North America Porcine Vaccine Market: Snapshot

For several decades, vaccination has remained one of the most important interventions for disease prevention among humans and animals. In veterinary medicine, vaccination has proven to be a boon for animal health. Diseases such as diarrhoea, swine influenza, porcine reproductive and respiratory virus (PRRSV), porcine circovirus associated disease (PCVAD), have been greatly reduced from spreading endemic in several cases. Some diseases such as foot and mouth disease and cholera high fever in swines have been significantly eliminated in North America with the help of vaccination.

The market for porcine vaccine in the region is expected to exhibit healthy growth in the next few years as well. The rising demand for meat and gelatin and concerns regarding the rising pace of occurrence of zoonotic diseases will be the key factors driving the market in the near future. Transparency Market Research estimates that the North America porcine vaccine market will expand at a 5.3% CAGR from 2016 to 2024. As a result, the market, which valued at US$540.9 mn in 2015, will rise to US$926.2 mn by 2024.

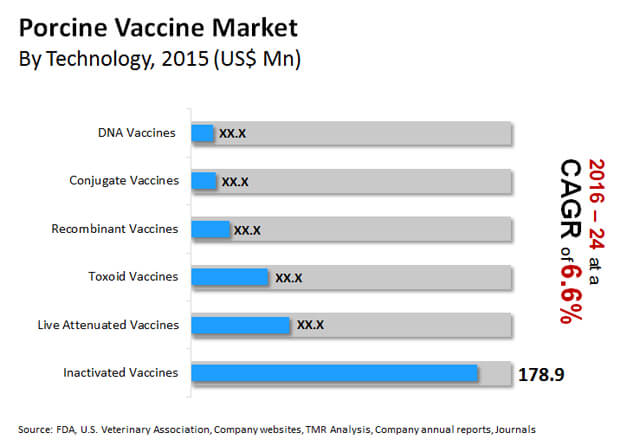

Inactivated Vaccines to Remain Most Preferred

In terms of the technology used to develop vaccines, the North America porcine vaccines market has been segmented into inactivated vaccines, live attenuated vaccines, recombinant vaccines, toxoid vaccines, DNA vaccines, and conjugate vaccines. Of these, the segment of inactivated vaccines dominated the market in 2015 and is expected to account for a 53.3% of the North America veterinary vaccine market in 2016. The segment is also expected to exhibit the most promising growth in the near future, expanding at a 6.7% CAGR over the period between 2016 and 2024.

The segment of live attenuated vaccines will exhibit a strong 5.9% CAGR over the said period. Rise in the number of swine farms, rising prevalence of zoonotic disease, and increase in investments by key players are likely to drive the live attenuated vaccine segment. The DNA vaccine segment is projected to emerge as a high-growth segment owing to rise in demand and increase in R&D investments. DNA vaccines have shown excellent results in granting strong immunity against homologous infections and have a good score in terms of approval from regulatory bodies in the region. As a result, the demand for these vaccines is expected to rise at a healthy pace in the region over the forecast period.  U.S. Market to Continue to Account for Dominant Chunk in Sales

U.S. Market to Continue to Account for Dominant Chunk in Sales

The North America porcine vaccine market has been examined for two countries in the region: the U.S. and Canada. The U.S. market for porcine vaccines accounted for a larger 63% share in the North America market in 2015. The U.S. porcine vaccine market is expected to exhibit the most lucrative 6.6% CAGR over the period between 2016 and 2024. Factors such as well-established infrastructure in immunological research, high concentration of key players, highly organized farming structure, increased demand for animal protein, and rising expenditure on animal health by farm owners are attributed to the dominant share of the country in the North America market.

The market in Canada is also anticipated to expand at a healthy, but comparatively lower CAGR of 5.8% from 2016 to 2024. Factors such as the rising prevalence of PRRS virus and PCV2 among herds and rising focus of key players on R&D activities for the development of effective vaccines will contribute to the growth prospects of the Canada porcine vaccines market in the near future. Moreover, export and import permits among contract manufacturers or distributer firms and low estimated cost of products are also expected to make the porcine vaccine market more popular in Canada.

Some of the key players in the market are Bayer AG., Bimeda Animal Health, Boehringer Ingelheim GmbH, Ceva Santé Animale, Merck & Co., Inc., Merial (Sanofi), Vetoquinol, Zoetis, Inc., Elanco (Eli Lilly and Company).

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : North America Porcine Vaccine Market

4. Market Overview

4.1. Introduction

4.1.1. Disease Indication Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Key Market Indicators

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity

4.5. North America Porcine Vaccine Market Analysis and Forecasts, 2014–2024

4.6. Porter’s Five Force Analysis

4.7.Regulations of Veterinary Vaccine in North America

5. North America Porcine Vaccine Market Analysis and Forecasts, By Disease Indication

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Market Value Share Analysis Forecast By Disease Indication , 2014–2024

5.4.1. Diarrhoea

5.4.2. Swine Influenza

5.4.3. Arthritis

5.4.4. Bordatella Rhinitis

5.4.5. Porcine Reproductive and Respiratory Virus (PRRSV)

5.4.6. Porcine Circovirus Associated Disease (PCVAD)

5.4.7. Others

5.5. Disease Indication Comparison Matrix

5.6. Market Attractiveness By Disease Indication

6. North America Porcine Vaccine Market Analysis and Forecasts, By Technology

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Key Trends

6.4. Market Value Share Analysis Forecast By Technology , 2014–2024

6.4.1. Inactivated Vaccines

6.4.2. Live Attenuated Vaccines

6.4.3. Toxoid Vaccines

6.4.4. Recombinant Vaccines

6.4.5. Conjugate Vaccines

6.4.6. DNA Vaccines

6.6. Market Attractiveness By Technology

7. North America Porcine Vaccine Market Analysis and Forecasts, By End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Key Trends

7.4. Market Value Share Analysis Forecast By End-user , 2014–2024

7.4.1. Veterinary Hospitals

7.4.2. Hog/Pig Production Farm

7.5. End-user Comparison Matrix

7.6. Market Attractiveness By End-user

8. North America Porcine Vaccine Market Analysis and Forecasts, By Region

8.1. Key Findings

8.2. Policies and Regulations

8.3. Market Value Share Analysis Forecast By Region

8.4. Market Attractiveness By Country/Region

9. U.S. Porcine Vaccine Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.1.2. Policies and Regulations

9.1.3. Key Trends

9.2. Market Value Share Analysis Forecast By Disease Indication , 2014–2024

9.2.1. Diarrhoea

9.2.2. Swine Influenza

9.2.3. Arthritis

9.2.4. Bordatella Rhinitis

9.2.5. Porcine Reproductive and Respiratory Virus (PRRSV)

9.2.6. Porcine Circovirus Associated Disease (PCVAD)

9.2.7. Others

9.3. Market Value Share Analysis Forecast By Technology, 2014–2024

9.3.1. Inactivated Vaccines

9.3.2. Live Attenuated Vaccines

9.3.3. Toxoid Vaccines

9.3.4. Recombinant Vaccines

9.3.5. Conjugate Vaccines

9.3.6. DNA Vaccines

9.4. Market Value Share Analysis Forecast By End-user, 2014–2024

9.4.1. Veterinary Hospitals

9.4.2. Hog/Pig Production Farm

9.5. Market Value Share Analysis Forecast By Country , 2014–2024

9.6. Market Attractiveness Analysis

9.6.1. By Disease Indication

9.6.2. By End-user

9.6.3. By Technology

9.6.4. By Country

10. Canada Porcine Vaccine Market Analysis and Forecast

10.1.Introduction

10.1.1. Key Findings

10.1.2. Policies and Regulations

10.1.3. Key Trends

10.2.Market Value Share Analysis Forecast By Disease Indication , 2014–2024

10.2.1. Diarrhoea

10.2.2. Swine Influenza

10.2.3. Arthritis

10.2.4. Bordatella Rhinitis

10.2.5. Porcine Reproductive and Respiratory Virus (PRRSV)

10.2.6. Porcine Circovirus Associated Disease (PCVAD)

10.2.7. Others

10.3.Market Value Share Analysis Forecast By Technology , 2014–2024

10.3.1. Inactivated Vaccines

10.3.2. Live Attenuated Vaccines

10.3.3. Toxoid Vaccines

10.3.4. Recombinant Vaccines

10.3.5. Conjugate Vaccines

10.3.6. DNA Vaccines

10.4.Market Value Share Analysis Forecast By End-user , 2014–2024

10.4.1. Veterinary Hospitals

10.4.2. Hog/Pig Production Farm

10.5.Market Value Share Analysis Forecast By Country , 2014–2024

10.6.Market Attractiveness Analysis

10.6.1. By Disease Indication

10.6.2. By End-user

10.6.3. By Technology

10.6.4. By Country

11. Competition Landscape

11.1.Market Player – Competition Matrix

11.2.Market Share Analysis By Company (2016) Estimated

11.3.Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

11.3.1. Bayer AG.

11.3.1.1. Overview

11.3.1.2. Financials

11.3.1.3. Recent Developments

11.3.1.4. Strategy

11.3.2. Bimeda Animal Health

11.3.2.1. Overview

11.3.2.2. Financials

11.3.2.3. Recent Developments

11.3.2.4. Strategy

11.3.3. Boehringer Ingelheim GmbH

11.3.3.1. Overview

11.3.3.2. Financials

11.3.3.3. Recent Developments

11.3.3.4. Strategy

11.3.4. Ceva Santé Animale

11.3.4.1. Overview

11.3.4.2. Financials

11.3.4.3. Recent Developments

11.3.4.4. Strategy

11.3.5. Elanco (Eli Lilly and Company)

11.3.5.1. Overview

11.3.5.2. Financials

11.3.5.3. Recent Developments

11.3.5.4. Strategy

11.3.6. Merck & Co., Inc.

11.3.6.1. Overview

11.3.6.2. Financials

11.3.6.3. Recent Developments

11.3.6.4. Strategy

11.3.7. Merial (Sanofi)

11.3.7.1. Overview

11.3.7.2. Financials

11.3.7.3. Recent Developments

11.3.7.4. Strategy

11.3.8. Vetoquinol

11.3.8.1. Overview

11.3.8.2. Financials

11.3.8.3. Recent Developments

11.3.8.4. Strategy

11.3.9. Zoetis, Inc.

11.3.9.1. Overview

11.3.9.2. Financials

11.3.9.3. Recent Developments

11.3.9.4. Strategy

11.3.10. Others

List of Tables

Table 1: North America Porcine vaccine Market Size (US$ Mn) Forecast, by Disease Indication, 2014–2024

Table 2: North America Porcine vaccine Market Size (US$ Mn) Forecast, by Technology, 2014–2024

Table 3: North America Porcine vaccine Market Size (US$ Mn) Forecast, by End-user, 2014–2024

Table 4: North America Porcine vaccine Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 5: U.S. Porcine vaccine Market Size (US$ Mn) Forecast, by Disease Indication, 2014–2024

Table 6: U.S. Porcine vaccine Market Size (US$ Mn) Forecast, by Technology, 2014–2024

Table 7: U.S. Porcine vaccine Market Size (US$ Mn) Forecast, by End-user, 2014–2024

Table 8: Canada Porcine Vaccine Market Size (US$ Mn) Forecast, by Disease Indication, 2014–2024

Table 9: Canada Porcine Vaccine Market Size (US$ Mn) Forecast, by Technology, 2014–2024

Table 10 Canada Porcine Vaccine Market Size (US$ Mn) Forecast, by End-user, 2014–2024

List of Figures

FIG 1: North America Porcine Vaccine Market Size (US$ Mn) Forecast, 2014–2024

FIG 2: Market Value Share, by Disease Indication

FIG 3: Market Value Share, by Technology

FIG 4: Market Value Share, by Country

FIG 5: Market Value Share, by End-user

FIG 6: North America Porcine vaccine Market Value Share Analysis, by Disease Indication, 2016 and 2024

FIG 7: North America Diarrhea Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

FIG 8: North America Swine Influenza Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

FIG 9: North America Arthritis Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

FIG 10: North America Bordatella Rhinitis Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

FIG 11: North America PRRSV Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

FIG 12: North America PCVAD Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

FIG 13: North America Other Disease Indication Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

FIG 14: North America Porcine vaccine Market Attractiveness Analysis, by Disease Indication, 2016–2024

FIG 15: North America Porcine vaccine Market Value Share Analysis, by Technology, 2016 and 2024

FIG 16: North America Inactivated vaccine Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), 2014–2024

FIG 17: North America Live Attenuated vaccine Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%),

2014–2024

FIG 18: North America Toxoid vaccine Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), 2014–2024

FIG 19: North America Recombinant vaccine Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%),

2014–2024

FIG 20: North America Conjugate vaccine Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), 2014–2024

FIG 21: North America DNA vaccine Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), 2014–2024

FIG 22: North America Porcine vaccine Market Attractiveness Analysis, by Technology, 2016–2024

FIG 23: North America Porcine vaccine Market Value Share Analysis, By End-user, 2016 and 2024

FIG 24: North America Veterinary Hospitals Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), 2014–2024

FIG 25: North America Hog/Pig Production Farms Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%),

2014–2024

FIG 26: North America Porcine vaccine Market Attractiveness Analysis, by End-user, 2016–2024

FIG 27: North America Porcine vaccine Market Value Share Analysis, by Country, 2016 and 2024

FIG 28: North America Porcine Vaccine Market Attractiveness Analysis, by Country, 2016–2024

FIG 29: U.S. Porcine Vaccine Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2014–2024

FIG 30: U.S. Porcine vaccine Market Value Share Analysis, by Disease Indication, 2016 and 2024

FIG 31: U.S. Porcine vaccine Market Value Share Analysis, by Technology, 2016 and 2024

FIG 32: U.S. Porcine vaccine Market Value Share Analysis, by End-user, 2016 and 2024

FIG 33: U.S. Market Attractiveness Analysis, by Disease Indication, 2016–2024

FIG 34: U.S. Market Attractiveness Analysis, by Technology, 2016–2024

FIG 35: U.S. Market Attractiveness Analysis, by End-user, 2016–2024

FIG 36: Canada Porcine Vaccine Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2014–2024

FIG 37: Canada Porcine Vaccine Market Value Share Analysis, by Disease Indication, 2016 and 2024

FIG 38: Canada Porcine Vaccine Market Value Share Analysis, by Technology, 2016 and 2024

FIG 39: Canada Porcine Vaccine Market Value Share Analysis, by End-user, 2016 and 2024

FIG 40: Canada Porcine Vaccine Market Attractiveness Analysis, by Disease Indication, 2016–2024

FIG 41: Canada Porcine Vaccine Market Attractiveness Analysis, by Technology, 2016–2024

FIG 42: Canada Porcine Vaccine Market Attractiveness Analysis, by End-user, 2016–2024

FIG 43: North America Porcine Vaccine Market Share Analysis, by Company (2015)