Global Chromatography Accessories and Consumables Market: Snapshot

Chromatography is the most generally utilized procedure for partition of blends. Chromatography accessories and consumables comprise instruments and research facility gear which together supplement chromatography frameworks. The mechanical advancement throughout the years in the field of scientific innovation has in the end expanded the exactness and accuracy of chromatography methods. The rising demand for quality and virtue of different synthetic concoctions and dynamic pharmaceutical fixings (APIs) is enhancing the market development of chromatography accessories and consumables market. Expanded accessibility and worthiness of chromatography accessories and consumables would further lift the development of the market sooner rather than later. Different utilizations of chromatography procedures are crosswise over ventures, for example, pharmaceutical medication disclosure (pharma organizations, life science look into, CROs, and so on.), sustenance and drink, crime scene investigation, oil and gas, synthetic substances, sports, polymers, and drug.

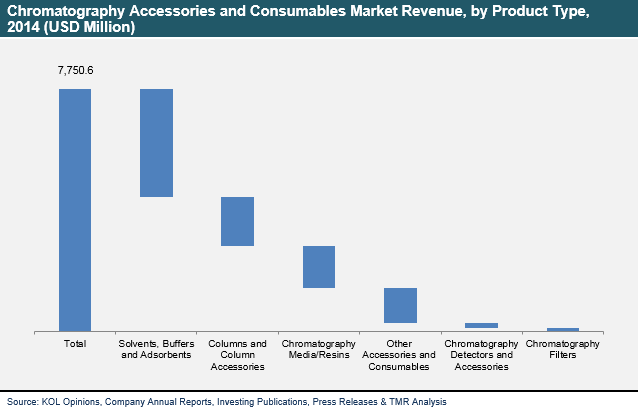

According to the report by Transparency Market Research (TMR), the global chromatography accessories and consumables market registered the revenue of about US$7.8 bn in 2014 and is expected to expand at a CAGR of 7.5% over the forecast period from 2015 and 2023 to attain the value of around US$15.0 bn by the end of 2023.

Global Chromatography Accessories and Consumables Market: Segments

The chromatography accessories and consumables market is segmented on the basis of the type and region. Based on device type, the chromatography accessories and consumables market is segmented into chromatography media/resins, chromatography detectors and accessories, columns and column accessories, chromatography filters, buffers and adsorbents, and solvents, other accessories and consumables. Of these, solvents, buffers and absorbents segment dominated the global chromatography accessories and consumables market. The key factor attributable to the growth is its dominance and significant growth is increasing demand for solvents, buffers and adsorbents especially from pharmaceutical and research industries.

Based on the end users, the chromatography accessories and consumables market is segregated in to academics and research, pharmaceuticals, hospitals and diagnostic laboratories, food and agriculture, and others. Of these, pharmaceuticals segment accounted for the largest share in the revenue of the global market. The high prevalence coupled with increasing incidences of several chronic diseases, development activities, potential drug discovery, and increased government funding in the R&D activities are driving growth of the global chromatography accessories and consumables market.

Global Chromatography Accessories and Consumables Market: Regional Analysis

On the basis of region, the global chromatography accessories and consumables market is segmented in to North America, Asia Pacific, Europe, the Middle East and Africa (MEA), and South America. Of these, North America dominates the global market for chromatography accessories and consumables market owing to high demand for advanced machines in the regions. Additionally, the Asia Pacific chromatography accessories and consumables market is expected to expand at a most lucrative growth rate.

Global Chromatography Accessories and Consumables Market: Competitive Landscape

Some of the key players operating in the global reprocessed medical devices market includes Agilent Technologies, Inc., GE Healthcare, Bio-Rad Laboratories, Inc., EMD Millipore, PerkinElmer, Inc., Pall Corporation, Phenomenex, Shimadzu Corporation, Thermo Fisher Scientific, Inc., Sigma-Aldrich Corporation, Waters Corporation, and Tosoh Corporation. The report identifies that in terms of revenue, the Waters Corporation accounted for the largest share in the global chromatography accessories and consumables market in 2013. This is attributed to active initiatives for constant innovations and technological developments in the chromatography accessories and consumables devices.

List of Figures

FIG. 1 Chromatography Accessories and Consumables: Market Segmentation

FIG. 2 Global Chromatography Accessories and Consumables Market Revenue, by Product Type, 2014 (USD Million)

FIG. 3 Global Chromatography Accessories and Consumables Market Revenue, by End-users, 2014 (USD Million)

FIG. 4 Comparative Analysis: Global Chromatography Accessories and Consumables Market Revenue, by Geography, 2014 & 2023 (Value %)

FIG. 5 Porter’s Five Forces Analysis: Global Chromatography Accessories and Consumables Market

FIG. 6 Market Attractiveness Analysis: Global Chromatography Accessories and Consumables Market, by Geography, 2014

FIG. 7 Market Share Analysis, by Key Players: Global Chromatography Accessories and Consumables Market, 2013 (Value %)

FIG. 8 Comparative Analysis: Global Chromatography Accessories and Consumables Market Revenue, by Product Type, 2014 & 2023 (Value %)

FIG. 9 Global Chromatography Media/Resins Market Revenue, 2013 – 2023 (USD Million)

FIG. 10 Global Columns and Column Accessories Market Revenue, 2013 – 2023 (USD Million)

FIG. 11 Global Chromatography Detectors and Accessories Market Revenue, 2013 – 2023 (USD Million)

FIG. 12 Global Chromatography Filters Market Revenue, 2013 – 2023 (USD Million)

FIG. 13 Global Solvents, Buffers and Adsorbents Market Revenue, 2013 – 2023 (USD Million)

FIG. 14 Global Other Accessories and Consumables Market Revenue, 2013 – 2023 (USD Million)

FIG. 15 Comparative Analysis: Global Chromatography Accessories and Consumables Market Revenue, by End-users, 2014 & 2023 (Value %)

FIG. 16 Global Academics and Research Market Revenue, 2013 – 2023 (USD Million)

FIG. 17 Global Hospitals and Diagnostic Laboratories Market Revenue, 2013 – 2023 (USD Million)

FIG. 18 Global Pharmaceuticals Market Revenue, 2013 – 2023 (USD Million)

FIG. 19 Global Food and Agriculture Market Revenue, 2013 – 2023 (USD Million)

FIG. 20 Global Other End-users Market Revenue, 2013 – 2023 (USD Million)

FIG. 21 United States Chromatography Accessories and Consumables Market Revenue, 2013 – 2023 (USD Million)

FIG. 22 Canada Chromatography Accessories and Consumables Market Revenue, 2013 – 2023 (USD Million)

FIG. 23 Germany Chromatography Accessories and Consumables Market Revenue, 2013 – 2023 (USD Million)

FIG. 24 France Chromatography Accessories and Consumables Market Revenue, 2013 – 2023 (USD Million)

FIG. 25 United Kingdom Chromatography Accessories and Consumables Market Revenue, 2013 – 2023 (USD Million)

FIG. 26 Rest of Europe Chromatography Accessories and Consumables Market Revenue, 2013 – 2023 (USD Million)

FIG. 27 China Chromatography Accessories and Consumables Market Revenue, 2013 – 2023 (USD Million)

FIG. 28 Japan Chromatography Accessories and Consumables Market Revenue, 2013 – 2023 (USD Million)

FIG. 29 India Chromatography Accessories and Consumables Market Revenue, 2013 – 2023 (USD Million)

FIG. 30 Rest of Asia Pacific Chromatography Accessories and Consumables Market Revenue, 2013 – 2023 (USD Million)

FIG. 31 Brazil Chromatography Accessories and Consumables Market Revenue, 2013 – 2023 (USD Million)

FIG. 32 Rest of Latin America Chromatography Accessories and Consumables Market Revenue, 2013 – 2023 (USD Million)

FIG. 33 South Africa Chromatography Accessories and Consumables Market Revenue, 2013 – 2023 (USD Million)

FIG. 34 Rest of MEA Chromatography Accessories and Consumables Market Revenue, 2013 – 2023 (USD Million)

FIG. 35 Agilent Technologies, Inc.: Annual Revenues, 2012 – 2014 (USD Million)

FIG. 36 Bio-Rad Laboratories, Inc.: Annual Revenue, 2012 – 2014 (USD Million)

FIG. 37 EMD Millipore: Annual Revenue, 2012 – 2014 (USD Million)

FIG. 38 GE Healthcare: Annual Revenue, 2012 – 2014 (USD Million)

FIG. 39 Pall Corporation: Annual Revenue, 2012 – 2014 (USD Million)

FIG. 40 PerkinElmer, Inc.: Annual Revenue, 2012 – 2014 (USD Million)

FIG. 41 Shimadzu Corporation: Annual Revenue, 2012 – 2014 (USD Million)

FIG. 42 Sigma-Aldrich Corporation: Annual Revenue, 2012 – 2014 (USD Million)

FIG. 43 Thermo Fisher Scientific, Inc.: Annual Revenues, 2012 – 2014 (USD Million)

FIG. 44 Tosoh Corporation: Annual Revenues, 2012 – 2014 (USD Million)

FIG. 45 Waters Corporation: Annual Revenues, 2012 – 2014 (USD Million)

FIG. 46 W. R. Grace & Co.: Annual Revenue, 2012 – 2014 (USD Million)