Global Ag Paste Market – An Overview

Silver is an important metal and the fact that it is not volatile like gold in terms of pricing creates a favorable demand trend in certain industries. When turned into a paste, it acts as a significant electrical and thermal conductor. This makes it extremely suitable for production of electronic and electrical components, solar cells, and automobiles. Growth in the demand for these is driving the market forward on an impressive trajectory, helping worth grow by a notable value.

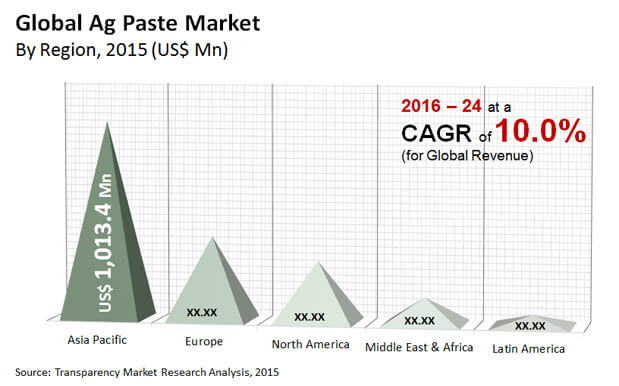

It is pertinent to note here that North America would hold a sizeable share of the market over the forecast period of 2016 to 2024, while the Asia Pacific region will chart new growth opportunities – lucrative and untapped. Players would do well to tap into these at the right time.

Some of the factors that are seen as major propellers of growth are explained below.

Global Ag Paste Market: Snapshot

Ag paste is made using pure silver metal and it is well known for its highest electrical conductivity, thermal conductivity, and reflectivity. The low price trends of silver have kept the demand for silver relatively low. Owing to these properties, Ag paste is extensively used for in production of solar cells, electrical and electronic components, and automobiles. The report states that the global Ag paste market will reach a valuation of US$4.5 bn by the end of 2024 from US$1.9 bn in 2015. The overall market is expected to expand at a CAGR of 10.0% between 2016 and 2024.

The development of the solar industry has triggered the demand for photovoltaic cells in recent years.

Demand for PV capacity is likely to rise to about 600 GW by 2020, which is projected to boost the demand for Ag paste during the forecast period. Technological developments have increased the applications of silver paste in automobiles as it is extensively being used for making printed circuits of defogging systems, alarm circuits, and antennae. Silver paste is also used for manufacturing multilayer ceramic capacitors, polymer inks, low temperature coal-fired ceramics, and adhesives, which are used in electronic and electrical components such as capacitors, resistors, and circuits. Thus, growing demand for electronic and electrical appliances is estimated to boost the demand for Ag paste during the forecast period.

Thermal Interface Material Segment Receives Boost from Emerging Electronic and Electricals Industry

On the basis application, the global market is segmented into thermal interface material and EMI shielding. Currently, thermal interface material segment accounts for a significant share of Ag paste market. The Ag paste consumption in thermal interface materials (TIMs) application is expected to be high due to the increasing demand for TIMs in photovoltaic cells and electrical and electronic components. The high conductivity, contact resistance, and adhesive strength of Ag paste has increased its applications in various end-use industries. On the other hand, the EMI shielding is expected to experience a narrow demand due to availability of low price substitutes in certain applications. Substitutes such as copper, aluminum, carbon nanomaterial, and conductive polymer have been used as alternatives in certain applications but they do not match the performance efficiency of Ag paste.

Asia Pacific to be the Frontrunner in Global Market

Geographically, the Ag paste market is been segmented into regions such as North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America. Demand for Ag paste was the largest in Asia Pacific in 2015 followed by Europe and North America. The forecast growth in North America and Europe is anticipated to be low due to the withdrawal of government support & subsidies on solar equipment and products. Asia Pacific is anticipated to experience high growth for the forecast period due to the growing economies such as China India and Japan. The growing demand for solar energy and high subsidies from local government bodies in China, India and Japan is expected to boost the demand for Ag paste market in Asia Pacific Region for the forecast period.

The key players operating in the global Ag paste market are Targray Technology International Inc, DuPont, 3M, Metalor, Johnson Matthey, AG PRO TECHNOLOGY CORP, Cermet Materials, Inc., CHIMET, Henkel AG & Company KGaA, and Heraeus Holding are amongst others.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Report Assumptions

2.2. Research Methodology

3. Executive Summary

3.1. Market Snapshot

4. Market Overview

4.1. Product Overview

4.2. Market Indicators

4.3. Market Dynamics

4.4. Drivers and Restraints Snapshot Analysis

4.5. Drivers

4.6. Restraints

4.7. Opportunity

4.8. Global Ag Paste Market Analysis & Forecast

4.9. Porter’s Analysis

4.9.1. Threat of Substitutes

4.9.2. Bargaining Power of Buyers

4.9.3. Bargaining Power of Suppliers

4.9.4. Threat of New Entrants

4.9.5. Degree of Competition

4.10. Value Chain Analysis

4.11. List of Ag Paste Manufacturers

4.12. List of Ag paste Customers

5. Global Ag Paste Market Analysis and Forecast, by Application Type

5.1. Introduction

5.2. Key Findings

5.3. Global Ag Paste Market Value Share Analysis, by Application Type

5.3.1. Global Ag Paste Market Forecast, by Application Type

5.3.2. Thermal Interface Material

5.3.3. EMI Shielding

5.4. Global Ag Paste Market Attractiveness Analysis, by Application Type

6. Global Ag Paste Market Analysis, by Region

6.1. Global Ag Paste Market Value Share Analysis, by Region

6.1.1. Global Ag Paste Market Forecast, by Region

6.1.2. Global Ag Paste Market Attractiveness Analysis, by Region

6.1.3. Market Trends

6.2. North America Ag Paste Market Analysis

6.2.1. Key Findings

6.2.2. North America Ag Paste Market Overview

6.2.3. North America Ag Paste Market Value Share Analysis, by Application Type

6.2.4. North America Ag Paste Market Forecast, by Application Type

6.2.5. North America Ag Paste Market Value Share Analysis, by Country

6.2.6. North America Ag Paste Market Forecast, by Country

6.2.6.1. U.S

6.2.6.2. Rest of North America

6.2.7. North America Ag Paste Market Analysis, by Country

6.2.8. North America Ag Paste Market Attractiveness Analysis

6.3. Asia Pacific Ag Paste Market Analysis

6.3.1. Key Findings

6.3.2. Asia Pacific Ag Paste Market Overview

6.3.3. Asia Pacific Ag Paste Market Value Share Analysis, by Application Type

6.3.4. Asia Pacific Ag Paste Market Forecast, by Application Type

6.3.5. Asia Pacific Ag Paste Market Value Share Analysis, by Country

6.3.6. Asia Pacific Ag Paste Market Forecast, by Country

6.3.6.1. China

6.3.6.2. Japan

6.3.6.3. India

6.3.6.4. ASEAN

6.3.6.5. Rest of Asia Pacific

6.3.7. Asia Pacific Ag Paste Market Analysis, by Country

6.3.8. Asia Pacific Ag Paste Market Attractiveness Analysis

6.4. Europe Ag Paste Market Analysis

6.4.1. Key Findings

6.4.2. Europe Ag Paste Market Overview

6.4.3. Europe Ag Paste Market Value Share Analysis, by Application Type

6.4.4. Europe Ag Paste Market Forecast, by Application Type

6.4.5. Europe Ag Paste Market Value Share Analysis, by Country

6.4.6. Europe Ag Paste Market Forecast, by Country

6.4.6.1. U.K.

6.4.6.2. France

6.4.6.3. Spain

6.4.6.4. Italy

6.4.6.5. Germany

6.4.6.6. Rest of Europe

6.4.7. Europe Ag Paste Market Analysis, by Country

6.4.8. Europe Ag Paste Market Attractiveness Analysis

6.5. Middle East & Africa (MEA) Ag Paste Market Analysis

6.5.1. Key Findings

6.5.2. Middle East & Africa Ag Paste Market Overview

6.5.3. Middle East & Africa Ag Paste Market Value Share Analysis, by Application Type

6.5.4. Middle East & Africa Ag Paste Market Forecast, by Application Type

6.5.5. Middle East & Africa Ag Paste Market Value Share Analysis, by Country

6.5.6. Middle East & Africa Ag Paste Market Forecast, by Country

6.5.6.1. GCC

6.5.6.2. South Africa

6.5.6.3. Rest of Middle East & Africa

6.5.7. MEA Ag Paste Market Analysis, by Country

6.5.8. Middle East & Africa Ag Paste Market Attractiveness Analysis

6.6. Latin America Ag Paste Market Analysis

6.6.1. Key Findings

6.6.2. Latin America Ag Paste Market Overview

6.6.3. Latin America Ag Paste Market Value Share Analysis, by Application Type

6.6.4. Latin America Ag Paste Market Forecast, by Application Type

6.6.5. Latin America Ag Paste Market Value Share Analysis, by Country

6.6.6. Latin America Ag Paste Market Forecast, by Country

6.6.6.1. Brazil

6.6.6.2. Rest of Latin America

6.6.7. Latin America Ag Paste Market Analysis, by Country

6.6.8. Latin America Ag Paste Market Attractiveness Analysis

7. Competition Landscape

7.1. Competition Matrix

7.2. Company Profiles

7.2.1. DuPont

7.2.1.1. Company Description

7.2.1.2. Business Overview

7.2.1.3. SWOT Analysis

7.2.1.4. Strategic Overview

7.2.2. 3M

7.2.2.1. Company Description

7.2.2.2. Business Overview

7.2.2.3. SWOT Analysis

7.2.2.4. Strategic Overview

7.3. Metalor

7.3.1.1. Company Description

7.3.1.2. Business Overview

7.4. Johnson Matthey

7.4.1.1. Company Description

7.4.1.2. Business Overview

7.4.1.3. SWOT Analysis

7.4.1.4. Strategic Overview

7.5. Cermet Materials, Inc.

7.5.1.1. Company Description

7.5.1.2. Business Overview

7.6. AG PRO TECHNOLOGY CORP

7.6.1.1. Company Description

7.6.1.2. Business Overview

7.7. Targray Technology International Inc

7.7.1.1. Company Description

7.7.1.2. Business Overview

7.8. CHIMET

7.8.1.1. Company Description

7.8.1.2. Business Overview

7.9. Henkel AG & Company KGaA

7.9.1.1. Company Description

7.9.1.2. Business Overview

7.9.1.3. SWOT Analysis

7.9.1.4. Strategic Overview

7.10. Heraeus Holding

7.10.1.1. Company Description

7.10.1.2. Business Overview

7.10.1.3. SWOT Analysis

7.10.1.4. Strategic Overview

8. Key Takeaways

List of Tables

Table 01: List of Ag Paste Manufacturers

Table 02: List of Ag paste Customers

Table 03: Global Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, by Application Type, 2015–2024

Table 04: Global Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, by Region, 2015–2024

Table 05: North America Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, by Application Type, 2015–2024

Table 06: North America Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, by Country, 2015–2024

Table 07: Asia Pacific Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, by Application Type, 2015–2024

Table 08: Asia Pacific Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, by Country, 2015–2024

Table 09: Europe Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, by Application Type, 2015–2024

Table 10: Europe Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, by Country, 2015–2024

Table 11: Middle East & Africa Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, by Application Type, 2015–2024

Table 12: Middle East & Africa Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, by Country, 2015–2024

Table 13: Latin America Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, by Application Type, 2015–2024

Table 14: Latin America Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, by Country, 2015–2024

List of Figures

Figure 01: Global Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 02: Global Ag Paste Average Price (US$/Kg) 2015–2024

Figure 3: Global Ag Paste Market Value Share Analysis, by Application Type, 2015 and 2024

Figure 4: Global Ag Paste Market Size (US$ Mn) and Volume (Tons), by Thermal Interface Material, 2015–2024

Figure 5: Global Ag Paste Market Size (US$ Mn) and Volume (Tons), by EMI Shielding, 2015–2024

Figure 6: Global Ag Paste Market Attractiveness Analysis, by Application Type

Figure 7: Global Ag Paste Market Value Share Analysis, by Region, 2015 and 2024

Figure 8: Global Ag Paste Market Attractiveness Analysis, by Region

Figure 9: North America Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 10: North America Ag Paste Market Attractiveness Analysis, by Country

Figure 11: North America Ag Paste Market Value Share Analysis, by Application Type, 2015 and 2024

Figure 12: North America Ag Paste Market Value Share Analysis, by Country, 2015 and 2024

Figure 13: U.S. Ag Paste Market Analysis, 2015–2024

Figure 14: Rest of North America Ag Paste Market Analysis, 2015–2024

Figure 15: North America Ag Paste Market Attractiveness Analysis, By Application Type

Figure 16: Asia Pacific Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 17: Asia Pacific Ag Paste Market Attractiveness Analysis, by Country

Figure 18: Asia Pacific Ag Paste Market Value Share Analysis, by Application Type, 2015 and 2024

Figure 19: Asia Pacific Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, by Application Type, 2015–2024

Figure 20: Asia Pacific Ag Paste Market Value Share Analysis, by Country, 2015 and 2024

Figure 21: China Ag Paste Market Analysis, 2015–2024

Figure 22: Japan Ag Paste Market Analysis, 2015–2024

Figure 23: India Ag Paste Market Analysis, 2015–2024

Figure 24: ASEAN Ag Paste Market Analysis, 2015–2024

Figure 25: Rest of Asia Pacific Ag Paste Market Analysis, 2015–2024

Figure 26: Asia Pacific Ag Paste Market Attractiveness Analysis, By Application Type

Figure 27: Europe Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 28: Europe Ag Paste Market Attractiveness Analysis, by Country

Figure 29: Europe Ag Paste Market Value Share Analysis, by Application Type, 2015 and 2024

Figure 30: Europe Ag Paste Market Value Share Analysis, by Country, 2015 and 2024

Figure 31: U.K. Ag Paste Market Analysis

Figure 32: France Ag Paste Market Analysis

Figure 33: Spain Ag Paste Market Analysis

Figure 34: Italy Ag Paste Market Analysis

Figure 35: Germany Ag Paste Market Analysis

Figure 36: Rest of Europe Ag Paste Market Analysis

Figure 37: Europe Ag Paste Market Attractiveness Analysis, By Application Type

Figure 38: MEA Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 39: MEA Ag Paste Market Attractiveness Analysis, by Country

Figure 40: MEA Ag Paste Market Value Share Analysis, by Application Type, 2015 and 2024

Figure 41: MEA Ag Paste Market Value Share Analysis, by Country, 2015 and 2024

Figure 42: GCC Ag Paste Market Analysis

Figure 43: South Africa Ag Paste Market Analysis

Figure 44: Rest of Middle East & Africa Ag Paste Market Analysis

Figure 45: Middle East & Africa Ag Paste Market Attractiveness Analysis, By Application Type

Figure 46: Latin America Ag Paste Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 47: Latin America Ag Paste Market Attractiveness Analysis, by Country

Figure 48: Latin America Ag Paste Market Value Share Analysis, by Application Type, 2015 and 2024

Figure 49: Latin America Ag Paste Market Value Share Analysis, by Country, 2015 and 2024

Figure 50: Brazil Ag Paste Market Analysis

Figure 51: Rest of Latin America Ag Paste Market Analysis

Figure 52: Latin America Ag Paste Market Attractiveness Analysis, By Application Type