Analysts’ Viewpoint on Global Market Scenario

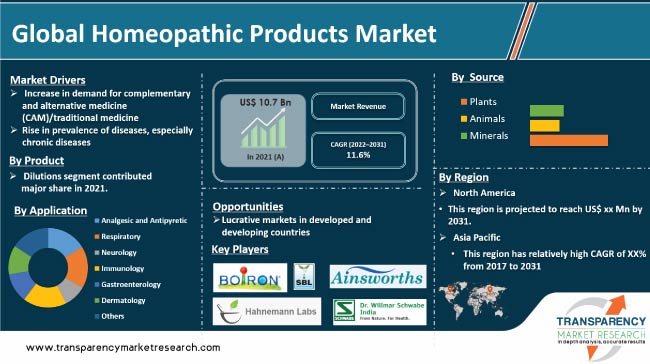

Increase in number of prescriptions for homeopathic medicine products during the COVID-19 pandemic has driven the global market for homeopathic products. Introduction of new products by various organizations is expected to propel the global homeopathic products market during the forecast period. The European League Against Rheumatism (EULAR) Congress disclosed that Traumeel and Zeel T co-administered intra-articular (IA) injections provided a new first line injection treatment option in the management of moderate to severe osteoarthritis of the knee, where oral pain management failed. Furthermore, acquisitions by companies contributed to the growth of the global market. In June 2020, Dr. Willmar Schwabe India acquired Sanat Products Limited to offer a diverse range of natural products in India and across the globe. The company aims to expand its presence in India with 50,000 outlets over a period of three to four years. Rise in prevalence of diseases, especially chronic diseases, increase in the demand for complementary products, cost-effectiveness of the products & safety, and less risk of adverse side-effects are augmenting the global market.

Homeopathy is an alternative medical system created more than 200 years ago in Germany. Homeopathic products are made from various sources, including plants, animals, and minerals. Typically, the products are composed of pellets that are meant to be ingested under the tongue. These could also come in different formulations including pills, ointments, drops, creams, and gels. Homeopathy primarily distinguishes between the clinical patterns of the signs & symptoms that are distinct from those of personalized medicine and uses a separate diagnostic method to allocate remedies to specific individuals.

Homeopathic and herbal products have similarities, but they are not the same. They differ in the remedy. Herbal medicines can be either medicinal plant or extract from them. It could include roots and stems. More often, it can include flowers, medicines, etc. There is one big difference between homeopathic and herbal products, i.e., the concentration of the medicine. Herbal medicines have measurable amounts of active ingredients, while homeopathic medicines contain little or no active ingredients. Homeopathic medicine products are usually dilute and even inert. Homeopathic medicine products are available on both platforms. One can avail of homeopathic products online or purchase from stores.

In 2016, the U.S. Federal Trade Commission (FTC) declared that it would hold efficacy and safety claims for over-the-counter homeopathic medicines to the same standards as those for other products making comparable claims. Additionally, it is noted that businesses should have qualified and trustworthy scientific proof the FTC demands any health-related claims, including those stating a product could treat a certain ailment. According to a 2016 review of survey data, the majority of persons who take homeopathic remedies do so for musculoskeletal discomfort and colds.

Numerous contemporary medical issues can be resolved with homeopathy as a complementary and alternative medicine (CAM) and holistic treatment. A German physician named Samuel Hahnemann first created homeopathy. Based on the ‘like cures like’ theory, about 3,000 homeopathic remedies were used to treat ailments (similia similibus curentur). Studies have shown that more people are using complementary and alternative medicine (CAM), including those who are unable to pay for traditional medical care.

According to the Homeopathy Research Institute (HRI), more than 200 million people across the world regularly use homeopathy. It is integrated into the national health systems of several countries such as Brazil, Chile, India, Mexico, Pakistan, and Switzerland. Hence, an increase in preference for complementary and alternative medicine (CAM)/traditional medicine over conventional medicine is driving the alternative medicines market.

Chronic diseases are the leading causes of death and disability globally. The incidence of comorbidities with these diseases is accelerating globally, developing in all regions and affecting all social and economic classes. Chronic diseases are primarily defined in terms of biomedical disease categories, such as diabetes, asthma, and depression. Chronic diseases are one of the most common and expensive health issues in the U.S. Nearly half of the people of the country (about 45% or 133 million) have at least one chronic disease, and the number is increasing. Chronic diseases such as cancer, diabetes, high blood pressure, stroke, heart disease, respiratory disease, arthritis, obesity, and oral disease could lead to hospitalization, long-term disability, reduction in quality of life, death, and disability. In the U.S. alone, chronic diseases account for nearly 75% of total healthcare costs, or about US$ 5,300 per person per year, according to the Centers for Disease Control and Prevention.

According to the National Health Service (NHS), homeopathy is used for a very wide range of health conditions. Several practitioners believe it helps with all conditions. As per homeopathic products market research, the most common conditions for which people seek homeopathic treatment include asthma, ear infections, and hay fever; psychiatric disorders such as depression, stress, and anxiety; allergies such as food allergies and dermatitis (allergic skin disease); arthritis; and high blood pressure. Therefore, the rise in the prevalence of various chronic diseases is expected to augment the global homeopathy products market revenue.

In terms of product type, the global homeopathic products market has been classified into tinctures, dilutions, bio-chemic, ointment, tablets, and others. The dilutions segment dominated the global market and held a major share in 2021. Homeopaths claim that each dilution is meant to make the remedy increasingly stronger, by which they mean more potent. A solution that is more dilute is described as having a higher potency, and the more dilute substances are considered by homeopaths to be stronger and deeper-acting.

Based on application, the global homeopathy products market has been segregated into analgesic & antipyretic, respiratory, neurology, immunology, gastroenterology, dermatology, and others. The immunology segment accounted for a major share of the global market in 2021. Immunology deals with the physiological functioning of the immune system in states of both health and disease as well as malfunctions of the immune system in immunological disorders such as allergies, hypersensitivities, immune deficiency, transplant rejection, and autoimmune disorders.

In terms of sources, the global homeopathic products market has been divided into plants, animals & minerals. The plant's segment accounted for the largest share of the global market in 2021. Homeopathic products are primarily made up of plants to maintain the drug quality. The material is collected either from the wild or cultivated in gardens under expert supervision.

North America accounted for a major share of the global homeopathic products business in 2021. The market in the region is likely to advance at a high CAGR from 2022 to 2031, owing to the high rate of adoption of homeopathic products. According to the Centers for Disease Control & Prevention, 6 in 10 people in the U.S. live with at least one chronic disease, such as heart disease and stroke, cancer, or diabetes. These and other chronic diseases are the leading causes of death and disability in the U.S. and are also a leading factor driving healthcare costs.

Asia Pacific held the second-largest share of the global market in 2021. The market in the region is likely to grow at a rapid pace from 2022 to 2031, owing to the high rate of adoption of homeopathic products. The rise in awareness and acceptance of homeopathy and support from governing authorities make the region a highly lucrative market for homeopathic products.

The global homeopathic products market is fragmented, with the presence of a large number of local as well as international players. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by the key players. Leading players in the global market for homeopathic products are Boiron, Dr. Reckeweg & Co. GmbH, Hyland's, Hahnemann Laboratories, Inc., Dr. Willmar Schwabe GmbH & Co. KG, Biologische Heilmittel Heel GmbH, Homeocan, Inc., Ainsworths (London) Limited, PEKANA, and SBL Pvt. Ltd.

Each of these players has been profiled in the homeopathic products market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 10.7 Bn |

|

Market Forecast Value in 2031 |

More than US$ 32.4 Bn |

|

Growth Rate (CAGR) |

11.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis at the global as well as regional levels. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market for homeopathic products was valued at US$ 10.7 Bn in 2021

The global homeopathy products market is projected to reach more than US$ 32.4 Bn by 2031

The global market advanced at a CAGR of 12.4% from 2017 to 2031.

The global market for homeopathic products is anticipated to advance at a CAGR of 11.6% from 2022 to 2031.

Rise in the prevalence of diseases, especially chronic diseases, and increase in demand for complementary and alternative medicine (CAM)/traditional medicine

North America is expected to account for the largest share of the global market during the forecast period.

Boiron, Dr. Reckeweg & Co. GmbH, Hyland's, Hahnemann Laboratories, Inc., Dr. Willmar Schwabe GmbH & Co. KG, Biologische Heilmittel Heel GmbH, Homeocan, Inc., Ainsworths (London) Limited, PEKANA, and SBL Pvt. Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Homeopathic Products Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Homeopathic Products Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key industry events (mergers & acquisitions, partnerships, product launches etc.)

5.2. Technological advancements

5.3. Regulatory scenario by Region/globally

6. Global Homeopathic Products Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Tincture

6.3.2. Dilutions

6.3.3. Bio-chemic

6.3.4. Ointment

6.3.5. Tablet

6.3.6. Others

6.4. Market Attractiveness Analysis, by Product

7. Global Homeopathic Products Market Analysis and Forecast, by Source

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Source, 2017–2031

7.3.1. Plants

7.3.2. Animals

7.3.3. Minerals

7.4. Market Attractiveness Analysis, by Source

8. Global Homeopathic Products Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Analgesic & Antipyretic

8.3.2. Respiratory

8.3.3. Neurology

8.3.4. Immunology

8.3.5. Gastroenterology

8.3.6. Dermatology

8.3.7. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Homeopathic Products Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Homeopathic Products Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Tincture

10.2.2. Dilutions

10.2.3. Bio-chemic

10.2.4. Ointment

10.2.5. Tablet

10.2.6. Others

10.3. Market Value Forecast, by Source, 2017–2031

10.3.1. Plants

10.3.2. Animals

10.3.3. Minerals

10.4. Market Value Forecast, by Application, 2017–2031

10.4.1. Analgesic & Antipyretic

10.4.2. Respiratory

10.4.3. Neurology

10.4.4. Immunology

10.4.5. Gastroenterology

10.4.6. Dermatology

10.4.7. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Source/p>

10.6.3. By Application

10.6.4. By Country

11. Europe Homeopathic Products Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Tincture

11.2.2. Dilutions

11.2.3. Bio-chemic

11.2.4. Ointment

11.2.5. Tablet

11.2.6. Others

11.3. Market Value Forecast, by Source, 2017–2031

11.3.1. Plants

11.3.2. Animals

11.3.3. Minerals

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Analgesic & Antipyretic

11.4.2. Respiratory

11.4.3. Neurology

11.4.4. Immunology

11.4.5. Gastroenterology

11.4.6. Dermatology

11.4.7. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Source

11.6.3. By Application

11.6.4. By Country/Sub-region

12. Asia Pacific Homeopathic Products Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Tincture

12.2.2. Dilutions

12.2.3. Bio-chemic

12.2.4. Ointment

12.2.5. Tablet

12.2.6. Others

12.3. Market Value Forecast, by Source, 2017–2031

12.3.1. Plants

12.3.2. Animals

12.3.3. Minerals

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Analgesic & Antipyretic

12.4.2. Respiratory

12.4.3. Neurology

12.4.4. Immunology

12.4.5. Gastroenterology

12.4.6. Dermatology

12.4.7. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Source

12.6.3. By Application

12.6.4. By Country/Sub-region

13. Latin America Homeopathic Products Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Tincture

13.2.2. Dilutions

13.2.3. Bio-chemic

13.2.4. Ointment

13.2.5. Tablet

13.2.6. Others

13.3. Market Value Forecast, by Source, 2017–2031

13.3.1. Plants

13.3.2. Animals

13.3.3. Minerals

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Analgesic & Antipyretic

13.4.2. Respiratory

13.4.3. Neurology

13.4.4. Immunology

13.4.5. Gastroenterology

13.4.6. Dermatology

13.4.7. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Source

13.6.3. By Application

13.6.4. By Country/Sub-region

14. Middle East & Africa Homeopathic Products Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Tincture

14.2.2. Dilutions

14.2.3. Bio-chemic

14.2.4. Ointment

14.2.5. Tablet

14.2.6. Others

14.3. Market Value Forecast, by Source, 2017–2031

14.3.1. Plants

14.3.2. Animals

14.3.3. Minerals

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Analgesic & Antipyretic

14.4.2. Respiratory

14.4.3. Neurology

14.4.4. Immunology

14.4.5. Gastroenterology

14.4.6. Dermatology

14.4.7. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Source

14.6.3. By Application

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. BOIRON

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Dr. Reckeweg & Co. GmbH

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. Hyland's

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Hahnemann Laboratories, Inc.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Dr. Willmar Schwabe GmbH & Co. KG

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Biologische Heilmittel Heel GmbH

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Homeocan, Inc.

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Ainsworths (London) Limited

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. PEKANA

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. SBL Pvt. Ltd

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

List of Tables

Table 01: Global Homeopathic Products Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 02: Global Homeopathic Products Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 03: Global Homeopathic Products Market Value (US$ Bn) Forecast, by Source, 2017-2031

Table 04: Global Homeopathic Products Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 05: North America Homeopathic Products Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 06: North America Homeopathic Products Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 07: North America Homeopathic Products Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 08: North America Homeopathic Products Market Value (US$ Bn) Forecast, by Source, 2017-2031

Table 09: Europe Homeopathic Products Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Europe Homeopathic Products Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 11: Europe Homeopathic Products Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 12: Europe Homeopathic Products Market Value (US$ Bn) Forecast, by Source, 2017-2031

Table 13: Asia Pacific Homeopathic Products Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Asia Pacific Homeopathic Products Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 15: Asia Pacific Homeopathic Products Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 16: Asia Pacific Homeopathic Products Market Value (US$ Bn) Forecast, by Source, 2017-2031

Table 17: Latin America Homeopathic Products Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Homeopathic Products Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 19: Latin America Homeopathic Products Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 20: Latin America Homeopathic Products Market Value (US$ Bn) Forecast, by Source, 2017-2031

Table 21: Middle East & Africa Homeopathic Products Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Homeopathic Products Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 23: Middle East & Africa Homeopathic Products Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 24: Middle East & Africa Homeopathic Products Market Value (US$ Bn) Forecast, by Source, 2017-2031

List of Figures

Figure 01: Global Homeopathic Products Market Value (US$ Bn) and Distribution, by Region, 2021 and 2031

Figure 02: Global Homeopathic Products Market Value (US$ Mn), by Type, 2021

Figure 03: Global Homeopathic Products Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 04: Global Homeopathic Products Market Value Share (%), by Product, 2021 and 2031

Figure 05: Global Homeopathic Products Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Tincture, 2017-2031

Figure 06: Global Homeopathic Products Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Dilutions, 2017-2031

Figure 07: Global Homeopathic Products Market Value (US$ Bn) and Y-o-Y Growth, by Bio-chemic, 2017-2031

Figure 08: Global Homeopathic Products Market Value (US$ Bn) and Y-o-Y Growth, by Ointment, 2017-2031

Figure 09: Global Homeopathic Products Market Value (US$ Bn) and Y-o-Y Growth, by Tablet, 2017-2031

Figure 10: Global Homeopathic Products Market Value (US$ Bn) and Y-o-Y Growth, by Others, 2017-2031

Figure 11: Global Homeopathic Products Market Attractiveness Analysis, by Product, 2022-2031

Figure 12: Global Homeopathic Products Market Attractiveness Analysis, by Application, 2022-2031

Figure 13: Global Homeopathic Products Market Value Share, by Application, 2021 and 2031

Figure 14: Global Homeopathic Products Market Value (US$ Bn) and Y-o-Y Growth, by Analgesic & Antipyretic, 2017-2031

Figure 15: Global Homeopathic Products Market Value (US$ Bn) and Y-o-Y Growth, by Respiratory, 2017-2031

Figure 16: Global Homeopathic Products Market Value (US$ Bn) and Y-o-Y Growth, by Neurology, 2017-2031

Figure 17: Global Homeopathic Products Market Value (US$ Bn) and Y-o-Y Growth, by Immunology, 2017-2031

Figure 18: Global Homeopathic Products Market Value (US$ Bn) and Y-o-Y Growth, by Gastroenterology, 2017-2031

Figure 19: Global Homeopathic Products Market Value (US$ Bn) and Y-o-Y Growth, by Dermatology, 2017-2031

Figure 20: Global Homeopathic Products Market Value (US$ Bn) and Y-o-Y Growth, by Others, 2017-2031

Figure 21: Global Homeopathic Products Market Value Share, by Source, 2021 and 2031

Figure 22: Global Homeopathic Products Market Attractiveness Analysis, by Source, 2022-2031

Figure 23: Global Homeopathic Products Market Value (US$ Bn) and Y-o-Y Growth, by Plants, 2017-2031

Figure 24: Global Homeopathic Products Market Value (US$ Bn) and Y-o-Y Growth, by Animals, 2017-2031

Figure 25: Global Homeopathic Products Market Value (US$ Bn) and Y-o-Y Growth, by Minerals, 2017-2031

Figure 26: Global Homeopathic Products Market Value Share, by Region, 2021 and 2031

Figure 27: Global Homeopathic Products Market Attractiveness Analysis, by Region, 2022-2031

Figure 28: North America Homeopathic Products Market Value (US$ Bn) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 29: North America Homeopathic Products Market Value Share (%), by Country, 2021 and 2031

Figure 30: North America Homeopathic Products Market Attractiveness Analysis, by Country, 2022-2031

Figure 31: North America Homeopathic Products Market Value Share, by Product, 2021 and 2031

Figure 32: North America Homeopathic Products Market Attractiveness Analysis, by Product, 2022-2031

Figure 33: North America Homeopathic Products Market Attractiveness Analysis, by Application, 2022-2031

Figure 34: North America Homeopathic Products Market Value Share Analysis, by Application, 2021 and 2031

Figure 35: North America Homeopathic Products Market Value Share Analysis, by Source, 2021 and 2031

Figure 36: North America Homeopathic Products Market Attractiveness Analysis, by Source, 2022-2031

Figure 37: Europe Homeopathic Products Market Value (US$ Bn) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 38: Europe Homeopathic Products Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 39: Europe Homeopathic Products Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 40: Europe Homeopathic Products Market Value Share, by Product, 2021 and 2031

Figure 41: Europe Homeopathic Products Market Attractiveness Analysis, by Product, 2022-2031

Figure 42: Europe Homeopathic Products Market Value Share Analysis, by Application, 2021 and 2031

Figure 43: Europe Homeopathic Products Market Attractiveness Analysis, by Application, 2022-2031

Figure 44: Europe Homeopathic Products Market Value Share Analysis, by Source, 2021 and 2031

Figure 45: Europe Homeopathic Products Market Attractiveness Analysis, by Source, 2022-2031

Figure 46: Asia Pacific Homeopathic Products Market Value (US$ Bn) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 47: Asia Pacific Homeopathic Products Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 48: Asia Pacific Homeopathic Products Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 49: Asia Pacific Homeopathic Products Market Value Share, by Product, 2021 and 2031

Figure 50: Asia Pacific Homeopathic Products Market Attractiveness Analysis, by Product, 2022-2031

Figure 51: Asia Pacific Homeopathic Products Market Value Share Analysis, by Application, 2021 and 2031

Figure 52: Asia Pacific Homeopathic Products Market Attractiveness Analysis, by Application, 2022-2031

Figure 53: Asia Pacific Homeopathic Products Market Value Share Analysis, by Source, 2021 and 2031

Figure 54: Asia Pacific Homeopathic Products Market Attractiveness Analysis, by Source, 2022-2031

Figure 55: Latin America Homeopathic Products Market Value (US$ Bn) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 56: Latin America Homeopathic Products Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 57: Latin America Homeopathic Products Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 58: Latin America Homeopathic Products Market Value Share, by Product, 2021 and 2031

Figure 59: Latin America Homeopathic Products Market Attractiveness Analysis, by Product, 2022-2031

Figure 60: Latin America Homeopathic Products Market Value Share Analysis, by Application, 2021 and 2031

Figure 61: Latin America Homeopathic Products Market Attractiveness Analysis, by Application, 2022-2031

Figure 62: Latin America Homeopathic Products Market Value Share Analysis, by Source, 2021 and 2031

Figure 63: Latin America Homeopathic Products Market Attractiveness Analysis, by Source, 2022-2031

Figure 64: Middle East & Africa Homeopathic Products Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 65: Middle East & Africa Homeopathic Products Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 66: Middle East & Africa Homeopathic Products Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 67: Middle East & Africa Homeopathic Products Market Value Share, by Product, 2021 and 2031

Figure 68: Middle East & Africa Homeopathic Products Market Attractiveness Analysis, by Product, 2022-2031

Figure 69: Middle East & Africa Homeopathic Products Market Value Share Analysis, by Application, 2021 and 2031

Figure 70: Middle East & Africa Homeopathic Products Market Attractiveness Analysis, by Application, 2022-2031

Figure 71: Middle East & Africa Homeopathic Products Market Value Share Analysis, by Source, 2021 and 2031

Figure 72: Middle East & Africa Homeopathic Products Market Attractiveness Analysis, by Source, 2022-2031