Analysts’ Viewpoint on Market Scenario

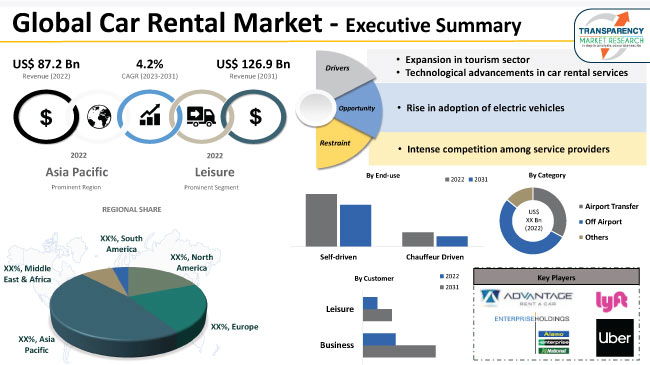

The future analysis of the car rental market suggests that with growth in international travel and changes in attitudes toward car ownership rise, the industry is projected to undergo significant transformations. Surge in disposable income and expansion in the tourism sector are also estimated to augment market expansion during the forecast period.

Rise in competition among service providers is a major challenge leading to market limitations. Thus, vendors in the global car rental industry are focused on technological advancements to broaden their customer base and increase their car rental market share. Surge in adoption of smartphones and rise in penetration of internet are likely to offer lucrative growth opportunities for car rental companies. Mobile applications and online platforms have simplified the reservation and rental process, making it more convenient for customers to book, pick up, and return vehicles.

Car rental is a popular service that provides individuals and businesses with the opportunity to rent vehicles for temporary use. It can be availed during a vacation, a business trip, or any transportation due to personal reasons. One of the major advantages of car rental is the flexibility it offers, allowing travelers to explore new destinations at their own pace and convenience. Instead of purchasing and maintaining a vehicle, customers can simply rent a car for a desired period, saving the costs and responsibilities associated with long-term vehicle ownership.

Car rental service providers maintain a diverse fleet of vehicles, ranging from compact cars and sedans to SUVs, luxury cars, vans, and even specialty vehicles. Such diversity allows customers to choose a vehicle that suits their specific needs, such as seating capacity, fuel efficiency, luggage space, or desired level of comfort and style. There are various types of car rental available, including short-term rentals for leisure or business travel, long-term rentals for extended periods, and specialty rentals for specific purposes like moving or luxury transportation.

Integration of technologies, such as GPS, keyless entry systems, and digital payment methods, has enhanced operational efficiency and streamlined the rental experience. Furthermore, the expansion of ride-hailing and car-sharing platforms into new markets, as well as their integration with traditional car rental services, is projected to shape the future landscape of the industry.

Many tourists are opting for vacation rentals, such as cabins, beach houses, or countryside villas, which are often located away from city centers. In such cases, having a rental car becomes essential for reaching these accommodations and exploring nearby attractions. Additionally, road trips are popular among travelers who want to explore scenic routes and visit multiple destinations within a region.

Rise in number of business travelers is projected to spur the car rental market growth in the near future. Many professionals require transportation for meetings, site visits, and other work-related activities in unfamiliar locations. Renting a car provides them with the flexibility and convenience needed for efficient business travel.

Growth in the tourism sector is boosting the car rental market development. This is especially true in emerging tourism markets and destinations where public transportation infrastructure may be limited. Tourist attractions, hotels, and travel agencies are collaborating with car rental companies to provide integrated packages or recommendations, further driving demand for car rental.

Emergence of online rental platforms and reservation systems has simplified the process of renting a car. Customers can now browse available vehicles, compare prices, and make reservations through user-friendly websites or mobile apps. This convenience has made it easier for people to book rental cars in advance, saving time and effort. Hence, technological advancements in car rental services are augmenting the car rental market progress.

Technological advancements have facilitated the growth of car-sharing and peer-to-peer rental platforms. These platforms enable individuals to rent out their personal vehicles or access shared vehicles for short durations. The availability of mobile apps and advanced booking systems allows for easy vehicle selection, booking, and payment, promoting flexible and convenient transportation options.

Many car rental companies are adopting keyless entry systems, which use smartphones or digital key fobs to unlock and start rental vehicles. This eliminates the need for physical keys and provides a more secure and streamlined rental experience. Additionally, vehicle tracking technology enables companies to monitor the location and status of rental cars, ensuring better fleet management and security.

According to the latest car rental market trends, the leisure customer segment is expected to dominate the industry during the forecast period. Car rental companies are offering a wide range of vehicles, including compact cars, SUVs, luxury cars, and specialty vehicles like convertibles or off-road vehicles. Car rental service providers allow customers to choose a vehicle that suits their specific needs and preferences for their leisure activities.

In some cases, renting a car can be more cost-effective than using other modes of transportation, particularly for larger groups or families. It eliminates the need to purchase or maintain a personal vehicle solely for occasional leisure trips, saving money on depreciation, insurance, and maintenance costs.

According to the latest car rental market forecast, Asia Pacific is projected to hold largest share from 2023 to 2031. Expansion in domestic and international tourism sectors is fueling market dynamics in the region. Tourists often prefer renting cars to explore various destinations at their own pace. Additionally, business travelers also contribute to the demand for car rentals in major cities. Rapid urbanization in countries, such as China and India, is also augmenting market statistics in Asia Pacific.

Changing consumer preferences, especially among millennials and younger generations, have driven the demand for shared mobility solutions like car rentals. These consumers often prioritize flexibility and convenience over car ownership.

The global industry is highly competitive, with the presence of several key players. Most companies are adopting various strategies to gain a competitive edge and capture a larger share of the market.

Advantage Rent A Car, Avis Budget Group, BIS Group, Carzonrent, China Auto Rental Inc., Citer SA, eHi Car Services, Enterprise Holdings, Europcar Mobility Group, Fox Rent A Car, Localiza Rent a Car, Lyft, Movida Rent a Car, Payless Car Rental, Rent-A-Wreck, Sixt SE, The Hertz Corporation, The Orix Corporation, Uber, and Zipcar are key companies in the car rental industry.

Each of these players has been profiled in the car rental market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 87.2 Bn |

|

Market Forecast Value in 2031 |

US$ 126.9 Bn |

|

Growth Rate (CAGR) |

4.2% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 87.2 Bn in 2022

It is projected to grow at a CAGR of 4.2% from 2023 to 2031

It is estimated to reach US$ 126.9 Bn by the end of 2031

Expansion in tourism sector and technological advancements in car rental services

The leisure customer segment is projected to account for major share during the forecast period

Asia Pacific is anticipated to record the highest demand during the forecast period

Advantage Rent A Car, Avis Budget Group, BIS Group, Carzonrent, China Auto Rental Inc., Citer SA, eHi Car Services, Enterprise Holdings, Europcar Mobility Group, Fox Rent A Car, Localiza Rent a Car, Lyft, Movida Rent a Car, Payless Car Rental, Rent-A-Wreck, Sixt SE, The Hertz Corporation, The Orix Corporation, Uber, and Zipcar

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Go to Market Strategy

2.8.1. Demand & Supply Side Trends

2.8.1.1. GAP Analysis

2.8.2. Identification of Potential Market Spaces

2.8.3. Understanding Buying Process of Customers

2.8.4. Preferred Sales & Marketing Strategy

3. Global Car Rental Market, By Car Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Car Rental Market Size & Forecast, 2017-2031, By Car Type

3.2.1. Minicompact (A Segment)

3.2.2. Supermini (B Segment)

3.2.3. Compact (C Segment)

3.2.4. Mid-size (D Segment)

3.2.5. Executive (E Segment)

3.2.6. Luxury (F Segment)

3.2.7. Utility Vehicle (Sport Utility Vehicles & Multi-purpose Vehicles)

4. Global Car Rental Market, By Category

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Car Rental Market Size & Forecast, 2017-2031, By Category

4.2.1. Airport Transfer

4.2.2. Off Airport

4.2.2.1. Local Usage

4.2.2.2. Outstation

4.2.3. Others

5. Global Car Rental Market, By Customer

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Car Rental Market Size & Forecast, 2017-2031, By Customer

5.2.1. Business

5.2.2. Leisure

6. Global Car Rental Market, By Booking

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Car Rental Market Size & Forecast, 2017-2031, By Booking

6.2.1. Online

6.2.2. Offline

7. Global Car Rental Market, By Rental Length

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Car Rental Market Size & Forecast, 2017-2031, By Rental Length

7.2.1. Short Term

7.2.2. Long Term

8. Global Car Rental Market, By End-use

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Car Rental Market Size & Forecast, 2017-2031, By End-use

8.2.1. Self-driven

8.2.2. Chauffeur Driven

9. Global Car Rental Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Car Rental Market Size & Forecast, 2017-2031, By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Car Rental Market

10.1. Market Snapshot

10.2. North America Car Rental Market Size & Forecast, 2017-2031, By Car Type

10.2.1. Minicompact (A Segment)

10.2.2. Supermini (B Segment)

10.2.3. Compact (C Segment)

10.2.4. Mid-size (D Segment)

10.2.5. Executive (E Segment)

10.2.6. Luxury (F Segment)

10.2.7. Utility Vehicle (Sport Utility Vehicles & Multi-purpose Vehicles)

10.3. North America Car Rental Market Size & Forecast, 2017-2031, By Category

10.3.1. Airport Transfer

10.3.2. Off Airport

10.3.2.1. Local Usage

10.3.2.2. Outstation

10.3.3. Others

10.4. North America Car Rental Market Size & Forecast, 2017-2031, By Customer

10.4.1. Business

10.4.2. Leisure

10.5. North America Car Rental Market Size & Forecast, 2017-2031, By Booking

10.5.1. Online

10.5.2. Offline

10.6. North America Car Rental Market Size & Forecast, 2017-2031, By Rental Length

10.6.1. Short Term

10.6.2. Long Term

10.7. North America Car Rental Market Size & Forecast, 2017-2031, By End-use

10.7.1. Self-driven

10.7.2. Chauffeur Driven

10.8. North America Car Rental Market Size & Forecast, 2017-2031, By Country

10.8.1. U. S.

10.8.2. Canada

10.8.3. Mexico

11. Europe Car Rental Market

11.1. Market Snapshot

11.2. Europe Car Rental Market Size & Forecast, 2017-2031, By Car Type

11.2.1. Minicompact (A Segment)

11.2.2. Supermini (B Segment)

11.2.3. Compact (C Segment)

11.2.4. Mid-size (D Segment)

11.2.5. Executive (E Segment)

11.2.6. Luxury (F Segment)

11.2.7. Utility Vehicle (Sport Utility Vehicles & Multi-purpose Vehicles)

11.3. Europe Car Rental Market Size & Forecast, 2017-2031, By Category

11.3.1. Airport Transfer

11.3.2. Off Airport

11.3.2.1. Local Usage

11.3.2.2. Outstation

11.3.3. Others

11.4. Europe Car Rental Market Size & Forecast, 2017-2031, By Customer

11.4.1. Business

11.4.2. Leisure

11.5. Europe Car Rental Market Size & Forecast, 2017-2031, By Booking

11.5.1. Online

11.5.2. Offline

11.6. Europe Car Rental Market Size & Forecast, 2017-2031, By Rental Length

11.6.1. Short Term

11.6.2. Long Term

11.7. Europe Car Rental Market Size & Forecast, 2017-2031, By End-use

11.7.1. Self-driven

11.7.2. Chauffeur Driven

11.8. Europe Car Rental Market Size & Forecast, 2017-2031, By Country

11.8.1. Germany

11.8.2. U.K.

11.8.3. France

11.8.4. Italy

11.8.5. Spain

11.8.6. Nordic Countries

11.8.7. Russia & CIS

11.8.8. Rest of Europe

12. Asia Pacific Car Rental Market

12.1. Market Snapshot

12.2. Asia Pacific Car Rental Market Size & Forecast, 2017-2031, By Car Type

12.2.1. Minicompact (A Segment)

12.2.2. Supermini (B Segment)

12.2.3. Compact (C Segment)

12.2.4. Mid-size (D Segment)

12.2.5. Executive (E Segment)

12.2.6. Luxury (F Segment)

12.2.7. Utility Vehicle (Sport Utility Vehicles & Multi-purpose Vehicles)

12.3. Asia Pacific Car Rental Market Size & Forecast, 2017-2031, By Category

12.3.1. Airport Transfer

12.3.2. Off Airport

12.3.2.1. Local Usage

12.3.2.2. Outstation

12.3.3. Others

12.4. Asia Pacific Car Rental Market Size & Forecast, 2017-2031, By Customer

12.4.1. Business

12.4.2. Leisure

12.5. Asia Pacific Car Rental Market Size & Forecast, 2017-2031, By Booking

12.5.1. Online

12.5.2. Offline

12.6. Asia Pacific Car Rental Market Size & Forecast, 2017-2031, By Rental Length

12.6.1. Short Term

12.6.2. Long Term

12.7. Asia Pacific Car Rental Market Size & Forecast, 2017-2031, By End-use

12.7.1. Self-driven

12.7.2. Chauffeur Driven

12.8. Asia Pacific Car Rental Market Size & Forecast, 2017-2031, By Country

12.8.1. China

12.8.2. India

12.8.3. Japan

12.8.4. ASEAN Countries

12.8.5. South Korea

12.8.6. ANZ

12.8.7. Rest of Asia Pacific

13. Middle East & Africa Car Rental Market

13.1. Market Snapshot

13.2. Middle East & Africa Car Rental Market Size & Forecast, 2017-2031, By Car Type

13.2.1. Minicompact (A Segment)

13.2.2. Supermini (B Segment)

13.2.3. Compact (C Segment)

13.2.4. Mid-size (D Segment)

13.2.5. Executive (E Segment)

13.2.6. Luxury (F Segment)

13.2.7. Utility Vehicle (Sport Utility Vehicles & Multi-purpose Vehicles)

13.3. Middle East & Africa Car Rental Market Size & Forecast, 2017-2031, By Category

13.3.1. Airport Transfer

13.3.2. Off Airport

13.3.2.1. Local Usage

13.3.2.2. Outstation

13.3.3. Others

13.4. Middle East & Africa Car Rental Market Size & Forecast, 2017-2031, By Customer

13.4.1. Business

13.4.2. Leisure

13.5. Middle East & Africa Car Rental Market Size & Forecast, 2017-2031, By Booking

13.5.1. Online

13.5.2. Offline

13.6. Middle East & Africa Car Rental Market Size & Forecast, 2017-2031, By Rental Length

13.6.1. Short Term

13.6.2. Long Term

13.7. Middle East & Africa Car Rental Market Size & Forecast, 2017-2031, By End-use

13.7.1. Self-driven

13.7.2. Chauffeur Driven

13.8. Middle East & Africa Car Rental Market Size & Forecast, 2017-2031, By Country

13.8.1. GCC

13.8.2. South Africa

13.8.3. Turkey

13.8.4. Rest of Middle East & Africa

14. South America Car Rental Market

14.1. Market Snapshot

14.2. South America Car Rental Market Size & Forecast, 2017-2031, By Car Type

14.2.1. Minicompact (A Segment)

14.2.2. Supermini (B Segment)

14.2.3. Compact (C Segment)

14.2.4. Mid-size (D Segment)

14.2.5. Executive (E Segment)

14.2.6. Luxury (F Segment)

14.2.7. Utility Vehicle (Sport Utility Vehicles & Multi-purpose Vehicles)

14.3. South America Car Rental Market Size & Forecast, 2017-2031, By Category

14.3.1. Airport Transfer

14.3.2. Off Airport

14.3.2.1. Local Usage

14.3.2.2. Outstation

14.3.3. Others

14.4. South America Car Rental Market Size & Forecast, 2017-2031, By Customer

14.4.1. Business

14.4.2. Leisure

14.5. South America Car Rental Market Size & Forecast, 2017-2031, By Booking

14.5.1. Online

14.5.2. Offline

14.6. South America Car Rental Market Size & Forecast, 2017-2031, By Rental Length

14.6.1. Short Term

14.6.2. Long Term

14.7. South America Car Rental Market Size & Forecast, 2017-2031, By End-use

14.7.1. Self-driven

14.7.2. Chauffeur Driven

14.8. South America Car Rental Market Size & Forecast, 2017-2031, By Country

14.8.1. Brazil

14.8.2. Argentina

14.8.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2022

15.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profile/ Key Players

16.1. Advantage Rent A Car

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. Avis Budget Group

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. BIS Group

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. Carzonrent

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. China Auto Rental Inc.

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. Citer SA

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. eHi Car Services

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. Enterprise Holdings

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. Europcar Mobility Group

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. Fox Rent A Car

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. Localiza Rent a Car

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. Lyft

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. Movida Rent a Car

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. Payless Car Rental

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Production Locations

16.14.4. Product Portfolio

16.14.5. Competitors & Customers

16.14.6. Subsidiaries & Parent Organization

16.14.7. Recent Developments

16.14.8. Financial Analysis

16.14.9. Profitability

16.14.10. Revenue Share

16.15. Rent-A-Wreck

16.15.1. Company Overview

16.15.2. Company Footprints

16.15.3. Production Locations

16.15.4. Product Portfolio

16.15.5. Competitors & Customers

16.15.6. Subsidiaries & Parent Organization

16.15.7. Recent Developments

16.15.8. Financial Analysis

16.15.9. Profitability

16.15.10. Revenue Share

16.16. Sixt SE

16.16.1. Company Overview

16.16.2. Company Footprints

16.16.3. Production Locations

16.16.4. Product Portfolio

16.16.5. Competitors & Customers

16.16.6. Subsidiaries & Parent Organization

16.16.7. Recent Developments

16.16.8. Financial Analysis

16.16.9. Profitability

16.16.10. Revenue Share

16.17. The Hertz Corporation

16.17.1. Company Overview

16.17.2. Company Footprints

16.17.3. Production Locations

16.17.4. Product Portfolio

16.17.5. Competitors & Customers

16.17.6. Subsidiaries & Parent Organization

16.17.7. Recent Developments

16.17.8. Financial Analysis

16.17.9. Profitability

16.17.10. Revenue Share

16.18. The Orix Corporation

16.18.1. Company Overview

16.18.2. Company Footprints

16.18.3. Production Locations

16.18.4. Product Portfolio

16.18.5. Competitors & Customers

16.18.6. Subsidiaries & Parent Organization

16.18.7. Recent Developments

16.18.8. Financial Analysis

16.18.9. Profitability

16.18.10. Revenue Share

16.19. Uber

16.19.1. Company Overview

16.19.2. Company Footprints

16.19.3. Production Locations

16.19.4. Product Portfolio

16.19.5. Competitors & Customers

16.19.6. Subsidiaries & Parent Organization

16.19.7. Recent Developments

16.19.8. Financial Analysis

16.19.9. Profitability

16.19.10. Revenue Share

16.20. Zipcar

16.20.1. Company Overview

16.20.2. Company Footprints

16.20.3. Production Locations

16.20.4. Product Portfolio

16.20.5. Competitors & Customers

16.20.6. Subsidiaries & Parent Organization

16.20.7. Recent Developments

16.20.8. Financial Analysis

16.20.9. Profitability

16.20.10. Revenue Share

16.21. Other Key Players

16.21.1. Company Overview

16.21.2. Company Footprints

16.21.3. Production Locations

16.21.4. Product Portfolio

16.21.5. Competitors & Customers

16.21.6. Subsidiaries & Parent Organization

16.21.7. Recent Developments

16.21.8. Financial Analysis

16.21.9. Profitability

16.21.10. Revenue Share

List of Tables

Table 1: Global Car Rental Market Revenue (US$ Bn) Forecast, by Car Type, 2017-2031

Table 2: Global Car Rental Market Revenue (US$ Bn) Forecast, by Category, 2017-2031

Table 3: Global Car Rental Market Revenue (US$ Bn) Forecast, by Customer, 2017-2031

Table 4: Global Car Rental Market Revenue (US$ Bn) Forecast, by Booking, 2017-2031

Table 5: Global Car Rental Market Revenue (US$ Bn) Forecast, by Rental Length, 2017-2031

Table 6: Global Car Rental Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 7: Global Car Rental Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 8: North America Car Rental Market Revenue (US$ Bn) Forecast, by Car Type, 2017-2031

Table 9: North America Car Rental Market Revenue (US$ Bn) Forecast, by Category, 2017-2031

Table 10: North America Car Rental Market Revenue (US$ Bn) Forecast, by Customer, 2017-2031

Table 11: North America Car Rental Market Revenue (US$ Bn) Forecast, by Booking, 2017-2031

Table 12: North America Car Rental Market Revenue (US$ Bn) Forecast, by Rental Length, 2017-2031

Table 13: North America Car Rental Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 14: North America Car Rental Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 15: Europe Car Rental Market Revenue (US$ Bn) Forecast, by Car Type, 2017-2031

Table 16: Europe Car Rental Market Revenue (US$ Bn) Forecast, by Category, 2017-2031

Table 17: Europe Car Rental Market Revenue (US$ Bn) Forecast, by Customer, 2017-2031

Table 18: Europe Car Rental Market Revenue (US$ Bn) Forecast, by Booking, 2017-2031

Table 19: Europe Car Rental Market Revenue (US$ Bn) Forecast, by Rental Length, 2017-2031

Table 20: Europe Car Rental Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 21: Europe Car Rental Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 22: Asia Pacific Car Rental Market Revenue (US$ Bn) Forecast, by Car Type, 2017-2031

Table 23: Asia Pacific Car Rental Market Revenue (US$ Bn) Forecast, by Category, 2017-2031

Table 24: Asia Pacific Car Rental Market Revenue (US$ Bn) Forecast, by Customer, 2017-2031

Table 25: Asia Pacific Car Rental Market Revenue (US$ Bn) Forecast, by Booking, 2017-2031

Table 26: Asia Pacific Car Rental Market Revenue (US$ Bn) Forecast, by Rental Length, 2017-2031

Table 27: Asia Pacific Car Rental Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 28: Asia Pacific Car Rental Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 29: Middle East & Africa Car Rental Market Revenue (US$ Bn) Forecast, by Car Type, 2017-2031

Table 30: Middle East & Africa Car Rental Market Revenue (US$ Bn) Forecast, by Category, 2017-2031

Table 31: Middle East & Africa Car Rental Market Revenue (US$ Bn) Forecast, by Customer, 2017-2031

Table 32: Middle East & Africa Car Rental Market Revenue (US$ Bn) Forecast, by Booking, 2017-2031

Table 33: Middle East & Africa Car Rental Market Revenue (US$ Bn) Forecast, by Rental Length, 2017-2031

Table 34: Middle East & Africa Car Rental Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 35: Middle East & Africa Car Rental Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 36: South America Car Rental Market Revenue (US$ Bn) Forecast, by Car Type, 2017-2031

Table 37: South America Car Rental Market Revenue (US$ Bn) Forecast, by Category, 2017-2031

Table 38: South America Car Rental Market Revenue (US$ Bn) Forecast, by Customer, 2017-2031

Table 39: South America Car Rental Market Revenue (US$ Bn) Forecast, by Booking, 2017-2031

Table 40: South America Car Rental Market Revenue (US$ Bn) Forecast, by Rental Length, 2017-2031

Table 41: South America Car Rental Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 42: South America Car Rental Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Car Rental Market Revenue (US$ Bn) Forecast, by Car Type, 2017-2031

Figure 2: Global Car Rental Market, Incremental Opportunity, by Car Type, Value (US$ Bn), 2023-2031

Figure 3: Global Car Rental Market Revenue (US$ Bn) Forecast, by Category, 2017-2031

Figure 4: Global Car Rental Market, Incremental Opportunity, by Category, Value (US$ Bn), 2023-2031

Figure 5: Global Car Rental Market Revenue (US$ Bn) Forecast, by Customer, 2017-2031

Figure 6: Global Car Rental Market, Incremental Opportunity, by Customer, Value (US$ Bn), 2023-2031

Figure 7: Global Car Rental Market Revenue (US$ Bn) Forecast, by Booking, 2017-2031

Figure 8: Global Car Rental Market, Incremental Opportunity, by Booking, Value (US$ Bn), 2023-2031

Figure 9: Global Car Rental Market Revenue (US$ Bn) Forecast, by Rental Length, 2017-2031

Figure 10: Global Car Rental Market, Incremental Opportunity, by Rental Length, Value (US$ Bn), 2023-2031

Figure 11: Global Car Rental Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 12: Global Car Rental Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2023-2031

Figure 13: Global Car Rental Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 14: Global Car Rental Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 15: North America Car Rental Market Revenue (US$ Bn) Forecast, by Car Type, 2017-2031

Figure 16: North America Car Rental Market, Incremental Opportunity, by Car Type, Value (US$ Bn), 2023-2031

Figure 17: North America Car Rental Market Revenue (US$ Bn) Forecast, by Category, 2017-2031

Figure 18: North America Car Rental Market, Incremental Opportunity, by Category, Value (US$ Bn), 2023-2031

Figure 19: North America Car Rental Market Revenue (US$ Bn) Forecast, by Customer, 2017-2031

Figure 20: North America Car Rental Market, Incremental Opportunity, by Customer, Value (US$ Bn), 2023-2031

Figure 21: North America Car Rental Market Revenue (US$ Bn) Forecast, by Booking, 2017-2031

Figure 22: North America Car Rental Market, Incremental Opportunity, by Booking, Value (US$ Bn), 2023-2031

Figure 23: North America Car Rental Market Revenue (US$ Bn) Forecast, by Rental Length, 2017-2031

Figure 24: North America Car Rental Market, Incremental Opportunity, by Rental Length, Value (US$ Bn), 2023-2031

Figure 25: North America Car Rental Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 26: North America Car Rental Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2023-2031

Figure 27: North America Car Rental Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 28: North America Car Rental Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 29: Europe Car Rental Market Revenue (US$ Bn) Forecast, by Car Type, 2017-2031

Figure 30: Europe Car Rental Market, Incremental Opportunity, by Car Type, Value (US$ Bn), 2023-2031

Figure 31: Europe Car Rental Market Revenue (US$ Bn) Forecast, by Category, 2017-2031

Figure 32: Europe Car Rental Market, Incremental Opportunity, by Category, Value (US$ Bn), 2023-2031

Figure 33: Europe Car Rental Market Revenue (US$ Bn) Forecast, by Customer, 2017-2031

Figure 34: Europe Car Rental Market, Incremental Opportunity, by Customer, Value (US$ Bn), 2023-2031

Figure 35: Europe Car Rental Market Revenue (US$ Bn) Forecast, by Booking, 2017-2031

Figure 36: Europe Car Rental Market, Incremental Opportunity, by Booking, Value (US$ Bn), 2023-2031

Figure 37: Europe Car Rental Market Revenue (US$ Bn) Forecast, by Rental Length, 2017-2031

Figure 38: Europe Car Rental Market, Incremental Opportunity, by Rental Length, Value (US$ Bn), 2023-2031

Figure 39: Europe Car Rental Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 40: Europe Car Rental Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2023-2031

Figure 41: Europe Car Rental Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 42: Europe Car Rental Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Car Rental Market Revenue (US$ Bn) Forecast, by Car Type, 2017-2031

Figure 44: Asia Pacific Car Rental Market, Incremental Opportunity, by Car Type, Value (US$ Bn), 2023-2031

Figure 45: Asia Pacific Car Rental Market Revenue (US$ Bn) Forecast, by Category, 2017-2031

Figure 46: Asia Pacific Car Rental Market, Incremental Opportunity, by Category, Value (US$ Bn), 2023-2031

Figure 47: Asia Pacific Car Rental Market Revenue (US$ Bn) Forecast, by Customer, 2017-2031

Figure 48: Asia Pacific Car Rental Market, Incremental Opportunity, by Customer, Value (US$ Bn), 2023-2031

Figure 49: Asia Pacific Car Rental Market Revenue (US$ Bn) Forecast, by Booking, 2017-2031

Figure 50: Asia Pacific Car Rental Market, Incremental Opportunity, by Booking, Value (US$ Bn), 2023-2031

Figure 51: Asia Pacific Car Rental Market Revenue (US$ Bn) Forecast, by Rental Length, 2017-2031

Figure 52: Asia Pacific Car Rental Market, Incremental Opportunity, by Rental Length, Value (US$ Bn), 2023-2031

Figure 53: Asia Pacific Car Rental Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 54: Asia Pacific Car Rental Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Car Rental Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 56: Asia Pacific Car Rental Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 57: Middle East & Africa Car Rental Market Revenue (US$ Bn) Forecast, by Car Type, 2017-2031

Figure 58: Middle East & Africa Car Rental Market, Incremental Opportunity, by Car Type, Value (US$ Bn), 2023-2031

Figure 59: Middle East & Africa Car Rental Market Revenue (US$ Bn) Forecast, by Category, 2017-2031

Figure 60: Middle East & Africa Car Rental Market, Incremental Opportunity, by Category, Value (US$ Bn), 2023-2031

Figure 61: Middle East & Africa Car Rental Market Revenue (US$ Bn) Forecast, by Customer, 2017-2031

Figure 62: Middle East & Africa Car Rental Market, Incremental Opportunity, by Customer, Value (US$ Bn), 2023-2031

Figure 63: Middle East & Africa Car Rental Market Revenue (US$ Bn) Forecast, by Booking, 2017-2031

Figure 64: Middle East & Africa Car Rental Market, Incremental Opportunity, by Booking, Value (US$ Bn), 2023-2031

Figure 65: Middle East & Africa Car Rental Market Revenue (US$ Bn) Forecast, by Rental Length, 2017-2031

Figure 66: Middle East & Africa Car Rental Market, Incremental Opportunity, by Rental Length, Value (US$ Bn), 2023-2031

Figure 67: Middle East & Africa Car Rental Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 68: Middle East & Africa Car Rental Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2023-2031

Figure 69: Middle East & Africa Car Rental Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 70: Middle East & Africa Car Rental Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 71: South America Car Rental Market Revenue (US$ Bn) Forecast, by Car Type, 2017-2031

Figure 72: South America Car Rental Market, Incremental Opportunity, by Car Type, Value (US$ Bn), 2023-2031

Figure 73: South America Car Rental Market Revenue (US$ Bn) Forecast, by Category, 2017-2031

Figure 74: South America Car Rental Market, Incremental Opportunity, by Category, Value (US$ Bn), 2023-2031

Figure 75: South America Car Rental Market Revenue (US$ Bn) Forecast, by Customer, 2017-2031

Figure 76: South America Car Rental Market, Incremental Opportunity, by Customer, Value (US$ Bn), 2023-2031

Figure 77: South America Car Rental Market Revenue (US$ Bn) Forecast, by Booking, 2017-2031

Figure 78: South America Car Rental Market, Incremental Opportunity, by Booking, Value (US$ Bn), 2023-2031

Figure 79: South America Car Rental Market Revenue (US$ Bn) Forecast, by Rental Length, 2017-2031

Figure 80: South America Car Rental Market, Incremental Opportunity, by Rental Length, Value (US$ Bn), 2023-2031

Figure 81: South America Car Rental Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 82: South America Car Rental Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2023-2031

Figure 83: South America Car Rental Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 84: South America Car Rental Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031