Global Diabetes Injection Pens Market: Snapshot

Owing to the increasing number of diabetics in the world and consequent rise in awareness and management, the global diabetes injection pens market is expected to expand at a remarkable pace. The evolution of smart insulin pens has taken over traditionally used syringes that cause needlestick injury, and has remarkably propelled the market with mobile app technology connectivity.

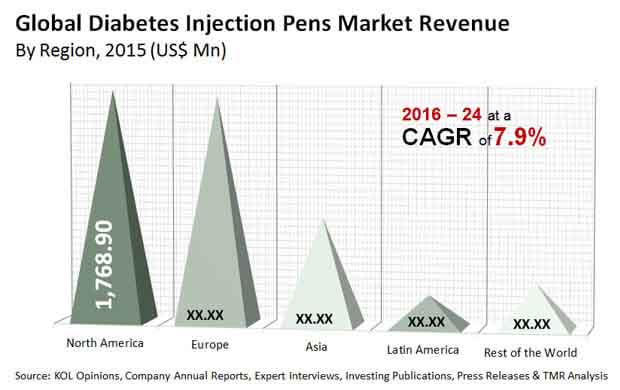

The global diabetes injection pens market is estimated to be worth a US$9.7 bn by 2024, rising from a US$4.9 bn earned in 2015. The market is expected to expand at 7.9% healthy CAGR during the forecast period of 2016 to 2024

The global diabetes injection pens market is estimated to be worth a US$9.7 bn by 2024, rising from a US$4.9 bn earned in 2015. The market is expected to expand at 7.9% healthy CAGR during the forecast period of 2016 to 2024

Insulin Pens Generating More Revenue by Diabetics

Based on segmentation by product, two important classifications of the global diabetes injection pens market are pen needles and insulin pens. Insulin pens have a larger share in the market as 90.0% of the diabetic population in Asia and Europe prefers them instead of pen needles. According to the 2015 statistics, insulin pens collected an over 65.0% as leading revenue generator. Insulin pens are cost-efficient, hence they could make massive sales among the diabetic population.

Diabetes injection pens are sold by means of hospital, pharmacies, diabetes centers and clinics, retail pharmacies, and online methods. Among these distribution channels, buying injection pens from hospitals are more preferred, and this contributed to a share of over 33.0% to the global diabetes injection pens market as of 2015. Owing to the availability of a flourishing global e-commerce sector, the online channel is becoming much more noticeable. However, since the adoption of diabetes injection pens in hospitals is rising in the developed markets such as Germany, the U.K., and the U.S., this segment is expected to witness immense growth through the forecast period.

Based on their usage, diabetes injection pens are classified into two types: disposable and reusable. Although both these segments have almost equally contributed to the market share, reusable pens have a slightly upper hand. Developing countries such as India and China prefer to use disposable pens, whereas countries such as Germany, the U.K., and Japan would rather pick reusable pens.

North America Contributing Largest Share is Dominating Injection Pen Market

The global diabetes injection pens market is studied on the basis of key geographies Asia, Latin America, North America, Europe, and the Rest of the World. Among these, North America and Europe dominated the market in 2015. In North America, the U.S. secured a stronger share of 94.0% in 2015. This was due to growing healthcare awareness regarding the management and treatment of glucose levels, increasing research and development activities, and various technological advancements.

Asia Pacific is also expected to exhibit strong growth during the forecast period due to significant contributions from India, China, and Japan. On the other hand, there is a probability of Europe expanding at a slow rate as the regional market has reached its saturation point.

Some of the leading players in the global diabetes injection pens market are Eli Lilly and Company, Dickinson and Company, AstraZeneca plc, Novo Nordisk A/S, and Sanofi S.A. The vendor landscape is dominated by a few companies, thus rendering the market consolidated.

Diabetes Injection Pens Market to Earn Notable Revenues Owing to Increasing Number of Diabetic Patients

Attributable to the expanding number of diabetics on the planet and subsequent ascent in mindfulness and the executives, the worldwide diabetes infusion pens market is required to extend at an astounding speed. The development of shrewd insulin pens has taken over generally utilized needles that cause needlestick injury, and has amazingly moved the market with versatile application innovation availability.

The thought behind diabetic injection pens is accommodation. As organizations work out groundbreaking thoughts for their items, they understand the quintessence of observing customer conduct reliably. What's more, this aides major parts in the worldwide diabetic injection pens market to zero in on making items more use-accommodating. By comfort, the items intend to make delivering an insulin shot an assignment for not over 10 seconds. The thought is to kill reliance to convey the medication.

Despite the strong sense of innovation, the diabetic injection pens market, may face certain challenges. It is the very drug organizations or those assembling clinical gadgets that instigate on the requirement for wearable to monitor wellbeing. Not simply that, assurance and mindfulness among the patient populace pushes them to dispose of insulin. Patients center around controlling their glucose levels, and along these lines intend to switch back to tablets or decrease the dose. This will stop development in the worldwide diabetic injection pens market.

Notwithstanding, the rising diabetic populace falling prey to inactive way of life will invalidate the counter impacts of innovation and assist players with staying pertinent and support in the worldwide diabetic injection pens market.

In spite of that, few organizations have additionally carried out items that emphasis on cost and strength. While there are brands that harp on the requirement for another pen each time the cartridge is out of insulin, there are galore in the market who give items that keep going long. It is one thing less to stress for a customer.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions

2.2. Acronyms Used

2.3. Research Methodology

3. Executive Summary

3.1. Global Diabetes Injection Pens Market Snapshot

4. Market Overview

4.1. Product Overview

4.2. Key Industry Events

4.3. Global Diabetes Injection Pens Market Size (US$ Mn) Forecast, 2014–2024

4.4. Porter’s Five Forces Analysis

4.5. Value Chain Analysis

4.6. Product Pricing Analysis

4.7. Global Diabetes Injection Pens Market Outlook

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.2. Drivers

5.2.1. Increase in prevalence of diabetes

5.2.2. Growing number of insulin syringe needle stick injury cases

5.2.3. Improving patient compliance and acceptability of novel technologies

5.2.4. Innovations in digital insulin pen

5.2.5. Impetus from insulin market

5.2.6. Rise in incidence of pediatric diabetes and geriatric population diabetes

5.3. Restraints

5.3.1. Threat of alternative technologies for insulin delivery

5.3.2. Pricing pressures in U.S.

5.1. Opportunity Analysis

5.2. Technology Trend

5.2.1. Smart Insulin Pen Connected with Mobile App

5.2.2. Smart Insulin Pen Caps

5.2.3. Prominent Innovator in the Future of Connected Insulin Pens

5.2.4. Future of Connected Devices in Blood Glucose Monitoring

6. Global Diabetes Injection Pens Market Analysis, by Product Type

6.1. Introduction

6.2. Key Findings

6.3. Global Diabetes Injection Pens Market Value Share Analysis, by Product Type, 2016 and 2024

6.3.1. Insulin Pens

6.3.2. Pen Needles

6.4. Global Diabetes Injection Pens Market Attractiveness Analysis, by Product Type, 2014–2024

6.5. Key Trends

7. Global Diabetes Injection Pens Market Analysis, by Usage

7.1. Introduction

7.2. Key Findings

7.3. Global Diabetes Injection Pens Market Value Share Analysis, by Usage, 2016 and 2024

7.3.1. Reusable Pens

7.3.2. Disposable Pens

7.4. Global Diabetes Injection Pens Market Attractiveness Analysis, by Usage, 2014–2024

7.5. Key Trends

8. Global Diabetes Injection Pens Market Analysis, by Distribution Channel

8.1. Introduction

8.2. Key Findings

8.3. Global Diabetes Injection Pens Market Value Share Analysis, by Distribution Channel, 2014-2024

8.3.1. Hospital Pharmacy

8.3.2. Retail Pharmacy

8.3.3. Online Sales

8.3.4. Diabetes Clinics/Centers

8.4. Global Diabetes Injection Pens Market Attractiveness Analysis, by Distribution Channel, 2014–2024

8.5. Key Trends

9. Global Diabetes Injection Pens Market Analysis, by Region

9.1. Global Market Scenario by Country

9.2. Global Diabetes Injection Pens Market Value Share Analysis, by Region, 2016 and 2024

10. North America Diabetes Injection Pens Market Analysis

10.1. Key Findings

10.2. Market Overview

10.3. North America Diabetes Injection Pens Market Value Share Analysis, by Country

10.4. North America Diabetes Injection Pens Market Value Share Analysis, by Product Type

10.5. North America Diabetes Injection Pens Market Value Share Analysis, by Usage

10.6. North America Diabetes Injection Pens Market Value Share Analysis, by Distribution Channel

10.7. North America Diabetes Injection Pens Market Attractiveness Analysis

10.8. North America Diabetes Injection Pens Market Trends

11. Europe Diabetes Injection Pens Market Analysis

11.1. Key Findings

11.2. Market Overview

11.3. Europe Diabetes Injection Pens Market Value Share Analysis, by Country

11.4. Europe Diabetes Injection Pens Market Value Share Analysis, by Product Type

11.5. Europe Diabetes Injection Pens Market Value Share Analysis, by Usage

11.6. Europe Diabetes Injection Pens Market Value Share Analysis, by Distribution Channel

11.7. Europe Diabetes Injection Pens Market Attractiveness Analysis

11.8. Europe Diabetes Injection Pens Market Trends

12. Asia Diabetes Injection Pens Market Analysis

12.1. Key Findings

12.2. Market Overview

12.3. Asia Diabetes Injection Pens Market Value Share Analysis, by Country

12.4. Asia Diabetes Injection Pens Market Value Share Analysis, by Product Type

12.5. Asia Diabetes Injection Pens Market Value Share Analysis, by Usage

12.6. Asia Diabetes Injection Pens Market Value Share Analysis, by Distribution Channel

12.7. Asia Diabetes Injection Pens Market Attractiveness Analysis

12.8. Asia Diabetes Injection Pens Market Trends

13. Latin America Diabetes Injection Pens Market Analysis

13.1. Key Findings

13.2. Market Overview

13.3. Latin America Diabetes Injection Pens Market Value Share Analysis, by Country

13.4. Latin America Diabetes Injection Pens Market Value Share Analysis, by Product Type

13.5. Latin America Diabetes Injection Pens Market Value Share Analysis, by Usage

13.6. Latin America Diabetes Injection Pens Market Value Share Analysis, by Distribution Channel

13.7. Latin America Diabetes Injection Pens Market Attractiveness Analysis

13.8. Latin America Diabetes Injection Pens Market Trends

14. Rest of the World Diabetes Injection Pens Market Analysis

14.1. Key Findings

14.2. Market Overview

14.3. Rest of the World Diabetes Injection Pens Market Value Share Analysis, by Country

14.4. Rest of the World Diabetes Injection Pens Market Value Share Analysis, by Product Type

14.5. Rest of the World Diabetes Injection Pens Market Value Share Analysis, by Usage

14.6. Rest of the World Diabetes Injection Pens Market Value Share Analysis, by Distribution Channel

14.7. Rest of the World Diabetes Injection Pens Market Attractiveness Analysis

14.8. Rest of the World Diabetes Injection Pens Market Trends

15. Competition Landscape

15.1. Diabetes Injection Pens Market Share Analysis By Company, 2015

15.2. Competition Matrix

15.3. Company Profiles

15.3.1. Novo Nordisk A/S

15.3.1.1. Company Details

15.3.1.2. Business Overview

15.3.1.3. Financial Overview

15.3.1.4. Strategic Overview

15.3.1.5. SWOT Analysis

15.3.2. Eli Lilly and Company

15.3.2.1. Company Details

15.3.2.2. Business Overview

15.3.2.3. Financial Overview

15.3.2.4. Strategic Overview

15.3.2.5. SWOT Analysis

15.3.3. AstraZeneca plc

15.3.3.1. Company Details

15.3.3.2. Business Overview

15.3.3.3. Financial Overview

15.3.3.4. Strategic Overview

15.3.3.5. SWOT Analysis

15.3.4. Biocon Ltd.

15.3.4.1. Company Details

15.3.4.2. Business Overview

15.3.4.3. Financial Overview

15.3.4.4. Strategic Overview

15.3.4.5. SWOT Analysis

15.3.5. Sanofi S.A.

15.3.5.1. Company Details

15.3.5.2. Business Overview

15.3.5.3. Financial Overview

15.3.5.4. Strategic Overview

15.3.5.5. SWOT Analysis

15.3.6. Becton, Dickinson and Company

15.3.6.1. Company Details

15.3.6.2. Business Overview

15.3.6.3. Financial Overview

15.3.6.4. Strategic Overview

15.3.6.5. SWOT Analysis

15.3.7. Owen Mumford Ltd.

15.3.7.1. Company Details

15.3.7.2. Business Overview

15.3.7.3. Financial Overview

15.3.7.4. Strategic Overview

15.3.7.5. SWOT Analysis

15.3.8. Jiangsu Delfu Co., Ltd.

15.3.8.1. Company Details

15.3.8.2. Business Overview

15.3.8.3. Financial Overview

15.3.8.4. Strategic Overview

15.3.8.5. SWOT Analysis

15.3.9. Wockhardt Ltd.

15.3.9.1. Company Details

15.3.9.2. Business Overview

15.3.9.3. Financial Overview

15.3.9.4. Strategic Overview

15.3.9.5. SWOT Analysis

15.4. Other Prominent Companies in Diabetes Injection Pens Market

List of Tables

TABLE 1 Global Diabetes Injection Pens Average Selling Price/Product, 2015

TABLE 2 Global Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Product Type, 2014–2024

TABLE 3 Global Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Usage, 2014–2024

TABLE 4 Global Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Distribution Channel, 2014–2024

TABLE 5 Global Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Region, 2014–2024

TABLE 6 North America Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Country, 2014–2024

TABLE 7 North America Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Product Type, 2014–2024

TABLE 8 North America Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Usage, 2014–2024

TABLE 9 North America Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Distribution Channel, 2014–2024

TABLE 10 Europe Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Country, 2014–2024

TABLE 11 Europe Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Product Type, 2014–2024

TABLE 12 Europe Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Usage, 2014–2024

TABLE 13 Europe Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Distribution Channel, 2014–2024

TABLE 14 Asia Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Country, 2014–2024

TABLE 15 Asia Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Product Type, 2014–2024

TABLE 16 Asia Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Usage, 2014–2024

TABLE 17 Asia Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Distribution Channel, 2014–2024

TABLE 18 Latin America Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Country, 2014–2024

TABLE 19 Latin America Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Product Type, 2014–2024

TABLE 20 Latin America Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Usage, 2014–2024

TABLE 21 Latin America Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Distribution Channel, 2014–2024

TABLE 22 Rest of the World Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Country, 2014–2024

TABLE 23 Rest of the World Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Product Type, 2014–2024

TABLE 24 Rest of the World Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Usage, 2014–2024

TABLE 25 Rest of the World Diabetes Injection Pens Market Size (US$ Mn) Forecast, by Distribution Channel, 2014–2024

List of Figures

FIG. 1 Global Diabetes Injection Pens Market Size (US$ Mn) Forecast, 2014–2024

FIG. 2 Global Diabetes Injection Pens Market Value Share Analysis, by Product Type, 2016 and 2024

FIG. 3 Global Diabetes Injection Pens Market - Insulin Pens Revenue, (US$ Mn), 2014–2024

FIG. 4 Global Diabetes Injection Pens Market - Pen Needles Revenue (US$ Mn), 2014–2024

FIG. 5 Global Diabetes Injection Pens Market Attractiveness Analysis, by Product Type, 2014–2024

FIG. 6 Global Diabetes Injection Pens Market Value Share Analysis, by Usage, 2016 and 2024

FIG. 7 Global Diabetes Injection Pens Market - Reusable Pens Revenue, (US$ Mn), 2014–2024

FIG. 8 Global Diabetes Injection Pens Market - Disposable Pens Revenue, (US$ Mn), 2014–2024

FIG. 9 Global Diabetes Injection Pens Market Attractiveness Analysis, by Usage, 2014–2024

FIG. 10 Global Diabetes Injection Pens Market Value Share Analysis, by Distribution Channel, 2016 and 2024

FIG. 11 Global Diabetes Injection Pens Market - Hospital Pharmacy Revenue (US$ Mn), 2014–2024

FIG. 12 Global Diabetes Injection Pens Market - Retail Pharmacy Revenue (US$ Mn), 2014–2024

FIG. 13 Global Diabetes Injection Pens Market - Online Sales Revenue (US$ Mn), 2014–2024

FIG. 14 Global Diabetes Injection Pens Market - Diabetes Clinics/Centers Pharmacy Revenue (US$ Mn), 2014–2024

FIG. 15 Global Diabetes Injection Pens Market Attractiveness Analysis, by Distribution Channel, 2014–2024

FIG. 16 Global Diabetes Injection Pens Market Value Share Analysis, by Region, 2016 and 2024

FIG. 17 Global Diabetes Injection Pens Market Attractiveness Analysis, by Region, 2014–2024

FIG. 18 North America Diabetes Injection Pens Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2014–2024

FIG. 19 North America Diabetes Injection Pens Market Attractiveness Analysis, by Country, 2016–2024

FIG. 20 North America Diabetes Injection Pens Market Value Share Analysis, by Country, 2016 and 2024

FIG. 21 North America Diabetes Injection Pens Market Value Share Analysis, by Product Type, 2016 and 2024

FIG. 22 North America Diabetes Injection Pens Market Value Share Analysis, by Usage, 2016 and 2024

FIG. 23 North America Diabetes Injection Pens Market Value Share Analysis, by Distribution Channel, 2016 and 2024

FIG. 24 North America Diabetes Injection Pens Market Attractiveness Analysis, by Product type,

FIG. 25 North America Diabetes Injection Pens Market Attractiveness Analysis, by Usage, 2016–2024

FIG. 26 North America Diabetes Injection Pens Market Attractiveness Analysis, by Distribution Channel, 2016–2024

FIG. 27 Europe Diabetes Injection Pens Market Size (US$ Mn) Forecast, 2014–2024

FIG. 28 Europe Market Attractiveness Analysis, by Country, 2016–2024

FIG. 29 Europe Diabetes Injection Pens Market Value Share Analysis, by Country, 2016 and 2024

FIG. 30 Europe Diabetes Injection Pens Market Value Share Analysis, by Product Type, 2016 and 2024

FIG. 31 Europe Diabetes Injection Pens Market Value Share Analysis, by Usage, 2016 and 2024

FIG. 32 Europe Diabetes Injection Pens Market Value Share Analysis, by Distribution Channel, 2016 and 2024

FIG. 33 Europe Diabetes Injection Pens Market Attractiveness Analysis, by Product Type, 2016–2024

FIG. 34 Europe Diabetes Injection Pens Market Attractiveness Analysis, by Usage, 2016–2024

FIG. 35 Europe Diabetes Injection Pens Market Attractiveness Analysis, by Distribution Channel, 2016–2024

FIG. 36 Asia Diabetes Injection Pens Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2014–2024

FIG. 37 Asia Market Attractiveness Analysis, by Country,

FIG. 38 Asia Market Value Share Analysis, by Country,

FIG. 39 Asia Market Value Share Analysis, by Product Type, 2016 and 2024

FIG. 40 Asia Market Value Share Analysis, by Usage,

FIG. 41 Asia Market Value Share Analysis, by Distribution Channel, 2016 and 2024

FIG. 42 Asia Market Attractiveness Analysis, by Product, 2016–2024

FIG. 43 Asia Market Attractiveness Analysis, by Usage, 2016–2024

FIG. 44 Asia Market Attractiveness Analysis, by Distribution Channel, 2016–2024

FIG. 45 Latin America Diabetes Injection Pens Market Size (US$ Mn) Forecast, 2014–2024

FIG. 46 Latin America Market Attractiveness Analysis, by Country, 2016–2024

FIG. 47 Latin America Market Value Share Analysis, by Country, 2016 and 2024

FIG. 48 Latin America Diabetes Injection Pens Size Market Value Share Analysis, by Product Type, 2016 and 2024

FIG. 49 Latin America Diabetes Injection Pens Market Value Share Analysis, by Usage, 2016 and 2024

FIG. 50 Latin America Market Value Share Analysis, by Distribution Channel, 2016 and 2024

FIG. 51 Latin America Market Attractiveness Analysis, by Product Type, 2016–2024

FIG. 52 Latin America Market Attractiveness Analysis, by Usage, 2016–2024

FIG. 53 Latin America Market Attractiveness Analysis, by Distribution Channel, 2016–2024

FIG. 54 Rest of the World Diabetes Injection Pens Market Size (US$ Mn) Forecast, 2014–2024

FIG. 55 Rest of the World Market Attractiveness Analysis, by Country, 2016–2024

FIG. 56 Rest of the World Diabetes Injection Pens Market Value Share Analysis, by Country, 2016 and 2024

FIG. 57 Rest of the World Diabetes Injection Pens Market Value Share Analysis, by Product Type, 2016 and 2024

FIG. 58 Rest of the World Diabetes Injection Pens Market Value Share Analysis, by Usage, 2016 and 2024

FIG. 59 Rest of the World Diabetes Injection Pens Market Value Share Analysis, by Distribution Channel, 2016 and 2024

FIG. 60 Rest of the World Market Attractiveness Analysis, by Product, 2016–2024

FIG. 61 Rest of the World Market Attractiveness Analysis, by Usage, 2016–2024

FIG. 62 Rest of the World Market Attractiveness Analysis, by Distribution Channel, 2016–2024

FIG. 63 Global Diabetes Injection Pens Market Share Analysis, by Company 2015 (estimated)