Over the last decade, the adoption of wireless intercom in Asia Pacific has witnessed a significant upswing. The infrastructural development in this region has boosted the need for efficient security systems, of which wireless intercoms are essential parts. This factor has been driving the demand for wireless intercoms in this region remarkably.

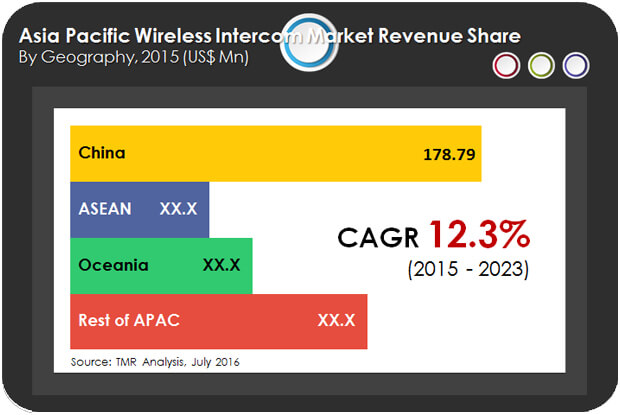

Analysts at Transparency Market Research project this trend to remain growing over the next few years, leading to an upsurge in the adoption of wireless intercoms in Asia Pacific. In 2014, the opportunity in wireless intercom across Asia Pacific was worth US$0.4 bn. Rising at a CAGR of 12.30% between 2015 and 2023, it is estimated to rise up to US$1.1 bn by 2023.

Security and Surveillance Emerges as Leading Application Area of Wireless Intercoms

Event management, security and surveillance, hospitality, retail, and transportation and logistics are the prime application areas of wireless intercoms. Among these, the security and surveillance segment has emerged as the leading adopter of these intercoms. The rising crime rate has increased the concerns over security among people in Asia Pacific, leading to the growing demand for robust security solutions. Hence, wireless intercoms, being an important part of these solutions, has also witnessed a surge in demand in the recent times.

In 2014, the revenue generated by the application of wireless intercoms in the security and surveillance segment stood at US$100.7 mn. Expanding at a CAGR of 13.2% between 2015 and 2023, it is likely to reach US$302.5 mn by the end of 2023.

Wireless Intercoms to Witness Significant Adoption in the Rest of Asia Pacific

The wireless intercom market in Asia Pacific stretches across Oceania, ASEAN, China, and the Rest of Asia Pacific. The Rest of Asia Pacific, including India, Taiwan, Japan, Pakistan, South Korea, Bangladesh, Fiji, and Sri Lanka, led the overall demand for wireless intercoms in 2014 with a share of nearly 40%. The rising number of industrial complexes, commercial infrastructure, and special economic zones (SEZs), owing to the rapid industrialization, has boosted the application of wireless intercoms in economies in the Rest of Asia Pacific in the recent past.

Looking forward, these intercoms are likely to witness a significant adoption in the security and surveillance, hospitality, and retail sectors in many of the countries in the Rest of Asia Pacific over the next few years. In Japan and South Korea, the application of these intercoms will experience a rise in the event management industry while in Pakistan, Bangladesh, and Sri Lanka, their demand will rise in the security and surveillance sector.

By the end of 2023, the opportunity in wireless intercoms across the Rest of Asia will increase up to US$2.1 bn from a US$0.83 bn in 2014.

Leading Manufacturers of Wireless Intercoms in Asia Pacific

At the forefront of the Asia Pacific wireless intercom market are Clear-Com Ltd., Commend International GmbH, and RTS Intercom. Other prominent wireless intercom manufacturers in this region are Panasonic Corp., Zenitel Group, Sena Technologies Inc., Riedel Communications GmbH & Co. KG, and Telephonics Corp.

Chapter 1 Preface

1.1 Report Description

1.2 Report Scope – Market Segmentation

1.3 Research Methodology

Chapter 2 Executive Summary

2.1 Market Snapshot

Chapter 3 Asia Pacific Wireless Intercom Market Analysis

3.1 Market Dynamics

3.2 Market Trends

3.3 Market Dynamics

3.4 Asia Pacific Wireless Intercom Market Overview

3.4.1 Asia Pacific Wireless Intercom Market Revenue, 2013 – 2023 (US$ Mn) and Y-o-Y Growth (%)

3.4.2 Asia Pacific Wireless Intercom Market Analysis: By Industry Vertical (Revenue - US$ Mn & Volume Mn Units)

3.4.3 Asia Pacific Wireless Intercom Market Analysis: By Group Size (Revenue - US$ Mn & Volume Mn Units)

3.4.4 Asia Pacific Wireless Intercom Market Analysis: By Technology (Revenue - US$ Mn & Volume Mn Units)

3.4.4.1 Wi-Fi Wireless Intercom, By Band

3.4.4.2 RF Wireless Intercom, By Band

3.4.4.3 RF Wireless Intercom, By Channel

3.4.5 Asia Pacific Wireless Intercom Market Analysis: By Dealership Price (Revenue - US$ Mn)

3.4.6 Asia Pacific Wireless Intercom Market Analysis: By End-user Price (Revenue - US$ Mn)

3.5 Competitive Landscape

3.5.1 Market Positioning

3.5.2 Competitive Strategies by Key Players

3.5.3 Top Brands in Market

3.5.4 Recommendations

3.5.5 Distribution Channel Analysis of Wireless Intercom Market

Chapter 4 China Wireless Intercom Market Analysis

4.1 Market Dynamics – Impact Analysis

4.2 China Wireless Intercom Market Overview

4.2.1 China Wireless Intercom Market Revenue, 2013 – 2023 (US$ Mn) and Y-o-Y Growth (%)

4.2.2 China Wireless Intercom Market Volume, 2013 – 2023 (US$ Mn) and Y-o-Y Growth (%)

4.3 China Wireless Intercom Market Analysis: By Industry Vertical (Revenue - US$ Mn & Volume Mn Units)

4.4 China Wireless Intercom Market Analysis: By Group Size (Revenue - US$ Mn & Volume Mn Units)

4.5 China Wireless Intercom Market Analysis: By Technology (Revenue - US$ Mn & Volume Mn Units)

4.5.1 Wi-Fi Wireless Intercom, By Band

4.5.2 RF Wireless Intercom, By Band

4.5.3 RF Wireless Intercom, By Channel

4.6 China Wireless Intercom Market Analysis: By Dealership Price (Revenue - US$ Mn)

4.7 China Wireless Intercom Market Analysis: By End-user Price (Revenue - US$ Mn)

Chapter 5 ASEAN Wireless Intercom Market Analysis

5.1 Market Dynamics – Impact Analysis

5.2 ASEAN Wireless Intercom Market Overview

5.2.1 ASEAN Wireless Intercom Market Revenue, 2013 – 2023 (US$ Mn) and Y-o-Y Growth (%)

5.2.2 ASEAN Wireless Intercom Market Volume, 2013 – 2023 (US$ Mn) and Y-o-Y Growth (%)

5.3 ASEAN Wireless Intercom Market Analysis: By Industry Vertical (Revenue - US$ Mn & Volume Mn Units)

5.4 ASEAN Wireless Intercom Market Analysis: By Group Size (Revenue - US$ Mn & Volume Mn Units)

5.5 ASEAN Wireless Intercom Market Analysis: By Technology (Revenue - US$ Mn & Volume Mn Units)

5.5.1 Wi-Fi Wireless Intercom, By Band

5.5.2 RF Wireless Intercom, By Band

5.5.3 RF Wireless Intercom, By Channel

5.6 ASEAN Wireless Intercom Market Analysis: By Dealership Price (Revenue - US$ Mn)

5.7 ASEAN Wireless Intercom Market Analysis: By End-user Price (Revenue - US$ Mn)

Chapter 6 Oceania Wireless Intercom Market Analysis

6.1 Market Dynamics – Impact Analysis

6.2 Oceania Wireless Intercom Market Overview

6.2.1 Oceania Wireless Intercom Market Revenue, 2013 – 2023 (US$ Mn) and Y-o-Y Growth (%)

6.2.2 Oceania Wireless Intercom Market Volume, 2013 – 2023 (US$ Mn) and Y-o-Y Growth (%)

6.3 Oceania Wireless Intercom Market Analysis: By Industry Vertical (Revenue - US$ Mn & Volume Mn Units)

6.4 Oceania Wireless Intercom Market Analysis: By Group Size (Revenue - US$ Mn & Volume Mn Units)

6.5 Oceania Wireless Intercom Market Analysis: By Technology (Revenue - US$ Mn & Volume Mn Units)

6.5.1 Wi-Fi Wireless Intercom, By Band

6.5.2 RF Wireless Intercom, By Band

6.5.3 RF Wireless Intercom, By Channel

6.6 Oceania Wireless Intercom Market Analysis: By Dealership Price (Revenue - US$ Mn)

6.7 Oceania Wireless Intercom Market Analysis: By End-user Price (Revenue - US$ Mn)

Chapter 7 Rest of Asia Pacific Wireless Intercom Market Analysis

7.1 Market Dynamics – Impact Analysis

7.2 Rest of Asia Pacific Wireless Intercom Market Overview

7.2.1 Rest of Asia Pacific Wireless Intercom Market Revenue, 2013 – 2023 (US$ Mn) and Y-o-Y Growth (%)

7.2.2 Rest of Asia Pacific Wireless Intercom Market Volume, 2013 – 2023 (US$ Mn) and Y-o-Y Growth (%)

7.3 Rest of Asia Pacific Wireless Intercom Market Analysis: By Industry Vertical (Revenue - US$ Mn & Volume Mn Units)

7.4 Rest of Asia Pacific Wireless Intercom Market Analysis: By Group Size (Revenue - US$ Mn & Volume Mn Units)

7.5 Rest of Asia Pacific Wireless Intercom Market Analysis: By Technology (Revenue - US$ Mn & Volume Mn Units)

7.5.1 Wi-Fi Wireless Intercom, By Band

7.5.2 RF Wireless Intercom, By Band

7.5.3 RF Wireless Intercom, By Channel

7.6 Rest of Asia Pacific Wireless Intercom Market Analysis: By Dealership Price (Revenue - US$ Mn)

7.7 Rest of Asia Pacific Wireless Intercom Market Analysis: By End-user Price (Revenue - US$ Mn)

Chapter 8 Company Profiles

8.1 Panasonic Corporation

8.2 Clear-Com Ltd.

8.3 Zenitel Group

8.4 Commend International GmbH

8.5 RTS Intercom (Part of Bosch Security Systems, Inc.)

8.6 Riedel Communications GmbH & Co. KG

8.7 Telephonics Corporation

8.8 Sena Technologies, Inc.