Analyst Viewpoint

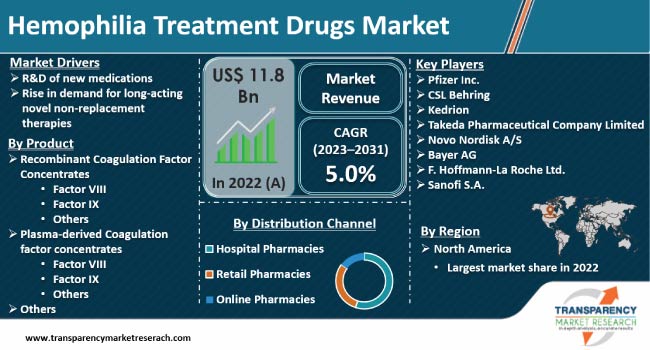

R&D of new medications and rise in demand for long-acting novel non-replacement therapies are expected to propel the hemophilia treatment drugs market size during the forecast period. Surge in diagnosis for hemophilia is also boosting demand for hemophilia treatment drugs.

R&D of personalized approaches in hemophilia treatment is likely to offer lucrative opportunities to vendors in the global hemophilia treatment drugs industry. Government bodies in various countries are funding the R&D of new drugs to reduce the burden of hemophilia. Anti-TFPI medications are gaining traction among patients as these medications aim to lower the mechanism that prevents blood from clotting excessively.

Hemophilia is an inherited bleeding illness. A person's blood does not clot effectively with this disease, which causes a variety of issues such as spontaneous bleeding. Hemophilia is most common among men. Hemophilia treatment drugs are pharmaceuticals that have been authorized by relevant regulatory bodies for the treatment of hemophilia. According to the Centers for Disease Control and Prevention (CDC), around 400 newborns in the U.S. are born with hemophilia A. According to the CDC report, about 33,000 men in the U.S. suffered from the disease. Thus, increase in cases of hemophilia is expected to spur the hemophilia treatment drugs market growth in the near future.

Research activities play a vital role in the hemophilia treatment drugs market value. Most hemophilia treatment drug manufacturers are investing heavily in these activities for the development of new formulations that are beneficial for the treatment of hemophilia.

Anti-TFPI is a novel hemophilia medication that aims to minimize bleeding by lowering (or slowing) the mechanism that prevents blood from clotting excessively. Anti-TFPI restores hemostatic equilibrium by inhibiting the function of one of the anticoagulants, TFPI. Since anticoagulants prevent clotting, interfering with how they function causes clotting to occur. Anti-TFPI is not based on the replacement of a specific clotting protein, such as factor VIII(8) or factor IX(9). As a result, this medication for hemophilia can be used to reduce bleeding episodes in patients with both hemophilia A and hemophilia B. Anti-TFPI clinical studies are now in phase 3.

RNA Interference (RNAi) treatment targets an anticoagulant, antithrombin. It is a new treatment that aims to restore hemostatic equilibrium by lowering antithrombin levels, allowing enough thrombin, a coagulant, to develop to prevent bleeding. It can be used to reduce bleeding episodes in both hemophilia A and hemophilia B since it does not rely on replacing a specific clotting protein, such as factor VIII(8) or factor IX(9). RNA interference is now in phase 3 clinical studies.

Novel non-replacement therapies for hemophilia A and B work by inhibiting the major natural anticoagulant antithrombin, which functions by inactivating activated factor X (FX) and thrombin. The suppression of antithrombin production by hepatocytes is accomplished by the use of RNA interference (RNAi), a natural method of gene silencing found in plants and humans. Fitusiran is an experimental small interfering RNA (siRNA) that inhibits antithrombin production in hepatocytes, restoring adequate hemostasis in people with hemophilia A or B. Fitusiran is now being studied in individuals with or without inhibitors as prophylaxis given subcutaneously every other month or once a month.

Another hemophilia therapy involves interfering with activated protein C (aPC). The thrombin-thrombomodulin complex activates PC to generate aPC, which inactivates FVIIIa and FVa de collaboration with its cofactor protein S, preventing further thrombin generation. These cause the prothrombinase and tenase-complex activities to be inactivated.

Inhibiting aPC may help restore hemostatic equilibrium in hemophilia patients by delaying thrombin production. SerpinPC is an aPC inhibitor that is now being tested in a proof-of-concept experiment in patients with severe hemophilia A and B. This modified serpin forms a covalent connection with aPC but not with a nonactivated PC and does not block thrombin. The absence of reported thrombotic events in clinical trials as of yet may be explained by the intact function of secondary aPC. These are key developments bolstering the hemophilia treatment drugs market progress.

According to the latest hemophilia treatment drugs market trends, the recombinant coagulation factor concentrates product segment is expected to dominate the industry during the forecast period. R&D of new recombinant drugs and gene therapies, such as Fitusiran (phase III trials) and valoctocogene roxaparvovec (phase III candidate), is boosting the segment.

According to the latest hemophilia treatment drugs market forecast, North America is anticipated to hold largest share from 2023 to 2031. Rise in prevalence of hemophilia is fueling the market dynamics of the region. According to the Centers for Disease Control and Prevention (CDC), hemophilia A affects one in every 5,000 male births. Increase in funding for hemophilia treatment is boosting the hemophilia treatment drugs industry statistics.

Many Hemophilia Treatment Centers (HTCs) in the U.S. are housed in large university medical and research facilities. More than 100 HTCs are funded by the federal government. Medical specialists at these HTCs give treatment, education, and support. Patients who receive care and treatment at HTCs generally have a lower risk of hospitalization and bleeding problems than those who receive care elsewhere.

The industry in Asia Pacific is projected to grow at the fastest rate during the forecast period. Rise in adoption of recombinant coagulation factor concentrates in developing countries, such as India and China, is augmenting the hemophilia treatment drugs market expansion in the region. The market in Latin America is poised to grow at a moderate pace during the forecast period.

Most hemophilia treatment drug companies are investing in R&D activities to expand their product portfolio. They are also adopting partnership, collaboration, and M&A strategies to increase their hemophilia treatment drugs market share.

Pfizer Inc., CSL Behring, Kedrion, Takeda Pharmaceutical Company Limited, Novo Nordisk A/S, Bayer AG, F. Hoffmann-La Roche Ltd., Octapharma AG, Biotest AG, and Sanofi S.A. are key entities operating in this market.

These companies have been profiled in the hemophilia treatment drugs market report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 11.8 Bn |

| Market Forecast Value in 2031 | US$ 18.6 Bn |

| Growth Rate (CAGR) | 5.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2020-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 11.8 Bn in 2022

It is likely to grow at a CAGR of 5.0% from 2023 to 2031

R&D of new medications and rise in demand for long-acting novel non-replacement therapies

The recombinant coagulation factor concentrates product segment held largest share in 2022

North America held largest share in 2022

Pfizer Inc., CSL Behring, Kedrion, Takeda Pharmaceutical Company Limited, Novo Nordisk A/S, Bayer AG, F. Hoffmann-La Roche Ltd., Octapharma AG, Biotest AG, and Sanofi S.A.

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Hemophilia Treatment Drugs Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Hemophilia Treatment Drugs Market Analysis and Forecast, 2023-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. List of Types of Hemophilia Treatment Drugs

5.3. Disease Prevalence & Incidence Rate Globally with Key Countries

5.4. COVID-19 Pandemic Impact on Industry

6. Global Hemophilia Treatment Drugs Market Analysis and Forecast, by Product

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2023–2031

6.3.1. Recombinant Coagulation Factor Concentrates

6.3.1.1. Factor VIII

6.3.1.2. Factor IX

6.3.1.3. Others

6.3.2. Plasma-derived Coagulation Factor Concentrates

6.3.2.1. Factor VIII

6.3.2.2. Factor IX

6.3.2.3. Others

6.3.3. Others

6.4. Market Attractiveness, by Product

7. Global Hemophilia Treatment Drugs Market Analysis and Forecast, by Disease Indication

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Disease Indication, 2023–2031

7.3.1. Hemophilia A

7.3.2. Hemophilia B

7.3.3. Others

7.4. Market Attractiveness, by Disease Indication

8. Global Hemophilia Treatment Drugs Market Analysis and Forecast, by Distribution Channel

8.1. Introduction and Definitions

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Distribution Channel, 2023–2031

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness, by Distribution Channel

9. Global Hemophilia Treatment Drugs Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2023–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Region

10. North America Hemophilia Treatment Drugs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2023–2031

10.2.1. Recombinant Coagulation Factor Concentrates

10.2.1.1. Factor VIII

10.2.1.2. Factor IX

10.2.1.3. Others

10.2.2. Plasma-derived Coagulation Factor Concentrates

10.2.2.1. Factor VIII

10.2.2.2. Factor IX

10.2.2.3. Others

10.2.3. Others

10.3. Market Attractiveness, by Product

10.4. Market Value Forecast, by Disease Indication, 2023–2031

10.4.1. Hemophilia A

10.4.2. Hemophilia B

10.4.3. Others

10.5. Market Attractiveness, by Disease Indication

10.6. Market Value Forecast, by Distribution Channel, 2023–2031

10.6.1. Hospital Pharmacies

10.6.2. Retail Pharmacies

10.6.3. Online Pharmacies

10.7. Market Attractiveness, by Distribution Channel

10.8. Market Value Forecast, by Country, 2023–2031

10.8.1. U.S.

10.8.2. Canada

10.9. Market Attractiveness Analysis

10.9.1. By Product

10.9.2. By Disease Indication

10.9.3. By Distribution Channel

10.9.4. By Country

11. Europe Hemophilia Treatment Drugs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.1.2. Recombinant Coagulation Factor Concentrates

11.1.2.1. Factor VIII

11.1.2.2. Factor IX

11.1.2.3. Others

11.1.3. Plasma-derived Coagulation Factor Concentrates

11.1.3.1. Factor VIII

11.1.3.2. Factor IX

11.1.3.3. Others

11.1.4. Others

11.2. Market Attractiveness, by Product

11.3. Market Value Forecast, by Disease Indication, 2023–2031

11.3.1. Hemophilia A

11.3.2. Hemophilia B

11.3.3. Others

11.4. Market Attractiveness, by Disease Indication

11.5. Market Value Forecast, by Distribution Channel, 2023–2031

11.5.1. Hospital Pharmacies

11.5.2. Retail Pharmacies

11.5.3. Online Pharmacies

11.6. Market Attractiveness, by Distribution Channel

11.7. Market Value Forecast, by Country/Sub-region, 2023–2031

11.7.1. Germany

11.7.2. U.K.

11.7.3. France

11.7.4. Italy

11.7.5. Spain

11.7.6. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Product

11.8.2. By Disease Indication

11.8.3. By Distribution Channel

11.8.4. By Country/Sub-region

12. Asia Pacific Hemophilia Treatment Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2023–2031

12.2.1. Recombinant Coagulation Factor Concentrates

12.2.1.1. Factor VIII

12.2.1.2. Factor IX

12.2.1.3. Others

12.2.2. Plasma-derived Coagulation Factor Concentrates

12.2.2.1. Factor VIII

12.2.2.2. Factor IX

12.2.2.3. Others

12.2.3. Others

12.3. Market Attractiveness, by Product

12.4. Market Value Forecast, by Disease Indication, 2023–2031

12.4.1. Hemophilia A

12.4.2. Hemophilia B

12.4.3. Others

12.5. Market Attractiveness, by Disease Indication

12.6. Market Value Forecast, by Distribution Channel, 2023–2031

12.6.1. Hospital Pharmacies

12.6.2. Retail Pharmacies

12.6.3. Online Pharmacies

12.7. Market Attractiveness, by Distribution Channel

12.8. Market Value Forecast, by Country/Sub-region, 2023–2031

12.8.1. China

12.8.2. Japan

12.8.3. India

12.8.4. Australia & New Zealand

12.8.5. Rest of Asia Pacific

12.9. Market Attractiveness Analysis

12.9.1. By Product

12.9.2. By Disease Indication

12.9.3. By Distribution Channel

12.9.4. By Country/Sub-region

13. Latin America Hemophilia Treatment Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2023–2031

13.2.1. Recombinant Coagulation Factor Concentrates

13.2.1.1. Factor VIII

13.2.1.2. Factor IX

13.2.1.3. Others

13.2.2. Plasma-derived Coagulation Factor Concentrates

13.2.2.1. Factor VIII

13.2.2.2. Factor IX

13.2.2.3. Others

13.2.3. Others

13.3. Market Attractiveness, by Product

13.4. Market Value Forecast, by Disease Indication, 2023–2031

13.4.1. Hemophilia A

13.4.2. Hemophilia B

13.4.3. Others

13.5. Market Attractiveness, by Disease Indication

13.6. Market Value Forecast, by Distribution Channel, 2023–2031

13.6.1. Hospital Pharmacies

13.6.2. Retail Pharmacies

13.6.3. Online Pharmacies

13.7. Market Attractiveness, by Distribution Channel

13.8. Market Value Forecast, by Country/Sub-region, 2023–2031

13.8.1. Brazil

13.8.2. Mexico

13.8.3. Rest of Latin America

13.9. Market Attractiveness Analysis

13.9.1. By Product

13.9.2. By Disease Indication

13.9.3. By Distribution Channel

13.9.4. By Country/Sub-region

14. Middle East & Africa Hemophilia Treatment Drugs Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2023–2031

14.2.1. Recombinant Coagulation Factor Concentrates

14.2.1.1. Factor VIII

14.2.1.2. Factor IX

14.2.1.3. Others

14.2.2. Plasma-derived Coagulation Factor Concentrates

14.2.2.1. Factor VIII

14.2.2.2. Factor IX

14.2.2.3. Others

14.2.3. Others

14.3. Market Attractiveness, by Product

14.4. Market Value Forecast, by Disease Indication, 2023–2031

14.4.1. Hemophilia A

14.4.2. Hemophilia B

14.4.3. Others

14.5. Market Attractiveness, by Disease Indication

14.6. Market Value Forecast, by Distribution Channel, 2023–2031

14.6.1. Hospital Pharmacies

14.6.2. Retail Pharmacies

14.6.3. Online Pharmacies

14.7. Market Attractiveness, by Distribution Channel

14.8. Market Value Forecast, by Country/Sub-region, 2023–2031

14.8.1. GCC Countries

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Market Attractiveness Analysis

14.9.1. By Product

14.9.2. By Disease Indication

14.9.3. By Distribution Channel

14.9.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Pfizer Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. CSL Behring

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Kedrion

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Takeda Pharmaceutical Company Limited

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Novo Nordisk A/S

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Bayer AG

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. F. Hoffmann-La Roche Ltd.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Octapharma AG

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Biotest AG

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Sanofi S.A.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

List of Tables

Table 1: Global Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 2: Global Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Disease Indication, 2023–2031

Table 3: Global Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2023–2031

Table 4: Global Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Region, 2023–2031

Table 5: North America Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Country, 2023–2031

Table 6: North America Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 7: North America Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Disease Indication, 2023–2031

Table 8: North America Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2023–2031

Table 9: Europe Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 10: Europe Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 11: Europe Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Disease Indication, 2023–2031

Table 12: Europe Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Distribution Channel 2023–2031

Table 13: Asia Pacific Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 14: Asia Pacific Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 15: Asia Pacific Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Disease Indication, 2023–2031

Table 16: Asia Pacific Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2023–2031

Table 17: Latin America Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 18: Latin America Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 19: Latin America Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Disease Indication, 2023–2031

Table 20: Latin America Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Distribution Channel 2023–2031

Table 21: Middle East & Africa Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 22: Middle East & Africa Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 23: Middle East & Africa Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Disease Indication, 2023–2031

Table 24: Middle East & Africa Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, by Distribution Channel 2023–2031

List of Figures

Figure 1: Global Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, 2023–2031

Figure 2: Global Hemophilia Treatment Drugs Market Value Share, by Product, 2022

Figure 3: Global Hemophilia Treatment Drugs Market Value Share, by Disease Indication, 2022

Figure 4: Global Hemophilia Treatment Drugs Market Value Share, by Distribution Channel, 2022

Figure 5: Global Hemophilia Treatment Drugs Market Value Share Analysis, by Product, 2022 and 2031

Figure 6: Global Hemophilia Treatment Drugs Market Attractiveness Analysis, by Product, 2023–2031

Figure 7: Global Hemophilia Treatment Drugs Market Value Share Analysis, by Disease Indication, 2022 and 2031

Figure 8: Global Hemophilia Treatment Drugs Market Attractiveness Analysis, by Disease Indication, 2023–2031

Figure 9: Global Hemophilia Treatment Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 10: Global Hemophilia Treatment Drugs Market Attractiveness Analysis, by Distribution Channel 2023–2031

Figure 11: Global Hemophilia Treatment Drugs Market Value Share Analysis, by Region, 2022 and 2031

Figure 12: Global Hemophilia Treatment Drugs Market Attractiveness Analysis, by Region, 2023–2031

Figure 13: North America Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, 2023–2031

Figure 14: North America Hemophilia Treatment Drugs Market Value Share Analysis, by Country, 2022 and 2031

Figure 15: North America Hemophilia Treatment Drugs Market Attractiveness Analysis, by Country, 2023–2031

Figure 16: North America Hemophilia Treatment Drugs Market Value Share Analysis, by Product, 2022 and 2031

Figure 17: North America Hemophilia Treatment Drugs Market Attractiveness Analysis, by Product, 2023–2031

Figure 18: North America Hemophilia Treatment Drugs Market Value Share Analysis, by Disease Indication, 2022 and 2031

Figure 19: North America Hemophilia Treatment Drugs Market Attractiveness Analysis, by Disease Indication, 2023–2031

Figure 20: North America Hemophilia Treatment Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 21: North America Hemophilia Treatment Drugs Market Attractiveness Analysis, by Distribution Channel 2023–2031

Figure 22: Europe Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, 2023–2031

Figure 23: Europe Hemophilia Treatment Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 24: Europe Hemophilia Treatment Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 25: Europe Hemophilia Treatment Drugs Market Value Share Analysis, by Product, 2022 and 2031

Figure 26: Europe America Hemophilia Treatment Drugs Market Attractiveness Analysis, by Product, 2023–2031

Figure 27: Europe Hemophilia Treatment Drugs Market Value Share Analysis, by Disease Indication, 2022 and 2031

Figure 28: Europe Hemophilia Treatment Drugs Market Attractiveness Analysis, by Disease Indication, 2023–2031

Figure 29: Europe Hemophilia Treatment Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 30: Europe Hemophilia Treatment Drugs Market Attractiveness Analysis, by Distribution Channel 2023–2031

Figure 31: Asia Pacific Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, 2023–2031

Figure 32: Asia Pacific Hemophilia Treatment Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Asia Pacific Hemophilia Treatment Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 34: Asia Pacific Hemophilia Treatment Drugs Market Value Share Analysis, by Product, 2022 and 2031

Figure 35: Asia Pacific Hemophilia Treatment Drugs Market Attractiveness Analysis, by Product, 2023–2031

Figure 36: Asia Pacific Hemophilia Treatment Drugs Market Value Share Analysis, by Disease Indication, 2022 and 2031

Figure 37: Asia Pacific Hemophilia Treatment Drugs Market Attractiveness Analysis, by Disease Indication, 2023–2031

Figure 38: Asia Pacific Hemophilia Treatment Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 39: Asia Pacific Hemophilia Treatment Drugs Market Attractiveness Analysis, by Distribution Channel 2023–2031

Figure 40: Latin America Hemophilia Treatment Drugs Market Value (US$ Bn) Forecast, 2023–2031

Figure 41: Latin America Hemophilia Treatment Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Latin America Hemophilia Treatment Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 43: Latin America Hemophilia Treatment Drugs Market Value Share Analysis, by Product, 2022 and 2031

Figure 44: Latin America Hemophilia Treatment Drugs Market Attractiveness Analysis, by Product, 2023–2031

Figure 45: Latin America Hemophilia Treatment Drugs Market Value Share Analysis, by Disease Indication, 2022 and 2031

Figure 46: Latin America Hemophilia Treatment Drugs Market Attractiveness Analysis, by Disease Indication, 2023–2031

Figure 47: Latin America Hemophilia Treatment Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 48: Latin America Hemophilia Treatment Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 49: Middle East & Africa Hemophilia Treatment Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 50: Middle East & Africa Hemophilia Treatment Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 51: Middle East & Africa America Hemophilia Treatment Drugs Market Value Share Analysis, by Product, 2023–2031

Figure 52: Middle East & Africa America Hemophilia Treatment Drugs Market Attractiveness Analysis, by Product, 2023–2031

Figure 53: Middle East & Africa Hemophilia Treatment Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 54: Middle East & Africa Hemophilia Treatment Drugs Market Attractiveness Analysis, by Distribution Channel 2023–2031

Figure 55: Global Hemophilia Treatment Drugs Market Share Analysis, by Company (2022)