New trends in the pet food market are attracting customers. There is a growing demand for protective and informative packaging of pert food. Hence, manufacturers in the pet food market are increasing their efforts to develop sustainable pet food packaging. Growing concerns about the environmental impact of plastic has led to a rise in the development of sustainable packaging solutions. For instance, in April 2019, global flexible packaging company ProAmpac, revealed their fiber-based PRO-EVP multiwall bags that are made from renewable resources.

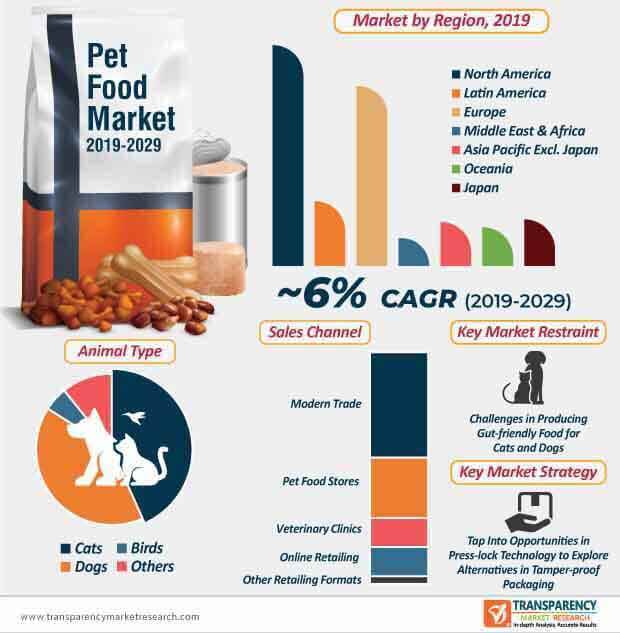

Companies in the pet food market are increasing their offerings in hybrid packaging solutions such as paper/poly materials. They are tapping into opportunities in woven polypropylene bags that offer flexibility and durability to customers. Manufacturers are replacing plastic with paper-based packaging for dog food. Attractive and innovative packaging plays an important role in boosting the demand for these products in supermarkets and retail stores. Moreover, the modern trade sales channel segment is projected to lead the pet food market, and is estimated to reach a value of ~US$ 71.1 Bn by the end of 2029.

There is a growing awareness about clean label in the pet food market. The clean label pet food trend has led to innovation to meet customer demands. Companies are increasing R&D to produce shelf-stable and safe pet food. The competition is increasing with growing demand for highly palatable pet food produced from limited amount of ingredients to achieve the target of clean label.

The introduction of clean label is fueling the demand for organic pet food. Though conventional pet food dominates the pet food market, in terms of value and volume, market players are leveraging high growth opportunities in the organic pet food segment. As such, organic nature segment of the pet food market is anticipated to reach a value of ~US$ 23.5 Bn by 2029. Hence, manufacturers are streamlining their production processes to make pet food that meets industry food safety standards. They are tapping into opportunities in clean label sustainable packaging to improve their positon in the pet food market landscape.

The pet food market is expected to expand at a significant CAGR of ~6% during the forecast period. However, producing gut-friendly food for cats and dogs acts as a restraint for the manufacturers. As such, in terms of animal type, the cats segment is projected to lead the pet food market during the forecast period. The cats segment is projected to reach a value of ~US$ 71 Bn by 2029. Hence, it is crucial for companies to address the challenges of producing ethical cat food. Thus, several startups are introducing new pet nutrition options.

Various startups are associating themselves with mentorship programs to gain a competitive edge in the pet food market landscape. For instance, in January 2019, the U.S. pet food company, Purina, announced the finalists for their third pet care innovation prize to encourage startups to reimagine pet nutrition. Companies are experimenting by upcycling ingredients to produce premium dog treats. They are adding value to products by introducing new flavors that are ethically palatable and provide optimal nutrition to pets.

Superfoods and Regional Recipes Lead to New Product Innovations

Product innovations are gaining popularity in the pet food market. Leading pet food companies are introducing dry food options for cats and dogs that are inspired from regional recipes. As such, dry food product segment is expected to dominate the pet food market, in terms of value and volume, during the forecast period. Companies are increasing efforts to develop grain-free and high-protein food sans artificial ingredients.

Moreover, manufacturers are exploring opportunities in wet cat food formulations made from specific fish varieties such as Alaskan Cod or the Canadian Duck. They are actively participating in trade fairs to strategically position their brand in the global pet food market landscape. This participation is enabling manufacturers to convert new customers and address their issues with product offerings. New trends of functional nutrition and superfoods are taking the lead in the pet food market. The inclusion of meat as the first ingredient is becoming increasingly mainstream in pet food production.

Analysts’ Viewpoint

Premiumization has driven manufacturers in the pet food market to source quality ingredients and streamline their production processes. They are focusing on touch-based packaging to improve their product offerings. Additionally, companies are increasing R&D in cellular agriculture technologies to institute animal proteins in dog and cat food.

However, food wastage associated with paper-based packaging of food containing high meat content acts as an obstacle for market players. Hence, manufacturers are launching hybrid packaging materials and plastic composites to address the issue of food wastage. Moreover, they should focus on introducing new products in North America, since the region is likely to dominate the pet food market, in terms of value and volume, during the forecast period.

Pet Food Market: Overview

Pet Food Market Frontrunners

Pet Food Market: Trends

Pet Food Market: Strategies

Target Region for Pet Food Market

Pet Food Market: Key Players

Key players operating in the pet food market, as profiled in the study, include

Pet Food Market is projected to reach US$ 71.1 Bn by the end of 2029

Pet Food Market is expected to grow at a CAGR of 6% during 2019-2029

Supermarkets and retail stores are performing important role in boosting the demand of Pet Food

North America is more attractive region for vendors in the Pet Food Market

Key vendors in the Pet Food Market are Mars and Incorporated, Hill’s Pet Nutrition, Nutro Products Inc., Lafeber Co., Dave’s Pet Food, etc

1. Global Outlook

2. Global Pet Food Market - Executive Summary

2.1. Global Pet Food Market Country Analysis

2.2. Vertical Specific Market Penetration

2.3. Application - Product Mapping

2.4. Competition Blueprint

2.5. Technology Time Line Mapping

2.6. TMR Analysis and Recommendations

3. Introduction

3.1. Global Pet Food Market Introduction

3.2. Global Pet Food Market Taxonomy

3.3. Global Pet Food Market Definition

4. Market Dynamics

4.1. Macro-economic Factors

4.1.1. Rise in Consumption of Pet Food and Animal Feeds across Globe

4.1.2. Pet Population of Key Countries

4.1.3. Animal Feed Industry Overview

4.2. Global Aquaculture Market Overview

4.3. Global Demands for Marine By Products

4.4. Active Participants for the Market

4.5. Drivers

4.5.1. Economic Drivers

4.5.2. Supply Side Drivers

4.5.3. Demand Side Drivers

4.6. Market Restraints

4.6.1. Regulatory Concerns

4.6.2. Supply Chain issues

4.6.3. Others

4.7. Market Trends

4.8. Trend Analysis- Impact on Time Line (2018-2029

4.9. Forecast Factor - Relevance and Impact

4.10. Key Regulations By Regions

5. Associated Industry and Key Indicators Assessment

5.1. Parent Industry Overview

5.1.1. Market Size and Forecast

5.1.2. Market Size and Y-o-Y Growth

5.1.3. Absolute $ Opportunity

6. Supply Chain Analysis

6.1. Profitability and Gross Margin Analysis By Competition

6.2. List of Active Participants- By Region

6.2.1. Raw Material Supplier

6.2.2. Private Label/Contract Manufacturers

6.2.3. Wholesaler/Distributor/Retailers

7. Global Pet Food Market Pricing Analysis

7.1. Price Point Assessment By Nature

7.2. Regional Average Pricing Analysis

7.2.1. North America

7.2.2. Latin America

7.2.3. Europe

7.2.4. Asia Pacific Ex. Japan (APEJ)

7.2.5. Middle East and Africa

7.2.6. Japan

7.2.7. Oceania

7.3. Price Forecast till 2029

7.4. Factors Influencing Pricing

8. Global Pet Food Market Analysis and Forecast

8.1. Market Size Analysis (2014-2018) and Forecast (2019-2029)

8.1.1. Market Value (US$ Mn) and Volume (Tons) and Y-o-Y Growth

8.1.2. Absolute $ Opportunity

8.2. Global Pet Food Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

8.2.1. Forecast Factors and Relevance of Impact

8.2.2. Regional Pet Food Market Business Performance Summary

9. Global Pet Food Market Analysis By Nature

9.1. Introduction

9.1.1. Y-o-Y Growth Comparison By Nature

9.1.2. Basis Point Share (BPS) Analysis By Nature

9.2. Pet Food Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Nature

9.2.1. Organic

9.2.2. Conventional

9.3. Market Attractiveness Analysis By Nature

10. Global Pet Food Market Analysis By Product Type

10.1. Introduction

10.1.1. Y-o-Y Growth Comparison By Product Type

10.1.2. Basis Point Share (BPS) Analysis By Product Type

10.2. Pet Food Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Product Type

10.2.1. Wet Food

10.2.2. Dry Food

10.2.3. Treats and Chews

10.2.4. Others (Frozen, Raw Food, etc.)

10.3. Market Attractiveness Analysis By Product Type

11. Global Pet Food Market Analysis By Animal Type

11.1. Introduction

11.1.1. Y-o-Y Growth Comparison By Animal Type

11.1.2. Basis Point Share (BPS) Analysis By Animal Type

11.2. Pet Food Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Animal Type

11.2.1. Cats

11.2.2. Dogs

11.2.3. Birds

11.2.4. Others (Rabbits, Hamsters, etc.)

11.2.5. Market Attractiveness Analysis By Animal Type

12. Global Pet Food Market Analysis By Sales Channel

12.1. Introduction

12.1.1. Y-o-Y Growth Comparison By Sales Channel

12.1.2. Basis Point Share (BPS) Analysis By Sales Channel

12.1.3. Pet Food Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Sales Channel

12.1.4. Modern Trade

12.1.5. Pet Food Stores

12.1.6. Veterinary Clinics

12.1.7. Online Retailing

12.1.8. Other Retailing Formats

12.2. Market Attractiveness Analysis By Sales Channel

13. Global Pet Food Market Analysis and Forecast, By Region

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis By Region

13.1.2. Y-o-Y Growth Projections By Region

13.2. Pet Food Market Size (US$ Mn) and Volume (MT) & Forecast (2019-2029) Analysis By Region

13.2.1. North America

13.2.2. Europe

13.2.3. APEJ

13.2.4. Japan

13.2.5. Oceania

13.2.6. Latin America

13.2.7. Middle East and Africa

13.3. Market Attractiveness Analysis By Region

14. North America Pet Food Market Size and Forecast, 2018-2029

14.1. North America Outlook

14.2. North America Parent Market Outlook

14.3. North America Target Market Outlook

14.4. Revenue (US$ Mn) Comparison, By Country

14.4.1. US Market Size and Forecast (US$ Mn), 2018-2029

14.4.2. Canada Market Size and Forecast (US$ Mn), 2018-2029

14.5. Revenue (US$ Mn) Comparison, By Animal Types

14.6. Revenue (US$ Mn) Comparison, By Nature

14.7. Revenue (US$ Mn) Comparison, By Product Type

14.8. Revenue (US$ Mn) Comparison, By Sales Channel

15. Latin America Pet Food Market Size and Forecast, 2018-2029

15.1. Latin America Outlook

15.2. Latin America Parent Market Outlook

15.3. Latin America Target Market Outlook

15.4. Revenue (US$ Mn) Comparison, By Country

15.4.1. Brazil Market Size and Forecast (US$ Mn), 2018-2029

15.4.2. Mexico Market Size and Forecast (US$ Mn), 2018-2029

15.4.3. Chile Market Size and Forecast (US$ Mn), 2018-2029

15.4.4. Peru Market Size and Forecast (US$ Mn), 2018-2029

15.4.5. Argentina Market Size and Forecast (US$ Mn), 2018-2029

15.4.6. Rest of LATAM Market Size and Forecast (US$ Mn), 2018-2029

15.5. Revenue (US$ Mn) Comparison, By Animal Types

15.6. Revenue (US$ Mn) Comparison, By Nature

15.7. Revenue (US$ Mn) Comparison, By Product Type

15.8. Revenue (US$ Mn) Comparison, By Sales Channel

16. Europe Pet Food Market Size and Forecast, 2018-2029

16.1. Europe Outlook

16.2. Europe Parent Market Outlook

16.3. Europe Target Market Outlook

16.4. Revenue (US$ Mn) Comparison, By Country

16.4.1. EU-4 Market Size and Forecast (US$ Mn), 2018-2029

16.4.2. UK Market Size and Forecast (US$ Mn), 2018-2029

16.4.3. BENLUX Market Size and Forecast (US$ Mn), 2018-2029

16.4.4. Nordic Market Size and Forecast (US$ Mn), 2018-2029

16.4.5. Russia Market Size and Forecast (US$ Mn), 2018-2029

16.4.6. Poland Market Size and Forecast (US$ Mn), 2018-2029

16.4.7. Rest of Europe Market Size and Forecast (US$ Mn), 2018-2029

16.5. Revenue (US$ Mn) Comparison, By Animal Types

16.6. Revenue (US$ Mn) Comparison, By Nature

16.7. Revenue (US$ Mn) Comparison, By Product Type

16.8. Revenue (US$ Mn) Comparison, By Sales Channel

17. APEJ Pet Food Market Size and Forecast, 2018-2029

17.1. APEJ Outlook

17.2. APEJ Parent Market Outlook

17.3. APEJ Target Market Outlook

17.4. Revenue (US$ Mn) Comparison, By Country

17.4.1. India Market Size and Forecast (US$ Mn), 2018-2029

17.4.2. China Market Size and Forecast (US$ Mn), 2018-2029

17.4.3. ASEAN Market Size and Forecast (US$ Mn), 2018-2029

17.4.4. South Korea Market Size and Forecast (US$ Mn), 2018-2029

17.4.5. Rest of APEJ Market Size and Forecast (US$ Mn), 2018-2029

17.5. Revenue (US$ Mn) Comparison, By Animal Types

17.6. Revenue (US$ Mn) Comparison, By Nature

17.7. Revenue (US$ Mn) Comparison, By Product Type

17.8. Revenue (US$ Mn) Comparison, By Sales Channel

18. MEA Pet Food Market Size and Forecast, 2018-2029

18.1. MEA Outlook

18.2. MEA Parent Market Outlook

18.3. MEA Target Market Outlook

18.4. Revenue (US$ Mn) Comparison, By Country

18.4.1. GCC Countries Market Size and Forecast (US$ Mn), 2018-2029

18.4.2. South Africa Market Size and Forecast (US$ Mn), 2018-2029

18.4.3. Turkey Market Size and Forecast (US$ Mn), 2018-2029

18.4.4. Turkey Market Size and Forecast (US$ Mn), 2018-2029

18.4.5. Iran Market Size and Forecast (US$ Mn), 2018-2029

18.4.6. Israel Market Size and Forecast (US$ Mn), 2018-2029

18.4.7. Rest of MEA Market Size and Forecast (US$ Mn), 2018-2029

18.5. Revenue (US$ Mn) Comparison, By Animal Types

18.6. Revenue (US$ Mn) Comparison, By Nature

18.7. Revenue (US$ Mn) Comparison, By Product Type

18.8. Revenue (US$ Mn) Comparison, By Sales Channel

19. Oceania Pet Food Market Size and Forecast, 2018-2029

19.1. Oceania Outlook

19.2. Oceania Parent Market Outlook

19.3. Oceania Target Market Outlook

19.4. Revenue (US$ Mn) Comparison, By Country

19.5. Australia Countries Market Size and Forecast (US$ Mn), 2018-2029

19.6. New Zealand Market Size and Forecast (US$ Mn), 2018-2029

19.7. Revenue (US$ Mn) Comparison, By Animal Types

19.7.1. Revenue (US$ Mn) Comparison, By Nature

19.7.2. Revenue (US$ Mn) Comparison, By Product Type

19.8. Revenue (US$ Mn) Comparison, By Sales Channel

20. Japan Pet Food Market Size and Forecast, 2018-2029

20.1. Japan Outlook

20.2. Japan Parent Market Outlook

20.3. Japan Target Market Outlook

20.3.1. Revenue (US$ Mn) Comparison, By Country

20.4. Japan Market Size Revenue (US$ Mn) Comparison, By Product Types

20.5. Revenue (US$ Mn) Comparison, By Animal Types

20.6. Revenue (US$ Mn) Comparison, By Nature

20.7. Revenue (US$ Mn) Comparison, By Product Type

20.8. Revenue (US$ Mn) Comparison, By Sales Channel

21. Global Pet Food Market Company Share, Competition Landscape and Company Profiles

21.1. Company Share Analysis

21.1.1. Competition Landscape

21.2. Company Profiles

21.2.1. Evanger’s Dog & Cat Food Company, Inc.

21.2.1.1. Overview

21.2.1.2. Product Portfolio

21.2.1.3. Production Footprint

21.2.1.4. Sales Footprint

21.2.1.5. Strategies Overview

21.2.1.6. SWOT Analysis

21.2.1.7. Financial Analysis

21.2.2. Mars, Incorporated.

21.2.2.1. Overview

21.2.2.2. Product Portfolio

21.2.2.3. Production Footprint

21.2.2.4. Sales Footprint

21.2.2.5. Strategies Overview

21.2.2.6. SWOT Analysis

21.2.2.7. Financial Analysis

21.2.3. Nestlé Purina PetCare

21.2.3.1. Overview

21.2.3.2. Product Portfolio

21.2.3.3. Production Footprint

21.2.3.4. Sales Footprint

21.2.3.5. Strategies Overview

21.2.3.6. SWOT Analysis

21.2.3.7. Financial Analysis

21.2.4. Affinity Petcare SA

21.2.4.1. Overview

21.2.4.2. Product Portfolio

21.2.4.3. Production Footprint

21.2.4.4. Sales Footprint

21.2.4.5. Strategies Overview

21.2.4.6. SWOT Analysis

21.2.4.7. Financial Analysis

21.2.5. Nutro Products Inc.

21.2.5.1. Overview

21.2.5.2. Product Portfolio

21.2.5.3. Production Footprint

21.2.5.4. Sales Footprint

21.2.5.5. Strategies Overview

21.2.5.6. SWOT Analysis

21.2.5.7. Financial Analysis

21.2.6. Hill's Pet Nutrition

21.2.6.1. Overview

21.2.6.2. Product Portfolio

21.2.6.3. Production Footprint

21.2.6.4. Sales Footprint

21.2.6.5. Strategies Overview

21.2.6.6. SWOT Analysis

21.2.6.7. Financial Analysis

21.2.7. Lafeber Co.

21.2.7.1. Overview

21.2.7.2. Product Portfolio

21.2.7.3. Production Footprint

21.2.7.4. Sales Footprint

21.2.7.5. Strategies Overview

21.2.7.6. SWOT Analysis

21.2.7.7. Financial Analysis

21.2.8. 4Legs Pet Food Company

21.2.8.1. Overview

21.2.8.2. Product Portfolio

21.2.8.3. Production Footprint

21.2.8.4. Sales Footprint

21.2.8.5. Strategies Overview

21.2.8.6. SWOT Analysis

21.2.8.7. Financial Analysis

21.2.9. Champion Petfoods

21.2.9.1. Overview

21.2.9.2. Product Portfolio

21.2.9.3. Production Footprint

21.2.9.4. Sales Footprint

21.2.9.5. Strategies Overview

21.2.9.6. SWOT Analysis

21.2.9.7. Financial Analysis

21.2.10. Betagro Public Company Limited

21.2.10.1. Overview

21.2.10.2. Product Portfolio

21.2.10.3. Production Footprint

21.2.10.4. Sales Footprint

21.2.10.5. Strategies Overview

21.2.10.6. SWOT Analysis

21.2.10.7. Financial Analysis

21.2.11. Fromm Family Foods LLC.

21.2.11.1. Overview

21.2.11.2. Product Portfolio

21.2.11.3. Production Footprint

21.2.11.4. Sales Footprint

21.2.11.5. Strategies Overview

21.2.11.6. SWOT Analysis

21.2.11.7. Financial Analysis

21.2.12. Dave's Pet Food

21.2.12.1. Overview

21.2.12.2. Product Portfolio

21.2.12.3. Production Footprint

21.2.12.4. Sales Footprint

21.2.12.5. Strategies Overview

21.2.12.6. SWOT Analysis

21.2.12.7. Financial Analysis

21.2.13. Boulder Dog Food Company, L.L.C.

21.2.13.1. Overview

21.2.13.2. Product Portfolio

21.2.13.3. Production Footprint

21.2.13.4. Sales Footprint

21.2.13.5. Strategies Overview

21.2.13.6. SWOT Analysis

21.2.13.7. Financial Analysis

21.2.14. Rollover Premium Pet Food Ltd.

21.2.14.1. Overview

21.2.14.2. Product Portfolio

21.2.14.3. Production Footprint

21.2.14.4. Sales Footprint

21.2.14.5. Strategies Overview

21.2.14.6. SWOT Analysis

21.2.14.7. Financial Analysis

21.2.15. Real Pet Food Company

21.2.15.1. Overview

21.2.15.2. Product Portfolio

21.2.15.3. Production Footprint

21.2.15.4. Sales Footprint

21.2.15.5. Strategies Overview

21.2.15.6. SWOT Analysis

21.2.15.7. Financial Analysis

21.2.16. Party Animal, Inc.

21.2.16.1. Overview

21.2.16.2. Product Portfolio

21.2.16.3. Production Footprint

21.2.16.4. Sales Footprint

21.2.16.5. Strategies Overview

21.2.16.6. SWOT Analysis

21.2.16.7. Financial Analysis

21.2.17. Freshpet

21.2.17.1. Overview

21.2.17.2. Product Portfolio

21.2.17.3. Production Footprint

21.2.17.4. Sales Footprint

21.2.17.5. Strategies Overview

21.2.17.6. SWOT Analysis

21.2.17.7. Financial Analysis

21.2.18. Burgess Group PLC

21.2.18.1. Overview

21.2.18.2. Product Portfolio

21.2.18.3. Production Footprint

21.2.18.4. Sales Footprint

21.2.18.5. Strategies Overview

21.2.18.6. SWOT Analysis

21.2.18.7. Financial Analysis

21.2.19. Green Pawz, A Bentley's Pet Stuff Company

21.2.19.1. Overview

21.2.19.2. Product Portfolio

21.2.19.3. Production Footprint

21.2.19.4. Sales Footprint

21.2.19.5. Strategies Overview

21.2.19.6. SWOT Analysis

21.2.19.7. Financial Analysis

21.2.20. Diamond pet foods

21.2.20.1. Overview

21.2.20.2. Product Portfolio

21.2.20.3. Production Footprint

21.2.20.4. Sales Footprint

21.2.20.5. Strategies Overview

21.2.20.6. SWOT Analysis

21.2.20.7. Financial Analysis

21.2.21. Other Key Players

22. Research Methodology

23. Secondary and Primary Sources

24. Assumptions and Acronyms

25. Disclaimer

List of Table

Table 01: Global Pet Food Market Value (US$ Mn) Forecast, by Animal Type, 2019-2029

Table 02: Global Pet Food Market Volume (MT) Forecast, by Animal Type, 2019-2029

Table 03: Global Pet Food Market Value (US$ Mn) Forecast, by Nature, 2019-2029

Table 04: Global Pet Food Market Volume (MT) Forecast, by Nature, 2019-2029

Table 05: Global Pet Food Market Value (US$ Mn) Forecast, by Product Type, 2019-2029

Table 06: Global Pet Food Market Volume (MT) Forecast, by Product Type, 2019-2029

Table 07: Global Pet Food Market Value (US$ Mn) Forecast, by Sales Channel, 2019-2029

Table 08: Global Pet Food Market Volume (MT) Forecast, by Sales Channel, 2019-2029

Table 09: Global Pet Food Market Value (US$ Mn) Forecast, by Region, 2019-2029

Table 10: Global Pet Food Market Volume (MT) Forecast, by Region, 2019-2029

Table 11: North America Pet Food Market Value (US$ Mn) Forecast, by Animal Type, 2019-2029

Table 12: North America Pet Food Market Volume (MT) Forecast, by Animal Type, 2019-2029

Table 13: North America Pet Food Market Value (US$ Mn) Forecast, by Nature, 2019-2029

Table 14: North America Pet Food Market Volume (MT) Forecast, by Nature, 2019-2029

Table 15: North America Pet Food Market Value (US$ Mn) Forecast, by Product Type, 2019-2029

Table 16: North America Pet Food Market Volume (MT) Forecast, by Product Type, 2019-2029

Table 17: North America Pet Food Market Value (US$ Mn) Forecast, by Sales Channel, 2019-2029

Table 18: North America Pet Food Market Volume (MT) Forecast, by Sales Channel, 2019-2029

Table 19: North America Pet Food Market Value (US$ Mn) Forecast, by Region, 2019-2029

Table 20: North America Pet Food Market Volume (MT) Forecast, by Region, 2019-2029

Table 21: Latin America Pet Food Market Value (US$ Mn) Forecast, by Animal Type, 2019-2029

Table 22: Latin America Pet Food Market Volume (MT) Forecast, by Animal Type, 2019-2029

Table 23: Latin America Pet Food Market Value (US$ Mn) Forecast, by Nature, 2019-2029

Table 24: Latin America Pet Food Market Volume (MT) Forecast, by Nature, 2019-2029

Table 25: Latin America Pet Food Market Value (US$ Mn) Forecast, by Product Type, 2019-2029

Table 26: Latin America Pet Food Market Volume (MT) Forecast, by Product Type, 2019-2029

Table 27: Latin America Pet Food Market Value (US$ Mn) Forecast, by Sales Channel, 2019-2029

Table 28: Latin America Pet Food Market Volume (MT) Forecast, by Sales Channel, 2019-2029

Table 29: Latin America Pet Food Market Value (US$ Mn) Forecast, by Region, 2019-2029

Table 30: Latin America Pet Food Market Volume (MT) Forecast, by Region, 2019-2029

Table 31: Europe Pet Food Market Value (US$ Mn) Forecast, by Animal Type, 2019-2029

Table 32: Europe Pet Food Market Volume (MT) Forecast, by Animal Type, 2019-2029

Table 33: Europe Pet Food Market Value (US$ Mn) Forecast, by Nature, 2019-2029

Table 34: Europe Pet Food Market Volume (MT) Forecast, by Nature, 2019-2029

Table 35: Europe Pet Food Market Value (US$ Mn) Forecast, by Product Type, 2019-2029

Table 36: Europe Pet Food Market Volume (MT) Forecast, by Product Type, 2019-2029

Table 37: Europe Pet Food Market Value (US$ Mn) Forecast, by Sales Channel,2019-2029

Table 38: Europe Pet Food Market Volume (MT) Forecast, by Sales Channel, 2019-2029

Table 39: Europe Pet Food Market Value (US$ Mn) Forecast, by Region, 2019-2029

Table 40: Europe Pet Food Market Volume (MT) Forecast, by Region, 2019-2029

Table 41: APEJ Pet Food Market Value (US$ Mn) Forecast, by Animal Type, 2019-2029

Table 42: APEJ Pet Food Market Volume (MT) Forecast, by Animal Type, 2019-2029

Table 43: APEJ Pet Food Market Value (US$ Mn) Forecast, by Nature, 2019-2029

Table 44: APEJ Pet Food Market Volume (MT) Forecast, by Nature, 2019-2029

Table 45: APEJ Pet Food Market Value (US$ Mn) Forecast, by Product Type, 2019-2029

Table 46: APEJ Pet Food Market Volume (MT) Forecast, by Product Type, 2019-2029

Table 47: APEJ Pet Food Market Value (US$ Mn) Forecast, by Sales Channel, 2019-2029

Table 48: APEJ Pet Food Market Volume (MT) Forecast, by Sales Channel, 2019-2029

Table 49: APEJ Pet Food Market Value (US$ Mn) Forecast, by Region, 2019-2029

Table 50: APEJ Pet Food Market Volume (MT) Forecast, by Region, 2019-2029

Table 51: MEA Pet Food Market Value (US$ Mn) Forecast, by Animal Type, 2019-2029

Table 52: MEA Pet Food Market Volume (MT) Forecast, by Animal Type, 2019-2029

Table 53: MEA Pet Food Market Value (US$ Mn) Forecast, by Nature, 2019-2029

Table 54: MEA Pet Food Market Volume (MT) Forecast, by Nature, 2019-2029

Table 55: MEA Pet Food Market Value (US$ Mn) Forecast, by Product Type, 2019-2029

Table 56: MEA Pet Food Market Volume (MT) Forecast, by Product Type, 2019-2029

Table 57: MEA Pet Food Market Value (US$ Mn) Forecast, by Sales Channel, 2019-2029

Table 58: MEA Pet Food Market Volume (MT) Forecast, by Sales Channel, 2019-2029

Table 59: MEA Pet Food Market Value (US$ Mn) Forecast, by Region, 2019-2029

Table 60: MEA Pet Food Market Volume (MT) Forecast, by Region, 2019-2029

Table 61: Oceania Pet Food Market Value (US$ Mn) Forecast, by Animal Type, 2019-2029

Table 62: Oceania Pet Food Market Volume (MT) Forecast, by Animal Type, 2019-2029

Table 63: Oceania Pet Food Market Value (US$ Mn) Forecast, by Nature, 2019-2029

Table 64: Oceania Pet Food Market Volume (MT) Forecast, by Nature, 2019-2029

Table 65: Oceania Pet Food Market Value (US$ Mn) Forecast, by Product Type, 2019-2029

Table 66: Oceania Pet Food Market Volume (MT) Forecast, by Product Type, 2019-2029

Table 67: Oceania Pet Food Market Value (US$ Mn) Forecast, by Sales Channel, 2019-2029

Table 68: Oceania Pet Food Market Volume (MT) Forecast, by Sales Channel, 2019-2029

Table 69: Oceania Pet Food Market Value (US$ Mn) Forecast, by Region, 2019-2029

Table 70: Oceania Pet Food Market Volume (MT) Forecast, by Region, 2019-2029

Table 71: Japan Pet Food Market Value (US$ Mn) Forecast, by Animal Type, 2019-2029

Table 72: Japan Pet Food Market Volume (MT) Forecast, by Animal Type, 2019-2029

Table 73: Japan Pet Food Market Value (US$ Mn) Forecast, by Nature, 2019-2029

Table 74: Japan Pet Food Market Volume (MT) Forecast, by Nature, 2019-2029

Table 75: Japan Pet Food Market Value (US$ Mn) Forecast, by Product Type, 2019-2029

Table 76: Japan Pet Food Market Volume (MT) Forecast, by Product Type, 2019-2029

Table 77: Japan Pet Food Market Value (US$ Mn) Forecast, by Sales Channel, 2019-2029

Table 78: Japan Pet Food Market Volume (MT) Forecast, by Sales Channel, 2019-2029

Table 79: Japan Pet Food Market Value (US$ Mn) Forecast, by Region, 2019-2029

Table 80: Japan Pet Food Market Volume (MT) Forecast, by Region, 2019-2029

List of Figures

Figure 01: Global Pet Food Market Size and Incremental $ Opportunity (US$ Mn), 2014-2029

Figure 02: Global Pet Food Market Value and Volume Analysis, 2019

Figure 03: Global Pet Food Market Attractiveness, by Animal Type, 2014 to 2018

Figure 04: Global Pet Food Market Attractiveness, by Nature, 2014 to 2018

Figure 05: Global Pet Food Market Attractiveness, by Product Type, 2014 to 2018

Figure 06: Global Pet Food Market Attractiveness, by Sales Channel, 2014 to 2018

Figure 07: Global Pet Food Market Attractiveness, by Animal Type, 2019 to 2029

Figure 08: Global Pet Food Market Attractiveness, by Nature, 2019 to 2029

Figure 09: Global Pet Food Market Attractiveness, by Product Type, 2019 to 2029

Figure 10: Global Pet Food Market Attractiveness, by Sales Channel, 2019 to 2029

Figure 11 : Global Pet Food Market Share and BPS Analysis by Region - 2019 to 2029

Figure 12: Global Pet Food Market Y-o-Y Growth Projections by Region, 2019-2029

Figure 13: Global Pet Food Market Attractiveness Index by Region, 2019-2029

Figure 14: North America Pet Food Market Value (US$ Mn), Volume (MT) and Forecast, 2014-2029

Figure 15: North America Pet Food Market Value BPS Analysis, by Country, 2019 to 2029

Figure 16: North America Pet Food Market Value Share Analysis, by Animal Type, 2014 to 2018

Figure 17: North America Pet Food Market Value Share Analysis, by Nature, 2014 to 2018

Figure 18: North America Pet Food Market Value Share Analysis, by Product Type, 2014 to 2018

Figure 19: North America Pet Food Market Value Share Analysis, by Sales Channel, 2014 to 2018

Figure 20: North America Pet Food Market Value Share Analysis, by Animal Type, 2019 to 2029

Figure 21: North America Pet Food Market Value Share Analysis, by Nature, 2019 to 2029

Figure 22: North America Pet Food Market Value Share Analysis, by Product Type, 2019 to 2029

Figure 23: North America Pet Food Market Value Share Analysis, by Sales Channel, 2019 to 2029

Figure 24: Latin America Pet Food Market Value (US$ Mn), Volume (MT) and Forecast, 2014-2029

Figure 25: Latin America Pet Food Market Value BPS Analysis, by Country, 2019 to 2029

Figure 26: Latin America Pet Food Market Value Share Analysis, by Animal Type, 2014 to 2018

Figure 27: Latin America Pet Food Market Value Share Analysis, by Nature, 2014 to 2018

Figure 28: Latin America Pet Food Market Value Share Analysis, by Product Type, 2014 to 2018

Figure 29: Latin America Pet Food Market Value Share Analysis, by Sales Channel, 2014 to 2018

Figure 30: Latin America Pet Food Market Value Share Analysis, by Animal Type, 2019 to 2029

Figure 31: Latin America Pet Food Market Value Share Analysis, by Nature, 2019 to 2029

Figure 32: Latin America Pet Food Market Value Share Analysis, by Product Type, 2019 to 2029

Figure 33: Latin America Pet Food Market Value Share Analysis, by Sales Channel, 2019 to 2029

Figure 34: Europe Pet Food Market Value (US$ Mn), Volume (MT) and Forecast, 2014-2029

Figure 35: Europe Pet Food Market Value BPS Analysis, by Country, 2019 to 2029

Figure 36: Europe Pet Food Market Value Share Analysis, by Animal Type, 2014 to 2018

Figure 37: Europe Pet Food Market Value Share Analysis, by Nature, 2014 to 2018

Figure 38: Europe Pet Food Market Value Share Analysis, by Product Type, 2014 to 2018

Figure 39: Europe Pet Food Market Value Share Analysis, by Sales Channel, 2014 to 2018

Figure 40: Europe Pet Food Market Value Share Analysis, by Animal Type, 2019 to 2029

Figure 41: Europe Pet Food Market Value Share Analysis, by Nature, 2019 to 2029

Figure 42: Europe Pet Food Market Value Share Analysis, by Product Type, 2019 to 2029

Figure 43: Europe Pet Food Market Value Share Analysis, by Sales Channel, 2019 to 2029

Figure 44: MEA Pet Food Market Value (US$ Mn), Volume (MT) and Forecast, 2014-2029

Figure 45: MEA Pet Food Market Value BPS Analysis, by Country, 2019 to 2029

Figure 46: MEA Pet Food Market Value Share Analysis, by Animal Type, 2014 to 2018

Figure 47: MEA Pet Food Market Value Share Analysis, by Nature, 2014 to 2018

Figure 48: MEA Pet Food Market Value Share Analysis, by Product Type, 2014 to 2018

Figure 49: MEA Pet Food Market Value Share Analysis, by Sales Channel, 2014 to 2018

Figure 50: MEA Pet Food Market Value Share Analysis, by Animal Type, 2019 to 2029

Figure 51: MEA Pet Food Market Value Share Analysis, by Nature, 2019 to 2029

Figure 52: MEA Pet Food Market Value Share Analysis, by Product Type, 2019 to 2029

Figure 53: MEA Pet Food Market Value Share Analysis, by Sales Channel, 2019 to 2029

Figure 54: APEJ Pet Food Market Value (US$ Mn), Volume (MT) and Forecast, 2014-2029

Figure 55: APEJ Pet Food Market Value BPS Analysis, by Country, 2019 to 2029

Figure 56: APEJ Pet Food Market Value Share Analysis, by Animal Type, 2014 to 2018

Figure 57: APEJ Pet Food Market Value Share Analysis, by Nature, 2014 to 2018

Figure 58: APEJ Pet Food Market Value Share Analysis, by Product Type, 2014 to 2018

Figure 59: APEJ Pet Food Market Value Share Analysis, by Sales Channel, 2014 to 2018

Figure 60: APEJ Pet Food Market Value Share Analysis, by Animal Type, 2019 to 2029

Figure 61: APEJ Pet Food Market Value Share Analysis, by Nature, 2019 to 2029

Figure 62: APEJ Pet Food Market Value Share Analysis, by Product Type, 2019 to 2029

Figure 63: APEJ Pet Food Market Value Share Analysis, by Sales Channel, 2019 to 2029

Figure 64: Oceania Pet Food Market Value (US$ Mn), Volume (MT) and Forecast, 2014-2029

Figure 65: Oceania Pet Food Market Value BPS Analysis, by Country, 2019 to 2029

Figure 66: Oceania Pet Food Market Value Share Analysis, by Animal Type, 2014 to 2018

Figure 67: Oceania Pet Food Market Value Share Analysis, by Nature, 2014 to 2018

Figure 68: Oceania Pet Food Market Value Share Analysis, by Product Type, 2014 to 2018

Figure 69: Oceania Pet Food Market Value Share Analysis, by Sales Channel, 2014 to 2018

Figure 70: Oceania Pet Food Market Value Share Analysis, by Animal Type, 2019 to 2029

Figure 71: Oceania Pet Food Market Value Share Analysis, by Nature, 2019 to 2029

Figure 72: Oceania Pet Food Market Value Share Analysis, by Product Type, 2019 to 2029

Figure 73: Oceania Pet Food Market Value Share Analysis, by Sales Channel, 2019 to 2029

Figure 74: Japan Pet Food Market Value (US$ Mn), Volume (MT) and Forecast, 2014-2029

Figure 75: Japan Pet Food Market Value BPS Analysis, by Country, 2019 to 2029

Figure 76: Japan Pet Food Market Value Share Analysis, by Animal Type, 2014 to 2018

Figure 77: Japan Pet Food Market Value Share Analysis, by Nature, 2014 to 2018

Figure 78: Japan Pet Food Market Value Share Analysis, by Product Type, 2014 to 2018

Figure 79: Japan Pet Food Market Value Share Analysis, by Sales Channel, 2014 to 2018

Figure 80: Japan Pet Food Market Value Share Analysis, by Animal Type, 2019 to 2029

Figure 81: Japan Pet Food Market Value Share Analysis, by Nature, 2019 to 2029

Figure 82: Japan Pet Food Market Value Share Analysis, by Product Type, 2019 to 2029

Figure 83: Japan Pet Food Market Value Share Analysis, by Sales Channel, 2019 to 2029