Analysts’ Viewpoint

Rise in global population is driving the need to increase food production. Demand can be met by improving farm cultivation efficiency and adopting automatic & semiautomatic agricultural machinery. Therefore, growing population around the world increases the need for farm machinery and equipment, which in turn is fueling market expansion. On the other hand, ignorance about the advantages of adopting agricultural technology and equipment among farmers is a prominent factor restraining the market.

Increase in government subsidies, demand for contract farming, and public knowledge about rental services are also projected to boost the agriculture machinery and equipment industry growth. Furthermore, rise in efforts to increase crop production and reduce noise and emissions are also estimated to drive the agriculture machinery and equipment market growth during the forecast period.

Agricultural machinery is a term used to describe mechanical tools and equipment used in farming and other forms of agriculture. Such equipment comes in a wide variety of forms, including hand tools, power tools, tractors, and endless varieties of farm implements that can be pulled or driven.

The term ‘agricultural machinery and equipment’ may also refer to any machinery employed in the operation of a farm, or ranch, or in any activity that eventually results in the production of an agricultural product and is compliant with the law, including machinery used to transport domestic animals or crops.

Farm mechanization is more necessary in developing countries due to decline in labor force, water supplies, and land productivity. Demand for agri-machinery is rising in these nations due to favorable government policies such as offering subsidies, granting loans without interest, and boosting financial aid. For instance, the US Farm Service Agency provides family-size farmers who are unable to obtain commercial financing through a bank, farm credit system institution, or other lenders with guaranteed and direct farm ownership and operation loans. Farmers can purchase farm machinery thanks to such loans.

The rate of penetration of farm machinery and equipment is poor in developing countries. Thus, farm mechanization has considerable potential to increase the penetration of farm equipment, such as tractors, and consequently, boost agriculture machinery and equipment market demand.

Unlike human planting and fertilizing techniques, the price of planting and fertilizing machinery is primarily driven by the increase in demand for agricultural products. Sprayers operate more swiftly and effectively while covering a larger area each day. These devices help reduce overall costs and boost crop yields by ensuring that nutrients and protective agents are supplied equally. Low-pressure, high-pressure, fogger, and air-carrying sprayer models are available for numerous machine-operated sprayer types.

Additionally, governments across the globe are undertaking initiatives to boost the rapid adoption of agricultural mechanization. This is a key factor that is anticipated to have a favorable impact on the demand for agricultural tractors and harvesters. Furthermore, the forestry industry is increasingly using agricultural equipment to transport various goods, including recently cut wood. Therefore, the forestry sector is estimated to propel the future of the agriculture machinery and equipment market.

Based on machinery & equipment type, the tractors segment accounted for 47.2% of the agriculture machinery and equipment market share in 2022. Tractors improve productivity in the agriculture sector and help satisfy the world's food needs.

Emergence of electric tractors is expected to offer agriculture machinery and equipment business opportunities for key manufacturers. The cost-effectiveness of electric tractors in addition to their high efficiency and environmental friendliness contribute to their high demand. However, their adoption is estimated to be hampered during the forecast period due to a lack of energy density to support big field operations.

Based on global agriculture machinery and equipment industry trends, Asia Pacific is regarded as the largest and fastest-growing market due to rapid innovations and product launches by businesses in the region. The Government in China is improving agricultural mechanization for a variety of crops, including rice, wheat, maize, potatoes, oilseed rape, cotton, and sugarcane.

The market in India is also estimated to expand at a rapid pace due to increase in government subsidies for purchase of tractors and machinery. The farming sector contributes significantly to the GDP of the country. Therefore, the government is focusing on mechanizing agriculture through various programs.

A few companies in the agriculture machinery and equipment market control majority of share. Market participants are creating supply chain networks to increase their revenue share. However, key players are consolidating their positions by adopting various strategies such as collaboration, merger, acquisition, and expansion of product lines. Prominent companies operating in the agriculture machinery and equipment business across the globe include AGCO Corporation, Alamo Group Inc., ARGO SpA, Bucher Industries AG, CLASS KGaA GmbH, CNH Industrial NV, Deere & Company, Escorts Ltd., JCB Ltd., Kubota Corporation, Mahindra & Mahindra Ltd., Valmont Industries Inc., Yanmar Co. Ltd., and Zetor Tractors A.S.

The agriculture machinery and equipment market report contains profiles of players who have been analyzed on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 132.3 Bn |

|

Market Forecast Value in 2031 |

US$ 219.5 Bn |

|

Growth Rate (CAGR) |

5.8% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

Volume (Units) & US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

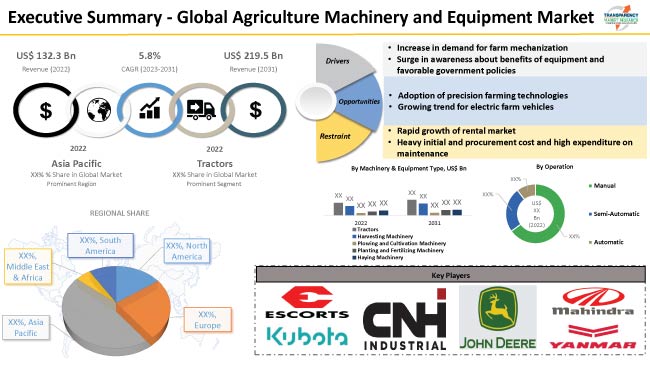

The global market was valued at US$ 132.3 Bn in 2022.

It is expected to expand at a CAGR of 5.8% from 2023 to 2031.

The global market is expected to reach a value of US$ 219.5 Bn in 2031.

Increase in demand for farm mechanization in developing countries, rise in awareness about benefits of agriculture equipment and constructive government initiatives.

The tractors segment accounted for 47.2% share in 2022.

Asia Pacific is a highly lucrative region for vendors in 2022.

AGCO Corporation, Alamo Group Inc., ARGO SpA, Bucher Industries AG, CLASS KGaA GmbH, CNH Industrial NV, Deere & Company, Escorts Ltd., JCB Ltd., Kubota Corporation, Mahindra & Mahindra Ltd., Valmont Industries Inc., Yanmar Co. Ltd., and Zetor Tractors A.S.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Units, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. COVID-19 Impact Analysis – Agriculture Machinery and Equipment Market

4. Global Agriculture Machinery and Equipment Market, by Machinery & Equipment Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Machinery & Equipment Type

4.2.1. Tractors

4.2.1.1. Type

4.2.1.1.1. Wheeled Tractors

4.2.1.1.2. Track Tractors

4.2.1.1.3. Others

4.2.1.2. Power Output

4.2.1.2.1. < 30 HP

4.2.1.2.2. 30-100 HP

4.2.1.2.3. 101-200 HP

4.2.1.2.4. > 200 HP

4.2.2. Harvesting Machinery

4.2.2.1. Combine Harvester

4.2.2.2. Forage Harvester

4.2.2.3. Thresher

4.2.2.4. Reaper

4.2.3. Plowing and Cultivation Machinery

4.2.3.1. Ploughs

4.2.3.2. Harrows

4.2.3.3. Cultivators & Tillers

4.2.4. Planting and Fertilizing Machinery

4.2.4.1. Seed Drills

4.2.4.2. Planters

4.2.4.3. Spreaders

4.2.4.4. Sprayers

4.2.5. Haying Machinery

4.2.5.1. Balers

4.2.5.2. Mowers-Conditioners

4.2.5.3. Tedders & Rakes

4.2.5.4. Sprayers

5. Global Agriculture Machinery and Equipment Market, by Operation

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Operation

5.2.1. Manual

5.2.2. Semi-Automatic

5.2.3. Automatic

6. Global Agriculture Machinery and Equipment Market, by Propulsion

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Propulsion

6.2.1. Diesel

6.2.2. Gasoline

6.2.3. Electric

6.2.4. Others

7. Global Agriculture Machinery and Equipment Market, by Region

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Agriculture Machinery and Equipment Market

8.1. Market Snapshot

8.2. North America Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Machinery & Equipment Type

8.2.1. Tractors

8.2.1.1. Type

8.2.1.1.1. Wheeled Tractors

8.2.1.1.2. Track Tractors

8.2.1.1.3. Others

8.2.1.2. Power Output

8.2.1.2.1. < 30 HP

8.2.1.2.2. 30-100 HP

8.2.1.2.3. 101-200 HP

8.2.1.2.4. > 200 HP

8.2.2. Harvesting Machinery

8.2.2.1. Combine Harvester

8.2.2.2. Forage Harvester

8.2.2.3. Thresher

8.2.2.4. Reaper

8.2.3. Plowing and Cultivation Machinery

8.2.3.1. Ploughs

8.2.3.2. Harrows

8.2.3.3. Cultivators & Tillers

8.2.4. Planting and Fertilizing Machinery

8.2.4.1. Seed Drills

8.2.4.2. Planters

8.2.4.3. Spreaders

8.2.4.4. Sprayers

8.2.5. Haying Machinery

8.2.5.1. Balers

8.2.5.2. Mowers-Conditioners

8.2.5.3. Tedders & Rakes

8.2.5.4. Sprayers

8.3. North America Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Operation

8.3.1. Manual

8.3.2. Semi-Automatic

8.3.3. Automatic

8.4. North America Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Propulsion

8.4.1. Diesel

8.4.2. Gasoline

8.4.3. Electric

8.4.4. Others

8.5. North America Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Country

8.5.1. The U. S.

8.5.2. Canada

8.5.3. Mexico

9. Europe Agriculture Machinery and Equipment Market

9.1. Market Snapshot

9.2. Europe Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Machinery & Equipment Type

9.2.1. Tractors

9.2.1.1. Type

9.2.1.1.1. Wheeled Tractors

9.2.1.1.2. Track Tractors

9.2.1.1.3. Others

9.2.1.2. Power Output

9.2.1.2.1. < 30 HP

9.2.1.2.2. 30-100 HP

9.2.1.2.3. 101-200 HP

9.2.1.2.4. > 200 HP

9.2.2. Harvesting Machinery

9.2.2.1. Combine Harvester

9.2.2.2. Forage Harvester

9.2.2.3. Thresher

9.2.2.4. Reaper

9.2.3. Plowing and Cultivation Machinery

9.2.3.1. Ploughs

9.2.3.2. Harrows

9.2.3.3. Cultivators & Tillers

9.2.4. Planting and Fertilizing Machinery

9.2.4.1. Seed Drills

9.2.4.2. Planters

9.2.4.3. Spreaders

9.2.4.4. Sprayers

9.2.5. Haying Machinery

9.2.5.1. Balers

9.2.5.2. Mowers-Conditioners

9.2.5.3. Tedders & Rakes

9.2.5.4. Sprayers

9.3. Europe Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Operation

9.3.1. Manual

9.3.2. Semi-Automatic

9.3.3. Automatic

9.4. Europe Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Propulsion

9.4.1. Diesel

9.4.2. Gasoline

9.4.3. Electric

9.4.4. Others

9.5. Europe Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Country

9.5.1. Germany

9.5.2. U. K.

9.5.3. France

9.5.4. Italy

9.5.5. Spain

9.5.6. Nordic Countries

9.5.7. Russia & CIS

9.5.8. Rest of Europe

10. Asia Pacific Agriculture Machinery and Equipment Market

10.1. Market Snapshot

10.2. Asia Pacific Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Machinery & Equipment Type

10.2.1. Tractors

10.2.1.1. Type

10.2.1.1.1. Wheeled Tractors

10.2.1.1.2. Track Tractors

10.2.1.1.3. Others

10.2.1.2. Power Output

10.2.1.2.1. < 30 HP

10.2.1.2.2. 30-100 HP

10.2.1.2.3. 101-200 HP

10.2.1.2.4. > 200 HP

10.2.2. Harvesting Machinery

10.2.2.1. Combine Harvester

10.2.2.2. Forage Harvester

10.2.2.3. Thresher

10.2.2.4. Reaper

10.2.3. Plowing and Cultivation Machinery

10.2.3.1. Ploughs

10.2.3.2. Harrows

10.2.3.3. Cultivators & Tillers

10.2.4. Planting and Fertilizing Machinery

10.2.4.1. Seed Drills

10.2.4.2. Planters

10.2.4.3. Spreaders

10.2.4.4. Sprayers

10.2.5. Haying Machinery

10.2.5.1. Balers

10.2.5.2. Mowers-Conditioners

10.2.5.3. Tedders & Rakes

10.2.5.4. Sprayers

10.3. Asia Pacific Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Operation

10.3.1. Manual

10.3.2. Semi-Automatic

10.3.3. Automatic

10.4. Asia Pacific Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Propulsion

10.4.1. Diesel

10.4.2. Gasoline

10.4.3. Electric

10.4.4. Others

10.5. Asia Pacific Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Country

10.5.1. China

10.5.2. India

10.5.3. Japan

10.5.4. ASEAN Countries

10.5.5. South Korea

10.5.6. ANZ

10.5.7. Rest of Asia Pacific

11. Middle East & Africa Agriculture Machinery and Equipment Market

11.1. Market Snapshot

11.2. Middle East & Africa Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Machinery & Equipment Type

11.2.1. Tractors

11.2.1.1. Type

11.2.1.1.1. Wheeled Tractors

11.2.1.1.2. Track Tractors

11.2.1.1.3. Others

11.2.1.2. Power Output

11.2.1.2.1. < 30 HP

11.2.1.2.2. 30-100 HP

11.2.1.2.3. 101-200 HP

11.2.1.2.4. > 200 HP

11.2.2. Harvesting Machinery

11.2.2.1. Combine Harvester

11.2.2.2. Forage Harvester

11.2.2.3. Thresher

11.2.2.4. Reaper

11.2.3. Plowing and Cultivation Machinery

11.2.3.1. Ploughs

11.2.3.2. Harrows

11.2.3.3. Cultivators & Tillers

11.2.4. Planting and Fertilizing Machinery

11.2.4.1. Seed Drills

11.2.4.2. Planters

11.2.4.3. Spreaders

11.2.4.4. Sprayers

11.2.5. Haying Machinery

11.2.5.1. Balers

11.2.5.2. Mowers-Conditioners

11.2.5.3. Tedders & Rakes

11.2.5.4. Sprayers

11.3. Middle East & Africa Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Operation

11.3.1. Manual

11.3.2. Semi-Automatic

11.3.3. Automatic

11.4. Middle East & Africa Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Propulsion

11.4.1. Diesel

11.4.2. Gasoline

11.4.3. Electric

11.4.4. Others

11.5. Middle East & Africa Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Country

11.5.1. GCC

11.5.2. South Africa

11.5.3. Turkey

11.5.4. Rest of Middle East & Africa

12. South America Agriculture Machinery and Equipment Market

12.1. Market Snapshot

12.2. South America Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Machinery & Equipment Type

12.2.1. Tractors

12.2.1.1. Type

12.2.1.1.1. Wheeled Tractors

12.2.1.1.2. Track Tractors

12.2.1.1.3. Others

12.2.1.2. Power Output

12.2.1.2.1. < 30 HP

12.2.1.2.2. 30-100 HP

12.2.1.2.3. 101-200 HP

12.2.1.2.4. > 200 HP

12.2.2. Harvesting Machinery

12.2.2.1. Combine Harvester

12.2.2.2. Forage Harvester

12.2.2.3. Thresher

12.2.2.4. Reaper

12.2.3. Plowing and Cultivation Machinery

12.2.3.1. Ploughs

12.2.3.2. Harrows

12.2.3.3. Cultivators & Tillers

12.2.4. Planting and Fertilizing Machinery

12.2.4.1. Seed Drills

12.2.4.2. Planters

12.2.4.3. Spreaders

12.2.4.4. Sprayers

12.2.5. Haying Machinery

12.2.5.1. Balers

12.2.5.2. Mowers-Conditioners

12.2.5.3. Tedders & Rakes

12.2.5.4. Sprayers

12.3. South America Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Operation

12.3.1. Manual

12.3.2. Semi-Automatic

12.3.3. Automatic

12.4. South America Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Propulsion

12.4.1. Diesel

12.4.2. Gasoline

12.4.3. Electric

12.4.4. Others

12.5. South America Agriculture Machinery and Equipment Market Size & Forecast, 2017-2031, by Country

12.5.1. Brazil

12.5.2. Argentina

12.5.3. Rest of South America

13. Competitive Landscape

13.1. Company Share Analysis/ Brand Share Analysis, 2022

13.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

14. Company Profile/ Key Players

14.1. AGCO Corporation

14.1.1. Company Overview

14.1.2. Company Footprints

14.1.3. Production Locations

14.1.4. Product Portfolio

14.1.5. Competitors & Customers

14.1.6. Subsidiaries & Parent Organization

14.1.7. Recent Developments

14.1.8. Financial Analysis

14.1.9. Profitability

14.1.10. Revenue Share

14.2. Alamo Group Inc.

14.2.1. Company Overview

14.2.2. Company Footprints

14.2.3. Production Locations

14.2.4. Product Portfolio

14.2.5. Competitors & Customers

14.2.6. Subsidiaries & Parent Organization

14.2.7. Recent Developments

14.2.8. Financial Analysis

14.2.9. Profitability

14.2.10. Revenue Share

14.3. ARGO SpA

14.3.1. Company Overview

14.3.2. Company Footprints

14.3.3. Production Locations

14.3.4. Product Portfolio

14.3.5. Competitors & Customers

14.3.6. Subsidiaries & Parent Organization

14.3.7. Recent Developments

14.3.8. Financial Analysis

14.3.9. Profitability

14.3.10. Revenue Share

14.4. Bucher Industries AG

14.4.1. Company Overview

14.4.2. Company Footprints

14.4.3. Production Locations

14.4.4. Product Portfolio

14.4.5. Competitors & Customers

14.4.6. Subsidiaries & Parent Organization

14.4.7. Recent Developments

14.4.8. Financial Analysis

14.4.9. Profitability

14.4.10. Revenue Share

14.5. CLASS KGaA mbH

14.5.1. Company Overview

14.5.2. Company Footprints

14.5.3. Production Locations

14.5.4. Product Portfolio

14.5.5. Competitors & Customers

14.5.6. Subsidiaries & Parent Organization

14.5.7. Recent Developments

14.5.8. Financial Analysis

14.5.9. Profitability

14.5.10. Revenue Share

14.6. CNH Industrial NV

14.6.1. Company Overview

14.6.2. Company Footprints

14.6.3. Production Locations

14.6.4. Product Portfolio

14.6.5. Competitors & Customers

14.6.6. Subsidiaries & Parent Organization

14.6.7. Recent Developments

14.6.8. Financial Analysis

14.6.9. Profitability

14.6.10. Revenue Share

14.7. Deere & Company

14.7.1. Company Overview

14.7.2. Company Footprints

14.7.3. Production Locations

14.7.4. Product Portfolio

14.7.5. Competitors & Customers

14.7.6. Subsidiaries & Parent Organization

14.7.7. Recent Developments

14.7.8. Financial Analysis

14.7.9. Profitability

14.7.10. Revenue Share

14.8. Escorts Ltd

14.8.1. Company Overview

14.8.2. Company Footprints

14.8.3. Production Locations

14.8.4. Product Portfolio

14.8.5. Competitors & Customers

14.8.6. Subsidiaries & Parent Organization

14.8.7. Recent Developments

14.8.8. Financial Analysis

14.8.9. Profitability

14.8.10. Revenue Share

14.9. JCB Ltd

14.9.1. Company Overview

14.9.2. Company Footprints

14.9.3. Production Locations

14.9.4. Product Portfolio

14.9.5. Competitors & Customers

14.9.6. Subsidiaries & Parent Organization

14.9.7. Recent Developments

14.9.8. Financial Analysis

14.9.9. Profitability

14.9.10. Revenue Share

14.10. Kubota Corporation

14.10.1. Company Overview

14.10.2. Company Footprints

14.10.3. Production Locations

14.10.4. Product Portfolio

14.10.5. Competitors & Customers

14.10.6. Subsidiaries & Parent Organization

14.10.7. Recent Developments

14.10.8. Financial Analysis

14.10.9. Profitability

14.10.10. Revenue Share

14.11. Mahindra & Mahindra Ltd

14.11.1. Company Overview

14.11.2. Company Footprints

14.11.3. Production Locations

14.11.4. Product Portfolio

14.11.5. Competitors & Customers

14.11.6. Subsidiaries & Parent Organization

14.11.7. Recent Developments

14.11.8. Financial Analysis

14.11.9. Profitability

14.11.10. Revenue Share

14.12. Valmont Industries Inc.

14.12.1. Company Overview

14.12.2. Company Footprints

14.12.3. Production Locations

14.12.4. Product Portfolio

14.12.5. Competitors & Customers

14.12.6. Subsidiaries & Parent Organization

14.12.7. Recent Developments

14.12.8. Financial Analysis

14.12.9. Profitability

14.12.10. Revenue Share

14.13. Yanmar Co. Ltd

14.13.1. Company Overview

14.13.2. Company Footprints

14.13.3. Production Locations

14.13.4. Product Portfolio

14.13.5. Competitors & Customers

14.13.6. Subsidiaries & Parent Organization

14.13.7. Recent Developments

14.13.8. Financial Analysis

14.13.9. Profitability

14.13.10. Revenue Share

14.14. Zetor Tractors A.S.

14.14.1. Company Overview

14.14.2. Company Footprints

14.14.3. Production Locations

14.14.4. Product Portfolio

14.14.5. Competitors & Customers

14.14.6. Subsidiaries & Parent Organization

14.14.7. Recent Developments

14.14.8. Financial Analysis

14.14.9. Profitability

14.14.10. Revenue Share

14.15. Other Key Players

14.15.1. Company Overview

14.15.2. Company Footprints

14.15.3. Production Locations

14.15.4. Product Portfolio

14.15.5. Competitors & Customers

14.15.6. Subsidiaries & Parent Organization

14.15.7. Recent Developments

14.15.8. Financial Analysis

14.15.9. Profitability

14.15.10. Revenue Share

List of Tables

Table 1: Global Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Machinery & Equipment Type, 2017-2031

Table 2: Global Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Machinery & Equipment Type, 2017‒2031

Table 3: Global Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Operation, 2017-2031

Table 4: Global Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Operation, 2017‒2031

Table 5: Global Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 6: Global Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 7: Global Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Region, 2017-2031

Table 8: Global Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 9: North America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Machinery & Equipment Type, 2017-2031

Table 10: North America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Machinery & Equipment Type, 2017‒2031

Table 11: North America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Operation, 2017-2031

Table 12: North America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Operation, 2017‒2031

Table 13: North America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 14: North America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 15: North America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Country, 2017-2031

Table 16: North America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 17: Europe Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Machinery & Equipment Type, 2017-2031

Table 18: Europe Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Machinery & Equipment Type, 2017‒2031

Table 19: Europe Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Operation, 2017-2031

Table 20: Europe Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Operation, 2017‒2031

Table 21: Europe Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 22: Europe Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 23: Europe Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Country, 2017-2031

Table 24: Europe Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Asia Pacific Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Machinery & Equipment Type, 2017-2031

Table 26: Asia Pacific Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Machinery & Equipment Type, 2017‒2031

Table 27: Asia Pacific Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Operation, 2017-2031

Table 28: Asia Pacific Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Operation, 2017‒2031

Table 29: Asia Pacific Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 30: Asia Pacific Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 31: Asia Pacific Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Country, 2017-2031

Table 32: Asia Pacific Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 33: Middle East & Africa Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Machinery & Equipment Type, 2017-2031

Table 34: Middle East & Africa Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Machinery & Equipment Type, 2017‒2031

Table 35: Middle East & Africa Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Operation, 2017-2031

Table 36: Middle East & Africa Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Operation, 2017‒2031

Table 37: Middle East & Africa Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 38: Middle East & Africa Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 39: Middle East & Africa Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Country, 2017-2031

Table 40: Middle East & Africa Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 41: South America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Machinery & Equipment Type, 2017-2031

Table 42: South America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Machinery & Equipment Type, 2017‒2031

Table 43: South America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Operation, 2017-2031

Table 44: South America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Operation, 2017‒2031

Table 45: South America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 46: South America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 47: South America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Country, 2017-2031

Table 48: South America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Machinery & Equipment Type, 2017-2031

Figure 2: Global Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Machinery & Equipment Type, 2017-2031

Figure 3: Global Agriculture Machinery and Equipment Market, Incremental Opportunity, by Machinery & Equipment Type, Value (US$ Bn), 2023-2031

Figure 4: Global Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Operation, 2017-2031

Figure 5: Global Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Operation, 2017-2031

Figure 6: Global Agriculture Machinery and Equipment Market, Incremental Opportunity, by Operation, Value (US$ Bn), 2023-2031

Figure 7: Global Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 8: Global Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 9: Global Agriculture Machinery and Equipment Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 10: Global Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Region, 2017-2031

Figure 11: Global Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Agriculture Machinery and Equipment Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 13: North America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Machinery & Equipment Type, 2017-2031

Figure 14: North America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Machinery & Equipment Type, 2017-2031

Figure 15: North America Agriculture Machinery and Equipment Market, Incremental Opportunity, by Machinery & Equipment Type, Value (US$ Bn), 2023-2031

Figure 16: North America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Operation, 2017-2031

Figure 17: North America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Operation, 2017-2031

Figure 18: North America Agriculture Machinery and Equipment Market, Incremental Opportunity, by Operation, Value (US$ Bn), 2023-2031

Figure 19: North America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 20: North America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 21: North America Agriculture Machinery and Equipment Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 22: North America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Country, 2017-2031

Figure 23: North America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Agriculture Machinery and Equipment Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 25: Europe Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Machinery & Equipment Type, 2017-2031

Figure 26: Europe Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Machinery & Equipment Type, 2017-2031

Figure 27: Europe Agriculture Machinery and Equipment Market, Incremental Opportunity, by Machinery & Equipment Type, Value (US$ Bn), 2023-2031

Figure 28: Europe Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Operation, 2017-2031

Figure 29: Europe Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Operation, 2017-2031

Figure 30: Europe Agriculture Machinery and Equipment Market, Incremental Opportunity, by Operation, Value (US$ Bn), 2023-2031

Figure 31: Europe Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 32: Europe Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 33: Europe Agriculture Machinery and Equipment Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 34: Europe Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Country, 2017-2031

Figure 35: Europe Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Agriculture Machinery and Equipment Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Machinery & Equipment Type, 2017-2031

Figure 38: Asia Pacific Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Machinery & Equipment Type, 2017-2031

Figure 39: Asia Pacific Agriculture Machinery and Equipment Market, Incremental Opportunity, by Machinery & Equipment Type, Value (US$ Bn), 2023-2031

Figure 40: Asia Pacific Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Operation, 2017-2031

Figure 41: Asia Pacific Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Operation, 2017-2031

Figure 42: Asia Pacific Agriculture Machinery and Equipment Market, Incremental Opportunity, by Operation, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 44: Asia Pacific Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 45: Asia Pacific Agriculture Machinery and Equipment Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Country, 2017-2031

Figure 47: Asia Pacific Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Agriculture Machinery and Equipment Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Machinery & Equipment Type, 2017-2031

Figure 50: Middle East & Africa Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Machinery & Equipment Type, 2017-2031

Figure 51: Middle East & Africa Agriculture Machinery and Equipment Market, Incremental Opportunity, by Machinery & Equipment Type, Value (US$ Bn), 2023-2031

Figure 52: Middle East & Africa Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Operation, 2017-2031

Figure 53: Middle East & Africa Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Operation, 2017-2031

Figure 54: Middle East & Africa Agriculture Machinery and Equipment Market, Incremental Opportunity, by Operation, Value (US$ Bn), 2023-2031

Figure 55: Middle East & Africa Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 56: Middle East & Africa Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 57: Middle East & Africa Agriculture Machinery and Equipment Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 58: Middle East & Africa Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Country, 2017-2031

Figure 59: Middle East & Africa Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Agriculture Machinery and Equipment Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: South America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Machinery & Equipment Type, 2017-2031

Figure 62: South America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Machinery & Equipment Type, 2017-2031

Figure 63: South America Agriculture Machinery and Equipment Market, Incremental Opportunity, by Machinery & Equipment Type, Value (US$ Bn), 2023-2031

Figure 64: South America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Operation, 2017-2031

Figure 65: South America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Operation, 2017-2031

Figure 66: South America Agriculture Machinery and Equipment Market, Incremental Opportunity, by Operation, Value (US$ Bn), 2023-2031

Figure 67: South America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 68: South America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 69: South America Agriculture Machinery and Equipment Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 70: South America Agriculture Machinery and Equipment Market Volume (Units) Forecast, by Country, 2017-2031

Figure 71: South America Agriculture Machinery and Equipment Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South America Agriculture Machinery and Equipment Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031