The significant rise in the consumption of confectionery and bakery items has been influencing the growth of the confectionery ingredients market at the global level. The heavy demand for chocolate, sugar confectionery, and bakery products is likely to accelerate the progress of this market in the next few years. The influence of the western culture on the food habits of consumers in developing economies is also expected to boost the demand for confectionery in the near future, reflecting substantially on the sales of confectionery ingredients.

The increasing demand for better food, fueled by the frequent changes in consumers’ lifestyle, have made it very difficult for food product manufacturers to meet the tastes and requirements of consumers, which has prompted confectionery producers to explore the market scope with the use of ingredients. This, as a result, is anticipated to open new growth avenues for the worldwide market for confectionery ingredients over the forthcoming years. The opportunity in this market is likely to rise at a CAGR of 4.20% between 2017 and 2025, progressing from a value of US$76.25 bn in 2016 to US$109.48 bn by the end of 2025.

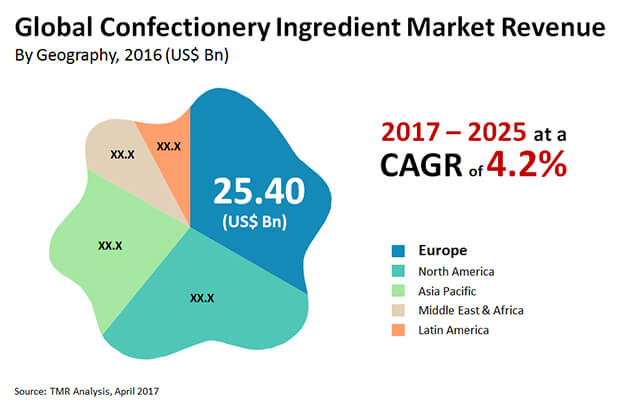

On the basis of the geography, the global market for confectionery ingredients has been categorized into North America, the Middle East and Africa, Europe, Asia Pacific, and Latin America. North America and Europe have emerged as the leading regional markets for confectionery ingredients. They collectively accounted for a share of more than 60% in the overall market in 2016. Europe is the dominant region in this market and is reported to have shown a higher consumption of confectionery products such as chocolates and gums.

The confectionery ingredients market in Europe is majorly driven by the growing demand of sweetened items, bread and ice cream in domestic regions, such as the U.K., Germany, France and the Rest of Europe. However, the demand for confectionery ingredients in this region is expected to exhibit a moderate growth rate over the forthcoming years, owing to its maturation.

Asia Pacific, on the other hand, is anticipated to register a higher growth rate as compared to the other regions between 2017 and 2025, especially in countries such as India, Japan, and China. The continual research on the consumption of chocolate and procurement of good quality confectionery ingredients from reliable sources are expected to complement the rise of the market for confectionery ingredients in this region in the near future.

Confectionery ingredients are widely utilized in chocolates, sugar confectionery, and bakery products. With a high consumption rate, the usage of these ingredients is significantly high in chocolates. Over the coming years, this trend is likely to remain so on the grounds of the growing awareness among consumers regarding the health benefits of dark chocolates. Bakery products and sugar confectionery are also projected to witness a considerable rise in the usage of confectionary ingredients in the near future due to the western influence in emerging economies and the changing palate of consumers across the world.

Cargill Inc., Olam International Ltd., E. I. Du Pont De Nemours and Co., Archer Daniels Midland Co., Ingredion Inc., Barry Callebaut, Tate & Lyle Plc, Koninklijke DSM N.V., and Kerry Group Plc are some of the key vendors of confectionery ingredients across the world.

Rising Demand for Confectioneries to Boost Confectionery Ingredient Market

Confectionery is a term that is used to describe carbohydrate-rich and sugary foods such as chocolates and candy. Sugar is widely used in confectionery items. Confectioneries are in high demand in a wide variety of settings, including restaurants and food joints, households, and food processing plants. Confectionery ingredients are utilized to produce sweet and sugary things like baked goods, lollipops, candies, chocolates, and other sugary treats. Extensive use of the product is estimated to support expansion of the global confectionery ingredient market in the years to come.

Confectionery ingredients are in high demand due to the rising number of confectionery applications in the food and beverage industry. In addition to that, the customers' perception about the multiple health benefits of chocolate, as well as changing lifestyles of consumers are expected to have a major impact on the global confectionery ingredients market. Furthermore, augmented consumption of confectionery items in both developing and developed countries is expected to have a significant effect on the global confectionery ingredients market in the near future. Festive, seasonal, and emerging demand are expected to create untapped potential for market participants.

Increasing Demand for Innovative Products in the Confectionery Industry to Support Market Growth

The desire for flavored confectioneries like orange, strawberry, and chocolate and other flavors has been steadily growing. Thanks to its distinctive taste, promotional and marketing activities undertaken by prominent players, and enticing packaging of items, there has been an augmented penetration of their products amongst their targeted end-users, the global confectionery ingredient market is expected to grow. Besides that, regular releases of innovative products in the confectionery industry, like organic confectioneries and sugar-free chocolate, are likely to add to growth of the market in near future.

Because of rising disposable income with augmented purchasing power, the increasing demand for confectionery items, and a rising number of regional companies, particularly in countries like China and India, the Asia Pacific region is anticipated to be one of the rapidly growing regions in the global confectionery ingredient market. Furthermore, the acceptance of western culture and increased understanding of the nutritional benefits of dark chocolate consumption are expected to boost market growth.

The segments covered in the global confectionery ingredients market are as follows:

|

By Types |

|

|

By Form |

|

|

By Application |

|

|

By Geography |

|

Confectionery Ingredient Market is expected to reach US$109.48 bn by 2025

Confectionery Ingredient Market is estimated to rise at a CAGR of 4.2% during forecast period

High demand due to the rising number of confectionery applications in the food and beverage industry is expected to drive the Confectionery Ingredient Market

Europe is more attractive for vendors in the Confectionery Ingredient Market

Key players of Confectionery Ingredient Market are Cargill Inc., Olam International Ltd., E. I. Du Pont De Nemours and Co., Archer Daniels Midland Co., Ingredion Inc., Barry Callebaut, Tate & Lyle Plc, Koninklijke DSM N.V., and Kerry Group Plc

Chapter 1 Preface

1.1 Report Scope and Market Segmentation

1.2 Research Highlights

Chapter 2 Assumptions and Research Methodology

2.1 Assumptions and Acronyms Used

2.2 Research Methodology

Chapter 3 Executive Summary

3.1 Market Snapshot

Chapter 4 Market Overview

4.1 Product Overview

4.2 Market Introduction

Chapter 5 Global Confectionery Ingredient Market: Market Dynamics

5.1 Drivers and Restraints Snapshot Analysis

5.1.1 Drivers

5.1.2 Restraints

5.1.3 Opportunities

5.2 Key Trend Analysis

5.3 Global Confectionery Ingredient Market Attractiveness Analysis (2016) by Application

5.4 Global Confectionery Ingredient Market Share Analysis By Company (2016)

Chapter 6 Global Confectionery Ingredient Market Analysis By Type

6.1 Introduction

6.1.1 Global Confectionery Ingredient Market Value Share Analysis, By Type

6.1.2 Global Market Revenue Forecast by Type

6.1.3 Global Confectionery Ingredient Market Revenue Analysis By Type

Chapter 7 Global Confectionery Ingredient Market Analysis By Form

7.1 Introduction

7.1.1 Global Confectionery Ingredient Market Value Share Analysis, By Form

7.1.2 Global Market Revenue Forecast by Form

7.1.3 Global Confectionery Ingredient Market Revenue Analysis By Form

Chapter 8 Global Confectionery Ingredient Market Analysis By Application

8.1 Introduction

8.2 Global Confectionery Ingredient Market Value Share Analysis, By Application

8.3 Global Market Revenue Forecast by Application

8.4 Global Confectionery Ingredient Market Revenue Analysis By Application

Chapter 9 Global Confectionery Ingredient Market Analysis By Region

9.1 Geographical Scenario

9.2 Global Confectionery Ingredient Market Value Share Analysis, By Region Type

Chapter 10 North America Confectionery Ingredient Market Analysis

10.1 North America Confectionery Ingredient Market Overview

10.2 North America Confectionery Ingredient Market, Revenue Share Analysis, by Type

10.2.1 North America Market Revenue Forecast by Type

10.3 North America Confectionery Ingredient Market, Revenue Share Analysis, by Form

10.3.1 North America Market Revenue Forecast by Form

10.4 North America Confectionery Ingredient Market, Revenue Share Analysis, by Application

10.4.1 North America Market Revenue Forecast by Application

10.5 North America Market Revenue Share Analysis, by Country

10.5.1 North America Market Revenue Forecast by Country

Chapter 11 Europe Confectionery Ingredient Market Analysis

11.1 Europe Confectionery Ingredient Market Overview

11.2 Europe Confectionery Ingredient Market, Revenue Share Analysis, by Type

11.2.1 Europe Market Revenue Forecast by Type

11.3 Europe Confectionery Ingredient Market, Revenue Share Analysis, by Form

11.3.1 Europe Market Revenue Forecast by Form

11.4 Europe Confectionery Ingredient Market, Revenue Share Analysis, by Application

11.4.1 Europe Market Revenue Forecast by Application

11.5 Europe Market Revenue Share Analysis, by Country

11.5.1 Europe Market Revenue Forecast by Country

Chapter 12 Asia Pacific Confectionery Ingredient Market Analysis

12.1 Asia Pacific Confectionery Ingredient Market Overview

12.2 Asia Pacific Confectionery Ingredient Market, Revenue Share Analysis, by Type

12.2.1 Asia Pacific Market Revenue Forecast by Type

12.3 Asia Pacific Confectionery Ingredient Market, Revenue Share Analysis, by Form

12.3.1 Asia Pacific Market Revenue Forecast by Form

12.4 Asia Pacific Confectionery Ingredient Market, Revenue Share Analysis, by Application

12.4.1 Asia Pacific Market Revenue Forecast by Application

12.5 Asia Pacific Market Revenue Share Analysis, by Country

12.5.1 Asia Pacific Market Revenue Forecast by Country

Chapter 13 Middle East and Africa Confectionery Ingredient Market Analysis

13.1 Middle East and Africa Confectionery Ingredient Market Overview

13.2 Middle East and Africa Confectionery Ingredient Market, Revenue Share Analysis, by Type

13.2.1 Middle East and Africa Market Revenue Forecast by Type

13.3 Middle East and Africa Confectionery Ingredient Market, Revenue Share Analysis, by Form

13.3.1 Middle East and Africa Market Revenue Forecast by Form

13.4 Middle East and Africa Confectionery Ingredient Market, Revenue Share Analysis, by Application

13.4.1 Middle East and Africa Market Revenue Forecast by Application

13.5 Middle East and Africa Market Revenue Share Analysis, by Country

13.5.1 Middle East and Africa Market Revenue Forecast by Country

Chapter 14 Latin America Confectionery Ingredient Market Analysis

14.1 Latin America Confectionery Ingredient Market Overview

14.2 Latin America Confectionery Ingredient Market, Revenue Share Analysis, by Type

14.2.1 Latin America Market Revenue Forecast by Type

14.3 Latin America Confectionery Ingredient Market, Revenue Share Analysis, by Form

14.3.1 Latin America Market Revenue Forecast by Form

14.4 Latin America Confectionery Ingredient Market, Revenue Share Analysis, by Application

14.4.1 Latin America Market Revenue Forecast by Application

14.5 Latin America Market Revenue Share Analysis, by Country

14.5.1 Latin America Market Revenue Forecast by Country

Chapter 15 Company Profile

15.1 Cargill Incorporated

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Financial Information (Revenue and Y-o-Y Growth)

15.2 Olam International Ltd

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Financial Information (Revenue and Y-o-Y Growth)

15.3 E. I. Du Pont De Nemours and Company

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Financial Information (Revenue and Y-o-Y Growth)

15.4 Archer Daniels Midland

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Financial Information (Revenue and Y-o-Y Growth)

15.5 Barry Callebaut

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Financial Information (Revenue and Y-o-Y Growth)

15.6 Kerry Group

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Financial Information (Revenue and Y-o-Y Growth)

15.7 Tate and Lyle Plc

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Financial Information (Revenue and Y-o-Y Growth)

15.8 Koninklijke DSM N.V.

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Financial Information (Revenue and Y-o-Y Growth)

15.9 ZuChem Inc.

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Financial Information (Revenue and Y-o-Y Growth)

15.10 Ingredion Incorporated

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Financial Information (Revenue and Y-o-Y Growth)

List of Tables

Table 1 Global confectionery ingredient Market Revenue (US$ Bn) Forecast, by Type, 2016–2025

Table 2 Global confectionery ingredient Market Revenue (US$ Bn) Forecast, by Form, 2016–2025

Table 3 Global confectionery ingredient Market Revenue (US$ Bn) Forecast, by Application, 2016–2025

Table 4 North America confectionery ingredient Market Revenue (US$ Bn) Forecast, by Type, 2016 - 2025

Table 5 North America confectionery ingredient Market Revenue (US$ Bn) Forecast, by Form, 2016–2025

Table 6 North America confectionery ingredient Market Revenue (US$ Bn) Forecast, by Application, 2016–2025

Table 7 North America confectionery ingredient Market Revenue (US$ Bn) Forecast, by Country, 2016 – 2025

Table 8 Europe confectionery ingredient Market Revenue (US$ Bn) Forecast, by Type, 2016 - 2025

Table 9 Europe confectionery ingredient Market Revenue (US$ Bn) Forecast, by Form, 2016–2025

Table 10 Europe confectionery ingredient Market Revenue (US$ Bn) Forecast, by Application, 2016–2025

Table 11 Europe confectionery ingredient Market Revenue (US$ Bn) Forecast, by Country, 2016 – 2025

Table 12 Asia Pacific confectionery ingredient Market Revenue (US$ Bn) Forecast, by Type, 2016 - 2025

Table 13 Asia Pacific confectionery ingredient Market Revenue (US$ Bn) Forecast, by Form, 2016–2025

Table 14 Asia Pacific confectionery ingredient Market Revenue (US$ Bn) Forecast, by Application, 2016–2025

Table 15 Asia Pacific confectionery ingredient Market Revenue (US$ Bn) Forecast, by Country, 2016 – 2025

Table 16 Middle-East and Africa (MEA) confectionery ingredient Market Revenue (US$ Bn) Forecast, by Type, 2016 - 2025

Table 17 Middle-East and Africa (MEA) confectionery ingredient Market Revenue (US$ Bn) Forecast, by Form, 2016–2025

Table 18 Middle-East and Africa (MEA) confectionery ingredient Market Revenue (US$ Bn) Forecast, by Application, 2016–2025

Table 19 Middle-East and Africa (MEA) confectionery ingredient Market Revenue (US$ Bn) Forecast, by Country, 2016 – 2025

Table 20 Latin America confectionery ingredient Market Revenue (US$ Bn) Forecast, by Type, 2016 - 2025

Table 21 Latin America confectionery ingredient Market Revenue (US$ Bn) Forecast, by Form, 2016–2025

Table 22 Latin America confectionery ingredient Market Revenue (US$ Bn) Forecast, by Application, 2016–2025

Table 23 Latin America confectionery ingredient Market Revenue (US$ Bn) Forecast, by Country, 2016 – 2025

List of Figures

FIG: 1 Report Scope and Market Segmentation

FIG: 2 Market Snapshot

FIG: 3 Global Confectionery Ingredient Market Attractiveness Analysis (2016) by Type

FIG: 4 Global Confectionery Ingredient Market Share Analysis By Company (2016)

FIG: 6 Global Confectionery Ingredient Market Value Share Analysis By Type, 2017 and 2025

FIG: 7 Global Chocolates & Cocoa Market Revenue (US$ Bn), 2016– 2025

FIG: 8 Global Sugar Market Revenue (US$ Bn), 2016 – 2025

FIG: 9 Global Dairy Ingredients Market Revenue (US$ Bn), 2016– 2025

FIG: 10 Global Emulsifiers Market Revenue (US$ Bn), 2016 – 2025

FIG: 11 Global Sweeteners Market Revenue (US$ Bn), 2016– 2025

FIG: 12 Global Other Confectionery Ingredient Market Revenue (US$ Bn), 2016 – 2025

FIG: 13 Global Confectionery Ingredient Market Value Share Analysis By Form, 2016 and 2025

FIG: 14 Global dry confectionery ingredient Market, Revenue (US$ Bn), 2016– 2025

FIG: 15 Global liquid Confectionery Ingredient Market, Revenue (US$ Bn), 2016 – 2025

FIG: 16 Global confectionery ingredient Market Value Share Analysis By Application, 2016 and 2025

FIG: 17 Global Chocolate confectionery ingredient Market, Revenue (US$ Bn), 2016– 2025

FIG: 18 Global Sugar confectionery ingredient Market, Revenue (US$ Bn), 2016 – 2025

FIG: 19 Global Bakery confectionery ingredient Market, Revenue (US$ Bn), 2016– 2025

FIG: 20 Global Others confectionery ingredient Market, Revenue (US$ Bn), 2016 – 2025

FIG: 21 North America Confectionery Ingredient Market Revenue (US$ Bn) Forecast, 2016–2025

FIG: 22 North America Market Revenue Share Analysis by Type, 2016 and 2025

FIG: 23 North America Market Revenue Share Analysis by Form , 2016 and 2025

FIG: 24 North America Market Revenue Share Analysis by Application , 2016 and 2025

FIG: 25 North America Market Revenue Share Analysis by Country, 2016 and 2025

FIG: 26 Europe Confectionery Ingredient Market Revenue (US$ Bn) Forecast, 2016–2025

FIG: 27 Europe Market Revenue Share Analysis by Type, 2016 and 2025

FIG: 28 Europe Market Revenue Share Analysis by Form, 2016 and 2025

FIG: 29 Europe Market Revenue Share Analysis by Applications, 2016 and 2025

FIG: 30 Europe Market Revenue Share Analysis by Country, 2016 and 2025

FIG: 31 Asia Pacific Confectionery Ingredient Market Revenue (US$ Bn) Forecast, 2016–2025

FIG: 32 Asia Pacific Market Revenue Share Analysis by Type, 2016 and 2025

FIG: 33 Asia Pacific Market Revenue Share Analysis by Application, 2016 and 2025

FIG: 34 Asia Pacific Market Revenue Share Analysis by Application, 2016 and 2025

FIG: 35 Asia Pacific Market Revenue Share Analysis by Country, 2016 and 2025

FIG: 36 Middle East and Africa Confectionery Ingredient Market Revenue (US$ Bn) Forecast, 2016–2025

FIG: 37 Middle East and Africa Market Revenue Share Analysis by Type, 2016 and 2025

FIG: 38 Middle East and Africa Market Revenue Share Analysis by Form, 2016 and 2025

FIG: 39 Middle East and Africa Market Revenue Share Analysis by Application, 2016 and 2025

FIG: 40 Middle East and Africa Market Revenue Share Analysis by Country, 2016 and 2025

FIG: 41 Latin America Confectionery Ingredient Market Revenue (US$ Bn) Forecast, 2016–2025

FIG: 42 Latin America Market Revenue Share Analysis by Packaging Type, 2016 and 2025

FIG: 43 Latin America Market Revenue Share Analysis by Distribution Channel , 2016 and 2025

FIG: 44 Latin America Market Revenue Share Analysis by Distribution Channel , 2016 and 2025

FIG: 45 Latin America Market Revenue Share Analysis by Country, 2016 and 2025