Analysts’ Viewpoint on Market Scenario

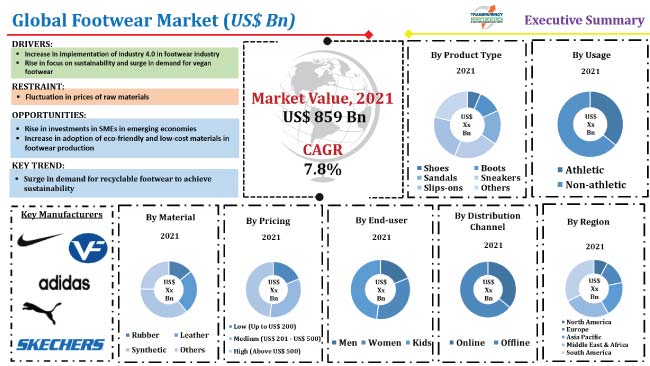

Rise in demand for comfortable and advanced footwear is driving the global footwear market. Surge in preference for eco-friendly products is prompting manufacturers to use natural and recyclable raw materials instead of conventional leather in footwear production. Emerging economies are focusing on boosting the market share of regional players through various initiatives. They are also increasing the export volume of products to support these initiatives. Rise in sports activities and surge in health awareness among the populace are augmenting the demand for athletic and non-athletic footwear. Key players operating in the global market are focusing on product performance and technological advancements to enhance their revenue streams.

Footwear is used for various purposes such as cycling, running, or casual walking. It is available in different styles, patterns, and colors. Industrial protective footwear such as safety shoes are used in various sectors such as construction, mining, oil & gas, chemical, and food & beverages. Leather (real and synthetic), rubber, textiles, synthetics, and foam are some of the materials used in the manufacture of footwear. Key players are adopting recycled plastic in the making of shoes. Synthetic leather is low-cost and abrasion- and water-resistant. It is not prone to crack or peel and does not fade as easily in ultraviolet (UV) light. Footwear for men includes walking shoes, flip-flops, sneakers, loafers, boat shoes, ethnic footwear, boots, and espadrilles. Women’s footwear includes pumps (casual footwear for girls), stilettos, kitten heels, ankle booties, ankle strap heels, wedges, cone heels, high heels, and gladiator sandals.

Companies in the footwear business are increasingly integrating industry 4.0 in the production process to maintain a balance in terms of knowledge, artisanal skills, and automation in manufacturing. Integration of Industry 4.0 is expected to enhance supply chain management, thereby enabling manufacturers to effectively cater to the rise in demand for footwear. Additionally, application of big data and cloud computing allows manufacturers to retrieve large amounts of data through the supply chain network. This data can be utilized to simulate, model, and augment the manufacturing process. The data also helps in customization of products as per customer requirements.

Sustainable production is the future of the footwear industry. Prominent players in the market are focused on manufacturing footwear sustainably by using plant-based and recyclable materials. In April 2021, Reebok International Limited, a leading footwear company, launched Floatride Energy Grow, a pair of running shoes manufactured from 50% USDA-certified bio-based materials. Similarly, Veja offers sneakers manufactured from raw materials that are collected from organic farming and ecological agriculture.

Rise in vegan population has led to a surge in demand for vegan footwear. Various companies are launching vegan collections to cater to the increase in demand for vegan footwear. In October 2022, Reebok International Limited and National Geographic collaborated to launch a new vegan footwear collection made from cotton and eucalyptus.

In terms of usage, the footwear industry has been bifurcated into athletic and non-athletic. The athletic segment is expected to grow at the highest CAGR during the forecast period. Growth of the segment can be ascribed to the surge the number of athletes participating in sporting events. Athletic shoes have an ergonomic design, which imparts more comfort and high efficiency during physical activities.

The non-athletic segment held the largest share of the market in 2021, led by the rise in demand for casual and formal footwear across the globe. Customers are increasingly opting for eco-friendly and low-cost products.

Based on distribution channel, the footwear market has been segmented into online and offline. The online segment is expected to hold major share of the market during the forecast period owing to the rapid expansion of the e-commerce sector in key regions across the globe. Customers are increasingly purchasing footwear online, as online shops offer various discounts and products at affordable prices. Brand endorsement is a key marketing strategy for footwear manufacturers to boost online and offline sales.

Asia Pacific is expected to be the most lucrative region of the footwear market in terms of market share. Rise in demand for footwear and increase in disposable income are augmenting the market in the region. Increase in number of sports activities is boosting the demand for sports shoes, thereby driving the sports shoes market in Asia Pacific. Rapid urbanization and government initiatives to boost the local production of footwear are likely to propel the market in the region during the forecast period. According to the Ministry of Commerce and Industry, Government of India, the footwear industry in the country is expected to reach US$ 15.5 Bn by the end of 2022 from US$ 10.6 Bn in 2019.

The footwear industry is influenced by the presence of several local and regional players. Key players are primarily investing in R&D activities to expand their product portfolio. They are also adopting various marketing strategies such as partnerships, collaborations, and mergers & acquisitions to enhance their market share. Adidas AG, ASICS Corporation, Bata Corporation, Burberry Group Plc, Coach New York, Deckers Outdoor Corporation, FILA Luxembourg, S.a.r.l., Kering, New Balance Athletics, Inc., Nike Inc., Puma SE, Skechers USA, Inc., Under Armour, Inc., VF Corporation, and Wolverine World Wide, Inc. are prominent entities operating in the market.

Each of these players has been profiled in the report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 | US$ 859 Bn |

| Market Forecast Value in 2031 | US$ 1.09 Trn |

| Growth Rate (CAGR) | 7.8% |

| Forecast Period | 2022-2031 |

| Historical Data Available for | 2017-2020 |

| Quantitative Units | US$ Bn/Trn for Value & Million Units for Volume |

| Market Analysis | Includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, trade analysis and key trend analysis. |

| Competition Landscape |

|

| Format | Consumer Goods (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The footwear industry stood at US$ 859 Bn in 2021

The footwear market is estimated to grow at a CAGR of 7.8% from 2022 to 2031

Rise in implementation of Industry 4.0, increase in focus on sustainable production, and surge in demand for vegan footwear

The non-athletic segment accounted for around 53.1% share of the market in 2021

Asia Pacific is likely to be the most lucrative region of the global footwear market

Adidas AG, ASICS Corporation, Bata Corporation, Burberry Group Plc, Coach New York, Deckers Outdoor Corporation, FILA Luxembourg, S.a.r.l., Kering, New Balance Athletics, Inc., Nike Inc., Puma SE, Skechers USA, Inc., Under Armour, Inc., VF Corporation, and Wolverine World Wide, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Fashion Industry Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Trade Analysis

5.7.1. Top 10 Exporting Countries

5.7.2. Top 10 Importing Countries

5.8. Product Analysis

5.8.1. Raw Material Analysis

5.8.2. Color Trends

5.9. Global Footwear Market Analysis and Forecast, 2017-2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Million Units)

6. Global Footwear Market Analysis and Forecast, By Product Type

6.1. Global Footwear Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017-2031

6.1.1. Shoes

6.1.2. Boots

6.1.3. Sandals

6.1.4. Sneakers

6.1.5. Slip-ons

6.1.6. Others

6.2. Incremental Opportunity, By Product Type

7. Global Footwear Market Analysis and Forecast, By Usage

7.1. Global Footwear Market Size (US$ Bn and Million Units) Forecast, By Usage, 2017-2031

7.1.1. Athletic

7.1.1.1. Running

7.1.1.2. Football

7.1.1.3. Basketball

7.1.1.4. Tennis

7.1.1.5. Golf

7.1.1.6. Others

7.1.2. Non-athletic

7.1.2.1. Casual

7.1.2.2. Formal

7.2. Incremental Opportunity, By Usage

8. Global Footwear Market Analysis and Forecast, By Material

8.1. Global Footwear Market Size (US$ Bn and Million Units) Forecast, By Material, 2017-2031

8.1.1. Rubber

8.1.2. Leather

8.1.3. Synthetic

8.1.4. Others

8.2. Incremental Opportunity, By Material

9. Global Footwear Market Analysis and Forecast, By Pricing

9.1. Global Footwear Market Size (US$ Bn and Million Units) Forecast, By Pricing, 2017-2031

9.1.1. Low (Up to US$ 200)

9.1.2. Medium (US$ 201 - US$ 500)

9.1.3. High (Above US$ 500)

9.2. Incremental Opportunity, By Pricing

10. Global Footwear Market Analysis and Forecast, By End-user

10.1. Global Footwear Market Size (US$ Bn and Million Units) Forecast, By End-user, 2017-2031

10.1.1. Men

10.1.2. Women

10.1.3. Kids

10.2. Incremental Opportunity, By End-user

11. Global Footwear Market Analysis and Forecast, By Distribution Channel

11.1. Global Footwear Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017-2031

11.1.1. Online

11.1.1.1. E-commerce Websites

11.1.1.2. Company-owned Websites

11.1.2. Offline

11.1.2.1. Hypermarkets & Supermarkets

11.1.2.2. Specialty Stores

11.1.2.3. Departmental Stores

11.1.2.4. Others

11.2. Incremental Opportunity, By Distribution Channel

12. Global Footwear Market Analysis and Forecast, By Region

12.1. Global Footwear Market Size (US$ Bn and Million Units) Forecast, By Region, 2017-2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity, By Region

13. North America Footwear Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Covid-19 Impact Analysis

13.3. Key Trend Analysis

13.3.1. Demand Side

13.3.2. Supply Side

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.5.1. Preferred Product Type

13.5.2. Target Audience

13.5.3. Preferred Mode of Buying (Online/Offline)

13.5.4. Spending Capacity

13.6. Demographic Overview

13.7. Price Trend Analysis

13.7.1. Weighted Average Selling Price (US$)

13.8. Footwear Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017-2031

13.8.1. Shoes

13.8.2. Boots

13.8.3. Sandals

13.8.4. Sneakers

13.8.5. Slip-ons

13.8.6. Others

13.9. Footwear Market Size (US$ Bn and Million Units) Forecast, By Usage, 2017-2031

13.9.1. Athletic

13.9.1.1. Running

13.9.1.2. Football

13.9.1.3. Basketball

13.9.1.4. Tennis

13.9.1.5. Golf

13.9.1.6. Others

13.9.2. Non-athletic

13.9.2.1. Casual

13.9.2.2. Formal

13.10. Footwear Market Size (US$ Bn and Million Units) Forecast, By Material, 2017-2031

13.10.1. Rubber

13.10.2. Leather

13.10.3. Synthetic

13.10.4. Others

13.11. Footwear Market Size (US$ Bn and Million Units) Forecast, By Pricing, 2017-2031

13.11.1. Low (Up to US$ 200)

13.11.2. Medium (US$ 201 - US$ 500)

13.11.3. High (Above US$ 500)

13.12. Footwear Market Size (US$ Bn and Million Units) Forecast, By End-user, 2017-2031

13.12.1. Men

13.12.2. Women

13.12.3. Kids

13.13. Footwear Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017-2031

13.13.1. Online

13.13.1.1. E-commerce Websites

13.13.1.2. Company-owned Websites

13.13.2. Offline

13.13.2.1. Hypermarkets & Supermarkets

13.13.2.2. Specialty Stores

13.13.2.3. Departmental Stores

13.13.2.4. Others

13.14. Footwear Market Size (US$ Bn and Million Units) Forecast, By Country, 2017-2031

13.14.1. The U.S.

13.14.2. Canada

13.14.3. Rest of North America

13.15. Incremental Opportunity Analysis

14. Europe Footwear Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Covid-19 Impact Analysis

14.3. Key Trend Analysis

14.3.1. Demand Side

14.3.2. Supply Side

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.5.1. Preferred Product Type

14.5.2. Target Audience

14.5.3. Preferred Mode of Buying (Online/Offline)

14.5.4. Spending Capacity

14.6. Demographic Overview

14.7. Price Trend Analysis

14.7.1. Weighted Average Selling Price (US$)

14.8. Footwear Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017-2031

14.8.1. Shoes

14.8.2. Boots

14.8.3. Sandals

14.8.4. Sneakers

14.8.5. Slip-ons

14.8.6. Others

14.9. Footwear Market Size (US$ Bn and Million Units) Forecast, By Usage, 2017-2031

14.9.1. Athletic

14.9.1.1. Running

14.9.1.2. Football

14.9.1.3. Basketball

14.9.1.4. Tennis

14.9.1.5. Golf

14.9.1.6. Others

14.9.2. Non-athletic

14.9.2.1. Casual

14.9.2.2. Formal

14.10. Footwear Market Size (US$ Bn and Million Units) Forecast, By Material, 2017-2031

14.10.1. Rubber

14.10.2. Leather

14.10.3. Synthetic

14.10.4. Others

14.11. Footwear Market Size (US$ Bn and Million Units) Forecast, By Pricing, 2017-2031

14.11.1. Low (Up to US$ 200)

14.11.2. Medium (US$ 201 - US$ 500)

14.11.3. High (Above US$ 500)

14.12. Footwear Market Size (US$ Bn and Million Units) Forecast, By End-user, 2017-2031

14.12.1. Men

14.12.2. Women

14.12.3. Kids

14.13. Footwear Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017-2031

14.13.1. Online

14.13.1.1. E-commerce Websites

14.13.1.2. Company-owned Websites

14.13.2. Offline

14.13.2.1. Hypermarkets & Supermarkets

14.13.2.2. Specialty Stores

14.13.2.3. Departmental Stores

14.13.2.4. Others

14.14. Footwear Market Size (US$ Bn and Million Units) Forecast, By Country, 2017-2031

14.14.1. The U.K.

14.14.2. Germany

14.14.3. France

14.14.4. Rest of Europe

14.15. Incremental Opportunity Analysis

15. Asia Pacific Footwear Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Covid-19 Impact Analysis

15.3. Key Trend Analysis

15.3.1. Demand Side

15.3.2. Supply Side

15.4. Brand Analysis

15.5. Consumer Buying Behavior Analysis

15.5.1. Preferred Product Type

15.5.2. Target Audience

15.5.3. Preferred Mode of Buying (Online/Offline)

15.5.4. Spending Capacity

15.6. Demographic Overview

15.7. Price Trend Analysis

15.7.1. Weighted Average Selling Price (US$)

15.8. Footwear Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017-2031

15.8.1. Shoes

15.8.2. Boots

15.8.3. Sandals

15.8.4. Sneakers

15.8.5. Slip-ons

15.8.6. Others

15.9. Footwear Market Size (US$ Bn and Million Units) Forecast, By Usage, 2017-2031

15.9.1. Athletic

15.9.1.1. Running

15.9.1.2. Football

15.9.1.3. Basketball

15.9.1.4. Tennis

15.9.1.5. Golf

15.9.1.6. Others

15.9.2. Non-athletic

15.9.2.1. Casual

15.9.2.2. Formal

15.10. Footwear Market Size (US$ Bn and Million Units) Forecast, By Material, 2017-2031

15.10.1. Rubber

15.10.2. Leather

15.10.3. Synthetic

15.10.4. Others

15.11. Footwear Market Size (US$ Bn and Million Units) Forecast, By Pricing, 2017-2031

15.11.1. Low (Up to US$ 200)

15.11.2. Medium (US$ 201 - US$ 500)

15.11.3. High (Above US$ 500)

15.12. Footwear Market Size (US$ Bn and Million Units) Forecast, By End-user, 2017-2031

15.12.1. Men

15.12.2. Women

15.12.3. Kids

15.13. Footwear Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017-2031

15.13.1. Online

15.13.1.1. E-commerce Websites

15.13.1.2. Company-owned Websites

15.13.2. Offline

15.13.2.1. Hypermarkets & Supermarkets

15.13.2.2. Specialty Stores

15.13.2.3. Departmental Stores

15.13.2.4. Others

15.14. Footwear Market Size (US$ Bn and Million Units) Forecast, By Country, 2017-2031

15.14.1. China

15.14.2. India

15.14.3. Japan

15.14.4. Rest of Asia Pacific

15.15. Incremental Opportunity Analysis

16. Middle East & Africa Footwear Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Covid-19 Impact Analysis

16.3. Key Trend Analysis

16.3.1. Demand Side

16.3.2. Supply Side

16.4. Brand Analysis

16.5. Consumer Buying Behavior Analysis

16.5.1. Preferred Product Type

16.5.2. Target Audience

16.5.3. Preferred Mode of Buying (Online/Offline)

16.5.4. Spending Capacity

16.6. Demographic Overview

16.7. Price Trend Analysis

16.7.1. Weighted Average Selling Price (US$)

16.8. Footwear Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017-2031

16.8.1. Shoes

16.8.2. Boots

16.8.3. Sandals

16.8.4. Sneakers

16.8.5. Slip-ons

16.8.6. Others

16.9. Footwear Market Size (US$ Bn and Million Units) Forecast, By Usage, 2017-2031

16.9.1. Athletic

16.9.1.1. Running

16.9.1.2. Football

16.9.1.3. Basketball

16.9.1.4. Tennis

16.9.1.5. Golf

16.9.1.6. Others

16.9.2. Non-athletic

16.9.2.1. Casual

16.9.2.2. Formal

16.10. Footwear Market Size (US$ Bn and Million Units) Forecast, By Material, 2017-2031

16.10.1. Rubber

16.10.2. Leather

16.10.3. Synthetic

16.10.4. Others

16.11. Footwear Market Size (US$ Bn and Million Units) Forecast, By Pricing, 2017-2031

16.11.1. Low (Up to US$ 200)

16.11.2. Medium (US$ 201 - US$ 500)

16.11.3. High (Above US$ 500)

16.12. Footwear Market Size (US$ Bn and Million Units) Forecast, By End-user, 2017-2031

16.12.1. Men

16.12.2. Women

16.12.3. Kids

16.13. Footwear Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017-2031

16.13.1. Online

16.13.1.1. E-commerce Websites

16.13.1.2. Company-owned Websites

16.13.2. Offline

16.13.2.1. Hypermarkets & Supermarkets

16.13.2.2. Specialty Stores

16.13.2.3. Departmental Stores

16.13.2.4. Others

16.14. Footwear Market Size (US$ Bn and Million Units) Forecast, By Country, 2017-2031

16.14.1. GCC

16.14.2. South Africa

16.14.3. Rest of Middle East & Africa

16.15. Incremental Opportunity Analysis

17. South America Footwear Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Covid-19 Impact Analysis

17.3. Key Trend Analysis

17.3.1. Demand Side

17.3.2. Supply Side

17.4. Brand Analysis

17.5. Consumer Buying Behavior Analysis

17.5.1. Preferred Product Type

17.5.2. Target Audience

17.5.3. Preferred Mode of Buying (Online/Offline)

17.5.4. Spending Capacity

17.6. Demographic Overview

17.7. Price Trend Analysis

17.7.1. Weighted Average Selling Price (US$)

17.8. Footwear Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017-2031

17.8.1. Shoes

17.8.2. Boots

17.8.3. Sandals

17.8.4. Sneakers

17.8.5. Slip-ons

17.8.6. Others

17.9. Footwear Market Size (US$ Bn and Million Units) Forecast, By Usage, 2017-2031

17.9.1. Athletic

17.9.1.1. Running

17.9.1.2. Football

17.9.1.3. Basketball

17.9.1.4. Tennis

17.9.1.5. Golf

17.9.1.6. Others

17.9.2. Non-athletic

17.9.2.1. Casual

17.9.2.2. Formal

17.10. Footwear Market Size (US$ Bn and Million Units) Forecast, By Material, 2017-2031

17.10.1. Rubber

17.10.2. Leather

17.10.3. Synthetic

17.10.4. Others

17.11. Footwear Market Size (US$ Bn and Million Units) Forecast, By Pricing, 2017-2031

17.11.1. Low (Up to US$ 200)

17.11.2. Medium (US$ 201 - US$ 500)

17.11.3. High (Above US$ 500)

17.12. Footwear Market Size (US$ Bn and Million Units) Forecast, By End-user, 2017-2031

17.12.1. Men

17.12.2. Women

17.12.3. Kids

17.13. Footwear Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017-2031

17.13.1. Online

17.13.1.1. E-commerce Websites

17.13.1.2. Company-owned Websites

17.13.2. Offline

17.13.2.1. Hypermarkets & Supermarkets

17.13.2.2. Specialty Stores

17.13.2.3. Departmental Stores

17.13.2.4. Others

17.14. Footwear Market Size (US$ Bn and Million Units) Forecast, By Country, 2017-2031

17.14.1. Brazil

17.14.2. Rest of South America

17.15. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player - Competition Dashboard

18.2. Market Share Analysis-2021 (%)

18.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Financial/Revenue (Segmental Revenue), Strategy & Business Overview, Sales Channel Analysis, Product Portfolio & Pricing)

18.3.1. Adidas AG

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Financial/Revenue (Segmental Revenue)

18.3.1.4. Strategy & Business Overview

18.3.1.5. Sales Channel Analysis

18.3.1.6. Product Portfolio & Pricing

18.3.2. ASICS Corporation

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Financial/Revenue (Segmental Revenue)

18.3.2.4. Strategy & Business Overview

18.3.2.5. Sales Channel Analysis

18.3.2.6. Product Portfolio & Pricing

18.3.3. Bata Corporation

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Financial/Revenue (Segmental Revenue)

18.3.3.4. Strategy & Business Overview

18.3.3.5. Sales Channel Analysis

18.3.3.6. Product Portfolio & Pricing

18.3.4. Burberry Limited

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Financial/Revenue (Segmental Revenue)

18.3.4.4. Strategy & Business Overview

18.3.4.5. Sales Channel Analysis

18.3.4.6. Product Portfolio & Pricing

18.3.5. Coach New York

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Financial/Revenue (Segmental Revenue)

18.3.5.4. Strategy & Business Overview

18.3.5.5. Sales Channel Analysis

18.3.5.6. Product Portfolio & Pricing

18.3.6. Deckers Outdoor Corporation

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Financial/Revenue (Segmental Revenue)

18.3.6.4. Strategy & Business Overview

18.3.6.5. Sales Channel Analysis

18.3.6.6. Product Portfolio & Pricing

18.3.7. FILA Luxembourg, S.a.r.l.

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Financial/Revenue (Segmental Revenue)

18.3.7.4. Strategy & Business Overview

18.3.7.5. Sales Channel Analysis

18.3.7.6. Product Portfolio & Pricing

18.3.8. Kering

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Financial/Revenue (Segmental Revenue)

18.3.8.4. Strategy & Business Overview

18.3.8.5. Sales Channel Analysis

18.3.8.6. Product Portfolio & Pricing

18.3.9. New Balance Athletics, Inc.

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Financial/Revenue (Segmental Revenue)

18.3.9.4. Strategy & Business Overview

18.3.9.5. Sales Channel Analysis

18.3.9.6. Product Portfolio & Pricing

18.3.10. Nike Inc.

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Financial/Revenue (Segmental Revenue)

18.3.10.4. Strategy & Business Overview

18.3.10.5. Sales Channel Analysis

18.3.10.6. Product Portfolio & Pricing

18.3.11. Puma SE

18.3.11.1. Company Overview

18.3.11.2. Sales Area/Geographical Presence

18.3.11.3. Financial/Revenue (Segmental Revenue)

18.3.11.4. Strategy & Business Overview

18.3.11.5. Sales Channel Analysis

18.3.11.6. Product Portfolio & Pricing

18.3.12. Skechers USA, Inc.

18.3.12.1. Company Overview

18.3.12.2. Sales Area/Geographical Presence

18.3.12.3. Financial/Revenue (Segmental Revenue)

18.3.12.4. Strategy & Business Overview

18.3.12.5. Sales Channel Analysis

18.3.12.6. Product Portfolio & Pricing

18.3.13. Under Armour, Inc.

18.3.13.1. Company Overview

18.3.13.2. Sales Area/Geographical Presence

18.3.13.3. Financial/Revenue (Segmental Revenue)

18.3.13.4. Strategy & Business Overview

18.3.13.5. Sales Channel Analysis

18.3.13.6. Product Portfolio & Pricing

18.3.14. VF Corporation

18.3.14.1. Company Overview

18.3.14.2. Sales Area/Geographical Presence

18.3.14.3. Financial/Revenue (Segmental Revenue)

18.3.14.4. Strategy & Business Overview

18.3.14.5. Sales Channel Analysis

18.3.14.6. Product Portfolio & Pricing

18.3.15. Wolverine World Wide, Inc.

18.3.15.1. Company Overview

18.3.15.2. Sales Area/Geographical Presence

18.3.15.3. Financial/Revenue (Segmental Revenue)

18.3.15.4. Strategy & Business Overview

18.3.15.5. Sales Channel Analysis

18.3.15.6. Product Portfolio & Pricing

19. Key Takeaway

19.1. Identification of Potential Market Spaces

19.1.1. Product Type

19.1.2. Usage

19.1.3. Material

19.1.4. Pricing

19.1.5. End-user

19.1.6. Distribution Channel

19.1.7. Geography

19.2. Understanding the Buying Process of the Customers

19.2.1. Preferred Type

19.2.2. Target Usage

19.2.3. Preferred Material/Pricing

19.2.4. Preferred Mode of Buying Products

19.2.5. Target End-user

19.3. Prevailing Market Risks

19.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Footwear Market Value Size & Forecast, by Product Type (US$ Bn) 2017-2031

Table 2: Global Footwear Market Volume Size & Forecast, by Product Type (Million Units) 2017-2031

Table 3: Global Footwear Market Value Size & Forecast, by Usage (US$ Bn) 2017-2031

Table 4: Global Footwear Market Volume Size & Forecast, by Usage (Million Units) 2017-2031

Table 5: Global Footwear Market Value Size & Forecast, by Material (US$ Bn) 2017-2031

Table 6: Global Footwear Market Volume Size & Forecast, by Material (Million Units) 2017-2031

Table 7: Global Footwear Market Value Size & Forecast, by Pricing (US$ Bn) 2017-2031

Table 8: Global Footwear Market Volume Size & Forecast, by Pricing (Million Units) 2017-2031

Table 9: Global Footwear Market Value Size & Forecast, by End-user (US$ Bn) 2017-2031

Table 10: Global Footwear Market Volume Size & Forecast, by End-user (Million Units) 2017-2031

Table 11: Global Footwear Market Value Size & Forecast, by Distribution Channel (US$ Bn) 2017-2031

Table 12: Global Footwear Market Volume Size & Forecast, by Distribution Channel (Million Units) 2017-2031

Table 13: North America Footwear Market Value Size & Forecast, by Product Type (US$ Bn) 2017-2031

Table 14: North America Footwear Market Volume Size & Forecast, by Product Type (Million Units) 2017-2031

Table 15: North America Footwear Market Value Size & Forecast, by Usage (US$ Bn) 2017-2031

Table 16: North America Footwear Market Volume Size & Forecast, by Usage (Million Units) 2017-2031

Table 17: North America Footwear Market Value Size & Forecast, by Material (US$ Bn) 2017-2031

Table 18: North America Footwear Market Volume Size & Forecast, by Material (Million Units) 2017-2031

Table 19: North America Footwear Market Value Size & Forecast, by Pricing (US$ Bn) 2017-2031

Table 20: North America Footwear Market Volume Size & Forecast, by Pricing (Million Units) 2017-2031

Table 21: North America Footwear Market Value Size & Forecast, by End-user (US$ Bn) 2017-2031

Table 22: North America Footwear Market Volume Size & Forecast, by End-user (Million Units) 2017-2031

Table 23: North America Footwear Market Value Size & Forecast, by Distribution Channel (US$ Bn) 2017-2031

Table 24: North America Footwear Market Volume Size & Forecast, by Distribution Channel (Million Units) 2017-2031

Table 25: North America Footwear Market Value Size & Forecast, by Country (Million Units) 2017-2031

Table 26: North America Footwear Market Volume Size & Forecast, by Country (Million Units) 2017-2031

Table 27: Europe Footwear Market Value Size & Forecast, by Product Type (US$ Bn) 2017-2031

Table 28: Europe Footwear Market Volume Size & Forecast, by Product Type (Million Units) 2017-2031

Table 29: Europe Footwear Market Value Size & Forecast, by Usage (US$ Bn) 2017-2031

Table 30: Europe Footwear Market Volume Size & Forecast, by Usage (Million Units) 2017-2031

Table 31: Europe Footwear Market Value Size & Forecast, by Material (US$ Bn) 2017-2031

Table 32: Europe Footwear Market Volume Size & Forecast, by Material (Million Units) 2017-2031

Table 33: Europe Footwear Market Value Size & Forecast, by Pricing (US$ Bn) 2017-2031

Table 34: Europe Footwear Market Volume Size & Forecast, by Pricing (Million Units) 2017-2031

Table 35: Europe Footwear Market Value Size & Forecast, by End-user (US$ Bn) 2017-2031

Table 36: Europe Footwear Market Volume Size & Forecast, by End-user (Million Units) 2017-2031

Table 37: Europe Footwear Market Value Size & Forecast, by Distribution Channel (US$ Bn) 2017-2031

Table 38: Europe Footwear Market Volume Size & Forecast, by Distribution Channel (Million Units) 2017-2031

Table 39: Europe Footwear Market Value Size & Forecast, by Country (US$ Bn) 2017-2031

Table 40: Europe Footwear Market Volume Size & Forecast, by Country (Million Units) 2017-2031

Table 41: Asia Pacific Footwear Market Value Size & Forecast, by Product Type (US$ Bn) 2017-2031

Table 42: Asia Pacific Footwear Market Volume Size & Forecast, by Product Type (Million Units) 2017-2031

Table 43: Asia Pacific Footwear Market Value Size & Forecast, by Usage (US$ Bn) 2017-2031

Table 44: Asia Pacific Footwear Market Volume Size & Forecast, by Usage (Million Units) 2017-2031

Table 45: Asia Pacific Footwear Market Value Size & Forecast, by Material (US$ Bn) 2017-2031

Table 46: Asia Pacific Footwear Market Volume Size & Forecast, by Material (Million Units) 2017-2031

Table 47: Asia Pacific Footwear Market Value Size & Forecast, by Pricing (US$ Bn) 2017-2031

Table 48: Asia Pacific Footwear Market Volume Size & Forecast, by Pricing (Million Units) 2017-2031

Table 49: Asia Pacific Footwear Market Value Size & Forecast, by End-user (US$ Bn) 2017-2031

Table 50: Asia Pacific Footwear Market Volume Size & Forecast, by End-user (Million Units) 2017-2031

Table 51: Asia Pacific Footwear Market Value Size & Forecast, by Distribution Channel (US$ Bn) 2017-2031

Table 52: Asia Pacific Footwear Market Volume Size & Forecast, by Distribution Channel (Million Units) 2017-2031

Table 53: Asia Pacific Footwear Market Value Size & Forecast, by Country (US$ Bn) 2017-2031

Table 54: Asia Pacific Footwear Market Volume Size & Forecast, by Country (Million Units) 2017-2031

Table 55: Middle East & Africa Footwear Market Value Size & Forecast, by Product Type (US$ Bn) 2017-2031

Table 56: Middle East & Africa Footwear Market Volume Size & Forecast, by Product Type (Million Units) 2017-2031

Table 57: Middle East & Africa Footwear Market Value Size & Forecast, by Usage (US$ Bn) 2017-2031

Table 58: Middle East & Africa Footwear Market Volume Size & Forecast, by Usage (Million Units) 2017-2031

Table 59: Middle East & Africa Footwear Market Value Size & Forecast, by Material (US$ Bn) 2017-2031

Table 60: Middle East & Africa Footwear Market Volume Size & Forecast, by Material (Million Units) 2017-2031

Table 61: Middle East & Africa Footwear Market Value Size & Forecast, by Pricing (US$ Bn) 2017-2031

Table 62: Middle East & Africa Footwear Market Volume Size & Forecast, by Pricing (Million Units) 2017-2031

Table 63: Middle East & Africa Footwear Market Value Size & Forecast, by End-user (US$ Bn) 2017-2031

Table 64: Middle East & Africa Footwear Market Volume Size & Forecast, by End-user (Million Units) 2017-2031

Table 65: Middle East & Africa Footwear Market Value Size & Forecast, by Distribution Channel (US$ Bn) 2017-2031

Table 66: Middle East & Africa Footwear Market Volume Size & Forecast, by Distribution Channel (Million Units) 2017-2031

Table 67: Middle East & Africa Footwear Market Value Size & Forecast, by Country (US$ Bn) 2017-2031

Table 68: Middle East & Africa Footwear Market Volume Size & Forecast, by Country (Million Units) 2017-2031

Table 69: South America Footwear Market Value Size & Forecast, by Product Type (US$ Bn) 2017-2031

Table 70: South America Footwear Market Volume Size & Forecast, by Product Type (Million Units) 2017-2031

Table 71: South America Footwear Market Value Size & Forecast, by Usage (US$ Bn) 2017-2031

Table 72: South America Footwear Market Volume Size & Forecast, by Usage (Million Units) 2017-2031

Table 73: South America Footwear Market Value Size & Forecast, by Material (US$ Bn) 2017-2031

Table 74: South America Footwear Market Volume Size & Forecast, by Material (Million Units) 2017-2031

Table 75: South America Footwear Market Value Size & Forecast, by Pricing (US$ Bn) 2017-2031

Table 76: South America Footwear Market Volume Size & Forecast, by Pricing (Million Units) 2017-2031

Table 77: South America Footwear Market Value Size & Forecast, by End-user (US$ Bn) 2017-2031

Table 78: South America Footwear Market Volume Size & Forecast, by End-user (Million Units) 2017-2031

Table 79: South America Footwear Market Value Size & Forecast, by Distribution Channel (US$ Bn) 2017-2031

Table 80: South America Footwear Market Volume Size & Forecast, by Distribution Channel (Million Units) 2017-2031

Table 81: South America Footwear Market Value Size & Forecast, by Country (US$ Bn) 2017-2031

Table 82: South America Footwear Market Volume Size & Forecast, by Country (Million Units) 2017-2031

List of Figures

Figure 1: Global Footwear Market Value Size & Forecast, by Product Type (US$ Bn) 2017-2031

Figure 2: Global Footwear Market Volume Size & Forecast, by Product Type (Million Units) 2017-2031

Figure 3: Global Footwear Market Incremental Opportunity, by Product Type (US$ Bn) 2017-2031

Figure 4: Global Footwear Market Value Size & Forecast, by Usage (US$ Bn) 2017-2031

Figure 5: Global Footwear Market Volume Size & Forecast, by Usage (Million Units) 2017-2031

Figure 6: Global Footwear Market Incremental Opportunity, by Usage (US$ Bn) 2017-2031

Figure 7: Global Footwear Market Value Size & Forecast, by Material (US$ Bn) 2017-2031

Figure 8: Global Footwear Market Volume Size & Forecast, by Material (Million Units) 2017-2031

Figure 9: Global Footwear Market Incremental Opportunity, by Material (US$ Bn) 2017-2031

Figure 10: Global Footwear Market Value Size & Forecast, by Pricing (US$ Bn) 2017-2031

Figure 11: Global Footwear Market Volume Size & Forecast, by Pricing (Million Units) 2017-2031

Figure 12: Global Footwear Market Incremental Opportunity, by Pricing (US$ Bn) 2017-2031

Figure 13: Global Footwear Market Value Size & Forecast, by End-user (US$ Bn) 2017-2031

Figure 14: Global Footwear Market Volume Size & Forecast, by End-user (Million Units) 2017-2031

Figure 15: Global Footwear Market Incremental Opportunity, by Pricing (US$ Bn) 2017-2031

Figure 16: Global Footwear Market Value Size & Forecast, by Distribution Channel (US$ Bn) 2017-2031

Figure 17: Global Footwear Market Volume Size & Forecast, by Distribution Channel (Million Units) 2017-2031

Figure 18: Global Footwear Market Incremental Opportunity, by Distribution Channel (US$ Bn) 2017-2031

Figure 19: North America Footwear Market Value Size & Forecast, by Product Type (US$ Bn) 2017-2031

Figure 20: North America Footwear Market Volume Size & Forecast, by Product Type (Million Units) 2017-2031

Figure 21: North America Footwear Market Incremental Opportunity, by Product Type (US$ Bn) 2017-2031

Figure 22: North America Footwear Market Value Size & Forecast, by Usage (US$ Bn) 2017-2031

Figure 23: North America Footwear Market Volume Size & Forecast, by Usage (Million Units) 2017-2031

Figure 24: North America Footwear Market Incremental Opportunity, by Usage (US$ Bn) 2017-2031

Figure 25: North America Footwear Market Value Size & Forecast, by Material (US$ Bn) 2017-2031

Figure 26: North America Footwear Market Volume Size & Forecast, by Material (Million Units) 2017-2031

Figure 27: North America Footwear Market Incremental Opportunity, by Material (US$ Bn) 2017-2031

Figure 28: North America Footwear Market Value Size & Forecast, by Pricing (US$ Bn) 2017-2031

Figure 29: North America Footwear Market Volume Size & Forecast, by Pricing (Million Units) 2017-2031

Figure 30: North America Footwear Market Incremental Opportunity, by Pricing (US$ Bn) 2017-2031

Figure 31: North America Footwear Market Value Size & Forecast, by End-user (US$ Bn) 2017-2031

Figure 32: North America Footwear Market Volume Size & Forecast, by End-user (Million Units) 2017-2031

Figure 33: North America Footwear Market Incremental Opportunity, by End-user (US$ Bn) 2017-2031

Figure 34: North America Footwear Market Value Size & Forecast, by Distribution Channel (US$ Bn) 2017-2031

Figure 35: North America Footwear Market Volume Size & Forecast, by Distribution Channel (Million Units) 2017-2031

Figure 36: North America Footwear Market Incremental Opportunity, by Distribution Channel (US$ Bn) 2017-2031

Figure 37: North America Footwear Market Value Size & Forecast, by Country (Million Units) 2017-2031

Figure 38: North America Footwear Market Volume Size & Forecast, by Country (Million Units) 2017-2031

Figure 39: North America Footwear Market Incremental Opportunity, by Country (US$ Bn) 2017-2031

Figure 40: Europe Footwear Market Value Size & Forecast, by Product Type (US$ Bn) 2017-2031

Figure 41: Europe Footwear Market Volume Size & Forecast, by Product Type (Million Units) 2017-2031

Figure 42: Europe Footwear Market Incremental Opportunity, by Product Type (US$ Bn) 2017-2031

Figure 43: Europe Footwear Market Value Size & Forecast, by Usage (US$ Bn) 2017-2031

Figure 44: Europe Footwear Market Volume Size & Forecast, by Usage (Million Units) 2017-2031

Figure 45: Europe Footwear Market Incremental Opportunity, by Usage (US$ Bn) 2017-2031

Figure 46: Europe Footwear Market Value Size & Forecast, by Material (US$ Bn) 2017-2031

Figure 47: Europe Footwear Market Volume Size & Forecast, by Material (Million Units) 2017-2031

Figure 48: Europe Footwear Market Incremental Opportunity, by Material (US$ Bn) 2017-2031

Figure 49: Europe Footwear Market Value Size & Forecast, by Pricing (US$ Bn) 2017-2031

Figure 50: Europe Footwear Market Volume Size & Forecast, by Pricing (Million Units) 2017-2031

Figure 51: Europe Footwear Market Incremental Opportunity, by Pricing (US$ Bn) 2017-2031

Figure 52: Europe Footwear Market Value Size & Forecast, by End-user (US$ Bn) 2017-2031

Figure 53: Europe Footwear Market Volume Size & Forecast, by End-user (Million Units) 2017-2031

Figure 54: Europe Footwear Market Incremental Opportunity, by End-user (US$ Bn) 2017-2031

Figure 55: Europe Footwear Market Value Size & Forecast, by Distribution Channel (US$ Bn) 2017-2031

Figure 56: Europe Footwear Market Volume Size & Forecast, by Distribution Channel (Million Units) 2017-2031

Figure 57: Europe Footwear Market Incremental Opportunity, by Distribution Channel (US$ Bn) 2017-2031

Figure 58: Europe Footwear Market Value Size & Forecast, by Country (US$ Bn) 2017-2031

Figure 59: Europe Footwear Market Volume Size & Forecast, by Country (Million Units) 2017-2031

Figure 60: Europe Footwear Market Incremental Opportunity, by Country (US$ Bn) 2017-2031

Figure 61: Asia Pacific Footwear Market Value Size & Forecast, by Product Type (US$ Bn) 2017-2031

Figure 62: Asia Pacific Footwear Market Volume Size & Forecast, by Product Type (Million Units) 2017-2031

Figure 63: Asia Pacific Footwear Market Incremental Opportunity, by Product Type (US$ Bn) 2017-2031

Figure 64: Asia Pacific Footwear Market Value Size & Forecast, by Usage (US$ Bn) 2017-2031

Figure 65: Asia Pacific Footwear Market Volume Size & Forecast, by Usage (Million Units) 2017-2031

Figure 66: Asia Pacific Footwear Market Incremental Opportunity, by Usage (US$ Bn) 2017-2031

Figure 67: Asia Pacific Footwear Market Value Size & Forecast, by Material (US$ Bn) 2017-2031

Figure 68: Asia Pacific Footwear Market Volume Size & Forecast, by Material (Million Units) 2017-2031

Figure 69: Asia Pacific Footwear Market Incremental Opportunity, by Material (US$ Bn) 2017-2031

Figure 70: Asia Pacific Footwear Market Value Size & Forecast, by Pricing (US$ Bn) 2017-2031

Figure 71: Asia Pacific Footwear Market Volume Size & Forecast, by Pricing (Million Units) 2017-2031

Figure 72: Asia Pacific Footwear Market Incremental Opportunity, by Pricing (US$ Bn) 2017-2031

Figure 73: Asia Pacific Footwear Market Value Size & Forecast, by End-user (US$ Bn) 2017-2031

Figure 74: Asia Pacific Footwear Market Volume Size & Forecast, by End-user (Million Units) 2017-2031

Figure 75: Asia Pacific Footwear Market Incremental Opportunity, by End-user (US$ Bn) 2017-2031

Figure 76: Asia Pacific Footwear Market Value Size & Forecast, by Distribution Channel (US$ Bn) 2017-2031

Figure 77: Asia Pacific Footwear Market Volume Size & Forecast, by Distribution Channel (Million Units) 2017-2031

Figure 78: Asia Pacific Footwear Market Incremental Opportunity, by Distribution Channel (US$ Bn) 2017-2031

Figure 79: Asia Pacific Footwear Market Value Size & Forecast, by Country (US$ Bn) 2017-2031

Figure 80: Asia Pacific Footwear Market Volume Size & Forecast, by Country (Million Units) 2017-2031

Figure 81: Asia Pacific Footwear Market Incremental Opportunity, by Country (US$ Bn) 2017-2031

Figure 82: Middle East & Africa Footwear Market Value Size & Forecast, by Product Type (US$ Bn) 2017-2031

Figure 83: Middle East & Africa Footwear Market Volume Size & Forecast, by Product Type (Million Units) 2017-2031

Figure 84: Middle East & Africa Footwear Market Incremental Opportunity, by Product Type (US$ Bn) 2017-2031

Figure 85: Middle East & Africa Footwear Market Value Size & Forecast, by Usage (US$ Bn) 2017-2031

Figure 86: Middle East & Africa Footwear Market Volume Size & Forecast, by Usage (Million Units) 2017-2031

Figure 87: Middle East & Africa Footwear Market Incremental Opportunity, by Usage (US$ Bn) 2017-2031

Figure 88: Middle East & Africa Footwear Market Value Size & Forecast, by Material (US$ Bn) 2017-2031

Figure 89: Middle East & Africa Footwear Market Volume Size & Forecast, by Material (Million Units) 2017-2031

Figure 90: Middle East & Africa Footwear Market Incremental Opportunity, by Material (US$ Bn) 2017-2031

Figure 91: Middle East & Africa Footwear Market Value Size & Forecast, by Pricing (US$ Bn) 2017-2031

Figure 92: Middle East & Africa Footwear Market Volume Size & Forecast, by Pricing (Million Units) 2017-2031

Figure 93: Middle East & Africa Footwear Market Incremental Opportunity, by Pricing (US$ Bn) 2017-2031

Figure 94: Middle East & Africa Footwear Market Value Size & Forecast, by End-user (US$ Bn) 2017-2031

Figure 95: Middle East & Africa Footwear Market Volume Size & Forecast, by End-user (Million Units) 2017-2031

Figure 96: Middle East & Africa Footwear Market Incremental Opportunity, by End-user (US$ Bn) 2017-2031

Figure 97: Middle East & Africa Footwear Market Value Size & Forecast, by Distribution Channel (US$ Bn) 2017-2031

Figure 98: Middle East & Africa Footwear Market Volume Size & Forecast, by Distribution Channel (Million Units) 2017-2031

Figure 99: Middle East & Africa Footwear Market Incremental Opportunity, by Distribution Channel (US$ Bn) 2017-2031

Figure 100: Middle East & Africa Footwear Market Value Size & Forecast, by Country (US$ Bn) 2017-2031

Figure 101: Middle East & Africa Footwear Market Volume Size & Forecast, by Country (Million Units) 2017-2031

Figure 102: Middle East & Africa Footwear Market Incremental Opportunity, by Country (US$ Bn) 2017-2031

Figure 103: South America Footwear Market Value Size & Forecast, by Product Type (US$ Bn) 2017-2031

Figure 104: South America Footwear Market Volume Size & Forecast, by Product Type (Million Units) 2017-2031

Figure 105: South America Footwear Market Incremental Opportunity, by Product Type (US$ Bn) 2017-2031

Figure 106: South America Footwear Market Value Size & Forecast, by Usage (US$ Bn) 2017-2031

Figure 107: South America Footwear Market Volume Size & Forecast, by Usage (Million Units) 2017-2031

Figure 108: South America Footwear Market Incremental Opportunity, by Usage (US$ Bn) 2017-2031

Figure 109: South America Footwear Market Value Size & Forecast, by Material (US$ Bn) 2017-2031

Figure 110: South America Footwear Market Volume Size & Forecast, by Material (Million Units) 2017-2031

Figure 111: South America Footwear Market Incremental Opportunity, by Material (US$ Bn) 2017-2031

Figure 112: South America Footwear Market Value Size & Forecast, by Pricing (US$ Bn) 2017-2031

Figure 113: South America Footwear Market Volume Size & Forecast, by Pricing (Million Units) 2017-2031

Figure 114: South America Footwear Market Incremental Opportunity, by Pricing (US$ Bn) 2017-2031

Figure 115: South America Footwear Market Value Size & Forecast, by End-user (US$ Bn) 2017-2031

Figure 116: South America Footwear Market Volume Size & Forecast, by End-user (Million Units) 2017-2031

Figure 117: South America Footwear Market Incremental Opportunity, by End-user (US$ Bn) 2017-2031

Figure 118: South America Footwear Market Value Size & Forecast, by Distribution Channel (US$ Bn) 2017-2031

Figure 119: South America Footwear Market Volume Size & Forecast, by Distribution Channel (Million Units) 2017-2031

Figure 120: South America Footwear Market Incremental Opportunity, by Distribution Channel (US$ Bn) 2017-2031

Figure 121: South America Footwear Market Value Size & Forecast, by Country (US$ Bn) 2017-2031

Figure 122: South America Footwear Market Volume Size & Forecast, by Country (Million Units) 2017-2031

Figure 123: South America Footwear Market Incremental Opportunity, by Country (US$ Bn) 2017-2031