As old health rules are overturned, a physiological approach that starts from health in place of disease is gaining high emphasis. Hippocrates quote, ‘Let food be thy medicine and medicine be thy food’ has been put into practice, as individuals are considering medical nutrition and food for enhancing health and treating disease, despite the developments procured in the field of medical science.

The idea of disease prevention to avoid or simplify complicated therapeutics is supported by the convergence of the pharmaceutical and food industry. In the past years, literatures have stated that the gap between nutrition science and pharmacology has been narrowing, a progress stirred by both disciplines. The only substances considered pharmacologically active in the past were drugs. Progressing on these terms, medical nutrition, the new treatment pattern entails on the fact that nutrients can have an intense effect on metabolic, immunological and other pathophysiological processes of unhealthy patients.

TMR, in its new research study, reveals compelling insights into the medical nutrition space, to assist readers with data-driven decision making. According to the TMR study, revenues from the medical nutrition market closed in on a valuation of over US$ 13,000 Mn in 2018. This growth is attributed to the growing awareness of chronic diseases among consumers coupled with the various initiatives and programs commenced for the effective prevention and control of these diseases. This has led to the growing inclination towards medical nutrition supplements.

Developments in biotechnology has further resulted in the revolution of the medical nutrition market as key manufacturers are concentrating on research and development of improved and personalized medical nutrition offerings. Moreover, the development of disease-specific specialized solution for the medical nutrition markets is also observed, particularly in the developed economies.

From industry giants to first-movers, enterprises have long been in mercy of revolutionizing industry trends. Key trends shaping the medical nutrition landscape are discussed below.

The digestive wellness trend embodies the increasing awareness around new ingredients, nutritional products which are based on the public health recommendations and science. This is led to the reduction of sugar content of foods. According to reports, a large part of the consumer base prefers the consumption of health-improving ingredients through food, as consumers care about nutrition with which they gain a control over their health and lifestyle. Foods that help reduce the gastrointestinal symptoms including the ‘free-from’ foods, ‘added-benefits’ ingredients, fermented foods, prebiotics, and probiotics are gaining focus with this trend.

Driven by key developments in technology along with the continual progress attained by the field of science, the personalized medical nutrition has become much more than just a concept. Medical nutrition solutions providers are incorporating multidisciplinary approach to set up centers that focus on development of nutritional products that cater to specific needs. The future of personalized medical nutrition is cited to be fully individualized backed with constant monitoring of personalized information including gut bacteria, biomarkers or genes.

There is a major demand witnessed for the foods perceived to be free-from, clean, and natural allied to the growth in healthy eating. Studies have found that the label claims are likely to influence the buying decisions of consumers on a large scale as the need for authenticity and transparency in foods and beverages has witnessed a significant growth. In addition, key regulations pertaining to food product labelling are further necessitating medical nutrition product manufacturers to concentrate on this progressive trend.

The medical nutrition market players continue to progress in the medical nutrition landscape with a key focus on investments. Major investments are carried out in areas of research and development, acquisition of local medical nutrition providers and expansion in promising regions. A number of partnerships and collaborations are also likely to foster the growth of businesses.

North America reflects key growth opportunities for the medical nutrition market players and is expected to remain the leading region for medical nutrition market through 2026. Europe is also one of the attractive regional markets for the medical nutrition. Companies are witnessing various growth opportunities in both North America and Europe owing to the healthy demand for preventive medical nutrition supplements from these regions which are attributed to the high prevalence of malnutrition in older adults in geriatric care facilities and hospitals. Asia Pacific excluding Japan is estimated to a high growth market, opening key opportunities for the companies.

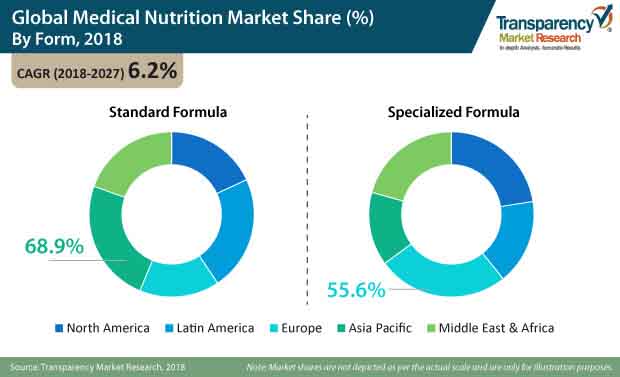

Formula type and mode of delivery have emerged as lucrative segments in the medical nutrition market. In formula type, the specialized formula has been in demand over the years. However, the growth of standard formula is high on account of the rising consumption of medical nutrition products for consumer’s general well-being. The enteral medical nutrition is the most preferred mode of delivery by consumers. However, people suffering from digestive problems and GI tract infections are advised to consume medical nutrition by parenteral mode of delivery in which the supplements are given to the patients intravenously. As a result of this, although the demand for parenteral medical nutrition will not grow at a high rate, it is expected to remain a very attractive segment. Various medical nutrition companies are cashing on the attractiveness of the parenteral formula, incorporating newer strategies to gain profits.

Key developments carried out by leading players in the medical nutrition market:

The medical nutrition market is consolidated market as a significant market share captured by leading players in the medical nutrition market. The medical nutrition product manufacturers are focusing on innovating products by developing R&D facilities that help scrutinize the specific consumer requirements, resulting in new product launches in a short time span. Merger and acquisition strategy has emerged key strategy for medical nutrition market players. Expansion of capacity with the collaboration of R&D departments, implementation of developments programs, and more are emerging as a key focus areas of the medical nutrition market players.

Analysts’ Viewpoint on the Medical Nutrition Market

The medical nutrition products primarily witness high demand from the geriatric population. However, the utilization of medical nutrition by adults for the purpose of general well-being is creating wealthy opportunities for companies. Companies operating in the medical nutrition market can expect progressive growth with investments in the specialization of the products by launching medical nutrition offering that target specific conditions. As consumers are ready to pay premium prices, the medical nutrition business will sustain progress in the near future. Moreover, the increasing illness among consumers globally could lead to higher sales.

Differentiation strategy is laying the foundation of a significant market foothold for various medical nutrition market players. While established medical nutrition market players can invest in R&D activities to manufacture innovative products, similar approach can be implemented by new entrants. Premix ingredients are in high demand owing to urbanization, resulting in a demand for less time consuming alternatives that match the fast-paced lives. Medical nutrition companies can direct their efforts towards these transforming consumer requirements to further benefit from these profit gaining opportunities. Companies providing medical nutrition offerings are recommended to increase their global presence and capture emerging markets such as the APEJ and the MEA, that exhibit growth potential for the medical nutrition business.

In 2018, Medical Nutrition Market was valued at US$ 13,000 Mn

Medical Nutrition Market is estimated to rise at a CAGR of 6.2% during forecast period

Major demand witnessed for the foods perceived to be free-from, clean, and natural allied is expected to drive the Medical Nutrition Market

North America is more attractive for vendors in the Medical Nutrition Market

Key players of Medical Nutrition Market are NUTRICIÓN MÉDICA SL, Meiji Holdings Co., Ltd., Medtrition Inc., Baxter International Inc., B. Braun Melsungen AG., Fresenius Kabi AG, Danone Nutricia, Nestlé S.A., LLC, Otsuka Holdings Co., Ltd. (Parent of Otsuka Pharmaceutical) Europe Ltd. and Abbott Laboratories amongst others

1. Global Medical Nutrition Market - Executive Summary

1.1. Global Medical Nutrition Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Application – Product Mapping

1.4. Competition Blueprint

1.5. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Dynamics

3.1. Macro-economic Factors

3.1.1. Global Healthcare Expenditure

3.1.2. Population of Key Countries

3.1.3. Healthcare Industry Overview

3.1.4. Business Environment Outlook

3.1.5. Global Trade Scenario

3.1.6. Economic Outlook

3.1.7. Political Outlook

3.2. Drivers

3.2.1. Increasing Malnutrition Cases Associated with Chronic Diseases

3.2.2. Increasing Geriatric Population in Developed Countries

3.2.3. Approvals of Novel Parenteral Nutrition Combinations

3.3. Market Restraints

3.3.1. Side-effects or Complications Related to Parenteral Nutrition Products

3.3.2. Higher Adoption of Alternatives to Nutrition Intake

3.3.3. Higher HAI in Preterm Infants to Restrict the Use of Parenteral Nutrition

3.4. Market Trends

3.4.1. Increasing Shortage of Components of Parenteral Nutrition in the U.S.

3.4.2. Use of Hypo caloric over Traditional Parenteral Nutrition

3.4.3. Technology Advancements

3.5. Trend Analysis- Impact on Time Line (2018-2027)

3.6. Forecast Factors – Relevance and Impact

3.7. Regulatory Scenario

3.8. Procurement Process in Europe : HealthTrust Europe

3.9. Cost Structure Analysis

3.10. List of Market Participants

3.11. Overview of Hospital Cases

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview

4.1.1. Market Size and Forecast

4.1.2. Market Size and Y-o-Y Growth

4.1.3. Absolute $ Opportunity

5. Supply Chain Analysis

5.1. Profitability and Gross Margin Analysis By Competition

5.2. List of Active Participants- By Region

5.2.1. Raw Material Suppliers

5.2.2. Key Manufacturers

5.2.3. Key Distributor/Retailers

5.2.4. Operating Margins

6. Global Medical Nutrition Market Pricing Analysis

6.1. Price Point Assessment by Product Type

6.2. Regional Average Pricing Analysis

6.2.1. North America

6.2.2. Latin America

6.2.3. Europe

6.2.4. Asia Pacific Ex. Japan (APEJ)

6.2.5. Japan

6.2.6. Oceania

6.2.7. Middle East and Africa

6.3. Price Forecast till 2027

6.4. Factors Influencing Pricing

7. Global Medical Nutrition Market Analysis and Forecast

7.1. Market Size Analysis (2013-2017) and Forecast (2018-2027)

7.1.1. Market Value (US$ Mn) and Volume (Tons) and Y-o-Y Growth

7.1.2. Absolute $ Opportunity

7.2. Global Medical Nutrition Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

7.2.1. Forecast Factors and Relevance of Impact

7.2.2. Regional Medical Nutrition Market Business Performance Summary

8. Global Medical Nutrition Market Analysis By Product Type

8.1. Introduction

8.1.1. Y-o-Y Growth Comparison By Product Type

8.1.2. Basis Point Share (BPS) Analysis By Product Type

8.2. Medical Nutrition Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2027) By Product Type

8.2.1. Standardized Formula

8.2.2. Specialized Formula

8.3. Market Attractiveness Analysis By Product Type

9. Global Medical Nutrition Market Analysis By Indication

9.1. Introduction

9.1.1. Y-o-Y Growth Comparison By Indication

9.1.2. Basis Point Share (BPS) Analysis By Indication

9.2. Medical Nutrition Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2027) By Indication

9.2.1. General Well-being

9.2.1.1. Enteral Nutrition

9.2.1.2. Parental Nutrition

9.2.2. Renal Disorders

9.2.2.1. Enteral Nutrition

9.2.2.2. Parental Nutrition

9.2.3. Hepatic Disorders

9.2.3.1. Enteral Nutrition

9.2.3.2. Parental Nutrition

9.2.4. Oncology Nutrition

9.2.4.1. Enteral Nutrition

9.2.4.2. Parental Nutrition

9.2.5. Diabetes

9.2.5.1. Enteral Nutrition

9.2.5.2. Parental Nutrition

9.2.6. Dysphagia

9.2.6.1. Enteral Nutrition

9.2.6.2. Parental Nutrition

9.2.7. Respiratory Disorders

9.2.7.1. Enteral Nutrition

9.2.7.2. Parental Nutrition

9.2.8. IBD & GI

9.2.8.1. Enteral Nutrition

9.2.8.2. Parental Nutrition

9.2.9. Neurological Disorders

9.2.9.1. Enteral Nutrition

9.2.9.2. Parental Nutrition

9.2.10. Respiratory Disorders

9.2.10.1. Enteral Nutrition

9.2.10.2. Parental Nutrition

9.2.11. Others

9.2.11.1. Enteral Nutrition

9.2.11.2. Parental Nutrition

9.3. Market Attractiveness Analysis By Indication

10. Global Medical Nutrition Market Analysis By End User

10.1. Introduction

10.1.1. Y-o-Y Growth Comparison By End User

10.1.2. Basis Point Share (BPS) Analysis By End User

10.2. Medical Nutrition Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2027) By End User

10.2.1. Adult

10.2.2. Geriatric

10.2.3. Paediatric

10.3. Market Attractiveness Analysis By End User

11. Global Medical Nutrition Market Analysis By Flavor

11.1. Introduction

11.1.1. Y-o-Y Growth Comparison By Flavor

11.1.2. Basis Point Share (BPS) Analysis By Flavor

11.2. Medical Nutrition Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2027) By Flavor

11.2.1. Regular

11.2.2. Flavored

11.2.2.1. Chocolate

11.2.2.2. Vanilla

11.2.2.3. Strawberry

11.2.2.4. Apple

11.2.2.5. Mixed Berries

11.2.2.6. Orange

11.2.2.7. Nut Flavor

11.2.2.8. Others

11.3. Market Attractiveness Analysis By Flavor

12. Global Medical Nutrition Market Analysis By Distribution Channel

12.1. Introduction

12.1.1. Y-o-Y Growth Comparison By Distribution Channel

12.1.2. Basis Point Share (BPS) Analysis By Distribution Channel

12.2. Medical Nutrition Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2027) By Distribution Channel

12.2.1. Regular

12.2.2. Flavored

12.2.2.1. Chocolate

12.2.2.2. Vanilla

12.2.2.3. Strawberry

12.2.2.4. Apple

12.2.2.5. Mixed Berries

12.2.2.6. Orange

12.2.2.7. Nut Flavor

12.2.2.8. Others

12.3. Market Attractiveness Analysis By Distribution Channel

13. Global Medical Nutrition Market Analysis and Forecast, By Region

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis By Region

13.1.2. Y-o-Y Growth Projections By Region

13.2. Medical Nutrition Market Size (US$ Mn) and Volume (MT) & Forecast (2018-2027) Analysis By Region

13.2.1. North America

13.2.2. Europe

13.2.3. APEJ

13.2.4. Japan

13.2.5. Oceania

13.2.6. Latin America

13.2.7. Middle East and Africa

13.3. Market Attractiveness Analysis By Region

14. North America Medical Nutrition Market Analysis and Forecast

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis By Country

14.1.2. Y-o-Y Growth Projections By Country

14.2. Medical Nutrition Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2027)

14.2.1. Market Attractiveness By Country

14.2.1.1. U.S.

14.2.1.2. Canada

14.2.2. By Product Type

14.2.3. By Indication

14.2.4. By End User

14.2.5. By Flavor

14.2.6. By Distribution Channel

14.3. Market Attractiveness Analysis

14.3.1. By Country

14.3.2. By Product Type

14.3.3. By Indication

14.3.4. By End User

14.3.5. By Flavor

14.3.6. By Distribution Channel

14.4. Drivers and Restraints: Impact Analysis

15. Latin America Medical Nutrition Market Analysis and Forecast

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.1.3. Key Regulations

15.2. Medical Nutrition Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2027)

15.2.1. By Country

15.2.1.1. Brazil

15.2.1.2. Mexico

15.2.1.3. Chile

15.2.1.4. Peru

15.2.1.5. Argentina

15.2.1.6. Rest of Latin America

15.2.2. By Product Type

15.2.3. By Indication

15.2.4. By End User

15.2.5. By Flavor

15.2.6. By Distribution Channel

15.3. Market Attractiveness Analysis

15.3.1. By Country

15.3.2. By Product Type

15.3.3. By Indication

15.3.4. By End User

15.3.5. By Flavor

15.3.6. By Distribution Channel

15.4. Drivers and Restraints: Impact Analysis

16. Europe Medical Nutrition Market Analysis and Forecast

16.1. Introduction

16.1.1. Basis Point Share (BPS) Analysis By Country

16.1.2. Y-o-Y Growth Projections By Country

16.1.3. Key Regulations

16.2. Medical Nutrition Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2027)

16.2.1. By Country

16.2.1.1. EU-4 (Germany, France, Italy, Spain)

16.2.1.2. U.K.

16.2.1.3. BENELUX

16.2.1.4. Nordic

16.2.1.5. Russia

16.2.1.6. Poland

16.2.1.7. Rest of Europe

16.2.2. By Product Type

16.2.3. By Indication

16.2.4. By End User

16.2.5. By Flavor

16.2.6. By Distribution Channel

16.3. Market Attractiveness Analysis

16.3.1. By Country

16.3.2. By Product Type

16.3.3. By Indication

16.3.4. By End User

16.3.5. By Flavor

16.3.6. By Distribution Channel

16.4. Drivers and Restraints: Impact Analysis

17. APEJ Medical Nutrition Market Analysis and Forecast

17.1. Introduction

17.1.1. Basis Point Share (BPS) Analysis By Country

17.1.2. Y-o-Y Growth Projections By Country

17.1.3. Key Regulations

17.2. Medical Nutrition Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2027)

17.2.1. By Country

17.2.1.1. China

17.2.1.2. India

17.2.1.3. South Korea

17.2.1.4. ASEAN

17.2.2. By Product Type

17.2.3. By Indication

17.2.4. By End User

17.2.5. By Flavor

17.2.6. By Distribution Channel

17.3. Market Attractiveness Analysis

17.3.1. By Country

17.3.2. By Product Type

17.3.3. By Indication

17.3.4. By End User

17.3.5. By Flavor

17.3.6. By Distribution Channel

17.4. Drivers and Restraints: Impact Analysis

18. Japan Medical Nutrition Market Analysis and Forecast

18.1. Introduction

18.1.1. Basis Point Share (BPS) Analysis By Country

18.1.2. Y-o-Y Growth Projections By Country

18.1.3. Key Regulations

18.2. Medical Nutrition Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2027)

18.2.1. By Product Type

18.2.2. By Indication

18.2.3. By End User

18.2.4. By Flavor

18.2.5. By Distribution Channel

18.3. Market Attractiveness Analysis

18.3.1. By Product Type

18.3.2. By Indication

18.3.3. By End User

18.3.4. By Flavor

18.3.5. By Distribution Channel

18.4. Drivers and Restraints: Impact Analysis

19. Oceania Medical Nutrition Market Analysis and Forecast

19.1. Introduction

19.1.1. Basis Point Share (BPS) Analysis By Country

19.1.2. Y-o-Y Growth Projections By Country

19.1.3. Key Regulations

19.2. Medical Nutrition Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2027)

19.2.1. By Product Type

19.2.2. By Indication

19.2.3. By End User

19.2.4. By Flavor

19.2.5. By Distribution Channel

19.3. Market Attractiveness Analysis

19.3.1. By Product Type

19.3.2. By Indication

19.3.3. By End User

19.3.4. By Flavor

19.3.5. By Distribution Channel

19.4. Drivers and Restraints: Impact Analysis

20. Middle East and Africa (MEA) Medical Nutrition Market Analysis and Forecast

20.1. Introduction

20.1.1. Basis Point Share (BPS) Analysis By Country

20.1.2. Y-o-Y Growth Projections By Country

20.1.3. Key Regulations

20.2. Medical Nutrition Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2027)

20.2.1. By Country

20.2.1.1. GCC Countries

20.2.1.2. South Africa

20.2.1.3. North Africa

20.2.1.4. Rest of MEA

20.2.2. By Product Type

20.2.3. By Indication

20.2.4. By End User

20.2.5. By Flavor

20.2.6. By Distribution Channel

20.3. Market Attractiveness Analysis

20.3.1. By Country

20.3.2. By Product Type

20.3.3. By Indication

20.3.4. By End User

20.3.5. By Flavor

20.3.6. By Distribution Channel

20.4. Drivers and Restraints: Impact Analysis

21. Competition Assessment

21.1. Global Medical Nutrition Market Competition - a Dashboard View

21.2. Global Medical Nutrition Market Structure Analysis

21.3. Global Medical Nutrition Market Company Share Analysis

21.3.1. For Tier 1 Market Players, 2017

21.3.2. Company Market Share Analysis of Top 20 Players

21.4. Key Participants Market Presence (Intensity Mapping) by Region

22. Brand Assessment

22.1. Brand Identity (Brand as Product, Brand as Organization, Brand as Person, Brand as Symbol)

22.2. Medical Nutrition Audience and Positioning (Demographic Segmentation, Geographic Segmentation, Psychographic Segmentation, Situational Segmentation)

22.3. Brand Strategy

23. Competition Deep-dive (Manufacturers/Suppliers)

23.1. NUTRICIÓN MÉDICA SL.

23.1.1. Overview

23.1.2. Product Portfolio

23.1.3. Sales Footprint

23.1.4. Channel Footprint

23.1.4.1. Distributors List

23.1.4.2. Sales Channel (Clients)

23.1.5. Strategy Overview

23.1.5.1. Marketing Strategy

23.1.5.2. Culture Strategy

23.1.5.3. Channel Strategy

23.1.6. SWOT Analysis

23.1.7. Financial Analysis

23.1.8. Revenue Share

23.1.8.1. By Product Type

23.1.8.2. By Region

23.1.9. Key Clients

23.1.10. Analyst Comments

23.2. Meiji Holdings Co., Ltd.

23.3. Medtrition Inc.

23.4. Baxter International Inc.

23.5. B. Braun Melsungen AG.

23.6. Fresenius Kabi AG

23.7. Mead Johnson & Company, LLC

23.8. Otsuka Holdings Co., Ltd. (Parent of Otsuka Pharmaceutical) Europe Ltd.

23.9. Abbott Laboratories

23.10. Danone Nutricia

23.11. Victus, Inc.

23.12. Adriaan Goede BV

23.13. Cambrooke Therapeutics, Inc.

23.14. GlaxoSmithKline plc

23.15. Nestlé S.A.

23.16. Kate Farms, Inc.

23.17. Perrigo Company plc

23.18. Sichuan Kelun Pharmaceutical Co., Ltd.

23.19. AYMES International Ltd.

23.20. Others (On Request)

24. Recommendation- Critical Success Factors

25. Research Methodology

26. Assumptions & Acronyms Used

List of Tables

Table 01: Global Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Region, 2018-2027

Table 02: Global Medical Nutrition Market Volume (MT) Analysis and Forecast by Region, 2018-2027

Table 03: Global Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Product Type, 2018-2027

Table 04: Global Medical Nutrition Market Volume (MT) Analysis and Forecast by Product Type, 2018-2027

Table 05: Global Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Indication, 2018-2027

Table 06: Global Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Indication, 2018-2027

Table 07: Global Medical Nutrition Market Volume (MT) Analysis and Forecast by Indication, 2018-2027

Table 08: Global Medical Nutrition Market Volume (MT) Analysis and Forecast by Indication, 2018-2027

Table 09: Global Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by End User, 2018-2027

Table 10: Global Medical Nutrition Market Volume (MT) Analysis and Forecast by End User, 2018-2027

Table 11: Global Medical Nutrition Market Value (US$) Analysis and Forecast by Flavored Segment, 2018-2027

Table 12: Global Medical Nutrition Market Value (US$) Analysis and Forecast by Flavor, 2018-2027

Table 13: Global Medical Nutrition Market Volume (MT) Analysis and Forecast by Flavored Segment, 2018-2027

Table 14: Global Medical Nutrition Market Volume (MT) Analysis and Forecast by Flavor, 2018-2027

Table 15: Global Medical Nutrition Market Value (US$) Analysis and Forecast by Indirect Segment, 2018-2027

Table 16: Global Medical Nutrition Market Value (US$) Analysis and Forecast by Distribution Channel, 2018-2027

Table 17: Global Medical Nutrition Market Volume (MT) Analysis and Forecast by Indirect Segment, 2018-2027

Table 18: Global Medical Nutrition Market Volume (MT) Analysis and Forecast by Distribution Channel, 2018-2027

Table 19: North America Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2027

Table 20: North America Medical Nutrition Market Volume (MT) Analysis and Forecast by Country, 2018-2027

Table 21: North America Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Product Type, 2018-2027

Table 22: North America Medical Nutrition Market Volume (MT) Analysis and Forecast by Product Type, 2018-2027

Table 23: North America Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Indication, 2018-2027

Table 24: North America Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Indication, 2018-2027

Table 25: North America Medical Nutrition Market Volume (MT) Analysis and Forecast by Indication, 2018-2027

Table 26: North America Medical Nutrition Market Volume (MT) Analysis and Forecast by Indication, 2018-2027

Table 27: North America Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by End User, 2018-2027

Table 28: North America Medical Nutrition Market Volume (MT) Analysis and Forecast by End User, 2018-2027

Table 29: North America Medical Nutrition Market Value (US$) Analysis and Forecast by Flavored Segment, 2018-2027

Table 30: North America Medical Nutrition Market Value (US$) Analysis and Forecast by Flavor, 2018-2027

Table 31: North America Medical Nutrition Market Volume (MT) Analysis and Forecast by Flavored Segment, 2018-2027

Table 32: North America Medical Nutrition Market Volume (MT) Analysis and Forecast by Flavor, 2018-2027

Table 33: North America Medical Nutrition Market Value (US$) Analysis and Forecast by Indirect Segment, 2018-2027

Table 34: North America Medical Nutrition Market Value (US$) Analysis and Forecast by Distribution Channel, 2018-2027

Table 35: North America Medical Nutrition Market Volume (MT) Analysis and Forecast by Indirect Segment, 2018-2027

Table 36: North America Medical Nutrition Market Volume (MT) Analysis and Forecast by Distribution Channel, 2018-2027

Table 37: Latin America Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2027

Table 38: Latin America Medical Nutrition Market Volume (MT) Analysis and Forecast by Country, 2018-2027

Table 39: Latin America Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Product Type, 2018-2027

Table 40: Latin America Medical Nutrition Market Volume (MT) Analysis and Forecast by Product Type, 2018-2027

Table 41: Latin America Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Indication, 2018-2027

Table 42: Latin America Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Indication, 2018-2027

Table 43: Latin America Medical Nutrition Market Volume (MT) Analysis and Forecast by Indication, 2018-2027

Table 44: Latin America Medical Nutrition Market Volume (MT) Analysis and Forecast by Indication, 2018-2027

Table 45: Latin America Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by End User, 2018-2027

Table 46: Latin America Medical Nutrition Market Volume (MT) Analysis and Forecast by End User, 2018-2027

Table 47: Latin America Medical Nutrition Market Value (US$) Analysis and Forecast by Flavored Segment, 2018-2027

Table 48: Latin America Medical Nutrition Market Value (US$) Analysis and Forecast by Flavor, 2018-2027

Table 49: Latin America Medical Nutrition Market Volume (MT) Analysis and Forecast by Flavored Segment, 2018-2027

Table 50: Latin America Medical Nutrition Market Volume (MT) Analysis and Forecast by Flavor, 2018-2027

Table 51: Latin America Medical Nutrition Market Value (US$) Analysis and Forecast by Indirect Segment, 2018-2027

Table 52: Latin America Medical Nutrition Market Value (US$) Analysis and Forecast by Distribution Channel, 2018-2027

Table 53: Latin America Medical Nutrition Market Volume (MT) Analysis and Forecast by Indirect Segment, 2018-2027

Table 54: Latin America Medical Nutrition Market Volume (MT) Analysis and Forecast by Distribution Channel, 2018-2027

Table 55: Europe Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2027

Table 56: Europe Medical Nutrition Market Volume (MT) Analysis and Forecast by Country, 2018-2027

Table 57: Europe Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Product Type, 2018-2027

Table 58: Europe Medical Nutrition Market Volume (MT) Analysis and Forecast by Product Type, 2018-2027

Table 59: Europe Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Indication, 2018-2027

Table 60: Europe Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Indication, 2018-2027

Table 61: Europe Medical Nutrition Market Volume (MT) Analysis and Forecast by Indication, 2018-2027

Table 62: Europe Medical Nutrition Market Volume (MT) Analysis and Forecast by Indication, 2018-2027

Table 63: Europe Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by End User, 2018-2027

Table 64: Europe Medical Nutrition Market Volume (MT) Analysis and Forecast by End User, 2018-2027

Table 65: Europe Medical Nutrition Market Value (US$) Analysis and Forecast by Flavored Segment, 2018-2027

Table 66: Europe Medical Nutrition Market Value (US$) Analysis and Forecast by Flavor, 2018-2027

Table 67: Europe Medical Nutrition Market Volume (MT) Analysis and Forecast by Flavored Segment, 2018-2027

Table 68: Europe Medical Nutrition Market Volume (MT) Analysis and Forecast by Flavor, 2018-2027

Table 69: Europe Medical Nutrition Market Value (US$) Analysis and Forecast by Indirect Segment, 2018-2027

Table 70: Europe Medical Nutrition Market Value (US$) Analysis and Forecast by Distribution Channel, 2018-2027

Table 71: Europe Medical Nutrition Market Volume (MT) Analysis and Forecast by Indirect Segment, 2018-2027

Table 72: Europe Medical Nutrition Market Volume (MT) Analysis and Forecast by Distribution Channel, 2018-2027

Table 73: APAC Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2027

Table 74: APAC Medical Nutrition Market Volume (MT) Analysis and Forecast by Country, 2018-2027

Table 75: APAC Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Product Type, 2018-2027

Table 76: APAC Medical Nutrition Market Volume (MT) Analysis and Forecast by Product Type, 2018-2027

Table 77: APAC Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Indication, 2018-2027

Table 78: APAC Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Indication, 2018-2027

Table 79: APAC Medical Nutrition Market Volume (MT) Analysis and Forecast by Indication, 2018-2027

Table 80: APAC Medical Nutrition Market Volume (MT) Analysis and Forecast by Indication, 2018-2027

Table 81: APAC Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by End User, 2018-2027

Table 82: APAC Medical Nutrition Market Volume (MT) Analysis and Forecast by End User, 2018-2027

Table 83: APAC Medical Nutrition Market Value (US$) Analysis and Forecast by Flavored Segment, 2018-2027

Table 84: APAC Medical Nutrition Market Value (US$) Analysis and Forecast by Flavor, 2018-2027

Table 85: APAC Medical Nutrition Market Volume (MT) Analysis and Forecast by Flavored Segment, 2018-2027

Table 86: APAC Medical Nutrition Market Volume (MT) Analysis and Forecast by Flavor, 2018-2027

Table 87: APAC Medical Nutrition Market Value (US$) Analysis and Forecast by Indirect Segment, 2018-2027

Table 88: APAC Medical Nutrition Market Value (US$) Analysis and Forecast by Distribution Channel, 2018-2027

Table 89: APAC Medical Nutrition Market Volume (MT) Analysis and Forecast by Indirect Segment, 2018-2027

Table 90: APAC Medical Nutrition Market Volume (MT) Analysis and Forecast by Distribution Channel, 2018-2027

Table 91: MEA Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2027

Table 92: MEA Medical Nutrition Market Volume (MT) Analysis and Forecast by Country, 2018-2027

Table 93: MEA Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Product Type, 2018-2027

Table 94: MEA Medical Nutrition Market Volume (MT) Analysis and Forecast by Product Type, 2018-2027

Table 95: MEA Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Indication, 2018-2027

Table 96: MEA Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by Indication, 2018-2027

Table 97: MEA Medical Nutrition Market Volume (MT) Analysis and Forecast by Indication, 2018-2027

Table 98: MEA Medical Nutrition Market Volume (MT) Analysis and Forecast by Indication, 2018-2027

Table 99: MEA Medical Nutrition Market Value (US$ Mn) Analysis and Forecast by End User, 2018-2027

Table 100: MEA Medical Nutrition Market Volume (MT) Analysis and Forecast by End User, 2018-2027

Table 101: MEA Medical Nutrition Market Value (US$) Analysis and Forecast by Flavored Segment, 2018-2027

Table 102: MEA Medical Nutrition Market Value (US$) Analysis and Forecast by Flavor, 2018-2027

Table 103: MEA Medical Nutrition Market Volume (MT) Analysis and Forecast by Flavored Segment, 2018-2027

Table 104: MEA Medical Nutrition Market Volume (MT) Analysis and Forecast by Flavor, 2018-2027

Table 105: MEA Medical Nutrition Market Value (US$) Analysis and Forecast by Indirect Segment, 2018-2027

Table 106: MEA Medical Nutrition Market Value (US$) Analysis and Forecast by Distribution Channel, 2018-2027

Table 107: MEA Medical Nutrition Market Volume (MT) Analysis and Forecast by Indirect Segment, 2018-2027

Table 108: MEA Medical Nutrition Market Volume (MT) Analysis and Forecast by Distribution Channel, 2018-2027

List of Figures

Figure 01: Global Medical Nutrition Market Value (US$ Mn) by Indication, 2018 & 2027

Figure 02: Global Medical Nutrition Market Value (US$ Mn) by Product Type, 2018 & 2027

Figure 03: Global Medical Nutrition Market Value (US$ Mn) by Flavor, 2018 & 2027

Figure 04: Global Medical Nutrition Market Value (US$ Mn) by End User, 2018 & 2027

Figure 05: Global Medical Nutrition Market Value (US$ Mn) by Distribution Channel, 2018 & 2027

Figure 06: Global Medical Nutrition Market Value (US$ Mn) by Region, 2018 & 2027

Figure 07: Global Medical Nutrition Market Share (%) & BPS Analysis by Region, 2018 & 2027

Figure 08: Global Medical Nutrition Market Y-o-Y Growth Rate (%) by Region, 2018–2027

Figure 09: Global Medical Nutrition Market Value (US$ Mn) Analysis & Forecast by Region, 2018–2027

Figure 10: Global Medical Nutrition Market Volume (MT) Analysis & Forecast by Region, 2018–2027

Figure 11: Global Medical Nutrition Market Share (%) & BPS Analysis by Product Type, 2018 & 2027

Figure 12: Global Medical Nutrition Market Y-o-Y Growth Rate (%) by Product Type, 2018–2027

Figure 13: Global Medical Nutrition Market Value (US$ Mn) Analysis & Forecast by Product Type, 2018–2027

Figure 14: Global Medical Nutrition Market Volume (MT) Analysis & Forecast by Product Type, 2018–2027

Figure 15: Global Medical Nutrition Market Share (%) & BPS Analysis by Indication, 2018 & 2027

Figure 16: Global Medical Nutrition Market Y-o-Y Growth Rate (%) by Indication, 2018–2027

Figure 17: Global Medical Nutrition Market Share (%) & BPS Analysis by End User, 2018 & 2027

Figure 18: Global Medical Nutrition Market Y-o-Y Growth Rate (%) by End User, 2018–2027

Figure 19: Global Medical Nutrition Market Value (US$ Mn) Analysis & Forecast by End User, 2018–2027

Figure 20: Global Medical Nutrition Market Volume (MT) Analysis & Forecast by End User, 2018–2027

Figure 21: Global Medical Nutrition Market Share (%) & BPS Analysis by Flavor, 2018 & 2027

Figure 22: Global Medical Nutrition Market Y-o-Y Growth Rate (%) by Flavor, 2018–2027

Figure 23: Global Medical Nutrition Market Value (US$ Mn) Analysis & Forecast by Flavor, 2018–2027

Figure 24: Global Medical Nutrition Market Volume (MT) Analysis & Forecast by Flavor, 2018–2027

Figure 25: Global Medical Nutrition Market Share (%) & BPS Analysis by Distribution Channel, 2018 & 2027

Figure 26: Global Medical Nutrition Market Y-o-Y Growth Rate (%) by Distribution Channel, 2018–2027

Figure 27: Global Medical Nutrition Market Value (US$ Mn) Analysis & Forecast by Distribution Channel, 2018–2027

Figure 28: Global Medical Nutrition Market Volume (MT) Analysis & Forecast by Distribution Channel, 2018–2027

Figure 29: Global Medical Nutrition Market Attractiveness Index by Product Type, 2018–2027

Figure 30: Global Medical Nutrition Market Attractiveness Index by Flavor, 2018–2027

Figure 31: Global Medical Nutrition Market Attractiveness Index by Indication, 2018–2027

Figure 32: Global Medical Nutrition Market Attractiveness Index by End User, 2018–2027

Figure 33: Global Medical Nutrition Market Attractiveness Index by Distribution Channel, 2018–2027

Figure 34: Global Medical Nutrition Market Attractiveness Index by Region, 2018–2027

Figure 35: North America Medical Nutrition Market Value (US$ Mn) by Indication, 2018 & 2027

Figure 36: North America Medical Nutrition Market Value (US$ Mn) by Product Type, 2018 & 2027

Figure 37: North America Medical Nutrition Market Value (US$ Mn) by Flavor, 2018 & 2027

Figure 38: North America Medical Nutrition Market Value (US$ Mn) by End User, 2018 & 2027

Figure 39: North America Medical Nutrition Market Value (US$ Mn) by Distribution Channel, 2018 & 2027

Figure 40: North America Medical Nutrition Market Value (US$ Mn) by Country, 2018 & 2027

Figure 41: North America Medical Nutrition Market Share (%) & BPS Analysis by Country, 2018 & 2027

Figure 42: North America Medical Nutrition Market Y-o-Y Growth Rate (%) by Country, 2018–2027

Figure 43: North America Medical Nutrition Market Value (US$ Mn) Analysis & Forecast by Country, 2018–2027

Figure 44: North America Medical Nutrition Market Volume (MT) Analysis & Forecast by Country, 2018–2027

Figure 45: North America Medical Nutrition Market Share (%) & BPS Analysis by Product Type, 2018 & 2027

Figure 46: North America Medical Nutrition Market Y-o-Y Growth Rate (%) by Product Type, 2018–2027

Figure 47: North America Medical Nutrition Market Share (%) & BPS Analysis by Indication, 2018 & 2027

Figure 48: North America Medical Nutrition Market Y-o-Y Growth Rate (%) by Indication, 2018–2027

Figure 49: North America Medical Nutrition Market Share (%) & BPS Analysis by End User, 2018 & 2027

Figure 50: North America Medical Nutrition Market Y-o-Y Growth Rate (%) by End User, 2018–2027

Figure 51: North America Medical Nutrition Market Share (%) & BPS Analysis by Flavor, 2018 & 2027

Figure 52: North America Medical Nutrition Market Y-o-Y Growth Rate (%) by Flavor, 2018–2027

Figure 53: North America Medical Nutrition Market Share (%) & BPS Analysis by Distribution Channel, 2018 & 2027

Figure 54: North America Medical Nutrition Market Y-o-Y Growth Rate (%) by Distribution Channel, 2018–2027

Figure 55: North America Medical Nutrition Market Attractiveness Index by Product Type, 2018–2027

Figure 56: North America Medical Nutrition Market Attractiveness Index by Flavor, 2018–2027

Figure 57: North America Medical Nutrition Market Attractiveness Index by Indication, 2018–2027

Figure 58: North America Medical Nutrition Market Attractiveness Index by End User, 2018–2027

Figure 59: North America Medical Nutrition Market Attractiveness Index by Distribution Channel, 2018–2027

Figure 60: North America Medical Nutrition Market Attractiveness Index by Region, 2018–2027

Figure 61: Latin America Medical Nutrition Market Value (US$ Mn) by Indication, 2018 & 2027

Figure 62: Latin America Medical Nutrition Market Value (US$ Mn) by Product Type, 2018 & 2027

Figure 63: Latin America Medical Nutrition Market Value (US$ Mn) by Flavor, 2018 & 2027

Figure 64: Latin America Medical Nutrition Market Value (US$ Mn) by End User, 2018 & 2027

Figure 65: Latin America Medical Nutrition Market Value (US$ Mn) by Distribution Channel, 2018 & 2027

Figure 66: Latin America Medical Nutrition Market Value (US$ Mn) by Country, 2018 & 2027

Figure 67: Latin America Medical Nutrition Market Share (%) & BPS Analysis by Country, 2018 & 2027

Figure 68: Latin America Medical Nutrition Market Y-o-Y Growth Rate (%) by Country, 2018–2027

Figure 69: Latin America Medical Nutrition Market Value (US$ Mn) Analysis & Forecast by Country, 2018–2027

Figure 70: Latin America Medical Nutrition Market Volume (MT) Analysis & Forecast by Country, 2018–2027

Figure 71: Latin America Medical Nutrition Market Share (%) & BPS Analysis by Product Type, 2018 & 2027

Figure 72: Latin America Medical Nutrition Market Y-o-Y Growth Rate (%) by Product Type, 2018–2027

Figure 73: Latin America Medical Nutrition Market Share (%) & BPS Analysis by Indication, 2018 & 2027

Figure 74: Latin America Medical Nutrition Market Y-o-Y Growth Rate (%) by Indication, 2018–2027

Figure 75: Latin America Medical Nutrition Market Share (%) & BPS Analysis by End User, 2018 & 2027

Figure 76: Latin America Medical Nutrition Market Y-o-Y Growth Rate (%) by End User, 2018–2027

Figure 77: Latin America Medical Nutrition Market Share (%) & BPS Analysis by Flavor, 2018 & 2027

Figure 78: Latin America Medical Nutrition Market Y-o-Y Growth Rate (%) by Flavor, 2018–2027

Figure 79: Latin America Medical Nutrition Market Share (%) & BPS Analysis by Distribution Channel, 2018 & 2027

Figure 80: Latin America Medical Nutrition Market Y-o-Y Growth Rate (%) by Distribution Channel, 2018–2027

Figure 81: Latin America Medical Nutrition Market Attractiveness Index by Product Type, 2018–2027

Figure 82: Latin America Medical Nutrition Market Attractiveness Index by Flavor, 2018–2027

Figure 83: Latin America Medical Nutrition Market Attractiveness Index by Indication, 2018–2027

Figure 84: Latin America Medical Nutrition Market Attractiveness Index by End User, 2018–2027

Figure 85: Latin America Medical Nutrition Market Attractiveness Index by Distribution Channel, 2018–2027

Figure 86: Latin America Medical Nutrition Market Attractiveness Index by Region, 2018–2027

Figure 87: Europe Medical Nutrition Market Value (US$ Mn) by Indication, 2018 & 2027

Figure 88: Europe Medical Nutrition Market Value (US$ Mn) by Product Type, 2018 & 2027

Figure 89: Europe Medical Nutrition Market Value (US$ Mn) by Flavor, 2018 & 2027

Figure 90: Europe Medical Nutrition Market Value (US$ Mn) by End User, 2018 & 2027

Figure 91: Europe Medical Nutrition Market Value (US$ Mn) by Distribution Channel, 2018 & 2027

Figure 92: Europe America Medical Nutrition Market Value (US$ Mn) by Country, 2018 & 2027

Figure 93: Europe Medical Nutrition Market Share (%) & BPS Analysis by Country, 2018 & 2027

Figure 94: Europe Medical Nutrition Market Y-o-Y Growth Rate (%) by Country, 2018–2027

Figure 95: Europe Medical Nutrition Market Value (US$ Mn) Analysis & Forecast by Country, 2018–2027

Figure 96: Europe Medical Nutrition Market Volume (MT) Analysis & Forecast by Country, 2018–2027

Figure 97: Europe Medical Nutrition Market Share (%) & BPS Analysis by Product Type, 2018 & 2027

Figure 98: Europe Medical Nutrition Market Y-o-Y Growth Rate (%) by Product Type, 2018–2027

Figure 99: Europe Medical Nutrition Market Share (%) & BPS Analysis by Indication, 2018 & 2027

Figure 100: Europe Medical Nutrition Market Y-o-Y Growth Rate (%) by Indication, 2018–2027

Figure 101: Europe Medical Nutrition Market Share (%) & BPS Analysis by End User, 2018 & 2027

Figure 102: Europe Medical Nutrition Market Y-o-Y Growth Rate (%) by End User, 2018–2027

Figure 103: Europe Medical Nutrition Market Share (%) & BPS Analysis by Flavor, 2018 & 2027

Figure 104: Europe Medical Nutrition Market Y-o-Y Growth Rate (%) by Flavor, 2018–2027

Figure 105: Europe Medical Nutrition Market Share (%) & BPS Analysis by Distribution Channel, 2018 & 2027

Figure 106: Europe Medical Nutrition Market Y-o-Y Growth Rate (%) by Distribution Channel, 2018–2027

Figure 107: Europe Medical Nutrition Market Attractiveness Index by Product Type, 2018–2027

Figure 108: Europe Medical Nutrition Market Attractiveness Index by Flavor, 2018–2027

Figure 109: Europe Medical Nutrition Market Attractiveness Index by Indication, 2018–2027

Figure 110: Europe Medical Nutrition Market Attractiveness Index by End User, 2018–2027

Figure 111: Europe Medical Nutrition Market Attractiveness Index by Distribution Channel, 2018–2027

Figure 112: Europe Medical Nutrition Market Attractiveness Index by Region, 2018–2027

Figure 113: Asia Pacific Medical Nutrition Market Value (US$ Mn) by Indication, 2018 & 2027

Figure 114: Asia Pacific Medical Nutrition Market Value (US$ Mn) by Product Type, 2018 & 2027

Figure 115: Asia Pacific Medical Nutrition Market Value (US$ Mn) by Flavor, 2018 & 2027

Figure 116: Asia Pacific Medical Nutrition Market Value (US$ Mn) by End User, 2018 & 2027

Figure 117: Asia Pacific Medical Nutrition Market Value (US$ Mn) by Distribution Channel, 2018 & 2027

Figure 118: Asia Pacific Medical Nutrition Market Value (US$ Mn) by Country, 2018 & 2027

Figure 119: APAC Medical Nutrition Market Share (%) & BPS Analysis by Country, 2018 & 2027

Figure 120: APAC Medical Nutrition Market Y-o-Y Growth Rate (%) by Country, 2018–2027

Figure 121: APAC Medical Nutrition Market Value (US$ Mn) Analysis & Forecast by Country, 2018–2027

Figure 122: APAC Medical Nutrition Market Volume (MT) Analysis & Forecast by Country, 2018–2027

Figure 123: APAC Medical Nutrition Market Share (%) & BPS Analysis by Product Type, 2018 & 2027

Figure 124: APAC Medical Nutrition Market Y-o-Y Growth Rate (%) by Product Type, 2018–2027

Figure 125: APAC Medical Nutrition Market Share (%) & BPS Analysis by Indication, 2018 & 2027

Figure 126: APAC Medical Nutrition Market Y-o-Y Growth Rate (%) by Indication, 2018–2027

Figure 127: APAC Medical Nutrition Market Share (%) & BPS Analysis by End User, 2018 & 2027

Figure 128: APAC Medical Nutrition Market Y-o-Y Growth Rate (%) by End User, 2018–2027

Figure 129: APAC Medical Nutrition Market Share (%) & BPS Analysis by Flavor, 2018 & 2027

Figure 130: APAC Medical Nutrition Market Y-o-Y Growth Rate (%) by Flavor, 2018–2027

Figure 131: APAC Medical Nutrition Market Share (%) & BPS Analysis by Distribution Channel, 2018 & 2027

Figure 132: APAC Medical Nutrition Market Y-o-Y Growth Rate (%) by Distribution Channel, 2018–2027

Figure 133: APAC Medical Nutrition Market Attractiveness Index by Product Type, 2018–2027

Figure 134: APAC Medical Nutrition Market Attractiveness Index by Flavor, 2018–2027

Figure 135: APAC Medical Nutrition Market Attractiveness Index by Indication, 2018–2027

Figure 136: APAC Medical Nutrition Market Attractiveness Index by End User, 2018–2027

Figure 137: APAC Medical Nutrition Market Attractiveness Index by Distribution Channel, 2018–2027

Figure 138: APAC Medical Nutrition Market Attractiveness Index by Region, 2018–2027

Figure 139: Middle East & Africa Medical Nutrition Market Value (US$ Mn) by Indication, 2018 & 2027

Figure 140: Middle East & Africa Medical Nutrition Market Value (US$ Mn) by Product Type, 2018 & 2027

Figure 141: Middle East & Africa Medical Nutrition Market Value (US$ Mn) by Flavor, 2018 & 2027

Figure 142: Middle East & Africa Medical Nutrition Market Value (US$ Mn) by End User, 2018 & 2027

Figure 143: Middle East & Africa Medical Nutrition Market Value (US$ Mn) by Distribution Channel, 2018 & 2027

Figure 144: Middle East & Africa Medical Nutrition Market Value (US$ Mn) by Country, 2018 & 2027

Figure 145: MEA Medical Nutrition Market Share (%) & BPS Analysis by Country, 2018 & 2027

Figure 146: MEA Medical Nutrition Market Y-o-Y Growth Rate (%) by Country, 2018–2027

Figure 147: MEA Medical Nutrition Market Value (US$ Mn) Analysis & Forecast by Country, 2018–2027

Figure 148: MEA Medical Nutrition Market Volume (MT) Analysis & Forecast by Country, 2018–2027

Figure 149: MEA Medical Nutrition Market Share (%) & BPS Analysis by Product Type, 2018 & 2027

Figure 150: MEA Medical Nutrition Market Y-o-Y Growth Rate (%) by Product Type, 2018–2027

Figure 151: MEA Medical Nutrition Market Share (%) & BPS Analysis by Indication, 2018 & 2027

Figure 152: MEA Medical Nutrition Market Y-o-Y Growth Rate (%) by Indication, 2018–2027

Figure 153: MEA Medical Nutrition Market Share (%) & BPS Analysis by End User, 2018 & 2027

Figure 154: MEA Medical Nutrition Market Y-o-Y Growth Rate (%) by End User, 2018–2027

Figure 155: MEA Medical Nutrition Market Share (%) & BPS Analysis by Flavor, 2018 & 2027

Figure 156: MEA Medical Nutrition Market Y-o-Y Growth Rate (%) by Flavor, 2018–2027

Figure 157: MEA Medical Nutrition Market Share (%) & BPS Analysis by Distribution Channel, 2018 & 2027

Figure 158: MEA Medical Nutrition Market Y-o-Y Growth Rate (%) by Distribution Channel, 2018–2027

Figure 159: MEA Medical Nutrition Market Attractiveness Index by Product Type, 2018–2027

Figure 160: MEA Medical Nutrition Market Attractiveness Index by Flavor, 2018–2027

Figure 161: MEA Medical Nutrition Market Attractiveness Index by Indication, 2018–2027

Figure 162: MEA Medical Nutrition Market Attractiveness Index by End User, 2018–2027

Figure 163: MEA Medical Nutrition Market Attractiveness Index by Distribution Channel, 2018–2027

Figure 164: MEA Medical Nutrition Market Attractiveness Index by Region, 2018–2027