figure 28: North America Gas Sensors Market Share Analysis, by Technology, 2023 and 2031

Figure 29: North America Gas Sensors Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 30: North America Gas Sensors Market, Incremental Opportunity, by Application, 2023-2031

Figure 31: North America Gas Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 32: North America Gas Sensors Market Projections by End-use Industry Value (US$ Bn), 2017-2031

Figure 33: North America Gas Sensors Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 34: North America Gas Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 35: North America Gas Sensors Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 36: North America Gas Sensors Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 37: North America Gas Sensors Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 38: Europe Gas Sensors Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 39: Europe Gas Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 40: Europe Gas Sensors Market Projections by Sensor Type, Value (US$ Bn), 2017-2031

Figure 41: Europe Gas Sensors Market, Incremental Opportunity, by Sensor Type, 2023-2031

Figure 42: Europe Gas Sensors Market Share Analysis, by Sensor Type, 2023 and 2031

Figure 43: Europe Gas Sensors Market Projections by Technology, Value (US$ Bn), 2017-2031

Figure 44: Europe Gas Sensors Market, Incremental Opportunity, by Technology, 2023-2031

Figure 45: Europe Gas Sensors Market Share Analysis, by Technology, 2023 and 2031

Figure 46: Europe Gas Sensors Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 47: Europe Gas Sensors Market, Incremental Opportunity, by Application, 2023-2031

Figure 48: Europe Gas Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 49: Europe Gas Sensors Market Projections by End-use Industry, Value (US$ Bn), 2017-2031

Figure 50: Europe Gas Sensors Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 51: Europe Gas Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 52: Europe Gas Sensors Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 53: Europe Gas Sensors Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 54: Europe Gas Sensors Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 55: Asia Pacific Gas Sensors Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 56: Asia Pacific Gas Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 57: Asia Pacific Gas Sensors Market Projections by Sensor Type Value (US$ Bn), 2017-2031

Figure 58: Asia Pacific Gas Sensors Market, Incremental Opportunity, by Sensor Type, 2023-2031

Figure 59: Asia Pacific Gas Sensors Market Share Analysis, by Sensor Type, 2023 and 2031

Figure 60: Asia Pacific Gas Sensors Market Projections by Technology, Value (US$ Bn), 2017-2031

Figure 61: Asia Pacific Gas Sensors Market, Incremental Opportunity, by Technology, 2023-2031

Figure 62: Asia Pacific Gas Sensors Market Share Analysis, by Technology, 2023 and 2031

Figure 63: Asia Pacific Gas Sensors Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 64: Asia Pacific Gas Sensors Market, Incremental Opportunity, by Application, 2023-2031

Figure 65: Asia Pacific Gas Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 66: Asia Pacific Gas Sensors Market Projections by End-use Industry, Value (US$ Bn), 2017-2031

Figure 67: Asia Pacific Gas Sensors Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 68: Asia Pacific Gas Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 69: Asia Pacific Gas Sensors Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 70: Asia Pacific Gas Sensors Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 71: Asia Pacific Gas Sensors Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 72: Middle East & Africa Gas Sensors Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 73: Middle East & Africa Gas Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 74: Middle East & Africa Gas Sensors Market Projections by Sensor Type Value (US$ Bn), 2017-2031

Figure 75: Middle East & Africa Gas Sensors Market, Incremental Opportunity, by Sensor Type, 2023-2031

Figure 76: Middle East & Africa Gas Sensors Market Share Analysis, by Sensor Type, 2023 and 2031

Figure 77: Middle East & Africa Gas Sensors Market Projections by Technology, Value (US$ Bn), 2017-2031

Figure 78: Middle East & Africa Gas Sensors Market, Incremental Opportunity, by Technology, 2023-2031

Figure 79: Middle East & Africa Gas Sensors Market Share Analysis, by Technology, 2023 and 2031

Figure 80: Middle East & Africa Gas Sensors Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 81: Middle East & Africa Gas Sensors Market, Incremental Opportunity, by Application, 2023-2031

Figure 82: Middle East & Africa Gas Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 83: Middle East & Africa Gas Sensors Market Projections by End-use Industry Value (US$ Bn), 2017-2031

Figure 84: Middle East & Africa Gas Sensors Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 85: Middle East & Africa Gas Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 86: Middle East & Africa Gas Sensors Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 87: Middle East & Africa Gas Sensors Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 88: Middle East & Africa Gas Sensors Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 89: South America Gas Sensors Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 90: South America Gas Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 91: South America Gas Sensors Market Projections by Sensor Type Value (US$ Bn), 2017-2031

Figure 92: South America Gas Sensors Market, Incremental Opportunity, by Sensor Type, 2023-2031

Figure 93: South America Gas Sensors Market Share Analysis, by Sensor Type, 2023 and 2031

Figure 94: South America Gas Sensors Market Projections by Technology, Value (US$ Bn), 2017-2031

Figure 95: South America Gas Sensors Market, Incremental Opportunity, by Technology, 2023-2031

Figure 96: South America Gas Sensors Market Share Analysis, by Technology, 2023 and 2031

Figure 97: South America Gas Sensors Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 98: South America Gas Sensors Market, Incremental Opportunity, by Application, 2023-2031

Figure 99: South America Gas Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 100: South America Gas Sensors Market Projections by End-use Industry Value (US$ Bn), 2017-2031

Figure 101: South America Gas Sensors Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 102: South America Gas Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 103: South America Gas Sensors Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 104: South America Gas Sensors Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 105: South America Gas Sensors Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 106: Global Gas Sensors Market Competition

Figure 107: Global Gas Sensors Market Company Share Analysis