Analysts’ Viewpoint on Market Scenario

Major players operating in the air conditioning system market are collaborating with start-ups by investing in them to develop new technologies in air conditioning systems and expand their global reach in order to maintain their competitive advantage. Companies are focusing on achieving long-term growth through effective integration and continuous improvement and innovation in air conditioning systems.

Rise in construction activities in developing countries and the upgrade of disaster-prone buildings, coupled with large-scale investments in infrastructure, provide significant opportunity for the manufacturers of air conditioning systems.

Furthermore, market players are emphasizing on air conditioning systems that consume less energy due to government regulation on energy-saving models, which is expected to propel the market during the forecast period.

Consumers across the globe are increasingly spending on various types of air conditioning systems. This can be ascribed to the rising standard of living, which is encouraging people to own basic household items, thereby significantly boosting the market. The central air conditioning market is anticipated to grow considerably during the forecast period due to rising urbanization, upgrade of disaster-prone buildings, large-scale investments in infrastructure and industrial sectors, and an increase in construction in emerging economies across the globe.

The global air conditioning system market is expected to grow at a significant pace during the forecast period due to a rise in new construction activities worldwide. The market in Asia Pacific is estimated to rise at the highest growth rate due to the presence of growing economies such as China and India in the region.

The construction of both residential and non-residential buildings is increasing, which is driving the development of both the home air conditioner as well as the commercial air conditioner markets in the region. Rising populations and economic development are also boosting the market. The World Economic Forum estimates that the construction sector generates almost US$ 10 Trn in total yearly revenue and US$ 3.6 Trn in added value. Approximately 6% of the worldwide GDP is accounted for by the construction sector.

More specifically, in industrialized nations, it accounts for roughly 5% of overall GDP, while in underdeveloped nations it typically makes up more than 8% of GDP. The industry is expected to grow extensively in the next few years, with estimated revenues of US$ 15 Trn by 2025. More than 100 million people are already employed in construction worldwide.

Rise in population with increasing disposable income in Asia Pacific is driving the demand for air conditioning systems for homes in the region. This is encouraging global air conditioner market players to shift production of air conditioners closer to consumption markets. For instance, Japan-based air conditioner manufacturer Daikin Industries, Ltd. established air conditioner manufacturing plants in Thailand, Malaysia, and India, which witnessed high demand for portable air conditioners.

In May 2018, Daikin started the operation of a new air conditioning system manufacturing plant in Vietnam to cater to the increasing demand for air conditioners in Asia Pacific. Daikin established the new plant in Vietnam due to a rise in the demand for residential air conditioners in the country.

In October 2014, rise in demand for VRF systems has prompted Japan-based air conditioner manufacturer, Mitsubishi Electric Corp., to shift its production of VRF indoor units from Japan to Thailand. Likewise, in October 2014, Mitsubishi Electric shifted production of residential air conditioners for the U.S. market from Thailand to Mexico. Thus, localizing AC production is increasing the demand for air conditioners.

In terms of product type, the split air conditioner segment dominated the global air conditioning system market. Overflowing demand for energy efficiency is a key element driving the split air conditioning systems segment. Government regulations for energy-saving models, which are the future of air conditioning systems, have resulted in the replacement of old air conditioning system types with energy-saving home air conditioner ones in developed nations in North America and Europe.

Split air conditioning system manufacturers are approving advanced and green technologies to develop energy-saving systems owing to the increase in electricity consumption of these systems in the last few years. Rise in the adoption of green technology and an increase in the number of smart homes is anticipated to augment the demand for split HVAC systems during the forecast period.

In terms of region, Asia Pacific holds the largest share of the global air conditioning system market. The market in Asia Pacific is driven by factors such as rise in the construction of residential and non-residential buildings. China holds the highest market share of the market in Asia Pacific. India, Thailand, the Philippines, etc., are emerging markets in the region.

Authorities in the region are investing in residential projects due to an increase in population. On the other hand, manufacturers based out of different regions are building their manufacturing plants in Asia Pacific. This is expected to result in higher market growth in the region during the forecast period.

The air conditioning system market is consolidated, with a few large-scale vendors controlling majority of the market share. Most firms are spending a significant amount of money on comprehensive research and development. Expansion of product portfolios and mergers and acquisitions are the main strategies adopted by key players. Lennox International Inc., Sharp Corporation, Hitachi, Ltd., United Technologies Corp., Panasonic Corporation, Electrolux AB, Samsung Electronics Co., Ltd., Midea Group Co., Ltd., Mitsubishi Electric Corporation, and Daikin Industries, Ltd. are the prominent entities operating in the market.

Each of these players has been profiled in the air conditioning system market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 | US$ 1.68 Bn |

| Market Forecast Value in 2031 | US$ 2.70 Bn |

| Growth Rate (CAGR) | 4.9% |

| Forecast Period | 2022-2031 |

| Historical Data Available for | 2017-2020 |

| Quantitative Units | US$ Bn for Value & Thousand Units for Volume |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

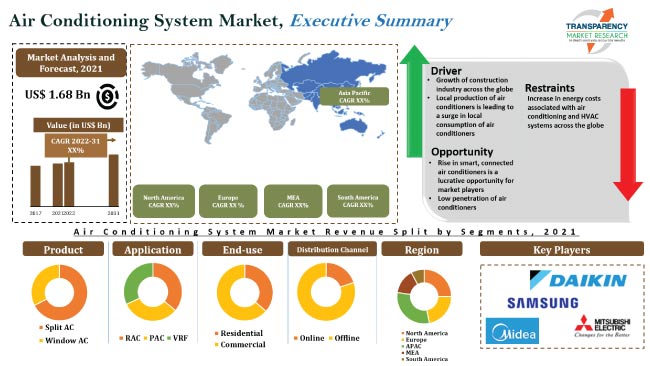

The market stood at US$ 1.68 Bn in 2021.

The market is estimated to grow at a CAGR of 4.9% during 2022-2031.

Local production of air conditioners, which is boosting the local consumption of air conditioners, and growth of the construction industry worldwide.

Split AC accounted for around 85% share of the market in 2021.

Asia Pacific region is likely to be the most lucrative region of the air conditioning system market in the next few years.

Lennox International Inc., Sharp Corporation, Hitachi, Ltd., United Technologies Corp., Panasonic Corporation, Electrolux AB, Samsung Electronics Co., Ltd., Midea Group Co., Ltd., Mitsubishi Electric Corporation, and Daikin Industries, Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.2.1. Overall HVAC Market

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Technology Overview

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. COVID-19 Impact Analysis

5.9. Global Air Conditioning System Market Analysis and Forecast, 2017-2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global Air Conditioning System Market Analysis and Forecast, by Product

6.1. Global Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Product, 2017-2031

6.1.1. Split AC

6.1.2. Window AC

6.2. Incremental Opportunity, by Product

7. Global Air Conditioning System Market Analysis and Forecast, by Application

7.1. Global Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Application, 2017-2031

7.1.1. RAC

7.1.2. PAC

7.1.3. VRF

7.2. Incremental Opportunity, by Application

8. Global Air Conditioning System Market Analysis and Forecast, by End-use

8.1. Global Air Conditioning System Market Size (US$ Mn) (Thousand Units), by End-use, 2017-2031

8.1.1. Residential

8.1.2. Commercial

8.2. Incremental Opportunity, by End-use

9. Global Air Conditioning System Market Analysis and Forecast, by Distribution Channel

9.1. Global Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

9.1.1. Online

9.1.2. Offline

9.2. Incremental Opportunity, by Distribution Channel

10. Global Air Conditioning System Market Analysis and Forecast, by Region

10.1. Global Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Region, 2017-2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Air Conditioning System Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Brand Analysis

11.3. Key Trends Analysis

11.3.1. Supply side

11.3.2. Demand Side

11.4. Price Trend Analysis

11.4.1. Weighted Average Selling Price (US$)

11.5. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Product, 2017-2031

11.5.1. Split AC

11.5.2. Window AC

11.6. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Application, 2017-2031

11.6.1. RAC

11.6.2. PAC

11.6.3. VRF

11.7. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by End-use, 2017-2031

11.7.1. Residential

11.7.2. Commercial

11.8. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

11.8.1. Online

11.8.2. Offline

11.9. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Country & Sub-region, 2017-2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Air Conditioning System Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Brand Analysis

12.3. Key Trends Analysis

12.3.1. Supply side

12.3.2. Demand Side

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Product, 2017-2031

12.5.1. Split AC

12.5.2. Window AC

12.6. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Application, 2017-2031

12.6.1. RAC/p>

12.6.2. PAC

12.6.3. VRF

12.7. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by End-use, 2017-2031

12.7.1. Residential

12.7.2. Commercial

12.8. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

12.8.1. Online

12.8.2. Offline

12.9. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Country & Sub-region, 2017-2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Air Conditioning System Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Brand Analysis

13.3. Key Trends Analysis

13.3.1. Supply side

13.3.2. Demand Side

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Product, 2017-2031

13.5.1. Split AC

13.5.2. Window AC

13.6. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Application, 2017-2031

13.6.1. RAC

13.6.2. PAC

13.6.3. VRF

13.7. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by End-use, 2017-2031

13.7.1. Residential

13.7.2. Commercial

13.8. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

13.8.1. Online

13.8.2. Offline

13.9. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Country & Sub-region, 2017-2031

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa Air Conditioning System Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Brand Analysis

14.3. Key Trends Analysis

14.3.1. Supply side

14.3.2. Demand Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Product, 2017-2031

14.5.1. Split AC

14.5.2. Window AC

14.6. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Application, 2017-2031

14.6.1. RAC

14.6.2. PAC

14.6.3. VRF

14.7. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by End-use, 2017-2031

14.7.1. Residential

14.7.2. Commercial

14.8. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

14.8.1. Online

14.8.2. Offline

14.9. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Country & Sub-region, 2017-2031

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Air Conditioning System Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Brand Analysis

15.3. Key Trends Analysis

15.3.1. Supply side

15.3.2. Demand Side

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Product, 2017-2031

15.5.1. Split AC

15.5.2. Window AC

15.6. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Application, 2017-2031

15.6.1. RAC

15.6.2. PAC

15.6.3. VRF

15.7. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by End-use, 2017-2031

15.7.1. Residential

15.7.2. Commercial

15.8. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

15.8.1. Online

15.8.2. Offline

15.9. Air Conditioning System Market Size (US$ Mn) (Thousand Units), by Country & Sub-region, 2017-2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Competition Dashboard

16.2. Market Share Analysis % (2021)

16.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

16.3.1. Daikin Industries, Ltd.

16.3.1.1. Company Overview

16.3.1.2. Product Portfolio

16.3.1.3. Financial Information, (Subject to Data Availability)

16.3.1.4. Business Strategies / Recent Developments

16.3.2. Electrolux AB

16.3.2.1. Company Overview

16.3.2.2. Product Portfolio

16.3.2.3. Financial Information, (Subject to Data Availability)

16.3.2.4. Business Strategies / Recent Developments

16.3.3. Hitachi, Ltd.

16.3.3.1. Company Overview

16.3.3.2. Product Portfolio

16.3.3.3. Financial Information, (Subject to Data Availability)

16.3.3.4. Business Strategies / Recent Developments

16.3.4. Lennox International Inc.

16.3.4.1. Company Overview

16.3.4.2. Product Portfolio

16.3.4.3. Financial Information, (Subject to Data Availability)

16.3.4.4. Business Strategies / Recent Developments

16.3.5. Midea Group Co., Ltd.

16.3.5.1. Company Overview

16.3.5.2. Product Portfolio

16.3.5.3. Financial Information, (Subject to Data Availability)

16.3.5.4. Business Strategies / Recent Developments

16.3.6. Mitsubishi Electric Corporation

16.3.6.1. Company Overview

16.3.6.2. Product Portfolio

16.3.6.3. Financial Information, (Subject to Data Availability)

16.3.6.4. Business Strategies / Recent Developments

16.3.7. Panasonic Corporation

16.3.7.1. Company Overview

16.3.7.2. Product Portfolio

16.3.7.3. Financial Information, (Subject to Data Availability)

16.3.7.4. Business Strategies / Recent Developments

16.3.8. Samsung Electronics Co., Ltd.

16.3.8.1. Company Overview

16.3.8.2. Product Portfolio

16.3.8.3. Financial Information, (Subject to Data Availability)

16.3.8.4. Business Strategies / Recent Developments

16.3.9. Sharp Corporation

16.3.9.1. Company Overview

16.3.9.2. Product Portfolio

16.3.9.3. Financial Information, (Subject to Data Availability)

16.3.9.4. Business Strategies / Recent Developments

16.3.10. United Technologies Corp.

16.3.10.1. Company Overview

16.3.10.2. Product Portfolio

16.3.10.3. Financial Information, (Subject to Data Availability)

16.3.10.4. Business Strategies / Recent Developments

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. Product

17.1.2. Application

17.1.3. End-use

17.1.4. Distribution Channel

17.1.5. Geography

17.2. Understanding the Buying Process of Customers

17.3. Prevailing Market Risks

17.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Air Conditioning System Market, by Product, Thousand Units, 2017-2031

Table 2: Global Air Conditioning System Market, by Product, US$ Mn, 2017-2031

Table 3: Global Air Conditioning System Market, by Application, Thousand Units, 2017-2031

Table 4: Global Air Conditioning System Market, by Application, US$ Mn, 2017-2031

Table 5: Global Air Conditioning System Market, by End-use, Thousand Units, 2017-2031

Table 6: Global Air Conditioning System Market, by End-use, US$ Mn, 2017-2031

Table 7: Global Air Conditioning System Market, by Distribution Channel, Thousand Units, 2017-2031

Table 8: Global Air Conditioning System Market, by Distribution Channel, US$ Mn, 2017-2031

Table 9: Global Air Conditioning System Market, by Region, Thousand Units, 2017-2031

Table 10: Global Air Conditioning System Market, by Region, US$ Mn, 2017-2031

Table 11: North America Air Conditioning System Market, by Product, Thousand Units, 2017-2031

Table 12: North America Air Conditioning System Market, by Product, US$ Mn, 2017-2031

Table 13: North America Air Conditioning System Market, by Application, Thousand Units, 2017-2031

Table 14: North America Air Conditioning System Market, by Application, US$ Mn, 2017-2031

Table 15: North America Air Conditioning System Market, by End-use, Thousand Units, 2017-2031

Table 16: North America Air Conditioning System Market, by End-use, US$ Mn, 2017-2031

Table 17: North America Air Conditioning System Market, by Distribution Channel, Thousand Units, 2017-2031

Table 18: North America Air Conditioning System Market, by Distribution Channel, US$ Mn, 2017-2031

Table 19: North America Air Conditioning System Market, by Country & Sub-region, Thousand Units, 2017-2031

Table 20: North America Air Conditioning System Market, by Country & Sub-region, US$ Mn, 2017-2031

Table 21: Europe Air Conditioning System Market, by Product, Thousand Units, 2017-2031

Table 22: Europe Air Conditioning System Market, by Product, US$ Mn, 2017-2031

Table 23: Europe Air Conditioning System Market, by Application, Thousand Units, 2017-2031

Table 24: Europe Air Conditioning System Market, by Application, US$ Mn, 2017-2031

Table 25: Europe Air Conditioning System Market, by End-use, Thousand Units, 2017-2031

Table 26: Europe Air Conditioning System Market, by End-use, US$ Mn, 2017-2031

Table 27: Europe Air Conditioning System Market, by Distribution Channel, Thousand Units, 2017-2031

Table 28: Europe Air Conditioning System Market, by Distribution Channel, US$ Mn, 2017-2031

Table 29: Europe Air Conditioning System Market, by Country & Sub-region, Thousand Units, 2017-2031

Table 30: Europe Air Conditioning System Market, by Country & Sub-region, US$ Mn, 2017-2031

Table 31: Asia Pacific Air Conditioning System Market, by Product, Thousand Units, 2017-2031

Table 32: Asia Pacific Air Conditioning System Market, by Product, US$ Mn, 2017-2031

Table 33: Asia Pacific Air Conditioning System Market, by Application, Thousand Units, 2017-2031

Table 34: Asia Pacific Air Conditioning System Market, by Application, US$ Mn, 2017-2031

Table 35: Asia Pacific Air Conditioning System Market, by End-use, Thousand Units, 2017-2031

Table 36: Asia Pacific Air Conditioning System Market, by End-use, US$ Mn, 2017-2031

Table 37: Asia Pacific Air Conditioning System Market, by Distribution Channel, Thousand Units, 2017-2031

Table 38: Asia Pacific Air Conditioning System Market, by Distribution Channel, US$ Mn, 2017-2031

Table 39: Asia Pacific Air Conditioning System Market, by Country & Sub-region, Thousand Units, 2017-2031

Table 40: Asia Pacific Air Conditioning System Market, by Country & Sub-region, US$ Mn, 2017-2031

Table 41: Middle East & Africa Air Conditioning System Market, by Product, Thousand Units, 2017-2031

Table 42: Middle East & Africa Air Conditioning System Market, by Product, US$ Mn, 2017-2031

Table 43: Middle East & Africa Air Conditioning System Market, by Application, Thousand Units, 2017-2031

Table 44: Middle East & Africa Air Conditioning System Market, by Application, US$ Mn, 2017-2031

Table 45: Middle East & Africa Air Conditioning System Market, by End-use, Thousand Units, 2017-2031

Table 46: Middle East & Africa Air Conditioning System Market, by End-use, US$ Mn, 2017-2031

Table 47: Middle East & Africa Air Conditioning System Market, by Distribution Channel, Thousand Units, 2017-2031

Table 48: Middle East & Africa Air Conditioning System Market, by Distribution Channel, US$ Mn, 2017-2031

Table 49: Middle East & Africa Air Conditioning System Market, by Country & Sub-region, Thousand Units, 2017-2031

Table 50: Middle East & Africa Air Conditioning System Market, by Country & Sub-region, US$ Mn, 2017-2031

Table 51: South America Air Conditioning System Market, by Product, Thousand Units, 2017-2031

Table 52: South America Air Conditioning System Market, by Product, US$ Mn, 2017-2031

Table 53: South America Air Conditioning System Market, by Application, Thousand Units, 2017-2031

Table 54: South America Air Conditioning System Market, by Application, US$ Mn, 2017-2031

Table 55: South America Air Conditioning System Market, by End-use, Thousand Units, 2017-2031

Table 56: South America Air Conditioning System Market, by End-use, US$ Mn, 2017-2031

Table 57: South America Air Conditioning System Market, by Distribution Channel, Thousand Units, 2017-2031

Table 58: South America Air Conditioning System Market, by Distribution Channel, US$ Mn, 2017-2031

Table 59: South America Air Conditioning System Market, by Country & Sub-region, Thousand Units, 2017-2031

Table 60: South America Air Conditioning System Market, by Country & Sub-region, US$ Mn, 2017-2031

List of Figures

Figure 1: Global Air Conditioning System Market, by Product, Thousand Units, 2017-2031

Figure 2: Global Air Conditioning System Market, by Product, US$ Mn, 2017-2031

Figure 3: Global Air Conditioning System Market, by Incremental Opportunity, By Product, 2017-2031

Figure 4: Global Air Conditioning System Market, by Application, Thousand Units, 2017-2031

Figure 5: Global Air Conditioning System Market, by Application, US$ Mn, 2017-2031

Figure 6: Global Air Conditioning System Market, by Incremental Opportunity, by Application, 2017-2031

Figure 7: Global Air Conditioning System Market, by End-use, Thousand Units, 2017-2031

Figure 8: Global Air Conditioning System Market, by End-use, US$ Mn, 2017-2031

Figure 9: Global Air Conditioning System Market, by Incremental Opportunity, By End-use, 2017-2031

Figure 10: Global Air Conditioning System Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 11: Global Air Conditioning System Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 12: Global Air Conditioning System Market, by Incremental Opportunity, By Distribution Channel, 2017-2031

Figure 13: Global Air Conditioning System Market, by Region, Thousand Units, 2017-2031

Figure 14: Global Air Conditioning System Market, by Region, US$ Mn, 2017-2031

Figure 15: Global Air Conditioning System Market, by Incremental Opportunity, by Region, 2017-2031

Figure 16: North America, Air Conditioning System Market, by Product, Thousand Units, 2017-2031

Figure 17: North America, Air Conditioning System Market, by Product, US$ Mn, 2017-2031

Figure 18: North America, Air Conditioning System Market, by Incremental Opportunity, By Product, 2017-2031

Figure 19: North America, Air Conditioning System Market, by Application, Thousand Units, 2017-2031

Figure 20: North America, Air Conditioning System Market, by Application, US$ Mn, 2017-2031

Figure 21: North America, Air Conditioning System Market, by Incremental Opportunity, By Application, 2017-2031

Figure 22: North America, Air Conditioning System Market, by End-use, Thousand Units, 2017-2031

Figure 23: North America, Air Conditioning System Market, by End-use, US$ Mn, 2017-2031

Figure 24: North America, Air Conditioning System Market, by Incremental Opportunity, By End-use, 2017-2031

Figure 25: North America, Air Conditioning System Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 26: North America, Air Conditioning System Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 27: North America, Air Conditioning System Market, by Incremental Opportunity, By Distribution Channel, 2017-2031

Figure 28: North America, Air Conditioning System Market, by Country & Sub-region, Thousand Units, 2017-2031

Figure 29: North America, Air Conditioning System Market, by Country & Sub-region, US$ Mn, 2017-2031

Figure 30: North America, Air Conditioning System Market, by Incremental Opportunity, by Country & Sub-region, 2017-2031

Figure 31: Europe, Air Conditioning System Market, by Product, Thousand Units, 2017-2031

Figure 32: Europe, Air Conditioning System Market, by Product, US$ Mn, 2017-2031

Figure 33: Europe, Air Conditioning System Market, by Incremental Opportunity, by Product, 2017-2031

Figure 34: Europe, Air Conditioning System Market, by Application, Thousand Units, 2017-2031

Figure 35: Europe, Air Conditioning System Market, by Application, US$ Mn, 2017-2031

Figure 36: Europe, Air Conditioning System Market, by Incremental Opportunity, by Application, 2017-2031

Figure 37: Europe, Air Conditioning System Market, by End-use, Thousand Units, 2017-2031

Figure 38: Europe, Air Conditioning System Market, by End-use, US$ Mn, 2017-2031

Figure 39: Europe, Air Conditioning System Market, by Incremental Opportunity, by End-use, 2017-2031

Figure 40: Europe, Air Conditioning System Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 41: Europe, Air Conditioning System Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 42: Europe, Air Conditioning System Market, by Incremental Opportunity, by Distribution Channel, 2017-2031

Figure 43: Europe, Air Conditioning System Market, by Country & Sub-region, Thousand Units, 2017-2031

Figure 44: Europe, Air Conditioning System Market, by Country & Sub-region, US$ Mn, 2017-2031

Figure 45: Europe, Air Conditioning System Market, by Incremental Opportunity, by Country & Sub-region, 2017-2031

Figure 46: Asia Pacific, Air Conditioning System Market, by Product, Thousand Units, 2017-2031

Figure 47: Asia Pacific, Air Conditioning System Market, by Product, US$ Mn, 2017-2031

Figure 48: Asia Pacific, Air Conditioning System Market, by Incremental Opportunity, by Product, 2017-2031

Figure 49: Asia Pacific, Air Conditioning System Market, by Application, Thousand Units, 2017-2031

Figure 50: Asia Pacific, Air Conditioning System Market, by Application, US$ Mn, 2017-2031

Figure 51: Asia Pacific, Air Conditioning System Market, by Incremental Opportunity, by Application, 2017-2031

Figure 52: Asia Pacific, Air Conditioning System Market, by End-use, Thousand Units, 2017-2031

Figure 53: Asia Pacific, Air Conditioning System Market, by End-use, US$ Mn, 2017-2031

Figure 54: Asia Pacific, Air Conditioning System Market, by Incremental Opportunity, by End-use, 2017-2031

Figure 55: Asia Pacific, Air Conditioning System Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 56: Asia Pacific, Air Conditioning System Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 57: Asia Pacific, Air Conditioning System Market, by Incremental Opportunity, by Distribution Channel, 2017-2031

Figure 58: Asia Pacific, Air Conditioning System Market, by Country & Sub-region, Thousand Units, 2017-2031

Figure 59: Asia Pacific, Air Conditioning System Market, by Country & Sub-region, US$ Mn, 2017-2031

Figure 60: Asia Pacific, Air Conditioning System Market, by Incremental Opportunity, by Country & Sub-region, 2017-2031

Figure 61: Middle East & Africa, Air Conditioning System Market, by Product, Thousand Units, 2017-2031

Figure 62: Middle East & Africa, Air Conditioning System Market, by Product, US$ Mn, 2017-2031

Figure 63: Middle East & Africa, Air Conditioning System Market, by Incremental Opportunity, by Product, 2017-2031

Figure 64: Middle East & Africa, Air Conditioning System Market, by Application, Thousand Units, 2017-2031

Figure 65: Middle East & Africa, Air Conditioning System Market, by Application, US$ Mn, 2017-2031

Figure 66: Middle East & Africa, Air Conditioning System Market, by Incremental Opportunity, by Application, 2017-2031

Figure 67: Middle East & Africa, Air Conditioning System Market, by End-use, Thousand Units, 2017-2031

Figure 68: Middle East & Africa, Air Conditioning System Market, by End-use, US$ Mn, 2017-2031

Figure 69: Middle East & Africa, Air Conditioning System Market, by Incremental Opportunity, by End-use, 2017-2031

Figure 70: Middle East & Africa, Air Conditioning System Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 71: Middle East & Africa, Air Conditioning System Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 72: Middle East & Africa, Air Conditioning System Market, by Incremental Opportunity, by Distribution Channel, 2017-2031

Figure 73: Middle East & Africa, Air Conditioning System Market, by Country & Sub-region, Thousand Units, 2017-2031

Figure 74: Middle East & Africa, Air Conditioning System Market, by Country & Sub-region, US$ Mn, 2017-2031

Figure 75: Middle East & Africa, Air Conditioning System Market, by Incremental Opportunity, by Country & Sub-region, 2017-2031

Figure 76: South America, Air Conditioning System Market, by Product, Thousand Units, 2017-2031

Figure 77: South America, Air Conditioning System Market, by Product, US$ Mn, 2017-2031

Figure 78: South America, Air Conditioning System Market, by Incremental Opportunity, by Product, 2017-2031

Figure 79: South America, Air Conditioning System Market, by Application, Thousand Units, 2017-2031

Figure 80: South America, Air Conditioning System Market, by Application, US$ Mn, 2017-2031

Figure 81: South America, Air Conditioning System Market, by Incremental Opportunity, by Application, 2017-2031

Figure 82: South America, Air Conditioning System Market, by End-use, Thousand Units, 2017-2031

Figure 83: South America, Air Conditioning System Market, by End-use, US$ Mn, 2017-2031

Figure 84: South America, Air Conditioning System Market, by Incremental Opportunity, by End-use, 2017-2031

Figure 85: South America, Air Conditioning System Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 86: South America, Air Conditioning System Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 87: South America, Air Conditioning System Market, by Incremental Opportunity, by Distribution Channel, 2017-2031

Figure 88: South America, Air Conditioning System Market, by Country & Sub-region, Thousand Units, 2017-2031

Figure 89: South America, Air Conditioning System Market, by Country & Sub-region, US$ Mn, 2017-2031

Figure 90: South America, Air Conditioning System Market, by Incremental Opportunity, by Country & Sub-region, 2017-2031