Analysts’ Viewpoint

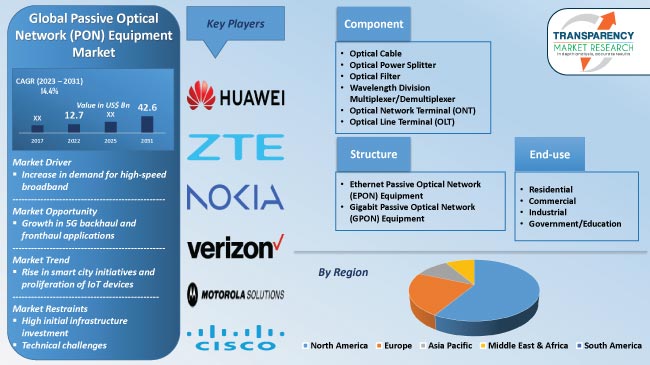

Increase in demand for high-speed broadband, rise in government initiatives and regulations to promote digital inclusion, and rapid urbanization are some of the factors that are projected to contribute to the passive optical network (PON) equipment market growth in the near future. Increase in adoption of advanced technologies in the communication industry, rise in smart city initiatives, and proliferation of IoT devices are also fueling market value.

Passive optical network (PON) equipment manufacturers are focusing on the development of products that are cost-effective, scalable, durable, and safe to use. Furthermore, they are also working to improve the performance of PON equipment to meet the demands of users for high-bandwidth applications such as streaming video and online gaming. However, high initial infrastructure investment and technical challenges are likely to hamper industry development during the forecast period.

The PON is a fiber-optic network that uses optical splitters and point-to-multipoint topology to send data from a single transmission point to multiple user endpoints. PON equipment consists of various components, including optical line terminals (OLTs), optical network units (ONUs), splitters, and optical distribution networks (ODNs).

PON equipment provides numerous advantages for broadband deployment. It offers high bandwidth capacity, enabling fast and efficient data transmission over long distances. The shared fiber infrastructure reduces the need for extensive cabling, resulting in cost savings and simplified network management. Additionally, PON technology eliminates the need for separate power cables, streamlining installation and maintenance processes.

Increase in data traffic and bandwidth requirements and improving network reliability and performance are estimated to drive market statistics during the forecast period.

Currently, the demand for high-speed broadband connectivity has skyrocketed, fueled by the exponential growth of data-intensive applications, video streaming, cloud computing, and the Internet of Things (IoT). Telecommunication providers and network operators are turning to passive optical network (PON) technology to meet these ever-increasing bandwidth requirements. PON equipment can deliver high-speed data, voice, and video services.

Furthermore, increase in number of broadband connections across the globe is a prominent factor that is projected to fuel market progress during the forecast period. For instance, according to the Organization for Economic Co-operation and Development, in June 2022, fixed broadband subscriptions in OECD countries totaled 476.0 Mn, up from 463.0 Mn in 2021, with an average of 34.7 subscriptions per 100 inhabitants. In June 2022, mobile broadband subscriptions totaled 1.8 Bn, up from 1.7 Bn in 2021, with an average of 128 subscriptions per 100 inhabitants.

However, PON technology involves complex optical transmission and multiplexing techniques, which may require specialized skills and expertise for deployment and maintenance. Technical challenges in implementing and managing PON networks can act as a restraint for market growth, especially for smaller service providers with limited technical resources.

Several governments are recognizing the importance of providing equal access to high-speed broadband connectivity across urban, suburban, and rural areas. Bridging the digital divide is a key objective for several governments, as it promotes social inclusion and equal opportunities. Accordingly, governments are implementing policies that encourage the deployment of PON technology, particularly for Fiber-to-the-Home (FTTH) networks. Financial incentives, subsidies, and regulatory support are being provided to promote the expansion of broadband infrastructure, which further fuels the demand for PON equipment.

In 2022, the U.K. Government invested US$ 140 Mn in Scotland to connect more than 740,000 homes and businesses to superfast speeds - in excess of 30Mbps – and US$ 72 Mn in Wales to roll out superfast broadband to more than 740,000 homes and businesses, with at least 110,000 receiving gigabit upgrades.

Numerous countries are implementing initiatives and policies to accelerate the deployment of high-speed broadband networks, often with a focus on fiber optic infrastructure. For instance, in July 2021, Governor Gavin Newsom approved Senate Bill 156, which established an open-access middle-mile network to provide all Californians with fair access to high-speed broadband service.

In terms of structure, the global passive optical network (PON) equipment market segmentation comprises ethernet passive optical network (EPON) equipment and gigabit passive optical network (GPON) equipment. The gigabit passive optical network (GPON) equipment structure segment is likely to account for significant share of the global market in the next few years, owing to its advantageous properties such as energy efficiency, high speed, security, and stability.

GPON, the most advanced and efficient network infrastructure in the market, also provides durability and affordability. It offers a future-proof access network that can adapt and upgrade as technology evolves. This environment-friendly, power-saving technology with its substantial bandwidth is revolutionizing various sectors such as mining camps, hotels, educational institutions, residential complexes, retirement communities, and commercial buildings, benefiting businesses and government organizations alike.

Some of the leading players are following the latest market trends and have expanded their product offerings. For instance, in September 2022, Vecima Networks Inc. broadened its product portfolio with the release of its Entra EXS1610 All-PON 10G solution. The EPON, GPON, 10G-EPON, and XGS-PON standards are supported by the EXS1610.

As per the passive optical network (PON) equipment market research report, in terms of component, the optical line terminal (OLT) component segment is anticipated to lead the global industry during the forecast period due to increase in demand for high-speed and reliable broadband services. The OLT, being a vital element in delivering fiber-based broadband services, is expected to witness an increase in adoption in the next few years.

The optical line terminal (OLT) is a crucial component in a PON system. It serves as the aggregation point and control unit that connects the optical fibers from multiple optical network units (ONUs) or optical network terminals (ONTs) to the wider network infrastructure. Essentially, the OLT acts as the gateway between the PON and the service provider's network.

According to the latest passive optical network (PON) equipment market forecast, Asia Pacific region is projected to account for major share of the global industry in the near future. Growth in population, rise in internet penetration, and government initiatives promoting digital inclusion are some of the major factors contributing to the passive optical network (PON) equipment market growth in the region.

Countries such as China, Japan, South Korea, and India are witnessing substantial investments in fiber optic infrastructure to meet the increase in demand for high-speed broadband services. The region is also witnessing the deployment of PON technology in smart city projects, which is further boosting the demand for PON equipment.

The passive optical network (PON) equipment market size in North America is anticipated to increase during the forecast period, owing to the high-speed internet connectivity and advanced telecommunication infrastructure in the region. The U.S. is the major contributor to the region's growth. Well-established service providers, strong emphasis on network modernization, and government initiatives promoting broadband expansion are some of the factors fueling market development in the region.

The global industry is fragmented, with the presence of many large-scale players that control majority of the passive optical network (PON) equipment market share. According to the passive optical network (PON) equipment market analysis, expansion of product portfolios, partnerships, and acquisitions are major strategies adopted by leading manufacturers.

Adtran Inc., Calix, Inc., Cisco Systems, Inc., Huawei Technologies Co., Ltd, InCoax Networks AB, Mitsubishi Electric Corporation, Molex, Motorola Solutions Inc., Nokia Corporation, Verizon Communications, Inc., and ZTE Corporation are among the prominent manufacturers operating in the global passive optical network (PON) equipment market.

Key players have been profiled in the passive optical network (PON) equipment market report based on parameters including business segments, latest developments, company overview, business strategies, financial overview, and product portfolio.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 12.7 Bn |

|

Market Forecast Value in 2031 |

US$ 42.6 Bn |

|

Growth Rate (CAGR) |

14.4% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Example: Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 12.7 Bn in 2022

It is expected to advance at a CAGR of 14.4% by 2031

It would be worth US$ 42.6 Bn in 2031

Adtran Inc., Calix, Inc., Cisco Systems, Inc., Huawei Technologies Co., Ltd, InCoax Networks AB, Mitsubishi Electric Corporation, Molex, Motorola Solutions Inc., Nokia Corporation, Verizon Communications, Inc., and ZTE Corporation

The U.S. catered to approximately 19.0% share in 2022

Increase in demand for high-speed broadband, government initiatives and regulations to accelerate the deployment of high-speed broadband networks, and rise in urbanization

Asia Pacific is more lucrative region for PON equipment

1. Preface

1.1. Market and Segments Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Passive Optical Network (PON) Equipment Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Telecommunication Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

5. Global Passive Optical Network (PON) Equipment Market Analysis, by Component

5.1. Passive Optical Network (PON) Equipment Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017-2031

5.1.1. Optical Cable

5.1.2. Optical Power Splitter

5.1.3. Optical Filter

5.1.4. Wavelength Division Multiplexer/Demultiplexer

5.1.5. Optical Network Terminal (ONT)

5.1.6. Optical Line Terminal (OLT)

5.2. Market Attractiveness Analysis, by Component

6. Global Passive Optical Network (PON) Equipment Market Analysis, by Structure

6.1. Passive Optical Network (PON) Equipment Market Size (US$ Bn) Analysis & Forecast, by Structure, 2017-2031

6.1.1. Ethernet Passive Optical Network (EPON) Equipment

6.1.2. Gigabit Passive Optical Network (GPON) Equipment

6.2. Market Attractiveness Analysis, by Structure

7. Global Passive Optical Network (PON) Equipment Market Analysis, by End-use

7.1. Passive Optical Network (PON) Equipment Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017-2031

7.1.1. Residential

7.1.2. Commercial

7.1.3. Industrial

7.1.4. Government/Education

7.2. Market Attractiveness Analysis, by End-use

8. Global Passive Optical Network (PON) Equipment Market Analysis and Forecast, by Region

8.1. Passive Optical Network (PON) Equipment Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Region, 2017-2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America Passive Optical Network (PON) Equipment Market Analysis and Forecast

9.1. Market Snapshot

9.2. Passive Optical Network (PON) Equipment Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017-2031

9.2.1. Optical Cable

9.2.2. Optical Power Splitter

9.2.3. Optical Filter

9.2.4. Wavelength Division Multiplexer/Demultiplexer

9.2.5. Optical Network Terminal (ONT)

9.2.6. Optical Line Terminal (OLT)

9.3. Passive Optical Network (PON) Equipment Market Size (US$ Bn) Analysis & Forecast, by Structure, 2017-2031

9.3.1. Ethernet Passive Optical Network (EPON) Equipment

9.3.2. Gigabit Passive Optical Network (GPON) Equipment

9.4. Passive Optical Network (PON) Equipment Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017-2031

9.4.1. Residential

9.4.2. Commercial

9.4.3. Industrial

9.4.4. Government/Education

9.5. Passive Optical Network (PON) Equipment Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

9.5.1. The U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. Market Attractiveness Analysis

9.6.1. By Component

9.6.2. By Structure

9.6.3. By End-use

9.6.4. By Country/Sub-region

10. Europe Passive Optical Network (PON) Equipment Market Analysis and Forecast

10.1. Market Snapshot

10.2. Passive Optical Network (PON) Equipment Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017-2031

10.2.1. Optical Cable

10.2.2. Optical Power Splitter

10.2.3. Optical Filter

10.2.4. Wavelength Division Multiplexer/Demultiplexer

10.2.5. Optical Network Terminal (ONT)

10.2.6. Optical Line Terminal (OLT)

10.3. Passive Optical Network (PON) Equipment Market Size (US$ Bn) Analysis & Forecast, by Structure, 2017-2031

10.3.1. Ethernet Passive Optical Network (EPON) Equipment

10.3.2. Gigabit Passive Optical Network (GPON) Equipment

10.4. Passive Optical Network (PON) Equipment Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017-2031

10.4.1. Residential

10.4.2. Commercial

10.4.3. Industrial

10.4.4. Government/Education

10.5. Passive Optical Network (PON) Equipment Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

10.5.1. The U.K.

10.5.2. Germany

10.5.3. France

10.5.4. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Component

10.6.2. By Structure

10.6.3. By End-use

10.6.4. By Country/Sub-region

11. Asia Pacific Passive Optical Network (PON) Equipment Market Analysis and Forecast

11.1. Market Snapshot

11.2. Passive Optical Network (PON) Equipment Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017-2031

11.2.1. Optical Cable

11.2.2. Optical Power Splitter

11.2.3. Optical Filter

11.2.4. Wavelength Division Multiplexer/Demultiplexer

11.2.5. Optical Network Terminal (ONT)

11.2.6. Optical Line Terminal (OLT)

11.3. Passive Optical Network (PON) Equipment Market Size (US$ Bn) Analysis & Forecast, by Structure, 2017-2031

11.3.1. Ethernet Passive Optical Network (EPON) Equipment

11.3.2. Gigabit Passive Optical Network (GPON) Equipment

11.4. Passive Optical Network (PON) Equipment Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017-2031

11.4.1. Residential

11.4.2. Commercial

11.4.3. Industrial

11.4.4. Government/Education

11.5. Passive Optical Network (PON) Equipment Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. South Korea

11.5.5. ASEAN

11.5.6. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Component

11.6.2. By Structure

11.6.3. By End-use

11.6.4. By Country/Sub-region

12. Middle East & Africa Passive Optical Network (PON) Equipment Market Analysis and Forecast

12.1. Market Snapshot

12.2. Passive Optical Network (PON) Equipment Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017-2031

12.2.1. Optical Cable

12.2.2. Optical Power Splitter

12.2.3. Optical Filter

12.2.4. Wavelength Division Multiplexer/Demultiplexer

12.2.5. Optical Network Terminal (ONT)

12.2.6. Optical Line Terminal (OLT)

12.3. Passive Optical Network (PON) Equipment Market Size (US$ Bn) Analysis & Forecast, by Structure, 2017-2031

12.3.1. Ethernet Passive Optical Network (EPON) Equipment

12.3.2. Gigabit Passive Optical Network (GPON) Equipment

12.4. Passive Optical Network (PON) Equipment Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017-2031

12.4.1. Residential

12.4.2. Commercial

12.4.3. Industrial

12.4.4. Government/Education

12.5. Passive Optical Network (PON) Equipment Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

12.5.1. GCC

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Market Attractiveness Analysis

12.6.1. By Component

12.6.2. By Structure

12.6.3. By End-use

12.6.4. By Country/Sub-region

13. South America Passive Optical Network (PON) Equipment Market Analysis and Forecast

13.1. Market Snapshot

13.2. Passive Optical Network (PON) Equipment Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017-2031

13.2.1. Optical Cable

13.2.2. Optical Power Splitter

13.2.3. Optical Filter

13.2.4. Wavelength Division Multiplexer/Demultiplexer

13.2.5. Optical Network Terminal (ONT)

13.2.6. Optical Line Terminal (OLT)

13.3. Passive Optical Network (PON) Equipment Market Size (US$ Bn) Analysis & Forecast, by Structure, 2017-2031

13.3.1. Ethernet Passive Optical Network (EPON) Equipment

13.3.2. Gigabit Passive Optical Network (GPON) Equipment

13.4. Passive Optical Network (PON) Equipment Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017-2031

13.4.1. Residential

13.4.2. Commercial

13.4.3. Industrial

13.4.4. Government/Education

13.5. Passive Optical Network (PON) Equipment Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Rest of South America

13.6. Market Attractiveness Analysis

13.6.1. By Component

13.6.2. By Structure

13.6.3. By End-use

13.6.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Passive Optical Network (PON) Equipment Market Competition Matrix - a Dashboard View

14.1.1. Global Passive Optical Network (PON) Equipment Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Adtran Inc.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Calix, Inc.

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Cisco Systems, Inc.

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Huawei Technologies Co., Ltd

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. InCoax Networks AB

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Mitsubishi Electric Corporation

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Molex

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Motorola Solutions Inc.

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Nokia Corporation

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Verizon Communications, Inc.

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. ZTE Corporation

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Other Key Players

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

16. Go To Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Value (US$ Bn), 2017-2031

Table 2: Global Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 3: Global Passive Optical Network (PON) Equipment Market Size & Forecast, by Structure, Value (US$ Bn), 2017-2031

Table 4: Global Passive Optical Network (PON) Equipment Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 5: Global Passive Optical Network (PON) Equipment Market Size & Forecast, by Region, Value (US$ Bn), 2017-2031

Table 6: Global Passive Optical Network (PON) Equipment Market Size & Forecast, by Region, Volume (Million Units), 2017-2031

Table 7: North America Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Value (US$ Bn), 2017-2031

Table 8: North America Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 9: North America Passive Optical Network (PON) Equipment Market Size & Forecast, by Structure, Value (US$ Bn), 2017-2031

Table 10: North America Passive Optical Network (PON) Equipment Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 11: North America Passive Optical Network (PON) Equipment Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 12: North America Passive Optical Network (PON) Equipment Market Size & Forecast, by Country Volume (Million Units), 2017-2031

Table 13: Europe Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Value (US$ Bn), 2017-2031

Table 14: Europe Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 15: Europe Passive Optical Network (PON) Equipment Market Size & Forecast, by Structure, Value (US$ Bn), 2017-2031

Table 16: Europe Passive Optical Network (PON) Equipment Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 17: Europe Passive Optical Network (PON) Equipment Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 18: Europe Passive Optical Network (PON) Equipment Market Size & Forecast, by Country Volume (Million Units), 2017-2031

Table 19: Asia Pacific Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Value (US$ Bn), 2017-2031

Table 20: Asia Pacific Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 21: Asia Pacific Passive Optical Network (PON) Equipment Market Size & Forecast, by Structure, Value (US$ Bn), 2017-2031

Table 22: Asia Pacific Passive Optical Network (PON) Equipment Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 23: Asia Pacific Passive Optical Network (PON) Equipment Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 24: Asia Pacific Passive Optical Network (PON) Equipment Market Size & Forecast, by Country Volume (Million Units), 2017-2031

Table 25: Middle East & Africa Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Value (US$ Bn), 2017-2031

Table 26: Middle East & Africa Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 27: Middle East & Africa Passive Optical Network (PON) Equipment Market Size & Forecast, by Structure, Value (US$ Bn), 2017-2031

Table 28: Middle East & Africa Passive Optical Network (PON) Equipment Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 29: Middle East & Africa Passive Optical Network (PON) Equipment Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 30: Middle East & Africa Passive Optical Network (PON) Equipment Market Size & Forecast, by Country Volume (Million Units), 2017-2031

Table 31: South America Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Value (US$ Bn), 2017-2031

Table 32: South America Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 33: South America Passive Optical Network (PON) Equipment Market Size & Forecast, by Structure, Value (US$ Bn), 2017-2031

Table 34: South America Passive Optical Network (PON) Equipment Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 35: South America Passive Optical Network (PON) Equipment Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 36: South America Passive Optical Network (PON) Equipment Market Size & Forecast, by Country Volume (Million Units), 2017-2031

List of Figures

Figure 01: Global Passive Optical Network (PON) Equipment Market Share Analysis, by Region

Figure 02: Global Passive Optical Network (PON) Equipment Price Trend Analysis (Average Price, Thousand US$)

Figure 03: Global Passive Optical Network (PON) Equipment Market, Value (US$ Bn), 2017-2031

Figure 04: Global Passive Optical Network (PON) Equipment Market, Volume (Million Units), 2017-2031

Figure 05: Global Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Revenue (US$ Bn), 2017-2031

Figure 06: Global Passive Optical Network (PON) Equipment Market Share Analysis, by Component, 2023 and 2031

Figure 07: Global Passive Optical Network (PON) Equipment Market Attractiveness, By Component, Value (US$ Bn), 2023-2031

Figure 08: Global Passive Optical Network (PON) Equipment Market Size & Forecast, by Structure, Revenue (US$ Bn), 2017-2031

Figure 09: Global Passive Optical Network (PON) Equipment Market Share Analysis, by Structure, 2023 and 2031

Figure 10: Global Passive Optical Network (PON) Equipment Market Attractiveness, By Structure, Value (US$ Bn), 2023-2031

Figure 11: Global Passive Optical Network (PON) Equipment Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 12: Global Passive Optical Network (PON) Equipment Market Share Analysis, by End-use, 2023 and 2031

Figure 13: Global Passive Optical Network (PON) Equipment Market Attractiveness, By End-use, Value (US$ Bn), 2023-2031

Figure 14: Global Passive Optical Network (PON) Equipment Market Size & Forecast, by Region, Revenue (US$ Bn), 2017-2031

Figure 15: Global Passive Optical Network (PON) Equipment Market Share Analysis, by Region, 2023 and 2031

Figure 16: Global Passive Optical Network (PON) Equipment Market Attractiveness, By Region, Value (US$ Bn), 2023-2031

Figure 17: North America Passive Optical Network (PON) Equipment Market, Value (US$ Bn), 2017-2031

Figure 18: North America Passive Optical Network (PON) Equipment Market, Volume (Million Units), 2017-2031

Figure 19: North America Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Revenue (US$ Bn), 2017-2031

Figure 20: North America Passive Optical Network (PON) Equipment Market Share Analysis, by Component, 2023 and 2031

Figure 21: North America Passive Optical Network (PON) Equipment Market Attractiveness, By Component, Value (US$ Bn), 2023-2031

Figure 22: North America Passive Optical Network (PON) Equipment Market Size & Forecast, by Structure, Revenue (US$ Bn), 2017-2031

Figure 23: North America Passive Optical Network (PON) Equipment Market Share Analysis, by Structure, 2023 and 2031

Figure 24: North America Passive Optical Network (PON) Equipment Market Attractiveness, By Structure, Value (US$ Bn), 2023-2031

Figure 25: North America Passive Optical Network (PON) Equipment Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 26: North America Passive Optical Network (PON) Equipment Market Share Analysis, by End-use, 2023 and 2031

Figure 27: North America Passive Optical Network (PON) Equipment Market Attractiveness, By End-use, Value (US$ Bn), 2023-2031

Figure 28: North America Passive Optical Network (PON) Equipment Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 29: North America Passive Optical Network (PON) Equipment Market Share Analysis, by Country 2023 and 2031

Figure 30: North America Passive Optical Network (PON) Equipment Market Attractiveness, By Country Value (US$ Bn), 2023-2031

Figure 31: Europe Passive Optical Network (PON) Equipment Market, Value (US$ Bn), 2017-2031

Figure 32: Europe Passive Optical Network (PON) Equipment Market, Volume (Million Units), 2017-2031

Figure 33: Europe Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Revenue (US$ Bn), 2017-2031

Figure 34: Europe Passive Optical Network (PON) Equipment Market Share Analysis, by Component, 2023 and 2031

Figure 35: Europe Passive Optical Network (PON) Equipment Market Attractiveness, By Component, Value (US$ Bn), 2023-2031

Figure 36: Europe Passive Optical Network (PON) Equipment Market Size & Forecast, by Structure, Revenue (US$ Bn), 2017-2031

Figure 37: Europe Passive Optical Network (PON) Equipment Market Share Analysis, by Structure, 2023 and 2031

Figure 38: Europe Passive Optical Network (PON) Equipment Market Attractiveness, By Structure, Value (US$ Bn), 2023-2031

Figure 39: Europe Passive Optical Network (PON) Equipment Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 40: Europe Passive Optical Network (PON) Equipment Market Share Analysis, by End-use, 2023 and 2031

Figure 41: Europe Passive Optical Network (PON) Equipment Market Attractiveness, By End-use, Value (US$ Bn), 2023-2031

Figure 42: Europe Passive Optical Network (PON) Equipment Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 43: Europe Passive Optical Network (PON) Equipment Market Share Analysis, by Country 2023 and 2031

Figure 44: Europe Passive Optical Network (PON) Equipment Market Attractiveness, By Country Value (US$ Bn), 2023-2031

Figure 45: Asia Pacific Passive Optical Network (PON) Equipment Market, Value (US$ Bn), 2017-2031

Figure 46: Asia Pacific Passive Optical Network (PON) Equipment Market, Volume (Million Units), 2017-2031

Figure 47: Asia Pacific Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Revenue (US$ Bn), 2017-2031

Figure 48: Asia Pacific Passive Optical Network (PON) Equipment Market Share Analysis, by Component, 2023 and 2031

Figure 49: Asia Pacific Passive Optical Network (PON) Equipment Market Attractiveness, By Component, Value (US$ Bn), 2023-2031

Figure 50: Asia Pacific Passive Optical Network (PON) Equipment Market Size & Forecast, by Structure, Revenue (US$ Bn), 2017-2031

Figure 51: Asia Pacific Passive Optical Network (PON) Equipment Market Share Analysis, by Structure, 2023 and 2031

Figure 52: Asia Pacific Passive Optical Network (PON) Equipment Market Attractiveness, By Structure, Value (US$ Bn), 2023-2031

Figure 53: Asia Pacific Passive Optical Network (PON) Equipment Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 54: Asia Pacific Passive Optical Network (PON) Equipment Market Share Analysis, by End-use, 2023 and 2031

Figure 55: Asia Pacific Passive Optical Network (PON) Equipment Market Attractiveness, By End-use, Value (US$ Bn), 2023-2031

Figure 56: Asia Pacific Passive Optical Network (PON) Equipment Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 57: Asia Pacific Passive Optical Network (PON) Equipment Market Share Analysis, by Country 2023 and 2031

Figure 58: Asia Pacific Passive Optical Network (PON) Equipment Market Attractiveness, By Country Value (US$ Bn), 2023-2031

Figure 59: Middle East & Africa Passive Optical Network (PON) Equipment Market, Value (US$ Bn), 2017-2031

Figure 60: Middle East & Africa Passive Optical Network (PON) Equipment Market, Volume (Million Units), 2017-2031

Figure 61: Middle East & Africa Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Revenue (US$ Bn), 2017-2031

Figure 62: Middle East & Africa Passive Optical Network (PON) Equipment Market Share Analysis, by Component, 2023 and 2031

Figure 63: Middle East & Africa Passive Optical Network (PON) Equipment Market Attractiveness, By Component, Value (US$ Bn), 2023-2031

Figure 64: Middle East & Africa Passive Optical Network (PON) Equipment Market Size & Forecast, by Structure, Revenue (US$ Bn), 2017-2031

Figure 65: Middle East & Africa Passive Optical Network (PON) Equipment Market Share Analysis, by Structure, 2023 and 2031

Figure 66: Middle East & Africa Passive Optical Network (PON) Equipment Market Attractiveness, By Structure, Value (US$ Bn), 2023-2031

Figure 67: Middle East & Africa Passive Optical Network (PON) Equipment Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 68: Middle East & Africa Passive Optical Network (PON) Equipment Market Share Analysis, by End-use, 2023 and 2031

Figure 69: Middle East & Africa Passive Optical Network (PON) Equipment Market Attractiveness, By End-use, Value (US$ Bn), 2023-2031

Figure 70: Middle East & Africa Passive Optical Network (PON) Equipment Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 71: Middle East & Africa Passive Optical Network (PON) Equipment Market Share Analysis, by Country 2023 and 2031

Figure 72: Middle East & Africa Passive Optical Network (PON) Equipment Market Attractiveness, By Country Value (US$ Bn), 2023-2031

Figure 73: South America Passive Optical Network (PON) Equipment Market, Value (US$ Bn), 2017-2031

Figure 74: South America Passive Optical Network (PON) Equipment Market, Volume (Million Units), 2017-2031

Figure 75: South America Passive Optical Network (PON) Equipment Market Size & Forecast, by Component, Revenue (US$ Bn), 2017-2031

Figure 76: South America Passive Optical Network (PON) Equipment Market Share Analysis, by Component, 2023 and 2031

Figure 77: South America Passive Optical Network (PON) Equipment Market Attractiveness, By Component, Value (US$ Bn), 2023-2031

Figure 78: South America Passive Optical Network (PON) Equipment Market Size & Forecast, by Structure, Revenue (US$ Bn), 2017-2031

Figure 79: South America Passive Optical Network (PON) Equipment Market Share Analysis, by Structure, 2023 and 2031

Figure 80: South America Passive Optical Network (PON) Equipment Market Attractiveness, By Structure, Value (US$ Bn), 2023-2031

Figure 81: South America Passive Optical Network (PON) Equipment Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 82: South America Passive Optical Network (PON) Equipment Market Share Analysis, by End-use, 2023 and 2031

Figure 83: South America Passive Optical Network (PON) Equipment Market Attractiveness, By End-use, Value (US$ Bn), 2023-2031

Figure 84: South America Passive Optical Network (PON) Equipment Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 85: South America Passive Optical Network (PON) Equipment Market Share Analysis, by Country 2023 and 2031

Figure 86: South America Passive Optical Network (PON) Equipment Market Attractiveness, By Country Value (US$ Bn), 2023-2031