Global Latex Medical Disposables Market: Snapshot

Latex medical disposables such as latex gloves are used during surgeries and check-ups. The demand for latex medical disposables is therefore quite high among doctors, surgeons, and dentists across the globe. Primarily, there are two types of latex gloves available in the market. These are powdered and non-powdered latex gloves. The non-powdered gloves might witness relatively more demand when compared with powdered gloves, as powdered gloves were found to be hindering the healing process of patients.

The market might encounter obstacles owing to the prevalence of latex allergies that induce several healthcare professionals to use non-latex products instead. Moreover, with the intensifying competition, the market players might have to bring down the prices of their products. As a result, sluggish growth in revenue might restrict the growth of the global market for latex medical disposables. However, the impact of these restraints will be negated by the emergence of novel technologies.

The global market for latex medical disposables was pegged at US$4.1bn in 2015, and is expected to rise up to achieve US$6.4bn by the end of 2024, expanding at a CAGR of 4.9%.

Rising Demand from Countries in Asia Pacific to Accelerate Growth

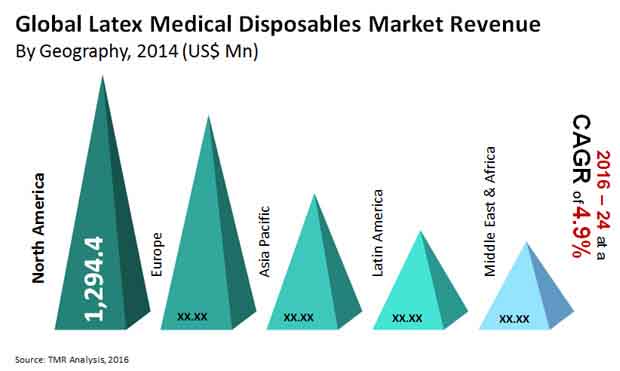

Based on geography, the global latex medical disposables market has been segmented into Europe, Asia pacific, Latin America, the Middle East and Africa, and North America. The global latex medical disposables market is presently dominated by North America, which accounted for a 33% share of the global market during 2016, with Europe close-by at its heels. The increasing concerns about safety, growing awareness about health and the spread of contagious diseases, and increasing measures for preventing the spread of these diseases are some of the major factors driving the the market in Europe and North America.

Asia Pacific is also slated for substantial growth during the forecast period, expanding at a promising CAGR of 5.8% between 2016 and 2024. The countries in Asia Pacific such as India, Japan, Singapore, China, Australia, and Thailand are likely to represent a significant portion of the global market for latex medical disposables over the coming years. The growth of these regions can be attributed to the growing awareness about the safety of patients and healthcare professionals, rising per capita incomes of people, increasing healthcare expenditures of governments, and flourishing medical and pharmaceutical sectors in these regions.

Latex Gloves Emerge as Dominant Product Segment

By product, the global market for latex medical disposables has been segmented into latex, foley catheters, latex gloves, urine bags, latex probe covers, and others. Hospitals, clinics, ambulatory surgical centers, diagnostic centers, and others are the key segments by end user. Of these, latex gloves have been witnessing increasing demand over the past few years. As a result, these products have been dominating the global market. In terms of revenue, this product segment accounted for nearly 60.4% of the global market for latex medical disposables during 2015. Latex gloves might continue to hold the foremost position as these gloves are an easy and effective way of protecting the hands of patients and healthcare providers from the risk of infection.

By end user, the hospitals segment dominated the global market for latex medical disposables in terms of revenue during 2015. The increasing number of surgical procedures and check-ups in hospitals, coupled with establishment of new clinics and hospitals is responsible for the dominance of this segment. This segment is slated to contribute 28.7% to the global market for latex medical disposables by the end of 2024. The diagnostic centers segment might hold the second-most position over the forecast period.

Some of the major companies operating in the global market for latex medical disposables are Hartalega Holdings Bhd., Supermax Corporation Berhad, B. Braun Melsungen, C.R. Bard, Ansell, Top Glove Corporation, Dynarex Corporation, and Medtronic plc.

Rising Prevalence of Latex Allergies to Boost Latex Medical Disposables Market Growth

Growing adoption of medical care enterprises of electronic wellbeing records (EHRs) in various regions across the globe is boosting the IT spending on clinical analytics. EHRs have shown promising potential in reducing medication mistakes, bring significant expense savings, and in improving population wellbeing. Medical services providers have likewise been leveraging the Latex medical disposables, for example, latex gloves are utilized during surgeries and registration. The interest for latex medical disposables is in this way quite high among specialists, surgeons, and dentists across the globe.

The market might experience deterrents owing to the pervasiveness of latex allergies that induce a few medical services professionals to utilize non-latex items instead. Additionally, with the intensifying competition, the market players might need to bring down the prices of their items. Therefore, sluggish development in income might restrict the development of the worldwide market for latex medical disposables. Be that as it may, the impact of these restraints will be discredited by the development of novel technologies.

Increasing number of situations where individuals are suffering from latex sensitivity is likely to challenge development in the worldwide latex medical disposable market. Owing to this reality, various medical services providers are using non-latex items that might limit development in this market.

Players are indulging in intense competition that leads in reducing prices of these items that as a rule diminish profits of the players. Consequently, lower incomes might hamper advancement in the worldwide latex medical disposable market.

Technological progressions taking spot in the medical services region is the key compute driving advancement the worldwide latex medical disposables market. Key market participants are investing in innovative technologies and developing new items for reducing infections and risks, thereby aiding in expansion of the global latex medical disposables market.

Chapter 1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

Chapter 2. Assumptions and Research Methodology

2.1. Assumptions

2.2. Research Methodology

Chapter 3. Executive Summary

3.1. Global Latex Medical Disposables Market Snapshot

3.2. Market Share Analysis by Region, 2015

3.3. Global Latex Medical Disposables Market : Opportunity Map

Chapter 4. Market Overview

4.1. Product Overview

4.2. Global Latex Medical Disposables Market : Key Industry Events

4.3. Global Latex Medical Disposables Market Size (US$ Mn) Forecast, 2014–2024

4.4. Latex Medical Disposables Market Outlook

4.5. Global Latex Medical Disposables Supply Demand Scenario

4.6. Porter’s Analysis

Chapter 5. Market Dynamics

5.1. Drivers

5.1.1. Technological advancements in latex catheters

5.1.2. Launch of novel latex catheters

5.1.3. Broad range of product offerings

5.1.4. Prominence in treatment of age-related disorders/diseases

5.1.5. Increasing prostate gland surgeries with use of latex catheters

5.1.6. Growing awareness about hygiene among patients and health care providers

5.2. Restrains

5.2.1. Latex allergy restricting growth of latex products

5.2.2. Use of substitute raw materials such as polyester

5.2.3. Stagnant pricing of latex gloves

5.3. Opportunities

5.3.1. Introduction of newer latex variants to gain competitive edge over non-latex products

5.3.2. Tap the emerging countries

5.4. Key Trends

5.4.1. Innovation and technology breakthroughs in synthetic variants

5.4.2. Manufacturers of latex gloves rise to the challenge

5.4.3. Vytex natural rubber latex - a modified and defined NRL source

Chapter 6. Latex Medical Disposables Market Analysis, by Product Type

6.1. Key Findings

6.2. Introduction

6.3. Global Latex Medical Disposables Market Value Share Analysis, by Product Type

6.4. Latex Medical Disposables Market Analysis, by Product Type

6.4.1. Latex Gloves

6.4.2. Latex Foley Catheters

6.4.3. Latex Probe Covers

6.4.4. Urine Bags

6.4.5. Others

6.5. Latex Medical Disposables Market Attractiveness Analysis, by Product Type

6.6. Key Trends

Chapter 7. Latex Medical Disposables Market Analysis, by End User

7.1. Key Findings

7.2. Introduction

7.3. Global Latex Medical Disposables Market Value Share Analysis, by End User

7.4. Latex Medical Disposables Market Analysis, by End User

7.4.1. Hospitals

7.4.1.1. Public Hospitals

7.4.1.2. Private Hospitals

7.4.2. Ambulatory Surgical Centers

7.4.3. Clinics

7.4.4. Diagnostic Centers

7.4.5. Others

7.5. Latex Medical Disposables Market Attractiveness Analysis, by End User

7.6. Key Trends

Chapter 8. Latex Medical Disposables Market Analysis, by Region

8.1. Global Latex Medical Disposables Market Snapshot, by Country

8.2. Global Latex Medical Disposables Market Value Share Analysis, by Region

8.3. Latex Medical Disposables Market Forecast, by Region

8.4. Latex Medical Disposables Market Attractiveness Analysis, by Region

Chapter 9. North America Latex Medical Disposables Market Analysis

9.1. Key Findings

9.2. North America Latex Medical Disposables Market Overview

9.3. North America Market Value Share Analysis, by Product

9.4. North America Market Forecast, by Product

9.4.1. Latex Gloves

9.4.2. Latex Foley Catheters

9.4.3. Latex Probe Covers

9.4.4. Urine Bags

9.4.5. Others

9.5. North America Latex Medical Disposables Market Value Share Analysis, by End User

9.6. North America Market Forecast, by End User

9.6.1. Hospitals

9.6.1.1. Public Hospitals

9.6.1.2. Private Hospitals

9.6.2. Ambulatory Surgical Centers

9.6.3. Clinics

9.6.4. Diagnostic Centers

9.6.5. Others

9.7. Market Analysis, by Country

9.8. Market Value Share Analysis, by Country

9.9. Market Size (US$ Mn) Forecast, by Country, 2016–2024

9.9.1. U.S.

9.9.2. Canada

9.10. Market Attractiveness Analysis

9.10.1. By Product

9.10.2. By End User

9.10.3. By Country

9.11. Market Trends

Chapter 10. Europe Latex Medical Disposables Market Analysis

10.1. Key Findings

10.2. Europe Latex Medical Disposables Market Overview

10.3. Europe Market Value Share Analysis, by Product

10.4. Europe Market Forecast, by Product

10.4.1. Latex Gloves

10.4.2. Latex Foley Catheters

10.4.3. Latex Probe Covers

10.4.4. Urine Bags

10.4.5. Others

10.5. Europe Latex Medical Disposables Market Value Share Analysis, by End User

10.6. Europe Market Forecast, by End User

10.6.1. Hospitals

10.6.1.1. Public Hospitals

10.6.1.2. Private Hospitals

10.6.2. Ambulatory Surgical Centers

10.6.3. Clinics

10.6.4. Diagnostic Centers

10.6.5. Others

10.7. Market Analysis, by Country

10.8. Market Value Share Analysis, by Country

10.9. Market Size (US$ Mn) Forecast, by Country, 2016–2024

10.9.1. Germany

10.9.2. U.K.

10.9.3. France

10.9.4. Spain

10.9.5. Italy

10.9.6. Russia

10.9.7. Rest of Europe

10.10. Market Attractiveness Analysis

10.10.1. By Product

10.10.2. By End User

10.10.3. By Country

10.11. Market Trends

Chapter 11. Asia Pacific Latex Medical Disposables Market Analysis

11.1. Key Findings

11.2. Asia Pacific Latex Medical Disposables Market Overview

11.3. Asia Pacific Market Value Share Analysis, by Product

11.4. Asia Pacific Market Forecast, by Product

11.4.1. Latex Gloves

11.4.2. Latex Foley Catheters

11.4.3. Latex Probe Covers

11.4.4. Urine Bags

11.4.5. Others

11.5. Asia Pacific Latex Medical Disposables Market Value Share Analysis, by End User

11.6. Asia Pacific Market Forecast, by End User

11.6.1. Hospitals

11.6.1.1. Public Hospitals

11.6.1.2. Private Hospitals

11.6.2. Ambulatory Surgical Centers

11.6.3. Clinics

11.6.4. Diagnostic Centers

11.6.5. Others

11.7. Market Analysis, by Country

11.8. Market Value Share Analysis, by Country

11.9. Market Size (US$ Mn) Forecast, by Country, 2016–2024

11.9.1. China

11.9.2. India

11.9.3. Japan

11.9.4. Australia & New Zealand

11.9.5. Rest of Asia Pacific

11.10. Market Attractiveness Analysis

11.10.1. By Product

11.10.2. By End User

11.10.3. By Country

11.11. Market Trends

Chapter 12. Latin America Latex Medical Disposables Market Analysis

12.1. Key Findings

12.2. Latin America Latex Medical Disposables Market Overview

12.3. Latin America Market Value Share Analysis, by Product

12.4. Latin America Market Forecast, by Product

12.4.1. Latex Gloves

12.4.2. Latex Foley Catheters

12.4.3. Latex Probe Covers

12.4.4. Urine Bags

12.4.5. Others

12.5. Latin America Latex Medical Disposables Market Value Share Analysis, by End User

12.6. Latin America Market Forecast, by End User

12.6.1. Hospitals

12.6.1.1. Public Hospitals

12.6.1.2. Private Hospitals

12.6.2. Ambulatory Surgical Centers

12.6.3. Clinics

12.6.4. Diagnostic Centers

12.6.5. Others

12.7. Market Analysis, by Country

12.8. Market Value Share Analysis, by Country

12.9. Market Size (US$ Mn) Forecast, by Country, 2016–2024

12.9.1. Brazil

12.9.2. Mexico

12.9.3. Rest of Latin America

12.10. Market Attractiveness Analysis

12.10.1. By Product

12.10.2. By End User

12.10.3. By Country

12.11. Market Trends

Chapter 13. Middle East & Africa Latex Medical Disposables Market Analysis

13.1. Key Findings

13.2. Middle East & Africa Latex Medical Disposables Market Overview

13.3. Middle East & Africa Market Value Share Analysis, by Product

13.4. Middle East & Africa Market Forecast, by Product

13.4.1. Latex Gloves

13.4.2. Latex Foley Catheters

13.4.3. Latex Probe Covers

13.4.4. Urine Bags

13.4.5. Others

13.5. Middle East & Africa Latex Medical Disposables Market Value Share Analysis, by End User

13.6. Middle East & Africa Market Forecast, by End User

13.6.1. Hospitals

13.6.1.1. Public Hospitals

13.6.1.2. Private Hospitals

13.6.2. Ambulatory Surgical Centers

13.6.3. Clinics

13.6.4. Diagnostic Centers

13.6.5. Others

13.7. Market Analysis, by Country

13.8. Market Value Share Analysis, by Country

13.9. Market Size (US$ Mn) Forecast, by Country, 2016–2024

13.9.1. South Africa

13.9.2. Saudi Arabia

13.9.3. UAE

13.9.4. Rest of Middle East & Africa

13.10. Market Attractiveness Analysis

13.10.1. By Product

13.10.2. By End User

13.10.3. By Country

13.11. Market Trends

Chapter 14. Company Profiles

14.1. Latex Medical Disposables Market Share Analysis, by Company (2015)

14.2. Competition Matrix

14.3. Company Profiles

14.3.1. Ansell

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Financial Overview

14.3.1.3. Product Portfolio

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Top Glove Corporation

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Financial Overview

14.3.2.3. Product Portfolio

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Hartalega Holdings Berhad

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Financial Overview

14.3.3.3. Product Portfolio

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Dynarex Corporation

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Financial Overview

14.3.4.3. Product Portfolio

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Supermax Corporation Berhad

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Financial Overview

14.3.5.3. Product Portfolio

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. B. Braun Melsungen AG

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Financial Overview

14.3.6.3. Product Portfolio

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. C. R. Bard, Inc.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Financial Overview

14.3.7.3. Product Portfolio

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Medtronic plc.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Financial Overview

14.3.8.3. Product Portfolio

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

List of Tables

Table 1: Global Latex Medical Disposables Market Size (US$ Mn) Forecast, by Product Type, 2014–2024

Table 2: Global Latex Medical Disposables Market Size (US$ Mn) Forecast, by End User, 2014–2024

Table 3: Global Latex Medical Disposables Market Size (US$ Mn) Forecast, by Hospital Types, 2014–2024

Table 4: Global Latex Medical Disposables Market Size (US$ Mn) Forecast, by Region, 2014–2024

Table 5: North America Latex Medical Disposables Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 6: North America Latex Medical Disposables Market Size (US$ Mn) Forecast, by End User, 2014–2024

Table 7: North America Latex Medical Disposables Market Size (US$ Mn) Forecast, by Hospital Types, 2014–2024

Table 8: North America Latex Medical Disposables Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 9: Europe Latex Medical Disposables Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 10: Europe Latex Medical Disposables Market Size (US$ Mn) Forecast, by End User, 2014–2024

Table 11: Europe Latex Medical Disposables Market Size (US$ Mn) Forecast, by Hospital Types, 2014–2024

Table 12: Europe Latex Medical Disposables Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 13: Asia Pacific Latex Medical Disposables Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 14: Asia Pacific Latex Medical Disposables Market Size (US$ Mn) Forecast, by End User, 2014–2024

Table 15: Asia Pacific Latex Medical Disposables Market Size (US$ Mn) Forecast, by Hospital Types, 2014–2024

Table 16: Asia Pacific Latex Medical Disposables Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 17: Latin America Latex Medical Disposables Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 18: Latin America Latex Medical Disposables Market Size (US$ Mn) Forecast, by End User, 2014–2024

Table 19: Latin America Latex Medical Disposables Market Size (US$ Mn) Forecast, by Hospital Types, 2014–2024

Table 20: Latin America Latex Medical Disposables Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 21: Middle East & Africa Latex Medical Disposables Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 22: Middle East & Africa Latex Medical Disposables Market Size (US$ Mn) Forecast, by End User, 2014–2024

Table 23: Middle East & Africa Latex Medical Disposables Market Size (US$ Mn) Forecast, by Hospital Types, 2014–2024

Table 24: Middle East & Africa Latex Medical Disposables Market Size (US$ Mn) Forecast, by Country, 2014–2024

List of Figures

Figure 1: Global Latex Medical Disposables Market Size (US$ Mn) Forecast, 2014–2024

Figure 2: Global Latex Medical Disposables Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 3: Global Latex Gloves Market Revenue, US$ Mn,

Figure 4: Global Latex Foley Catheters Market Revenue, US$ Mn, 2014–2024

Figure 5: Global Latex Probe Covers Market Revenue, US$ Mn, 2014–2024

Figure 6: Global Urine Bags Market Revenue, US$ Mn, 2014–2024

Figure 7: Global Others Market Revenue, US$ Mn, 2014–2024

Figure 8: Latex Medical Disposables Market Attractiveness Analysis, by Product Type, 2016-2024

Figure 9: Global Latex Medical Disposables Market Value Share Analysis, by End User, 2016 and 2024

Figure 10: Global Hospitals Market Revenue, US$ Mn,

Figure 11: Global Ambulatory Surgical Centers Market Revenue, US$ Mn, 2014–2024

Figure 12: Global Clinics Market Revenue, US$ Mn, 2014–2024

Figure 13: Global Diagnostic Centers Market Revenue, US$ Mn, 2014–2024

Figure 14: Global Others Market Revenue, US$ Mn, 2014–2024

Figure 15: Latex Medical Disposables Market Attractiveness Analysis, by End User, 2016-2024

Figure 16: Global Latex Medical Disposables Market Value Share Analysis, by Region, 2016 and 2024

Figure 17: Latex Medical Disposables Market Attractiveness Analysis, by Region

Figure 18: North America Latex Medical Disposables Market Size (US$ Mn) Forecast, 2016–2024

Figure 19: North America Market Attractiveness Analysis, by Country

Figure 20: North America Market Value Share Analysis, by Product, 2016 and 2024

Figure 21: North America Latex Medical Disposables Market Value Share Analysis, by End User, 2016 and 2024

Figure 22: North America Market Value Share Analysis, by Country, 2016 and 2024

Figure 23: North America Market Attractiveness Analysis, by Product

Figure 24: North America Market Attractiveness Analysis, by End User

Figure 25: Europe Latex Medical Disposables Market Size (US$ Mn) Forecast, 2016–2024

Figure 26: Europe Market Attractiveness Analysis, by Country

Figure 27: Europe Market Value Share Analysis, by Product, 2016 and 2024

Figure 28: Europe Latex Medical Disposables Market Value Share Analysis, by End User, 2016 and 2024

Figure 29: Europe Market Value Share Analysis, by Country, 2016 and 2024

Figure 30: Europe Market Attractiveness Analysis, by Product, 2016-2024

Figure 31: Europe Market Attractiveness Analysis, by End User, 2016-2024

Figure 32: Asia Pacific Latex Medical Disposables Market Size (US$ Mn) Forecast, 2016–2024

Figure 33: Asia Pacific Market Attractiveness Analysis, by Country

Figure 34: Asia Pacific Market Value Share Analysis, by Product, 2016 and 2024

Figure 35: Asia Pacific Latex Medical Disposables Market Value Share Analysis, by End User, 2016 and 2024

Figure 36: Asia Pacific Market Value Share Analysis, by Country, 2016 and 2024

Figure 37: Asia Pacific Market Attractiveness Analysis, by Product, 2016-2024

Figure 38: Asia Pacific Market Attractiveness Analysis, by End User, 2016-2024

Figure 39: Latin America Latex Medical Disposables Market Size (US$ Mn) Forecast, 2016–2024

Figure 40: Latin America Market Attractiveness Analysis, by Country, 2016- 2024

Figure 41: Latin America Market Value Share Analysis, by Product, 2016 and 2024

Figure 42: Latin America Latex Medical Disposables Market Value Share Analysis, by End User, 2016 and 2024

Figure 43: Latin America Market Value Share Analysis, by Country, 2016 and 2024

Figure 44: Latin America Market Attractiveness Analysis, by Product, 2016-2024

Figure 45: Latin America Market Attractiveness Analysis, by End User, 2016-2024

Figure 46: Middle East & Africa Latex Medical Disposables Market Size (US$ Mn) Forecast, 2016–2024

Figure 47: Middle East & Africa Market Attractiveness Analysis, by Country

Figure 48: Middle East & Africa Market Value Share Analysis, by Product, 2016 and 2024

Figure 49: Middle East & Africa Latex Medical Disposables Market Value Share Analysis, by End User, 2016 and 2024

Figure 50: Middle East & Africa Market Value Share Analysis, by Country, 2016 and 2024

Figure 51: Middle East & Africa Market Attractiveness Analysis, by Product, 2016-2024

Figure 52: Middle East & Africa Market Attractiveness Analysis, by End User, 2016-2024

Figure 53: Global Latex Medical Disposables Market Share Analysis, by Company (2015)