Analysts’ Viewpoint

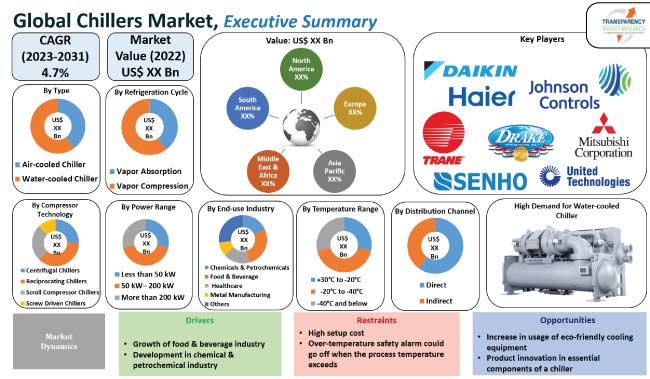

Rise in demand in the food & beverage industry is driving the global chillers industry growth. Expanding chemical & petrochemical industry is expected to accelerate market progress. Development of eco-friendly chillers, which utilize minimal energy and have less negative impact on the environment, is one of the major chillers market trends. This has prompted the development of several chillers, such as magnetic-bearing compressors, oil-free chillers, and low-GWP refrigerants that are gaining popularity among end-users.

Leading players in the chillers market that are considering sustainability as the primary goal have made significant innovations and developments in cooling technologies to create lucrative chillers market opportunities.

A chiller is a type of cooling system, which circulates a refrigerant that absorbs heat through a series of mechanisms releasing heat. The essential components of a chiller are compressor, condenser, expansion valve, and evaporator.

Chillers operate on the principle of compression or absorption of vapor. These provide a continuous flow of coolant in order to maintain a predetermined temperature.

Chillers are used in a range of highly efficient and accurate heat source machines that can supply a large amount of water at a stable temperature. The need to reuse industrial water has prompted the adoption of hybrid chillers, which are a combination of air- and water-cooled chillers, in order to reduce site water consumption.

Chillers improve production quality and efficiency in the industrial sector. Chemicals & petrochemicals, food & beverage, healthcare, metal manufacturing, and plastics are some of the most common end-use industries for chillers.

Manufacturing and storage processes in the food & beverage industry increasingly require low temperatures. A chiller system is able to adequately supply and maintain this temperature range through precise temperature control. Hence, expansion of the food & beverage industry is anticipated to propel global chillers market growth during the forecast period.

According to the U.S. Department of Agriculture, the foodservice and food retailing sectors supplied approximately US$ 2.12 Trn worth of food in 2021. Out of this aggregate, US$ 1.17 Trn was provided by foodservice facilities. As per a report by the European Commission, the food industry in the European Union (EU) is one of the largest manufacturing industries in the EU, with a turnover of EUR 1.1 Trn and a value addition of EUR 230 bn.

India's food ecosystem is huge owing to positive monetary strategies, attractive financial incentives, and a developing food processing sector. The Government of India's PMKSY scheme, which has been allocated INR 4,600 CR until March 2026, has increased investment in the food processing sector.

According to data from the National Bureau of Statistics of China, the total value of all food products produced in China in the first half of 2022 was CNY 903.2 Bn (US$ 130 Bn), an increase of 9.9% year-on-year. These factors are fueling chillers market development.

In the chemical industry, a chiller removes unwanted heat from materials being stored, and from the process by which those materials are then manufactured.

As per The European Chemical Industry Council factsheet, the global chemical industry sales expanded by 15.2% from EUR 3,494 Bn in 2020 to EUR 4,026 Bn in 2021. China is the world's largest chemical producer, accounting for 43% of global chemical sales in 2021 with EUR 1,729 Bn.

The chemical industry in the EU takes the second place in terms of total sales of 14.7%, followed by the U.S. with 10.9% sales. Sales revenue in the U.S. chemical industry increased significantly by 7.3% in 2021, in comparison to 2020. After a sharp decline in business growth in 2020, Brazil's business development returned to normal in 2021 with EUR 77.4 Bn.

Chillers help chemical laboratory equipment run efficiently, along with supplying water for injections, sterile solutions, and cell culture media. Environmental regulations and challenging economic situations lead to the development of better standards on chemical operations. Furthermore, developed cooling technologies are emerging to help address the issues in industries.

These factors are anticipated to lead to the expansion in the global chemical & petrochemical industry, boosting the chillers market revenue.

In terms of type, the global market has been bifurcated into air-cooled chiller and water-cooled chiller. As per the latest chillers market analysis, the water-cooled chiller segment is expected to account for major market share in the near future.

Water-cooled chillers guarantee a stable environment for the process, which is essential to achieve maximum efficiency. These chillers are extremely efficient at rapidly lowering temperatures in large industrial applications owing to their principle of operation.

Water-cooled chiller systems are typically constructed by process chiller manufacturers to last for a longer duration. These are long lasting and durable than other types of cooling systems.

Asia Pacific is expected to account for the largest global chillers market share during the forecast period. Recovery of various end-use industries in China, India, and Southeast Asian nations is driving the market in the region. Expanding industrial sector and rise in number of construction projects in these countries also drive the regional market value.

The market in Europe is expected to witness robust growth during the forecast period. Rise in demand for cooler units with small or medium power in Southern Europe is anticipated to lead market expansion in the region.

Prominent players have adopted several strategies such as investment in R&D, product expansion, and merger & acquisition. Product development is a key marketing strategy adopted by chiller manufacturers. The market is highly stagnant and competitive, with the presence of various global and regional players.

Daikin Industries, Ltd., Drake Refrigeration, Inc. Haier Electronics Group Co. Ltd., Ingersoll Rand (Trane), Johnson Controls, LG Electronics, Mitsubishi Corporation, Robert Bosch GmbH, Senho Machinery (Shenzhen) Co., Ltd., and United Technologies Corporation are the prominent entities profiled in the chillers market report.

Each of these players has been profiled in the chillers industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|---|---|

|

Size in 2022 |

US$ 4.8 Bn |

|

Forecast (Value) in 2031 |

US$ 7.1 Bn |

|

Growth Rate (CAGR) |

4.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 4.8 Bn in 2022

It is projected to expand at a CAGR of 4.7% from 2023 to 2031

Growth of the food & beverage industry and developments in chemical & petrochemical industry are propelling the global market

Water-cooled chillers is the prominent chiller type segment

Asia Pacific is an attractive region for vendors

Daikin Industries, Ltd., Drake Refrigeration, Inc., Haier Electronics Group Co. Ltd., Ingersoll Rand (Trane), Johnson Controls, LG Electronics, Mitsubishi Corporation, Robert Bosch GmbH, Senho Machinery (Shenzhen) Co., Ltd., and United Technologies Corporation are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Technological Overview Analysis

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Regulatory Framework

5.10. Global Chillers Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Chillers Market Analysis and Forecast, by Type

6.1. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

6.1.1. Air-cooled Chiller

6.1.1.1. Air-cooled Scroll Compressor Chiller

6.1.1.2. Air-cooled Screw Compressor Chiller

6.1.1.3. Air-cooled High Efficiency Modular Chiller

6.1.1.4. Others

6.1.2. Water-cooled Chiller

6.1.2.1. Water-cooled Screw Compressor Chiller

6.1.2.2. Modular Central Plant

6.1.2.3. Scroll Water Heater

6.1.2.4. Magnetic Bearing Centrifugal Chiller

6.1.2.5. Others

6.2. Incremental Opportunity, by Type

7. Global Chillers Market Analysis and Forecast, by Refrigeration Cycle

7.1. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Refrigeration Cycle, 2017 - 2031

7.1.1. Vapor Absorption

7.1.2. Vapor Compression

7.2. Incremental Opportunity, by Refrigeration Cycle

8. Global Chillers Market Analysis and Forecast, by Compressor Technology

8.1. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Compressor Technology, 2017 - 2031

8.1.1. Centrifugal Chillers

8.1.2. Reciprocating Chillers

8.1.3. Scroll Compressor Chillers

8.1.4. Screw Driven Chillers

8.2. Incremental Opportunity, by Compressor Technology

9. Global Chillers Market Analysis and Forecast, by Power Range

9.1. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Power Range, 2017 - 2031

9.1.1. Less than 50 kW

9.1.2. 50 kW -200 kW

9.1.3. More than 200 kW

9.2. Incremental Opportunity, by Power Range

10. Global Chillers Market Analysis and Forecast, by Temperature Range

10.1. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Temperature Range, 2017 - 2031

10.1.1. +30°C to -20°C

10.1.2. -20°C to -40°C

10.1.3. -40°C and below

10.2. Incremental Opportunity, by Temperature Range

11. Global Chillers Market Analysis and Forecast, by End-use Industry

11.1. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by End-use Industry, 2017 - 2031

11.1.1. Chemicals & Petrochemicals

11.1.2. Food & Beverage

11.1.3. Healthcare

11.1.4. Metal Manufacturing

11.1.5. Others

11.2. Incremental Opportunity, by End-use Industry

12. Global Chillers Market Analysis and Forecast, by Distribution Channel

12.1. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

12.1.1. Direct

12.1.2. Indirect

12.2. Incremental Opportunity, by Distribution Channel

13. Global Chillers Market Analysis and Forecast, by Region

13.1. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Region, 2017 - 2031

13.1.1. North America

13.1.2. Europe

13.1.3. Asia Pacific

13.1.4. Middle East & Africa

13.1.5. South America

13.2. Incremental Opportunity, by Region

14. North America Chillers Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Brand Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Trends Analysis

14.4.1. Demand Side

14.4.2. Supplier Side

14.5. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

14.5.1. Air-cooled Chiller

14.5.1.1. Air-cooled Scroll Compressor Chiller

14.5.1.2. Air-cooled Screw Compressor Chiller

14.5.1.3. Air-cooled High Efficiency Modular Chiller

14.5.1.4. Others

14.5.2. Water-cooled Chiller

14.5.2.1. Water-cooled Screw Compressor Chiller

14.5.2.2. Modular Central Plant

14.5.2.3. Scroll Water Heater

14.5.2.4. Magnetic Bearing Centrifugal Chiller

14.5.2.5. Others

14.6. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Refrigeration Cycle, 2017 - 2031

14.6.1. Vapor Absorption

14.6.2. Vapor Compression

14.7. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Compressor Technology, 2017 - 2031

14.7.1. Centrifugal Chillers

14.7.2. Reciprocating Chillers

14.7.3. Scroll Compressor Chillers

14.7.4. Screw Driven Chillers

14.8. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Power Range, 2017 - 2031

14.8.1. Less than 50 kW

14.8.2. 50 kW-200 kW

14.8.3. More than 200 kW

14.9. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Temperature Range, 2017 - 2031

14.9.1. +30°C to -20°C

14.9.2. -20°C to -40°C

14.9.3. -40°C and below

14.10. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by End-use Industry, 2017 - 2031

14.10.1. Chemicals & Petrochemicals

14.10.2. Food & Beverage

14.10.3. Healthcare

14.10.4. Metal Manufacturing

14.10.5. Others

14.11. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

14.11.1. Direct

14.11.2. Indirect

14.12. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

14.12.1. U.S.

14.12.2. Canada

14.12.3. Rest of North America

14.13. Incremental Opportunity Analysis

15. Europe Chillers Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Brand Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Price

15.4. Key Trends Analysis

15.4.1. Demand Side

15.4.2. Supplier Side

15.5. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

15.5.1. Air-cooled Chiller

15.5.1.1. Air-cooled Scroll Compressor Chiller

15.5.1.2. Air-cooled Screw Compressor Chiller

15.5.1.3. Air-cooled High Efficiency Modular Chiller

15.5.1.4. Others

15.5.2. Water-cooled Chiller

15.5.2.1. Water-cooled Screw Compressor Chiller

15.5.2.2. Modular Central Plant

15.5.2.3. Scroll Water Heater

15.5.2.4. Magnetic Bearing Centrifugal Chiller

15.5.2.5. Others

15.6. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Refrigeration Cycle, 2017 - 2031

15.6.1. Vapor Absorption

15.6.2. Vapor Compression

15.7. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Compressor Technology, 2017 - 2031

15.7.1. Centrifugal Chillers

15.7.2. Reciprocating Chillers

15.7.3. Scroll Compressor Chillers

15.7.4. Screw Driven Chillers

15.8. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Power Range, 2017 - 2031

15.8.1. Less than 50 kW

15.8.2. 50 kW-200 kW

15.8.3. More than 200 kW

15.9. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Temperature Range, 2017 - 2031

15.9.1. +30°C to -20°C

15.9.2. -20°C to -40°C

15.9.3. -40°C and below

15.10. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by End-use Industry, 2017 - 2031

15.10.1. Chemicals & Petrochemicals

15.10.2. Food & Beverage

15.10.3. Healthcare

15.10.4. Metal Manufacturing

15.10.5. Others

15.11. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

15.11.1. Direct

15.11.2. Indirect

15.12. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

15.12.1. U.K.

15.12.2. Germany

15.12.3. France

15.12.4. Rest of Europe

15.13. Incremental Opportunity Analysis

16. Asia Pacific Chillers Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Brand Analysis

16.3. Key Trends Analysis

16.3.1. Demand Side

16.3.2. Supplier Side

16.4. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

16.4.1. Air-cooled Chiller

16.4.1.1. Air-cooled Scroll Compressor Chiller

16.4.1.2. Air-cooled Screw Compressor Chiller

16.4.1.3. Air-cooled High Efficiency Modular Chiller

16.4.1.4. Others

16.4.2. Water-cooled Chiller

16.4.2.1. Water-cooled Screw Compressor Chiller

16.4.2.2. Modular Central Plant

16.4.2.3. Scroll Water Heater

16.4.2.4. Magnetic Bearing Centrifugal Chiller

16.4.2.5. Others

16.5. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Refrigeration Cycle, 2017 - 2031

16.5.1. Vapor Absorption

16.5.2. Vapor Compression

16.6. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Compressor Technology, 2017 - 2031

16.6.1. Centrifugal Chillers

16.6.2. Reciprocating Chillers

16.6.3. Scroll Compressor Chillers

16.6.4. Screw Driven Chillers

16.7. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Power Range, 2017 - 2031

16.7.1. Less than 50 kW

16.7.2. 50 kW-200 kW

16.7.3. More than 200 kW

16.8. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Temperature Range, 2017 - 2031

16.8.1. +30°C to -20°C

16.8.2. -20°C to -40°C

16.8.3. -40°C and below

16.9. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by End-use Industry, 2017 - 2031

16.9.1. Chemicals & Petrochemicals

16.9.2. Food & Beverage

16.9.3. Healthcare

16.9.4. Metal Manufacturing

16.9.5. Others

16.10. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

16.10.1. Direct

16.10.2. Indirect

16.11. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

16.11.1. India

16.11.2. China

16.11.3. Japan

16.11.4. Rest of Asia Pacific

16.12. Incremental Opportunity Analysis

17. Middle East & South Africa Chillers Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Brand Analysis

17.3. Price Trend Analysis

17.3.1. Weighted Average Price

17.4. Key Trends Analysis

17.4.1. Demand Side

17.4.2. Supplier Side

17.5. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

17.5.1. Air-cooled Chiller

17.5.1.1. Air-cooled Scroll Compressor Chiller

17.5.1.2. Air-cooled Screw Compressor Chiller

17.5.1.3. Air-cooled High Efficiency Modular Chiller

17.5.1.4. Others

17.5.2. Water-cooled Chiller

17.5.2.1. Water-cooled Screw Compressor Chiller

17.5.2.2. Modular Central Plant

17.5.2.3. Scroll Water Heater

17.5.2.4. Magnetic Bearing Centrifugal Chiller

17.5.2.5. Others

17.6. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Refrigeration Cycle, 2017 - 2031

17.6.1. Vapor Absorption

17.6.2. Vapor Compression

17.7. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Compressor Technology, 2017 - 2031

17.7.1. Centrifugal Chillers

17.7.2. Reciprocating Chillers

17.7.3. Scroll Compressor Chillers

17.7.4. Screw Driven Chillers

17.8. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Power Range, 2017 - 2031

17.8.1. Less than 50 kW

17.8.2. 50 kW-200 kW

17.8.3. More than 200 kW

17.9. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Temperature Range, 2017 - 2031

17.9.1. +30°C to -20°C

17.9.2. -20°C to -40°C

17.9.3. -40°C and below

17.10. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by End-use Industry, 2017 - 2031

17.10.1. Chemicals & Petrochemicals

17.10.2. Food & Beverage

17.10.3. Healthcare

17.10.4. Metal Manufacturing

17.10.5. Others

17.11. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

17.11.1. Direct

17.11.2. Indirect

17.12. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

17.12.1. GCC

17.12.2. Rest of Middle East & Africa

17.13. Incremental Opportunity Analysis

18. South America Chillers Market Analysis and Forecast

18.1. Regional Snapshot

18.2. Brand Analysis

18.3. Price Trend Analysis

18.3.1. Weighted Average Price

18.4. Key Trends Analysis

18.4.1. Demand Side

18.4.2. Supplier Side

18.5. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

18.5.1. Air-cooled Chiller

18.5.1.1. Air-cooled Scroll Compressor Chiller

18.5.1.2. Air-cooled Screw Compressor Chiller

18.5.1.3. Air-cooled High Efficiency Modular Chiller

18.5.1.4. Others

18.5.2. Water-cooled Chiller

18.5.2.1. Water-cooled Screw Compressor Chiller

18.5.2.2. Modular Central Plant

18.5.2.3. Scroll Water Heater

18.5.2.4. Magnetic Bearing Centrifugal Chiller

18.5.2.5. Others

18.6. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Refrigeration Cycle, 2017 - 2031

18.6.1. Vapor Absorption

18.6.2. Vapor Compression

18.7. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Compressor Technology, 2017 - 2031

18.7.1. Centrifugal Chillers

18.7.2. Reciprocating Chillers

18.7.3. Scroll Compressor Chillers

18.7.4. Screw Driven Chillers

18.8. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Power Range, 2017 - 2031

18.8.1. Less than 50 kW

18.8.2. 50 kW-200 kW

18.8.3. More than 200 kW

18.9. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Temperature Range, 2017 - 2031

18.9.1. +30°C to -20°C

18.9.2. -20°C to -40°C

18.9.3. -40°C and below

18.10. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by End-use Industry, 2017 - 2031

18.10.1. Chemicals & Petrochemicals

18.10.2. Food & Beverage

18.10.3. Healthcare

18.10.4. Metal Manufacturing

18.10.5. Others

18.11. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

18.11.1. Direct

18.11.2. Indirect

18.12. Chillers Market Size (US$ Bn and Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

18.12.1. Brazil

18.12.2. Rest of South America

18.13. Incremental Opportunity Analysis

19. Competition Landscape

19.1. Market Player - Competition Dashboard

19.2. Market Share Analysis (%), by Company, (2022)

19.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

19.3.1. Daikin Industries, Ltd.

19.3.1.1. Company Overview

19.3.1.2. Sales Area/Geographical Presence

19.3.1.3. Revenue

19.3.1.4. Strategy & Business Overview

19.3.2. Drake Refrigeration Inc.

19.3.2.1. Company Overview

19.3.2.2. Sales Area/Geographical Presence

19.3.2.3. Revenue

19.3.2.4. Strategy & Business Overview

19.3.3. Haier Electronics Group Co. Ltd.

19.3.3.1. Company Overview

19.3.3.2. Sales Area/Geographical Presence

19.3.3.3. Revenue

19.3.3.4. Strategy & Business Overview

19.3.4. Ingersoll Rand (Trane)

19.3.4.1. Company Overview

19.3.4.2. Sales Area/Geographical Presence

19.3.4.3. Revenue

19.3.4.4. Strategy & Business Overview

19.3.5. Johnson Controls

19.3.5.1. Company Overview

19.3.5.2. Sales Area/Geographical Presence

19.3.5.3. Revenue

19.3.5.4. Strategy & Business Overview

19.3.6. LG Electronics

19.3.6.1. Company Overview

19.3.6.2. Sales Area/Geographical Presence

19.3.6.3. Revenue

19.3.6.4. Strategy & Business Overview

19.3.7. Mitsubishi Corporation

19.3.7.1. Company Overview

19.3.7.2. Sales Area/Geographical Presence

19.3.7.3. Revenue

19.3.7.4. Strategy & Business Overview

19.3.8. Robert Bosch GmbH

19.3.8.1. Company Overview

19.3.8.2. Sales Area/Geographical Presence

19.3.8.3. Revenue

19.3.8.4. Strategy & Business Overview

19.3.9. Senho Machinery (Shenzhen) Co., Ltd

19.3.9.1. Company Overview

19.3.9.2. Sales Area/Geographical Presence

19.3.9.3. Revenue

19.3.9.4. Strategy & Business Overview

19.3.10. United Technologies Corporation

19.3.10.1. Company Overview

19.3.10.2. Sales Area/Geographical Presence

19.3.10.3. Revenue

19.3.10.4. Strategy & Business Overview

20. Key Takeaways

20.1. Identification of Potential Market Spaces

20.1.1. Type

20.1.2. Refrigeration Cycle

20.1.3. Compressor Technology

20.1.4. Power Range

20.1.5. Temperature Range

20.1.6. End-use Industry

20.1.7. Distribution Channel

20.1.8. By Region

20.2. Prevailing Market Risks

20.3. Understanding the Buying Process of the Customers

20.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Chillers Market Value (US$ Bn), by Type, 2017-2031

Table 2: Global Chillers Market Volume (Thousand Units), by Type 2017-2031

Table 3: Global Chillers Market Value (US$ Bn), by Refrigeration Cycle, 2017-2031

Table 4: Global Chillers Market Volume (Thousand Units), by Refrigeration Cycle 2017-2031

Table 5: Global Chillers Market Value (US$ Bn), by Compressor Technology, 2017-2031

Table 6: Global Chillers Market Volume (Thousand Units), by Compressor Technology 2017-2031

Table 7: Global Chillers Market Value (US$ Bn), by Power Range, 2017-2031

Table 8: Global Chillers Market Volume (Thousand Units), by Power Range, 2017-2031

Table 9: Global Chillers Market Value (US$ Bn), by Temperature Range, 2017-2031

Table 10: Global Chillers Market Volume (Thousand Units), by Temperature Range, 2017-2031

Table 11: Global Chillers Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 12: Global Chillers Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 13: Global Chillers Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 14: Global Chillers Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 15: North America Chillers Market Value (US$ Bn), by Type, 2017-2031

Table 16: North America Chillers Market Volume (Thousand Units), by Type, 2017-2031

Table 17: North America Chillers Market Value (US$ Bn), by Refrigeration Cycle, 2017-2031

Table 18: North America Chillers Market Volume (Thousand Units), by Refrigeration Cycle, 2017-2031

Table 19: North America Chillers Market Value (US$ Bn), by Compressor Technology, 2017-2031

Table 20: North America Chillers Market Volume (Thousand Units), by Compressor Technology, 2017-2031

Table 21: North America Chillers Market Value (US$ Bn), by Power Range, 2017-2031

Table 22: North America Chillers Market Volume (Thousand Units), by Power Range, 2017-2031

Table 23: North America Chillers Market Value (US$ Bn), by Temperature Range, 2017-2031

Table 24: North America Chillers Market Volume (Thousand Units), by Temperature Range, 2017-2031

Table 25: North America Chillers Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 26: North America Chillers Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 27: North America Chillers Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 28: North America Chillers Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 29: Europe Chillers Market Value (US$ Bn), by Type, 2017-2031

Table 30: Europe Chillers Market Volume (Thousand Units), by Type, 2017-2031

Table 31: Europe Chillers Market Value (US$ Bn), by Refrigeration Cycle, 2017-2031

Table 32: Europe Chillers Market Volume (Thousand Units), by Refrigeration Cycle, 2017-2031

Table 33: Europe Chillers Market Value (US$ Bn), by Compressor Technology, 2017-2031

Table 34: Europe Chillers Market Volume (Thousand Units), by Compressor Technology, 2017-2031

Table 35: Europe Chillers Market Value (US$ Bn), by Power Range, 2017-2031

Table 36: Europe Chillers Market Volume (Thousand Units), by Power Range, 2017-2031

Table 37: Europe Chillers Market Value (US$ Bn), by Temperature Range, 2017-2031

Table 38: Europe Chillers Market Volume (Thousand Units), by Temperature Range, 2017-2031

Table 39: Europe Chillers Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 40: Europe Chillers Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 41: Europe Chillers Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 42: Europe Chillers Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 43: Asia Pacific Chillers Market Value (US$ Bn), by Type, 2017-2031

Table 44: Asia Pacific Chillers Market Volume (Thousand Units), by Type 2017-2031

Table 45: Asia Pacific Chillers Market Value (US$ Bn), by Refrigeration Cycle, 2017-2031

Table 46: Asia Pacific Chillers Market Volume (Thousand Units), by Refrigeration Cycle 2017-2031

Table 47: Asia Pacific Chillers Market Value (US$ Bn), by Compressor Technology, 2017-2031

Table 48: Asia Pacific Chillers Market Volume (Thousand Units), by Compressor Technology 2017-2031

Table 49: Asia Pacific Chillers Market Value (US$ Bn), by Power Range, 2017-2031

Table 50: Asia Pacific Chillers Market Volume (Thousand Units), by Power Range 2017-2031

Table 51: Asia Pacific Chillers Market Value (US$ Bn), by Temperature Range, 2017-2031

Table 52: Asia Pacific Chillers Market Volume (Thousand Units), by Temperature Range, 2017-2031

Table 53: Asia Pacific Chillers Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 54: Asia Pacific Chillers Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 55: Asia Pacific Chillers Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 56: Asia Pacific Chillers Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 57: Middle East & Africa Chillers Market Value (US$ Bn), by Type, 2017-2031

Table 58: Middle East & Africa Chillers Market Volume (Thousand Units), by Type, 2017-2031

Table 59: Middle East & Africa Chillers Market Value (US$ Bn), by Refrigeration Cycle, 2017-2031

Table 60: Middle East & Africa Chillers Market Volume (Thousand Units), by Refrigeration Cycle, 2017-2031

Table 61: Middle East & Africa Chillers Market Value (US$ Bn), by Compressor Technology, 2017-2031

Table 62: Middle East & Africa Chillers Market Volume (Thousand Units), by Compressor Technology, 2017-2031

Table 63: Middle East & Africa Chillers Market Value (US$ Bn), by Power Range, 2017-2031

Table 64: Middle East & Africa Chillers Market Volume (Thousand Units), by Power Range, 2017-2031

Table 65: Middle East & Africa Chillers Market Value (US$ Bn), by Temperature Range, 2017-2031

Table 66: Middle East & Africa Chillers Market Volume (Thousand Units), by Temperature Range, 2017-2031

Table 67: Middle East & Africa Chillers Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 68: Middle East & Africa Chillers Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 69: Middle East & Africa Chillers Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 70: Middle East & Africa Chillers Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 71: South America Chillers Market Value (US$ Bn), by Type, 2017-2031

Table 72: South America Chillers Market Volume (Thousand Units), by Type, 2017-2031

Table 73: South America Chillers Market Value (US$ Bn), by Refrigeration Cycle, 2017-2031

Table 74: South America Chillers Market Volume (Thousand Units), by Refrigeration Cycle, 2017-2031

Table 75: South America Chillers Market Value (US$ Bn), by Compressor Technology, 2017-2031

Table 76: South America Chillers Market Volume (Thousand Units), by Compressor Technology, 2017-2031

Table 77: South America Chillers Market Value (US$ Bn), by Power Range, 2017-2031

Table 78: South America Chillers Market Volume (Thousand Units), by Power Range, 2017-2031

Table 79: South America Chillers Market Value (US$ Bn), by Temperature Range, 2017-2031

Table 80: South America Chillers Market Volume (Thousand Units), by Temperature Range, 2017-2031

Table 81: South America Chillers Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 82: South America Chillers Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 83: South America Chillers Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 84: South America Chillers Market Volume (Thousand Units), by Distribution Channel, 2017-2031

List of Figures

Figure 1: Global Chillers Market Value (US$ Bn), by Type, 2017-2031

Figure 2: Global Chillers Market Volume (Thousand Units), by Type 2017-2031

Figure 3: Global Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 4: Global Chillers Market Value (US$ Bn), by Refrigeration Cycle, 2017-2031

Figure 5: Global Chillers Market Volume (Thousand Units), by Refrigeration Cycle 2017-2031

Figure 6: Global Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Refrigeration Cycle, 2023-2031

Figure 7: Global Chillers Market Value (US$ Bn), by Compressor Technology, 2017-2031

Figure 8: Global Chillers Market Volume (Thousand Units), by Compressor Technology 2017-2031

Figure 9: Global Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Compressor Technology, 2023-2031

Figure 10: Global Chillers Market Value (US$ Bn), by Power Range, 2017-2031

Figure 11: Global Chillers Market Volume (Thousand Units), by Power Range 2017-2031

Figure 12: Global Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Power Range, 2023-2031

Figure 13: Global Chillers Market Value (US$ Bn), by Temperature Range, 2017-2031

Figure 14: Global Chillers Market Volume (Thousand Units), by Temperature Range 2017-2031

Figure 15: Global Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Temperature Range, 2023-2031

Figure 16: Global Chillers Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 17: Global Chillers Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 18: Global Chillers Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 19: Global Chillers Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 20: Global Chillers Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 21: Global Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 22: Global Chillers Market Value (US$ Bn), by Region, 2017-2031

Figure 23: Global Chillers Market Volume (Thousand Units), by Region 2017-2031

Figure 24: Global Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 25: North America Chillers Market Value (US$ Bn), by Type, 2017-2031

Figure 26: North America Chillers Market Volume (Thousand Units), by Type 2017-2031

Figure 27: North America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 28: North America Chillers Market Value (US$ Bn), by Refrigeration Cycle, 2017-2031

Figure 29: North America Chillers Market Volume (Thousand Units), by Refrigeration Cycle 2017-2031

Figure 30: North America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Refrigeration Cycle, 2023-2031

Figure 31: North America Chillers Market Value (US$ Bn), by Compressor Technology, 2017-2031

Figure 32: North America Chillers Market Volume (Thousand Units), by Compressor Technology 2017-2031

Figure 33: North America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Compressor Technology, 2023-2031

Figure 34: North America Chillers Market Value (US$ Bn), by Power Range, 2017-2031

Figure 35: North America Chillers Market Volume (Thousand Units), by Power Range 2017-2031

Figure 36: North America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Power Range, 2023-2031

Figure 37: North America Chillers Market Value (US$ Bn), by Temperature Range, 2017-2031

Figure 38: North America Chillers Market Volume (Thousand Units), by Temperature Range 2017-2031

Figure 39: North America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Temperature Range, 2023-2031

Figure 40: North America Chillers Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 41: North America Chillers Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 42: North America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 43: North America Chillers Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 44: North America Chillers Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 45: North America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 46: North America Chillers Market Value (US$ Bn), by Region, 2017-2031

Figure 47: North America Chillers Market Volume (Thousand Units), by Region 2017-2031

Figure 48: North America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 49: Europe Chillers Market Value (US$ Bn), by Type, 2017-2031

Figure 50: Europe Chillers Market Volume (Thousand Units), by Type 2017-2031

Figure 51: Europe Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 52: Europe Chillers Market Value (US$ Bn), by Refrigeration Cycle, 2017-2031

Figure 53: Europe Chillers Market Volume (Thousand Units), by Refrigeration Cycle 2017-2031

Figure 54: Europe Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Refrigeration Cycle, 2023-2031

Figure 55: Europe Chillers Market Value (US$ Bn), by Compressor Technology, 2017-2031

Figure 56: Europe Chillers Market Volume (Thousand Units), by Compressor Technology 2017-2031

Figure 57: Europe Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Compressor Technology, 2023-2031

Figure 58: Europe Chillers Market Value (US$ Bn), by Power Range, 2017-2031

Figure 59: Europe Chillers Market Volume (Thousand Units), by Power Range 2017-2031

Figure 60: Europe Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Power Range, 2023-2031

Figure 61: Europe Chillers Market Value (US$ Bn), by Temperature Range, 2017-2031

Figure 62: Europe Chillers Market Volume (Thousand Units), by Temperature Range 2017-2031

Figure 63: Europe Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Temperature Range, 2023-2031

Figure 64: Europe Chillers Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 65: Europe Chillers Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 66: Europe Chillers Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 67: Europe Chillers Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 68: Europe Chillers Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 69: Europe Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 70: Europe Chillers Market Value (US$ Bn), by Region, 2017-2031

Figure 71: Europe Chillers Market Volume (Thousand Units), by Region 2017-2031

Figure 72: Europe Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 73: Asia Pacific Chillers Market Value (US$ Bn), by Type, 2017-2031

Figure 74: Asia Pacific Chillers Market Volume (Thousand Units), by Type 2017-2031

Figure 75: Asia Pacific Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 76: Asia Pacific Chillers Market Value (US$ Bn), by Refrigeration Cycle, 2017-2031

Figure 77: Asia Pacific Chillers Market Volume (Thousand Units), by Refrigeration Cycle 2017-2031

Figure 78: Asia Pacific Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Refrigeration Cycle, 2023-2031

Figure 79: Asia Pacific Chillers Market Value (US$ Bn), by Compressor Technology, 2017-2031

Figure 80: Asia Pacific Chillers Market Volume (Thousand Units), by Compressor Technology 2017-2031

Figure 81: Asia Pacific Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Compressor Technology, 2023-2031

Figure 82: Asia Pacific Chillers Market Value (US$ Bn), by Power Range, 2017-2031

Figure 83: Asia Pacific Chillers Market Volume (Thousand Units), by Power Range 2017-2031

Figure 84: Asia Pacific Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Power Range, 2023-2031

Figure 85: Asia Pacific Chillers Market Value (US$ Bn), by Temperature Range, 2017-2031

Figure 86: Asia Pacific Chillers Market Volume (Thousand Units), by Temperature Range, 2017-2031

Figure 87: Asia Pacific Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Temperature Range, 2023-2031

Figure 88: Asia Pacific Chillers Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 89: Asia Pacific Chillers Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 90: Asia Pacific Chillers Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 91: Asia Pacific Chillers Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 92: Asia Pacific Chillers Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 93: Asia Pacific Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 94: Asia Pacific Chillers Market Value (US$ Bn), by Region, 2017-2031

Figure 95: Asia Pacific Chillers Market Volume (Thousand Units), by Region 2017-2031

Figure 96: Asia Pacific Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 97: Middle East & Africa Chillers Market Value (US$ Bn), by Type, 2017-2031

Figure 98: Middle East & Africa Chillers Market Volume (Thousand Units), by Type 2017-2031

Figure 99: Middle East & Africa Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 100: Middle East & Africa Chillers Market Value (US$ Bn), by Refrigeration Cycle, 2017-2031

Figure 101: Middle East & Africa Chillers Market Volume (Thousand Units), by Refrigeration Cycle 2017-2031

Figure 102: Middle East & Africa Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Refrigeration Cycle, 2023-2031

Figure 103: Middle East & Africa Chillers Market Value (US$ Bn), by Compressor Technology, 2017-2031

Figure 104: Middle East & Africa Chillers Market Volume (Thousand Units), by Compressor Technology 2017-2031

Figure 105: Middle East & Africa Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Compressor Technology, 2023-2031

Figure 106: Middle East & Africa Chillers Market Value (US$ Bn), by Power Range, 2017-2031

Figure 107: Middle East & Africa Chillers Market Volume (Thousand Units), by Power Range 2017-2031

Figure 108: Middle East & Africa Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Power Range, 2023-2031

Figure 109: Middle East & Africa Chillers Market Value (US$ Bn), by Temperature Range, 2017-2031

Figure 110: Middle East & Africa Chillers Market Volume (Thousand Units), by Temperature Range 2017-2031

Figure 111: Middle East & Africa Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Temperature Range, 2023-2031

Figure 112: Middle East & Africa Chillers Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 113: Middle East & Africa Chillers Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 114: Middle East & Africa Chillers Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 115: Middle East & Africa Chillers Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 116: Middle East & Africa Chillers Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 117: Middle East & Africa Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 118: Middle East & Africa Chillers Market Value (US$ Bn), by Region, 2017-2031

Figure 119: Middle East & Africa Chillers Market Volume (Thousand Units), by Region 2017-2031

Figure 120: Middle East & Africa Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 121: South America Chillers Market Value (US$ Bn), by Type, 2017-2031

Figure 122: South America Chillers Market Volume (Thousand Units), by Type 2017-2031

Figure 123: South America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 124: South America Chillers Market Value (US$ Bn), by Refrigeration Cycle, 2017-2031

Figure 125: South America Chillers Market Volume (Thousand Units), by Refrigeration Cycle 2017-2031

Figure 126: South America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Refrigeration Cycle, 2023-2031

Figure 127: South America Chillers Market Value (US$ Bn), by Compressor Technology, 2017-2031

Figure 128: South America Chillers Market Volume (Thousand Units), by Compressor Technology 2017-2031

Figure 129: South America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Compressor Technology, 2023-2031

Figure 130: South America Chillers Market Value (US$ Bn), by Power Range, 2017-2031

Figure 131: South America Chillers Market Volume (Thousand Units), by Power Range 2017-2031

Figure 132: South America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Power Range, 2023-2031

Figure 133: South America Chillers Market Value (US$ Bn), by Temperature Range, 2017-2031

Figure 134: South America Chillers Market Volume (Thousand Units), by Temperature Range 2017-2031

Figure 135: South America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Temperature Range, 2023-2031

Figure 136: South America Chillers Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 137: South America Chillers Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 138: South America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 139: South America Chillers Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 140: South America Chillers Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 141: South America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 142: South America Chillers Market Value (US$ Bn), by Region, 2017-2031

Figure 143: South America Chillers Market Volume (Thousand Units), by Region 2017-2031

Figure 144: South America Chillers Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031