Analysts’ Viewpoint on Dermal Fillers Market Scenario

Dermal fillers are injectable implants commonly used to create the appearance of a flawless, rejuvenated face. Growth of the global dermal fillers market can be ascribed to the rise in usage of dermal fillers in various applications that aid in the enhancement of an individual's appearance. Increasing number of companies in the cosmetics industry are investing significantly in research & development (R&D) activities to introduce innovative technologies. Consequently, higher-quality fillers that are easier to use and provide high patient satisfaction have been developed. Hyaluronic acid derived from non-animal sources has long been used as a dermal filler. Key players in the industry have introduced new formulations that are anticipated to expand the dermal fillers market size.

The global dermal fillers market growth is driven by the rise in acceptance of anti-aging treatment by the elderly people. Dermal fillers can be defined as soft tissue fillers injected into the skin for the restoration of a smoother appearance and reduction of wrinkles and signs of aging. Regions with low-cost dermal filler procedures have witnessed a surge in demand for these procedures. Celebrity endorsement is a powerful and useful tool that magnifies the effect of a campaign. Hence, several key players use the celebrity endorsement strategy for marketing their products. This strategy is projected to strengthen the image of their brands in the digital world and attract new customers.

Increase in penetration of the Internet in developed and developing countries provides consumers an opportunity to research various dermal filler procedures available for the treatment of skin and facial ailments, which boosts online sales. Various types of dermal fillers are used in dermal filler procedures for different purposes. For instance, soft tissue fillers are used to smoothen skin and lessen the prominence of wrinkles, while face fillers are used to improve the appearance of facial lines. Facial fillers are substances injected into the skin to smoothen wrinkles and make them less noticeable. The advantage of product comparison, rise in inclination toward maintaining youthful features, and increase in the fad of anti-aging, owing to the surge in social media awareness, contribute to the growth of the market in the U.S.

Tear trough filler is an injectable treatment used under the eyes. Its purpose is to add volume beneath the eyelids. The product most often used in this area is typically made of hyaluronic acid, although other ingredients may be used.

The COVID-19 outbreak has hampered the dermal fillers market. Lockdown restrictions and closure of borders across countries led to a disruption in supply chain and logistics operations. However, easing of lockdown restrictions is likely to drive the dermal fillers market.

Request a sample to get extensive insights into the Dermal Fillers Market

Demand for non-surgical dermatological procedures has increased significantly due to several advantages offered by these methods. These include faster results, cost-effectiveness, and fewer associated risks than conventional methods. Furthermore, increase in focus of people on facial correction and rise in desire to look young are driving the demand for non-invasive dermatological procedures. In minimally invasive procedures, injectable dermal fillers are used to plump thin lips, enhance shallow contours, soften facial creases, remove wrinkles, and improve the appearance of scars. An estimated 1.4 million surgical and non-surgical treatments were performed in 2021, with plastic surgeons conducting 600 more operations on an average than they did in 2020.

According to the American Society of Plastic Surgeons, 2.7 million facial filler procedures were performed in 2017. Thus, rise in preference for minimally invasive procedures is expected to propel the global market during the forecast period.

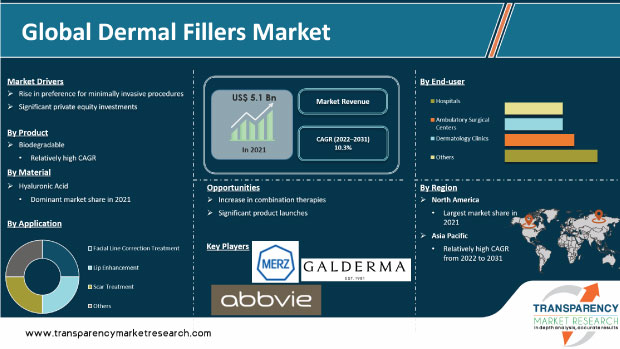

Based on product, the biodegradable segment dominated the market in 2021. This trend is expected to continue during the forecast period. The segment is likely to grow at a high CAGR during the forecast period owing to the rise in usage and demand for hyaluronic acid dermal fillers, which account for major share of the market. Additionally, lesser number of side-effects of biodegradable dermal fillers, compared to non-biodegradable fillers, is propelling the segment. Benefits of biodegradable products, such as non-toxicity and prolonged material shelf life, are also contributing to the growth of the segment. Thus, increase in procedural volume and product benefits are likely to propel the biodegradable dermal fillers segment during the forecast period.

Request a custom report on Dermal Fillers Market

Based on material, the hyaluronic acid segment dominated the global market in 2021. The segment is likely to grow at a high CAGR during the forecast period due to the increase in the number of hyaluronic acid dermal fillers procedures performed annually. According to the International Society of Aesthetic Plastic Surgery (ISAPS), among the international surgeries performed in 2017, more than 3,298,266 hyaluronic acid dermal filler procedures were performed annually. Additionally, various forms of hyaluronic acid dermal fillers are available, which differ according to the concentration of hyaluronic acid and the degree of cross-linking. Technological advances leading to the development of newer HA dermal fillers are propelling the segment.

Based on application, the facial line correction segment dominated the global market in 2021. The segment is anticipated to grow at a high CAGR during the forecast period. Growth of the segment can be ascribed to the rise in inclination toward youthful physical appearance and focus on addressing facial volume loss and dynamic lines. One of the prominent dermal fillers market drivers is the introduction of Radiesse filler, which is an injectable filler used to plump wrinkled or folded areas of the skin, most often on the face.

In terms of end-user, the hospitals segment dominated the global market in 2021. This trend is anticipated to continue during the forecast period. Increase in patient preference for dermal filler procedures in hospitals is likely to propel the hospitals segment during the forecast period. However, the dermatology clinics segment is likely to grow at a higher CAGR during the forecast period, owing to the increase in number of dermatology clinics, rise in number of dermatological consultations, and surge in patient demand to be treated by specialist dermatologists.

North America and Europe, cumulatively, accounted for more than 40.3% share of the global market in 2021. North America was the dominant market in 2021. This trend is anticipated to continue during the forecast period. Growth of the market in the region can be ascribed to the increase in number of hyaluronic acid dermal filler procedures performed in the U.S.

According to ASPS, more than 2,091,476 hyaluronic acid procedures were performed in 2017, an increase of 4% over that in 2016. The market in Asia Pacific is likely to expand at a high CAGR during the forecast period due to the strong growth in Japan and India. Companies in Asia Pacific are increasing the availability of dermal fillers owing to the rise in demand for anti-aging and scar treatment applications.

The report concludes with the company profiles section, which includes information about key players in the global dermal fillers market. Dermal filler companies analyzed in the report are AbbVie, Inc., Sinclair, Merz Pharma, GALDERMA, BioPlus Co., Ltd., Bioxis pharmaceuticals, SCULPT Luxury Dermal Fillers Ltd., Dr. Korman, Prollenium Medical Technologies, Advanced Aesthetic Technologies, Inc., and TEOXANE Laboratories. Key players are adopting strategies such as new product development, product launches, product approval, agreement, partnerships, and mergers. For instance, Restylane filler is a FDA-approved dermal filler made primarily with hyaluronic acid. Restylane Lyft is the first FDA-approved hyaluronic acid filler used for the face and the back of the hands.

Each of these players has been profiled in the dermal fillers market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 5.1 Bn |

|

Market Forecast Value in 2031 |

More than US$ 13 Bn |

|

Growth Rate (CAGR) for 2022-2031 |

10.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, the qualitative analysis includes dermal fillers market drivers, restraints, opportunities, key trends, and a parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global dermal fillers market was valued at US$ 5.1 Bn in 2021

The global dermal fillers market is projected to reach more than US$ 13 Bn by 2031

The global dermal fillers market grew at a CAGR of 8.5% from 2017 to 2021.

The global dermal fillers market is anticipated to grow at a CAGR of 10.3% from 2022 to 2031

The biodegradable segment held over 86% share of the global dermal fillers market in 2021

North America is expected to account for major share of the global dermal fillers market during the forecast period

AbbVie, Inc., Sinclair, Merz Pharma, GALDERMA, BioPlus Co., Ltd., Bioxis pharmaceuticals, SCULPT Luxury Dermal Fillers Ltd., DR. Korman, Prollenium Medical Technologies, Advanced Aesthetic Technologies, Inc., and TEOXANE Laboratories

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Dermal Fillers Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Dermal Fillers Market Analysis and Forecast, 2021–2031

5. Key Insights

5.1. Key Industry Developments

5.2. Dermal Fillers – Products Comparison

5.3. Dermal Filler Procedures

5.4. Regulatory Approval Process

5.5. Evolution of Dermal Fillers

5.6. Technological Advances

6. Global Dermal Fillers Market Analysis, by Product

6.1. Introduction

6.2. Global Dermal Fillers Market Value Share Analysis, by Product

6.3. Global Dermal Fillers Market Value Forecast, by Product, 2017-2031

6.3.1. Biodegradable

6.3.2. Non-biodegradable

6.4. Global Dermal Fillers Market Attractiveness Analysis, by Product

7. Global Dermal Fillers Market Analysis, by Material

7.1. Introduction

7.2. Global Dermal Fillers Market Value Share Analysis, by Material

7.3. Global Dermal Fillers Market Value Forecast, by Material, 2017-2031

7.3.1. Calcium Hydroxylapatite

7.3.2. Hyaluronic Acid

7.3.3. Collagen

7.3.4. Poly-L-Lactic Acid

7.3.5. PMMA

7.3.6. Fat

7.3.7. Others

7.4. Global Dermal Fillers Market Attractiveness Analysis, by Material

8. Global Dermal Fillers Market Analysis, by Application

8.1. Introduction

8.2. Global Dermal Fillers Market Value Share Analysis, by Application

8.3. Global Dermal Fillers Market Value Forecast, by Application, 2017-2031

8.3.1. Facial Line Correction Treatment

8.3.2. Lip Enhancement

8.3.3. Scar Treatment

8.3.4. Others

8.4. Global Dermal Fillers Market Attractiveness Analysis, by Application

9. Global Dermal Fillers Market Analysis, by End-user

9.1. Introduction

9.2. Global Dermal Fillers Market Value Share Analysis, by End-user

9.3. Global Dermal Fillers Market Value Forecast, by End-user, 2017-2031

9.3.1. Hospitals

9.3.2. Ambulatory Surgical Centers

9.3.3. Dermatology Clinics

9.3.4. Others

9.4. Global Dermal Fillers Market Attractiveness Analysis, by End-user

10. Global Dermal Fillers Market Analysis, by Region

10.1. Introduction

10.2. Global Dermal Fillers Market Value Share Analysis, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Global Dermal Fillers Market Attractiveness Analysis, by Region

11. North America Dermal Fillers Market Analysis

11.1. Key Findings

11.2. North America Dermal Fillers Market Value Forecast, by Country, 2017-2031

11.2.1. U.S.

11.2.2. Canada

11.3. North America Dermal Fillers Market Value Forecast, by Product, 2017-2031

11.3.1. Biodegradable

11.3.2. Non-biodegradable

11.4. North America Dermal Fillers Market Value Forecast, by Material, 2017-2031

11.4.1. Calcium Hydroxylapatite

11.4.2. Hyaluronic Acid

11.4.3. Collagen

11.4.4. Poly-L-Lactic Acid

11.4.5. PMMA

11.4.6. Fat

11.4.7. Others

11.5. North America Dermal Fillers Market Value Forecast, by Application, 2017-2031

11.5.1. Facial Line Correction Treatment

11.5.2. Lip Enhancement

11.5.3. Scar Treatment

11.5.4. Others

11.6. North America Dermal Fillers Market Value Forecast, by End-user, 2017-2031

11.6.1. Hospitals

11.6.2. Ambulatory Surgical Centers

11.6.3. Dermatology Clinics

11.6.4. Others

11.7. North America Market Attractiveness Analysis

11.7.1. By Country

11.7.2. By Product

11.7.3. By Material

11.7.4. By Application

11.7.5. By End-user

12. Europe Dermal Fillers Market Analysis

12.1. Key Findings

12.2. Europe Dermal Fillers Market Value Forecast, by Country/Sub-region, 2017-2031

12.2.1. U.K.

12.2.2. Germany

12.2.3. France

12.2.4. Italy

12.2.5. Spain

12.2.6. Rest of Europe

12.3. Europe Dermal Fillers Market Value Forecast, by Product, 2017-2031

12.3.1. Biodegradable

12.3.2. Non-biodegradable

12.4. Europe Dermal Fillers Market Value Forecast, by Material, 2017-2031

12.4.1. Calcium Hydroxylapatite

12.4.2. Hyaluronic Acid

12.4.3. Collagen

12.4.4. Poly-L-Lactic Acid

12.4.5. PMMA

12.4.6. Fat

12.4.7. Others

12.5. Europe Dermal Fillers Market Value Forecast, by Application, 2017-2031

12.5.1. Facial Line Correction Treatment

12.5.2. Lip Enhancement

12.5.3. Scar Treatment

12.5.4. Others

12.6. Europe Dermal Fillers Market Value Forecast, by End-user, 2017-2031

12.6.1. Hospitals

12.6.2. Ambulatory Surgical Centers

12.6.3. Dermatology Clinics

12.6.4. Others

12.7. Europe Market Attractiveness Analysis

12.7.1. By Country/Sub-region

12.7.2. By Product

12.7.3. By Material

12.7.4. By Application

12.7.5. By End-user

13. Asia Pacific Dermal Fillers Market Analysis

13.1. Key Findings

13.2. Asia Pacific Dermal Fillers Market Value Forecast, by Country/Sub-region, 2017-2031

13.2.1. China

13.2.2. Japan

13.2.3. India

13.2.4. Australia

13.2.5. Rest of Asia Pacific

13.3. Asia Pacific Dermal Fillers Market Value Forecast, by Product, 2017-2031

13.3.1. Biodegradable

13.3.2. Non-biodegradable

13.4. Asia Pacific Dermal Fillers Market Value Forecast, by Material, 2017-2031

13.4.1. Calcium Hydroxylapatite

13.4.2. Hyaluronic Acid

13.4.3. Collagen

13.4.4. Poly-L-Lactic Acid

13.4.5. PMMA

13.4.6. Fat

13.4.7. Others

13.5. Asia Pacific Dermal Fillers Market Value Forecast, by Application, 2017-2031

13.5.1. Facial Line Correction Treatment

13.5.2. Lip Enhancement

13.5.3. Scar Treatment

13.5.4. Others

13.6. Asia Pacific Dermal Fillers Market Value Forecast, by End-user, 2021–2031

13.6.1. Hospitals

13.6.2. Ambulatory Surgical Centers

13.6.3. Dermatology Clinics

13.6.4. Others

13.7. Asia Pacific Market Attractiveness Analysis

13.7.1. By Country/Sub-region

13.7.2. By Product

13.7.3. By Material

13.7.4. By Application

13.7.5. By End-user

14. Latin America Dermal Fillers Market Analysis

14.1. Key Findings

14.2. Latin America Dermal Fillers Market Value Forecast, by Country/Sub-region, 2017-2031

14.2.1. Brazil

14.2.2. Mexico

14.2.3. Rest of Latin America

14.3. Latin America Dermal Fillers Market Value Forecast, by Product, 2017-2031

14.3.1. Biodegradable

14.3.2. Non-biodegradable

14.4. Latin America Dermal Fillers Market Value Forecast, by Material, 2017-2031

14.4.1. Calcium Hydroxylapatite

14.4.2. Hyaluronic Acid

14.4.3. Collagen

14.4.4. Poly-L-Lactic Acid

14.4.5. PMMA

14.4.6. Fat

14.4.7. Others

14.5. Latin America Dermal Fillers Market Value Forecast, by Application, 2017-2031

14.5.1. Facial Line Correction Treatment

14.5.2. Lip Enhancement

14.5.3. Scar Treatment

14.5.4. Others

14.6. Latin America Dermal Fillers Market Value Forecast, by End-user, 2017-2031

14.6.1. Hospitals

14.6.2. Ambulatory Surgical Centers

14.6.3. Dermatology Clinics

14.6.4. Others

14.7. Latin America Market Attractiveness Analysis

14.7.1. By Country/Sub-region

14.7.2. By Product

14.7.3. By Material

14.7.4. By Application

14.7.5. By End-user

15. Middle East & Africa Dermal Fillers Market Analysis

15.1. Key Findings

15.2. Middle East & Africa Dermal Fillers Market Value Forecast, by Country/Sub-region, 2017-2031

15.2.1. GCC Countries

15.2.2. South Africa

15.2.3. Rest of Middle East & Africa

15.3. Middle East & Africa Dermal Fillers Market Value Forecast, by Product, 2017-2031

15.3.1. Biodegradable

15.3.2. Non-biodegradable

15.4. Middle East & Africa Dermal Fillers Market Value Forecast, by Material, 2017-2031

15.4.1. Calcium Hydroxylapatite

15.4.2. Hyaluronic Acid

15.4.3. Collagen

15.4.4. Poly-L-Lactic Acid

15.4.5. PMMA

15.4.6. Fat

15.4.7. Others

15.5. Middle East & Africa Dermal Fillers Market Value Forecast, by Application, 2017-2031

15.5.1. Facial Line Correction Treatment

15.5.2. Lip Enhancement

15.5.3. Scar Treatment

15.5.4. Others

15.6. Middle East & Africa Dermal Fillers Market Value Forecast, by End-user, 2017-2031

15.6.1. Hospitals

15.6.2. Ambulatory Surgical Centers

15.6.3. Dermatology Clinics

15.6.4. Others

15.7. Middle East & Africa Market Attractiveness Analysis

15.7.1. By Country/Sub-region

15.7.2. By Product

15.7.3. By Material

15.7.4. By Application

15.7.5. By End-user

16. Competitive Landscape

16.1. Competition Matrix

16.2. Company Profiles

16.2.1. AbbVie Inc.

16.2.1.1. Company Overview (Headquarters, Business Segments, Employee Strength)

16.2.1.2. Financial Overview

16.2.1.3. Product Portfolio

16.2.1.4. SWOT Analysis

16.2.1.5. Strategic Overview

16.2.2. Sinclair

16.2.2.1. Company Overview (Headquarters, Business Segments, Employee Strength)

16.2.2.2. Product Portfolio

16.2.2.3. SWOT Analysis

16.2.2.4. Strategic Overview

16.2.3. Merz Pharma

16.2.3.1. Company Overview (Headquarters, Business Segments, Employee Strength)

16.2.3.2. Financial Overview

16.2.3.3. Product Portfolio

16.2.3.4. SWOT Analysis

16.2.3.5. Strategic Overview

16.2.4. GALDERMA

16.2.4.1. Company Overview (Headquarters, Business Segments, Employee Strength)

16.2.4.2. Financial Overview

16.2.4.3. Product Portfolio

16.2.4.4. SWOT Analysis

16.2.4.5. Strategic Overview

16.2.5. BioPlus Co., Ltd.

16.2.5.1. Company Overview (Headquarters, Business Segments, Employee Strength)

16.2.5.2. Product Portfolio

16.2.5.3. SWOT Analysis

16.2.5.4. Strategic Overview

16.2.6. Bioxis pharmaceuticals

16.2.6.1. Company Overview (Headquarters, Business Segments, Employee Strength)

16.2.6.2. Financial Overview

16.2.6.3. Product Portfolio

16.2.6.4. SWOT Analysis

16.2.7. SCULPT Luxury Dermal Fillers LTD

16.2.7.1. Company Overview (Headquarters, Business Segments, Employee Strength)

16.2.7.2. Product Portfolio

16.2.7.3. SWOT Analysis

16.2.8. DR. Korman

16.2.8.1. Company Overview (Headquarters, Business Segments, Employee Strength)

16.2.8.2. Financial Overview

16.2.8.3. Product Portfolio

16.2.8.4. SWOT Analysis

16.2.9. Prollenium Medical Technologies

16.2.9.1. Company Overview (Headquarters, Business Segments, Employee Strength)

16.2.9.2. Product Portfolio

16.2.9.3. SWOT Analysis

16.2.10. Advanced Aesthetic Technologies, Inc.

16.2.10.1. Company Overview (Headquarters, Business Segments, Employee Strength)

16.2.10.2. Financial Overview

16.2.10.3. Product Portfolio

16.2.10.4. SWOT Analysis

16.2.11. TEOXANE Laboratories

16.2.11.1. Company Overview (Headquarters, Business Segments, Employee Strength)

16.2.11.2. Financial Overview

16.2.11.3. Product Portfolio

16.2.11.4. SWOT Analysis

List of Tables

Table 01: Dermal Fillers – Product Comparison

Table 02: Global Dermal Fillers Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 03: Global Dermal Fillers Market Value (US$ Mn) Forecast, by Material, 2017-2031

Table 04: Global Dermal Fillers Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 05: Global Dermal Fillers Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 06: Global Dermal Fillers Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 07: North America Dermal Fillers Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 08: North America Dermal Fillers Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 09: North America Dermal Fillers Market Value (US$ Mn) Forecast, by Material, 2017-2031

Table 10: North America Dermal Fillers Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 11: North America Dermal Fillers Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 12: Europe Dermal Fillers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 13: Europe Dermal Fillers Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 14: Europe Dermal Fillers Market Value (US$ Mn) Forecast, by Material, 2017-2031

Table 15: Europe Dermal Fillers Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 16: Europe Dermal Fillers Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 17: Asia Pacific Dermal Fillers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Asia Pacific Dermal Fillers Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 19: Asia Pacific Dermal Fillers Market Value (US$ Mn) Forecast, by Material, 2017-2031

Table 20: Asia Pacific Dermal Fillers Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 21: Asia Pacific Dermal Fillers Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 22: Latin America Dermal Fillers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 23: Latin America Dermal Fillers Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 24: Latin America Dermal Fillers Market Value (US$ Mn) Forecast, by Material, 2017-2031

Table 25: Latin America Dermal Fillers Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 26: Latin America Dermal Fillers Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 27: Middle East & Africa Dermal Fillers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 28: Middle East & Africa Dermal Fillers Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 29: Middle East & Africa Dermal Fillers Market Value (US$ Mn) Forecast, by Material, 2017-2031

Table 30: Middle East & Africa Dermal Fillers Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 31: Middle East & Africa Dermal Fillers Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Dermal Fillers Market Value (US$ Mn) and Distribution, by Geography, 2021 and 2031

Figure 02: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%), and Forecast, 2022–2031

Figure 03: Global Dermal Fillers Market Value Share, by Product (2021)

Figure 04: Global Dermal Fillers Market Value Share, by Material (2021)

Figure 05: Global Dermal Fillers Market Value Share, by Application (2021)

Figure 06: Global Dermal Fillers Market Value Share, by End-user (2021)

Figure 07: Global Dermal Fillers Market Value Share, by Region (2021)

Figure 08: Dermal Filler Procedures – By Material (2021)

Figure 09: Dermal Filler Procedures – By Material (2021)

Figure 10: U.S. Medical Device Approval Process

Figure 11: Europe Medical Device Approval Process

Figure 12: Japan Medical Device Approval Process

Figure 13: Evolution of Dermal Fillers

Figure 14: Technological Advances – Dermal Fillers

Figure 15: Global Dermal Fillers Market Value Share Analysis, by Product, 2021 and 2031

Figure 16: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Biodegradable, 2017-2031

Figure 17: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Non-biodegradable, 2017-2031

Figure 18: Global Dermal Fillers Market Attractiveness Analysis, by Product, 2022‒2031

Figure 19: Global Dermal Fillers Market Value Share Analysis, by Material, 2021 and 2031

Figure 20: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Calcium Hydroxylapatite, 2017-2031

Figure 21: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Hyaluronic Acid, 2017-2031

Figure 22: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Collagen, 2017-2031

Figure 23: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Poly-L-lactic Acid, 2017-2031

Figure 24: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by PMMA, 2017-2031

Figure 25: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Fat, 2017-2031

Figure 26: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Others, 2017-2031

Figure 27: Global Dermal Fillers Market Attractiveness Analysis, by Material, 2022‒2031

Figure 28: Global Dermal Fillers Market Value Share Analysis, by Application, 2021 and 2031

Figure 29: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Facial Line Correction Treatment, 2017-2031

Figure 30: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Lip Enhancement, 2017-2031

Figure 31: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Scar Treatment, 2017-2031

Figure 32: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Others, 2017-2031

Figure 33: Global Dermal Fillers Market Attractiveness Analysis, by Application, 2022‒2031

Figure 34: Global Dermal Fillers Market Value Share Analysis, by End-user, 2021 and 2031

Figure 35: Global Dermal Fillers Market Attractiveness Analysis, by End-user, 2022‒2031

Figure 36: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Hospitals, 2017-2031

Figure 37: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Dermatology Clinics, 2017-2031

Figure 38: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Ambulatory Surgical Centers, 2017-2031

Figure 39: Global Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Others, 2017-2031

Figure 40: Dermal Fillers- Regional Outlook

Figure 41: Global Dermal Fillers Market Value (US$ Mn) Forecast, 2017-2031

Figure 42: Global Dermal Fillers Market Value Share Analysis, by Region, 2021 and 2031

Figure 43: Global Dermal Fillers Market Attractiveness Analysis, by Region, 2021–2032

Figure 44: North America Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 45: North America Dermal Fillers Market Attractiveness Analysis, by Country, 2022–2031

Figure 46: North America Dermal Fillers Market Value Share Analysis, by Country, 2021 and 2031

Figure 47: North America Dermal Fillers Market Value Share Analysis, by Product, 2021 and 2031

Figure 48: North America Dermal Fillers Market Attractiveness Analysis, by Product, 2022‒2031

Figure 49: North America Dermal Fillers Market Value Share Analysis, by Material, 2021 and 2031

Figure 50: North America Dermal Fillers Market Attractiveness Analysis, by Material, 2022‒2031

Figure 51: North America Dermal Fillers Market Value Share Analysis, by Application, 2021 and 2031

Figure 52: North America Dermal Fillers Market Attractiveness Analysis, by Application, 2022‒2031

Figure 53: North America Dermal Fillers Market Value Share Analysis, by End-user, 2021 and 2031

Figure 54: North America Dermal Fillers Market Attractiveness Analysis, by End-user, 2022‒2031

Figure 55: Europe Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 56: Europe Dermal Fillers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 57: Europe Dermal Fillers Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 58: Europe Dermal Fillers Market Value Share Analysis, by Product, 2021 and 2031

Figure 59: Europe Dermal Fillers Market Attractiveness Analysis, by Product, 2022‒2031

Figure 60: Europe Dermal Fillers Market Value Share Analysis, by Material, 2021 and 2031

Figure 61: Europe Dermal Fillers Market Attractiveness Analysis, by Material, 2022‒2031

Figure 62: Europe Dermal Fillers Market Value Share Analysis, by Application, 2021 and 2031

Figure 63: Europe Dermal Fillers Market Attractiveness Analysis, by Application, 2022‒2031

Figure 64: Europe Dermal Fillers Market Value Share Analysis, by End-user, 2021 and 2031

Figure 65: Europe Dermal Fillers Market Attractiveness Analysis, by End-user, 2021–2031

Figure 66: Asia Pacific Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 67: Asia Pacific Dermal Fillers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 68: Asia Pacific Dermal Fillers Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 69: Asia Pacific Dermal Fillers Market Value Share Analysis, by Product, 2021 and 2031

Figure 70: Asia Pacific Dermal Fillers Market Attractiveness Analysis, by Product, 2022‒2031

Figure 71: Asia Pacific Dermal Fillers Market Value Share Analysis, by Material, 2021 and 2031

Figure 72: Asia Pacific Dermal Fillers Market Attractiveness Analysis, by Material, 2022‒2031

Figure 73: Asia Pacific Dermal Fillers Market Value Share Analysis, by Application, 2021 and 2031

Figure 74: Asia Pacific Dermal Fillers Market Attractiveness Analysis, by Application, 2022‒2031

Figure 75: Asia Pacific Dermal Fillers Market Value Share Analysis, by End-user, 2021 and 2031

Figure 76: Asia Pacific Dermal Fillers Market Attractiveness Analysis, by End-user, 2022‒2031

Figure 77: Latin America Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 78: Latin America Dermal Fillers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 79: Latin America Dermal Fillers Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 80: Latin America Dermal Fillers Market Value Share Analysis, by Product, 2021 and 2031

Figure 81: Latin America Dermal Fillers Market Attractiveness Analysis, by Product, 2022‒2031

Figure 82: Latin America Dermal Fillers Market Value Share Analysis, by Material, 2021 and 2031

Figure 83: Latin America Dermal Fillers Market Attractiveness Analysis, by Material, 2022‒2031

Figure 84: Latin America Dermal Fillers Market Value Share Analysis, by Application, 2021 and 2031

Figure 85: Latin America Dermal Fillers Market Attractiveness Analysis, by Application, 2022‒2031

Figure 86: Latin America Dermal Fillers Market Value Share Analysis, by End-user, 2021 and 2031

Figure 87: Latin America Dermal Fillers Market Attractiveness Analysis, by End-user, 2022‒2031

Figure 88: Middle East & Africa Dermal Fillers Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 89: Middle East & Africa Dermal Fillers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 90: Middle East & Africa Dermal Fillers Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 91: Middle East & Africa Dermal Fillers Market Value Share Analysis, by Product, 2021 and 2031

Figure 92: Middle East & Africa Dermal Fillers Market Attractiveness Analysis, by Product, 2022‒2031

Figure 93: Middle East & Africa Dermal Fillers Market Value Share Analysis, by Material, 2021 and 2031

Figure 94: Middle East & Africa Dermal Fillers Market Attractiveness Analysis, by Material, 2022‒2031

Figure 95: Middle East & Africa Dermal Fillers Market Value Share Analysis, by Application, 2021 and 2031

Figure 96: Middle East & Africa Dermal Fillers Market Attractiveness Analysis, by Application, 2022‒2031

Figure 97: Middle East & Africa Dermal Fillers Market Value Share Analysis, by End-user, 2021 and 2031

Figure 98: Middle East & Africa Dermal Fillers Market Attractiveness Analysis, by End-user, 2022‒2031