Global Digital Signature Market: Snapshot

Driven by the improved operational efficiency at reduced costs, enhanced security, and an organized workflow, the global market for digital signature is expected to witness a substantial rise over the forthcoming years. The rising number of government-funded and industry associations’ initiatives, such as awareness programs for various industries, is also projected to boost the growth of this market in the near future. However, the concerns among consumers over the legality of digital signatures and the disparity between digital signature regulations across various regions may limit the market’s progress over the next few years. In 2016, the global digital signature market was worth US$631.5 mn. Researchers expect it to rise at a notable CAGR of 26.40% from 2017 to 2025 and reach US$4,983.6 mn by the end of 2025.

Cloud Deployment Model to Witness High Adoption Rate

On the basis of the type of deployment, the global market for digital signature has been segmented into on-premise-based digital signature solutions and cloud-based digital signature solutions. Currently, the demand for on-premise-based solutions is much higher than its cloud-based counterpart. However, the popularity of the latter is increasing by leaps and bounds and it will be safe to say that the cloud-based solutions will surpass the on-premise ones in the near future. The rising level of digitization and the growing adoption of cloud computing technologies, especially across Asia Pacific and Europe, are likely to support the cloud segment remarkably over the next few years.

In terms of the industry vertical, the market has been classified into the BFSI, real estate, education, government, healthcare, retail, transportation, legal, and various other sectors and nonprofit organizations. The BFSI segment dominated this market in 2016 with a share of 23%. Thanks to the advent of ‘digital client on boarding’ in the banking sector, is likely to boost the demand for digital signature in the BFSI industry over the forthcoming years.

Europe to Surpass North America in Future

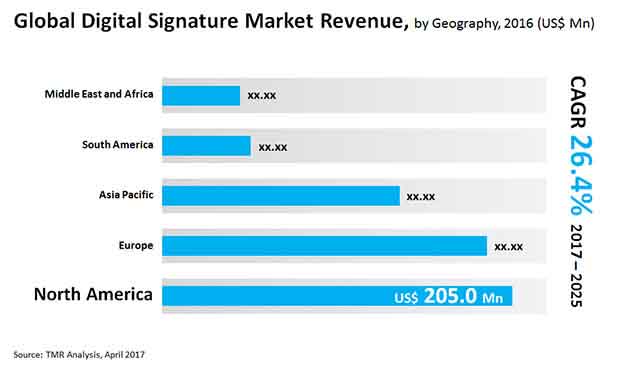

The worldwide market for digital signature is spread across North America, Europe, Asia Pacific, the Middle East and Africa, and South America. With US$205.0 in revenues, North America led the global market in 2016, thanks to the implementation of several regulations, such as ‘Health Information Technology for Economic and Clinical Health (HITECH) Act’ that encourages the acceptance and meaningful utilization of Information Technology (IT) across the healthcare industry.

Although the North America market for digital signature is expected to report a healthy rise, it will lose its grounds to the Europe market over the forthcoming years. Supported by the initiatives taken by the governments to create opportunities for organizations to conduct cross border business, the Europe digital signature market is likely to proliferate significantly in the near future. The enforcement of ‘Electronic Identification and Trust Services for Electronic Transactions in the Internal Market’ (eIDAS)’ by the Council of the European Union, establishing a new legal structure for electronic documents, identification, signatures and seals throughout the European Union is also projected to stimulate this market over the next few years.

The global market for digital signature is highly competitive in nature. Adobe Systems Inc., Gemalto NV, Secured Signing Ltd., SIGNiX, Ascertia, Entrust Datacard Corp., eSignLive, RPost, DocuSign Inc., IdenTrust Inc. and Thales e-Security Inc. are some of the prominent players operational in this market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Digital Signature Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

4.3. Key Trends

4.4. Global Digital Signature Market Analysis and Forecasts, 2015 – 2025

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

4.6. Market Outlook

5. Global Digital Signature Market Analysis and Forecast by Deployment

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Market Size (US$ Mn) Forecast By Deployment, 2015 – 2025

5.3.1. On-Premise

5.3.2. Cloud

5.4. Market Attractiveness By Deployment

6. Global Digital Signature Market Analysis and Forecast by Industry Vertical

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Size (US$ Mn) Forecast By Industry Vertical, 2015 – 2025

6.3.1. BFSI

6.3.2. Real Estate

6.3.3. Education

6.3.4. Government

6.3.5. Healthcare

6.3.6. Retail

6.3.7. Transportation

6.3.8. Legal

6.3.9. Other (Nonprofit etc.)

6.4. Market Attractiveness By Industry Vertical

7. Global Digital Signature Market Analysis and Forecast, By Region

7.1. Key Findings / Developments

7.2. Market Size (US$ Mn) Forecast By Region, 2015 – 2025

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East and Africa

7.2.5. South America

7.3. Market Attractiveness By Region

8. North America Digital Signature Market Analysis and Forecast

8.1. Key Findings

8.2. Key Trends

8.3. Market Size (US$ Mn) Forecast By Deployment, 2015 – 2025

8.3.1. On-Premise

8.3.2. Cloud

8.4. Market Size (US$ Mn) Forecast By Industry Vertical, 2015 – 2025

8.4.1. BFSI

8.4.2. Real Estate

8.4.3. Education

8.4.4. Government

8.4.5. Healthcare

8.4.6. Retail

8.4.7. Transportation

8.4.8. Legal

8.4.9. Other (Nonprofit etc.)

8.5. Market Size (US$ Mn) Forecast By Country/Region, 2015 – 2025

8.5.1. The U.S.

8.5.2. Canada

8.5.3. Rest of North America

8.6. Market Attractiveness Analysis

8.6.1. By Deployment

8.6.2. By Industry Vertical

8.6.3. By Country/Region

9. Europe Digital Signature Market Analysis and Forecast

9.1. Key Findings

9.2. Key Trends

9.3. Market Size (US$ Mn) Forecast By Deployment, 2015 – 2025

9.3.1. On-Premise

9.3.2. Cloud

9.4. Market Size (US$ Mn) Forecast By Industry Vertical, 2015 – 2025

9.4.1. BFSI

9.4.2. Real Estate

9.4.3. Education

9.4.4. Government

9.4.5. Healthcare

9.4.6. Retail

9.4.7. Transportation

9.4.8. Legal

9.4.9. Other (Nonprofit etc.)

9.5. Market Size (US$ Mn) Forecast By Country/Region, 2015 – 2025

9.5.1. The U.K.

9.5.2. Germany

9.5.3. France

9.5.4. Rest of Europe

9.6. Market Attractiveness Analysis

9.6.1. By Deployment

9.6.2. By Industry Vertical

9.6.3. By Country/Region

10. Asia Pacific Digital Signature Market Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. Market Size (US$ Mn) Forecast By Deployment, 2015 – 2025

10.4. Market Size (US$ Mn) Forecast By Deployment, 2015 – 2025

10.4.1. On-Premise

10.4.2. Cloud

10.5. Market Size (US$ Mn) Forecast By Industry Vertical, 2015 – 2025

10.5.1. BFSI

10.5.2. Real Estate

10.5.3. Education

10.5.4. Government

10.5.5. Healthcare

10.5.6. Retail

10.5.7. Transportation

10.5.8. Legal

10.5.9. Other (Nonprofit etc.)

10.6. Market Size (US$ Mn) Forecast By Country/Region, 2015 – 2025

10.6.1. China

10.6.2. Japan

10.6.3. Australia

10.6.4. Rest of Asia Pacific

10.7. Market Attractiveness Analysis

10.7.1. By Deployment

10.7.2. By Industry Vertical

10.7.3. By Country/Region

11. Middle East and Africa (MEA) Digital Signature Market Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Market Size (US$ Mn) Forecast By Deployment, 2015 – 2025

11.3.1. On-Premise

11.3.2. Cloud

11.4. Market Size (US$ Mn) Forecast By Industry Vertical, 2015 – 2025

11.4.1. BFSI

11.4.2. Real Estate

11.4.3. Education

11.4.4. Government

11.4.5. Healthcare

11.4.6. Retail

11.4.7. Transportation

11.4.8. Legal

11.4.9. Other (Nonprofit etc.)

11.5. Market Size (US$ Mn) Forecast By Country/Region, 2015 – 2025

11.5.1. GCC

11.5.2. South Africa

11.5.3. Rest of Middle East and Africa

11.6. Market Attractiveness Analysis

11.6.1. By Deployment

11.6.2. By Industry Vertical

11.6.3. By Country/Region

12. South America Digital Signature Market Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. Market Size (US$ Mn) Forecast By Deployment, 2015 – 2025

12.3.1. On-Premise

12.3.2. Cloud

12.4. Market Size (US$ Mn) Forecast By Industry Vertical, 2015 – 2025

12.4.1. BFSI

12.4.2. Real Estate

12.4.3. Education

12.4.4. Government

12.4.5. Healthcare

12.4.6. Retail

12.4.7. Transportation

12.4.8. Legal

12.4.9. Other (Nonprofit etc.)

12.5. Market Size (US$ Mn) Forecast By Country/Region, 2015 – 2025

12.5.1. Brazil

12.5.2. Rest of South America

12.6. Market Attractiveness Analysis

12.6.1. By Deployment

12.6.2. By Industry Vertical

12.6.3. By Country/Region

13. Competition Landscape

13.1. Market Player – Competition Matrix (By Tier and Size of companies)

13.2. Market Share Analysis By Company (2016)

13.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

13.3.1. Adobe Systems Incorporated

13.3.1.1 Overview

13.3.1.2 Financials

13.3.1.3 Recent Developments

13.3.1.4 Strategy

13.3.2. Gemalto NV

13.3.2.1 Overview

13.3.2.2 Financials

13.3.2.3 Recent Developments

13.3.2.4 Strategy

13.3.3. Secured Signing Limited

13.3.3.1 Overview

13.3.3.2 Financials

13.3.3.3 Recent Developments

13.3.3.4 Strategy

13.3.4. SIGNiX

13.3.4.1 Overview

13.3.4.2 Financials

13.3.4.3 Recent Developments

13.3.4.4 Strategy

13.3.5. Ascertia

13.3.5.1 Overview

13.3.5.2 Financials

13.3.5.3 Recent Developments

13.3.5.4 Strategy

13.3.6. Entrust Datacard Corp.

13.3.6.1 Overview

13.3.6.2 Financials

13.3.6.3 Recent Developments

13.3.6.4 Strategy

13.3.7. eSignLive

13.3.7.1 Overview

13.3.7.2 Financials

13.3.7.3 Recent Developments

13.3.7.4 Strategy

13.3.8. RPost

13.3.8.1 Overview

13.3.8.2 Financials

13.3.8.3 Recent Developments

13.3.8.4 Strategy

13.3.9. DocuSign Inc.

13.3.9.1 Overview

13.3.9.2 Financials

13.3.9.3 Recent Developments

13.3.9.4 Strategy

13.3.10. IdenTrust, Inc.

13.3.10.1 Overview

13.3.10.2 Financials

13.3.10.3 Recent Developments

13.3.10.4 Strategy

13.3.11. Thales e-Security, Inc.

13.3.11.1 Overview

13.3.11.2 Financials

13.3.11.3 Recent Developments

13.3.11.4 Strategy

14 Key Takeaways

List of Tables

Table 01: Table 01: Global Digital Signature Market Size (US$ Mn) Forecast, By Deployment, 2015–2025

Table 02: Global Digital Signature Market Size (US$ Mn) Forecast, By Industry Vertical, 2015–2025

Table 03: Global Digital Signature Market Size (US$ Mn) Forecast, By Industry Vertical, 2015–2025

Table 04: Global Digital Signature Market Size (US$ Mn) Forecast, By Region, 2015–2025

Table 05: North America Digital Signature Market Size (US$ Mn) Forecast, By Deployment, 2015–2025

Table 06: North America Digital Signature Market Size (US$ Mn) Forecast, By Industry Vertical, 2015–2025

Table 07: North America Digital Signature Market Size (US$ Mn) Forecast, By Industry Vertical, 2015–2025

Table 08: North America Digital Signature Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 09: Europe Digital Signature Market Size (US$ Mn) Forecast, By Deployment, 2015–2025

Table 10: Europe Digital Signature Market Size (US$ Mn) Forecast, By Industry Vertical, 2015–2025

Table 11: Europe Digital Signature Market Size (US$ Mn) Forecast, By Industry Vertical, 2015–2025

Table 12: Europe Digital Signature Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 13: Asia Pacific Digital Signature Market Size (US$ Mn) Forecast, By Deployment, 2015–2025

Table 14: Asia Pacific Digital Signature Market Size (US$ Mn) Forecast, By Industry Vertical, 2015–2025

Table 15: Asia Pacific Digital Signature Market Size (US$ Mn) Forecast, By Industry Vertical, 2015–2025

Table 16: Asia Pacific Digital Signature Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 17: Middle East and Africa Digital Signature Market Size (US$ Mn) Forecast, By Deployment, 2015–2025

Table 18: Middle East and Africa Digital Signature Market Size (US$ Mn) Forecast, By Industry Vertical, 2015–2025

Table 19: Middle East and Africa Digital Signature Market Size (US$ Mn) Forecast, By Industry Vertical, 2015–2025

Table 20: Middle East and Africa Digital Signature Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 21: South America Digital Signature Market Size (US$ Mn) Forecast, By Deployment, 2015–2025

Table 22: South America Digital Signature Market Size (US$ Mn) Forecast, By Industry Vertical, 2015–2025

Table 23: South America Digital Signature Market Size (US$ Mn) Forecast, By Industry Vertical, 2015–2025

Table 24: South America Digital Signature Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

List of Figures

Figure 01: Global Digital Signature Market Size (US$ Mn) Forecast, 2015 – 2025

Figure 02: Global Digital Signature Market Y-o-Y Growth (Value %) Forecast, 2016 – 2025

Figure 03: Market Revenue (US$ Mn) Growth Analysis By Deployment Type, 2017-2025

Figure 04: Market Growth Trend Analysis By Industry Vertical, 2017-2025

Figure 05: Market Value Share By Region, 2017-2025

Figure 06: Global Digital Signature Market Revenue Share Analysis, By Deployment, 2016 and 2025

Figure 07: Global Digital Signature Market Attractiveness Analysis By Deployment Type

Figure 08: Global Digital Signature Market Revenue Share Analysis, By Industry Vertical, 2016 and 2025

Figure 09: Global Digital Signature Market Attractiveness Analysis By Industry Vertical

Figure 10: Global Digital Signature Market Attractiveness Analysis By Region

Figure 11: North America Digital Signature Market Size (US$ Mn) Forecast, 2015–2025

Figure 12: North America Digital Signature Market Size Y-o-Y Growth Projections, 2016–2025

Figure 13: North America Digital Signature Market Revenue Share Analysis, By Deployment, 2016 and 2025

Figure 14: North America Digital Signature Market Revenue Share Analysis, By Industry Vertical, 2016 and 2025

Figure 15: North America Digital Signature Market Revenue Share Analysis, By Country/Region, 2016 and 2025

Figure 16: North America Digital Signature Market Attractiveness Analysis By Country/Region

Figure 17: North America Digital Signature Market Attractiveness Analysis By Deployment

Figure 18: North America Digital Signature Market Attractiveness Analysis By Industry Vertical

Figure 19: Europe Digital Signature Market Size (US$ Mn) Forecast, 2015–2025

Figure 20: Europe Digital Signature Market Size Y-o-Y Growth Projections, 2016–2025

Figure 21: Europe Digital Signature Market Revenue Share Analysis, By Deployment, 2016 and 2025

Figure 22: Europe Digital Signature Market Revenue Share Analysis, By Industry Vertical, 2016 and 2025

Figure 23: Europe Digital Signature Market Revenue Share Analysis, By Country/Region, 2016 and 2025

Figure 24: Europe Digital Signature Market Attractiveness Analysis By Country/Region

Figure 25: Europe Digital Signature Market Attractiveness Analysis By Deployment

Figure 26: Europe Digital Signature Market Attractiveness Analysis By Industry Vertical

Figure 27: Asia Pacific Digital Signature Market Size (US$ Mn) Forecast, 2015–2025

Figure 28: Asia Pacific Digital Signature Market Size Y-o-Y Growth Projections, 2016–2025

Figure 29: Asia Pacific Digital Signature Market Revenue Share Analysis, By Deployment, 2016 and 2025

Figure 30: Asia Pacific Digital Signature Market Revenue Share Analysis, By Industry Vertical, 2016 and 2025

Figure 31: Asia Pacific Digital Signature Market Revenue Share Analysis, By Country/Region, 2016 and 2025

Figure 32: Asia Pacific Digital Signature Market Attractiveness Analysis By Country/Region

Figure 33: Asia Pacific Digital Signature Market Attractiveness Analysis By Deployment

Figure 34: Asia Pacific Digital Signature Market Attractiveness Analysis By Industry Vertical

Figure 35: Middle East and Africa Digital Signature Market Size (US$ Mn) Forecast, 2015–2025

Figure 36: Middle East and Africa Digital Signature Market Size Y-o-Y Growth Projections, 2016–2025

Figure 37: Middle East and Africa Digital Signature Market Revenue Share Analysis, By Deployment, 2016 and 2025

Figure 38: Middle East and Africa Digital Signature Market Revenue Share Analysis, By Industry Vertical, 2016 and 2025

Figure 39: Middle East and Africa Digital Signature Market Revenue Share Analysis, By Country/Region, 2016 and 2025

Figure 40: Middle East and Africa Digital Signature Market Attractiveness Analysis By Country/Region

Figure 41: Middle East and Africa Digital Signature Market Attractiveness Analysis By Deployment

Figure 42: Middle East and Africa Digital Signature Market Attractiveness Analysis By Industry Vertical

Figure 43: South America Digital Signature Market Size (US$ Mn) Forecast, 2015–2025

Figure 44: South America Digital Signature Market Size Y-o-Y Growth Projections, 2016–2025

Figure 45: South America Digital Signature Market Revenue Share Analysis, By Deployment, 2016 and 2025

Figure 46: South America Digital Signature Market Revenue Share Analysis, By Industry Vertical, 2016 and 2025

Figure 47: South America Digital Signature Market Revenue Share Analysis, By Country/Region, 2016 and 2025

Figure 48: South America Digital Signature Market Attractiveness Analysis By Country/Region

Figure 49: South America Digital Signature Market Attractiveness Analysis By Deployment

Figure 50: South America Digital Signature Market Attractiveness Analysis By Industry Vertical

Figure 51: Digital Signature Market Share Analysis By Company (2016)