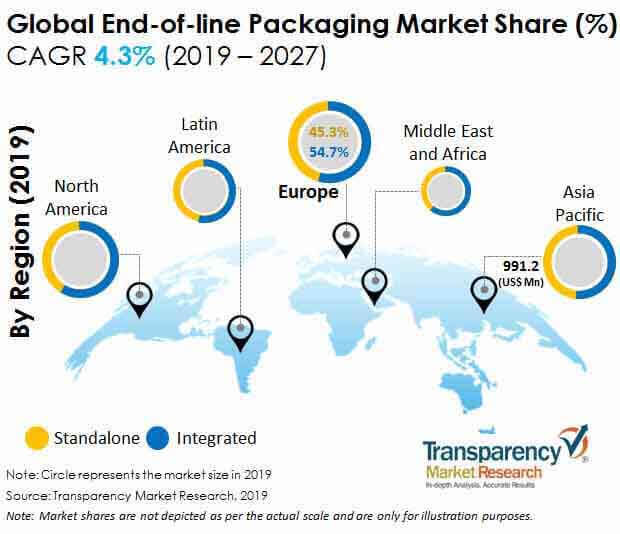

The global end-of-line packaging market was valued at US$ 4,376.3 million in 2018. The market is forecast to expand at a CAGR of 4.3% during the forecast period, 2019-2027.

An end-of-line packaging solution for an industrial unit helps to automate the entire manufacturing and packaging process. Automation of processes in machines helps increase the production quantity for any industry and aid the escalating demand. Several companies competing in the global market want to upgrade their businesses by transforming their manufacturing services for increased productivity in the long run. Industries in developing countries such as India, China, Malaysia, and Korea are implementing automated manufacturing procedures to overcome the difficulties such as shortage of labor and cost optimization. End-of-line packaging eradicates the requirement of training workers. This allows companies to engross the available labor in other valuable tasks.

Introduction of robot hands in packaging processes is rapidly becoming prevalent to surge manufacturing efficiency. Robotic systems in end-of-line packaging improve the overall production efficiency. Robotic systems in end-of-line packaging also diminish physical tasks including packaging, palletizing, and picking. A robotic arm enables augmented production efficiency that results into high investment returns and low operational costs. Robotic arms in end-of-line packaging are especially used to handle lightweight packaging as it decreases the risk of damage. The benefits of incorporating robotic arm automation in end-of-line packaging are influencing key manufacturers in various industries to install these systems.

The end-of-line packaging market is segmented on the basis of technology and the automatic segment is expected to account for the highest share during the forecast period 2019-2027. The semi-automatic segment is expected to drop its share in the overall market by the end of 2027. Automation in manufacturing facilities is gaining traction within companies to overcome the scarcity of skilled workforce, specifically in developing countries. Increased implementation of automatic production processes in production lines is expected to drive the end-of-line packaging market.

On the basis of received order type, the customized order segment is expected to witness lucrative growth and is to be valued at US$ 2,907.3 Mn by 2018. End-use industries are progressively opting for customized end-of-line packaging solutions. Therefore, the share of customized order segment is expected to rise through 2027. As industries opt for standardized solutions for improved efficiency in end-of-line packaging, it is expected that the received order type segment will witness an increased demand during the forecast period.

The food & beverages end-use segment is expected to be the most attractive segment during 2019-2027. Rapid industrialization is the key factor influencing the growth of the end-of-line packaging market. The demand for end-of-line packaging machineries is increasing in food and beverage end-use industries as it reduces the manual handling of products, which reduces the risk of contamination. Electronics & semiconductor, pharmaceuticals, and automotive are some of the key segments in the global end-of-line packaging market.

High production costs translate to lower profits. Today, enterprises with profitable businesses are planning to reduce costs to achieve better efficiency. Although capital costs are a major influence in the decision to adopt automation techniques such as end-of-line packaging, in reality, these solutions are proving to be instrumental in decreasing costs along with providing significant increment in production capabilities through increased speed, reduction of bottle necks, and capability to run 24/7. Food packaging industries adopt for automated packaging techniques that enable the staff to avoid performing dangerous and physically demanding tasks, in turn, reducing costly OHS (Occupational Health and Safety) issues.

On the basis of geography, China is expected to be the most attractive market followed by the US and Germany in the end-of-line packaging market. The US and Germany end-of-line packaging market being a comparatively mature market is expected to show slow growth. Key companies functioning in the global end-of-line packaging market are, Bosch Packaging Technology Krones AG, Optima Packaging Group GmbH, Pro Mach Inc., Gebo Cermex, IMA S.p.A., Festo Corporation, Combi Packaging Systems LLC, DS Smith plc, and Schneider Packaging Equipment.

Global End-of-Line Packaging Market to Grow with Advancements in Product Positioning and Branding

The demand within the global end-of-line packaging market is slated to rise at a stellar pace in the times to follow. There is little contention about the overbearing relevance of packaging technologies across the domain of pharmaceuticals, healthcare, and semiconductors. There is little contention about the overbearing capacity of the food industry to embrace new packaging technologies. The need for attracting the attention of the consumers through attractive food packaging has brought end-of-line packaging under the spotlight of attention. In light of these factors, it is safe to state that the global end-of-line packaging market would tread along a lucrative trajectory.

The global biopesticides market has been segmented as follows:

|

Source |

|

|

Product |

|

|

Application |

|

|

Region |

|

The End-of-line Packaging Market is studied from 2019 - 2027.

The End-of-line Packaging market is projected to reach the valuation of US$ 4,376.3 million by 2027

The End-of-line Packaging market is expected to grow at a CAGR of 4.3% during 2019-2030

US, China, Malaysia, Korea, Germany, Japan, UK

Bosch Packaging Technology Krones AG, Optima Packaging Group GmbH, Pro Mach Inc., Gebo Cermex, IMA S.p.A., Festo Corporation, Combi Packaging Systems LLC are a few of the key vendors in the End-of-line Packaging market.

1.Global End of Line Packaging Market - Executive Summary

2.Research Methodology

3.Assumptions and Acronyms Used

4.Global End of Line Packaging Market Overview

4.1.Introduction

4.1.1.Global End of Line Packaging Market Taxonomy

4.1.2.Global End of Line Packaging Market Definition

4.2.Macroeconomic Indicators

4.3.Global End of Line Packaging Market Dynamics

4.3.1.Drivers

4.3.1.1.Supply Side

4.3.1.2.Demand Side

4.3.2.Restraints

4.3.3.Opportunities

4.4.Global Packaging Industry Outlook (Parent Market)

4.5.Global End of Line Packaging Market Forecast, 2019–2027

4.6.Global End of Line Packaging Market Snapshot

4.6.1.Global End of Line Packaging Market Share by Technology

4.6.2.Global End of Line Packaging Market Share Function

4.6.3.Global End of Line Packaging Market Share by Received order type

4.6.4.Global End of Line Packaging Market Share by End Use Industry

4.6.5.Global End of Line Packaging Market Share by Region

4.7.Global End of Line Packaging Market Trends

5.Global End of Line Packaging Market Analysis and Forecast (2019–2027), by Technology

5.1.Introduction

5.1.1.Market Share and BPS Analysis, by Technology

5.1.2.Y-o-Y growth comparison, by Technology

5.2.Global End of Line Packaging Market Size and Forecast (2019–2027), by Technology

5.2.1.Automatic

5.2.1.1.Absolute $ Opportunity

5.2.1.2.Market Value & Volume Forecast (2019–2027)

5.2.2.Semi-Automatic

5.2.2.1.Absolute $ Opportunity

5.2.2.2.Market Value & Volume Forecast (2019–2027)

5.3.Market Attractiveness Analysis, by Technology

5.4.Prominent Trends

6.Global End of Line Packaging Market Analysis, by Function

6.1.Introduction

6.1.1.Market Share and BPS Analysis, by Function

6.1.2.Y-o-Y growth comparison, by Function

6.2.Global End of Line Packaging Market Size and Forecast (2019–2027), by Function

6.2.1.Stand Alone

6.2.1.1.Palletizing

6.2.1.1.1.Absolute $ Opportunity

6.2.1.1.2.Market Value & Volume Forecast (2019–2027)

6.2.1.2.Carton erecting, packing & sealing

6.2.1.2.1.Absolute $ Opportunity

6.2.1.2.2.Market Value & Volume Forecast (2019–2027)

6.2.1.3.Stretch Wrapping

6.2.1.3.1.Absolute $ Opportunity

6.2.1.3.2.Market Value & Volume Forecast (2019–2027)

6.2.1.4.Labelling

6.2.1.4.1.Absolute $ Opportunity

6.2.1.4.2.Market Value & Volume Forecast (2019–2027)

6.2.1.5.Others

6.2.1.5.1.Absolute $ Opportunity

6.2.1.5.2.Market Value & Volume Forecast (2019–2027)

6.2.2.Integrated

6.2.2.1.Absolute $ Opportunity

6.2.2.2.Market Value & Volume Forecast (2019–2027)

6.3. Market Attractiveness Analysis, by Function

6.4.Prominent Trends

7.Global End of Line Packaging Market Analysis, by Received Order Type

7.1.Introduction

7.1.1.Market Share and BPS Analysis, by Received Order Type

7.1.2.Y-o-Y growth comparison, by Received Order Type

7.2.Global End of Line Packaging Market Size and Forecast (2019–2027), by Received Order Type

7.2.1.Customized Order

7.2.1.1.Absolute $ Opportunity

7.2.1.2.Market Value & Volume Forecast (2019–2027)

7.2.2.Standard Order

7.2.2.1.Absolute $ Opportunity

7.2.2.2.Market Value & Volume Forecast (2019–2027)

7.3.Market Attractiveness Analysis, by Received Order Type

7.4.Prominent Trends

8.Global End of Line Packaging Market Analysis, by End Use Industry

8.1.Introduction

8.1.1.Market Share and BPS Analysis, by End Use Industry

8.1.2.Y-o-Y growth comparison, by End Use Industry

8.2.Global End of Line Packaging Market Size and Forecast (2019–2027), by End Use Industry

8.2.1.Food

8.2.1.1.Absolute $ Opportunity

8.2.1.2.Market Value & Volume Forecast (2019–2027)

8.2.2.Pharmaceutical

8.2.2.1.Absolute $ Opportunity

8.2.2.2.Market Value & Volume Forecast (2019–2027)

8.2.3.Electronics and Semiconductor

8.2.3.1.Absolute $ Opportunity

8.2.3.2.Market Value & Volume Forecast (2019–2027)

8.2.4.Automotive

8.2.4.1.Absolute $ Opportunity

8.2.4.2.Market Value & Volume Forecast (2019–2027)

8.2.5.Others

8.2.5.1.Absolute $ Opportunity

8.2.5.2.Market Value & Volume Forecast (2019–2027)

8.3.Market Attractiveness Analysis , by End Use Industry

8.4.Prominent Trends

9.Global End of Line Packaging Market Analysis, by Region

9.1.Introduction

9.1.1.Y-o-Y Growth Projections, by Region

9.1.2.Basis Point Share (BPS) Analysis, by Region

9.2.Market Forecast (2019–2027) by Region

9.2.1.North America Market Volume & Value Forecast (2019–2027)

9.2.2.Latin America Market Volume & Value Forecast (2019–2027)

9.2.3.Europe Market Volume & Value Forecast (2019–2027)

9.2.4.APAC Market Volume & Value Forecast (2019–2027)

9.2.5.Middle East & Africa Market Volume & Value Forecast (2019–2027)

9.3.Regional Attractiveness Analysis

10.North America Global End of Line Packaging Market Analysis

10.1.Introduction

10.1.1.Y-o-Y Growth Projections, by Country

10.1.2.Basis Point Share (BPS) Analysis, by Country

10.1.3.Key Trends

10.2.North America Market Forecast (2019–2027)

10.2.1.Market Volume and Value Forecast (2019–2027) by Country

10.2.1.1.U.S.

10.2.1.2.Canada

10.2.2.Market Volume & Value Forecast (2019–2027), by Technology

10.2.2.1.Automatic

10.2.2.2.Semi-Automatic

10.2.3.Market Volume & Value Forecast (2019–2027), by Function

10.2.3.1.Stand Alone

10.2.3.1.1.Palletizing

10.2.3.1.2.Carton erecting, packing and sealing

10.2.3.1.3.Stretch Wrapping

10.2.3.1.4.Labelling

10.2.3.1.5.Others

10.2.3.2.Integrated

10.2.4.Market Volume & Value Forecast (2019–2027) by Received Order Type

10.2.4.1.Customized Order

10.2.4.2.Standard Order

10.2.5.Market Volume & Value Forecast (2019–2027) by End Use Industry

10.2.5.1.Food

10.2.5.2.Pharmaceutical

10.2.5.3.Electronics & Semiconductor

10.2.5.4.Automotive

10.2.5.5.Others

10.2.6.Market Attractiveness Analysis

10.2.6.1.By Country

10.2.6.2.By Technology

10.2.6.3. by Functions

10.2.6.4.By Received Order Type

10.2.6.5.By End Use Industry

10.2.7.Drivers & Restraints: Impact Analysis

11.Latin America Global End of Line Packaging Market Analysis

11.1.Introduction

11.1.1.Y-o-Y Growth Projections, by Country

11.1.2.Basis Point Share (BPS) Analysis, by Country

11.1.3.Key Trends

11.2.Latin America Global End of Line Packaging Market Forecast (2019–2027)

11.2.1.Market Volume and Value Forecast (2019–2027) by Country

11.2.1.1.Mexico

11.2.1.2.Brazil

11.2.1.3.Rest of LATAM

11.2.2.Market Volume & Value Forecast (2019–2027) by Technology

11.2.2.1.Automatic

11.2.2.2.Semi-Automatic

11.2.3.1.Stand Alone

11.2.3.1.1.Palletizing

11.2.3.1.2.Carton erecting, packing and sealing

11.2.3.1.3.Stretch Wrapping

11.2.3.1.4.Labelling

11.2.3.1.5.Others

11.2.3.2.Integrated

11.2.4.Market Volume & Value Forecast (2019–2027) by Received Order Type

11.2.4.1.Customized Order

11.2.4.2.Standard Order

11.2.5.Market Volume & Value Forecast (2019–2027) by End Use Industry

11.2.5.1.Food

11.2.5.2.Pharmaceutical

11.2.5.3.Electronics & Semiconductor

11.2.5.4.Automotive

11.2.5.5.Others

11.2.6.Market Attractiveness Analysis

11.2.6.1.By Country

11.2.6.2.By Technology

11.2.6.3. by Functions

11.2.6.4.By Received Order Type

11.2.6.5.By End Use Industry

11.2.7.Drivers & Restraints: Impact Analysis

12.Europe Global End of Line Packaging Market Analysis

12.1.Introduction

12.1.1.Y-o-Y Growth Projections, by Country

12.1.2.Basis Point Share (BPS) Analysis, by Country

12.1.3.Key Trends

12.2.Europe Global End of Line Packaging Market Forecast (2019–2027)

12.2.1.Market Volume and Value Forecast (2019–2027) by Country

12.2.1.1.Germany

12.2.1.2.France

12.2.1.3.U.K.

12.2.1.4.Spain

12.2.1.5.Italy

12.2.1.6.Nordic

12.2.1.7.Russia

12.2.1.8.Poland

12.2.1.9.BENELUX

12.2.1.10.Rest of Europe

12.2.2.Market Volume & Value Forecast (2019–2027) by Technology

12.2.2.1.Automatic

12.2.2.2.Semi-Automatic

12.2.3.Market Volume & Value Forecast (2019–2027) by Function

12.2.3.1.Stand Alone

12.2.3.1.1.Palletizing

12.2.3.1.2.Carton erecting, packing and sealing

12.2.3.1.3.Stretch Wrapping

12.2.3.1.4.Labelling

12.2.3.1.5.Others

12.2.3.2.Integrated

12.2.4.Market Volume & Value Forecast (2019–2027) by Received Order Type

12.2.4.1.Customized Order

12.2.4.2.Standard Order

12.2.5.Market Volume & Value Forecast (2019–2027) by End Use Industry

12.2.5.1.Food

12.2.5.2.Pharmaceutical

12.2.5.3.Electronics & Semiconductor

12.2.5.4.Automotive

12.2.5.5.Others

12.2.6.Market Attractiveness Analysis

12.2.6.1.By Country

12.2.6.2.By Technology

12.2.6.3. by Functions

12.2.6.4.By Received Order Type

12.2.6.5.By End Use Industry

12.2.7.Drivers & Restraints: Impact Analysis

13.APAC Global End of Line Packaging Market Analysis

13.1.Introduction

13.1.1.Y-o-Y Growth Projections, by Country

13.1.2.Basis Point Share (BPS) Analysis, by Country

13.1.3.Key Trends

13.2.APAC Global End of Line Packaging Market Forecast (2019–2027)

13.2.1.Market Volume and Value Forecast (2019–2027) by Country

13.2.1.1.China

13.2.1.2.India

13.2.1.3.Japan

13.2.1.4.ASEAN

13.2.1.5.ANZ

13.2.1.6.Rest of APAC

13.2.2.Market Volume & Value Forecast (2019–2027) by Technology

13.2.2.1.Automatic

13.2.2.2.Semi-Automatic

13.2.3.Market Volume & Value Forecast (2019–2027) by Function

13.2.3.1.Stand Alone

13.2.3.1.1.Palletizing

13.2.3.1.2.Carton erecting, packing and sealing

13.2.3.1.3.Stretch Wrapping

13.2.3.1.4.Labelling

13.2.3.1.5.Others

13.2.3.2.Integrated

13.2.4.Market Volume & Value Forecast (2019–2027) by Received Order Type

13.2.4.1.Customized Order

13.2.4.2.Standard Order

13.2.5.Market Volume & Value Forecast (2019–2027) by End Use Industry

13.2.5.1.Food

13.2.5.2.Pharmaceutical

13.2.5.3.Electronics & Semiconductor

13.2.5.4.Automotive

13.2.5.5.Others

13.2.6.Market Attractiveness Analysis

13.2.6.1.By Country

13.2.6.2.By Technology

13.2.6.3. by Functions

13.2.6.4.By Received Order Type

13.2.6.5.By End Use Industry

13.2.7.Drivers & Restraints: Impact Analysis

14.Middle East & Africa Global End of Line Packaging Market Analysis

14.1.Introduction

14.1.1.Y-o-Y Growth Projections, by Country

14.1.2.Basis Point Share (BPS) Analysis, by Country

14.1.3.Key Trends

14.2.Middle East & Africa Global End of Line Packaging Market Forecast (2019–2027)

14.2.1.Market Volume and Value Forecast (2019–2027) by Country

14.2.1.1.GCC

14.2.1.2.North Africa

14.2.1.3.South Africa

14.2.1.4.Rest of MEA

14.2.2.Market Volume & Value Forecast (2019–2027) by Technology

14.2.2.1.Automatic

14.2.2.2.Semi-Automatic

14.2.3.Market Volume & Value Forecast (2019–2027) by Function

14.2.3.1.Stand Alone

14.2.3.1.1.Palletizing

14.2.3.1.2.Carton erecting, packing and sealing

14.2.3.1.3.Stretch Wrapping

14.2.3.1.4.Labelling

14.2.3.1.5.Others

14.2.3.2.Integrated

14.2.4.Market Volume & Value Forecast (2019–2027) by Received Order Type

14.2.4.1.Customized Order

14.2.4.2.Standard Order

14.2.5.Market Volume & Value Forecast (2019–2027) by End Use Industry

14.2.5.1.Food

14.2.5.2.Pharmaceutical

14.2.5.3.Electronics & Semiconductor

14.2.5.4.Automotive

14.2.5.5.Others

14.2.6.Market Attractiveness Analysis

14.2.6.1.By Country

14.2.6.2.By Technology

14.2.6.3. by Functions

14.2.6.4.By Received Order Type

14.2.6.5.By End Use Industry

14.2.7.Drivers & Restraints: Impact Analysis

15.Competitive Landscape

15.1.Competition Dashboard

15.2.Market Structure and Company Market Share

15.3.Company Profiles: (Revenue, Products/Brand Offerings, Company Highlights)

15.3.1. Krones AG

15.3.2. IMA S.p.A.

15.3.3. Bosch Packaging Technology

15.3.4. DS Smith plc.

15.3.5. Pro Mach, Inc.

15.3.6. Combi Packaging Systems LLC

15.3.7. Festo Group

15.3.8. Schneider Packaging Equipment Co. Inc.

15.3.9 Gebo Cermex

15.3.10.OPTIMA Packaging Group GmbH

List of Tables

Table 01: Global End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Technology (2015-2027)

Table 02: Global End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Function (2015-2027)

Table 03: Global End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Stand Alone (2015-2027)

Table 04: Global End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Received Order (2015-2027)

Table 05: Global End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by End-use (2015-2027)

Table 06: Global End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Region (2015-2027)

Table 07: North America End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Country (2015-2027)

Table 08: North America End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Technology (2015-2027)

Table 09: North America End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Function (2015-2027)

Table 10: North America End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Stand Alone (2015-2027)

Table 11: North America End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Received Order (2015-2027)

Table 12: North America End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by End-use (2015-2027)

Table 13: Latin America End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Country (2015-2027)

Table 14: Latin America End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Technology (2015-2027)

Table 15: Latin America End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Function (2015-2027)

Table 16: Latin America End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Stand Alone (2015-2027)

Table 17: Latin America End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Received Order (2015-2027)

Table 18: Latin America End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by End-use (2015-2027)

Table 19: Europe End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Country (2015-2027)

Table 20: Europe End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Technology (2015-2027)

Table 21: Europe End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Function (2015-2027)

Table 22: Europe End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Stand Alone (2015-2027)

Table 23: Europe End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Received Order (2015-2027)

Table 24: Europe End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by End-use (2015-2027)

Table 25: APAC End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Country (2015-2027)

Table 26: APAC End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Technology (2015-2027)

Table 27: APAC End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Function (2015-2027)

Table 28: APAC End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Stand Alone (2015-2027)

Table 29: APAC End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Received Order (2015-2027)

Table 30: APAC End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by End-use (2015-2027)

Table 31: MEA End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Country (2015-2027)

Table 32: MEA End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Technology (2015-2027)

Table 33: MEA End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Function (2015-2027)

Table 34: MEA End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Stand Alone (2015-2027)

Table 35: MEA End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by Received Order (2015-2027)

Table 36: MEA End-of-line Packaging Market Value (US$ Mn) & Volume (Units), by End-use (2015-2027)

List of Figures

Figure 01: Global End-of-line Packaging Market Value Share by Technology, 2019

Figure 02: Global End-of-line Packaging Market Value Share by Function, 2019

Figure 03: Global End-of-line Packaging Market Value Share by Received Order, 2019

Figure 04: Global End-of-line Packaging Market Value Share by End-use Industry, 2019

Figure 05: Global End-of-line Packaging Market Value (US$ Mn) and Y-o-Y Growth (%), 2015–2027

Figure 06: Global End-of-line Packaging Market Absolute $ Opportunity (US$ Mn), 2019?2027

Figure 07: Global End-of-line Packaging Market, BPS Analysis by Technology,

Figure 08: Global End-of-line Packaging Market Revenue Y-o-Y Growth by Technology, 2016–2027

Figure 09: Global End-of-line Packaging Market Attractiveness by Technology, 2019–2027

Figure 10: Global End-of-line Packaging Market Value (US$ Mn) by Automatic Segment, 2015–2027

Figure 11: Global End-of-line Packaging Market Value (US$ Mn) by Semi-automatic Segment, 2015–2027

Figure 12: Global End-of-line Packaging Market, BPS Analysis by Function, 2019 & 2026

Figure 13: Global End-of-line Packaging Market Revenue Y-o-Y Growth by Function, 2016–2027

Figure 14: Global End-of-line Packaging Market Attractiveness by Function, 2019–2027

Figure 15: Global End-of-line Packaging Market Value (US$ Mn) by Standalone Segment, 2015–2027

Figure 16: Global End-of-line Packaging Market Value (US$ Mn) by Integrated Segment, 2015–2027

Figure 17: Global End-of-line Packaging Market, BPS Analysis by Received Order Type, 2019 & 2026

Figure 18: Global End-of-line Packaging Market Revenue Y-o-Y Growth by Received Order Type, 2016–2027

Figure 19: Global End-of-line Packaging Market Attractiveness by Received Order Type, 2019–2027

Figure 20: Global End-of-line Packaging Market Value (US$ Mn) by Customized Order Segment, 2015–2027

Figure 21: Global End-of-line Packaging Market Value (US$ Mn) by Standard Order Segment, 2015–2027

Figure 22: Global End-of-line Packaging Market, BPS Analysis by End-use Industry, 2019 & 2026

Figure 23: Global End-of-line Packaging Market Revenue Y-o-Y Growth by End-use Industry, 2016–2027

Figure 24: Global End-of-line Packaging Market Attractiveness by End-use Industry, 2019–2027

Figure 25: Global End-of-line Packaging Market Value (US$ Mn) by Food & Beverages Segment, 2015–2027

Figure 26: Global End-of-line Packaging Market Value (US$ Mn) by Pharmaceuticals Segment, 2015–2027

Figure 27: Global End-of-line Packaging Market Value (US$ Mn) by Electronics & Semiconductor Segment, 2015–2027

Figure 28: Global End-of-line Packaging Market Value (US$ Mn) by Automotive Segment, 2015–2027

Figure 29: Global End-of-line Packaging Market Value (US$ Mn) by Others Segment, 2015–2027

Figure 30: Global End-of-line Packaging Market, BPS Analysis by Region,

Figure 31: Global End-of-line Packaging Market Revenue Y-o-Y Growth by Region, 2015–2027

Figure 32: Global End-of-line Packaging Market Attractiveness by Region,

Figure 33: North America End-of-line Packaging Market Value (US$ Mn) and Y-o-Y Growth (%), 2015–2027

Figure 34: North America End-of-line Packaging Market Absolute $ Opportunity (US$ Mn), 2019?2027

Figure 35: North America End-of-line Packaging Market, BPS Analysis by Country, 2019 & 2026

Figure 36: North America End-of-line Packaging Market Revenue Y-o-Y Growth by Country, 2016–2027

Figure 37: North America End-of-line Packaging Market Attractiveness by Country, 2019–2027

Figure 38: North America End-of-line Packaging Market BPS Analysis by Technology, 2019 & 2026

Figure 39: North America End-of-line Packaging Market Revenue Y-o-Y Growth by Technology, 2016–2027

Figure 40: North America End-of-line Packaging Market Attractiveness by Technology, 2019–2027

Figure 41: North America End-of-line Packaging Market BPS Analysis by Function,

Figure 42: North America End-of-line Packaging Market Revenue Y-o-Y Growth by Function, 2016–2027

Figure 43: North America End-of-line Packaging Market Attractiveness by Function,

Figure 44: North America End-of-line Packaging Market, BPS Analysis by Received Order Type, 2019 & 2026

Figure 45: North America End-of-line Packaging Market Revenue Y-o-Y Growth by Received Order Type, 2016–2027

Figure 46: North America End-of-line Packaging Market Attractiveness by Received Order Type, 2019–2027

Figure 47: North America End-of-line Packaging Market, BPS Analysis by End-use Industry, 2019 & 2026

Figure 48: North America End-of-line Packaging Market Revenue Y-o-Y Growth by End-use Industry, 2016–2027

Figure 49: North America End-of-line Packaging Market Attractiveness by End-use Industry, 2019–2027

Figure 50: Latin America End-of-line Packaging Market Value (US$ Mn) and Y-o-Y Growth (%), 2015–2027

Figure 51: Latin America End-of-line Packaging Market Absolute $ Opportunity (US$ Mn), 2019?2027

Figure 52: Latin America End-of-line Packaging Market, BPS Analysis by Country, 2019 & 2026

Figure 53: Latin America End-of-line Packaging Market Revenue Y-o-Y Growth by Country, 2016–2027

Figure 54: Latin America End-of-line Packaging Market Attractiveness by Country, 2019–2027

Figure 55: Latin America End-of-line Packaging Market BPS Analysis by Technology, 2019 & 2026

Figure 56: Latin America End-of-line Packaging Market Revenue Y-o-Y Growth by Technology, 2016–2027

Figure 57: Latin America End-of-line Packaging Market Attractiveness by Technology, 2019–2027

Figure 58: Latin America End-of-line Packaging Market BPS Analysis by Function, 2019 & 2026

Figure 59: Latin America End-of-line Packaging Market Revenue Y-o-Y Growth by Function, 2016–2027

Figure 60: Latin America End-of-line Packaging Market Attractiveness by Function, 2019–2027

Figure 61: Latin America End-of-line Packaging Market, BPS Analysis by Received Order Type, 2019 & 2026

Figure 62: Latin America End-of-line Packaging Market Revenue Y-o-Y Growth by Received Order Type, 2015–2027

Figure 63: Latin America End-of-line Packaging Market Attractiveness by Received Order Type, 2019–2027

Figure 64: Latin America End-of-line Packaging Market, BPS Analysis by End-use Industry, 2019 & 2026

Figure 65: Latin America End-of-line Packaging Market Revenue Y-o-Y Growth by End-use Industry, 2015–2027

Figure 66: Latin America End-of-line Packaging Market Attractiveness by End-use Industry, 2019–2027

Figure 67: Europe End-of-line Packaging Market Value (US$ Mn) and Y-o-Y Growth (%), 2015–2027

Figure 68: Europe End-of-line Packaging Market Absolute $ Opportunity (US$ Mn), 2019?2027

Figure 69: Europe End-of-line Packaging Market, BPS Analysis by Country,

Figure 70: Europe End-of-line Packaging Market Revenue Y-o-Y Growth by Country, 2015–2027

Figure 71: Europe End-of-line Packaging Market Attractiveness by Country,

Figure 72: Europe End-of-line Packaging Market BPS Analysis by Technology,

Figure 73: Europe End-of-line Packaging Market Revenue Y-o-Y Growth by Technology, 2015–2027

Figure 74: Europe End-of-line Packaging Market Attractiveness by Technology, 2019–2027

Figure 75: Europe End-of-line Packaging Market BPS Analysis by Function,

Figure 76: Europe End-of-line Packaging Market Revenue Y-o-Y Growth by Function, 2016–2027

Figure 77: Europe End-of-line Packaging Market Attractiveness by Function,

Figure 78: Europe End-of-line Packaging Market, BPS Analysis by Received Order Type, 2019 & 2027

Figure 79: Europe End-of-line Packaging Market Revenue Y-o-Y Growth by Received Order Type, 2016–2027

Figure 80: Europe End-of-line Packaging Market Attractiveness by Received Order Type, 2019–2027

Figure 81: Europe End-of-line Packaging Market, BPS Analysis by End-use Industry, 2019 & 2027

Figure 82: Europe End-of-line Packaging Market Revenue Y-o-Y Growth by End-use Industry, 2016–2027

Figure 83: Europe End-of-line Packaging Market Attractiveness by End-use Industry, 2019–2027

Figure 84: APAC End-of-line Packaging Market Value (US$ Mn) and Y-o-Y Growth (%), 2015–2027

Figure 85: APAC End-of-line Packaging Market Absolute $ Opportunity (US$ Mn), 2019?2027

Figure 86: APAC End-of-line Packaging Market, BPS Analysis by Country,

Figure 87: APAC End-of-line Packaging Market Revenue Y-o-Y Growth by Country, 2015–2027

Figure 88: APAC End-of-line Packaging Market Attractiveness by Country, 2019–2027

Figure 89: APAC End-of-line Packaging Market BPS Analysis by Technology,

Figure 90: APAC End-of-line Packaging Market Revenue Y-o-Y Growth by Technology, 2015–2027

Figure 91: APAC End-of-line Packaging Market Attractiveness by Technology, 2019–2027

Figure 92: APAC End-of-line Packaging Market BPS Analysis by Function,

Figure 93: APAC End-of-line Packaging Market Revenue Y-o-Y Growth by Function, 2015–2027

Figure 94: APAC End-of-line Packaging Market Attractiveness by Function,

Figure 95: APAC End-of-line Packaging Market, BPS Analysis by Received Order Type, 2019 & 2026

Figure 96: APAC End-of-line Packaging Market Revenue Y-o-Y Growth by Received Order Type, 2015–2027

Figure 97: APAC End-of-line Packaging Market Attractiveness by Received Order Type, 2019–2027

Figure 98: APAC End-of-line Packaging Market, BPS Analysis by End-use Industry, 2019 & 2027

Figure 99: APAC End-of-line Packaging Market Revenue Y-o-Y Growth by End-use Industry, 2015–2027

Figure 100: APAC End-of-line Packaging Market Attractiveness by End-use Industry, 2019–2027

Figure 101: MEA End-of-line Packaging Market Value (US$ Mn) and Y-o-Y Growth (%), 2015–2027

Figure 102: MEA End-of-line Packaging Market Absolute $ Opportunity (US$ Mn), 2019?2027

Figure 103: MEA End-of-line Packaging Market, BPS Analysis by Country,

Figure 104: MEA End-of-line Packaging Market Revenue Y-o-Y Growth by Country, 2016–2027

Figure 105: MEA End-of-line Packaging Market Attractiveness by Country,

Figure 106: MEA End-of-line Packaging Market BPS Analysis by Technology, 2019 & 2026

Figure 107: MEA End-of-line Packaging Market Revenue Y-o-Y Growth by Technology, 2015–2027

Figure 108: MEA End-of-line Packaging Market Attractiveness by Technology, 2019–2027

Figure 109: MEA End-of-line Packaging Market BPS Analysis by Function, 2019 & 2026

Figure 110: MEA End-of-line Packaging Market Revenue Y-o-Y Growth by Function, 2015–2027

Figure 111: MEA End-of-line Packaging Market Attractiveness by Function, 2019–2027

Figure 112: MEA End-of-line Packaging Market, BPS Analysis by Received Order Type, 2019 & 2026

Figure 113: MEA End-of-line Packaging Market Revenue Y-o-Y Growth by Received Order Type, 2015–2027

Figure 114: MEA End-of-line Packaging Market Attractiveness by Received Order Type, 2019–2027

Figure 115: MEA End-of-line Packaging Market, BPS Analysis by End-use Industry, 2019 & 2026

Figure 116: MEA End-of-line Packaging Market Revenue Y-o-Y Growth by End-use Industry, 2015–2027

Figure 117: MEA End-of-line Packaging Market Attractiveness by End-use Industry, 2019–2027