The India regenerative uninterruptible power supply (UPS) market is expected to garner momentum in terms of growth. Industrial activities are considerably rising in India over the years. After liberalization in 1991, the industrial sector has seen key changes and many investors and manufacturers started investing in India for setting up industries. Hence, carrying out industrial activities smoothly without any disturbance or interruption is key for economic prosperity. This is where regenerative UPS comes in the picture. The regenerative units use regenerative load from the braking action for creating regulated power which is attached to machines generating regenerative load. Therefore, this leads to electricity generation, thus providing an uninterrupted power supply during power cuts.

Peak of Industrialization Creates UPS Demand in India

As India finds itself on the verge of an industrial makeover, the country is exhibiting a great demand for power supply. The weakest link in this situation, however, is that the country's energy mix largely depends on fossil fuels. The high cost of these fossil fuels and the irregularities in the supply of energy have left several industrial verticals in a lurch, bringing down their productivity by about 10% every day.

According to a research report published by Transparency Market Research, these dynamics of the energy market have created a huge stir amongst manufacturers and industry honchos to seek smooth power supply solutions. Citing these reasons, Transparency Market Research states that the India regenerative uninterruptible power supply market has a huge scope in the foreseeable future.

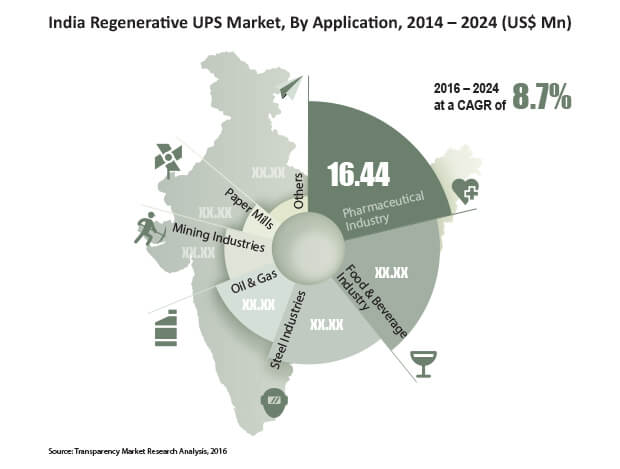

According to the research report, the opportunity in the India regenerative UPS market will be worth US$163.11 mn by 2024 from US$76.86 mn in 2015. Between the 2016 and 2024, the overall market is anticipated to rise at a CAGR of 8.7%. The impressive growth of this market will be attributable to the relentless growth of the Indian economy and the steady prospect of its financial future. The rampant industrialization that needs the constant power supply will steer the growth of this market.

Ability to Conserve Energy Lures in Companies to Spend on UPS Systems

The unique selling point of regenerative UPS systems is their ability to conserve energy for a nation that has been battling the energy crisis since long. Given these factors, the regenerative converter is the top selling product in the overall market. Installation of these units not only ensures an uninterrupted supply but also allows a seamless manufacturing experience. The report suggests that regenerative converter UPS units are also being considered by end users such as the oil and gas industry, pharmaceutical industry, and the food and beverage industry as they prevent the machinery from being damaged.

Despite the shining future of the India UPS market, the heavy installation costs and the capital-intensive nature of this equipment are shadowing the market. The failure to see the long-term benefits of installing UPS units such as improving operational efficiency are also contributing towards hampering this market from realizing its full potential. Furthermore, the undeterred entry of counterfeit UPS units into the Indian market are also preventing the possible growth options of this market.

South Zone to Flourish in Comparison with Other Regions

Regionally, the south zone of India is expected to show a remarkable support for the growth of the India UPS market. Besides being the most developed region in the country, it has huge manufacturing hubs. The south zone has a strong presence of key automobile manufacturers, textile industries, chemical companies, and several food and beverages players as well. Adoption of energy conservation measures by these companies is going propel the India UPS market in the forecast period.

The chief operating players in the India UPS market are Genesis Power Equipments Limited, Hitachi Hi-Rel Power Electronics Pvt. Ltd., Riello PCI India Pvt. Ltd., SU-KAM Power Systems Ltd., and Bonfiglioli Transmissions Pvt. Ltd. amongst others. To create a mark amongst the consumers, these companies will have to cater to the specific needs of their clients by customizing their solutions.

Table of Content

Section 1 Preface

Section 2 Executive Summary

Section 3 Industry Analysis

Section 4 India Regenerative UPS: Product Type Overview

Section 5 India Regenerative UPS: Technology Overview

Section 6 India Regenerative UPS: Application Overview

Section 7 Regenerative UPS Market: Regional Overview

Section 8 Company Profiles

List of Tables

Table 1 India Regenerative UPS Market: Snapshot

Table 2 India Regenerative UPS Market Value, By Application, 2014 - 2024 (US$ Mn)

List of Figures

Figure 1 Regenerative UPS Market – Market Segmentation

Figure 2 India Regenerative UPS Market, Estimates and Forecast, by Revenue (US$ Mn), 2014–2024

Figure 3 India Regenerative UPS Market, Product Revenue, By Region, 2015 (US$ Mn)

Figure 4 Industry Analysis – Value Chain Analysis

Figure 5 Industrial Production Index of Major Industries, India (2010–2016)

Figure 6 Rise in Industrial Power Demand (2009–2016)

Figure 7 Power Supply-Demand Scenario in India (2009-20016)

Figure 8 Uninterrupted Power Technology Adoption, By Industries, 2014

Figure 9 Major Government Initiatives for Energy Conservations Timeline

Figure 10 Supply of Working Capital for MSMEs, 2010 to 2017

Figure 11 Contribution of MSMEs to Indian Economy

Figure 12 Strategic Analysis – Porters Five Forces Model

Figure 13 Market Attractiveness Analysis of India Regenerative UPS Market, 2014

Figure 14 India Regenerative UPS, Company Market Share (%) (2014)

Figure 15 India Regenerative UPS Market Value, By Product Type, 2014 - 2024

Figure 16 India Regenerative UPS Market Share Analysis, By Product Type, 2014 and 2024

Figure 17 Regenerative UPS Market Value, By Regenerative Converter Type, 2014 - 2024

Figure 18 Market Growth Meter: Regenerative Converter, CAGR (2016–2024)

Figure 19 Regenerative UPS Market Value, By Sinusoidal PWM Type, 2014 and 2024

Figure 20 Market Growth Meter: Sinusoidal PWM, CAGR (2016–2024)

Figure 21 Regenerative UPS Market Value, By Matrix Converter Type, 2014 - 2024

Figure 22 Market Growth Meter: Matrix Converter, CAGR (2016–2024)

Figure 23 India Regenerative UPS Market Value, By Technology Type, 2014 - 2024

Figure 24 India Regenerative UPS Market Share Analysis, By Technology Type, 2014 and 2024

Figure 25 Regenerative UPS Market Value, By Spindle Drives Type, 2014 - 2024

Figure 26 Spindle Drives Market Growth Meter: CAGR (2016–2024)

Figure 27 Regenerative UPS Market Value, By Decanter Centrifuges Type, 2014 - 2024

Figure 28 Decanter Centrifuges Market Growth Meter: CAGR (2016–2024)

Figure 29 Regenerative UPS Market Value, By Elevators Type, 2014 - 2024

Figure 30 Elevators Market Growth Meter: CAGR (2016–2024)

Figure 31 Regenerative UPS Market Value, By Other Type, 2014 and 2024

Figure 32 Other Market Growth Meter: CAGR (2016–2024)

Figure 33 India Regenerative UPS Market Share Analysis, By Application, 2014 and 2024

Figure 34 Regenerative UPS Market Value, By Pharmaceutical Industry Application, 2014 and 2024

Figure 35 Regenerative UPS Market Value, Food & Beverage Industry Application, 2014 and 2024

Figure 36 Regenerative UPS Market Value, By Steel Industries Application, 2014 and 2024

Figure 37 Regenerative UPS Market Value, By Oil & Gas Application, 2014 and 2024

Figure 38 Regenerative UPS Market Value, By Mining Industry Application, 2014 and 2024

Figure 39 Regenerative UPS Market Value, By Paper Mills Application, 2014 and 2024

Figure 40 Regenerative UPS Market Value, By Other Applications, 2014 and 2024

Figure 41 India Regenerative UPS Market Share Analysis, By Geography, 2014

Figure 42 East Zone Regenerative Converter Market, 2014–2024

Figure 43 East Zone Matrix Converter Market, 2014–2024

Figure 44 East Zone Sinusoidal PWM Market, 2014–2024

Figure 45 East Zone Regenerative UPS Market, By Spindle Drives Technology, 2014–2024

Figure 46 East Zone Regenerative UPS Market, By Elevators Technology, 2014–2024

Figure 47 East Zone Regenerative UPS Market, By Decanter Centrifuges Technology, 2014–2024

Figure 48 East Zone Regenerative UPS Market, By Other Technology, 2014–2024

Figure 49 East Zone Regenerative UPS Market, By Pharmaceutical Application, 2014–2024

Figure 50 East Zone Regenerative UPS Market, By Steel Industries Application, 2014–2024

Figure 51 East Zone Regenerative UPS Market, By Food & Beverage Industry Application, 2014–2024

Figure 52 East Zone Regenerative UPS Market, By Oil & Gas Application, 2014–2024

Figure 53 East Zone Regenerative UPS Market, By Mining Application, 2014–2024

Figure 54 East Zone Regenerative UPS Market, By Other Applications, 2014–2024

Figure 55 East Zone Regenerative UPS Market, By Paper Mills Industry Application, 2014–2024

Figure 56 West Zone Regenerative Converter Market, 2014–2024

Figure 57 West Zone Matrix Converter Market, 2014–2024

Figure 58 West Zone Sinusoidal PWM Market, 2014–2024

Figure 59 West Zone Regenerative UPS Market, By Spindle Drives Technology, 2014–2024

Figure 60 West Zone Regenerative UPS Market, By Elevators Technology, 2014–2024

Figure 61 West Zone Regenerative UPS Market, By Decanter Centrifuges Technology, 2014–2024

Figure 62 West Zone Regenerative UPS Market, By Other Technology, 2014–2024

Figure 63 West Zone Regenerative UPS Market, By Pharmaceutical Application, 2014–2024

Figure 64 West Zone Regenerative UPS Market, By Steel Industries Application, 2014–2024

Figure 65 West Zone Regenerative UPS Market, By Food & Beverage Industry Application, 2014–2024

Figure 66 West Zone Regenerative UPS Market, By Oil & Gas Application, 2014–2024

Figure 67 West Zone Regenerative UPS Market, By Mining Application, 2014–2024

Figure 68 West Zone Regenerative UPS Market, By Other Applications, 2014–2024

Figure 69 West Zone Regenerative UPS Market, By Paper Mills Industry Application, 2014–2024

Figure 70 North Zone Regenerative Converter Market, 2014–2024

Figure 71 North Zone Matrix Converter Market, 2014–2024

Figure 72 North Zone Sinusoidal PWM Market, 2014–2024

Figure 73 North Zone Regenerative UPS Market, By Spindle Drives Technology, 2014–2024

Figure 74 North Zone Regenerative UPS Market, By Elevators Technology, 2014–2024

Figure 75 North Zone Regenerative UPS Market, By Decanter Centrifuges Technology, 2014–2024

Figure 76 North Zone Regenerative UPS Market, By Other Technology, 2014–2024

Figure 77 North Zone Regenerative UPS Market, By Pharmaceutical Application, 2014–2024

Figure 78 North Zone Regenerative UPS Market, By Steel Industries Application, 2014–2024

Figure 79 North Zone Regenerative UPS Market, By Food & Beverage Industry Application, 2014–2024

Figure 80 North Zone Regenerative UPS Market, By Oil & Gas Application, 2014–2024

Figure 81 North Zone Regenerative UPS Market, By Mining Application, 2014–2024

Figure 82 North Zone Regenerative UPS Market, By Other Applications, 2014–2024

Figure 83 North Zone Regenerative UPS Market, By Paper Mills Industry Application, 2014–2024

Figure 84 South Zone Regenerative Converter Market, 2014–2024

Figure 85 South Zone Matrix Converter Market, 2014–2024

Figure 86 South Zone Sinusoidal PWM Market, 2014–2024

Figure 87 South Zone Regenerative UPS Market, By Spindle Drives Technology, 2014–2024

Figure 88 South Zone Regenerative UPS Market, By Elevators Technology, 2014–2024

Figure 89 South Zone Regenerative UPS Market, By Decanter Centrifuges Technology, 2014–2024

Figure 90 South Zone Regenerative UPS Market, By Other Technology, 2014–2024

Figure 91 South Zone Regenerative UPS Market, By Pharmaceutical Application, 2014–2024

Figure 92 South Zone Regenerative UPS Market, By Steel Industries Application, 2014–2024

Figure 93 South Zone Regenerative UPS Market, By Food & Beverage Industry Application, 2014–2024

Figure 94 South Zone Regenerative UPS Market, By Oil & Gas Application, 2014–2024

Figure 95 South Zone Regenerative UPS Market, By Mining Application, 2014–2024

Figure 96 South Zone Regenerative UPS Market, By Other Applications, 2014–2024

Figure 97 South Zone Regenerative UPS Market, By Paper Mills Industry Application, 2014–2024