Global Mobile Robotics Market: Snapshot

With the escalating need for industrial mobile robots to enhance workplace efficiency, the global market for mobile robotics is registering a significant progress in its size and valuation. These mobile robots have the ability to move inside the factories without modifying the factory layout and they can also re-plan their routes autonomously to avoid obstacles, which make them highly effective in the factory setup. Owing to these factors, companies are prompted to deploy mobile robots in their plants, which is reflecting greatly on the sales of mobile robotics.

Over the coming years, the significant increase in labor costs, aging workforce, and the rising demand for productivity are expected to drive the growth of the global market for mobile robotics remarkably. However, the high initial investment may limit the uptake of these robots, which may impact the overall market negatively in the near future.

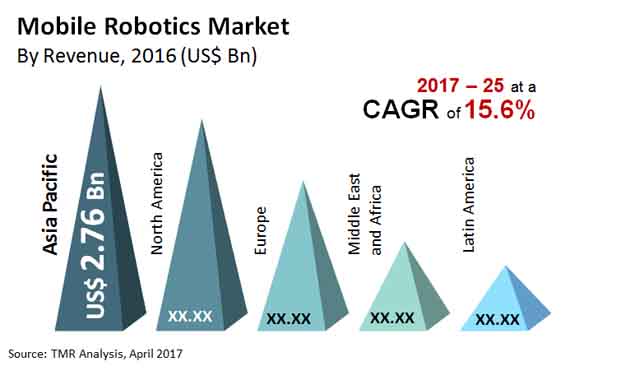

In 2016, the total opportunity in the global mobile robotics market was US$8.58 bn. Analysts expect it to report a substantial rise at a CAGR of 15.60% between 2017 and 2025, reaching US$30.96 bn by the end of 2025.

Demand for Unmanned Ground Vehicles to Remain Strong

Based on the type of mobile robots, the global market for mobile robotics has been classified into unmanned ground vehicles, unmanned aerial vehicles, unmanned surface vehicles, and autonomous underwater vehicles. Currently, unmanned ground vehicles are the most preferred ones among all and are expected to witness constant high demand over the next few years, thanks to the increasing usage of mobile robots in the defense sector to accomplish missions in dangerous, inconvenient, and difficult situations.

Unmanned aerial vehicles are also projected to witness a substantial rise in their demand over the next few years, thanks to the rising awareness regarding its usage in agriculture practices, border surveillance, and law enforcement.

Asia Pacific to Continue Leading Global Mobile Robotics Market

Geographically, the worldwide market for mobile robotics is categorized into Latin America, North America, Asia Pacific, Europe, and the Middle East and Africa. With a share of 32.20%, Asia Pacific dominated the global market in 2016. Thanks to the increasing investment in defense and logistics sectors, the adoption of mobile robots is likely to augment remarkably in Asia Pacific, influencing the overall market in the near future.

North America is also projected to witness a healthy rise in its market for mobile robotics over the next few years. The growing demand for domestic robots, such as vacuum and floor cleaning robots, lawn mowing robots, and entertainment and leisure robots is expected to boost the North America market for mobile robotics in the coming years. The U.S. and Canada have emerged as the leading domestic markets for mobile robotics in this region.

The Europe market for mobile robotics is anticipated to gain considerably in the near future from the augmenting demand for mobile robots in warehouse automation. Apart from this, the rising adoption of these robots in various industries, such as the medical, defense, and the agriculture, is also projected to boost this regional market over the forthcoming years.

The key players in the global mobile robotics market are iRobot Corp., Barrett Technology, Swisslog, John Deere, FANUC Corp., KUKA AG, Honda Motor Co. Ltd., Boeing Co., Seegrid Corp., Google Inc., Northrop Grumman Corp., Lowe’s Co. Inc, Amazon, Fetch Robotics Inc., Omron Adept Technologies, Clearpath Robotics Inc., Bossa Nova Robotics, Savioke, Aethon Inc., and Locus Robotics.

Increased Adoption of Industry Robots Boosts Demand Opportunities in Mobile Robotics Market

Many companies from various industrial sectors across the globe are growing focus toward achieving high efficiency at workplace. As a result, they are growing the use of industrial mobile robots. These robots are gaining traction they can move inside factories with no need to make changes in the layout of factory. In addition to this, the industrial robots hold an ability to autonomously re-plan their routes and avoid obstacles. As a result, mobile robots are considered highly efficient in various factory setups. Owing to all these advantages, the global mobile robotics market is experiencing upward sales curve.

Several industrial sectors across the globe are facing issues related to aging workforce and increased labor costs. In addition to this, increased demand for high efficiency is encouraging companies from many industrial sectors to grow the use of mobile robots. All these factors are encouraging companies for the deployment of mobile robots in their factories, which is working as a key factor boosting the expansion of the mobile robotics market.

Players operating in the global mobile robotics market are consistently investing their time and money in research and development activities. The main motive of these researches is improving the quality of the products they offer. This factor is likely to push the growth of the global mobile robotics market in the years ahead.

The COVID-19 pandemic has affected the production as well as distribution channels of many industrial sectors including the global mobile robotics market. The companies had to stop their production activities as many government authorities had compelled lockdowns in many regions to contain the spread of coronavirus. This scenario has resulted into drop in the revenues of the overall mobile robotics market. Industry leaders are growing efforts to strategize business moves to combat the situation. Thus, the global mobile robotics market is likely to bounce back in short period of time and show lucrative growth during upcoming years.

Chapter 1 Global Mobile Robotics Market

1.1 Research description

1.2 Research scope

1.3 Research methodology

Chapter 2 Executive Summary

Chapter 3 Market Overview

3.1 Introduction

3.2 Market dynamics

3.2.1 Market Drivers

3.2.1.1 Increasing demand for factory automation

3.2.1.2 Global rising investment in defense applications

3.2.1.3 Integration of mobile robots for e-Commerce Logistics

3.2.1.4 Increasing adaptation of mobile robots in China is driving the APAC market

3.2.2 Market Restraints

3.2.2.1 High Initial Investment

3.2.3 Market opportunities

3.2.3.1 Emerging idea of Industry 4.0 is expected to drive the mobile robotics market in future

3.3 Value chain analysis

3.3.1 Standard components and subsystems providers

3.3.2 Special components suppliers

3.3.3 Robotics software providers

3.3.4 Mobile robot manufacturers and suppliers

3.3.5 System integrators and value added resellers

3.4 Mobile robot industry – Porter’s Five Forces Analysis

3.4.1 Bargaining power of suppliers

3.4.2 Bargaining power of buyers

3.4.3 Threat from substitute

3.4.4 Threat from new entrants

3.4.5 Degree of competition

3.5 Global Mobile Robotics: Market attractiveness analysis

3.6 Market Share by Key Players, 2016 (%)

Chapter 4 Global Mobile Robotics Market Analysis, by Type, 2016 - 2025

4.1 Overview

4.2 Unmanned Ground Vehicles (UGVs)

4.3 Unmanned Aerial Vehicles (UAVs)

4.4 Unmanned Surface Vehicles (USVs)

4.5 Autonomous Underwater Vehicles

Chapter 5 Global Mobile RoboticsMarket Analysis, by Application, 2016 - 2025

5.1 Overview

5.1.1 Global Mobile Robotics Market, revenue share by Application, 2016 and 2025

5.2 Industrial Application

5.2.1 Mobile robotics market size and forecast, industrial application 2016 – 2025 (USD billion)

5.2.2 Mobile robotics market size and forecast, Logistics and warehousing, 2016 – 2025 (USD billion)

5.3 Service Application

5.3.1 Mobile robotics market size and forecast, Service application 2016 – 2025 (USD billion)

5.3.2 Mobile robotics market size and forecast, by professional service application 2016 – 2025 (USD billion)

5.3.3 Mobile robotics market size and forecast, by Personal service application 2016 – 2025 (USD billion)

Chapter 6 Global Mobile Robotics Market by Geography, 2016 – 2025

6.1 Introduction

6.1.1 Global mobilerobotics market revenue share, by geography, 2016 and 2025 (%)

6.2 North America

6.2.1 North America mobile robotics market revenue and forecast, 2016 – 2025 (USD billion)

6.2.2 North America mobile roboticsmarket revenue and forecast, 2016 – 2025 (USD billion)

6.2.3 North America mobile robotics market revenue and forecast,by Types, 2016 – 2025 (USD billion)

6.2.4 North America mobile robotics market revenue and forecast,by application, 2016 – 2025 (USD billion)

6.2.4.1 North America mobile robotics market size and forecast, industrial application 2016 – 2025 (USD billion)

6.2.4.1.1 North America mobile robotics market size and forecast, Logistics and Warehousing application,2016 – 2025 (USD billion)

6.2.4.2 North America mobile robotics market size and forecast, by service application 2016 – 2025 (USD billion)

6.2.4.2.1 North America mobile robotics market size and forecast, by professional service application 2016 – 2025 (USD billion)

6.2.4.2.2 North America mobile robotics market size and forecast, by personal service application 2016 – 2025 (USD billion)

6.2.5 North America mobile robotics market size and forecast, by Country,2016 – 2025 (USD billion)

6.3 Europe

6.3.1 Europe Mobile Robotics Market Revenue, 2016 - 2025, (USD Billion )

6.3.2 Europe Mobile Robotics Market, by Type, 2016 - 2025, (USD Billion)

6.3.3 Europe Mobile Robotics Market, by Application, 2016 - 2025, (USD Billion)

6.3.3.1 EuropeMobile robotics Market, by Industrial, 2016 - 2025, (USD Billion)

6.3.3.1.1 Europe Mobile robotics Market, by Logistics and Warehousing, 2016 - 2025, (USD Billion)

6.3.3.2 EuropeMobile robotics Market, by Service, 2016 - 2025, (USD Billion)

6.3.3.2.1 EuropeMobile robotics Market, by Professional, 2016 - 2025, (Billion Ton)

6.3.3.2.2 EuropeMobile robotics Market, by Personal, 2016 - 2025, (USD Billion)

6.3.3.3 EuropeMobile robotics Market, by Country, 2016 - 2025, (USD Billion)

6.4 Asia Pacific

6.4.1 Asia Pacific mobile robotics market revenue and forecast, 2016 – 2025 (USD billion)

6.4.2 Asia Pacificmobile robotics market revenue and forecast, by Type, 2016 – 2025 (USD billion)

6.4.3 Asia Pacificmobile robotics market revenue and forecast, by Application, 2016 – 2025 (USD billion)

6.4.3.1 Asia Pacific mobile robotics market size and forecast, industrial application 2016 – 2025 (USD billion)

6.4.3.1.1 Asia Pacific mobile robotics market size and forecast, By Logistics and warehousing, 2016 – 2025 (USD billion)

6.4.3.2 Asia Pacific mobile robotics market size and forecast, Service application 2016 – 2025 (USD billion)

6.4.3.2.1 Asia Pacific mobile robotics market size and forecast, by professional service application 2016 – 2025 (USD billion)

6.4.3.2.2 Asia Pacific mobile robotics market size and forecast, by Personal service application 2016 – 2025 (USD billion)

6.4.4 Asia Pacificmobile robotics market revenue and forecast, by Countries, 2016 – 2025 (USD billion)

6.5 Middle East and Africa

6.5.1 Middle East and AfricaMobile robotics Market Revenue, 2016 - 2025, (USD Billion )

6.5.2 Middle East and AfricaMobile Robotics Market, by Type, 2016 - 2025, (USD Billion)

6.5.3 Middle East and Africa Mobile Robotics Market, by Application, 2016 - 2025, (USD Billion)

6.5.3.1 Middle East and AfricaMobile robotics Market, by Industrial, 2016 - 2025, (USD Billion)

6.5.3.1.1 Middle East and Africa Mobile robotics Market, by Logistics and Warehousing, 2016 - 2025, (USD billion)

6.5.3.2 Middle East and AfricaMobile robotics Market, by Service, 2016 - 2025, (USD billion)

6.5.3.2.1 Middle East and AfricaMobile robotics Market, by Professional, 2016 - 2025, (Billion Ton)

6.5.3.2.2 Middle East and AfricaMobile robotics Market, by Personal, 2016 - 2025, (USD Billion)

6.5.3.3 Middle East and AfricaMobile robotics Market, by Country, 2016 - 2025, (USD Billion)

6.6 Latin America

6.6.1 Latin America mobile robotics market revenue and forecast, 2016 – 2025 (USD billion)

6.6.2 Latin America mobile robotics market revenue and forecast, by Type, 2016 – 2025 (USD billion)

6.6.3 Latin America mobile robotics market revenue and forecast, by Application, 2016 – 2025 (USD billion)

6.6.3.1 Latin America mobile robotics market size and forecast, industrial application 2016 – 2025 (USD billion)

6.6.3.1.1 Latin America mobile robotics market size and forecast, By Logistics and warehousing, 2016 – 2025 (USD billion)

6.6.3.2 Latin America mobile robotics market size and forecast, Service application 2016 – 2025 (USD billion)

6.6.3.2.1 Latin America mobile robotics market size and forecast, by professional service application 2016 – 2025 (USD billion)

6.6.3.2.2 Latin America mobile robotics market size and forecast, by Personal service application 2016 – 2025 (USD billion)

6.6.4 Latin America mobile robotics market revenue and forecast, by Countries, 2016 – 2025 (USD billion)

Chapter 7 Company Profiles

7.1 iRobot Corporation

7.1.1 Company Overview

7.1.2 Business Segments

7.1.3 Key Developments

7.1.4 Financial Overview

7.1.5 Historical Roadmap

7.1.6 Strategic Overview

7.2 Barrett Technology

7.2.1 Company Overview

7.2.2 Business Segments

7.2.3 Key Developments

7.2.4 Financial Overview

7.2.5 Historical Roadmap

7.2.6 Strategic Overview

7.3 Swisslog

7.3.1 Company Overview

7.3.2 Business Segments

7.3.3 Key Developments

7.3.4 Financial Overview

7.3.5 Historical Roadmap

7.3.6 Strategic Overview

7.4 John Deere

7.4.1 Company Overview

7.4.2 Business Segments

7.4.3 Key Developments

7.4.4 Financial Overview

7.4.5 Historical Roadmap

7.4.6 Strategic Overview

7.5 FANUC Corporation

7.5.1 Company Overview

7.5.2 Business Segments

7.5.3 Key Developments

7.5.4 Financial Overview

7.5.5 Historical Roadmap

7.5.6 Strategic Overview

7.6 KUKA AG

7.6.1 Company Overview

7.6.2 Business Segments

7.6.3 Key Developments

7.6.4 Financial Overview

7.6.5 Historical Roadmap

7.6.6 Strategic Overview

7.7 Honda Motor Co. Ltd.

7.7.1 Company Overview

7.7.2 Business Segments

7.7.3 Key Developments

7.7.4 Financial Overview

7.7.5 Historical Roadmap

7.7.6 Strategic Overview

7.8 Boeing Co.

7.8.1 Company Overview

7.8.2 Business Segments

7.8.3 Key Developments

7.8.4 Financial Overview

7.8.5 Historical Roadmap

7.8.6 Strategic Overview

7.9 Seegrid Corporation

7.9.1 Company Overview

7.9.2 Business Segments

7.9.3 Key Developments

7.9.4 Financial Overview

7.9.5 Historical Roadmap

7.9.6 Strategic Overview

7.10 Google Inc.

7.10.1 Company Overview

7.10.2 Business Segments

7.10.3 Key Developments

7.10.4 Financial Overview

7.10.5 Historical Roadmap

7.10.6 Strategic Overview

7.11 Northrop Grumman Corporation

7.11.1 Company Overview

7.11.2 Business Segments

7.11.3 Key Developments

7.11.4 Financial Overview

7.11.5 Historical Roadmap

7.11.6 Strategic Overview

7.12 Lowe’s Company Inc.

7.12.1 Company Overview

7.12.2 Business Segments

7.12.3 Key Developments

7.12.4 Financial Overview

7.12.5 Historical Roadmap

7.12.6 Strategic Overview

7.13 Amazon

7.13.1 Company Overview

7.13.2 Business Segments

7.13.3 Key Developments

7.13.4 Financial Overview

7.13.5 Historical Roadmap

7.13.6 Strategic Overview

7.14 Fetch Robotics Inc.

7.14.1 Company Overview

7.14.2 Business Segments

7.14.3 Key Developments

7.14.4 Financial Overview

7.14.5 Historical Roadmap

7.14.6 Strategic Overview

7.15 Omron Adept Technologies

7.15.1 Company Overview

7.15.2 Business Segments

7.15.3 Key Developments

7.15.4 Financial Overview

7.15.5 Historical Roadmap

7.15.6 Strategic Overview

7.16 Clearpath Robotics Inc.

7.16.1 Company Overview

7.16.2 Business Segments

7.16.3 Key Developments

7.16.4 Financial Overview

7.16.5 Historical Roadmap

7.16.6 Strategic Overview

7.17 Bossa Nova Robotics

7.17.1 Company Overview

7.17.2 Business Segments

7.17.3 Key Developments

7.17.4 Financial Overview

7.17.5 Historical Roadmap

7.17.6 Strategic Overview

7.18 Savioke

7.18.1 Company Overview

7.18.2 Business Segments

7.18.3 Key Developments

7.18.4 Financial Overview

7.18.5 Historical Roadmap

7.18.6 Strategic Overview

7.19 Aethon Inc.

7.19.1 Company Overview

7.19.2 Business Segments

7.19.3 Key Developments

7.19.4 Financial Overview

7.19.5 Historical Roadmap

7.19.6 Strategic Overview

7.20 Locus Robotics

7.20.1 Company Overview

7.20.2 Business Segments

7.20.3 Key Developments

7.20.4 Financial Overview

7.20.5 Historical Roadmap

7.20.6 Strategic Overview

List of Figures

FIG. 1 Mobile robot industry – Value chain analysis

FIG. 2 Porter’s five forces analysis for mobile robot industry

FIG. 3 Market attractiveness analysis, by Type, 2016

FIG. 4 Market Share by Key Players, 2016 (%)

FIG. 5 Global Mobile Robotics Market, Share by Type, 2016 and 2025 (Value %)

FIG. 6 Unmanned Ground Vehicle Market, Value, 2016–2025 (USD billion)

FIG. 7 Unmanned Aerial VehicleMarket, Value, 2016 – 2025 (USD billion)

FIG. 8 Global Unmanned Surface Vehicles Market, Value, 2016 – 2025 (USD billion)

FIG. 9 Autonomous Underwater Vehicles Market, Value, 2016 – 2025 (USD billion)

FIG. 10 Global Mobile Robotics Market Share by Application, 2016 and 2025 (Value %)

FIG. 11 Global Mobile Robotics Market, By Industrial application, 2016 – 2025 (USD billion)

FIG. 12 Global Mobile Robotics Market, By Service application, 2016 – 2025 (USD billion)

FIG. 13 Global mobilerobotics market revenue share, by geography, 2016 and 2025 (%)

FIG. 14 North America mobile robotics market revenue and forecast, 2016 – 2025 (USD billion)

FIG. 15 Europe Mobile Robotics MarketRevenue, 2016 - 2025, (USD Billion )

FIG. 16 Asia Pacific mobile robotics market revenue and forecast, 2016 – 2025 (USD billion)

FIG. 17 Middle East and AfricaMobile robotics Market Revenue, 2016 - 2025, (USD Billion )

FIG. 18 Latin America mobile robotics market revenue and forecast, 2016 – 2025 (USD billion)