LATAM Pharmaceutical Products and CMO Market: Snapshot

Latin America has a fast growing healthcare sector and the pharmaceutical industry in the region is likely to witness steady growth during the forecast period of 2016 to 2024. The growth of the pharmaceutical products and CMO market in LATAM is attributed to high foreign investment, a rising geriatric population, an improving regulatory environment, and an increase in trade agreements with other countries such as the U.S., Canada, Japan, and several countries in Europe.

Most pharmaceutical companies in LATAM are gradually outsourcing manufacturing activities to contract manufacturers in order to achieve cost efficiency, quality, capacity, and time to market. It is also being done to obtain expertise in a particular business category such as API manufacturing and packaging, which is not available in-house. According to Transparency Market Research, the pharmaceutical products and CMO market in Latin America is expected to grow from a value of US$127.9 bn in 2015 and to US$286.2 bn by 2024 at a strong CAGR of 9.3% therein.

TMR Reports Rising Demand for API and Ingredients in LATAM

Based on product type, the pharmaceutical products and CMO market comprises API and ingredients, finished dosage form, and pharmaceutical packaging.

The finished dosage form segment led the pharmaceutical products market in Latin America, accounting for a share of approximately 85% in 2015. This product form is an integral part of formulation and analytical research, clinical pharmacodynamics, and pharmacokinetics and as a result holds a significant share in the LATAM market. However, the API and ingredients segment is projected to expand at a high growth rate due to rising demand for APIs in the region and establishment of major multinational companies.

On the other hand, the API and ingredients segment dominated the CMO market in Latin America, accounting for a share of approximately 60% in 2015. The increasing demand for cost saving and efficiency is boosting this segment. The finished dosage form segment of the CMO market is expected to expand at a significant CAGR during the forecast period.

Improved Regulatory Scenario Works in Favor of Pharmaceutical Products and CMO Market in Brazil

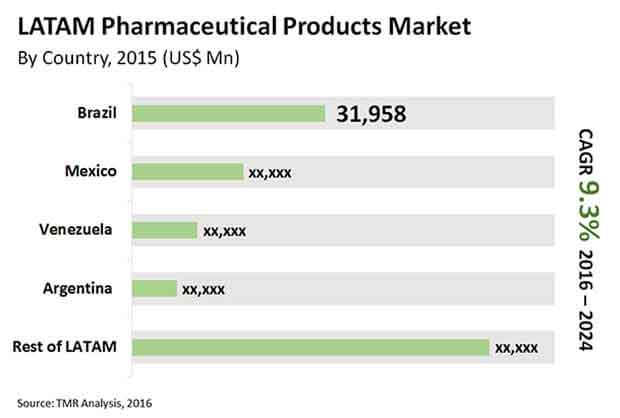

The pharmaceutical products and CMO market in Latin America has been segmented into major countries: Mexico, Brazil, Argentina, Venezuela, and Rest of Latin America.

Brazil accounted for a significant share in the LATAM pharmaceutical product and CMO market in 2015. Brazil’s dominance has been attributed to excellent geographical location, the development of innovative products, better regulatory scenario, and an accessible pricing structure. The rising income of the consumers and an expanding geriatric population will further boost the demand for medication, driving the pharmaceutical product and CMO market in Brazil.

Mexico was the second leading market for pharmaceutical products and CMO in 2015 due to its close proximity to North America. Rising free trade agreements with major countries in Europe and North America and the growing CMO industry are also expected to fuel the pharmaceutical product and CMO market in Mexico.

The pharmaceutical products market in Argentina is projected to expand at a high CAGR during the forecast period due to government support and the increasing reliability of domestic players. Rest of Latin America, which includes Chile, Colombia, Ecuador, Peru, Paraguay, Uruguay, and Bolivia, is projected to witness the second fastest growth rate during the course of the forecast period. Factors such as a large patient pool and favorable government initiatives aimed at improving access to healthcare facilities are likely to propel the pharmaceutical products and CMO market in Rest of Latin America.

Bayer AG, Novartis AG, Merck & Co., Inc., GSK plc, F. Hofmann La Roche, BASF SE, and Boehringer Ingelheim Group are some of the top players in the pharmaceutical products market in Latin America. Key participants in the CMO market in the region include Pisa Farmacéutica, Fresenius SE & Co. KGaA, Takeda Pharmaceutical Company Limited, Ferring Pharmaceuticals, and Inc., Landsteiner Scientific.

Section 1 Preface

1.1 Report Scope

1.2 Research Objective

Section 2 Assumptions and Research Methodology

Section 3 Executive Summary

Section 4 Market Overview

4.1 Product Overview

4.2 Key Industry Developments

4.3 Contract Manufacturing Regulations

Section 5 Market Dynamics

5.1 Drivers – Pharmaceutical Products Market

5.2 Restraints – Pharmaceutical Products Market

5.3 Opportunities – Pharmaceutical Products Market

5.4 Drivers – CMO Market

5.5 Restraints – CMO Market

5.6 Opportunities – CMO Market

5.7 Opportunity Analysis

5.8 Porter’s Analysis

5.9 Value Chain Analysis

Section 6 LATAM Pharmaceutical Products and CMO Market Analysis, by Product Type

6.1 Key Findings

6.2 Introduction

6.3 LATAM Pharmaceutical Products Market Value Share Analysis By Product Type, 2015 and 2024

6.4 LATAM Pharmaceutical Products Market Size (US$ Mn) Forecast By Product Type, 2014–2024

6.5 LATAM Pharmaceutical Products Market Analysis, by Product Type (1/7)

6.6 LATAM Pharmaceutical Products Market Attractiveness Analysis, by Product Type

6.7 LATAM CMO Market Size (US$ Mn) Forecast By Product Type, 2014–2024

6.8 Latin America CMO Market Value Share Analysis By Product Type, 2015 and 2024

6.9 LATAM CMO Market Analysis, by Product Type

6.10 LATAM CMO Market Attractiveness Analysis, by Product Type

6.11 Key Trends

Section 7 LATAM Pharmaceutical Products and CMO Market Analysis, by Country

7.1 Latin America Pharmaceutical Products Market Value Share Analysis, by Country

7.2 Pharmaceutical Products Market Forecast, by Country

7.3 Pharmaceutical Products Market Attractiveness Analysis, by Country, 2015

7.4 Latin America CMO Market Value Share Analysis, by Country, 2015 and 2024

7.5 Latin America CMO Market Forecast, by Country

Section 8 Mexico Pharmaceutical Products and CMO Market Analysis

8.1 Key Findings

8.2 Mexico Pharmaceutical Products Market Overview

8.3 Mexico Pharmaceutical Products Market Value Share Analysis, by Product, 2015 and 2024

8.4 Mexico Market Forecast, by Product

8.5 Mexico Market Attractiveness Analysis

8.6 Mexico CMO Market Overview

8.7 Mexico CMO Market Value Share Analysis, by Product, 2015 and 2024

8.8 Mexico CMO Market Forecast, by Product

8.9 Mexico CMO Market Attractiveness Analysis, by Product, 2015

8.10 Market Trends

Section 9 Brazil Pharmaceutical Products and CMO Market Analysis

9.1 Key Findings

9.2 Brazil Pharmaceutical Products Market Overview

9.3 Brazil Pharmaceutical Products Market Value Share Analysis, by Product, 2015 and 2024

9.4 Brazil Market Forecast, by Product

9.5 Brazil Market Attractiveness Analysis

9.6 Brazil CMO Market Overview

9.7 Brazil CMO Market Value Share Analysis, by Product, 2015 and 2024

9.8 Brazil CMO Market Forecast, by Product

9.9 Brazil CMO Market Attractiveness Analysis, by Product, 2015

9.10 Market Trends

Section 10 Venezuela Pharmaceutical Products and CMO Market Analysis

10.1 Key Findings

10.2 Venezuela Pharmaceutical Products Market Overview

10.3 Venezuela Pharmaceutical Products Market Value Share Analysis, by Product, 2015 and 2024

10.4 Venezuela Market Forecast, by Product

10.5 Venezuela Market Attractiveness Analysis

10.6 Venezuela CMO Market Overview

10.7 Venezuela CMO Market Value Share Analysis, by Product, 2015 and 2024

10.8 Venezuela CMO Market Forecast, by Product

10.9 Venezuela CMO Market Attractiveness Analysis, by Product, 2015

10.10 Market Trends

Section 11 Argentina Pharmaceutical Products and CMO Market Analysis

11.1 Key Findings

11.2 Argentina Pharmaceutical Products Market Overview

11.3 Argentina Pharmaceutical Products Market Value Share Analysis, by Product, 2015 and 2024

11.4 Argentina Market Forecast, by Product

11.5 Argentina Market Attractiveness Analysis

11.6 Argentina CMO Market Overview

11.7 Argentina CMO Market Value Share Analysis, by Product, 2015 and 2024

11.8 Argentina CMO Market Forecast, by Product

11.9 Argentina CMO Market Attractiveness Analysis, by Product, 2015

11.10 Market Trends

Section 12 Rest of Latin America Pharmaceutical Products and CMO Market Analysis

12.1 Key Findings

12.2 Rest of Latin America Pharmaceutical Products Market Overview

12.3 Rest of Latin America Pharmaceutical Products Market Value Share Analysis, by Product, 2015 and 2024

12.4 Rest of Latin America Market Forecast, by Product

12.5 Rest of Latin America Market Attractiveness Analysis

12.6 Rest of Latin America CMO Market Overview

12.7 Rest of Latin America CMO Market Value Share Analysis, by Product, 2015 and 2024

12.8 Rest of Latin America CMO Market Forecast, by Product

12.9 Rest of Latin America CMO Market Attractiveness Analysis, by Product, 2015

12.10 Market Trends

Section 13 Company Profiles

13.1 Competition Matrix

13.2 BASF SE

13.2.1 Company Overview (HQ, Business Segments, Employee Strength)

13.2.2 Financial Overview

13.2.3 Product Portfolio

13.2.4 SWOT Analysis

13.2.5 Strategic Overview

13.3 Bayer AG

13.3.1 Company Overview (HQ, Business Segments, Employee Strength)

13.3.2 Financial Overview

13.3.3 Product Portfolio

13.3.4 SWOT Analysis

13.3.5 Strategic Overview

13.4 Boehringer Ingelheim GmbH

13.4.1 Company Overview (HQ, Business Segments, Employee Strength)

13.4.2 Financial Overview

13.4.3 Product Portfolio

13.4.4 SWOT Analysis

13.4.5 Strategic Overview

13.5 F. Hoffmann-La Roche Ltd.

13.5.1 Company Overview (HQ, Business Segments, Employee Strength)

13.5.2 Financial Overview

13.5.3 Product Portfolio

13.5.4 SWOT Analysis

13.5.5 Strategic Overview

13.6 Merck & Co., Inc.

13.6.1 Company Overview (HQ, Business Segments, Employee Strength)

13.6.2 Financial Overview

13.6.3 Product Portfolio

13.6.4 SWOT Analysis

13.6.5 Strategic Overview

13.7 Novartis AG

13.7.1 Company Overview (HQ, Business Segments, Employee Strength)

13.7.2 Financial Overview

13.7.3 Product Portfolio

13.7.4 SWOT Analysis

13.7.5 Strategic Overview

13.8 Pfizer, Inc.

13.8.1 Company Overview (HQ, Business Segments, Employee Strength)

13.8.2 Financial Overview

13.8.3 Product Portfolio

13.8.4 SWOT Analysis

13.8.5 Strategic Overview

13.9 Pisa Farmacéutica

13.9.1 Company Overview (HQ, Business Segments, Employee Strength)

13.9.2 Financial Overview

13.9.3 Product Portfolio

13.9.4 SWOT Analysis

13.9.5 Strategic Overview

13.10 Fresenius SE & Co. KGaA

13.10.1 Company Overview (HQ, Business Segments, Employee Strength)

13.10.2 Financial Overview

13.10.3 Product Portfolio

13.10.4 SWOT Analysis

13.10.5 Strategic Overview

13.11 Takeda Pharmaceutical Company Limited

13.11.1 Company Overview (HQ, Business Segments, Employee Strength)

13.11.2 Financial Overview

13.11.3 Product Portfolio

13.11.4 SWOT Analysis

13.11.5 Strategic Overview

13.12 Ferring Pharmaceuticals, Inc.

13.12.1 Company Overview (HQ, Business Segments, Employee Strength)

13.12.2 Financial Overview

13.12.3 Product Portfolio

13.12.4 SWOT Analysis

13.12.5 Strategic Overview

13.13 Landsteiner Scientific

13.13.1 Company Overview (HQ, Business Segments, Employee Strength)

13.13.2 Financial Overview

13.13.3 Product Portfolio

13.13.4 SWOT Analysis

13.13.5 Strategic Overview

List of Tables

TABLE 1 LATAM Pharmaceutical Products Market Size (US$ Mn) Forecast, by Product Type, 2014–2024

TABLE 2 LATAM CMO Market Size (US$ Mn) Forecast, by Product Type, 2014–2024

TABLE 3 Latin America Pharmaceutical Products Market Size (US$ Mn) Forecast, by Country, 2016–2024

TABLE 4 Latin America Pharmaceutical Products Market Size (US$ Mn) Forecast, by Country, 2016–2024

TABLE 5 Mexico Pharmaceutical Products Market Size (US$ Mn) Forecast, by Product, 2014–2024

TABLE 6 Mexico CMO Market Size (US$ Mn) Forecast, by Product, 2016–2024

TABLE 7 Brazil Pharmaceutical Products Market Size (US$ Mn) Forecast, by Product, 2014–2024

TABLE 8 Brazil CMO Market Size (US$ Mn) Forecast, by Product, 2016–2024

TABLE 9 Venezuela Pharmaceutical Products Market Size (US$ Mn) Forecast, by Product, 2014–2024

TABLE 10 Venezuela CMO Market Size (US$ Mn) Forecast, by Product, 2016–2024

TABLE 11 Argentina Pharmaceutical Products Market Size (US$ Mn) Forecast, by Product, 2014–2024

TABLE 12 Argentina CMO Market Size (US$ Mn) Forecast, by Product, 2016–2024

TABLE 13 Rest of LATAM Pharmaceutical Products Market Size (US$ Mn) Forecast, by Product, 2014–2024

TABLE 14 Rest of LATAM CMO Market Size (US$ Mn) Forecast, by Product, 2016–2024

List of Figures

FIG. 1 LATAM Pharmaceutical Products Market Value Share Analysis, by Product Type, 2015 and 2024

FIG. 2 LATAM API and Ingredients Market Revenue (US$ Mn), 2014–2024

FIG. 3 LATAM Finished Dosage Form Market Revenue (US$ Mn), 2014–2024

FIG. 4 LATAM Pharmaceutical Packaging Market Revenue (US$ Mn), 2014–2024

FIG. 5 LATAM Pharmaceutical Products Market Attractiveness Analysis, by Product Type

FIG. 6 LATAM CMO Market Value Share Analysis By Product Type, 2015 and 2024

FIG. 7 LATAM API and Ingredients Market Revenue (US$ Mn), 2014–2024

FIG. 8 LATAM API and Ingredients Market Revenue (US$ Mn), 2014–2024

FIG. 9 LATAM Pharmaceutical Packaging Market Revenue (US$ Mn), 2014–2024

FIG. 10 LATAM CMO Market Attractiveness Analysis, by Product Type

FIG. 11 Latin America Pharmaceutical Products Market Value Share Analysis, by Country, 2015 and 2024

FIG. 12 Pharmaceutical Products Market Attractiveness Analysis, by Country, 2015

FIG. 13 Latin America Market Value Share Analysis,

FIG. 14 Mexico Pharmaceutical Products Market Size (US$ Mn) Forecast, 2014–2024

FIG. 15 Mexico Pharmaceutical Products Market Value Share Analysis, by Product, 2015 and 2024

FIG. 16 Mexico Pharmaceutical Products Market Attractiveness Analysis, by Product, 2015

FIG. 17 Mexico CMO Market Size (US$ Mn) Forecast, 2014–2024

FIG. 18 Mexico CMO Market Attractiveness Analysis, by Product

FIG. 19 Mexico CMO Market Value Share Analysis, by Product, 2015 and 2024

FIG. 20 Mexico CMO Market Attractiveness Analysis, By Product, 2015

FIG. 21 Brazil Pharmaceutical Products Market Size (US$ Mn) Forecast, 2014–2024

FIG. 22 Brazil Pharmaceutical Products Market Value Share Analysis, by Product, 2015 and 2024

FIG. 23 Brazil Pharmaceutical Products Market Attractiveness Analysis, by Product, 2015

FIG. 24 Brazil CMO Market Size (US$ Mn) Forecast, 2016–2024

FIG. 25 Brazil CMO Market Value Share Analysis, by Product, 2015 and 2024

FIG. 26 Brazil Market Attractiveness Analysis, by Product, 2015

FIG. 27 Venezuela Pharmaceutical Products Market Size (US$ Mn) Forecast, 2014–2024

FIG. 28 Venezuela Pharmaceutical Products Market Value Share Analysis, by Product, 2015 and 2024

FIG. 29 Venezuela Pharmaceutical Products Market Attractiveness Analysis, by Product, 2015

FIG. 30 Venezuela CMO Market Size (US$ Mn) Forecast, 2016–2024

FIG. 31 Venezuela CMO Market Value Share Analysis, by Product, 2015 and 2024

FIG. 32 Venezuela CMO Market Attractiveness Analysis, by Product, 2015 and 2024

FIG. 33 Argentina Pharmaceutical Products Market Size (US$ Mn) Forecast, 2014–2024

FIG. 34 Argentina Pharmaceutical Products Market Value Share Analysis, by Product, 2015 and 2024

FIG. 35 Argentina Pharmaceutical Products Market Attractiveness Analysis, by Product, 2015

FIG. 36 Argentina CMO Market Size (US$ Mn) Forecast, 2016–2024

FIG. 37 Argentina CMO Market Value Share Analysis,

FIG. 38 Argentina Market Attractiveness Analysis, by Product, 2015

FIG. 39 Rest of LATAM Pharmaceutical Products Market Size (US$ Mn) Forecast, 2014–2024

FIG. 40 Rest of LATAM Pharmaceutical Products Market Value Share Analysis, by Product, 2015 and 2024

FIG. 41 Rest of LATAM Pharmaceutical Products Market Attractiveness Analysis, by Product, 2015

FIG. 42 Rest of LATAM CMO Market Value Share Analysis,

FIG. 43 Rest of LATAM Market Attractiveness Analysis, by Product, 2015