Analysts’ Viewpoint on Global CINV Existing and Pipeline Drugs Market Scenario

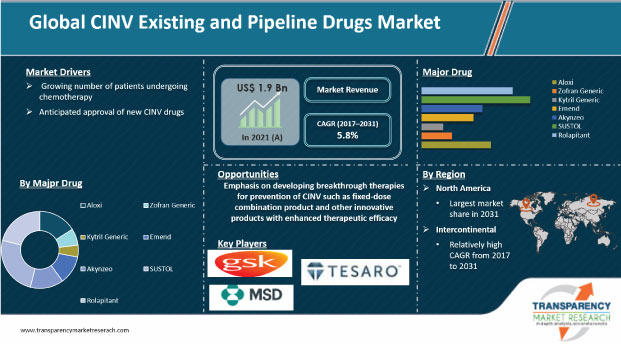

Large number of ongoing research & development activities, increasing healthcare investment by government, and rising geriatric population suffering from cancer are some of the factors driving the global CINV existing and pipeline drugs market. Companies in the global CINV existing and pipeline drugs market are focused on the development of novel drugs to offer better treatment to patients. However, dearth of awareness among people about the availability of effective drugs and treatments is expected to hamper the growth of the global CINV existing and pipeline drugs market during the forecast period.

Chemotherapy-induced nausea and vomiting (CINV) refers to nausea and vomiting associated with cancer chemotherapy. CINV is one of the most common side effects experienced by cancer patients undergoing chemotherapy. Presently, several drugs are available to manage CINV; however, side effects continue to be a key concern for patients and oncologists associated with chemotherapy. Companies such as Helsinn Holding S.A., Heron Therapeutics, Inc., and Tesaro, Inc. are striving to develop new and more efficacious therapeutic solutions to treat CINV.

The world is witnessing a continuous increase in the incidence rate of various types of cancer, which results in rise in the number of patients undergoing chemotherapy. According to estimates from the World Health Organization (WHO) in 2019, cancer is the first or second leading cause of death before the age of 70 years in 112 of 183 countries, and ranks third or fourth in a further 23 countries. These facts indicate that increase in cases of various types of cancer is likely to induce oncologists to prescribe chemotherapy to their patients for the effective treatment of cancer, thereby driving the CINV existing and pipeline drugs market.

Generally, 25% to 30% patients with cancer receive chemotherapy as a treatment option, and 70% to 80% of these patients undergoing chemotherapy exhibit nausea and vomiting as major symptoms.

Significant rise in cancer research and development efforts and increase in attention on the development of novel therapies are expected to drive the global CINV existing and pipeline drugs market over the next few years. Additionally, the introduction of new pharmaceuticals and the rapid growth of the healthcare industry are expected to propel the market in the near future. However, consumers' lack of information regarding the availability of innovative and effective pharmaceuticals and treatments is projected to impact the growth of the market in the next years.

SUSTOL (APF-530) was launched in 2015. The approval of SUSTOL drugs is likely to drive the global market during the forecast period. Increase in the number of patients undergoing chemotherapy is expected to contribute to the growth of the global CINV existing and pipeline drugs market. Various sources indicate that 70% to 80% cancer patients on chemotherapy exhibit nausea and vomiting as major side effects.

Rolapitant was approved in 2015. Since then, the demand for the drug has increased among various countries. Pipeline drugs have shown better efficacy than existing drugs during the clinical study. Rolapitant is used with other drugs to delay nausea and vomiting caused by cancer drug treatment (chemotherapy). It acts by suppressing one of the body's natural chemicals (substance P/neurokinin 1) that produces vomiting. Therefore, the launch of these more efficacious drugs is likely to encourage physicians to prescribe these new drugs over existing drugs

The global CINV existing and pipeline drugs market has been segmented into North America, Europe, Asia Pacific Latin America, and Middle East & Africa. North America was the largest market for CINV drugs in 2021, accounting for over 45% share. The region is expected to retain its leadership position during the forecast period. The market in North America is likely to expand at a CAGR of over 7% from 2022 to 2031.

Europe was the second largest market for CINV drugs in 2021. The launch of CINV pipeline drugs in Europe is projected to be a year later than in North America, given the delays on the past launches of CINV drugs such as Aloxi and Emend.

The CINV existing and pipeline drugs market in Asia Pacific is driven by increase in penetration of western companies and rise in the number of cancer patients. Generic manufacturers in countries in Asia Pacific and emerging regions compete with the branded CINV drug manufacturers. The demand for generic versions of expired branded drugs is high in the region due to low purchasing power of the people. Strong economic growth in countries such as India and China and improving healthcare infrastructure are anticipated to drive the CINV existing and pipeline drugs market in Asia Pacific.

Key players operating in the global CINV existing and pipeline drugs market include GlaxoSmithKline plc, Helsinn Holding S.A., Heron Therapeutics, Inc., Merck & Co., Inc., and Tesaro, Inc. Each of these players has been profiled in the global CINV existing and pipeline drugs market report based on parameters such as company overview, financial overview, business strategies, application portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 1.9 Bn |

|

Market Forecast Value in 2031 |

US$ 3.2 Bn |

|

Growth Rate (CAGR) |

5.8% |

|

Forecast Period |

2022–2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, pricing analysis, and parent industry overview. |

|

Format |

Electronic (PDF) |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global CINV existing and pipeline drugs market was valued at US$ 1.9 Bn in 2021

The global CINV existing and pipeline drugs market is projected to exceed US$ 3.2 Bn by 2031

The global CINV existing and pipeline drugs market is anticipated to grow at a CAGR of 5.8% during forecast period

The rolapitant segment accounted for nearly 61% share of the global CINV existing and pipeline drugs market in 2021

North America is expected to account for the largest share of the global market during the forecast period

Prominent players in the global CINV existing and pipeline drugs market are GlaxoSmithKline plc, Helsinn Holding S.A., Heron Therapeutics, Inc., Merck & Co., Inc., and Tesaro, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global CINV Existing and Pipeline Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Major Drugs Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1.Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global CINV Existing and Pipeline Drugs Market Analysis and Forecasts, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.4.2. Market Volume/Unit Shipments Projections

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Installed Base Scenario (2019)

5.1.1. Installed Base Scenario

5.1.1.1. By Major Drugs

5.1.1.2. By Region

5.1.1.3. By Major Players

5.1.2. New versus Replacement Unit Shipments

5.2. Export-Import Scenario

5.2.1. Export-Import Scenario, by Region*

5.3. Price Comparison Analysis (2019)

5.3.1. By Major Drugs Type

5.3.2. By End User Type

5.3.3. By Region

5.3.4. By Major Players

5.4. Key Potential Customers

5.4.1. Key Potential Customers by Region

5.5. Key Vendor and Distributor Analysis

5.5.1. Key Vendor Analysis by Major Players

5.5.2. Key Distributor Analysis by Major Players

5.6. Technological Advancements

5.7. Regulatory Scenario, by Region/globally

5.8. Key Industry Events (mergers, acquisitions, partnerships, etc.)

5.9. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global CINV Existing and Pipeline Drugs Market Analysis and Forecasts, By Major Drugs

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Major Drugs, 2017–2031

6.3.1. Aloxi (palonosetron)

6.3.2. Zofran Generic (ondansetron)

6.3.3. Kytril Generic (granisetron)

6.3.4. Emend (aprepitant)

6.3.5. Akynzeo (netupitant-palonosetron)

6.3.6. SUSTOL (extended release granisetron injection)

6.3.7. Rolapitant

6.4. Market Attractiveness Analysis, By Major Drugs

7. Global CINV Existing and Pipeline Drugs Market Analysis and Forecasts, By Region

7.1. Key Findings

7.2. Market Value Forecast, by Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Market Attractiveness Analysis, By Region

8. North America CINV Existing and Pipeline Drugs Market Analysis and Forecast

8.1. Introduction

8.1.1. Key Findings

8.2. Market Value Forecast, by Major Drugs, 2017–2031

8.2.1. Aloxi (palonosetron)

8.2.2. Zofran Generic (ondansetron)

8.2.3. Kytril Generic (granisetron)

8.2.4. Emend (aprepitant)

8.2.5. Akynzeo (netupitant-palonosetron)

8.2.6. SUSTOL (extended release granisetron injection)

8.2.7. Rolapitant

8.3. Market Value Forecast, by Country, 2017–2031

8.3.1. U.S.

8.3.2. Canada

8.4. Market Attractiveness Analysis

8.4.1. By Major Drugs

8.4.2. By Country

9. Europe CINV Existing and Pipeline Drugs Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Major Drugs, 2017–2031

9.2.1. Aloxi (palonosetron)

9.2.2. Zofran Generic (ondansetron)

9.2.3. Kytril Generic (granisetron)

9.2.4. Emend (aprepitant)

9.2.5. Akynzeo (netupitant-palonosetron)

9.2.6. SUSTOL (extended release granisetron injection)

9.2.7. Rolapitant

9.3. Market Value Forecast, by Country/Sub-region, 2017–2031

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Italy

9.3.5. Spain

9.3.6. Rest of Europe

9.4. Market Attractiveness Analysis

9.4.1. By Major Drugs

9.4.2. By Country/Sub-region

10. Asia Pacific CINV Existing and Pipeline Drugs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Major Drugs, 2017–2031

10.2.1. Aloxi (palonosetron)

10.2.2. Zofran Generic (ondansetron)

10.2.3. Kytril Generic (granisetron)

10.2.4. Emend (aprepitant)

10.2.5. Akynzeo (netupitant-palonosetron)

10.2.6. SUSTOL (extended release granisetron injection)

10.2.7. Rolapitant

10.3. Market Value Forecast, by Country/Sub-region, 2017–2031

10.3.1. Japan

10.3.2. China

10.3.3. India

10.3.4. Australia & New Zealand

10.3.5. Rest of Asia Pacific

10.4. Market Attractiveness Analysis

10.4.1. By Major Drugs

10.4.2. By Country/Sub-region

11. Latin America CINV Existing and Pipeline Drugs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Major Drugs, 2017–2031

11.2.1. Aloxi (palonosetron)

11.2.2. Zofran Generic (ondansetron)

11.2.3. Kytril Generic (granisetron)

11.2.4. Emend (aprepitant)

11.2.5. Akynzeo (netupitant-palonosetron)

11.2.6. SUSTOL (extended release granisetron injection)

11.2.7. Rolapitant

11.3. Market Value Forecast, by Country/Sub-region, 2017–2031

11.3.1. Brazil

11.3.2. Mexico

11.3.3. Rest of Latin America

11.4. Market Attractiveness Analysis

11.4.1. By Major Drugs

11.4.2. By Country/Sub-region

12. Middle East & Africa CINV Existing and Pipeline Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Major Drugs, 2017–2031

12.2.1. Aloxi (palonosetron)

12.2.2. Zofran Generic (ondansetron)

12.2.3. Kytril Generic (granisetron)

12.2.4. Emend (aprepitant)

12.2.5. Akynzeo (netupitant-palonosetron)

12.2.6. SUSTOL (extended release granisetron injection)

12.2.7. Rolapitant

12.3. Market Value Forecast, by Country/Sub-region, 2017–2031

12.3.1. GCC Countries

12.3.2. South Africa

12.3.3. Rest of Middle East & Africa

12.4. Market Attractiveness Analysis

12.4.1. By Major Drugs

12.4.2. By Country/Sub-region

13. Competition Landscape

13.1. GlaxoSmithKline plc

13.1.1. Company Overview

13.1.2. Financial Overview

13.1.3. Product Portfolio

13.1.4. Business Strategies

13.1.5. Recent Developments

13.2. Helsinn Holding S.A.

13.2.1. Company Overview

13.2.2. Financial Overview

13.2.3. Product Portfolio

13.2.4. Business Strategies

13.2.5. Recent Developments

13.3. Heron Therapeutics, Inc.

13.3.1. Company Overview

13.3.2. Financial Overview

13.3.3. Product Portfolio

13.3.4. Business Strategies

13.3.5. Recent Developments

13.4. Merck & Co., Inc.

13.4.1. Company Overview

13.4.2. Financial Overview

13.4.3. Product Portfolio

13.4.4. Business Strategies

13.4.5. Recent Developments

13.5. Tesaro, Inc.

13.5.1. Company Overview

13.5.2. Financial Overview

13.5.3. Product Portfolio

13.5.4. Business Strategies

13.5.5. Recent Developments

List of Tables

Table 1: List of Abbreviations

Table 2: Market Snapshot: Global CINV Existing and Pipeline Drugs Market (2021 & 2031)

Table 3: Chemotherapy Induced Nausea and Vomiting (CINV): Subtypes and Description

Table 4: Treatment Recommendations for CINV

Table 5: Event Impact Analysis: Global CINV Drugs Market

Table 6: Global CINV Drugs Market Revenue, by Major Drugs, 2017 - 2031

Table 7: Global CINV Estimated Patient Pool, by Major Drugs, 2017 - 2031 (Thousands)

Table 8: SWOT Analysis for SUSTOL

Table 9: Efficacy of SUSTOL with Difficult Chemo Regimens

Table 10: SWOT Analysis for Rolapitant

Table 11: Overview of Rolapitant Efficacy Analysis

Table 12: Global CINV Drugs Market Revenue, by Region, 2017 - 2031

Table 13: Global CINV Estimated Patient Pool, by Geography, 2017 - 2031 (Thousands)

Table 14: North America CINV Pipeline Drugs Market Revenue, 2017 - 2021

Table 15: North America CINV Estimated Patient Pool, by Pipeline Drug, 2017 - 2021 (Thousands)

Table 16: Europe CINV Pipeline Drugs Market Revenue, 2022 – 2031

Table 17: Europe CINV Estimated Patient Pool, by Pipeline Drug, 2022 – 2031 (Thousands)

Table 18: GlaxoSmithKline plc: Expenses & Revenue, 2011 – 2017

Table 19: Helsinn Holding S.A.: Pipeline Product Portfolio

Table 20: Heron Therapeutics, Inc.: Expenses & Revenue, 2011 – 2017

Table 21: Heron Therapeutics, Inc.: Pipeline Product Portfolio

Table 22: Merck & Co., Inc.: Expenses & Revenue, 2011 – 2017

Table 23: Tesaro, Inc.: Expenses & Revenue, 2011 – 2017

Table 24: Tesaro, Inc.: Pipeline Product Portfolio

List of Figures

Figure 1: CINV Existing and Pipeline Drugs: Market Segmentation

Figure 2: Global CINV Drugs Market (US$ Mn), by Major Drugs, 2021

Figure 3: Comparative Analysis: Global CINV Drugs Market Revenue, by Geography, 2017 & 2031 (Value %)

Figure 4: Pathogenesis of CINV

Figure 5: Unmet Needs in the CINV Market

Figure 6: Comparative Analysis: Global CINV Drugs Market Revenue, by Major Drugs, 2017 & 2031 (Value %)

Figure 7: Global Aloxi Market Revenue, 2017 - 2031

Figure 8: Global Zofran Generic Market Revenue, 2017 - 2031

Figure 9: Global Kytril Generic Market Revenue, 2017 - 2031

Figure 10: Global Emend Market Revenue, 2017 - 2031

Figure 11: Global Akynzeo Market Revenue, 2017 - 2021

Figure 12: Global SUSTOL Market Revenue, 2022 – 2031

Figure 13: Primary Efficacy Results: Complete Response with Patients Receiving MEC

Figure 14: Primary Efficacy Results: Complete Response with Patients Receiving HEC

Figure 15: Global Rolapitant Market Revenue, 2017 - 2021

Figure 16: North America CINV Drugs Market Revenue, 2017 - 2031

Figure 17: Europe CINV Drugs Market Revenue, 2017 - 2031

Figure 18: Asia Pacific CINV Drugs Market Revenue, 2017 - 2031

Figure 19: Latin America CINV Drugs Market Revenue, 2017 - 2031

Figure 20: Middle East & Africa CINV Drugs Market Revenue, 2017 - 2031