Analyst Viewpoint

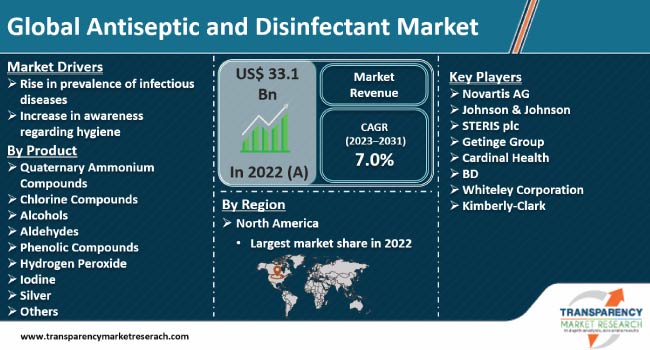

Increase in prevalence of infectious diseases and easy transmission of viruses are driving the antiseptic and disinfectant market size. Infectious diseases adversely affect people with weak immunity power. Maintaining hygiene is important to restrict the spread of infectious diseases. Thus, rise in demand for hygiene products in households, corporate places, schools, and healthcare settings is contributing to antiseptic and disinfectant industry growth.

Healthcare providers need to sanitize medical apparatus and surgical instruments to avoid disease transmission. Increase in number of surgical treatments is driving the need for medical disinfectants. Manufacturers are increasing their production capacities and introducing a wide range of products to meet consumer demand.

Antiseptics and disinfectants are used to control the spread of viruses and infections. They eliminate various microorganisms such as fungi, bacteria, and viruses. Disinfectants are employed to eliminate microorganisms on nonliving surfaces whereas antiseptics eliminate microorganisms on skin. Antiseptics are antimicrobial compounds that can be applied to living tissues. These compounds help reduce the risk of sepsis, infection, or putrefaction. Disinfectants are chemical compounds utilized to inactivate or destroy microorganisms on inert surfaces.

Disinfectants include chlorine and chlorine compounds, phenolic, formaldehyde, alcohols, glutaraldehyde, hydrogen peroxide, quaternary ammonium compounds, iodophors, peracetic acid, and ortho-phthalaldehyde. Antiseptic agents include hydrogen peroxide, hexachlorophene, povidone-iodine, chloroxylenol, benzalkonium chloride, chlorhexidine, and isopropyl alcohol. Antiseptics and disinfectants are used extensively in hospitals and other healthcare facilities for several topical and hard-surface applications. Antiseptic and disinfectants maintain hygiene, avoid virus transmission, and limit infectious diseases.

Infectious diseases are spread rapidly through organisms such as parasites, viruses, and fungi. Some infections can be passed from person to person and lead to colds, coughs, influenza, hepatitis, and respiratory syncytial virus. Rise in prevalence of infectious diseases due to changing environmental conditions is driving the antiseptic and disinfectant market growth. Infectious diseases are treated with antibiotics depending on the disease and cause. Disinfectants are used to maintain safety and prevent the spread of infections.

According to the National Institutes of Health, infectious diseases are leading causes of mortality and morbidity accounting for around 33% of annual deaths globally. Half of the world’s population is at risk of emerging and re-emerging infectious diseases.

High incidences of hospital-acquired infectious diseases are driving the antiseptic and disinfectant market development. Frequent visits to hospitals and lack of hygiene are major causes of infectious diseases, thereby leading to a high demand for sanitizing solutions. Surge in prevalence of infectious diseases is creating potential antiseptic and disinfectant business opportunities.

Hygiene maintenance is crucial to control the spread of infectious diseases. Awareness among people about the importance of hygiene is increasing due to the spread of viruses. Hand hygiene is the most important hygiene practice to control infection spread. Food hygiene and personal hygiene help curb the spread of various infections. Furthermore, toilet hygiene is important to avoid various diseases such as dysentery, diarrhea, typhoid, and cholera.

According to the latest antiseptic and disinfectant market trends, the healthcare providers end-user segment is projected to dominate the industry during the forecast period. Medical instruments are extensively used in surgeries, which increase the risk of infection among patients. Rise in number of surgeries is expected to augment the antiseptic and disinfectant industry share in the near future. Healthcare providers extensively use disinfectants to sanitize surfaces and medical instruments in order to avoid the spread of hazardous viruses. Healthcare professionals employ several hygiene solutions for sanitization such as alcohols, oxidizing agents, aldehydes, and phenolics.

Healthcare professionals sanitize beds and essential instruments before the admission of a patient as well as after the patient is discharged. This helps avoid cross-contamination and the spread of diseases. Disinfectants are utilized to clean floors, furniture surfaces, and bedsheets. Thus, demand for antiseptic and disinfectants is increasing in the healthcare sector.

According to the latest antiseptic and disinfectant market forecast, North America is anticipated to account for largest share from 2023 to 2031. Rapid growth in geriatric population and high adoption of surgical treatment are driving the antiseptic and disinfectant industry dynamics of the region. Presence of several healthcare facilities is also boosting the market statistics in North America. Various healthcare organizations in North America are focused on restricting the spread of infections, which is driving the demand for antiseptic and disinfectants.

Rise in incidence of food poisoning, typhoid, and cholera is augmenting the antiseptic and disinfectant industry progress in North America. Easy availability of antiseptics in the region allows healthcare providers to deliver appropriate treatment to patients.

Antiseptic and disinfectant manufacturers are implementing various business strategies, such as new product launches and M&As, to expand their customer base. Novartis AG, 3M, Johnson & Johnson, STERIS plc, Getinge Group, Cardinal Health, BD, Whiteley Corporation, and Kimberly-Clark are leading companies operating in this market.

These companies have been profiled in the antiseptic and disinfectant market report based on factors such as company overview, financial overview, business segments, product portfolio, business strategies, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 33.1 Bn |

| Market Forecast (Value) in 2031 | US$ 61.2 Bn |

| Growth Rate (CAGR) | 7.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 33.1 Bn in 2022

It is projected to register a CAGR of 7.0% from 2023 to 2031

Rise in prevalence of infectious diseases and increase in awareness regarding hygiene

North America was the most lucrative region in 2022

Novartis AG, 3M, Johnson & Johnson, STERIS plc, Getinge Group, Cardinal Health, BD, Whiteley Corporation, and Kimberly-Clark

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Antiseptic and Disinfectant Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Antiseptic and Disinfectant Market Analysis and Forecast, 2023-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. List of Antiseptics and Disinfectants Used for Sanitization

5.3. Disease Prevalence & Incidence Rate Globally with Key Countries

5.4. COVID-19 Pandemic Impact on Industry

6. Global Antiseptic and Disinfectant Market Analysis and Forecast, by Product

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2023-2031

6.3.1. Quaternary Ammonium Compounds

6.3.2. Chlorine Compounds

6.3.3. Alcohols

6.3.4. Aldehydes

6.3.5. Phenolic Compounds

6.3.6. Hydrogen Peroxide

6.3.7. Iodine

6.3.8. Silver

6.3.9. Others

6.4. Market Attractiveness, by Product

7. Global Antiseptic and Disinfectant Market Analysis and Forecast, by End-user

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2023-2031

7.3.1. Healthcare Providers

7.3.2. Commercial Users

7.3.3. Domestic Users

7.4. Market Attractiveness, by End-user

8. Global Antiseptic and Disinfectant Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2023-2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Antiseptic and Disinfectant Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2023-2031

9.2.1. Quaternary Ammonium Compounds

9.2.2. Chlorine Compounds

9.2.3. Alcohols

9.2.4. Aldehydes

9.2.5. Phenolic Compounds

9.2.6. Hydrogen Peroxide

9.2.7. Iodine

9.2.8. Silver

9.2.9. Others

9.3. Market Value Forecast, by End-user, 2023-2031

9.3.1. Healthcare Providers

9.3.2. Commercial Users

9.3.3. Domestic Users

9.4. Market Value Forecast, by Country, 2023-2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End-user

9.5.3. By Country

10. Europe Antiseptic and Disinfectant Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2023-2031

10.2.1. Quaternary Ammonium Compounds

10.2.2. Chlorine Compounds

10.2.3. Alcohols

10.2.4. Aldehydes

10.2.5. Phenolic Compounds

10.2.6. Hydrogen Peroxide

10.2.7. Iodine

10.2.8. Silver

10.2.9. Others

10.3. Market Value Forecast, by End-user, 2023-2031

10.3.1. Healthcare Providers

10.3.2. Commercial Users

10.3.3. Domestic Users

10.4. Market Value Forecast, by Country/Sub-region, 2023-2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Antiseptic and Disinfectant Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2023-2031

11.2.1. Quaternary Ammonium Compounds

11.2.2. Chlorine Compounds

11.2.3. Alcohols

11.2.4. Aldehydes

11.2.5. Phenolic Compounds

11.2.6. Hydrogen Peroxide

11.2.7. Iodine

11.2.8. Silver

11.2.9. Others

11.3. Market Value Forecast, by End-user, 2023-2031

11.3.1. Healthcare Providers

11.3.2. Commercial Users

11.3.3. Domestic Users

11.4. Market Value Forecast, by Country/Sub-region, 2023-2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Antiseptic and Disinfectant Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2023-2031

12.2.1. Quaternary Ammonium Compounds

12.2.2. Chlorine Compounds

12.2.3. Alcohols

12.2.4. Aldehydes

12.2.5. Phenolic Compounds

12.2.6. Hydrogen Peroxide

12.2.7. Iodine

12.2.8. Silver

12.2.9. Others

12.3. Market Value Forecast, by End-user, 2023-2031

12.3.1. Healthcare Providers

12.3.2. Commercial Users

12.3.3. Domestic Users

12.4. Market Value Forecast, by Country/Sub-region, 2023-2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Antiseptic and Disinfectant Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2023-2031

13.2.1. Quaternary Ammonium Compounds

13.2.2. Chlorine Compounds

13.2.3. Alcohols

13.2.4. Aldehydes

13.2.5. Phenolic Compounds

13.2.6. Hydrogen Peroxide

13.2.7. Iodine

13.2.8. Silver

13.2.9. Others

13.3. Market Value Forecast, by End-user, 2023-2031

13.3.1. Healthcare Providers

13.3.2. Commercial Users

13.3.3. Domestic Users

13.4. Market Value Forecast, by Country/Sub-region, 2023-2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Novartis AG

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. 3M

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Johnson & Johnson

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. STERIS plc

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Getinge Group

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Cardinal Health

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. BD

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Whiteley Corporation

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Kimberly-Clark

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

List of Tables

Table 01. Global Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 02. Global Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by End-user, 2023-2031

Table 03. Global Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 04. North America Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 05. North America Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by End-user, 2023-2031

Table 06. North America Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 07. Europe Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 08. Europe Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by End-user, 2023-2031

Table 09. Europe Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023-2031

Table 10. Asia Pacific Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 11. Asia Pacific Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by End-user, 2023-2031

Table 12. Asia Pacific Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023-2031

Table 13. Latin America Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 14. Latin America Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by End-user, 2023-2031

Table 15. Latin America Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023-2031

Table 16. Middle East & Africa Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 17. Middle East & Africa Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by End-user, 2023-2031

Table 18. Middle East & Africa Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023-2031

List of Figures

Figure 01. Global Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, 2023-2031

Figure 02. Global Antiseptic and Disinfectant Market Value Share Analysis, by Product 2022 and 2031

Figure 03. Global Antiseptic and Disinfectant Market Attractiveness Analysis, by Product, 2023-2031

Figure 04. Global Antiseptic and Disinfectant Market Value Share Analysis, by End-user, 2022 and 2031

Figure 05. Global Antiseptic and Disinfectant Market Attractiveness Analysis, by End-user, 2023-2031

Figure 06. Global Antiseptic and Disinfectant Market Value Share Analysis, by Region, 2022 and 2031

Figure 07. Global Antiseptic and Disinfectant Market Attractiveness Analysis, by Region, 2023-2031

Figure 08. North America Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, 2023-2031

Figure 09. North America Antiseptic and Disinfectant Market Value Share Analysis, by Product, 2022 and 2031

Figure 10. North America Antiseptic and Disinfectant Market Attractiveness Analysis, by Product, 2023-2031

Figure 11. North America Antiseptic and Disinfectant Market Value Share Analysis, by End-user, 2022 and 2031

Figure 12. North America Antiseptic and Disinfectant Market Attractiveness Analysis, by End-user, 2023-2031

Figure 13. North America Antiseptic and Disinfectant Market Value Share Analysis, by Country, 2022 and 2031

Figure 14. North America Antiseptic and Disinfectant Market Attractiveness Analysis, by Country, 2023-2031

Figure 15. Europe Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, 2023-2031

Figure 16. Europe Antiseptic and Disinfectant Market Value Share Analysis, by Product, 2022 and 2031

Figure 17. Europe Antiseptic and Disinfectant Market Attractiveness Analysis, by Product, 2023-2031

Figure 18. Europe Antiseptic and Disinfectant Market Value Share Analysis, by End-user, 2022 and 2031

Figure 19. Europe Antiseptic and Disinfectant Market Attractiveness Analysis, by End-user, 2023-2031

Figure 20. Europe Antiseptic and Disinfectant Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 21. Europe Antiseptic and Disinfectant Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 22. Asia Pacific Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, 2023-2031

Figure 23. Asia Pacific Antiseptic and Disinfectant Market Value Share Analysis, by Product 2022 and 2031

Figure 24. Asia Pacific Antiseptic and Disinfectant Market Attractiveness Analysis, by Product, 2023-2031

Figure 25. Asia Pacific Antiseptic and Disinfectant Market Value Share Analysis, by End-user, 2022 and 2031

Figure 26. Asia Pacific Antiseptic and Disinfectant Market Attractiveness Analysis, by End-user, 2023-2031

Figure 27. Asia Pacific Antiseptic and Disinfectant Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 28. Asia Pacific Antiseptic and Disinfectant Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 29. Latin America Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, 2023-2031

Figure 30. Latin America Antiseptic and Disinfectant Market Value Share Analysis, by Product, 2022 and 2031

Figure 31. Latin America Antiseptic and Disinfectant Market Attractiveness Analysis, by Product, 2023-2031

Figure 32. Latin America Antiseptic and Disinfectant Market Value Share Analysis, by End-user, 2022 and 2031

Figure 33. Latin America Antiseptic and Disinfectant Market Attractiveness Analysis, by End-user, 2023-2031

Figure 34. Latin America Antiseptic and Disinfectant Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35. Latin America Antiseptic and Disinfectant Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 36. Middle East & Africa Antiseptic and Disinfectant Market Value (US$ Bn) Forecast, 2023-2031

Figure 37. Middle East & Africa Antiseptic and Disinfectant Market Value Share Analysis, by Product, 2022 and 2031

Figure 38. Middle East & Africa Antiseptic and Disinfectant Market Attractiveness Analysis, by Product, 2023-2031

Figure 39. Middle East & Africa Antiseptic and Disinfectant Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40. Middle East & Africa Antiseptic and Disinfectant Market Attractiveness Analysis, by End-user, 2023-2031

Figure 41. Middle East & Africa Antiseptic and Disinfectant Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42. Middle East & Africa Antiseptic and Disinfectant Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 43. Global Antiseptic and Disinfectant Market Share Analysis, by Company, 2022