Europe Neurological Disorders Drugs Market: Snapshot

Several government initiatives across various countries to educate masses about the rise of various diseases and increasing healthcare sector producing new drugs are the prime reasons for growth of neurological disorder drugs market. European Parkinson’s Disease Association, in Europe is actively supporting research and development by campaigning to raise awareness, and providing medication to patients is boosting the overall neurological disorder drugs market. This region is also witnessing rising focus on research and development programs that will help in producing affordable and effective drugs. The countries are collectively spending on developing neurological disorder drugs thus, improving the revenue of the market during the forecast period.

Staggering increase in brain altering disorders such as Alzheimer’s, epilepsy, Parkinson’s, cerebrovascular, and sclerosis are promoting the pharmaceutical firms to tap into the significantly growing neurological disorder drugs market. This will potentially supplement the market growth in the coming years. Rise of several innovative drugs to manage these diseases will swell up the investments in the market. Increasing number of clinical trials are another reason boosting the market. Rise in geriatric population along with patients with strokes, migraines, and headaches leading to cerebrovascular diseases are likely to augment the growth of the market.

The treatment for neurological disorders can be expensive due to several additional expenses related to sedatives and hypotonic, antiepileptic and anticholinergic drugs. There has also been decline in development of drugs due to expensive cost of research and development. Maturation of product portfolio can also cause decline in innovation. Strict policies to prescribe sedatives act as the major restrain in the market.

However, increasing prevalence of neurological disorders have the potential to create growth opportunities for the Europe neurological disorders drugs market. Rise in awareness regarding the diseases along with government’s support will boost the growth of the Europe neurological disorders drugs market.

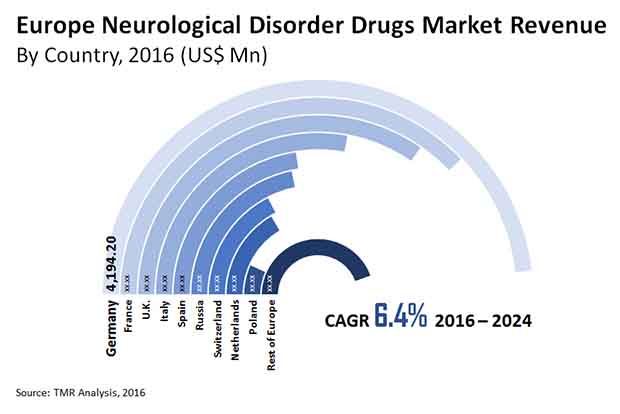

The Europe neurological disorder drugs market is anticipated to rise at a healthy CAGR of 6.4% during the forecast period of 2015 to 2024. The Europe market was worth US$18.3 bn during 2015 and is expected to attain a valuation of US$32.0 bn by the end of the forecast period.

Europe Neurological Disorders Drugs Market to Rise Owing to Increased Prevalence of Cerebrovascular Diseases

The European neurological disorder drugs market is segmented according to disorder into cerebrovascular diseases, multiple sclerosis, Alzheimer’s diseases, Parkinson’s diseases, and epilepsy. Among these, cerebrovascular diseases are dominating the market with a rising CAGR of 6.9% and is expected to rise by the end of 2024. This segment held the largest shares in the market during 2015. The drug class segment of Europe neurological disorder drugs market are Anticoagulants, Antihypertensive, Analgesics, Hypnotic and Sedative, Antipsychotic, antiepileptic, and anticholinergic. The major distribution channel segment of the neurological disorder drugs in Europe are retail pharmacy, Ecommerce, and hospital pharmacy.

Germany Providing Lucrative Growth to Market Due to Rise of Geriatrics Population

The Europe neurological disorder drugs market is geographically segmented into Poland, Switzerland, Netherlands, Russia, U.K., Spain, Italy, France, Germany, and other parts of Europe. Among these, Germany held significant shares in the market during 2015. Germany is expected to dominate the market during the forecast period. This was followed by France. The market is rising in these regions due to increasing neurological disorder and improved awareness regarding the disease by government initiatives and support groups. Rising number of geriatric population in Germany is one of the leading factor for the rise of neurological disorders drugs in this region. The other leading regions in neurological disorders drugs market are Spain, Switzerland, Italy, and the U.K. Switzerland is also anticipated to provide several opportunities for growth to the overall neurological disorders drugs market.

Some of the leading companies operating in the Europe neurological disorders drugs market are GlaxoSmithKline plc., Novartis AG, Teva Pharmaceutical Industries Ltd., Astra Zeneca, Bayer AG, Boehringer Ingelheim GmbH, and Merck & Co. These players are involving in expanding their outreach geographically to reserve their dominance in the market.

Rising Disease Burden to Accelerate R&D in Europe Neurological Disorder Drugs Market

Despite some of the exemplary strides neurosciences have made in the past ten years, the burden of neurological disorders has been growing worldwide. A number of translational research has been fueled by collaborative efforts by industry players in Europe neurological disorder drugs market. A case in point is rare forms of Alzheimer’s Disease. The regional market has witnessed growth on the back of growing body of research in central nervous system disorders through public private partnerships. Europe is seeing growing participation of pharmaceutical companies, academicians, and government agencies, who are focusing on reducing the prevalence of neurological disorders. The advent of new biomarkers and growing number of trials by various stakeholders are enriching the drug pipeline for the regional market. Conditional approval pathways are one of the key measures that might spur drug development pipeline in the Europe neurological disorder drugs market. In recent years, industry players have come to recognize the importance of multipronged approaches in treating neurological disorders. Europe is expected to accelerate research by adopting regulatory frameworks that can aid in the execution of clinical trials. In recent years, the market has also benefited from the focus on increasing the reproducibility of results.

The rapidly emerging COVID-19 pandemic has severely impacts the economic activities and international trade since it struck the world in 2019. The new waves in 2021 in various developing and developed regions including in Europe in the wake of emerging new virus variants have raised fresh alarms for policy makers. This has triggered regional and national governments to consolidate their public health infrastructure. Healthcare providers are also relying on cutting-edge technologies to meet the needs of patients of neurological disorders on one hand while constantly focusing on reducing operational costs. In these testing times, where cost-cutting has become more crucial than ever to retain the receding bottom line, repurposing of drugs has attracted considerable interest among pharmaceutical companies. The complex endpoints of clinical trials have stimulated the adoption of this approach in expediting drug development to meet the vast unmet need in the Europe neurological disorder drugs market.

Section 1 Preface

1.1 Report Scope and Market Segmentation

1.2 Assumptions and Acronyms Used

1.3 Research Methodology

Section 2 Market Overview

2.1 Executive Summary

2.2 Market Snapshot

Section 3 Market Dynamics

3.1 Drivers and Restraints Snapshot Analysis

3.2 Drivers

3.2.1 Aging population leading to increase neurological disorders

3.2.2 Increasing Therapeutic Treatments

3.2.3 Rise in interventions by government bodies

3.2.4 Rising Research & Development Programmes

3.2.5 Spending on neurological drugs to grow in developing countries

3.2.6 Growing awareness among people

3.3 Restraints

3.3.1 High treatment cost

3.3.2 Stringent regulations

3.4 Opportunities

3.5.1 Technological Advancement and Innovation

3.5.2 Significant Scope in Emerging Markets

Section 4 Market Overview

4.1 Europe Neurological Disorder Drugs Market Analysis and Forecasts, Market Revenue Projections (US$ Mn)

4.2 Disease description and epidemiology

4.2.1 Muscle Dystrophy

4.2.2 Multiple Sclerosis

4.2.3 Parkinson Disease

4.2.4 Amputees

4.3 Disease Frequency by Country

4.4 Future Outlook

4.5 Target population by Age Group

4.6 Alzheimer Disease - Prevalence Rate

4.7 Living Conditions

4.8 Neurological Disorder Drugs Market Outlook

Section 5 Europe Neurological Disorder Drugs Market Analysis, by Disorder

5.1 Introduction

5.2 Europe Neurological Disorder Drugs Market Value Share and Attractiveness Analysis, by Disorder

5.3 Europe Neurological Disorder Drugs Market Forecast, by Disorder

5.3.1 Epilepsy

5.3.2 Alzheimer’s Disease

5.3.3 Parkinson Disease

5.3.4 Multiple Sclerosis

5.3.5 Cerebrovascular Disease

5.3.6 Others

Section 6 Europe Neurological Disorder Drugs Market Analysis, by Drug Type

6.1 Introduction

6.2 Europe Neurological Disorder Drugs Market Value Share and Attractiveness Analysis, by Drug Type

6.3 Europe Neurological Disorder Drugs Market Forecast, by Drug Type

6.3.1 Anticholinergic

6.3.2 Antiepileptic

6.3.3 Antipsychotic

6.3.4 Analgesics

6.3.5 Hypnotic & Sedative

6.3.6 Antihypertensive

6.3.7 Anticoagulants

6.3.8 Others

Section 7 Europe Neurological Disorder Drugs Market Analysis, by Distribution Channel

7.1 Introduction

7.2 Europe Neurological Disorder Drugs Market Value Share and Attractiveness Analysis, by Distribution Channel

7.3 Europe Neurological Disorder Drugs Market Forecast, by Distribution Channel

7.3.1 Hospital Pharmacy

7.3.2 Retail Pharmacy

7.3.3 eCommerce

Section 8 Europe Neurological Disorder Drugs Market Analysis By Country

8.1 Neurological Disorder Drugs Market Forecast, By Country

Section 9 Germany Neurological Disorder Drugs Market Analysis

9.1 Germany Neurological Disorder Drugs Market Overview

9.2 Germany Market Value Share Analysis, By Disorder, Drug Type and Distribution channel

9.3 Germany Market Attractiveness Analysis, By Disorder, Drug Type and Distribution channel

9.4 Disease description and epidemiology

9.4.1 Muscular Dystrophy

9.4.2 Multiple Sclerosis

9.4.3 Parkinson’s Disease

9.4.4 Amputees

9.5 Disease Frequency by Country

9.6 Target population by Age Group

9.7 Alzheimer's Disease – Prevalence Rate

9.8 Living Conditions

Section 10 UK Neurological Disorder Drugs Market Analysis

10.1 UK Neurological Disorder Drugs Market Overview

10.2 UK Market Value Share Analysis, By Disorder, Drug Type and Distribution channel

10.3 UK Market Attractiveness Analysis, By Disorder, Drug Type and Distribution channel

10.4 Disease description and epidemiology

10.4.1 Muscular Dystrophy

10.4.2 Multiple Sclerosis

10.4.3 Parkinson’s Disease

10.4.4 Amputees

10.4.5 Disease Cost

10.5 Target population by Age Group

10.6 Alzheimer's Disease – Prevalence Rate

10.7 Living Conditions

Section 11 France Neurological Disorder Drugs Market Analysis

11.1 France Neurological Disorder Drugs Market Overview

11.2 France Market Value Share Analysis, By Disorder, Drug Type and Distribution channel

11.3 France Market Attractiveness Analysis, By Disorder, Drug Type and Distribution channel

11.4 Disease description and epidemiology

11.4.1 Muscular Dystrophy

11.4.2 Multiple Sclerosis

11.4.3 Factors Associated with Increased Risk for Multiple Sclerosis

11.4.4 Parkinson’s Disease

11.4.5 Amputees

11.5 Disease Cost

11.6 Target population by Age Group

11.7 Alzheimer's Disease – Prevalence Rate

11.8 Living Conditions

Section 12 Italy Neurological Disorder Drugs Market Analysis

12.1 Italy Neurological Disorder Drugs Market Overview

12.2 Italy Market Value Share Analysis, By Disorder, Drug Type and Distribution channel

12.3 Italy Market Attractiveness Analysis, By Disorder, Drug Type and Distribution channel

12.4 Disease description and epidemiology

12.4.1 Muscular Dystrophy

12.4.2 Multiple Sclerosis

12.4.3 Parkinson’s Disease

12.4.4 Amputees

12.5 Disease Frequency

12.6 Target population by Age Group

12.7 Alzheimer's Disease – Prevalence Rate

12.8 Disability – Targeted Age Group

12.9 Living Conditions

Section 13 Spain Neurological Disorder Drugs Market Analysis

13.1 Spain Neurological Disorder Drugs Market Overview

13.2 Spain Market Value Share Analysis, By Disorder, Drug Type and Distribution channel

13.3 Spain Market Attractiveness Analysis, By Disorder, Drug Type and Distribution channel

13.4 Disease description and epidemiology

13.4.1 Muscular Dystrophy

13.4.2 Multiple Sclerosis

13.4.3 Parkinson’s Disease

13.4.4 Amputees

13.5 Target population by Age Group

13.6 Alzheimer's Disease – Targeted Age Group

13.7 Living Conditions

Section 14 Russia Neurological Disorder Drugs Market Analysis

14.1 Russia Neurological Disorder Drugs Market Overview

14.2 Russia Market Value Share Analysis, By Disorder, Drug Type and Distribution channel

14.3 Russia Market Attractiveness Analysis, By Disorder, Drug Type and Distribution channel

14.4 Disease description and epidemiology

14.4.1 Muscular Dystrophy

14.4.2 Multiple Sclerosis

14.4.3 Parkinson’s Disease

14.4.4 Amputees

14.5 Target population by Age Group

14.6 Living Conditions

Section 15 Netherlands Neurological Disorder Drugs Market Analysis

15.1 Netherlands Neurological Disorder Drugs Market Overview

15.2 Netherlands Market Value Share Analysis, By Disorder, Drug Type and Distribution channel

15.3 Netherlands Market Attractiveness Analysis, By Disorder, Drug Type and Distribution channel

15.4 Disease description and epidemiology

15.4.1 Muscular Dystrophy

15.4.2 Multiple Sclerosis

15.4.3 Parkinson’s Disease

15.4.4 Amputees

15.5 Disease Cost

15.6 Target population by Age Group

15.7 Alzheimer's Disease – Prevalence Rate

15.8 Living Conditions

Section 16 Switzerland Neurological Disorder Drugs Market Analysis

16.1 Switzerland Neurological Disorder Drugs Market Overview

16.2 Switzerland Market Value Share Analysis, By Disorder, Drug Type and Distribution channel

16.3 Switzerland Market Attractiveness Analysis, By Disorder, Drug Type and Distribution channel

16.4 Disease description and epidemiology

16.4.1 Muscular Dystrophy

16.4.2 Multiple Sclerosis

16.4.3 Parkinson’s Disease

16.4.4 Amputees

16.5 Disease Cost

16.6 Target population by Age Group

16.7 Alzheimer's Disease – Prevalence Rate

16.8 Living Conditions

Section 17 Poland Neurological Disorder Drugs Market Analysis

17.1 Poland Neurological Disorder Drugs Market Overview

17.2 Poland Market Value Share Analysis, By Disorder, Drug Type and Distribution channel

17.3 Poland Market Attractiveness Analysis, By Disorder, Drug Type and Distribution channel

17.4 Disease description and epidemiology

17.4.1 Muscular Dystrophy

17.4.2 Multiple Sclerosis

17.4.3 Parkinson’s Disease

17.4.4 Amputees

17.5 Target population by Age Group

17.6 Alzheimer's Disease – Targeted Age Group

17.7 Alzheimer's Disease – Prevalence Rate

17.8 Living Conditions

Section 18 Rest of Europe Neurological Disorder Drugs Market Analysis

18.1 Rest of Europe Neurological Disorder Drugs Market Overview

18.2 Rest of Europe Market Value Share Analysis, By Disorder, Drug Type and Distribution channel

18.3 Rest of Europe Market Attractiveness Analysis, By Disorder, Drug Type and Distribution channel

18.4 Disease description and epidemiology

18.4.1 Muscular Dystrophy

18.4.2 Multiple Sclerosis

18.4.3 Parkinson’s Disease

18.4.4 Amputees

18.5 Alzheimer's Disease – Prevalence Rate

18.6 Living Conditions

Section 19 Company Profiles

19.1 Neurological Disorder Drugs Market Share Analysis, by Company (2015)

19.2 Company profiles

19.2.1 Novartis AG

19.2.1.1. Company Overview

19.2.1.2. Business Overview

19.2.1.3. Financial Overview

19.2.1.4. SWOT Analysis

19.2.1.5. Strategic Overview

19.2.2 GlaxoSmithKline plc

19.2.2.1. Company Overview

19.2.2.2. Business Overview

19.2.2.3. Financial Overview

19.2.2.4. SWOT Analysis

19.2.2.5. Strategic Overview

19.2.3 Merck & Co.

19.2.3.1. Company Overview

19.2.3.2. Business Overview

19.2.3.3. Financial Overview

19.2.3.4. SWOT Analysis

19.2.3.5. Strategic Overview

19.2.4 Bayer AG

19.2.4.1. Company Overview

19.2.4.2. Business Overview

19.2.4.3. Financial Overview

19.2.4.4. SWOT Analysis

19.2.4.5. Strategic Overview

19.2.5 AstraZeneca

19.2.5.1. Company Overview

19.2.5.2. Business Overview

19.2.5.3. Financial Overview

19.2.5.4. SWOT Analysis

19.2.5.5. Strategic Overview

19.2.6 Boehringer Ingelheim GmbH

19.2.6.1. Company Overview

19.2.6.2. Business Overview

19.2.6.3. Financial Overview

19.2.6.4. SWOT Analysis

19.2.6.5. Strategic Overview

19.2.7 Teva Pharmaceutical Industries Ltd.

19.2.7.1. Company Overview

19.2.7.2. Business Overview

19.2.7.3. Financial Overview

19.2.7.4. SWOT Analysis

19.2.7.5. Strategic Overview

19.2.8 F. Hoffmann-La Roche Ltd.

19.2.8.1. Company Overview

19.2.8.2. Business Overview

19.2.8.3. Financial Overview

19.2.8.4. SWOT Analysis

19.2.8.5. Strategic Overview

List of Tables

Table 01: Europe Neurological Disorder Drugs Market Size (US$ Mn) Forecast, by Disorder, 2014–2024

Table 02: Europe Neurological Disorder Drugs Market Size (US$ Mn) Forecast, by Drug Type, 2014–2024

Table 03: Europe Neurological Disorder Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2014–2024

Table 04: Europe Neurological Disorder Drugs Market Size (US$ Mn) Forecast, by Country, 2014–2024

List of Figures

Figure 01: Europe Neurological Disorder Drugs Market Size (US$ Mn) Forecast, 2015–2024

Figure 02: Europe Neurological Disorder Drugs Market Value Share Analysis, by Disorder, 2016 and 2024

Figure 03: Europe Neurological Disorder Drugs Market Attractiveness Analysis, by Disorder, 2015

Figure 04: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 05: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 06: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 07: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 08: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 09: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 10: Europe Neurological Disorder Drugs Market Value Share Analysis, by Drug Type, 2016 and 2024

Figure 11: Neurological Disorder Drugs Market Attractiveness Analysis, by Drug Type

Figure 12: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 13: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 14: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 15: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 16: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 17: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 18: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 19: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 20: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 21: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 22: Europe Neurological Disorder Drugs Market Value Share Analysis, by Distribution Channel, 2016 and 2024

Figure 23: Europe Neurological Disorder Drugs Market Attractiveness Analysis, by Distribution channel, 2015

Figure 24: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospital Pharmacy, 2014–2024

Figure 25: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Retail Pharmacy, 2014–2024

Figure 26: Europe Neurological Disorder Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by E-commerce, 2014–2024

Figure 27: Europe Neurological Disorder Drugs Market Value Share Analysis, by Country Type, 2016 and 2024

Figure 28: Neurological Disorder Drugs Market Attractiveness Analysis, by Region Type

Figure 29: Germany Neurological Disorder Drugs Market Size

Figure 30: Germany Neurological Disorder Drugs Market Size Y-o-Y Growth Projections, 2015–2024

Figure 31: Germany Market Value Share Analysis, by Disorder, 2016 and 2024

Figure 32: Germany Market Value Share Analysis, by Drug Type, 2016 and 2024

Figure 33: Germany Market Value Share Analysis, by Distribution channel, 2016 and 2024

Figure 34: U.K. Neurological Disorder Drugs Market Size (US$ Mn) Forecast, 2014–2024

Figure 35: U.K. Neurological Disorder Drugs Market Size Y-o-Y Growth Projections, 2015–2024

Figure 36: U.K. Market Value Share Analysis, by Disorder, 2016 and 2024

Figure 37: U.K. Market Value Share Analysis, by Drug Type, 2016 and 2024

Figure 38: U.K. Market Value Share Analysis, by Distribution Channel, 2016 and 2024

Figure 39: France Neurological Disorder Drugs Market Size (US$ Mn) Forecast, 2014–2024

Figure 40: France Neurological Disorder Drugs Market Size Y-o-Y Growth Projections, 2015–2024

Figure 41: France Market Value Share Analysis, by Disorder, 2016 and 2024

Figure 42: France Market Value Share Analysis, by Drug Type, 2016 and 2024

Figure 43: France Market Value Share Analysis, by Distribution Channel, 2016 and 2024

Figure 44: Italy Neurological Disorder Drugs Market Size (US$ Mn) Forecast, 2014–2024

Figure 45: Italy Neurological Disorder Drugs Market Size Y-o-Y Growth Projections, 2015–2024

Figure 46: Italy Market Value Share Analysis, by Disorder, 2016 and 2024

Figure 47: Italy Market Value Share Analysis, by Drug Type, 2016 and 2024

Figure 48: Italy Market Value Share Analysis, by Distribution Channel, 2016 and 2024

Figure 49: Spain Neurological Disorder Drugs Market Size (US$ Mn) Forecast, 2014–2024

Figure 50: Spain Neurological Disorder Drugs Market Size Y-o-Y Growth Projections, 2015–2024

Figure 51: Spain Market Value Share Analysis, by Disorder, 2016 and 2024

Figure 52: Spain Market Value Share Analysis, by Drug Type, 2016 and 2024

Figure 53: Spain Market Value Share Analysis, by Distribution Channel, 2016 and 2024

Figure 54: Russia Neurological Disorder Drugs Market Size

Figure 55: Russia Neurological Disorder Drugs Market Size Y-o-Y Growth Projections, 2015–2024

Figure 56: Russia Market Value Share Analysis, by Disorder, 2016 and 2024

Figure 57: Russia Market Value Share Analysis, by Drug Type, 2016 and 2024

Figure 58: Russia Market Value Share Analysis, by Distribution Channel, 2016 and 2024

Figure 59: Netherlands Neurological Disorder Drugs Market Size (US$ Mn) Forecast, 2014–2024

Figure 60: Netherlands Neurological Disorder Drugs Market Size Y-o-Y Growth Projections (%), 2015–2024

Figure 61: Netherlands Market Value Share Analysis, by Disorder, 2016 and 2024

Figure 62: Netherlands Market Value Share Analysis, by Drug Type, 2016 and 2024

Figure 63: Netherlands Market Value Share Analysis, by Distribution Channel, 2016 and 2024

Figure 64: Switzerland Neurological Disorder Drugs Market Size (US$ Mn) Forecast, 2014–2024

Figure 65: Switzerland Neurological Disorder Drugs Market Size Y-o-Y Growth Projections (%), 2015–2024

Figure 66: Switzerland Market Value Share Analysis, by Disorder, 2016 and 2024

Figure 67: Switzerland Market Value Share Analysis, by Drug Type, 2016 and 2024

Figure 68: Switzerland Market Value Share Analysis, by Distribution Channel, 2016 and 2024

Figure 69: Poland Neurological Disorder Drugs Market Size (US$ Mn) Forecast, 2014–2024

Figure 70: Poland Neurological Disorder Drugs Market Size Y-o-Y Growth Projections (%), 2015–2024

Figure 71: Poland Market Value Share Analysis, by Disorder, 2016 and 2024

Figure 72: Poland Market Value Share Analysis, by Drug Type, 2016 and 2024

Figure 73: Poland Market Value Share Analysis, by Distribution Channel, 2016 and 2024

Figure 74: Rest of Europe Neurological Disorder Drugs Market Size (US$ Mn) Forecast, 2014–2024

Figure 75: Rest of Europe Neurological Disorder Drugs Market Size Y-o-Y Growth Projections (%), 2015–2024

Figure 76: Rest of Europe Market Value Share Analysis, by Disorder, 2016 and 2024

Figure 77: Rest of Europe Market Value Share Analysis, by Drug Type, 2016 and 2024

Figure 78: Rest of Europe Market Value Share Analysis, by Distribution Channel, 2016 and 2024