Analysts’ Viewpoint on Automotive Thermal System Market Scenario

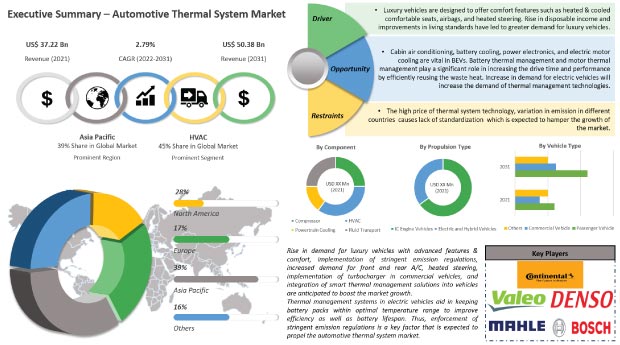

Rise in demand for luxury vehicles with advanced features & comfort, implementation of stringent emission regulations, increase in demand for front and rear A/C, heated steering, integration of turbocharger in commercial vehicles, and use of smart thermal management solutions in vehicles are anticipated to boost the automotive thermal systems market across the globe. Companies in the automotive thermal system market are focusing on the development of components such as compressor, HVAC, powertrain cooling, and fluid transport. Therefore, the market is estimated to expand at a decent growth rate (CAGR) of 2.79% during the forecast period.

Automotive thermal system monitors and maintains the temperature of key components of vehicles. It manages temperature of several components such as motor, battery, and cabin in vehicles to offer higher performance, enhanced fuel economy, and superior comfort. Efficient thermal management enables automotive components to operate in the optimum temperature range while also offering enhanced comfort in the vehicle interior through seat heating, front air conditioning, and rear air conditioning.

Luxury vehicles are equipped with high safety and advanced features. These vehicles are designed to offer comfort features such as heated & cooled comfortable seats, airbags, and heated steering. Rise in disposable income and improvements in living standards have led to greater demand for luxury vehicles. Manufacturers are integrating advanced thermal systems in luxury vehicles to improve performance and fuel-efficiency, which in turn is expected to increase the demand for automotive thermal systems. Therefore, an increase in demand for luxury vehicles with advanced features and comfort systems is anticipated to propel the automotive thermal systems market across the globe.

Thermal management system maintains the operating temperature of key components to reduce the risk of damage to components in vehicles. Manufacturers are integrating smart thermal solutions into new energy vehicles. Moreover, several manufacturers offer smart thermal solutions for automobiles. For instance, Johnson Electric offers thermal management solutions for battery, cabin heating, and power electronics. This integration of thermal management solutions into vehicles is expected to boost the demand for automotive thermal systems.

The global automotive industry has shifted focus on the development of efficient, affordable, long-range, battery-powered passenger vehicles that can compete with and ultimately replace fossil-fuel powered vehicles. Cabin air conditioning, battery cooling, power electronics, and electric motor cooling are vital in battery electric vehicles (BEVs). Battery thermal management and motor thermal management play a significant role in increasing the drive time and performance by efficiently reusing the waste heat. Thus, an increase in the demand for electric vehicles is projected to boost the demand for thermal management systems during the forecast period.

Automakers are investing in electric vehicles to comply with stringent emission regulations introduced by several governments across the globe. The introduction of new electric vehicles in the market by automotive brands has also fueled the need to address safety issues in terms of electric engine batteries. Thermal management systems in electric vehicles aid in keeping battery packs within optimal temperature range to improve efficiency as well as battery lifespan. Thus, enforcement of stringent emission regulations is a key factor that is expected to propel the automotive thermal system market across the globe.

In terms of component, the global automotive thermal system market has been classified into compressor, HVAC, powertrain cooling, and fluid transport. The HVAC segment held a major share of 45% in 2021. The segment is estimated to maintain its position in the market and grow at a CAGR of more than 2.82% during the forecast period. The HVAC system provides heat, ventilation, and air-conditioning in a vehicle. Increasing demand for advanced HVACs that are environment-friendly and lightweight are expected to drive the automotive thermal system market. Moreover, HVAC equipment are cost-effective and can optimize productivity, which is expected to further boost the segment in the near future. All these factors are anticipated to propel the automotive thermal system market during the forecast period.

In terms of propulsion type, the global automotive thermal system market has been bifurcated into IC engine vehicles and electric & hybrid vehicles. The IC engine vehicles segment held a major share of 56% in 2021. The segment is estimated to maintain its position in the market and grow at a CAGR of more than 2.76% during the forecast period. IC engine vehicles primarily utilize gasoline or diesel as a fuel, along with the renewable or alternative fuels. In IC engine vehicles, the ignition and combustion of the fuel occurs within the engine itself. Subsequently, the engine partially converts the energy from the combustion to mechanical work, as the expanding combustion gases push the piston, which rotates the crankshaft. This, in turn, is estimated to boost the global automotive thermal system market during the forecast period.

APAC dominated the global automotive thermal system market, and the region accounted for a major share of the market, in terms of revenue share, in 2021. The trend is expected to continue during the forecast period due to a consistent rise in the demand for passenger vehicles, owing to rapid urbanization, stable economic conditions, and lower interest rates in the region.

APAC has emerged as a hub for automotive production in the past few years. Changing consumer preferences, increase in per capita income of the middle-class population, and cost advantages have prompted OEMs to increase vehicle production in the region. Thus, China, India, and Japan have witnessed a significant increase in vehicle production. Significantly high vehicle production in the region offers considerable opportunity for the automotive thermal system market. Favorable investment policies and availability of cheap labor have also made Asia Pacific an ideal market for automotive OEMs. Increased demand for luxury cars with superior cabin comfort has fueled the demand for automotive thermal system in the region.

This region was followed by North America and Europe, in terms of share of market volume and value. North America and Europe held a significant share of the global automotive thermal system market in 2021. A trend of customization of automobiles is witnessed in these regions, which is driving the market, significantly.

The market in South America is estimated to expand at a sluggish pace in the next five years due to stagnant sales of vehicles in the region, primarily in Brazil.

The global automotive thermal system market is fragmented with a more number of manufacturers controlling the market share and company see the potential to increase the pace of growth by the way of product launches and sales through new channels. Expansion of product portfolios and mergers & acquisitions are major strategies adopted by key players. Some of the key manufacturers identified in the automotive thermal system market across the globe are Continental AG, Denso Corporation, Dana Incorporated, Grayson Thermal Systems, Gentherm Inc., Hanon Systems, Lennox International Inc., Modine Manufacturing Company Inc., MAHLE GmbH, Robert Bosch GmbH, Visteon Corporation, and Valeo SA.

Each of these players has been profiled in the automotive thermal system market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 37.22 Bn |

|

Market Forecast Value in 2031 |

US$ 50.38 Bn |

|

Growth Rate (CAGR) |

2.79% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The automotive thermal system market is valued at US$ 37.22 Bn in 2021

The automotive thermal system market is expected to grow at a CAGR of 2.79% by 2031

The automotive thermal system market will be worth US$ 50.38 Bn in 2031

Rise in demand for luxury vehicles with advanced features & comfort, implementation of stringent emission regulations, increase in demand for front and rear A/C, heated steering, integration of turbocharger in commercial vehicles, and use of smart thermal management solutions in vehicles are drivers of the automotive thermal system market

The HVAC segment accounts for 45% share of the automotive thermal system market

Asia Pacific is a most lucrative region in the global automotive thermal system market

The prominent players operating in the automotive thermal system market are Continental AG, Denso Corporation, Dana Incorporated, Grayson Thermal Systems, Gentherm Inc., Hanon Systems, Lennox International Inc., Modine Manufacturing Company Inc., MAHLE GmbH, Robert Bosch GmbH, Visteon Corporation, and Valeo SA

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Mn, 2017‒2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.6.3. Value Chain Analysis

2.6.3.1. Component Manufacturer

2.6.3.2. Automotive Thermal System Manufacturers

2.6.3.3. Assembly and Installation of the Automotive Thermal System

2.6.3.4. OEM

2.7. Regulatory Scenario

2.8. Key Trend Analysis

3. COVID-19 Impact Analysis – Automotive Thermal System Market

4. Global Automotive Thermal System Market, by Component

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Thermal System Market Size Analysis & Forecast, by Component, 2017‒2031

4.2.1. Compressor

4.2.2. HVAC

4.2.3. Powertrain Cooling

4.2.4. Fluid Transport

5. Global Automotive Thermal System Market, by Vehicle Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Thermal System Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

5.2.1. Passenger Vehicle

5.2.1.1. Hatchback

5.2.1.2. Sedan

5.2.1.3. Utility Vehicles

5.2.2. Light Commercial Vehicles

5.2.3. Trucks

5.2.4. Buses & Coaches

5.2.5. Off-road Vehicle

5.2.5.1. Agriculture Tractors & Equipment

5.2.5.2. Construction & Mining Equipment

5.2.6. Industrial Vehicles (Forklift, Etc.)

6. Global Automotive Thermal System Market, by Propulsion Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Thermal System Market Size Analysis & Forecast, by Propulsion Type, 2017‒2031

6.2.1. IC Engine Vehicles

6.2.2. Electric and Hybrid Vehicles

7. Global Automotive Thermal System Market, by Application

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Thermal System Market Size Analysis & Forecast, by Application, 2017‒2031

7.2.1. Front & Rear A/C

7.2.2. Engine and Transmission

7.2.3. Seat

7.2.4. Battery

7.2.5. Motor

7.2.6. Waste Heat Recovery

7.2.7. Power Electronics

7.2.8. Others

8. Global Automotive Thermal System Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Thermal System Market Size Analysis & Forecast, by Region, 2017‒2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. Latin America

9. North America Automotive Thermal System Market

9.1. Market Snapshot

9.2. Automotive Thermal System Market Size Analysis & Forecast, by Component, 2017‒2031

9.2.1. Compressor

9.2.2. HVAC

9.2.3. Powertrain Cooling

9.2.4. Fluid Transport

9.3. Automotive Thermal System Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

9.3.1. Passenger Vehicle

9.3.1.1. Hatchback

9.3.1.2. Sedan

9.3.1.3. Utility Vehicles

9.3.2. Light Commercial Vehicles

9.3.3. Trucks

9.3.4. Buses & Coaches

9.3.5. Off-road Vehicle

9.3.5.1. Agriculture Tractors & Equipment

9.3.5.2. Construction & Mining Equipment

9.3.6. Industrial Vehicles (Forklift, Etc.)

9.4. Automotive Thermal System Market Size Analysis & Forecast, by Propulsion Type, 2017‒2031

9.4.1. IC Engine Vehicles

9.4.2. Electric and Hybrid Vehicles

9.5. Automotive Thermal System Market Size Analysis & Forecast, by Application, 2017‒2031

9.5.1. Front & Rear A/C

9.5.2. Engine and Transmission

9.5.3. Seat

9.5.4. Battery

9.5.5. Motor

9.5.6. Waste Heat Recovery

9.5.7. Power Electronics

9.5.8. Others

9.6. Key Country Analysis – North America Automotive Thermal System Market Size Analysis & Forecast, 2017‒2031

9.6.1. U.S.

9.6.2. Canada

10. Europe Automotive Thermal System Market

10.1. Market Snapshot

10.2. Automotive Thermal System Market Size Analysis & Forecast, by Component, 2017‒2031

10.2.1. Compressor

10.2.2. HVAC

10.2.3. Powertrain Cooling

10.2.4. Fluid Transport

10.3. Automotive Thermal System Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

10.3.1. Passenger Vehicle

10.3.1.1. Hatchback

10.3.1.2. Sedan

10.3.1.3. Utility Vehicles

10.3.2. Light Commercial Vehicles

10.3.3. Trucks

10.3.4. Buses & Coaches

10.3.5. Off-road Vehicle

10.3.5.1. Agriculture Tractors & Equipment

10.3.5.2. Construction & Mining Equipment

10.3.6. Industrial Vehicles (Forklift, Etc.)

10.4. Automotive Thermal System Market Size Analysis & Forecast, by Propulsion Type, 2017‒2031

10.4.1. IC Engine Vehicles

10.4.2. Electric and Hybrid Vehicles

10.5. Automotive Thermal System Market Size Analysis & Forecast, by Application, 2017‒2031

10.5.1. Front & Rear A/C

10.5.2. Engine and Transmission

10.5.3. Seat

10.5.4. Battery

10.5.5. Motor

10.5.6. Waste Heat Recovery

10.5.7. Power Electronics

10.5.8. Others

10.6. Key Country Analysis – Europe Automotive Thermal System Market Size Analysis & Forecast, 2017‒2031

10.6.1. Germany

10.6.2. U. K.

10.6.3. France

10.6.4. Italy

10.6.5. Spain

10.6.6. Nordic Countries

10.6.7. Russia & CIS

10.6.8. Rest of Europe

11. Asia Pacific Automotive Thermal System Market

11.1. Market Snapshot

11.2. Automotive Thermal System Market Size Analysis & Forecast, by Component, 2017‒2031

11.2.1. Compressor

11.2.2. HVAC

11.2.3. Powertrain Cooling

11.2.4. Fluid Transport

11.3. Automotive Thermal System Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

11.3.1. Passenger Vehicle

11.3.1.1. Hatchback

11.3.1.2. Sedan

11.3.1.3. Utility Vehicles

11.3.2. Light Commercial Vehicles

11.3.3. Trucks

11.3.4. Buses & Coaches

11.3.5. Off-road Vehicle

11.3.5.1. Agriculture Tractors & Equipment

11.3.5.2. Construction & Mining Equipment

11.3.6. Industrial Vehicles (Forklift, Etc.)

11.4. Automotive Thermal System Market Size Analysis & Forecast, by Propulsion Type, 2017‒2031

11.4.1. IC Engine Vehicles

11.4.2. Electric and Hybrid Vehicles

11.5. Automotive Thermal System Market Size Analysis & Forecast, by Application, 2017‒2031

11.5.1. Front & Rear A/C

11.5.2. Engine and Transmission

11.5.3. Seat

11.5.4. Battery

11.5.5. Motor

11.5.6. Waste Heat Recovery

11.5.7. Power Electronics

11.5.8. Others

11.6. Key Country Analysis – Asia Pacific Automotive Thermal System Market Size Analysis & Forecast, 2017‒2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. ASEAN Countries

11.6.5. South Korea

11.6.6. ANZ

11.6.7. Rest of Asia Pacific

12. Middle East & Africa Automotive Thermal System Market

12.1. Market Snapshot

12.2. Automotive Thermal System Market Size Analysis & Forecast, by Component, 2017‒2031

12.2.1. Compressor

12.2.2. HVAC

12.2.3. Powertrain Cooling

12.2.4. Fluid Transport

12.3. Automotive Thermal System Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

12.3.1. Passenger Vehicle

12.3.1.1. Hatchback

12.3.1.2. Sedan

12.3.1.3. Utility Vehicles

12.3.2. Light Commercial Vehicles

12.3.3. Trucks

12.3.4. Buses & Coaches

12.3.5. Off-road Vehicle

12.3.5.1. Agriculture Tractors & Equipment

12.3.5.2. Construction & Mining Equipment

12.3.6. Industrial Vehicles (Forklift, Etc.)

12.4. Automotive Thermal System Market Size Analysis & Forecast, by Propulsion Type, 2017‒2031

12.4.1. IC Engine Vehicles

12.4.2. Electric and Hybrid Vehicles

12.5. Automotive Thermal System Market Size Analysis & Forecast, by Application, 2017‒2031

12.5.1. Front & Rear A/C

12.5.2. Engine and Transmission

12.5.3. Seat

12.5.4. Battery

12.5.5. Motor

12.5.6. Waste Heat Recovery

12.5.7. Power Electronics

12.5.8. Others

12.6. Key Country Analysis – Middle East & Africa Automotive Thermal System Market Size Analysis & Forecast, 2017‒2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Turkey

12.6.4. Rest of Middle East & Africa

13. Latin America Automotive Thermal System Market

13.1. Market Snapshot

13.2. Automotive Thermal System Market Size Analysis & Forecast, by Component, 2017‒2031

13.2.1. Compressor

13.2.2. HVAC

13.2.3. Powertrain Cooling

13.2.4. Fluid Transport

13.3. Automotive Thermal System Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

13.3.1. Passenger Vehicle

13.3.1.1. Hatchback

13.3.1.2. Sedan

13.3.1.3. Utility Vehicles

13.3.2. Light Commercial Vehicles

13.3.3. Trucks

13.3.4. Buses & Coaches

13.3.5. Off-road Vehicle

13.3.5.1. Agriculture Tractors & Equipment

13.3.5.2. Construction & Mining Equipment

13.3.6. Industrial Vehicles (Forklift, Etc.)

13.4. Automotive Thermal System Market Size Analysis & Forecast, by Propulsion Type, 2017‒2031

13.4.1. IC Engine Vehicles

13.4.2. Electric and Hybrid Vehicles

13.5. Automotive Thermal System Market Size Analysis & Forecast, by Application, 2017‒2031

13.5.1. Front & Rear A/C

13.5.2. Engine and Transmission

13.5.3. Seat

13.5.4. Battery

13.5.5. Motor

13.5.6. Waste Heat Recovery

13.5.7. Power Electronics

13.5.8. Others

13.6. Key Country Analysis – Latin America Automotive Thermal System Market Size Analysis & Forecast, 2017‒2031

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Argentina

13.6.4. Rest of Latin America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2020

14.2. Pricing comparison among key players

14.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

15. Company Profile/ Key Players

15.1.1. Continental AG

15.1.1.1. Company Overview

15.1.1.2. Company Footprints

15.1.1.3. Production Locations

15.1.1.4. Product Portfolio

15.1.1.5. Competitors & Customers

15.1.1.6. Subsidiaries & Parent Organization

15.1.1.7. Recent Developments

15.1.1.8. Financial Analysis

15.1.1.9. Profitability

15.1.1.10. Revenue Share

15.1.2. DENSO Corporation

15.1.2.1. Company Overview

15.1.2.2. Company Footprints

15.1.2.3. Production Locations

15.1.2.4. Product Portfolio

15.1.2.5. Competitors & Customers

15.1.2.6. Subsidiaries & Parent Organization

15.1.2.7. Recent Developments

15.1.2.8. Financial Analysis

15.1.2.9. Profitability

15.1.2.10. Revenue Share

15.1.3. Dana Incorporated

15.1.3.1. Company Overview

15.1.3.2. Company Footprints

15.1.3.3. Production Locations

15.1.3.4. Product Portfolio

15.1.3.5. Competitors & Customers

15.1.3.6. Subsidiaries & Parent Organization

15.1.3.7. Recent Developments

15.1.3.8. Financial Analysis

15.1.3.9. Profitability

15.1.3.10. Revenue Share

15.1.4. Grayson Thermal Systems

15.1.4.1. Company Overview

15.1.4.2. Company Footprints

15.1.4.3. Production Locations

15.1.4.4. Product Portfolio

15.1.4.5. Competitors & Customers

15.1.4.6. Subsidiaries & Parent Organization

15.1.4.7. Recent Developments

15.1.4.8. Financial Analysis

15.1.4.9. Profitability

15.1.4.10. Revenue Share

15.1.5. Gentherm Inc.

15.1.5.1. Company Overview

15.1.5.2. Company Footprints

15.1.5.3. Production Locations

15.1.5.4. Product Portfolio

15.1.5.5. Competitors & Customers

15.1.5.6. Subsidiaries & Parent Organization

15.1.5.7. Recent Developments

15.1.5.8. Financial Analysis

15.1.5.9. Profitability

15.1.5.10. Revenue Share

15.1.6. Hanon Systems

15.1.6.1. Company Overview

15.1.6.2. Company Footprints

15.1.6.3. Production Locations

15.1.6.4. Product Portfolio

15.1.6.5. Competitors & Customers

15.1.6.6. Subsidiaries & Parent Organization

15.1.6.7. Recent Developments

15.1.6.8. Financial Analysis

15.1.6.9. Profitability

15.1.6.10. Revenue Share

15.1.7. Lennox International Inc.

15.1.7.1. Company Overview

15.1.7.2. Company Footprints

15.1.7.3. Production Locations

15.1.7.4. Product Portfolio

15.1.7.5. Competitors & Customers

15.1.7.6. Subsidiaries & Parent Organization

15.1.7.7. Recent Developments

15.1.7.8. Financial Analysis

15.1.7.9. Profitability

15.1.7.10. Revenue Share

15.1.8. Modine Manufacturing Company Inc.

15.1.8.1. Company Overview

15.1.8.2. Company Footprints

15.1.8.3. Production Locations

15.1.8.4. Product Portfolio

15.1.8.5. Competitors & Customers

15.1.8.6. Subsidiaries & Parent Organization

15.1.8.7. Recent Developments

15.1.8.8. Financial Analysis

15.1.8.9. Profitability

15.1.8.10. Revenue Share

15.1.9. MAHLE GmbH

15.1.9.1. Company Overview

15.1.9.2. Company Footprints

15.1.9.3. Production Locations

15.1.9.4. Product Portfolio

15.1.9.5. Competitors & Customers

15.1.9.6. Subsidiaries & Parent Organization

15.1.9.7. Recent Developments

15.1.9.8. Financial Analysis

15.1.9.9. Profitability

15.1.9.10. Revenue Share

15.1.10. Robert Bosch GmbH

15.1.10.1. Company Overview

15.1.10.2. Company Footprints

15.1.10.3. Production Locations

15.1.10.4. Product Portfolio

15.1.10.5. Competitors & Customers

15.1.10.6. Subsidiaries & Parent Organization

15.1.10.7. Recent Developments

15.1.10.8. Financial Analysis

15.1.10.9. Profitability

15.1.10.10. Revenue Share

15.1.11. Valeo SA

15.1.11.1. Company Overview

15.1.11.2. Company Footprints

15.1.11.3. Production Locations

15.1.11.4. Product Portfolio

15.1.11.5. Competitors & Customers

15.1.11.6. Subsidiaries & Parent Organization

15.1.11.7. Recent Developments

15.1.11.8. Financial Analysis

15.1.11.9. Profitability

15.1.11.10. Revenue Share

15.1.12. Visteon Corporation

15.1.12.1. Company Overview

15.1.12.2. Company Footprints

15.1.12.3. Production Locations

15.1.12.4. Product Portfolio

15.1.12.5. Competitors & Customers

15.1.12.6. Subsidiaries & Parent Organization

15.1.12.7. Recent Developments

15.1.12.8. Financial Analysis

15.1.12.9. Profitability

15.1.12.10. Revenue Share

15.1.13. Other Key Players

List of Tables

Table 1: Global Automotive Thermal System Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 2: Global Automotive Thermal System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 3: Global Automotive Thermal System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Table 4: Global Automotive Thermal System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 5: Global Automotive Thermal System Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 6: North America Automotive Thermal System Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 7: North America Automotive Thermal System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 8: North America Automotive Thermal System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Table 9: North America Automotive Thermal System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 10: North America Automotive Thermal System Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 11: Europe Automotive Thermal System Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 12: Europe Automotive Thermal System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 13: Europe Automotive Thermal System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Table 14: Europe Automotive Thermal System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 15: Europe Automotive Thermal System Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 16: Asia Pacific Automotive Thermal System Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 17: Asia Pacific Automotive Thermal System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 18: Asia Pacific Automotive Thermal System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Table 19: Asia Pacific Automotive Thermal System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 20: Asia Pacific Automotive Thermal System Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 21: Middle East & Africa Automotive Thermal System Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 22: Middle East & Africa Automotive Thermal System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 23: Middle East & Africa Automotive Thermal System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Table 24: Middle East & Africa Automotive Thermal System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 25: Middle East & Africa Automotive Thermal System Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 26: Latin America Automotive Thermal System Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 27: Latin America Automotive Thermal System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 28: Latin America Automotive Thermal System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Table 29: Latin America Automotive Thermal System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 30: Latin America Automotive Thermal System Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Thermal System Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 2: Global Automotive Thermal System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2021‒2031

Figure 3: Global Automotive Thermal System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 4: Global Automotive Thermal System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2021‒2031

Figure 5: Global Automotive Thermal System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Figure 6: Global Automotive Thermal System Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2021‒2031

Figure 7: Global Automotive Thermal System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 8: Global Automotive Thermal System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 9: Global Automotive Thermal System Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Figure 10: Global Automotive Thermal System Market, Incremental Opportunity, by Region, Value (US$ Bn), 2021‒2031

Figure 11: North America Automotive Thermal System Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 12: North America Automotive Thermal System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2021‒2031

Figure 13: North America Automotive Thermal System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 14: North America Automotive Thermal System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2021‒2031

Figure 15: North America Automotive Thermal System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Figure 16: North America Automotive Thermal System Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2021‒2031

Figure 17: North America Automotive Thermal System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 18: North America Automotive Thermal System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 19: North America Automotive Thermal System Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 20: North America Automotive Thermal System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2021‒2031

Figure 21: Europe Automotive Thermal System Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 22: Europe Automotive Thermal System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2021‒2031

Figure 23: Europe Automotive Thermal System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 24: Europe Automotive Thermal System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2021‒2031

Figure 25: Europe Automotive Thermal System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Figure 26: Europe Automotive Thermal System Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2021‒2031

Figure 27: Europe Automotive Thermal System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 28: Europe Automotive Thermal System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 29: Europe Automotive Thermal System Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 30: Europe Automotive Thermal System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2021‒2031

Figure 31: Asia Pacific Automotive Thermal System Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 32: Asia Pacific Automotive Thermal System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2021‒2031

Figure 33: Asia Pacific Automotive Thermal System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 34: Asia Pacific Automotive Thermal System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2021‒2031

Figure 35: Asia Pacific Automotive Thermal System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Figure 36: Asia Pacific Automotive Thermal System Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2021‒2031

Figure 37: Asia Pacific Automotive Thermal System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 38: Asia Pacific Automotive Thermal System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 39: Asia Pacific Automotive Thermal System Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 40: Asia Pacific Automotive Thermal System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2021‒2031

Figure 41: Middle East & Africa Automotive Thermal System Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 42: Middle East & Africa Automotive Thermal System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2021‒2031

Figure 43: Middle East & Africa Automotive Thermal System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 44: Middle East & Africa Automotive Thermal System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2021‒2031

Figure 45: Middle East & Africa Automotive Thermal System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Figure 46: Middle East & Africa Automotive Thermal System Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2021‒2031

Figure 47: Middle East & Africa Automotive Thermal System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 48: Middle East & Africa Automotive Thermal System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 49: Middle East & Africa Automotive Thermal System Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 50: Middle East & Africa Automotive Thermal System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2021‒2031

Figure 51: Latin America Automotive Thermal System Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 52: Latin America Automotive Thermal System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2021‒2031

Figure 53: Latin America Automotive Thermal System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 54: Latin America Automotive Thermal System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2021‒2031

Figure 55: Latin America Automotive Thermal System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Figure 56: Latin America Automotive Thermal System Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2021‒2031

Figure 57: Latin America Automotive Thermal System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 58: Latin America Automotive Thermal System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 59: Latin America Automotive Thermal System Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 60: Latin America Automotive Thermal System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2021‒2031