Bag-in-box containers are used as convenient packaging solutions for packaging products such as, food & beverages, household, and industrial liquid products. Bag-in-box containers provide extra protection during transportation and can carry and package liquids efficiently. It is light in weight and helps in reduction in space during the process of storage and transportation. The demand for customized packaging is increasing due to the production of novel and variety of products. In addition, the growing trend of the use of high-quality and attractive printed packs to grab the attention of consumers has led to the growth of the bag-in-box container market. The demand for alternatives for plastic packaging containers for environmental reasons has projected the growth of the bag-in-box container market. The global bag-in-box container market is estimated to expand at a CAGR of 5% during the forecast period of 2019-2027.

The global bag-in-box container market is segmented into food & beverages, household products, and industrial liquid products. The food & beverages segment is further classified into alcoholic and non-alcoholic beverages. The global bag-in-box container market is gaining traction due to rising demand from the wine industry. The box-in-box containers are used for wine packaging as they are convenient to use and distribute. Additionally, they are cost-effective too. The oxygen transmission rate (OTR) of packaging determines the overall quality of wine and box-in-box containers offer low transmission on the rate. Thus, box-in-box containers market has exhibited substantial growth in the alcoholic beverages segment. Further, the bag-in-box containers are light weighted and can be transported easily and increasing its shelf life and decreasing the wastage of product. Also, the high barrier films used in the bag-in-box containers help keep the food fresh and increase its shelf life. These attributes have scaled the sales. In accordance with it, the market recorded massive sales of 870 thousand tons and reached the valuation of US$2.9 bn.

Rapid urbanization and population has increased the demand for household items, such as surface cleaners, dishwashers, and others. Taking into consideration, the growing demand for bag-in-box containers in these household products, the bag-in-box container market is forecasted to exhibit significant growth during the forecast period of 2019-2027.

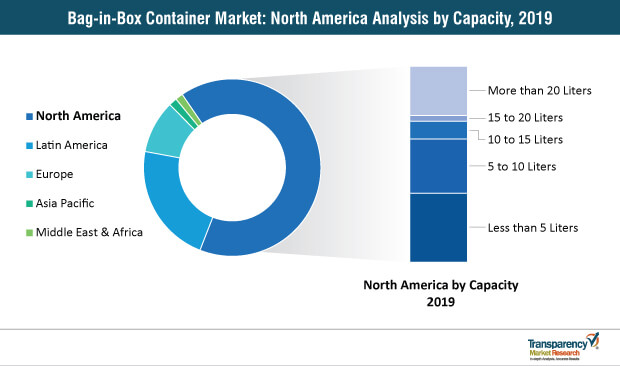

The market in Europe is projected to witness a prominent revenue share of the global market during the forecast period of 2019-2027. Countries such as Italy, the U.K, France, and Sweden are expected to contribute towards the growth of the bag-in-box market owing to, the rising demand for bag-in-box containers by wine manufacturers. North America is a lucrative bag-in-box market followed by the Asia Pacific. Rapid urbanization and industrialization are focusing on different types of packaging in bag-in-box containers. Major countries such as India and China have shown a rise in their disposable income and purchasing capacity of individuals. This aspect has propelled the growth of the bag-in-box market.

According to TMR studies, with reference to Environment Impact Assessment (EIA), the carbon-di-oxide emissions during the manufacturing of bag-in-box containers is eight times less than other packaging materials. The increasing awareness about carbon emissions is promoting the use of eco-friendly and green products has boosted the growth of the bag-in-box market. The wine producers are exploring new technologies to increase manufacturing efficiency. Various companies such as, Sutter Homes, Virginia Wine works are substituting existing brands with bag-in-box containers.

The competitors are indulging in strategies to maintain their dominance in the bag-in-box market. The lucrative opportunities in the dairy and juice industry are predicted to augment the growth of the bag-in-box market. The leading market players functional in the global bag-in-box market are namely, TPS Rental Systems Ltd., Vine Valley Ventures LLC, Liqui-Box, Scholle IPN, CDF Corporation, Amcor Limited, Liqui-Box, and Smurfit Kappa Group

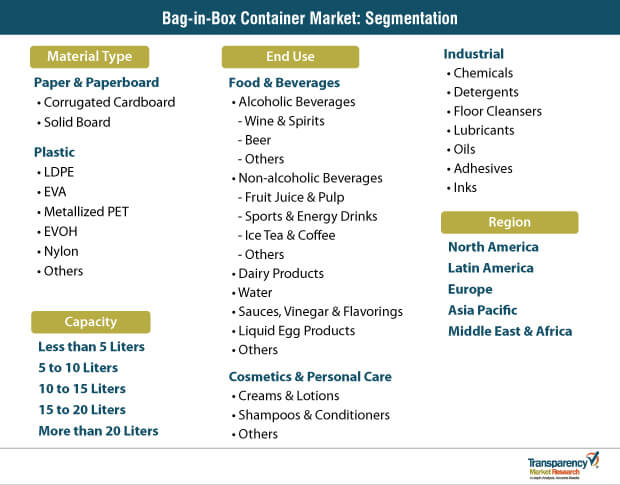

Segmentation of the Bag-in-Box Containers Market

TMR’s study on the bag-in-box containers market has been segmented into four categories - material type, end use, capacity, and region. The information featured in the study helps readers understand the growth prospects of the bag-in-box containers market according to the aforementioned segments.

|

Material Type |

|

|

End Use |

Food & Beverages

|

|

Capacity |

Less than 5 Liters

|

|

Region |

|

Bag-in-Box Containers Market is projected to reach US $4.5 Bn by 2027

Bag-in-Box Containers Market is expected to grow at a CAGR of 5% during 2019 - 2027

Bag-in-Box Containers Market is studied from 2019 - 2027

Key vendors in the Bag-in-Box Containers Market are Smurfit Kappa Group, DS Smith, Amcor Limited, Liqui-Box, Scholle IPN, CDF Corporation, Vine Valley Ventures LLC, Parish Manufacturing Inc., TPS Rental Systems Ltd., and Optopack Ltd. among others.

Europe region Takes Lead in the Bag-in-Box Containers Market

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Wheel of Opportunity

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

3. Market Viewpoint

3.1. Global Packaging Industry Overview

3.2. Product Innovation and Trends

3.3. Macroeconomic Indicators & Correlation Analysis

3.3.1. Gross Domestic Product

3.3.2. Manufacturing Value Added

3.3.3. Parent Market Overview

3.3.4. End Use Industry Analysis

3.4. Forecast Factors

3.5. Porter’s Analysis

3.5.1. Threat of New Entrants

3.5.2. Bargaining Power of Buyers

3.5.3. Bargaining Power of Suppliers

3.5.4. Threat of Substitutes

3.5.5. Competitive Rivalry

3.6. Value Chain Analysis

3.6.1. Key Participants

3.6.1.1.1. Raw Material Suppliers

3.6.1.1.2. Bag-in-Box Containers Manufacturers

3.6.1.1.3. Distributors

3.6.2. Profitability Margin

3.7. Market Dynamics

3.7.1. Drivers

3.7.1.1. Supply Side

3.7.1.2. Demand Side

3.7.2. Restraints

3.7.3. Opportunities

4. Global Bag-in-Box Containers Market Analysis

4.1. Market Value (US$ Mn) and Volume (Tons) Analysis & Forecast

4.2. Y-o-Y Growth Projections

4.3. Absolute $ Opportunity Analysis

5. Global Bag-in-Box Containers Market Analysis and Forecast, By Material Type

5.1. Section Summary

5.2. Introduction

5.2.1. Basis Point Share (BPS) Analysis By Material Type

5.2.2. Y-o-Y Growth Projections By Material Type

5.3. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Material Type

5.3.1. Paper/Paperboard

5.3.1.1. Corrugated Cardboard

5.3.1.2. Solid Board

5.3.2. Plastic

5.3.2.1. Low-density polyethylene (LDPE)

5.3.2.2. Ethylene Vinyl Acetate

5.3.2.3. Metallized Polyethylene Terephthalate

5.3.2.4. Ethylene Vinyl Alcohol

5.3.2.5. Nylon

5.3.2.6. Others

5.4. Market Attractiveness Analysis By Material Type

5.5. Prominent Trends

6. Global Bag-in-Box Containers Market Analysis and Forecast, By Capacity

6.1. Section Summary

6.2. Introduction

6.2.1. Basis Point Share (BPS) Analysis By Capacity

6.2.2. Y-o-Y Growth Projections By Capacity

6.3. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Capacity

6.3.1. Less than 5.0 liters

6.3.2. 5.0 – 10.0 liters

6.3.3. 10.0 - 15.0 liters

6.3.4. 15.0 – 20.0 liters

6.3.5. More than 20.0 liters

6.4. Market Attractiveness Analysis By Capacity

6.5. Prominent Trends

7. Global Bag-in-Box Containers Market Analysis and Forecast, By End-Use

7.1. Section Summary

7.2. Introduction

7.2.1. Basis Point Share (BPS) Analysis By End-Use

7.2.2. Y-o-Y Growth Projections By End-Use

7.3. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By End-Use

7.3.1. Food & Beverages

7.3.1.1. Alcoholic Beverages

7.3.1.1.1. Wine & Spirits

7.3.1.1.2. Beer

7.3.1.1.3. Others

7.3.1.2. Non-Alcoholic Beverages

7.3.1.2.1. Fruit Juices

7.3.1.2.2. Sports & Energy Drinks

7.3.1.2.3. Ice Tea & Coffee

7.3.1.2.4. Others

7.3.1.3. Dairy Products

7.3.1.4. Water

7.3.1.5. Sauces, Vinegar & Flavoring

7.3.1.6. Liquid Egg Products

7.3.1.7. Others

7.3.2. Industrial

7.3.2.1. Chemicals

7.3.2.2. Detergents

7.3.2.3. Floor Cleansers

7.3.2.4. Lubricants

7.3.2.5. Oils

7.3.2.6. Adhesives

7.3.2.7. Inks

7.3.3. Cosmetics & Personal Care

7.3.3.1. Creams & Lotions

7.3.3.2. Shampoo & Conditioner

7.3.3.3. Others

7.4. Market Attractiveness Analysis By End-Use

7.5. Prominent Trends

8. Global Bag-in-Box Containers Market Analysis and Forecast, By Region

8.1. Section Summary

8.2. Introduction

8.2.1. Basis Point Share (BPS) Analysis By Region

8.2.2. Y-o-Y Growth Projections By Region

8.3. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Region

8.3.1. North America

8.3.2. Latin America

8.3.3. Europe

8.3.4. Asia Pacific (APAC)

8.3.5. Middle East & Africa (MEA)

8.4. Market Attractiveness Analysis By Region

8.5. Prominent Trends

9. North America Bag-in-Box Containers Market Analysis and Forecast

9.1. Introduction

9.2. Pricing Analysis

9.3. Key Trends

9.4. Key Regulations

9.5. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Country

9.5.1. U.S.

9.5.2. Canada

9.6. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Material Type

9.6.1. Paper/Paperboard

9.6.1.1. Corrugated Cardboard

9.6.1.2. Solid Board

9.6.2. Plastic

9.6.2.1. Low-density polyethylene (LDPE)

9.6.2.2. Ethylene Vinyl Acetate

9.6.2.3. Metallized Polyethylene Terephthalate

9.6.2.4. Ethylene Vinyl Alcohol

9.6.2.5. Nylon

9.6.2.6. Others

9.7. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Capacity

9.7.1. Less than 5.0 liters

9.7.2. 5.0 – 10.0 liters

9.7.3. 10.0 - 15.0 liters

9.7.4. 15.0 – 20.0 liters

9.7.5. More than 20.0 liters

9.8. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By End-Use

9.8.1. Food & Beverages

9.8.1.1. Alcoholic Beverages

9.8.1.1.1. Wine & Spirits

9.8.1.1.2. Beer

9.8.1.1.3. Others

9.8.1.2. Non-Alcoholic Beverages

9.8.1.2.1. Fruit Juices

9.8.1.2.2. Sports & Energy Drinks

9.8.1.2.3. Ice Tea & Coffee

9.8.1.2.4. Others

9.8.1.3. Dairy Products

9.8.1.4. Water

9.8.1.5. Sauces, Vinegar & Flavoring

9.8.1.6. Liquid Egg Products

9.8.1.7. Others

9.8.2. Industrial

9.8.2.1. Chemicals

9.8.2.2. Detergents

9.8.2.3. Floor Cleansers

9.8.2.4. Lubricants

9.8.2.5. Oils

9.8.2.6. Adhesives

9.8.2.7. Inks

9.8.3. Cosmetics & Personal Care

9.8.3.1. Creams & Lotions

9.8.3.2. Shampoo & Conditioner

9.8.3.3. Others

9.9. Market Attractiveness Analysis

9.9.1. By Country

9.9.2. By Material Type

9.9.3. By Capacity

9.9.4. By End-Use

9.10. Market Trends

9.11. Key Representative Market Participants

9.12. Key Market Participants – Intensity Mapping

9.13. Drivers and Restraints – Impact Analysis

10. Latin America Bag-in-Box Containers Market Analysis and Forecast

10.1. Introduction

10.2. Pricing Analysis

10.3. Key Trends

10.4. Key Regulations

10.5. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Country

10.5.1. Brazil

10.5.2. Mexico

10.5.3. Argentina

10.5.4. Rest of Latin America

10.6. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Material Type

10.6.1. Paper/Paperboard

10.6.1.1. Corrugated Cardboard

10.6.1.2. Solid Board

10.6.2. Plastic

10.6.2.1. Low-density polyethylene (LDPE)

10.6.2.2. Ethylene Vinyl Acetate

10.6.2.3. Metallized Polyethylene Terephthalate

10.6.2.4. Ethylene Vinyl Alcohol

10.6.2.5. Nylon

10.6.2.6. Others

10.7. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Capacity

10.7.1. Less than 5.0 liters

10.7.2. 5.0 – 10.0 liters

10.7.3. 10.0 - 15.0 liters

10.7.4. 15.0 – 20.0 liters

10.7.5. More than 20.0 liters

10.8. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By End-Use

10.8.1. Food & Beverages

10.8.1.1. Alcoholic Beverages

10.8.1.1.1. Wine & Spirits

10.8.1.1.2. Beer

10.8.1.1.3. Others

10.8.1.2. Non-Alcoholic Beverages

10.8.1.2.1. Fruit Juices

10.8.1.2.2. Sports & Energy Drinks

10.8.1.2.3. Ice Tea & Coffee

10.8.1.2.4. Others

10.8.1.3. Dairy Products

10.8.1.4. Water

10.8.1.5. Sauces, Vinegar & Flavoring

10.8.1.6. Liquid Egg Products

10.8.1.7. Others

10.8.2. Industrial

10.8.2.1. Chemicals

10.8.2.2. Detergents

10.8.2.3. Floor Cleansers

10.8.2.4. Lubricants

10.8.2.5. Oils

10.8.2.6. Adhesives

10.8.2.7. Inks

10.8.3. Cosmetics & Personal Care

10.8.3.1. Creams & Lotions

10.8.3.2. Shampoo & Conditioner

10.8.3.3. Others

10.9. Market Attractiveness Analysis

10.9.1. By Country

10.9.2. By Material Type

10.9.3. By Capacity

10.9.4. By End-Use

10.10. Market Trends

10.11. Key Representative Market Participants

10.12. Key Market Participants – Intensity Mapping

10.13. Drivers and Restraints – Impact Analysis

11. Europe Bag-in-Box Containers Market Analysis and Forecast

11.1. Introduction

11.2. Pricing Analysis

11.3. Key Trends

11.4. Key Regulations

11.5. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Country

11.5.1. Germany

11.5.2. Spain

11.5.3. Italy

11.5.4. France

11.5.5. U.K.

11.5.6. BENELUX

11.5.7. Nordics

11.5.8. Russia

11.5.9. Poland

11.5.10. Rest of Europe

11.6. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Material Type

11.6.1. Paper/Paperboard

11.6.1.1. Corrugated Cardboard

11.6.1.2. Solid Board

11.6.2. Plastic

11.6.2.1. Low-density polyethylene (LDPE)

11.6.2.2. Ethylene Vinyl Acetate

11.6.2.3. Metallized Polyethylene Terephthalate

11.6.2.4. Ethylene Vinyl Alcohol

11.6.2.5. Nylon

11.6.2.6. Others

11.7. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Capacity

11.7.1. Less than 5.0 liters

11.7.2. 5.0 – 10.0 liters

11.7.3. 10.0 - 15.0 liters

11.7.4. 15.0 – 20.0 liters

11.7.5. More than 20.0 liters

11.8. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By End-Use

11.8.1. Food & Beverages

11.8.1.1. Alcoholic Beverages

11.8.1.1.1. Wine & Spirits

11.8.1.1.2. Beer

11.8.1.1.3. Others

11.8.1.2. Non-Alcoholic Beverages

11.8.1.2.1. Fruit Juices

11.8.1.2.2. Sports & Energy Drinks

11.8.1.2.3. Ice Tea & Coffee

11.8.1.2.4. Others

11.8.1.3. Dairy Products

11.8.1.4. Water

11.8.1.5. Sauces, Vinegar & Flavoring

11.8.1.6. Liquid Egg Products

11.8.1.7. Others

11.8.2. Industrial

11.8.2.1. Chemicals

11.8.2.2. Detergents

11.8.2.3. Floor Cleansers

11.8.2.4. Lubricants

11.8.2.5. Oils

11.8.2.6. Adhesives

11.8.2.7. Inks

11.8.3. Cosmetics & Personal Care

11.8.3.1. Creams & Lotions

11.8.3.2. Shampoo & Conditioner

11.8.3.3. Others

11.9. Market Attractiveness Analysis

11.9.1. By Country

11.9.2. By Material Type

11.9.3. By Capacity

11.9.4. By End-Use

11.10. Market Trends

11.11. Key Representative Market Participants

11.12. Key Market Participants – Intensity Mapping

11.13. Drivers and Restraints – Impact Analysis

12. Asia Pacific (APAC) Bag-in-Box Containers Market Analysis and Forecast

12.1. Introduction

12.2. Pricing Analysis

12.3. Key Trends

12.4. Key Regulations

12.5. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Country

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. ASEAN

12.5.5. Australia and New Zealand

12.5.6. Rest of APAC

12.6. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Material Type

12.6.1. Paper/Paperboard

12.6.1.1. Corrugated Cardboard

12.6.1.2. Solid Board

12.6.2. Plastic

12.6.2.1. Low-density polyethylene (LDPE)

12.6.2.2. Ethylene Vinyl Acetate

12.6.2.3. Metallized Polyethylene Terephthalate

12.6.2.4. Ethylene Vinyl Alcohol

12.6.2.5. Nylon

12.6.2.6. Others

12.7. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Capacity

12.7.1. Less than 5.0 liters

12.7.2. 5.0 – 10.0 liters

12.7.3. 10.0 - 15.0 liters

12.7.4. 15.0 – 20.0 liters

12.7.5. More than 20.0 liters

12.8. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By End-Use

12.8.1. Food & Beverages

12.8.1.1. Alcoholic Beverages

12.8.1.1.1. Wine & Spirits

12.8.1.1.2. Beer

12.8.1.1.3. Others

12.8.1.2. Non-Alcoholic Beverages

12.8.1.2.1. Fruit Juices

12.8.1.2.2. Sports & Energy Drinks

12.8.1.2.3. Ice Tea & Coffee

12.8.1.2.4. Others

12.8.1.3. Dairy Products

12.8.1.4. Water

12.8.1.5. Sauces, Vinegar & Flavoring

12.8.1.6. Liquid Egg Products

12.8.1.7. Others

12.8.2. Industrial

12.8.2.1. Chemicals

12.8.2.2. Detergents

12.8.2.3. Floor Cleansers

12.8.2.4. Lubricants

12.8.2.5. Oils

12.8.2.6. Adhesives

12.8.2.7. Inks

12.8.3. Cosmetics & Personal Care

12.8.3.1. Creams & Lotions

12.8.3.2. Shampoo & Conditioner

12.8.3.3. Others

12.9. Market Attractiveness Analysis

12.9.1. By Country

12.9.2. By Material Type

12.9.3. By Capacity

12.9.4. By End-Use

12.10. Market Trends

12.11. Key Representative Market Participants

12.12. Key Market Participants – Intensity Mapping

12.13. Drivers and Restraints – Impact Analysis

13. Middle East And Africa (MEA) Bag-in-Box Containers Market Analysis and Forecast

13.1. Introduction

13.2. Pricing Analysis

13.3. Key Trends

13.4. Key Regulations

13.5. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Country

13.5.1. GCC countries

13.5.2. Northern Africa

13.5.3. South Africa

13.5.4. Rest of MEA

13.6. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Material Type

13.6.1. Paper/Paperboard

13.6.1.1. Corrugated Cardboard

13.6.1.2. Solid Board

13.6.2. Plastic

13.6.2.1. Low-density polyethylene (LDPE)

13.6.2.2. Ethylene Vinyl Acetate

13.6.2.3. Metallized Polyethylene Terephthalate

13.6.2.4. Ethylene Vinyl Alcohol

13.6.2.5. Nylon

13.6.2.6. Others

13.7. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By Capacity

13.7.1. Less than 5.0 liters

13.7.2. 5.0 – 10.0 liters

13.7.3. 10.0 - 15.0 liters

13.7.4. 15.0 – 20.0 liters

13.7.5. More than 20.0 liters

13.8. Market Value (US$ Mn) and Volume (Tons) Historical Analysis 2014-2018 and Forecast 2019-2027, By End-Use

13.8.1. Food & Beverages

13.8.1.1. Alcoholic Beverages

13.8.1.1.1. Wine & Spirits

13.8.1.1.2. Beer

13.8.1.1.3. Others

13.8.1.2. Non-Alcoholic Beverages

13.8.1.2.1. Fruit Juices

13.8.1.2.2. Sports & Energy Drinks

13.8.1.2.3. Ice Tea & Coffee

13.8.1.2.4. Others

13.8.1.3. Dairy Products

13.8.1.4. Yogurts

13.8.1.5. Water

13.8.1.6. Sauces, Vinegar & Flavoring

13.8.1.7. Liquid Egg Products

13.8.1.8. Others

13.8.2. Industrial

13.8.2.1. Chemicals

13.8.2.2. Detergents

13.8.2.3. Floor Cleansers

13.8.2.4. Lubricants

13.8.2.5. Oils

13.8.2.6. Adhesives

13.8.2.7. Inks

13.8.3. Cosmetics & Personal Care

13.8.3.1. Creams & Lotions

13.8.3.2. Shampoo & Conditioner

13.8.3.3. Others

13.9. Market Attractiveness Analysis

13.9.1. By Country

13.9.2. By Material Type

13.9.3. By Capacity

13.9.4. By End-Use

13.10. Market Trends

13.11. Key Representative Market Participants

13.12. Key Market Participants – Intensity Mapping

13.13. Drivers and Restraints – Impact Analysis

14. Market Structure Analysis

14.1. Market Analysis, by Tier of Companies

14.1.1. By Large, Medium and Small

14.2. Market Concentration

14.2.1. By Top 5 and by Top 10

14.3. Production Capacity Share Analysis

14.3.1. By Large, Medium and Small

14.3.2. By Top 5 and Top 10

14.4. Market Share Analysis of Top 10 Players

14.4.1. The Americas Market Share Analysis, by Top Players

14.4.2. EMEA Market Share Analysis, by Top Players

14.4.3. Asia Pacific Market Share Analysis, by Top Players

14.5. Market Presence Analysis

14.5.1. By Regional footprint of Players

14.5.2. Product footprint by Players

14.5.3. Channel footprint by Players

15. Competition Analysis

15.1. Competition Dashboard

15.2. Competition Benchmarking

15.3. Profitability and Gross Margin Analysis By Competition

15.4. Competition Developments

15.5. Competition Deep Dive (10 Companies)

15.5.1. Smurfit Kappa Group

15.5.1.1. Overview

15.5.1.2. Product Portfolio

15.5.1.3. Profitability

15.5.1.4. Production Footprint

15.5.1.5. Sales Footprint

15.5.1.6. Channel Footprint

15.5.1.7. Competition Benchmarking

15.5.1.8. Strategy

15.5.1.8.1. Marketing Strategy

15.5.1.8.2. Product Strategy

15.5.1.8.3. Channel Strategy

15.5.2. DS Smith Plc.

15.5.2.1. Overview

15.5.2.2. Product Portfolio

15.5.2.3. Profitability

15.5.2.4. Production Footprint

15.5.2.5. Sales Footprint

15.5.2.6. Channel Footprint

15.5.2.7. Competition Benchmarking

15.5.2.8. Strategy

15.5.2.8.1. Marketing Strategy

15.5.2.8.2. Product Strategy

15.5.2.8.3. Channel Strategy

15.5.3. Amcor Limited

15.5.3.1. Overview

15.5.3.2. Product Portfolio

15.5.3.3. Profitability

15.5.3.4. Production Footprint

15.5.3.5. Sales Footprint

15.5.3.6. Channel Footprint

15.5.3.7. Competition Benchmarking

15.5.3.8. Strategy

15.5.3.8.1. Marketing Strategy

15.5.3.8.2. Product Strategy

15.5.3.8.3. Channel Strategy

15.5.4. Liqui-Box

15.5.4.1. Overview

15.5.4.2. Product Portfolio

15.5.4.3. Profitability

15.5.4.4. Production Footprint

15.5.4.5. Sales Footprint

15.5.4.6. Channel Footprint

15.5.4.7. Competition Benchmarking

15.5.4.8. Strategy

15.5.4.8.1. Marketing Strategy

15.5.4.8.2. Product Strategy

15.5.4.8.3. Channel Strategy

15.5.5. Scholle IPN

15.5.5.1. Overview

15.5.5.2. Product Portfolio

15.5.5.3. Profitability

15.5.5.4. Production Footprint

15.5.5.5. Sales Footprint

15.5.5.6. Channel Footprint

15.5.5.7. Competition Benchmarking

15.5.5.8. Strategy

15.5.5.8.1. Marketing Strategy

15.5.5.8.2. Product Strategy

15.5.5.8.3. Channel Strategy

15.5.6. CDF Corporation

15.5.6.1. Overview

15.5.6.2. Product Portfolio

15.5.6.3. Profitability

15.5.6.4. Production Footprint

15.5.6.5. Sales Footprint

15.5.6.6. Channel Footprint

15.5.6.7. Competition Benchmarking

15.5.6.8. Strategy

15.5.6.8.1. Marketing Strategy

15.5.6.8.2. Product Strategy

15.5.6.8.3. Channel Strategy

15.5.7. Vine Valley Ventures LLC

15.5.7.1. Overview

15.5.7.2. Product Portfolio

15.5.7.3. Profitability

15.5.7.4. Production Footprint

15.5.7.5. Sales Footprint

15.5.7.6. Channel Footprint

15.5.7.7. Competition Benchmarking

15.5.7.8. Strategy

15.5.7.8.1. Marketing Strategy

15.5.7.8.2. Product Strategy

15.5.7.8.3. Channel Strategy

15.5.8. Parish Manufacturing Inc.

15.5.8.1. Overview

15.5.8.2. Product Portfolio

15.5.8.3. Profitability

15.5.8.4. Production Footprint

15.5.8.5. Sales Footprint

15.5.8.6. Channel Footprint

15.5.8.7. Competition Benchmarking

15.5.8.8. Strategy

15.5.8.8.1. Marketing Strategy

15.5.8.8.2. Product Strategy

15.5.8.8.3. Channel Strategy

15.5.9. TPS Rental Systems Ltd

15.5.9.1. Overview

15.5.9.2. Product Portfolio

15.5.9.3. Profitability

15.5.9.4. Production Footprint

15.5.9.5. Sales Footprint

15.5.9.6. Channel Footprint

15.5.9.7. Competition Benchmarking

15.5.9.8. Strategy

15.5.9.8.1. Marketing Strategy

15.5.9.8.2. Product Strategy

15.5.9.8.3. Channel Strategy

15.5.10. Optopack Ltd.

15.5.10.1. Overview

15.5.10.2. Product Portfolio

15.5.10.3. Profitability

15.5.10.4. Production Footprint

15.5.10.5. Sales Footprint

15.5.10.6. Channel Footprint

15.5.10.7. Competition Benchmarking

15.5.10.8. Strategy

15.5.10.8.1. Marketing Strategy

15.5.10.8.2. Product Strategy

15.5.10.8.3. Channel Strategy

16. Assumptions and Acronyms Used

17. Research Methodology

List of Tables

Table 01: Global Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Capacity

Table 02: Global Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Material Type

Table 03: Global Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 04: Global Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 05: Global Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 06: Global Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 07: Global Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Region

Table 08: North America Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Country

Table 09: North America Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Capacity

Table 10: North America Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Material Type

Table 11: North America Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 12: North America Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 13: North America Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 14: North America Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 15: Latin America Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Country

Table 16: Latin America Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Capacity

Table 17: Latin America Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Material Type

Table 18: Latin America Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 19: Latin America Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 20: Latin America Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 21: Latin America Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 22: Europe Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Country

Table 23: Europe Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Capacity

Table 24: Europe Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Material Type

Table 25: Europe Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 26: Europe Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 27: Europe Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 28: Europe Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 29: APAC Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Country

Table 30: APAC Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Capacity

Table 31: APAC Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Material Type

Table 32: APAC Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 33: APAC Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 34: APAC Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 35: APAC Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 36: MEA Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Country

Table 37: MEA Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Capacity

Table 38: MEA Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Material Type

Table 39: MEA Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 40: MEA Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 41: MEA Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

Table 42: MEA Bag-in-Box Containers Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use

List of Figures

Figure 01: Global Bag-in-Box Containers Market BPS Analysis, by Capacity Type, 2014(A), 2019(E) & 2027(F)

Figure 02: Global Bag-in-Box Containers Market Y-o-Y growth, by Capacity Type, 2015(A) – 2027(F)

Figure 03: Global Bag-in-Box Containers Market BPS Analysis, by Capacity Type, 2014(A), 2019(E) & 2027(F)

Figure 04: Global Bag-in-Box Containers Market BPS Analysis, by Material Type, 2014(A), 2019(E) & 2027(F)

Figure 05: Global Bag-in-Box Containers Market Y-o-Y growth, by Material Type, 2015(A) – 2027(F)

Figure 06: Global Bag-in-Box Containers Market Attractiveness Index, by Material Type, 2019(E) – 2027(F)

Figure 07: Global Bag-in-Box Containers Market BPS Analysis, by End Use, 2014(A), 2019(E) & 2027(F)

Figure 08: Global Bag-in-Box Containers Market Y-o-Y growth, by End Use, 2015(A) – 2027(F)

Figure 09: Global Bag-in-Box Containers Market Attractiveness Index, by End Use, 2019(E) – 2027(F)

Figure 10: Global Bag-in-Box Containers Market BPS Analysis, by Region, 2014(A), 2019(E) & 2027(F)

Figure 11: Global Bag-in-Box Containers Market Y-o-Y growth, by Region, 2015(A) – 2027(F)

Figure 12: Global Bag-in-Box Containers Market Attractiveness Index, by Region, 2019(E) – 2027(F)

Figure 13: North America Bag-in-Box Containers Market Value share 2019(E) by Capacity

Figure 14: North America Bag-in-Box Containers Market Value share 2019(E) by Material

Figure 15: North America Bag-in-Box Containers Market Value share 2019(E) by End Use

Figure 16: North America Bag-in-Box Containers Market BPS Analysis, by Country, 2014(A), 2019(E) & 2027(F)

Figure 17: North America Bag-in-Box Containers Market Y-o-Y growth, by Country, 2019(E) – 2027(F)

Figure 18: North America Bag-in-Box Containers Market BPS Analysis, by Capacity, 2014(A), 2019(E) & 2027(F)

Figure 19: North America Bag-in-Box Containers Market BPS Analysis, by Capacity Type, 2014(A), 2019(E) & 2027(F)

Figure 20: North America Bag-in-Box Containers Market BPS Analysis, by Material, 2014(A), 2019(E) & 2027(F)

Figure 21: North America Bag-in-Box Containers Market Attractiveness Index, by Material Type, 2019(E) – 2027(F)

Figure 22: North America Bag-in-Box Containers Market BPS Analysis, by End Use, 2014(A), 2019(E) & 2027(F)

Figure 23: North America Bag-in-Box Containers Market Attractiveness Index, by End Use, 2019(E) – 2027(F)

Figure 24: Latin America Bag-in-Box Containers Market Value share 2019(E) by Capacity

Figure 25: Latin America Bag-in-Box Containers Market Value share 2019(E) by Material

Figure 26: Latin America Bag-in-Box Containers Market Value share 2019(E) by End Use

Figure 27: Latin America Bag-in-Box Containers Market BPS Analysis, by Country, 2014(A), 2019(E) & 2027(F)

Figure 28: Latin America Bag-in-Box Containers Market Y-o-Y growth, by Country, 2019(E) – 2027(F)

Figure 29: Latin America Bag-in-Box Containers Market BPS Analysis, by Capacity, 2014(A), 2019(E) & 2027(F)

Figure 30: Latin America Bag-in-Box Containers Market BPS Analysis, by Capacity Type, 2014(A), 2019(E) & 2027(F)

Figure 31: Latin America Bag-in-Box Containers Market BPS Analysis, by Material, 2014(A), 2019(E) & 2027(F)

Figure 32: Latin America Bag-in-Box Containers Market Attractiveness Index, by Material Type, 2019(E) – 2027(F)

Figure 33: Latin America Bag-in-Box Containers Market BPS Analysis, by End Use, 2014(A), 2019(E) & 2027(F)

Figure 34: Latin America Bag-in-Box Containers Market Attractiveness Index, by End Use, 2019(E) – 2027(F)

Figure 35: Europe Bag-in-Box Containers Market Value share 2019(E) by Capacity

Figure 36: Europe Bag-in-Box Containers Market Value share 2019(E) by Material

Figure 37: Europe Bag-in-Box Containers Market Value share 2019(E) by End Use

Figure 38: Europe Bag-in-Box Containers Market BPS Analysis, by Country, 2014(A), 2019(E) & 2027(F)

Figure 39: Europe Bag-in-Box Containers Market Y-o-Y growth, by Country, 2019(E) – 2027(F)

Figure 40: Europe Bag-in-Box Containers Market BPS Analysis, by Capacity, 2014(A), 2019(E) & 2027(F)

Figure 41: Europe Bag-in-Box Containers Market BPS Analysis, by Capacity, 2014(A), 2019(E) & 2027(F)

Figure 42: Europe Bag-in-Box Containers Market BPS Analysis, by Material, 2014(A), 2019(E) & 2027(F)

Figure 43: Europe Bag-in-Box Containers Market Attractiveness Index, by Material Type, 2019(E) – 2027(F)

Figure 44: Europe Bag-in-Box Containers Market BPS Analysis, by End Use, 2014(A), 2019(E) & 2027(F)

Figure 45: Europe Bag-in-Box Containers Market Attractiveness Index, by End Use, 2019(E) – 2027(F)

Figure 46: APAC Bag-in-Box Containers Market Value share 2019(E) by Capacity

Figure 47: APAC Bag-in-Box Containers Market Value share 2019(E) by Material

Figure 48: APAC Bag-in-Box Containers Market Value share 2019(E) by End Use

Figure 49: APAC Bag-in-Box Containers Market BPS Analysis, by Country, 2014(A), 2019(E) & 2027(F)

Figure 50: APAC Bag-in-Box Containers Market Y-o-Y growth, by Country, 2019(E) – 2027(F)

Figure 51: APAC Bag-in-Box Containers Market BPS Analysis, by Capacity, 2014(A), 2019(E) & 2027(F)

Figure 52: APAC Bag-in-Box Containers Market BPS Analysis, by Capacity, 2014(A), 2019(E) & 2027(F)

Figure 53: APAC Bag-in-Box Containers Market BPS Analysis, by Material, 2014(A), 2019(E) & 2027(F)

Figure 54: APAC Bag-in-Box Containers Market Attractiveness Index, by Material Type, 2019(E) – 2027(F)

Figure 55: APAC Bag-in-Box Containers Market BPS Analysis, by End Use, 2014(A), 2019(E) & 2027(F)

Figure 56: APAC Bag-in-Box Containers Market Attractiveness Index, by End Use, 2019(E) – 2027(F)

Figure 57: MEA Bag-in-Box Containers Market Value share 2019(E) by Capacity

Figure 58: MEA Bag-in-Box Containers Market Value share 2019(E) by Material

Figure 59: MEA Bag-in-Box Containers Market Value share 2019(E) by End Use

Figure 60: MEA Bag-in-Box Containers Market BPS Analysis, by Country, 2014(A), 2019(E) & 2027(F)

Figure 61: MEA Bag-in-Box Containers Market Y-o-Y growth, by Country, 2019(E) – 2027(F)

Figure 62: MEA Bag-in-Box Containers Market BPS Analysis, by Capacity, 2014(A), 2019(E) & 2027(F)

Figure 63: MEA Bag-in-Box Containers Market BPS Analysis, by Capacity, 2014(A), 2019(E) & 2027(F)

Figure 64: MEA Bag-in-Box Containers Market BPS Analysis, by Material, 2014(A), 2019(E) & 2027(F)

Figure 65: MEA Bag-in-Box Containers Market Attractiveness Index, by Material Type, 2019(E) – 2027(F)

Figure 66: MEA Bag-in-Box Containers Market BPS Analysis, by End Use, 2014(A), 2019(E) & 2027(F)

Figure 67: MEA Bag-in-Box Containers Market Attractiveness Index, by End Use, 2019(E) – 2027(F)