Analysts’ Viewpoint on Market Scenario

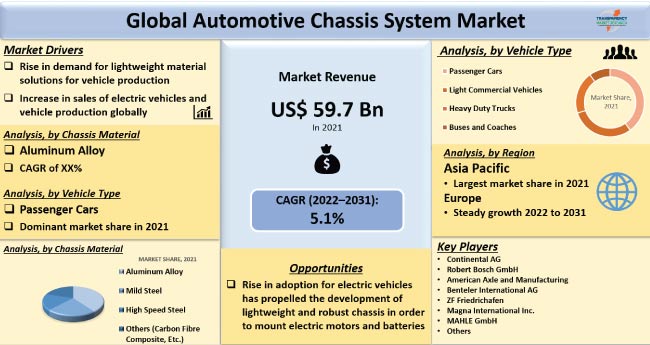

The market for automotive chassis system is being driven by an increase in production and adoption of EVs. In major economies, long-haul electric vehicles are gaining popularity, as governments are focusing on the reduction of carbon emissions in order to achieve their sustainability objectives. Tax exemptions and government assistance are helping more people buy electric vehicles.

The global EV market is anticipated to grow significantly during the forecast period due to an increase in demand for fast-charging or turbocharging stations. Lightweight materials are being used by automotive chassis system manufacturers more frequently in order to lower production costs and boost the performance of battery-powered pickup trucks. They are also introducing new products to increase their revenue sources and market share.

Chassis is the frame on which the vehicle body is mounted and makes up the underpart of a car. One of the most crucial components of any vehicle that has to be evaluated is the chassis. It is a strong metal frame that can support the entire weight of the vehicle in either a static or dynamic situation. In the manufacturing sector, the frame rod is referred to as the ‘backbone of the vehicle’ and is described as a ‘member’ that allows other parts or components, such as the engine, transmission, brakes, axles, tires, etc., to be fitted on it. Chassis are designed to provide adequate strength so that they can withstand loads.

Increase in sales of passenger as well as commercial vehicles is propelling the demand for automotive chassis. Rise in production of vehicles and growing trend of electrification are also likely to further boost the automotive chassis system market statistics across the globe.

The need for lightweight solutions has grown as a result of efforts to reduce CO2 emissions. Current generation vehicles in Europe are 12% lighter than those of previous generations. Therefore, the need for lightweight chassis is anticipated to increase further in the next few years. Asia and Latin America are witnessing an increase in vehicle production due to the surge in car manufacturing and economic expansion in these regions. This is expected to increase market demand for automobile chassis in these regions.

Crumple zones are built into the body shells of the monocoque chassis structure, which increases safety quotient of the vehicle in case of a collision. Utilization of metals, such as carbon fiber and glass composites, is a result of technological advancements. The Ultralight Steel Auto Body (ULSAB) improves torsional rigidity by 80%, while reducing mass by 25%.

Rise in demand for electric vehicles is propelling the development of lightweight and robust chassis in order to mount electric motors and batteries. Demand for lightweight aluminum chassis is anticipated to rise in key electric car markets such as China, Japan, and Germany. About 130,000 electric vehicles were sold globally in 2012. Currently, that many are sold in a single week.

The market for conventional cars contracted due to the global pandemic and manufacturers began to face supply chain bottlenecks; however, growth has been especially impressive for the last three years. Only 2.5% of all new automobiles sold in 2019 were electric vehicles, with 2.2 million sold.

The global auto industry shrank in 2020; however, sales of electric vehicles defied the trend. Sales increased to 3 million units and accounted for 4.1% of all auto sales. Sales of electric vehicles more than tripled from two million to 6.6 million in 2021, accounting for over 9% of the total global auto market. Thus, increase in sales of electric vehicles and vehicle production, globally, is the major factor aiding in the automotive chassis system market progress.

Rising demand for vehicle weight reduction to increase the fuel efficiency or battery life in case of electric vehicles is likely to be a significant factor that would boost the demand for the aluminum alloy material to manufacture vehicle chassis systems. Aluminum is the lightest metal and it reduces the weight of chassis significantly. Therefore, usage of aluminum alloy is expected to considerably reduce the overall weight of the vehicle.

Development in technology has led to utilization of metals such as carbon fiber and glass composites as well. Reduction of vehicle weight is a prominent method adopted by automakers and various OEMs, as it can drastically lower fuel consumption and CO2 emissions. Powering a lightweight vehicle requires less power and inertia to overcome; hence it uses less fuel. The simplest technique to improve fuel efficiency is to reduce vehicle weight. Reduction in the weight of a car by just 10% can enhance its mileage by roughly 6 to 8%.

According to the IEA, global SUV sales were extremely resilient throughout the pandemic, increasing by more than 10% between 2020 and 2021. SUV sales reached to a new high in 2021, in terms of volume and market share, accounting for more than 45% of all new car sales worldwide. SUV sales are still rising rapidly in several nations, including the U.S., India, and a few in Europe. However, in China, small battery-powered electric cars have been gaining popularity at a rapid pace, and the expansion of SUVs is declining. In 2021, more than 35 million more SUVs were on the roads across the globe. Thus, rise in sales of SUVs is projected to strongly drive automotive chassis market expansion worldwide.

Regional analysis of the global chassis system business is based on manufacturing patterns, political reforms, regulatory changes, and consumer demand. In terms of revenue share, Asia Pacific witnessed considerable demand for vehicle chassis system in 2021. This was primarily attributed to enormous populations and rising purchasing power parity of nations such as China and India, which are becoming the base of operations for various global corporations. In terms of share, the Asia Pacific automotive chassis system market is likely to be followed by Europe and North America, as these regions are home to the major consumer base for passenger and commercial vehicles and OEM /manufacturers.

Leading automotive chassis system manufacturers are emphasizing on expansion of their product portfolios and adopting mergers and acquisitions as key strategies. Some of the prominent players operating in the global automotive chassis market include Continental AG, Robert Bosch GmbH, American Axle and Manufacturing, Benteler International AG, ZF Friedrichafen, KLT-Auto, ALF ENGINEERING Pvt Ltd, Magna International Inc., MAHLE GmbH, Tower International, Meritor, INC., Dana Limited, and Detroit Diesel Corporation.

Key players in the automotive chassis system market report have been profiled in terms of company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 59.7 Bn |

|

Market Forecast Value in 2031 |

US$ 98.6 Bn |

|

Growth Rate (CAGR) |

5.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at Global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market is valued at US$ 59.7 Bn in 2021

It is expected to grow at a CAGR of 5.1% by 2031

It would be worth US$ 98.6 Bn in 2031

Increase in demand for lightweight material solutions for vehicle production and rise in sales of electric vehicles and vehicle production globally

The aluminum alloy segment accounted for major share in 2021.

Asia Pacific is anticipated to be a highly lucrative region

Continental AG, Robert Bosch GmbH, American Axle and Manufacturing, Benteler International AG, ZF Friedrichafen, KLT-Auto, ALF ENGINEERING Pvt Ltd, Magna International Inc., MAHLE GmbH, Tower International, Meritor, INC., Dana Limited, and Detroit Diesel Corporation.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Thousand Units, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. COVID-19 Impact Analysis – Automotive Chassis System Market

4. Global Automotive Chassis System Market, by Component

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Component

4.2.1. Suspension Ball Joints

4.2.2. Cross Axis Joints

4.2.3. Tie Rods

4.2.4. Stabilizer Links

4.2.5. Control Arms

4.2.6. Knuckles and Hubs

5. Global Automotive Chassis System Market, by Chassis Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Chassis Type

5.2.1. Backbone Chassis

5.2.2. Ladder Chassis

5.2.3. Monocoque Chassis

5.2.4. Modular Chassis

5.2.5. Others

6. Global Automotive Chassis System Market, by Chassis Material

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Chassis Material

6.2.1. Aluminum Alloy

6.2.2. Mild Steel

6.2.3. High Speed Steel

6.2.4. Others (Carbon Fibre Composite, Etc.)

7. Global Automotive Chassis System Market, by EV Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By EV Type

7.2.1. BEV

7.2.2. PHEV

7.2.3. HEV

8. Global Automotive Chassis System Market, by Vehicle Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

8.2.1. Passenger Cars

8.2.1.1. Hatchback

8.2.1.2. Sedan

8.2.1.3. Utility Vehicles

8.2.2. Light Commercial Vehicles

8.2.3. Heavy Duty Trucks

8.2.4. Buses and Coaches

9. Global Automotive Chassis System Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Automotive Chassis System Market

10.1. Market Snapshot

10.2. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Component

10.2.1. Suspension Ball Joints

10.2.2. Cross Axis Joints

10.2.3. Tie Rods

10.2.4. Stabilizer Links

10.2.5. Control Arms

10.2.6. Knuckles and Hubs

10.3. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Chassis Type

10.3.1. Backbone Chassis

10.3.2. Ladder Chassis

10.3.3. Monocoque Chassis

10.3.4. Modular Chassis

10.3.5. Others

10.4. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Chassis Material

10.4.1. Aluminum Alloy

10.4.2. Mild Steel

10.4.3. High Speed Steel

10.4.4. Others (Carbon Fibre Composite, Etc.)

10.5. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By EV Type

10.5.1. BEV

10.5.2. PHEV

10.5.3. HEV

10.6. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

10.6.1. Passenger Cars

10.6.1.1. Hatchback

10.6.1.2. Sedan

10.6.1.3. Utility Vehicles

10.6.2. Light Commercial Vehicles

10.6.3. Heavy Duty Trucks

10.6.4. Buses and Coaches

10.7. Key Country Analysis – North America Automotive Chassis System Market Size Analysis & Forecast, 2017-2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Mexico

11. Europe Automotive Chassis System Market

11.1. Market Snapshot

11.2. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Component

11.2.1. Suspension Ball Joints

11.2.2. Cross Axis Joints

11.2.3. Tie Rods

11.2.4. Stabilizer Links

11.2.5. Control Arms

11.2.6. Knuckles and Hubs

11.3. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Chassis Type

11.3.1. Backbone Chassis

11.3.2. Ladder Chassis

11.3.3. Monocoque Chassis

11.3.4. Modular Chassis

11.3.5. Others

11.4. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Chassis Material

11.4.1. Aluminum Alloy

11.4.2. Mild Steel

11.4.3. High Speed Steel

11.4.4. Others (Carbon Fibre Composite, Etc.)

11.5. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By EV Type

11.5.1. BEV

11.5.2. PHEV

11.5.3. HEV

11.6. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

11.6.1. Passenger Cars

11.6.1.1. Hatchback

11.6.1.2. Sedan

11.6.1.3. Utility Vehicles

11.6.2. Light Commercial Vehicles

11.6.3. Heavy Duty Trucks

11.6.4. Buses and Coaches

11.7. Key Country Analysis – Europe Automotive Chassis System Market Size Analysis & Forecast, 2017-2031

11.7.1. Germany

11.7.2. France

11.7.3. U.K.

11.7.4. Italy

11.7.5. Spain

11.7.6. Nordic Region

11.7.7. Rest of Europe

12. Asia Pacific Automotive Chassis System Market

12.1. Market Snapshot

12.2. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Component

12.2.1. Suspension Ball Joints

12.2.2. Cross Axis Joints

12.2.3. Tie Rods

12.2.4. Stabilizer Links

12.2.5. Control Arms

12.2.6. Knuckles and Hubs

12.3. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Chassis Type

12.3.1. Backbone Chassis

12.3.2. Ladder Chassis

12.3.3. Monocoque Chassis

12.3.4. Modular Chassis

12.3.5. Others

12.4. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Chassis Material

12.4.1. Aluminum Alloy

12.4.2. Mild Steel

12.4.3. High Speed Steel

12.4.4. Others (Carbon Fibre Composite, Etc.)

12.5. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By EV Type

12.5.1. BEV

12.5.2. PHEV

12.5.3. HEV

12.6. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

12.6.1. Passenger Cars

12.6.1.1. Hatchback

12.6.1.2. Sedan

12.6.1.3. Utility Vehicles

12.6.2. Light Commercial Vehicles

12.6.3. Heavy Duty Trucks

12.6.4. Buses and Coaches

12.7. Key Country Analysis – Asia-Pacific Automotive Chassis System Market Size Analysis & Forecast, 2017-2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. ASEAN Countries

12.7.5. South Korea

12.7.6. ANZ

12.7.7. Rest of Asia Pacific

13. Middle East & Africa Automotive Chassis System Market

13.1. Market Snapshot

13.2. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Component

13.2.1. Suspension Ball Joints

13.2.2. Cross Axis Joints

13.2.3. Tie Rods

13.2.4. Stabilizer Links

13.2.5. Control Arms

13.2.6. Knuckles and Hubs

13.3. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Chassis Type

13.3.1. Backbone Chassis

13.3.2. Ladder Chassis

13.3.3. Monocoque Chassis

13.3.4. Modular Chassis

13.3.5. Others

13.4. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Chassis Material

13.4.1. Aluminum Alloy

13.4.2. Mild Steel

13.4.3. High Speed Steel

13.4.4. Others (Carbon Fibre Composite, Etc.)

13.5. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By EV Type

13.5.1. BEV

13.5.2. PHEV

13.5.3. HEV

13.6. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

13.6.1. Passenger Cars

13.6.1.1. Hatchback

13.6.1.2. Sedan

13.6.1.3. Utility Vehicles

13.6.2. Light Commercial Vehicles

13.6.3. Heavy Duty Trucks

13.6.4. Buses and Coaches

13.7. Key Country Analysis – Middle East & Africa Automotive Chassis System Market Size Analysis & Forecast, 2017-2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Turkey

13.7.4. Rest of Middle East & Africa

14. South America Automotive Chassis System Market

14.1. Market Snapshot

14.2. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Component

14.2.1. Suspension Ball Joints

14.2.2. Cross Axis Joints

14.2.3. Tie Rods

14.2.4. Stabilizer Links

14.2.5. Control Arms

14.2.6. Knuckles and Hubs

14.3. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Chassis Type

14.3.1. Backbone Chassis

14.3.2. Ladder Chassis

14.3.3. Monocoque Chassis

14.3.4. Modular Chassis

14.3.5. Others

14.4. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Chassis Material

14.4.1. Aluminum Alloy

14.4.2. Mild Steel

14.4.3. High Speed Steel

14.4.4. Others (Carbon Fibre Composite, Etc.)

14.5. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By EV Type

14.5.1. BEV

14.5.2. PHEV

14.5.3. HEV

14.6. Automotive Chassis System Market Size (Thousand Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

14.6.1. Passenger Cars

14.6.1.1. Hatchback

14.6.1.2. Sedan

14.6.1.3. Utility Vehicles

14.6.2. Light Commercial Vehicles

14.6.3. Heavy Duty Trucks

14.6.4. Buses and Coaches

14.7. Key Country Analysis – South America Automotive Chassis System Market Size Analysis & Forecast, 2017-2031

14.7.1. Brazil

14.7.2. Argentina

14.7.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2021

15.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profile/ Key Players

16.1. Continental AG

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. Robert Bosch GmbH

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. American Axle and Manufacturing

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. Benteler International AG

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. ZF Friedrichafen

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. KLT-Auto

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. ALF ENGINEERING Pvt Ltd

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. Magna International Inc.

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. MAHLE GmbH

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. Tower International

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. Meritor, INC.

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. Dana Limited

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. Detroit Diesel Corporation

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. Other Key Players

List of Tables

Table 1: Global Automotive Chassis System Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 2: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 3: Global Automotive Chassis System Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 4: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 5: Global Automotive Chassis System Market Volume (Thousand Units) Forecast, by End Use Industry, 2017-2031

Table 6: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by End Use Industry, 2017-2031

Table 7: Global Automotive Chassis System Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 8: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 9: Global Automotive Chassis System Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 10: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 11: Global Automotive Chassis System Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 12: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 13: North America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 14: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 15: North America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 16: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 17: North America Automotive Chassis System Market Volume (Thousand Units) Forecast, by End Use Industry, 2017-2031

Table 18: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by End Use Industry, 2017-2031

Table 19: North America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 20: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 21: North America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 22: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 23: North America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 24: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 25: Europe Automotive Chassis System Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 26: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 27: Europe Automotive Chassis System Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 28: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 29: Europe Automotive Chassis System Market Volume (Thousand Units) Forecast, by End Use Industry, 2017-2031

Table 30: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by End Use Industry, 2017-2031

Table 31: Europe Automotive Chassis System Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 32: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 33: Europe Automotive Chassis System Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 34: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 35: Europe Automotive Chassis System Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 36: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 37: Asia Pacific Automotive Chassis System Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 38: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 39: Asia Pacific Automotive Chassis System Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 40: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 41: Asia Pacific Automotive Chassis System Market Volume (Thousand Units) Forecast, by End Use Industry, 2017-2031

Table 42: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by End Use Industry, 2017-2031

Table 43: Asia Pacific Automotive Chassis System Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 44: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 45: Asia Pacific Automotive Chassis System Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 46: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 47: Asia Pacific Automotive Chassis System Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 48: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 49: Middle East and Africa Automotive Chassis System Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 50: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 51: Middle East and Africa Automotive Chassis System Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 52: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 53: Middle East and Africa Automotive Chassis System Market Volume (Thousand Units) Forecast, by End Use Industry, 2017-2031

Table 54: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by End Use Industry, 2017-2031

Table 55: Middle East and Africa Automotive Chassis System Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 56: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 57: Middle East and Africa Automotive Chassis System Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 58: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 59: Middle East and Africa Automotive Chassis System Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 60: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 61: South America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 62: South America Automotive Chassis System Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 63: South America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 64: South America Automotive Chassis System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 65: South America Automotive Chassis System Market Volume (Thousand Units) Forecast, by End Use Industry, 2017-2031

Table 66: South America Automotive Chassis System Market Value (US$ Bn) Forecast, by End Use Industry, 2017-2031

Table 67: South America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 68: South America Automotive Chassis System Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 69: South America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 70: South America Automotive Chassis System Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 71: South America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 72: South America Automotive Chassis System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

List of Figures

Figure 1: Global Automotive Chassis System Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 2: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 3: Global Automotive Chassis System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 4: Global Automotive Chassis System Market Volume (Thousand Units) Forecast, by Chassis Type, 2017-2031

Figure 5: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2017-2031

Figure 6: Global Automotive Chassis System Market, Incremental Opportunity, by Chassis Type, Value (US$ Bn), 2022-2031

Figure 7: Global Automotive Chassis System Market Volume (Thousand Units) Forecast, by Chassis Material, 2017-2031

Figure 8: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Material, 2017-2031

Figure 9: Global Automotive Chassis System Market, Incremental Opportunity, by Chassis Material, Value (US$ Bn), 2022-2031

Figure 10: Global Automotive Chassis System Market Volume (Thousand Units) Forecast, by EV Type, 2017-2031

Figure 11: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by EV Type, 2017-2031

Figure 12: Global Automotive Chassis System Market, Incremental Opportunity, by EV Type, Value (US$ Bn), 2022-2031

Figure 13: Global Automotive Chassis System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 14: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 15: Global Automotive Chassis System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 16: Global Automotive Chassis System Market Volume (Thousand Units) Forecast, by Region Type, 2017-2031

Figure 17: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Automotive Chassis System Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 19: North America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 20: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 21: North America Automotive Chassis System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 22: North America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Chassis Type, 2017-2031

Figure 23: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2017-2031

Figure 24: North America Automotive Chassis System Market, Incremental Opportunity, by Chassis Type, Value (US$ Bn), 2022-2031

Figure 25: North America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Chassis Material, 2017-2031

Figure 26: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Material, 2017-2031

Figure 27: North America Automotive Chassis System Market, Incremental Opportunity, by Chassis Material, Value (US$ Bn), 2022-2031

Figure 28: North America Automotive Chassis System Market Volume (Thousand Units) Forecast, by EV Type, 2017-2031

Figure 29: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by EV Type, 2017-2031

Figure 30: North America Automotive Chassis System Market, Incremental Opportunity, by EV Type, Value (US$ Bn), 2022-2031

Figure 31: North America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 32: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 33: North America Automotive Chassis System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 34: North America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 35: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Automotive Chassis System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 37: Europe Automotive Chassis System Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 38: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 39: Europe Automotive Chassis System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 40: Europe Automotive Chassis System Market Volume (Thousand Units) Forecast, by Chassis Type, 2017-2031

Figure 41: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2017-2031

Figure 42: Europe Automotive Chassis System Market, Incremental Opportunity, by Chassis Type, Value (US$ Bn), 2022-2031

Figure 43: Europe Automotive Chassis System Market Volume (Thousand Units) Forecast, by Chassis Material, 2017-2031

Figure 44: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Material, 2017-2031

Figure 45: Europe Automotive Chassis System Market, Incremental Opportunity, by Chassis Material, Value (US$ Bn), 2022-2031

Figure 46: Europe Automotive Chassis System Market Volume (Thousand Units) Forecast, by EV Type, 2017-2031

Figure 47: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by EV Type, 2017-2031

Figure 48: Europe Automotive Chassis System Market, Incremental Opportunity, by EV Type, Value (US$ Bn), 2022-2031

Figure 49: Europe Automotive Chassis System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 50: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 51: Europe Automotive Chassis System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 52: Europe Automotive Chassis System Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 53: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: Europe Automotive Chassis System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 55: Asia Pacific Automotive Chassis System Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 56: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 57: Asia Pacific Automotive Chassis System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 58: Asia Pacific Automotive Chassis System Market Volume (Thousand Units) Forecast, by Chassis Type, 2017-2031

Figure 59: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2017-2031

Figure 60: Asia Pacific Automotive Chassis System Market, Incremental Opportunity, by Chassis Type, Value (US$ Bn), 2022-2031

Figure 61: Asia Pacific Automotive Chassis System Market Volume (Thousand Units) Forecast, by Chassis Material, 2017-2031

Figure 62: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Material, 2017-2031

Figure 63: Asia Pacific Automotive Chassis System Market, Incremental Opportunity, by Chassis Material, Value (US$ Bn), 2022-2031

Figure 64: Asia Pacific Automotive Chassis System Market Volume (Thousand Units) Forecast, by EV Type, 2017-2031

Figure 65: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by EV Type, 2017-2031

Figure 66: Asia Pacific Automotive Chassis System Market, Incremental Opportunity, by EV Type, Value (US$ Bn), 2022-2031

Figure 67: Asia Pacific Automotive Chassis System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 68: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 69: Asia Pacific Automotive Chassis System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 70: Asia Pacific Automotive Chassis System Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Country Type, 2017-2031

Figure 72: Asia Pacific Automotive Chassis System Market, Incremental Opportunity, by Country Type, Value (US$ Bn), 2022-2031

Figure 73: Middle East and Africa Automotive Chassis System Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 74: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 75: Middle East and Africa Automotive Chassis System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 76: Middle East and Africa Automotive Chassis System Market Volume (Thousand Units) Forecast, by Chassis Type, 2017-2031

Figure 77: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2017-2031

Figure 78: Middle East and Africa Automotive Chassis System Market, Incremental Opportunity, by Chassis Type, Value (US$ Bn), 2022-2031

Figure 79: Middle East and Africa Automotive Chassis System Market Volume (Thousand Units) Forecast, by Chassis Material, 2017-2031

Figure 80: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Material, 2017-2031

Figure 81: Middle East and Africa Automotive Chassis System Market, Incremental Opportunity, by Chassis Material, Value (US$ Bn), 2022-2031

Figure 82: Middle East and Africa Automotive Chassis System Market Volume (Thousand Units) Forecast, by EV Type, 2017-2031

Figure 83: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by EV Type, 2017-2031

Figure 84: Middle East and Africa Automotive Chassis System Market, Incremental Opportunity, by EV Type, Value (US$ Bn), 2022-2031

Figure 85: Middle East and Africa Automotive Chassis System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 86: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 87: Middle East and Africa Automotive Chassis System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 88: Middle East and Africa Automotive Chassis System Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East and Africa Automotive Chassis System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 91: South America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 92: South America Automotive Chassis System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 93: South America Automotive Chassis System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 94: South America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Chassis Type, 2017-2031

Figure 95: South America Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2017-2031

Figure 96: South America Automotive Chassis System Market, Incremental Opportunity, by Chassis Type, Value (US$ Bn), 2022-2031

Figure 97: South America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Chassis Material, 2017-2031

Figure 98: South America Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Material, 2017-2031

Figure 99: South America Automotive Chassis System Market, Incremental Opportunity, by Chassis Material, Value (US$ Bn), 2022-2031

Figure 100: South America Automotive Chassis System Market Volume (Thousand Units) Forecast, by EV Type, 2017-2031

Figure 101: South America Automotive Chassis System Market Value (US$ Bn) Forecast, by EV Type, 2017-2031

Figure 102: South America Automotive Chassis System Market, Incremental Opportunity, by EV Type, Value (US$ Bn), 2022-2031

Figure 103: South America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 104: South America Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 105: South America Automotive Chassis System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 106: South America Automotive Chassis System Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 107: South America Automotive Chassis System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: South America Automotive Chassis System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031