Analyst Viewpoint

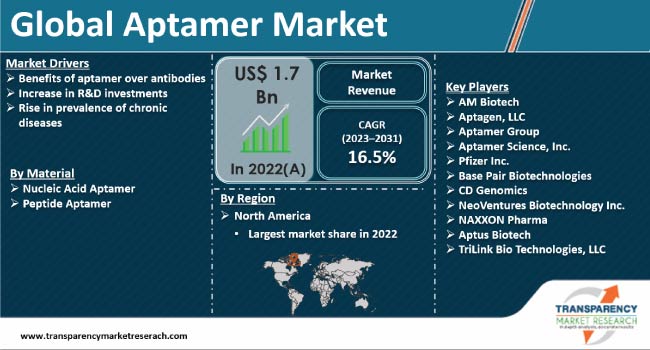

Growth in awareness about benefits of aptamer over antibodies is encouraging healthcare professionals to use aptamer-based therapies as a key treatment option to reduce recovery time. Aptamers are extensively employed in cancer treatments to deliver the drug to precise targeted cells. Increase in prevalence of cardiovascular and chronic diseases is driving the aptamer market value.

Rise in availability of healthcare facilities for chronic diseases in developing regions is also fueling market dynamics. Furthermore, increase in number of clinical trials conducted by healthcare organizations helps in research and development of novel treatments. In line with the latest aptamer market trends, key players are striving to introduce advanced treatments in order to increase their industry share.

Aptamer is a special class of nucleic acid molecule that is being investigated for clinical use. It is a short, single-stranded DNA or RNA molecule that can selectively bind to particular targets such as live cells, carbohydrates, peptides, toxins, small molecules, and proteins. These small RNA/DNA molecules can form tertiary and secondary structures capable of precisely binding proteins or other cellular targets and are equivalent to antibodies.

Aptamers are formed through an iterative selection process known as Systematic Evolution of Ligands by exponential enrichment (SELEX) by using single-stranded DNA or RNA. Aptamers are bound with nucleic acid macromolecules with specificity and high affinity.

Aptamers have a longer shelf life and are more stable than antibodies. They are produced through a simple and inexpensive process. The time required to generate aptamers is comparatively short.

Aptamers have significant benefits over antibodies such as superior affinity, easy modification, better stability, smaller size, high productivity, easy immobilization, and specificity to the target. These advantages make aptamers a preferred choice over antibodies. This is driving the aptamer market growth.

Aptamer conjugates are formed by hybridization of aptamers with nucleic acid drugs. This makes aptamer an efficient carrier and precise deliverer of nucleic acid to targeted cells. Furthermore, aptamer can be used under non-physiological conditions for analytical purposes.

Development of novel diagnostic procedures and creation of new diagnostic tests are augmenting the applications of aptamers in targeted drug delivery. Market dynamics of aptamers in cancer diagnostics are growing owing to the rise in incidence of cancer across the globe.

Aptamers are extensively employed in the treatment of chronic diseases, as they help with protein production monitoring, purification, and quality control required during treatments. Thus, growth in prevalence of chronic diseases across the globe is fueling market statistics.

According to a study conducted by the World Health Organization, around 74% of global deaths (approximately 41 million people) are caused by Noncommunicable Diseases (NCDs) each year. Cardiovascular diseases account for most NCD deaths, or 17.9 million people annually, followed by cancers (9.3 million), chronic respiratory diseases (4.1 million), and diabetes (2.0 million, including kidney disease deaths caused by diabetes).

Healthcare organizations are investing significantly in research and development activities to enhance their product portfolio. Growth in healthcare facilities and availability of advanced treatments for chronic diseases are bolstering the aptamer market revenue.

Increase in approvals for advanced technologies in aptamer therapies is encouraging healthcare professionals to investigate and innovate more efficient aptamers. Furthermore, rise in number of clinical trials conducted to develop aptamer-based therapeutics is augmenting the aptamer market size.

Thus, growth in awareness about the advantages of aptamer-based therapies to cure diseases is driving the demand for aptamers.

North America is likely to hold the largest aptamer market share during the forecast period. Availability of advanced healthcare facilities is fostering market expansion in the region. Increase in prevalence of chronic diseases and rise in focus of research laboratories in the aptamer field are creating lucrative aptamer industry opportunities for companies operating in North America.

Growth in investment in R&D to develop advanced treatments for chronic and cardiovascular diseases and ensure a faster recovery rate is also projected to boost the demand for aptamers in North America.

Leading market players are implementing strategies such as collaborations and partnerships to introduce advanced therapies. They are striving to increase their product portfolio in order to strengthen their market position. Companies are also aiming to secure funding from investors in order to further explore the potential of aptamers in the healthcare sector.

Some of the prominent companies in the aptamer industry are AM Biotech., Aptagen, LLC, Aptamer Group, Aptamer Science, Inc., Pfizer Inc., Base Pair Biotechnologies, CD Genomics, NeoVentures Biotechnology Inc., NAXXON Pharma, Aptus Biotech, and TriLink Bio Technologies, LLC.

These players have been profiled in the aptamer market report based on parameters such as financial overview, company overview, product portfolio, business strategies, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 1.7 Bn |

| Market Forecast (Value) in 2031 | US$ 7.0 Bn |

| Growth Rate (CAGR) | 16.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.7 Bn in 2022

It is projected to register a CAGR of 16.5% from 2023 to 2031

Benefits of aptamer over antibodies and increase in R&D investments

North America was the most lucrative region in 2022

AM Biotech, Aptagen, LLC, Aptamer Group, Aptamer Science, Inc., Pfizer Inc., Base Pair Biotechnologies, CD Genomics, NeoVentures Biotechnology Inc., NAXXON Pharma, Aptus Biotech, and TriLink Bio Technologies, LLC

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Aptamer Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Aptamer Market Analysis and Forecast, 2023-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. COVID-19 Pandemic Impact on Industry

6. Aptamer Market Analysis and Forecast, by Material

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Material, 2023-2031

6.3.1. Nucleic Acid Aptamer

6.3.2. Peptide Aptamer

6.4. Market Attractiveness, by Material

7. Aptamer Market Analysis and Forecast, by Application

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2023-2031

7.3.1. Research

7.3.2. Diagnostic

7.3.3. Therapeutics

7.3.4. Others

7.3.5. 7.4 Market Attractiveness, by Application

8. Global Aptamer Market Analysis and Forecast, by Technique

8.1. Introduction and Definitions

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Technique, 2023-2031

8.3.1. SELEX Technique

8.3.2. Others (MARAS, etc.)

8.4. Market Attractiveness, by Technique

9. Global Aptamer Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2023-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Region

10. North America Aptamer Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Material, 2023-2031

10.2.1. Nucleic Acid Aptamer

10.2.2. Peptide Aptamer

10.3. Market Attractiveness, by Material

10.4. Market Value Forecast, by Application, 2023-2031

10.4.1. Research

10.4.2. Diagnostic

10.4.3. Therapeutics

10.4.4. Others

10.5. Market Attractiveness, by Application

10.6. Market Value Forecast, by Technique, 2023-2031

10.6.1. SELEX Technique

10.6.2. Others (MARAS, etc.)

10.7. Market Attractiveness, by Technique

10.8. Market Value Forecast, by Country, 2022-2031

10.8.1. U.S.

10.8.2. Canada

10.9. Market Attractiveness Analysis

10.9.1. By Material

10.9.2. By Application

10.9.3. By Technique

10.9.4. By Country

11. Europe Aptamer Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Material, 2023-2031

11.2.1. Nucleic Acid Aptamer

11.2.2. Peptide Aptamer

11.3. Market Attractiveness, by Material

11.4. Market Value Forecast, by Application, 2023-2031

11.4.1. Research

11.4.2. Diagnostic

11.4.3. Therapeutics

11.4.4. Others

11.5. Market Attractiveness, by Application

11.6. Market Value Forecast, by Technique, 2023-2031

11.6.1. SELEX Technique

11.6.2. Others (MARAS, etc.)

11.7. Market Attractiveness, by Technique

11.8. Market Value Forecast, by Country/Sub-region, 2022-2031

11.8.1. Germany

11.8.2. U.K.

11.8.3. France

11.8.4. Italy

11.8.5. Spain

11.8.6. Rest of Europe

11.9. Market Attractiveness Analysis

11.9.1. By Material

11.9.2. By Application

11.9.3. By Technique

11.9.4. By Country/Sub-region

12. Asia Pacific Aptamer Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Material, 2023-2031

12.2.1. Nucleic Acid Aptamer

12.2.2. Peptide Aptamer

12.3. Market Attractiveness, by Material

12.4. Market Value Forecast, by Application, 2023-2031

12.4.1. Research

12.4.2. Diagnostic

12.4.3. Therapeutics

12.4.4. Others

12.5. Market Attractiveness, by Application

12.6. Market Value Forecast, by Technique, 2023-2031

12.6.1. SELEX Technique

12.6.2. Others (MARAS, etc.)

12.7. Market Attractiveness, by Technique

12.8. Market Value Forecast, by Country/Sub-region, 2023-2031

12.8.1. China

12.8.2. Japan

12.8.3. India

12.8.4. Australia & New Zealand

12.8.5. Rest of Asia Pacific

12.9. Market Attractiveness Analysis

12.9.1. By Material

12.9.2. By Application

12.9.3. By Technique

12.9.4. By Country/Sub-region

13. Latin America Aptamer Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Material, 2023-2031

13.2.1. Nucleic Acid Aptamer

13.2.2. Peptide Aptamer

13.3. Market Attractiveness, by Material

13.4. Market Value Forecast, by Application, 2023-2031

13.4.1. Research

13.4.2. Diagnostic

13.4.3. Therapeutics

13.4.4. Others

13.5. Market Attractiveness, by Application

13.6. Market Value Forecast, by Technique, 2023-2031

13.6.1. SELEX Technique

13.6.2. Others (MARAS, etc.)

13.7. Market Attractiveness, by Technique

13.8. Market Value Forecast, by Country/Sub-region, 2023-2031

13.8.1. Brazil

13.8.2. Mexico

13.8.3. Rest of Latin America

13.9. Market Attractiveness Analysis

13.9.1. By Material

13.9.2. By Application

13.9.3. By Technique

13.9.4. By Country/Sub-region

14. Middle East & Africa Aptamer Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Material, 2023-2031

14.2.1. Nucleic Acid Aptamer

14.2.2. Peptide Aptamer

14.3. Market Attractiveness, by Material

14.4. Market Value Forecast, by Application, 2023-2031

14.4.1. Research

14.4.2. Diagnostic

14.4.3. Therapeutics

14.4.4. Others

14.5. Market Attractiveness, by Application

14.6. Market Value Forecast, by Technique, 2023-2031

14.6.1. SELEX Technique

14.6.2. Others (MARAS, etc.)

14.7. Market Attractiveness, by Technique

14.8. Market Value Forecast, by Country/Sub-region, 2023-2031

14.8.1. GCC Countries

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Market Attractiveness Analysis

14.9.1. By Material

14.9.2. By Application

14.9.3. By Technique

14.9.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. AM Biotech

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Aptagen, LLC

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Aptamer Group

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Aptamer Science, Inc.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Pfizer Inc.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Base Pair Biotechnologies

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. CD Genomics

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. NeoVentures Biotechnology Inc.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. NAXXON Pharma

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Aptus Biotech

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. TriLink Bio Technologies, LLC

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

List of Tables

Table 1: Global Aptamer Market Value (US$ Mn) Forecast, by Material, 2023-2031

Table 2: Global Aptamer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 3: Global Aptamer Market Value (US$ Mn) Forecast, by Technique, 2023-2031

Table 4: Global Aptamer Market Value (US$ Mn) Forecast, by Region, 2023-2031

Table 5: North America Aptamer Market Value (US$ Mn) Forecast, by Country, 2023-2031

Table 6: North America Aptamer Market Value (US$ Mn) Forecast, by Material, 2023-2031

Table 7: North America Aptamer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 8: North America Aptamer Market Value (US$ Mn) Forecast, by Technique, 2023-2031

Table 9: Europe Aptamer Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

Table 10: Europe Aptamer Market Value (US$ Mn) Forecast, by Material, 2023-2031

Table 11: Europe Aptamer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 12: Europe Aptamer Market Value (US$ Mn) Forecast, by Technique 2023-2031

Table 13: Asia Pacific Aptamer Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

Table 14: Asia Pacific Aptamer Market Value (US$ Mn) Forecast, by Material, 2023-2031

Table 15: Asia Pacific Aptamer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 16: Asia Pacific Aptamer Market Value (US$ Mn) Forecast, by Technique, 2023-2031

Table 17: Latin America Aptamer Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

Table 18: Latin Americaa Aptamer Market Value (US$ Mn) Forecast, by Material, 2023-2031

Table 19: Latin America Aptamer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 20: Latin America Aptamer Market Value (US$ Mn) Forecast, by Technique 2023-2031

Table 21: Middle East & Africa Aptamer Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

Table 22: Middle East & Africa Aptamer Market Value (US$ Mn) Forecast, by Material, 2023-2031

Table 23: Middle East & Africa Aptamer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 24: Middle East & Africa Aptamer Market Value (US$ Mn) Forecast, by Technique 2023-2031

List of Figures

Figure 1: Global Aptamer Market Value (US$ Mn) Forecast, 2023-2031

Figure 2: Global Aptamer Market Value Share, by Material, 2022

Figure 3: Global Aptamer Market Value Share, by Application, 2022

Figure 4: Global Aptamer Market Value Share, by Technique, 2022

Figure 5: Global Aptamer Market Value Share Analysis, by Material, 2022 and 2031

Figure 6: Global Aptamer Market Attractiveness Analysis, by Material, 2023-2031

Figure 7: Global Aptamer Market Value Share Analysis, by Application, 2022 and 2031

Figure 8: Global Aptamer Market Attractiveness Analysis, by Application, 2023-2031

Figure 9: Global Aptamer Market Value Share Analysis, by Technique, 2022 and 2031

Figure 10: Global Aptamer Market Attractiveness Analysis, by Technique 2023-2031

Figure 11: Global Aptamer Market Value Share Analysis, by Region, 2022 and 2031

Figure 12: Global Aptamer Market Attractiveness Analysis, by Region, 2023-2031

Figure 13: North America Aptamer Market Value (US$ Mn) Forecast, 2023-2031

Figure 14: North America Aptamer Market Value Share Analysis, by Country, 2022 and 2031

Figure 15: North America Aptamer Market Attractiveness Analysis, by Country, 2023-2031

Figure 16: North America Aptamer Market Value Share Analysis, by Material, 2022 and 2031

Figure 17: North America Aptamer Market Attractiveness Analysis, by Material, 2023-2031

Figure 18: North America Aptamer Market Value Share Analysis, by Application, 2022 and 2031

Figure 19: North America Aptamer Market Attractiveness Analysis, by Application, 2023-2031

Figure 20: North America Aptamer Market Value Share Analysis, by Technique, 2022 and 2031

Figure 21: North America Aptamer Market Attractiveness Analysis, by Technique 2023-2031

Figure 22: Europe Aptamer Market Value (US$ Mn) Forecast, 2023-2031

Figure 23: Europe Aptamer Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 24: Europe Aptamer Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 25: Europe Aptamer Market Value Share Analysis, by Material, 2022 and 2031

Figure 26: Europe America Aptamer Market Attractiveness Analysis, by Material, 2023-2031

Figure 27: Europe Aptamer Market Value Share Analysis, by Application, 2022 and 2031

Figure 28: Europe Aptamer Market Attractiveness Analysis, by Application, 2023-2031

Figure 29: Europe Aptamer Market Value Share Analysis, by Technique, 2022 and 2031

Figure 30: Europe Aptamer Market Attractiveness Analysis, by Technique 2023-2031

Figure 31: Asia Pacific Aptamer Market Value (US$ Mn) Forecast, 2023-2031

Figure 32: Asia Pacific Aptamer Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Asia Pacific Aptamer Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 34: Asia Pacific Aptamer Market Value Share Analysis, by Material, 2022 and 2031

Figure 35: Asia Pacific America Aptamer Market Attractiveness Analysis, by Material, 2023-2031

Figure 36: Asia Pacific Aptamer Market Value Share Analysis, by Application, 2022 and 2031

Figure 37: Asia Pacific Aptamer Market Attractiveness Analysis, by Application, 2023-2031

Figure 38: Asia Pacific Aptamer Market Value Share Analysis, by Technique, 2022 and 2031

Figure 39: Asia Pacific Aptamer Market Attractiveness Analysis, by Technique 2023-2031

Figure 40: Latin America Aptamer Market Value (US$ Mn) Forecast, 2023-2031

Figure 41: Latin America Aptamer Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Latin America Aptamer Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 43: Latin America Aptamer Market Value Share Analysis, by Material, 2022 and 2031

Figure 44: Latin America Aptamer Market Attractiveness Analysis, by Material, 2023-2031

Figure 45: Latin America Aptamer Market Value Share Analysis, by Application, 2022 and 2031

Figure 46: Latin America Aptamer Market Attractiveness Analysis, by Application, 2023-2031

Figure 47: Latin America Aptamer Market Value Share Analysis, by Technique, 2022 and 2031

Figure 48: Latin America Aptamer Market Attractiveness Analysis, by Technique, 2023-2031

Figure 49: Middle East & Africa Aptamer Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 50: Middle East & Africa Aptamer Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 51: Middle East & Africa America Aptamer Market Value Share Analysis, by Material, 2023-2031

Figure 52: Middle East & Africa America Aptamer Market Attractiveness Analysis, by Material, 2023-2031

Figure 53: Middle East & Africa Aptamer Market Value Share Analysis, by Technique, 2022 and 2031

Figure 54: Middle East & Africa Aptamer Market Attractiveness Analysis, by Technique 2023-2031

Figure 55: Global Aptamer Market Share Analysis, by Company (2022)