Analysts’ Viewpoint

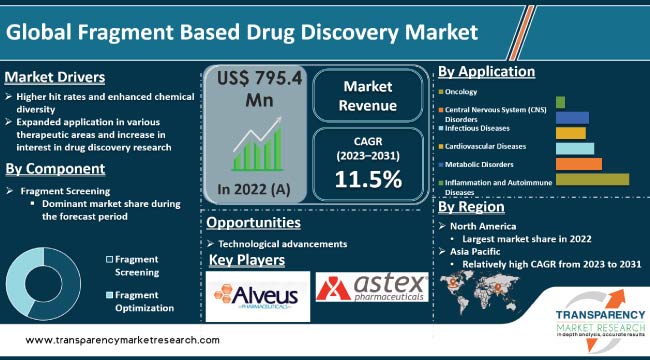

The global fragment-based drug discovery (FBDD) market is expected to grow at a rapid pace during the forecast period. FBDD has emerged as a promising approach in early-stage drug development. Higher hit rates, increased chemical diversity, and ability to target challenging proteins are likely to propel market expansion in the near future. Furthermore, increase in incidence of complex diseases, such as cancer and neurological disorders, is likely to fuel global fragment based drug discovery market demand in the next few years.

Development of biophysical techniques, such as NMR spectroscopy, X-ray crystallography, and SPR, offers lucrative opportunities to market players. Companies are increasing investment in R&D, collaborative efforts, and technological innovations to increase market presence. However, challenges related to optimization process, high cost, and regulatory requirements are projected to hamper global fragment based drug discovery market value in the near future.

Fragment-based drug discovery (FBDD) is an innovative approach used in early-stage drug development. Instead of traditional high-throughput screening (HTS) of large and complex molecules, FBDD involves screening small, low molecular weight fragments as starting points. These fragments interact with target proteins, providing valuable information for lead optimization.

FBDD offers several advantages, including increased chemical diversity, higher hit rates, and the ability to target challenging proteins that are difficult to address through conventional methods.

Biophysical techniques, such as NMR spectroscopy, X-ray crystallography, and SPR, are commonly used to screen and optimize fragments efficiently. This method has gained prominence in the pharmaceutical industry due to its potential to accelerate drug discovery and development, leading to the creation of novel and more effective therapeutic agents for various diseases and medical conditions.

Fragment-based drug discovery (FBDD) has emerged as a powerful and efficient approach in early-stage drug development, offering higher hit rates and enhanced chemical diversity compared to traditional high-throughput screening (HTS) methods. This has garnered significant attention from the pharmaceutical industry and research institutions seeking innovative solutions for drug discovery.

FBDD's ability to achieve higher hit rates stems from its unique screening strategy. It focuses on testing small, low molecular weight fragments. These fragments, often consisting of simple chemical structures, have a higher likelihood of interacting with target proteins. Consequently, FBDD leads to the identification of more hits or starting points for further drug development, streamlining the process of lead discovery.

In June 2023, AbbVie announced promising findings on the sustained long-term safety and efficacy of VENCLYXTO/ VENCLEXTA (venetoclax)-based combination therapies for CLL patients using fragment-based drug discovery. FBDD facilitated the identification of venetoclax, a successful drug targeting BCL-2, discovered through fragment screening and optimization. The study showcased improved PFS, higher rates of uMRD, and enhanced disease control in previously untreated CLL patients with co-existing conditions. These results underscore FBDD's significance in identifying lead compounds for transformative fixed-duration therapies, demonstrating lasting benefits and treatment opportunities for patients with CLL.

FBDD's ability to target challenging proteins and protein-protein interactions further contributes to its higher hit rates and enhanced chemical diversity. Conventional HTS methods often struggle to identify compounds that interact with complex and hard-to-reach target sites.

In contrast, FBDD's small fragments can penetrate such challenging regions and provide valuable information for lead optimization. This has been particularly valuable in addressing previously undruggable targets, expanding the potential for developing drugs for diseases that were previously difficult to tackle.

Fragment-based drug discovery (FBDD) has emerged as a versatile and promising approach in the pharmaceutical industry due to its applicability across various therapeutic areas. One of the key advantages of FBDD lies in its ability to explore and identify small, low-molecular-weight fragments. These fragments can be optimized to develop potent and selective drug candidates, making FBDD a valuable tool in the quest for novel therapeutics.

In the field of oncology, FBDD has shown significant potential in targeting specific cancer-associated proteins. For instance, researchers at a leading biotech company used FBDD to identify small molecule fragments that bind to an oncogenic protein involved in promoting tumor growth.

In May 2023, Evotec AG launched its Innovation Centre for Fragment-Based Drug Discovery (FBDD) in Hamburg, Germany, and Oxford, the U.K. The center aims to identify novel, small molecule hits (fragments) for challenging biological targets using its EVOlution platform. The platform combines ultra-sensitive screening technologies and protein-ligand X-ray crystallography to detect low molecular weight fragments in a biologically relevant environment. Evotec has validated the technology against various therapeutic targets, including CNS, oncology, inflammation, metabolic disease, and cardiovascular diseases.

In terms of component type, the fragment screening segment accounted for the largest global fragment based drug discovery market share in 2022. The segment includes services such as library screening, biophysical screening (NMR, X-ray crystallography), and computational screening.

Fragment screening enables the exploration of a vast chemical space using small, low molecular weight compounds. These fragments can access unique binding sites on target proteins that larger molecules might not be able to reach, potentially leading to the discovery of novel binding modes and unprecedented drug leads.

Fragment screening provides valuable information about the binding interactions between fragments and target proteins. By using biophysical techniques, such as NMR and X-ray crystallography, researchers can gain insights into the atomic-level interactions, guiding the subsequent optimization process effectively.

Fragment screening is highly efficient in terms of speed and cost. Screening smaller libraries of fragments is faster and more cost-effective than traditional high-throughput screening of larger compound libraries. This allows for a more streamlined and focused drug discovery process.

Based on application, the oncology segment is likely to dominate the global industry during the forecast period. This is ascribed to significant focus on cancer research and drug development.

Major pharmaceutical companies have increased investment in oncology-focused FBDD research and have initiated multiple collaborations with specialized FBDD providers. These partnerships aim to identify novel drug candidates for various oncology targets, including those that have been historically challenging to drug using conventional methods.

Astex Pharmaceuticals, renowned for its success in the oncology field, is now leveraging its fragment-based drug discovery (FBDD) platform to target neurodegenerative diseases in the central nervous system (CNS). The company aims to apply its expertise in FBDD to identify small molecule fragments that interact with specific proteins involved in neurodegenerative processes.

By utilizing this approach, Astex seeks to develop novel and targeted therapies for diseases such as Alzheimer's and Parkinson's. With a track record of success in oncology, Astex's expansion into the CNS field holds significant promise for advancing drug discovery efforts and addressing the urgent medical needs of patients suffering from neurodegenerative conditions.

In terms of end-user, the pharmaceutical & biotechnology companies segment is anticipated to account for largest global fragment based drug discovery market size during the forecast period. These companies are projected to drive adoption of FBDD services due to their substantial research & development budgets and strong focus on discovering innovative therapeutics.

Drug discovery is facing challenges with few clinical candidates reaching commercialization. Pharmaceutical/biotech R&D spending - around US$ 182 Bn in 2019 - has risen due to increasing complexity. Over 16,000 drug molecules were evaluated, emphasizing the resource-intensiveness. The industry strives to mitigate risks and meet growing patient demand for innovative therapies.

The segment's dominance can be attributed to rise in demand for novel drug candidates and the need to expedite the drug discovery process. Furthermore, as pharmaceutical and biotech firms increasingly seek external expertise and partnerships to complement their in-house capabilities, FBDD service providers become integral in delivering effective and targeted drug candidates. Hence, the segment is anticipated to witness the fastest growth during the forecast period.

As per fragment based drug discovery market trends, North America dominated the global industry in 2022. The trend is expected to continue during the forecast period. This can be ascribed to substantial investment by key players in FBDD research & development, well-established infrastructure, and robust healthcare systems in the U.S. and Canada. North America is often at the forefront of adopting technological advancements, making it a base for implementing FBDD techniques.

Demand for FBDD is increase in Asia Pacific, fueled by surge in investment in healthcare infrastructure and strong emphasis on improving quality management, particularly in countries such as China and Japan. Hence, the region is emerging as a potential market for FBDD services.

Increase in investment in R&D and collaboration are the key strategies adopted by leading players in order to increase global fragment based drug discovery market revenue and share.

Alveus Pharmaceuticals Pvt. Ltd., Astex Pharmaceuticals, Charles River Laboratories International, Inc., Beactica AB, Emerald BioStructures, Inc., Crown Bioscience, Inc., Evotec AG, Proteros Fragments GmbH, Kinetic Discovery Limited, Sprint Bioscience, Sygnature Discovery and Structure Based Design, Inc. are the prominent players in the market.

Prominent players have been profiled in the fragment based drug discovery market report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 795.4 Mn |

|

Forecast (Value) in 2031 |

More than US$ 2.1 Bn |

|

Growth Rate (CAGR) |

11.5% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 795.4 Mn in 2022.

It is projected to reach more than US$ 2.1 Bn by 2031.

It is anticipated to advance at a CAGR of 11.5% from 2023 to 2031.

Higher hit rates & enhanced chemical diversity, expanded application in various therapeutic areas, and increase in interest in drug discovery research.

The fragment screening component segment accounted for more than 57.0% share in 2022.

North America is expected to account for the largest share from 2023 to 2031.

Alveus Pharmaceuticals Pvt. Ltd., Astex Pharmaceuticals, Charles River Laboratories International, Inc., Beactica AB, Emerald BioStructures, Inc., Crown Bioscience, Inc., Evotec AG, Proteros Fragments GmbH, Kinetic Discovery Limited, Sprint Bioscience, Sygnature Discovery and Structure Based Design, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Fragment Based Drug Discovery Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Fragment Based Drug Discovery Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Technological Advancements

5.2. Key Industry Events

5.3. Regulatory Scenario by Region/Globally

5.4. Major Research Institutes Involved

5.5. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Global Fragment Based Drug Discovery Market Analysis and Forecast, by Component

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Component, 2017-2031

6.3.1. Fragment Screening

6.3.1.1. Biophysical Techniques

6.3.1.1.1. NMR Spectroscopy

6.3.1.1.2. Differential Scanning Fluorimetry (DSF) Assay

6.3.1.1.3. Fluorescence Polarization

6.3.1.1.4. Isothermal Titration Calorimetry

6.3.1.1.5. X-ray Crystallography

6.3.1.1.6. Surface Plasmon Resonance (SPR)

6.3.1.1.7. Bilayer Interferometry

6.3.1.1.8. Mass Spectrometry (MS)

6.3.1.1.9. Capillary Electrophoresis

6.3.1.1.10. Weak Affinity Chromatography (WAC - HPLC-UV/MS)

6.3.1.1.11. Other Assays (Biochemical)

6.3.1.2. Non-biophysical Techniques

6.3.2. Fragment Optimization

6.4. Market Attractiveness Analysis, by Component

7. Global Fragment Based Drug Discovery Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017-2031

7.3.1. Oncology

7.3.2. Central Nervous System (CNS) Disorders

7.3.3. Infectious Diseases

7.3.4. Cardiovascular Diseases

7.3.5. Metabolic Disorders

7.3.6. Inflammation & Autoimmune Diseases

7.4. Market Attractiveness Analysis, by Application

8. Global Fragment Based Drug Discovery Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017-2031

8.3.1. Academic & Research Institutions

8.3.2. Pharmaceutical & Biotechnology Companies

8.3.3. Contract Research Organizations (CROs)

8.4. Market Attractiveness Analysis, by End-user

9. Global Fragment Based Drug Discovery Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Global Fragment Based Drug Discovery Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Component, 2017-2031

10.2.1. Fragment Screening

10.2.1.1. Biophysical Techniques

10.2.1.1.1. NMR Spectroscopy

10.2.1.1.2. Differential Scanning Fluorimetry (DSF) Assay

10.2.1.1.3. Fluorescence Polarization

10.2.1.1.4. Isothermal Titration Calorimetry

10.2.1.1.5. X-ray Crystallography

10.2.1.1.6. Surface Plasmon Resonance (SPR)

10.2.1.1.7. Bilayer Interferometry

10.2.1.1.8. Mass Spectrometry (MS)

10.2.1.1.9. Capillary Electrophoresis

10.2.1.1.10. Weak Affinity Chromatography (WAC - HPLC-UV/MS)

10.2.1.1.11. Other Assays (Biochemical)

10.2.1.2. Non-biophysical Techniques

10.2.2. Fragment Optimization

10.3. Market Value Forecast, by Application, 2017-2031

10.3.1. Oncology

10.3.2. Central Nervous System (CNS) Disorders

10.3.3. Infectious Diseases

10.3.4. Cardiovascular Diseases

10.3.5. Metabolic Disorders

10.3.6. Inflammation & Autoimmune Diseases

10.4. Market Value Forecast, by End-user, 2017-2031

10.4.1. Academic & Research Institutions

10.4.2. Pharmaceutical & Biotechnology Companies

10.4.3. Contract Research Organizations (CROs)

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Component

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Global Fragment Based Drug Discovery Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Component, 2017-2031

11.2.1. Fragment Screening

11.2.1.1. Biophysical Techniques

11.2.1.1.1. NMR Spectroscopy

11.2.1.1.2. Differential Scanning Fluorimetry (DSF) Assay

11.2.1.1.3. Fluorescence Polarization

11.2.1.1.4. Isothermal Titration Calorimetry

11.2.1.1.5. X-ray Crystallography

11.2.1.1.6. Surface Plasmon Resonance (SPR)

11.2.1.1.7. Bilayer Interferometry

11.2.1.1.8. Mass Spectrometry (MS)

11.2.1.1.9. Capillary Electrophoresis

11.2.1.1.10. Weak Affinity Chromatography (WAC - HPLC-UV/MS)

11.2.1.1.11. Other Assays (Biochemical)

11.2.1.2. Non-biophysical Techniques

11.2.2. Fragment Optimization

11.3. Market Value Forecast, by Application, 2017-2031

11.3.1. Oncology

11.3.2. Central Nervous System (CNS) Disorders

11.3.3. Infectious Diseases

11.3.4. Cardiovascular Diseases

11.3.5. Metabolic Disorders

11.3.6. Inflammation & Autoimmune Diseases

11.4. Market Value Forecast, by End-user, 2017-2031

11.4.1. Academic & Research Institutions

11.4.2. Pharmaceutical & Biotechnology Companies

11.4.3. Contract Research Organizations (CROs)

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Component

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Global Fragment Based Drug Discovery Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Component, 2017-2031

12.2.1. Fragment Screening

12.2.1.1. Biophysical Techniques

12.2.1.1.1. NMR Spectroscopy

12.2.1.1.2. Differential Scanning Fluorimetry (DSF) Assay

12.2.1.1.3. Fluorescence Polarization

12.2.1.1.4. Isothermal Titration Calorimetry

12.2.1.1.5. X-ray Crystallography

12.2.1.1.6. Surface Plasmon Resonance (SPR)

12.2.1.1.7. Bilayer Interferometry

12.2.1.1.8. Mass Spectrometry (MS)

12.2.1.1.9. Capillary Electrophoresis

12.2.1.1.10. Weak Affinity Chromatography (WAC - HPLC-UV/MS)

12.2.1.1.11. Other Assays (Biochemical)

12.2.1.2. Non-biophysical Techniques

12.2.2. Fragment Optimization

12.3. Market Value Forecast, by Application, 2017-2031

12.3.1. Oncology

12.3.2. Central Nervous System (CNS) Disorders

12.3.3. Infectious Diseases

12.3.4. Cardiovascular Diseases

12.3.5. Metabolic Disorders

12.3.6. Inflammation & Autoimmune Diseases

12.4. Market Value Forecast, by End-user, 2017-2031

12.4.1. Academic & Research Institutions

12.4.2. Pharmaceutical & Biotechnology Companies

12.4.3. Contract Research Organizations (CROs)

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Component

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Global Fragment Based Drug Discovery Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Component, 2017-2031

13.2.1. Fragment Screening

13.2.1.1. Biophysical Techniques

13.2.1.1.1. NMR Spectroscopy

13.2.1.1.2. Differential Scanning Fluorimetry (DSF) Assay

13.2.1.1.3. Fluorescence Polarization

13.2.1.1.4. Isothermal Titration Calorimetry

13.2.1.1.5. X-ray Crystallography

13.2.1.1.6. Surface Plasmon Resonance (SPR)

13.2.1.1.7. Bilayer Interferometry

13.2.1.1.8. Mass Spectrometry (MS)

13.2.1.1.9. Capillary Electrophoresis

13.2.1.1.10. Weak Affinity Chromatography (WAC - HPLC-UV/MS)

13.2.1.1.11. Other Assays (Biochemical)

13.2.1.2. Non-biophysical Techniques

13.2.2. Fragment Optimization

13.3. Market Value Forecast, by Application, 2017-2031

13.3.1. Oncology

13.3.2. Central Nervous System (CNS) Disorders

13.3.3. Infectious Diseases

13.3.4. Cardiovascular Diseases

13.3.5. Metabolic Disorders

13.3.6. Inflammation & Autoimmune Diseases

13.4. Market Value Forecast, by End-user, 2017-2031

13.4.1. Academic & Research Institutions

13.4.2. Pharmaceutical & Biotechnology Companies

13.4.3. Contract Research Organizations (CROs)

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Component

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Global Fragment Based Drug Discovery Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Component, 2017-2031

14.2.1. Fragment Screening

14.2.1.1. Biophysical Techniques

14.2.1.1.1. NMR Spectroscopy

14.2.1.1.2. Differential Scanning Fluorimetry (DSF) Assay

14.2.1.1.3. Fluorescence Polarization

14.2.1.1.4. Isothermal Titration Calorimetry

14.2.1.1.5. X-ray Crystallography

14.2.1.1.6. Surface Plasmon Resonance (SPR)

14.2.1.1.7. Bilayer Interferometry

14.2.1.1.8. Mass Spectrometry (MS)

14.2.1.1.9. Capillary Electrophoresis

14.2.1.1.10. Weak Affinity Chromatography (WAC - HPLC-UV/MS)

14.2.1.1.11. Other Assays (Biochemical)

14.2.1.2. Non-biophysical Techniques

14.2.2. Fragment Optimization

14.3. Market Value Forecast, by Application, 2017-2031

14.3.1. Oncology

14.3.2. Central Nervous System (CNS) Disorders

14.3.3. Infectious Diseases

14.3.4. Cardiovascular Diseases

14.3.5. Metabolic Disorders

14.3.6. Inflammation & Autoimmune Diseases

14.4. Market Value Forecast, by End-user, 2017-2031

14.4.1. Academic & Research Institutions

14.4.2. Pharmaceutical & Biotechnology Companies

14.4.3. Contract Research Organizations (CROs)

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Component

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Alveus Pharmaceuticals Pvt. Ltd.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Astex Pharmaceuticals

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Charles River Laboratories International, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Beactica AB

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Emerald BioStructures, Inc.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Crown Bioscience, Inc.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Evotec AG

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Proteros Fragments GmbH

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Kinetic Discovery Limited

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Sprint Bioscience

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. Sygnature Discovery

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

15.3.12. Structure Based Design, Inc.

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Product Portfolio

15.3.12.3. Financial Overview

15.3.12.4. SWOT Analysis

15.3.12.5. Strategic Overview

List of Tables

Table 01: Global Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Component, 2017-2031

Table 02: Global Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Application, 2017-2031

Table 03: Global Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by End-user, 2017-2031

Table 04: Global Fragment Based Drug Discovery Market Size (US$ Million) Forecast, by Region, 2017-2031

Table 05: North America Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Country, 2017-2031

Table 06: North America Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Component, 2017-2031

Table 07: North America Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Application, 2017-2031

Table 08: North America Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by End-user, 2017-2031

Table 09: Europe Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Country/Sub-region, 2017-2031

Table 10: Europe Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Component, 2017-2031

Table 11: Europe Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Application, 2017-2031

Table 12 Europe Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by End-user, 2017-2031

Table 13: Asia Pacific Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Country/Sub-region, 2017-2031

Table 14: Asia Pacific Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Component, 2017-2031

Table 15: Asia Pacific Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Application, 2017-2031

Table 16: Asia Pacific Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by End-user, 2017-2031

Table 17: Latin America Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Component, 2017-2031

Table 19: Latin America Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Application, 2017-2031

Table 20: Latin America Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by End-user, 2017-2031

Table 21: Middle East & Africa Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Component, 2017-2031

Table 23: Middle East & Africa Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by Application, 2017-2031

Table 24: Middle East & Africa Fragment Based Drug Discovery Market Value (US$ Million) Forecast, by End-user, 2017-2031

List of Figures

Figure 01. Global Fragment Based Drug Discovery Market Size (US$ Million) and Distribution, by Region, 2022 and 2031

Figure 02: Global Fragment Based Drug Discovery Market Value (US$ Million) Forecast, 2017-2031

Figure 03: Global Fragment Based Drug Discovery Market Value Share, by Component (2022)

Figure 04: Global Fragment Based Drug Discovery Market Value Share, by Application (2022)

Figure 05: Global Fragment Based Drug Discovery Market Value Share, by End-user (2022)

Figure 06: Global Fragment Based Drug Discovery Market Value Share, by Component, 2022 and 2031

Figure 07: Global Fragment Based Drug Discovery Market Revenue (US$ Million) Forecast and Y-o-Y Growth (%) Projection, by Fragment Screening, 2017-2031

Figure 08: Global Fragment Based Drug Discovery Market Revenue (US$ Million) Forecast and Y-o-Y Growth (%) Projection, by Fragment Optimization, 2017-2031

Figure 09: Global Fragment Based Drug Discovery Market Attractiveness, by Component, 2017-2031

Figure 10: Global Fragment Based Drug Discovery Market Value Share, by Application, 2022 and 2031

Figure 11: Global Fragment Based Drug Discovery Market Revenue (US$ Million) Forecast and Y-o-Y Growth (%) Projection, by Oncology, 2017-2031

Figure 12: Global Fragment Based Drug Discovery Market Revenue (US$ Million) Forecast and Y-o-Y Growth (%) Projection, by Central Nervous System (CNS) Disorders, 2017-2031

Figure 13: Global Fragment Based Drug Discovery Market Revenue (US$ Million) Forecast and Y-o-Y Growth (%) Projection, by Infectious Diseases, 2017-2031

Figure 19: Global Fragment Based Drug Discovery Market Revenue (US$ Million) Forecast and Y-o-Y Growth (%) Projection, by Cardiovascular Diseases, 2017-2031

Figure 14: Global Fragment Based Drug Discovery Market Revenue (US$ Million) Forecast and Y-o-Y Growth (%) Projection, by Metabolic Disorders, 2017-2031

Figure 15: Global Fragment Based Drug Discovery Market Revenue (US$ Million) Forecast and Y-o-Y Growth (%) Projection, by Inflammation & Autoimmune Diseases, 2017-2031

Figure 16: Global Fragment Based Drug Discovery Market Attractiveness, by Application, 2017-2031

Figure 17: Global Fragment Based Drug Discovery Market Value Share, by End-user, 2022 and 2031

Figure 18: Global Fragment Based Drug Discovery Market Revenue (US$ Million) and Y-o-Y Growth (%) Forecast, by Academic & Research Institutions, 2017-2031

Figure 19: Global Fragment Based Drug Discovery Market Revenue (US$ Million) and Y-o-Y Growth (%) Forecast, by Pharmaceutical & Biotechnology Companies, 2017-2031

Figure 20: Global Fragment Based Drug Discovery Market Revenue (US$ Million) and Y-o-Y Growth (%) Forecast, by Contract Research Organizations (CROs), 2017-2031

Figure 21: Global Fragment Based Drug Discovery Market Attractiveness, by End-user, 2017-2031

Figure 22: Global Fragment Based Drug Discovery Market Value Share, by Region, 2022 and 2031

Figure 23: Global Fragment Based Drug Discovery Market Attractiveness, by Region, 2017-2031

Figure 24: North America Fragment Based Drug Discovery Market Value (US$ Million) Forecast and Y-o-Y Growth Projection (%) 2017-2031

Figure 25: North America Fragment Based Drug Discovery Market Value Share, by Country, 2022 and 2031

Figure 26: North America Fragment Based Drug Discovery Market Attractiveness, by Country, 2017-2031

Figure 27: North America Fragment Based Drug Discovery Market Attractiveness, by Component, 2017-2031

Figure 28: North America Fragment Based Drug Discovery Market Attractiveness, by Application, 2017-2031

Figure 29: North America Fragment Based Drug Discovery Market Attractiveness, by End-user, 2017-2031

Figure 30: Europe Fragment Based Drug Discovery Market Value (US$ Million) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 31: Europe Fragment Based Drug Discovery Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 32: Europe Fragment Based Drug Discovery Market Attractiveness, by Country/Sub-region, 2017-2031

Figure 33: Europe Fragment Based Drug Discovery Market Attractiveness, by Component, 2017-2031

Figure 34: Europe Fragment Based Drug Discovery Market Attractiveness, by Application, 2017-2031

Figure 35: Europe Fragment Based Drug Discovery Market Attractiveness, by End-user, 2017-2031

Figure 36: Asia Pacific Fragment Based Drug Discovery Market Value (US$ Million) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 37: Asia Pacific Fragment Based Drug Discovery Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 38: Asia Pacific Fragment Based Drug Discovery Market Attractiveness, by Country/Sub-region, 2017-2031

Figure 39: Asia Pacific Fragment Based Drug Discovery Market Attractiveness, by Component, 2017-2031

Figure 40: Asia Pacific Fragment Based Drug Discovery Market Attractiveness, by Application, 2017-2031

Figure 41: Asia Pacific Fragment Based Drug Discovery Market Attractiveness, by End-user, 2017-2031

Figure 42: Latin America Fragment Based Drug Discovery Market Value (US$ Million) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 43: Latin America Fragment Based Drug Discovery Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 44: Latin America Fragment Based Drug Discovery Market Attractiveness, by Country/Sub-region, 2017-2031

Figure 45: Latin America Fragment Based Drug Discovery Market Attractiveness, by Component, 2017-2031

Figure 46: Latin America Fragment Based Drug Discovery Market Attractiveness, by Application, 2017-2031

Figure 47: Latin America Fragment Based Drug Discovery Market Attractiveness, by End-user, 2017-2031

Figure 48: Middle East & Africa Fragment Based Drug Discovery Market Value (US$ Million) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 49: Middle East & Africa Fragment Based Drug Discovery Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 50: Middle East & Africa Fragment Based Drug Discovery Market Attractiveness, by Country/Sub-region, 2017-2031

Figure 51: Middle East & Africa Fragment Based Drug Discovery Market Attractiveness, by Component, 2017-2031

Figure 52: Middle East & Africa Fragment Based Drug Discovery Market Attractiveness, by Application, 2017-2031

Figure 53: Middle East & Africa Fragment Based Drug Discovery Market Attractiveness, by End-user, 2017-2031