Global Data Protection as a Service (DPaaS) Market - Snapshot

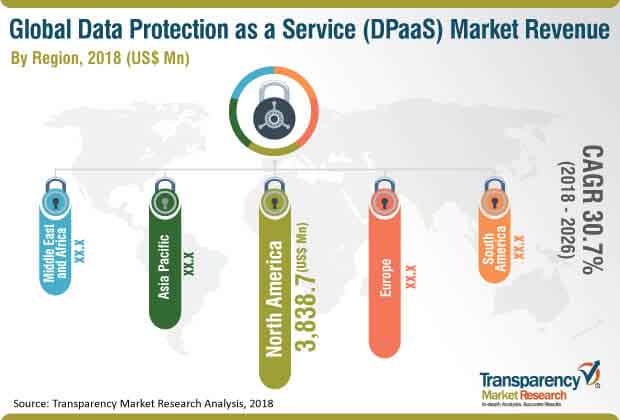

According to a new market report published by Transparency Market Research titled “Data Protection as a Service (DPaaS) Market – Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2018–2026,”the global Data Protection as a Service (DPaaS) market is expected to reach US$ 74,174.9 Mn by 2026, expanding at a CAGR of 30.7% from 2018 to 2026. North America held a prominent share of the Data Protection as a Service (DPaaS) market in 2017 and is projected to be at the forefront of global demand. Also, the Asia Pacific Data Protection as a Service (DPaaS) market is expected to expand at a significant CAGR.

DPaaS is a web-delivered or cloud-based service to protect data assets residing on the cloud. Enterprises generally utilize this service to build better security and enhance their network security for effective data management on the cloud. There is presently a rising need to reduce complexities in terms of large data volumes for application development. DPaaS services help organizations look after these issues by providing cost-effective cloud services. It is a multi-tenant model which allows management of various services through a single portal. On its deployment, DPaaS seamlessly provides virtual machine capabilities for each and every server.

Data protection is a cloud based or web based service that helps in protecting data assets on the cloud. Companies typically uses this service in order to develop a better security and improve their network stability and security for more efficient cloud data management. There is currently an increasing requirement to cut down the overall complexities in terms of greater data volumes for the development of different types of applications. DPaaS help companies to take of such data protection issues by offering cost efficient cloud services. The DPaaS is a multi-tenant model that helps management of a wide range of services via a single portal. After deployment, data protection as a service effortlessly offers different virtual machines capacities for each and every server.

In recent years, there has been a radical shift in the overall evolution of product-based solutions. These offerings have disrupted the IT infrastructure sector. The companies operating in the sector are growingly adopting service models to deliver business outcomes to their consumers as well as vendors. This migration to service-based models was mainly because of the increasing focus on resiliency. As companies and businesses manage vast amounts of data, it has become crucial for them to offer equally resistant data protection services for their clients.

Moreover, the growing stringency in regulations and standards, such as the GDPR policy and Data Protection Act, continues to put more obligations on enterprises to comply. As a result, it builds more pressure on the enterprises to carry out regular checks and focus on their compliance framework to evidence their accountability. With the rise in stringent requirements, data protection services provide a more useful way to meet the enterprises' challenges and reduce their exposure risks of data protection. It involves a collaborative approach to strategize, comply with checks, sight data protection artifacts and processes, and provide incident capabilities.

Disaster Recovery as a Service (DRaaS) segment to expand rapidly during the forecast period

By service, the DPaaS market is segmented into Disaster Recovery as a Service (DRaaS), Backup as a Service (BaaS), and Storage as a Service (STaaS). DRaaS is expected to be the fastest growing segment during the forecast period. Growing demand for data security and privacy across all data centers worldwide is playing a key role in driving the segment’s growth. On the basis of deployment models, the global DPaaS market is segmented into public cloud, private cloud, and hybrid cloud. In 2016, the hybrid cloud segment led the market accounting for approximately 50% of the total market revenue due to the growing number of large enterprises across the world looking for greater level of security and privacy on the cloud in order to cope with changing computing needs and costs associated with it. The segment is emerging as the best option for organizations that are looking to grab the benefits of public and private cloud deployment models at the same time. Also, hybrid cloud segment is projected to expand the fastest during the forecast period because of the growing complexities in cloud applications. By enterprise size, large enterprises led the global DPaaS market. Its growth is mainly attributed to the growing adoption of the hybrid cloud computing model, which is expected to be the future cloud computing model, mostly embraced by large enterprises. The small and medium enterprises (SMEs) segment is expected to rise the fastest during the forecast period. By industry, the DPaaS market is segmented into BFSI, Telecom & IT, government & public sector, healthcare, retail, energy & utilities, manufacturing, and others (aerospace & defense, travel & hospitality).

North America expected to hold a substantial share in the overall market

Based on geography, the global Data Protection as a Service (DPaaS)market has been divided into North America, South America, Europe, Asia Pacific, and Middle East & Africa. North America is expected to hold a prominent share and account for more than 40%of the global market in 2026, followed by Europe. The U.S. Data Protection as a Service (DPaaS) market accounted for the largest share compared to the Canada market due to greater spending on IT security solutions in the region. In Europe, the rising cloud spending by governments of countries such as the U.K., Germany, and France is observed as one of the major reasons for massive cloud adoption in both the public and private sectors of Europe. As a part of the strategy, several vendors are investing in tools development specific to a particular application and are focused on new product developments, partnerships, and mergers and acquisitions in order to increase geographical reach in the global Data Protection as a Service (DPaaS)market.

Major players operating in the global data protection as a service (DPaaS) market include Amazon Web Services, Inc., Dell EMC, Commvault Systems, Inc., Quantum Corporation, Asigra, Inc., Veritas Technologies, Acronis International GmbH, International Business Machines Corporation, Hewlett Packard Enterprise Company, and Carbonite, Inc.

Market Segmentation

|

Deployment Model |

|

|

Services |

|

|

Enterprise |

|

|

Industry |

|

|

Regional |

|

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global Data Protection as a Service (DPaaS) Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. World GDP Indicator – For Top 20 Economies

4.2.2. Global ICT Spending (US$ Mn), 2012, 2018, 2026

4.3. Technology/Product Roadmap

4.4. Market Factor Analysis

4.4.1. Porter’s Five Forces Analysis

4.4.2. PESTEL Analysis

4.4.3. Value Chain Analysis

4.4.4. Market Dynamics (Growth Influencers)

4.4.4.1. Drivers

4.4.4.2. Restraints

4.4.4.3. Opportunities

4.4.4.4. Impact Analysis of Drivers & Restraints

4.5. Global Data Protection as a Service (DPaaS) Market, Component Analysis

4.6. Global Data Protection as a Service (DPaaS) Market Analysis and Forecast, 2018 - 2026

4.6.1. Market Revenue Analysis (US$ Mn)

4.6.1.1. Historic Growth Trends, 2012-2017

4.6.1.2. Forecast Trends, 2018-2026

4.7. Market Attractiveness Analysis – By Region (Global/North America/

Europe/Asia Pacific/Middle East & Africa/South America)

4.7.1. By Region/Country

4.7.2. By Deployment Model

4.7.3. By Services

4.7.4. By Enterprise Size

4.7.5. By Industry

4.8. Market Outlook

4.9. Competitive Scenario and Trends

4.9.1. Data Protection as a Service (DPaaS) Market Concentration Rate

4.9.2. List of New Entrants

4.9.3. Mergers & Acquisitions, Expansions

5. Global Data Protection as a Service (DPaaS) Market Analysis and Forecast, By Deployment Model

5.1. Overview and Definitions

5.2. Key Segment Analysis

5.3. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Deployment Model, 2016 - 2026

5.3.1. Public Cloud

5.3.2. Private Cloud

5.3.3. Hybrid Cloud

6. Global Data Protection as a Service (DPaaS) Market Analysis and Forecast, By Services

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Services, 2016 - 2026

6.3.1. Disaster Recovery as a Service (DRaaS)

6.3.2. Backup as a Service (BaaS)

6.3.3. Storage as a Service (STaaS)

7. Global Data Protection as a Service (DPaaS) Market Analysis and Forecast, By Enterprise Size

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Enterprise Size, 2016 - 2026

7.3.1. Large Enterprises

7.3.2. Small and Medium Enterprises (SMEs)

8. Global Data Protection as a Service (DPaaS) Market Analysis and Forecast, By Industry

8.1. Overview

8.2. Key Segment Analysis

8.3. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Industry, 2016 - 2026

8.3.1. BFSI

8.3.2. Telecom & IT

8.3.3. Government & Public Sector

8.3.4. Healthcare

8.3.5. Retail

8.3.6. Energy & Utilities

8.3.7. Manufacturing

8.3.8. Others (Aerospace & Defense, Travel & Hospitality)

9. Global Data Protection as a Service (DPaaS) Market Analysis and Forecast, By Region

9.1. Overview

9.2. Key Segment Analysis

9.3. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, by Region, 2016 - 2026

9.3.1. North America

9.3.2. Europe

9.3.3. Asia Pacific

9.3.4. Middle East & Africa (MEA)

9.3.5. South America

9.4. Market Attractiveness by Region

10. North America Data Protection as a Service (DPaaS) Market Analysis and Forecast

10.1. Key Findings

10.2. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Deployment Model, 2016 - 2026

10.2.1. Public Cloud

10.2.2. Private Cloud

10.2.3. Hybrid Cloud

10.3. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Services, 2016 - 2026

10.3.1. Disaster Recovery as a Service (DRaaS)

10.3.2. Backup as a Service (BaaS)

10.3.3. Storage as a Service (STaaS)

10.4. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Enterprise Size, 2016 - 2026

10.4.1. Large Enterprises

10.4.2. Small and Medium Enterprises (SMEs)

10.5. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Application, 2016 - 2026

10.5.1. BFSI

10.5.2. Telecom & IT

10.5.3. Government & Public Sector

10.5.4. Healthcare

10.5.5. Retail

10.5.6. Energy & Utilities

10.5.7. Manufacturing

10.5.8. Others (Aerospace & Defense, Travel & Hospitality)

10.6. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Country, 2016 - 2026

10.6.1. U.S.

10.6.2. Canada

10.6.3. Rest of North America

11. Europe Data Protection as a Service (DPaaS) Market Analysis and Forecast

11.1. Key Findings

11.2. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Deployment Model, 2016 - 2026

11.2.1. Public Cloud

11.2.2. Private Cloud

11.2.3. Hybrid Cloud

11.3. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Services, 2016 - 2026

11.3.1. Disaster Recovery as a Service (DRaaS)

11.3.2. Backup as a Service (BaaS)

11.3.3. Storage as a Service (STaaS)

11.4. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Enterprise Size, 2016 - 2026

11.4.1. Large Enterprises

11.4.2. Small and Medium Enterprises (SMEs)

11.5. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Application, 2016 - 2026

11.5.1. BFSI

11.5.2. Telecom & IT

11.5.3. Government & Public Sector

11.5.4. Healthcare

11.5.5. Retail

11.5.6. Energy & Utilities

11.5.7. Manufacturing

11.5.8. Others (Aerospace & Defense, Travel & Hospitality)

11.6. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Country, 2016 - 2026

11.6.1. U.K.

11.6.2. France

11.6.3. Germany

11.6.4. Rest of Europe

12. Asia Pacific Data Protection as a Service (DPaaS) Market Analysis and Forecast

12.1. Key Findings

12.2. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Deployment Model, 2016 - 2026

12.2.1. Public Cloud

12.2.2. Private Cloud

12.2.3. Hybrid Cloud

12.3. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Services, 2016 - 2026

12.3.1. Disaster Recovery as a Service (DRaaS)

12.3.2. Backup as a Service (BaaS)

12.3.3. Storage as a Service (STaaS)

12.4. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Enterprise Size, 2016 - 2026

12.4.1. Large Enterprises

12.4.2. Small and Medium Enterprises (SMEs)

12.5. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Application, 2016 - 2026

12.5.1. BFSI

12.5.2. Telecom & IT

12.5.3. Government & Public Sector

12.5.4. Healthcare

12.5.5. Retail

12.5.6. Energy & Utilities

12.5.7. Manufacturing

12.5.8. Others (Aerospace & Defense, Travel & Hospitality)

12.6. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Country, 2016 - 2026

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. Rest of Asia Pacific

13. Middle East &Africa Data Protection as a Service (DPaaS) Market Analysis and Forecast

13.1. Key Findings

13.2. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Deployment Model, 2016 - 2026

13.2.1. Public Cloud

13.2.2. Private Cloud

13.2.3. Hybrid Cloud

13.3. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Services, 2016 - 2026

13.3.1. Disaster Recovery as a Service (DRaaS)

13.3.2. Backup as a Service (BaaS)

13.3.3. Storage as a Service (STaaS)

13.4. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Enterprise Size, 2016 - 2026

13.4.1. Large Enterprises

13.4.2. Small and Medium Enterprises (SMEs)

13.5. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Application, 2016 - 2026

13.5.1. BFSI

13.5.2. Telecom & IT

13.5.3. Government & Public Sector

13.5.4. Healthcare

13.5.5. Retail

13.5.6. Energy & Utilities

13.5.7. Manufacturing

13.5.8. Others (Aerospace & Defense, Travel & Hospitality)

13.6. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Country, 2016 - 2026

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of Middle East & Africa

14. South America Data Protection as a Service (DPaaS) Market Analysis and Forecast

14.1. Key Findings

14.2. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Deployment Model, 2016 - 2026

14.2.1. Public Cloud

14.2.2. Private Cloud

14.2.3. Hybrid Cloud

14.3. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Services, 2016 - 2026

14.3.1. Disaster Recovery as a Service (DRaaS)

14.3.2. Backup as a Service (BaaS)

14.3.3. Storage as a Service (STaaS)

14.4. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Enterprise Size, 2016 - 2026

14.4.1. Large Enterprises

14.4.2. Small and Medium Enterprises (SMEs)

14.5. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Application, 2016 - 2026

14.5.1. BFSI

14.5.2. Telecom & IT

14.5.3. Government & Public Sector

14.5.4. Healthcare

14.5.5. Retail

14.5.6. Energy & Utilities

14.5.7. Manufacturing

14.5.8. Others (Aerospace & Defense, Travel & Hospitality)

14.6. Data Protection as a Service (DPaaS) Market Size (US$ Mn) Forecast, By Country, 2016 - 2026

14.6.1. Brazil

14.6.2. Rest of South America

15. Competition Landscape

15.1. Market Player – Competition Matrix

15.2. Market Revenue Share Analysis (%), By Company (2017)

16. Company Profiles

Public Companies (Details – Basic Overview, Sales Area/Geographical Presence, Revenue, Recent Developments/Strategy)

16.1. Amazon Web Services, Inc.

16.2. Dell EMC

16.3. Commvault Systems, Inc.

16.4. Quantum Corporation

16.5. Veritas Technologies

16.6. IBM Corporation

16.7. Hewlett Packard Enterprise Company

16.8. Carbonite, Inc

Private Companies (Details – Basic Overview, Sales Area/Geographical Presence, Recent Developments/Strategy)

17.1. Acronis International GmbH

17.2. Asigra, Inc.

17. Key Takeaways

List of Tables

Table 1: Global Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Deployment Model, 2016 - 2026

Table 2: Global Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Services, 2016 - 2026

Table 3: Global Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Enterprise, 2016 - 2026

Table 4: Global Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Industry, 2016 - 2026

Table 5: Global Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Region, 2016 - 2026

Table 6: North America Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Deployment Model , 2016 - 2026

Table 7: North America Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Services, 2016 - 2026

Table 8: North America Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Enterprise, 2016 - 2026

Table 9: North America Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Industry, 2016 - 2026

Table 10: North America Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Country, 2016 - 2026

Table 11: Europe Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Deployment Model , 2016 - 2026

Table 12: Europe Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Services, 2016 - 2026

Table 13: Europe Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Enterprise, 2016 - 2026

Table 14: Europe Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Industry, 2016 - 2026

Table 15: Europe Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Country, 2016 - 2026

Table 16: Asia-Pacific Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Deployment Model, 2016 - 2026

Table 17: Asia-Pacific Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Services, 2016 - 2026

Table 18: Asia-Pacific Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Enterprise, 2016 - 2026

Table 19: Asia-Pacific Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Industry, 2016 - 2026

Table 20: Asia-Pacific Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Country, 2016 - 2026

Table 21: Middle East & Africa Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Deployment Model, 2016 - 2026

Table 22: Middle East & Africa Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Services, 2016 - 2026

Table 23: Middle East & Africa Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Enterprise, 2016 - 2026

Table 24: Middle East & Africa Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Industry, 2016 - 2026

Table 25: Middle East & Africa Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Country, 2016 - 2026

Table 26: South America Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Deployment Model, 2016 - 2026

Table 27: South America Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Services, 2016 - 2026

Table 28: South America Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Enterprise, 2016 - 2026

Table 29: South America Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Industry, 2016 - 2026

Table 30: South America Data Protection as a Service Market Revenue (US$ Mn) Forecast, by Country, 2016 - 2026

List of Figures

Figure 1: Global Data Protection as a Service Market Size (US$ Mn) Forecast, 2016–2026

Figure 2: Global CAGR Breakdown

Figure 3: Data Protection as a Service Market, Regional Outline

Figure 4: Global Data Protection as a Service Market Value (US$) Opportunity Assessment, by Region, 2018E

Figure 5: Top Data Protection as a Service Market Segment Analysis

Figure 6: Global Data Protection as a Service Market Value (US$) Opportunity Assessment, by Region, 2026F

Figure 7: North America Data Protection as a Service MarketAbstract

Figure 8: Europe Data Protection as a Service MarketAbstract

Figure 9: Asia Pacific Data Protection as a Service MarketAbstract

Figure 10: Middle East & Africa (MEA) Data Protection as a Service Market Abstract

Figure 11: South America Data Protection as a Service MarketAbstract

Figure 12: World GDP Indicator - 2017

Figure 13: Global ICT Spending (US$ Mn), 2017

Figure 14: Global Cyber security Market (US$ Bn), 2017-2025

Figure 15: Cloud data center workloads and compute instances (Mn)

Figure 16: Global Data Protection as a Service Market Size (US$ Mn) and Forecast, 2012 – 2026

Figure 17: Global Data Protection as a Service Market Opportunity Analysis (US$ Mn), 2016 – 2026

Figure 18: Global Data Protection as a Service Market Attractiveness Analysis, by Deployment Model

Figure 19: Global Data Protection as a Service Market Attractiveness Analysis, by Enterprise

Figure 20: Global Data Protection as a Service Market Attractiveness Analysis, by Services

Figure 21: Global Data Protection as a Service Market Attractiveness Analysis, by Industry

Figure 22: North America Data Protection as a Service Market Attractiveness Analysis, by Deployment Model

Figure 23: North America Data Protection as a Service Market Attractiveness Analysis, by Enterprise

Figure 24: North America Data Protection as a Service Market Attractiveness Analysis, by Services

Figure 25: North America Data Protection as a Service Market Attractiveness Analysis, by Industry

Figure 26: Europe Data Protection as a Service Market Attractiveness Analysis, by Deployment Model

Figure 28: Europe Data Protection as a Service Market Attractiveness Analysis, by Services

Figure 27: Europe Data Protection as a Service Market Attractiveness Analysis, by Enterprise

Figure 29: Europe Data Protection as a Service Market Attractiveness Analysis, by Industry

Figure 30: Asia Pacific Data Protection as a Service Market Attractiveness Analysis, by Deployment Model

Figure 31: Asia Pacific Data Protection as a Service Market Attractiveness Analysis, by Enterprise

Figure 32: Asia Pacific Data Protection as a Service Market Attractiveness Analysis, by Services

Figure 33: Asia Pacific Data Protection as a Service Market Attractiveness Analysis, by Industry

Figure 34: Middle East and Africa Data Protection as a Service Market Attractiveness Analysis, by Deployment Model

Figure 35: Middle East and Africa Data Protection as a Service Market Attractiveness Analysis, by Enterprise

Figure 36: Middle East and Africa Data Protection as a Service Market Attractiveness Analysis, by Services

Figure 37: Middle East and Africa Data Protection as a Service Market Attractiveness Analysis, by Industry

Figure 38: South America Data Protection as a Service Market Attractiveness Analysis, by Deployment Model

Figure 39: South America Data Protection as a Service Market Attractiveness Analysis, by Enterprise

Figure 40: South America Data Protection as a Service Market Attractiveness Analysis, by Services

Figure 41: South America Data Protection as a Service Market Attractiveness Analysis, by Industry

Figure 42: Global Data Protection as a Service Market Outlook (Value %), By Deployment Model

Figure 43: Global Data Protection as a Service Market Outlook (Value %), By Services

Figure 44: Global Data Protection as a Service Market Outlook (Value %), By Enterprise Size

Figure 45: Global Data Protection as a Service Market Outlook (Value %), By Region

Figure 46: Global Data Protection as a Service Market Outlook (Value %), By Industry

Figure 47: Global Data Protection as a Service Market Value Share (%), by Deployment Model (2018)

Figure 48: Global Data Protection as a Service Market Value Share(%), by Deployment Model (2026)

Figure 49: Global Data Protection as a Service Market Value Share (%), by Services (2018)

Figure 50: Global Data Protection as a Service Market Value Share(%), by Services (2026)

Figure 51: Global Data Protection as a Service Market Value Share (%), by Enterprise (2018)

Figure 52: Global Data Protection as a Service Market Value Share(%), by Enterprise (2026)

Figure 53: Global Data Protection as a Service Market Value Share (%), by Industry (2018)

Figure 54: Global Data Protection as a Service Market Value Share(%), by Industry (2026)

Figure 55: Global Data Protection as a Service Market Share Analysis (%), by Region, 2018

Figure 56: Global Data Protection as a Service Market Share Analysis (%), by Region, 2026

Figure 57: North America Data Protection as a Service Market Revenue (US$ Mn) and Y-o-Y Forecast, 2018– 2026

Figure 58: North America Data Protection as a Service Market Opportunity Growth Analysis (US$ Mn), 2016 – 2026

Figure 59: North America Data Protection as a Service Market Value Share (%), by Deployment Model (2018)

Figure 60: North America Data Protection as a Service Market Value Share (%), by Deployment Model (2026)

Figure 61: North America Data Protection as a Service Market Value Share (%), by Services (2018)

Figure 62: North America Data Protection as a Service Market Value Share (%), by Services (2026)

Figure 63: North America Data Protection as a Service Market Value Share, by Enterprise (2018)

Figure 64: North America Data Protection as a Service Market Value Share, by Enterprise (2026)

Figure 65: North America Data Protection as a Service Market Value Share, by Industry (2018)

Figure 66: North America Data Protection as a Service Market Value Share, by Industry (2026)

Figure 67: North America Data Protection as a Service Market Value Share (%), by Country (2018)

Figure 68: North America Data Protection as a Service Market Value Share (%), by Country (2026)

Figure 69: Europe Data Protection as a Service Market Revenue (US$ Mn) and Y-o-Y Forecast, 2018– 2026

Figure 70: Europe Data Protection as a Service Market Opportunity Growth Analysis (US$ Mn), 2016 – 2026

Figure 71: Europe Data Protection as a Service Market Value Share, by Deployment Model (2018)

Figure 72: Europe Data Protection as a Service Market Value Share, by Deployment Model (2026)

Figure 73: Europe Data Protection as a Service Market Value Share, by Services (2018)

Figure 74: Europe Data Protection as a Service Market Value Share, by Services (2026)

Figure 75: Europe Data Protection as a Service Market Value Share, by Enterprise (2018)

Figure 76: Europe Data Protection as a Service Market Value Share, by Enterprise (2026)

Figure 77: Europe Data Protection as a Service Market Value Share, by Industry (2018)

Figure 78: Europe Data Protection as a Service Market Value Share, by Industry (2026)

Figure 79: Europe Data Protection as a Service Market Value Share (%), by Country (2018)

Figure 80: Europe Data Protection as a Service Market Value Share (%), by Country (2026)

Figure 81: Asia-Pacific Data Protection as a Service Market Revenue (US$ Mn) and Y-o-Y Forecast, 2018– 2026

Figure 82: Asia-Pacific Data Protection as a Service Market Opportunity Growth Analysis (US$ Mn), 2016 – 2026

Figure 83: Asia-Pacific Data Protection as a Service Market Value Share, by Deployment Model (2018)

Figure 84: Asia-Pacific Data Protection as a Service Market Value Share, by Deployment Model (2026)

Figure 85: Asia-Pacific Data Protection as a Service Market Value Share, by Services (2018)

Figure 86: Asia-Pacific Data Protection as a Service Market Value Share, by Services (2026)

Figure 87: Asia-Pacific Data Protection as a Service Market Value Share, by Enterprise (2018)

Figure 88: Asia-Pacific Data Protection as a Service Market Value Share, by Enterprise (2026)

Figure 89: Asia-Pacific Data Protection as a Service Market Value Share, by Industry (2018)

Figure 90: Asia-Pacific Data Protection as a Service Market Value Share, by Industry (2026)

Figure 91: Asia-Pacific Data Protection as a Service Market Value Share (%), by Country (2018)

Figure 92: Asia-Pacific Data Protection as a Service Market Value Share (%), by Country (2026)

Figure 93: Middle East & Africa Data Protection as a Service Market Revenue (US$ Mn) and Y-o-Y Forecast, 2018– 2026

Figure 94: Middle East & Africa Data Protection as a Service Market Opportunity Growth Analysis (US$ Mn), 2016 – 2026

Figure 95: Middle East & Africa Data Protection as a Service Market Value Share, by Deployment Model (2018)

Figure 96: Middle East & Africa Data Protection as a Service Market Value Share, by Deployment Model (2026)

Figure 97: Middle East & Africa Data Protection as a Service Market Value Share, by Services (2018)

Figure 98: Middle East & Africa Data Protection as a Service Market Value Share, by Services (2026)

Figure 99: Middle East & Africa Data Protection as a Service Market Value Share, by Enterprise (2018)

Figure 100: Middle East & Africa Data Protection as a Service Market Value Share, by Enterprise (2026)

Figure 101: Middle East & Africa Data Protection as a Service Market Value Share, by Industry (2018)

Figure 102: Middle East & Africa Data Protection as a Service Market Value Share, by Industry (2026)

Figure 103: Middle East & Africa Data Protection as a Service Market Value Share (%), by Country (2018)

Figure 104: Middle East & Africa Data Protection as a Service Market Value Share (%), by Country (2026)

Figure 105: South America Data Protection as a Service Market Revenue (US$ Mn) and Y-o-Y Forecast, 2018– 2026

Figure 106: South America Data Protection as a Service Market Opportunity Growth Analysis (US$ Mn), 2016 – 2026

Figure 107: South America Data Protection as a Service Market Value Share, by Deployment Model (2018)

Figure 108: South America Data Protection as a Service Market Value Share, by Deployment Model (2026)

Figure 109: South America Data Protection as a Service Market Value Share, by Services (2018)

Figure 110: South America Data Protection as a Service Market Value Share, by Services (2026)

Figure 111: South America Data Protection as a Service Market Value Share, by Enterprise (2018)

Figure 112: South America Data Protection as a Service Market Value Share, by Enterprise (2026)

Figure 113: South America Data Protection as a Service Market Value Share, by Industry (2018)

Figure 114: South America Data Protection as a Service Market Value Share, by Industry (2026)

Figure 115: South America Data Protection as a Service Market Value Share (%), by Country (2018)

Figure 116: South America Data Protection as a Service Market Value Share (%), by Country (2026)

Figure 117: Data Protection as a Service Market Share Analysis By Company (2017)