Global Capric Acid Market: Snapshot

Capric acid, also known as decanoic acid, is seeing its market soar steadily. One reason behind it is the presence of several smaller regional vendors, which has served to drive up competition. To surge ahead of their rivals, players in the global capric acid market are seen expending money into research and development of better products. This has led to a diversification of products. The players are also seen competing on the basis of pricing.

Mainly fuelling the global capric acid market is the solid demand from food and beverage and personal care industries. This is mainly because of the economic development worldwide which has increased purchasing capacities of people thereby leading to increased demand for personal care products and convenience foods. Despite the overall bright prospects, the global capric acid is running into headwinds owing to fluctuating raw material prices and easy availability of substitutes. Nonetheless, the market is predicted to grow because of the unearthing of new types of raw materials for manufacturing capric acid.

A report on the global capric acid market by Transparency Market Research finds that it would rise at a steady 5.0% CAGR between 2015 and 2023. Expanding at this pace, the market is projected to attain a value of US$1.86 bn by 2023 from US$1.21 bn in 2014.

Usage in Personal Care Products Mainly Serves to Drive Global Capric Acid Market

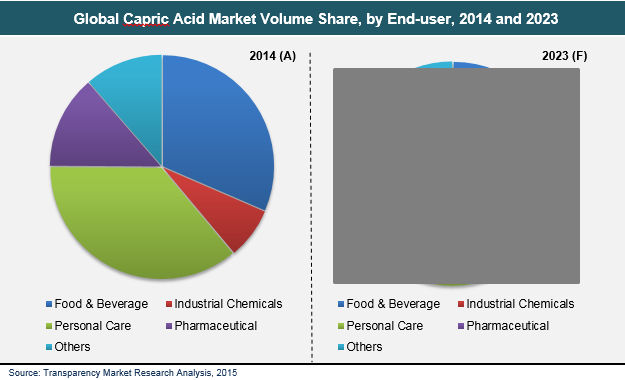

The different end use industries serving to drive demand in the global capric acid market are industrial chemicals, food and beverage, pharmaceutical, personal care, and others. Capric acid functions as an emulsifier and emollient. It is used for formulating lotions and creams in the personal care industry. In the food and beverage industry, it is used in the production of artificial flavors where it acts as an antimicrobial agent. This makes capric acid an ideal choice for commercial food handling. As a result, wineries, breweries, and meat processing plants are majorly boosting demand in the global capric acid market.

Other uses fuelling demand in the global capric acid market are in treatment of textiles and dye production. It is also used in the pharmaceutical industry and for the production of synthetic rubber. Apart from that, capric acid finds usage in making various kinds of plastics and lubricating grease.

Despite such wide ranging uses, the global capric acid market is predicted to surge mainly on account of the demand from the personal care sector. It is predicted to prop up demand at the maximum pace. Meanwhile, the food and beverage industry is expected to trail the personal care sector with respect to generating demand.

Asia Pacific Food and Beverage and Personal Care Industry Significantly Buoys Capric Acid Market

From a geographical standpoint, the global capric acid market can be segmented into Asia Pacific, Europe, North America, South America, and the Middle East and Africa. Among them, Asia Pacific is the leading regional segment. The Asia Pacific capric acid market has been catapulted mainly by the burgeoning personal care and food and beverage industries. This, in turn, is because of the solid economic development in the nations of China and India that has upped the purchasing power of people. In fact, China and India are leading demand drivers for capric acid in the region.

Apart from Asia Pacific, Latin America and the Middle East and Africa have also emerged as crucial regions in the global capric acid market.

Some of the prominent participants in the global capric acid market are Oleocomm Global SDN BHD, Chemical Associates, P&G Chemicals, KLK OLEO, and IOI Oleochemicals.

Chapter 1 Preface

1.1 Report Description

1.2 Research Scope

1.3 Assumptions

1.4 Market Segmentation

1.5 Research Methodology

Chapter 2 Executive Summary

2.1 Global Capric Acid Market, 2015 - 2023, (Kilo Tons) (US$ Mn)

2.2 Capric Acid: Market Snapshot

Chapter 3 Capric Acid Market– Industry Analysis

3.1 Introduction

3.2 Value Chain Analysis

3.3 Market Drivers

3.3.1 Rising Demand from Food & Beverage Industry Estimated to Drive Capric Acid Market

3.3.2 Increase in Demand from Personal Care Industry Projected to Boost Capric Acid Market

3.4 Restraints

3.4.1 Fluctuation in Raw Material Prices Expected to Act as Restraint for Capric Acid Market

3.5 Opportunity

3.5.1 Availability of New Source of Raw Material Anticipated to Act as Opportunity for Capric Acid Market

3.6 Porter’s Five Forces Analysis

3.6.1 Bargaining Power of Suppliers

3.6.2 Bargaining Power of Buyers

3.6.3 Threat of New Entrants

3.6.4 Threat of Substitutes

3.6.5 Degree of Competition

3.7 Capric Acid: Market Attractiveness Analysis

3.8 Capric Acid: Company Market Share Analysis, 2014

Chapter 4 Raw Material and Price Trend Analysis

4.1 Capric Acid Manufacturing Process

4.2 Raw Material Analysis

4.3 Capric Acid Price Trend

Chapter 5 Capric Acid Market – End-user Analysis

5.1 Global Capric Acid Market: End-user Overview

5.2 Global Capric Acid Market Volume Share, by End-user, 2014 and 2023

5.2.1 Global Capric Acid Market for Food & Beverage, 2014 – 2023 (Kilo Tons) (US$ Mn)

5.2.2 Global Capric Acid Market for Industrial Chemicals, 2014 – 2023 (Kilo Tons) (US$ Mn)

5.2.3 Global Capric Acid Market for Personal Care, 2014 – 2023 (Kilo Tons) (US$ Mn)

5.2.4 Global Capric Acid Market for Pharmaceutical, 2014 – 2023 (Kilo Tons) (US$ Mn)

5.2.5 Global Capric Acid Market for Others, 2014 – 2023 (Kilo Tons) (US$ Mn)

Chapter 6 Capric Acid Market - Regional Analysis

6.1 Global Capric Acid Market: Regional Overview

6.2 North America

6.2.1 North America Capric Acid Market Volume, by Product, 2014 – 2023 (Kilo Tons)

6.2.2 North America Capric Acid Market Revenue, by Product, 2014 – 2023 (US$ Mn)

6.2.3 U.S.

6.2.3.1 U.S. Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.2.3.2 U.S. Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.2.4 Rest of North America

6.2.4.1 Rest of North America Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.2.4.2 Rest of North America Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.3 Europe

6.3.1 Europe Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.3.2 Europe Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.3.3 France

6.3.3.1 France Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.3.3.2 France Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.3.4 Germany

6.3.4.1 Germany Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.3.4.2 Germany Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.3.5 Italy

6.3.5.1 Italy Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.3.5.2 Italy Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.3.6 Spain

6.3.6.1 Spain Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.3.6.2 Spain Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.3.7 U.K.

6.3.7.1 U.K. Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.3.7.2 U.K. Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.3.8 Rest of Europe

6.3.8.1 Rest of Europe Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.3.8.2 Rest of Europe Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.4 Asia Pacific

6.4.1 Asia Pacific Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.4.2 Asia Pacific Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.4.3 China

6.4.3.1 China Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.4.3.2 China Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.4.4 Japan

6.4.4.1 Japan Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.4.4.2 Japan Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.4.5 ASEAN

6.4.5.1 ASEAN Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.4.5.2 ASEAN Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.4.5 Rest of Asia Pacific

6.4.5.1 Rest of Asia Pacific Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.4.5.2 Rest of Asia Pacific Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.5 Latin America

6.5.1 Latin America Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.5.2 Latin America Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.5.3 Brazil

6.5.3.1 Brazil Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.5.3.2 Brazil Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.5.4 Rest of Latin America

6.5.4.1 Rest of Latin America Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.5.4.2 Rest of Latin America Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.6 Middle East & Africa

6.6.1 Middle East & Africa Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.6.2 Middle East & Africa Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.6.3 GCC

6.6.3.1 GCC Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.6.3.2 GCC Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.6.4 South Africa

6.6.4.1 South Africa Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.6.4.2 South Africa Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

6.6.5 Rest of Middle East & Africa

6.6.5.1 Rest of Middle East & Africa Capric Acid Market Volume, by End-user, 2014 – 2023 (Kilo Tons)

6.6.5.2 Rest of Middle East & Africa Capric Acid Market Revenue, by End-user, 2014 – 2023 (US$ Mn)

Chapter 7 Company Profiles

7.1 Chemical Associates

7.2 Oleocomm Global SDN BHD

7.3 KLK Oleo

7.4 P&G Chemicals

7.5 IOI Oleochemicals

7.6 Ecogreen Oleochemicals

7.7 Henan Eastar Chemicals Co., Ltd.

7.8 Temix Oleo Srl

7.9 VVF L.L.C.

7.1 PT Bakrie Sumatera Plantations Tbk.

Chapter 8 Primary Research – Key Findings